Overview of Strifor

Strifor, established in 2022 in Saint Vincent and the Grenadines, offers a wide range of trading assets including forex, metals, indices, and cryptocurrencies. With a user-friendly MT5 platform, it provides leverage of up to 1:500 and competitive spreads as low as 0 pips. However, its unregulated status poses risks to traders, and its high minimum deposit requirement for certain account types limit accessibility. Despite these drawbacks, Strifor's responsive customer support and various trading instruments attract traders seeking opportunities in the global financial markets.

Is Strifor legit or a scam?

Strifor operates without regulatory oversight. This absence of supervision can lead to unchecked practices, potentially risking consumer safety, financial stability, and environmental sustainability.

Without regulatory scrutiny, Strifor may exploit loopholes, engage in unethical behavior, and evade accountability. Lack of oversight could result in compromised product quality, fraudulent activities, and adverse impacts on public trust. Moreover, the absence of regulations fosters an environment where Strifor prioritizes profit over social responsibility, jeopardizing the well-being of stakeholders and broader societal interests.

Pros and Cons

Pros:

Various trading instruments: Strifor offers a wide range of trading instruments, including forex, metals, indexes, and cryptocurrencies. This diversity allows traders to access various markets and diversify their investment portfolios effectively.

MT5 trading platform: Strifor utilizes the MetaTrader 5 (MT5) platform, known for its advanced features, user-friendly interface, and customizable tools. MT5 provides traders with robust charting capabilities, automated trading options, and access to a vast ecosystem of third-party plugins and indicators.

Leverage up to 1:500: Strifor offers leverage ratios of up to 1:500, allowing traders to amplify their positions and potentially increase their profits. Higher leverage can provide traders with more trading opportunities and flexibility in managing their capital.

Responsive customer support: Strifor provides responsive customer support through various channels, including phone, email, and social media platforms. This ensures that traders can receive timely assistance and support whenever they encounter issues or have questions.

Competitive spreads as low as 0 pips: Strifor offers competitive spreads, with starting spreads as low as 0 pips for certain trading instruments. Low spreads can reduce trading costs for traders, allowing them to retain more of their profits.

Cons:

Unregulated: One notable drawback of Strifor is its lack of regulatory oversight. Operating without regulation can expose traders to higher levels of risk, as there are no regulatory bodies overseeing the platform's operations and ensuring compliance with industry standards.

High minimum deposit requirement for some account types: Strifor imposes relatively high minimum deposit requirements for certain account types, potentially excluding traders with limited capital from accessing certain features or account privileges.

Limited educational resources: Strifor provides limited educational resources and training materials for traders. This lack of educational content hinders the learning and development of less experienced traders who rely on educational resources to improve their trading skills.

Limited availability of advanced trading features: While Strifor offers a user-friendly trading platform, it lacks certain advanced trading features and tools that are available on other platforms.

Market Instruments

Strifor offers a wide range of trading assets, totaling over 300+ assets.

Among these assets are Cryptocurrency, providing access to various digital currencies such as Bitcoin, Ethereum, and Litecoin.

Additionally, traders can engage in the forex market through a selection of currency pairs, offering opportunities to trade major, minor, and exotic currency pairs.

The platform also features Contracts for Difference (CFDs), enabling users to speculate on the price movements of various financial instruments without owning the underlying assets.

For those interested in commodities, Metals such as gold, silver, platinum, and palladium are available for trading, providing exposure to the precious metals market.

Furthermore, Strifor offers trading options in Indexes, allowing investors to trade on the performance of stock market indices such as the S&P 500, NASDAQ, and FTSE 100.

Account Types

Strifor offers a variety of account types as follows:

The BASIC account type accommodates a wide range of clients, regardless of their trading experience or financial background. With a relatively low deposit requirement of $20, various currency options including USD, USDt, and EUR, and a maximum leverage of 1:500, it offers accessibility and flexibility. This account type features spreads starting from 0.1 point and allows trading in Forex, Metals, Indexes, and Cryptocurrency. While SWAP is enabled, there is no provision for Islamic rulings (IR), making it suitable for traders who do not require Sharia-compliant features.

The ADVANCED account serves users seeking more advanced trading capabilities and who can commit to a higher initial deposit of $10,000. Similar to the BASIC account, it supports multiple currencies and offers a maximum leverage of 1:500. However, it provides tighter spreads starting from 0 and extends trading options to include Cryptocurrency and Contracts for Difference (CFDs). This account type also includes SWAP functionality and accommodates Islamic rulings (IR), making it suitable for a broader range of traders, including those with Islamic finance preferences.

The PROFESSIONAL account type is tailored for experienced traders with a higher level of capital, requiring a substantial initial deposit of $20,000. It offers competitive advantages such as tighter spreads from 0, a maximum leverage of 1:200, and an expanded range of trading instruments including Cryptocurrency and CFDs. With lower commission rates per lot compared to BASIC and ADVANCED accounts, this option is ideal for traders looking for cost-effective trading solutions. Additionally, the PROFESSIONAL account offers the flexibility of Islamic rulings (IR), providing further options for traders with specific religious considerations.

The ISLAMIC account type is specifically structured to adhere to Islamic finance principles, making it suitable for traders who require Sharia-compliant trading options. With a modest deposit requirement of $2,000, it accommodates users seeking to align their trading activities with Islamic law. Offering trading in Forex, Metals, and Indexes, along with SWAP-free features, this account type ensures compliance with Islamic finance regulations. While it may have slightly higher commission rates compared to other account types, it provides a platform where traders can engage in financial activities in accordance with their religious beliefs.

How to Open an Account?

Opening an account with Strifor involves a straightforward process, typically completed in five clear steps:

Registration: Begin by visiting the official Strifor website and locate the “Register” button. Click on it to access the registration form. Fill in the required personal information accurately, including your full name, email address, phone number, and country of residence.

Verification: Once you've submitted the registration form, Strifor may require you to verify your identity and address. This step usually involves uploading scanned copies or photos of valid identification documents such as a passport or driver's license, as well as proof of address documents like a utility bill or bank statement. Ensure all documents are clear and legible before submission.

Account Type Selection: After successful verification, you'll need to select the type of account you wish to open based on your trading preferences, financial capabilities, and risk tolerance. Strifor typically offers several account types, each with varying features such as leverage, spreads, and commissions. Choose the account type that best aligns with your trading objectives.

Deposit Funds: Once your account type is selected, you'll need to fund your trading account. Strifor usually supports multiple deposit methods, including bank wire transfer, credit/debit card payments, and electronic payment processors. Follow the instructions provided on the platform to deposit funds into your account securely.

Start Trading: With your account funded, you're now ready to start trading. Log in to your Strifor trading account using the credentials provided during registration. Familiarize yourself with the trading platform's interface, tools, and features. Then, analyze the markets, place your trades, and monitor your positions closely to seize potential opportunities and manage risk effectively.

Leverage

Strifor offers varying maximum leverage ratios across its account types.

For BASIC and ADVANCED accounts, the maximum leverage is set at 1:500, providing clients with the ability to control larger positions with a smaller amount of capital.

However, for PROFESSIONAL accounts, the maximum leverage is slightly reduced to 1:200, likely due to the higher level of capital and sophistication expected from professional traders.

Interestingly, the ISLAMIC account maintains the same maximum leverage as BASIC and ADVANCED accounts at 1:500, reflecting the platform's adherence to Islamic principles while still offering competitive leverage options.

Spreads & Commissions

Strifor offers different spreads and commission rates across its various account types.

The BASIC account features spreads starting from 0.1 point across all trading instruments, with commissions per lot set at $8 for Forex and Metals trading.

Meanwhile, the ADVANCED account presents an attractive proposition with spreads starting from 0 and slightly reduced commission rates of $7 per lot for Forex and Metals.

For those seeking a more cost-effective option, the PROFESSIONAL account offers the tightest spreads from 0 and even lower commissions of $5 per lot for Forex and Metals trading.

However, the ISLAMIC account, while maintaining competitive spreads from 0.1 point, presents relatively higher commission rates, especially for Forex and Metals trading, at $12 per lot.

Considering the fee structure, BASIC and ADVANCED accounts are suitable for all types of traders, while the PROFESSIONAL account is more appealing to experienced traders looking for cost-saving opportunities. The ISLAMIC account, despite its higher fees, may still attract traders seeking Sharia-compliant options within the platform's offerings.

Trading Platform

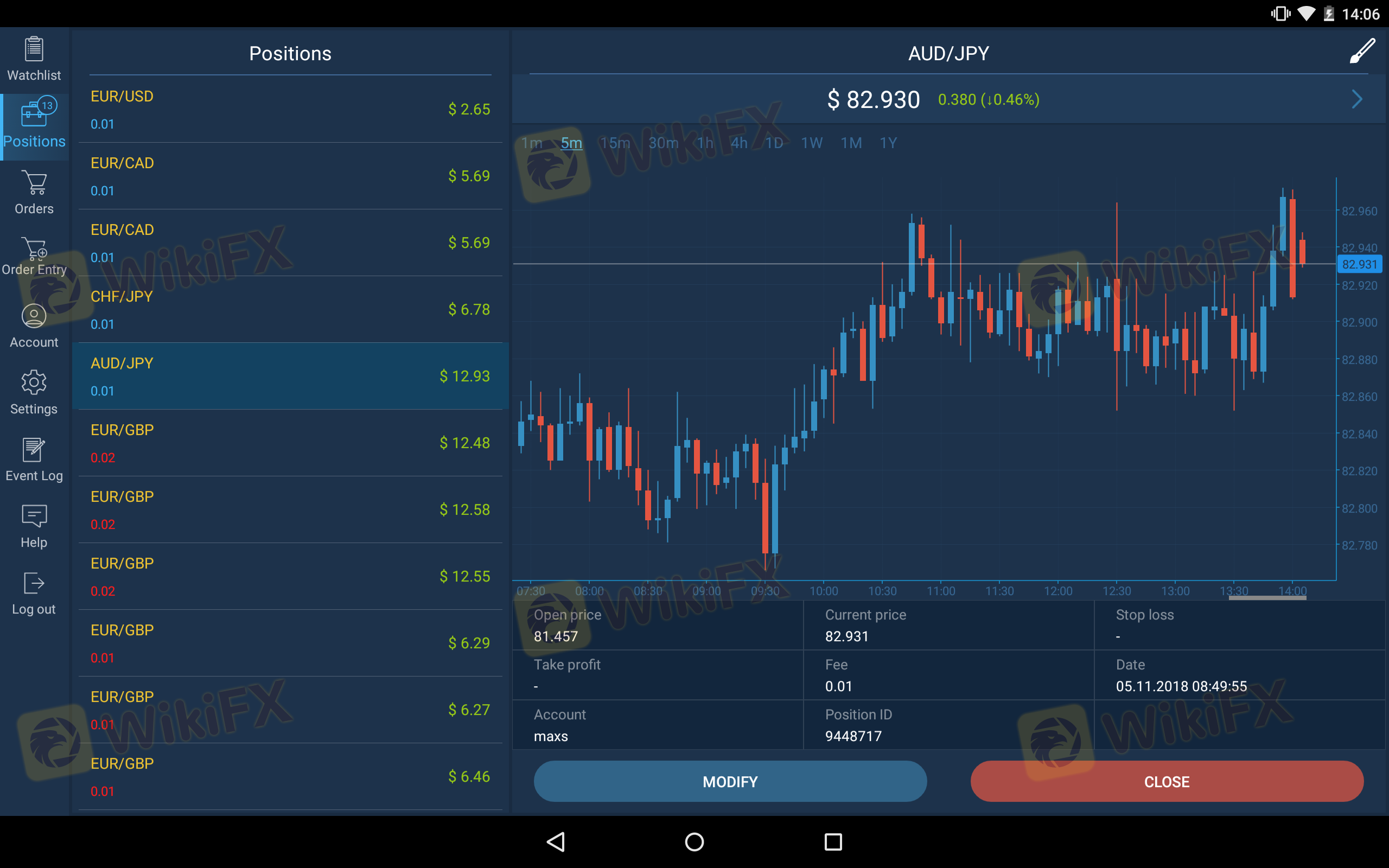

The trading platform offered by Strifor, primarily based on MetaTrader 5 (MT5), provides traders with a comprehensive and versatile trading experience. Strifor's choice of MT5 is justified by its robust features and functionality, aligning with the platform's commitment to offering a wide range of trading instruments, including Cryptocurrency, which is increasingly recognized as a significant asset class.

With MT5, traders on Strifor gain access to a plethora of tools and resources enhancing their trading strategies. The platform boasts advanced features such as Market Depth and Contract Specifications, allowing traders to gain insights into market liquidity and contract details for informed decision-making.

Furthermore, Strifor ensures accessibility to its trading platform by offering both mobile and browser-based versions, allowing traders to monitor and execute trades conveniently on-the-go. The platform also provides user notifications, including trading signals, to keep traders informed about market developments and potential trading opportunities.

Deposit & Withdrawal

Strifor offers USTD-ETH and USTD-TRX among its payment methods, allowing users to deposit funds using popular cryptocurrencies, appealing to those preferring the anonymity and security of blockchain-based transactions.

The BASIC account requires a $20 minimum deposit, enabling easy access for beginners and casual traders. The ADVANCED account sets a higher minimum deposit at $10,000. For professionals, the PROFESSIONAL account mandates a $20,000 minimum deposit, suitable for experienced traders and institutional clients accustomed to larger volumes. The ISLAMIC account maintains a lower $2,000 minimum deposit, aligning with Islamic finance principles and accommodating users seeking Sharia-compliant trading.

Customer Support

Strifor provides customer support primarily through its English-language contact number: +357 24812052. Additionally, users can reach out via email at help@strifor.ltd.

Social media platforms like Twitter, Facebook, Instagram, YouTube, and LinkedIn also serve as alternative channels for contacting support. These various communication options ensure users can seek assistance conveniently through their preferred means, whether it's traditional phone support or through popular social media platforms.

Conclusion

In conclusion, Strifor presents a compelling option for traders seeking access to various markets and competitive trading conditions. With a user-friendly MetaTrader 5 platform, traders can leverage up to 1:500 and benefit from competitive spreads as low as 0 pips.

However, its unregulated status raises risks about investor protection and oversight. Additionally, the platform's high minimum deposit requirement for certain account types limit accessibility for traders with limited capital. Despite these drawbacks, Strifor's responsive customer support and range of trading instruments attract traders looking to navigate the global financial markets with flexibility and convenience.

FAQs

Q: What trading instruments does Strifor offer?

A: Strifor offers a wide range of trading instruments including forex, metals, indices, and cryptocurrencies.

Q: Is Strifor regulated?

A: No, Strifor operates without regulatory oversight.

Q: What is the minimum deposit required to open an account with Strifor?

A: The minimum deposit ranges from $20 to $20,000 depending on the account type.

Q: How can I contact customer support at Strifor?

A: You can contact customer support via phone, email, or social media channels.

Q: What leverage does Strifor offer?

A: Strifor offers leverage of up to 1:500.

2024-04-18 13:26

2024-04-18 13:26

2024-04-17 13:05

2024-04-17 13:05

2024-03-15 03:31

2024-03-15 03:31

2024-03-12 02:11

2024-03-12 02:11

2024-03-08 18:58

2024-03-08 18:58

2024-03-06 01:00

2024-03-06 01:00

2024-02-26 16:28

2024-02-26 16:28

2024-02-15 02:23

2024-02-15 02:23

2024-01-24 02:38

2024-01-24 02:38

2024-01-16 14:25

2024-01-16 14:25