Company Summary

Note: Z.com Bullion's official website: https://bullion.z.com/en is currently inaccessible normally.

Z.com Bullion Information

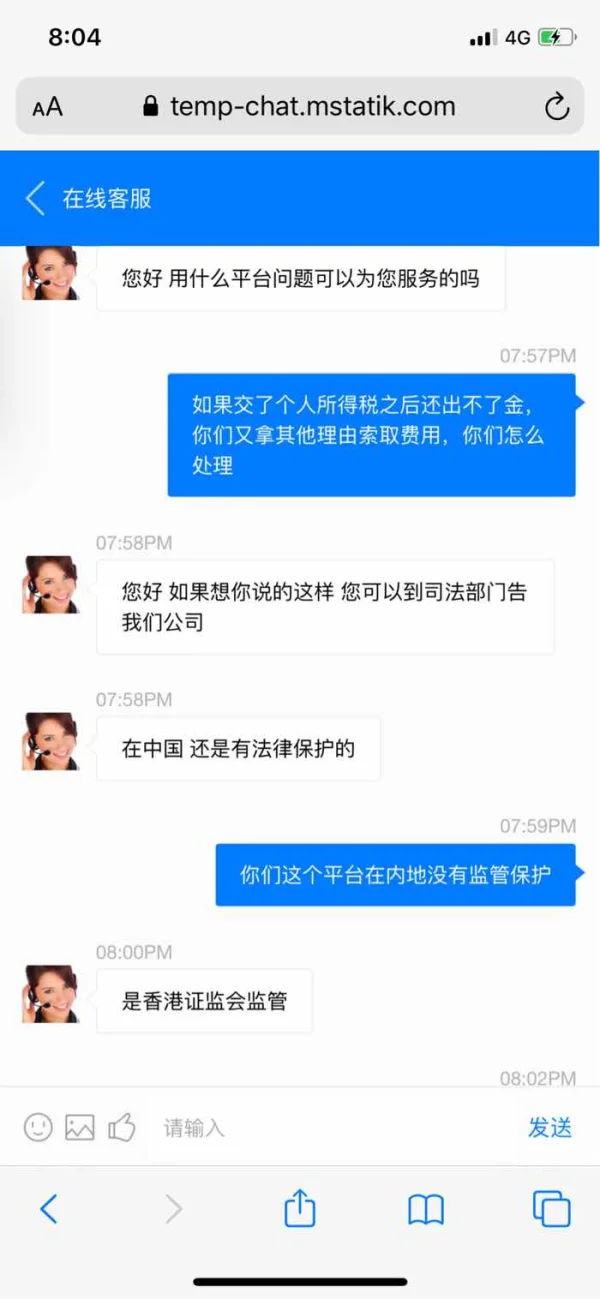

Z.com Bullion is a regulated brokerage company registered in Hong Kong. Due to the closure of the official website of this broker, traders cannot obtain more security information.

Is Z.com Bullion Legit?

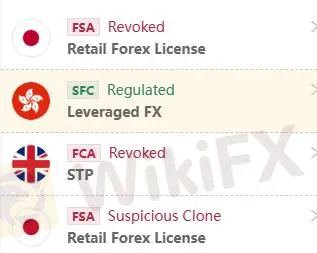

Z.com Bullion is authorized and regulated by SFC, license number AZE792, while the supervision of FSA and FCA is revoked and a suspicious clone status by FSA.

Downsides of Z.com Bullion

- Unavailable Website

Because of the inaccessible Z.com Bullion's official website raises concerns about its reliability and accessibility.

- Lack of Transparency

Since Z.com Bullion does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

Securities and Futures Commission of Hong Kong(FSC) regulates Z.com Bullion, which is safer than unregulated one. But risks are inevitable.

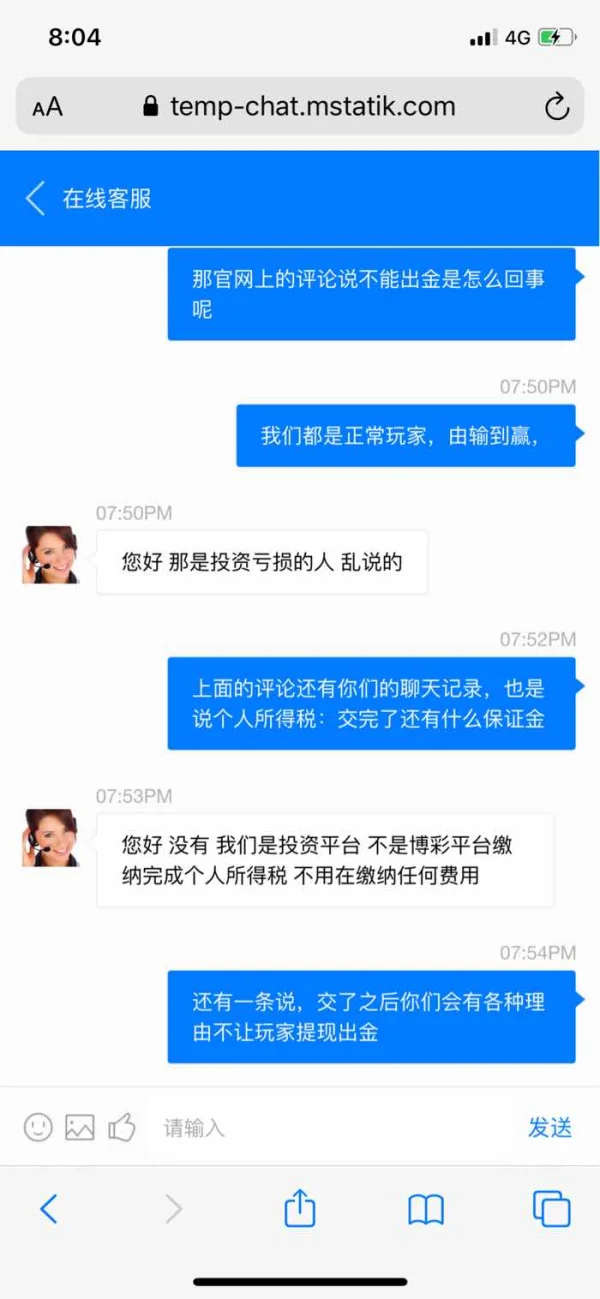

- Withdrawal Difficulty

According to a report on WikiFX, users encountered significant difficulties with fund withdrawals. The issue remained unresolved despite the request being pending for a long time.

Negative Z.com Bullion Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are many pieces of Z.com Bullion exposure.

Exposure. Cannot withdraw

| Classification | Unable to Withdraw |

| Date | 2020-2023 |

| Post Country | Hong Kong, China |

The user said that he was unable to withdraw, and it was still pending after a long time. You may visit: https://www.wikifx.com/en/comments/detail/202005071332653509.html.

Conclusion

Trading with Z.com Bullion may pose security risks as they have many negative comments about withdrawals and the official website is inaccessible, despite the company being regulated.

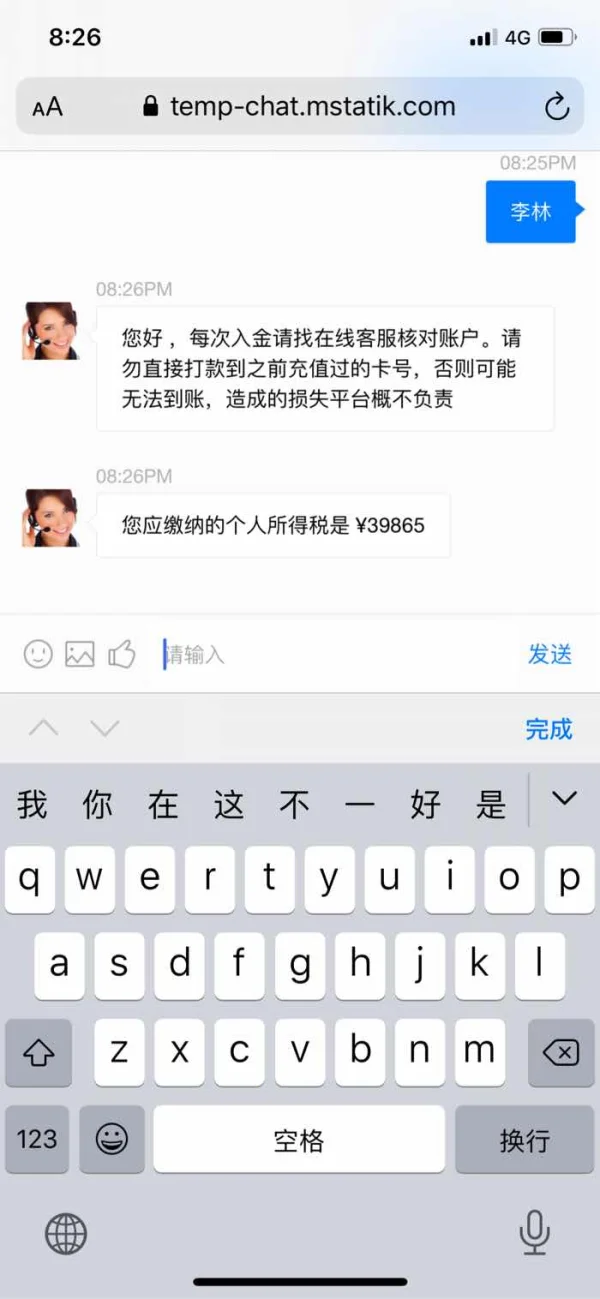

小太阳54676

Hong Kong

The withdrawal is unavailable. I was asked to pay the verification fee for twice.

Exposure

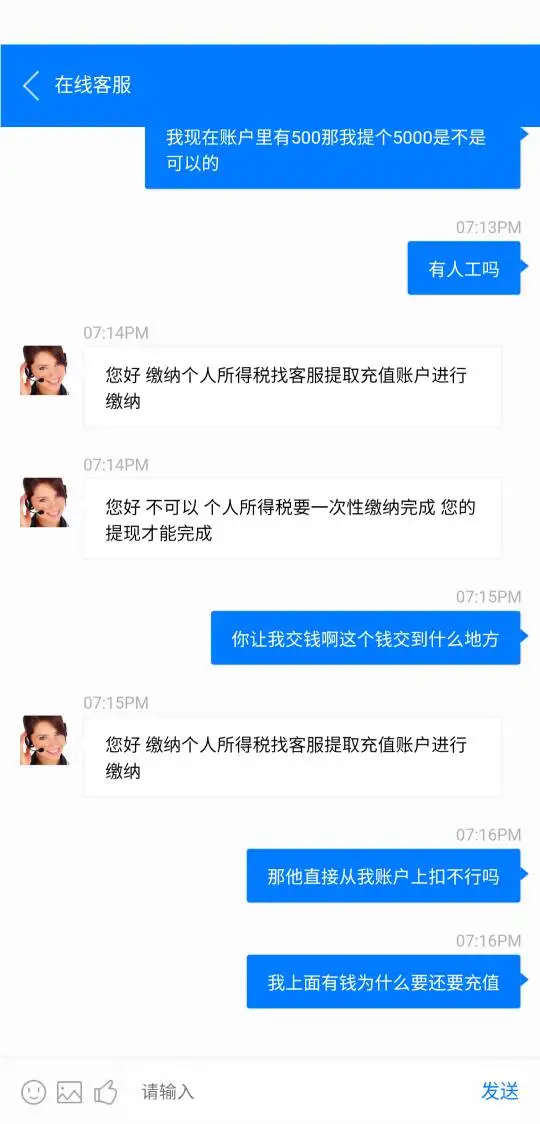

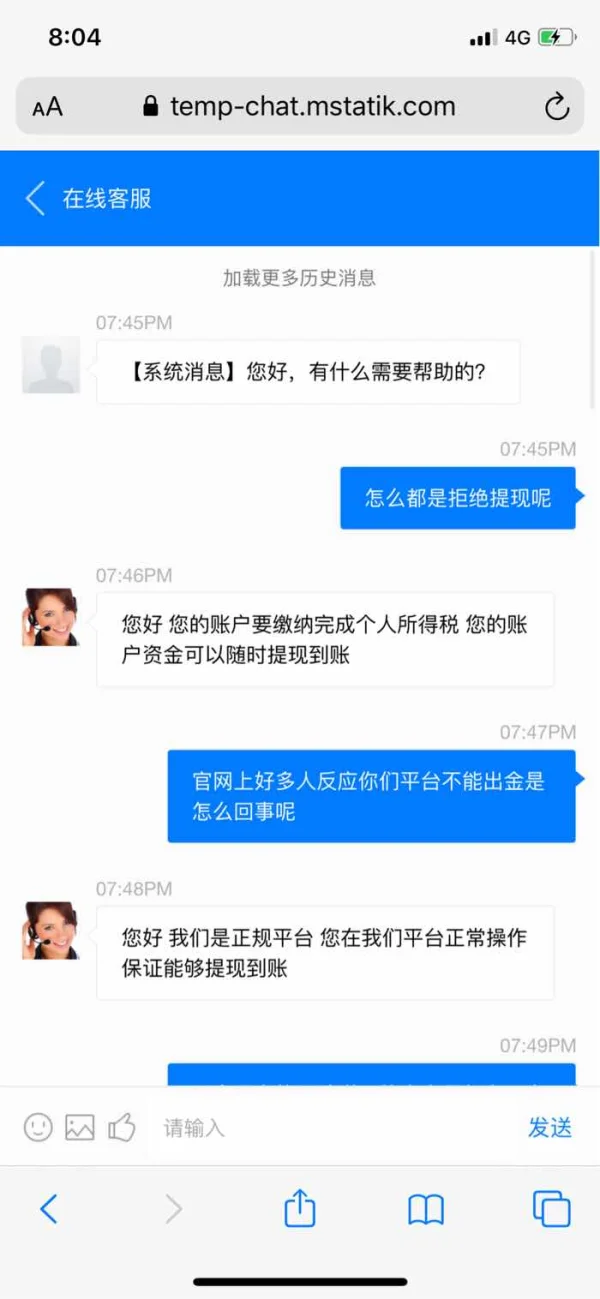

FX2818271179

Hong Kong

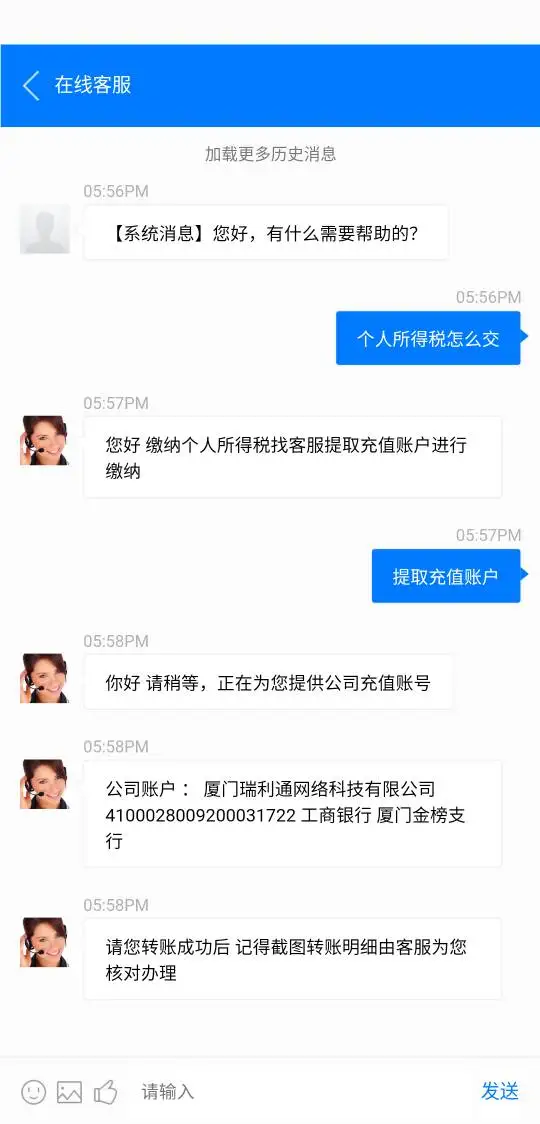

An individual tax is asked before withdrawing fund.

Exposure

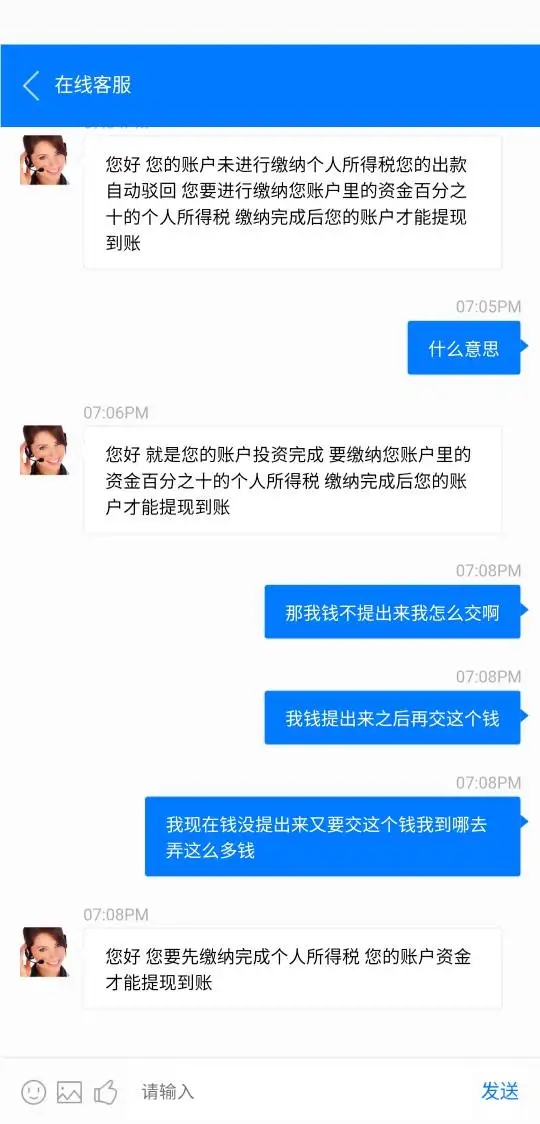

假如59427

Hong Kong

The withdrawal is unavailable for 15 days. I was even asked to pay 10% margin.

Exposure

黄金白银走势分析師

Hong Kong

Deposits and withdrawals are safe, but the spread is large and there is a slippage problem.

Neutral

孑然一身29483

United Kingdom

Great combination of everything a trader needs. Best experience! My experience with GMO from the Support regarding a problem with my credit card. Very Nice, Fast and very Kind.

Positive

高山流水30187

Colombia

I really wanted to trade gmo before but gave up after seeing other people's reviews on wikifx. I can't risk my money.

Positive

개미-근酱

Hong Kong

The broker says that you can start with only 5 dollars, and they also offers flexible leverage up to 1:500, as well as competitive spreads and the industry-standard mt4 platform. However, they are all just their advertisements. The fact is that you can’t withdraw your funds smoothly and even you have to pay some unspecified fees.

Neutral

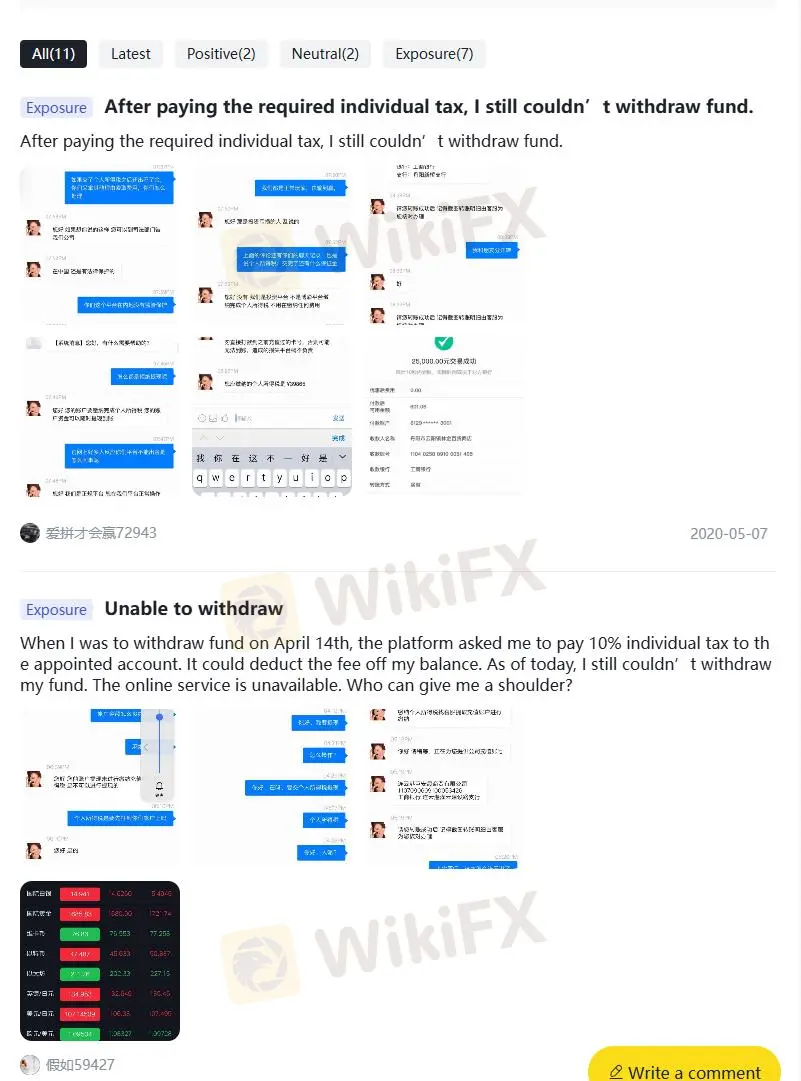

爱拼才会赢72943

Hong Kong

After paying the required individual tax, I still couldn’t withdraw fund.

Exposure

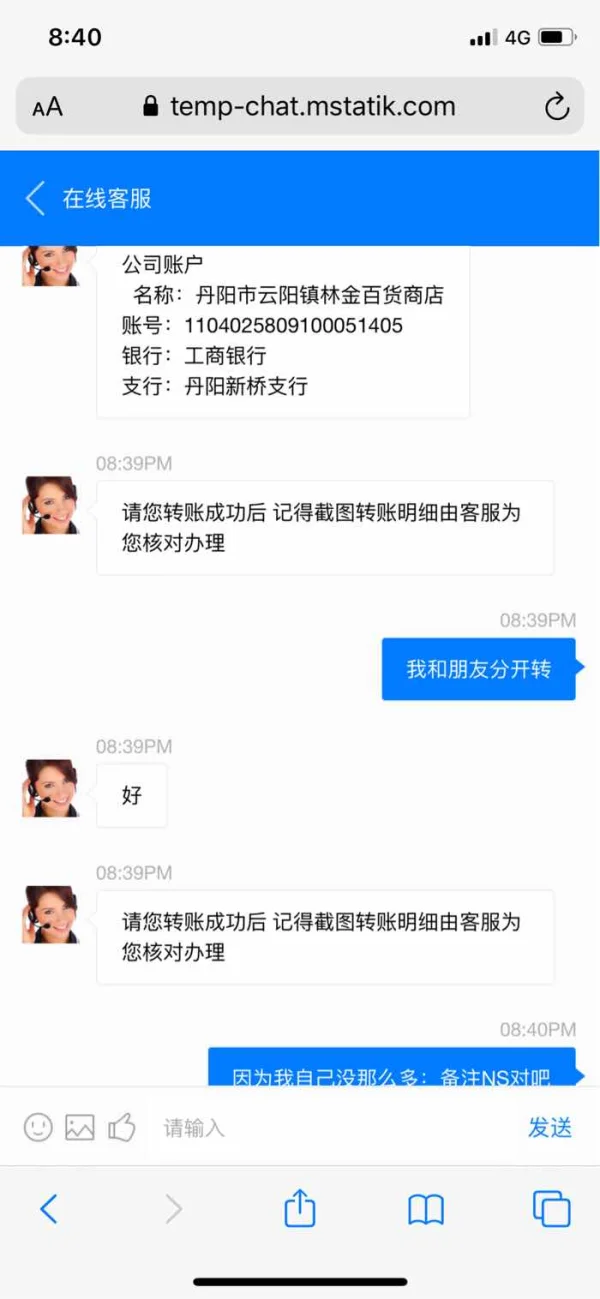

假如59427

Hong Kong

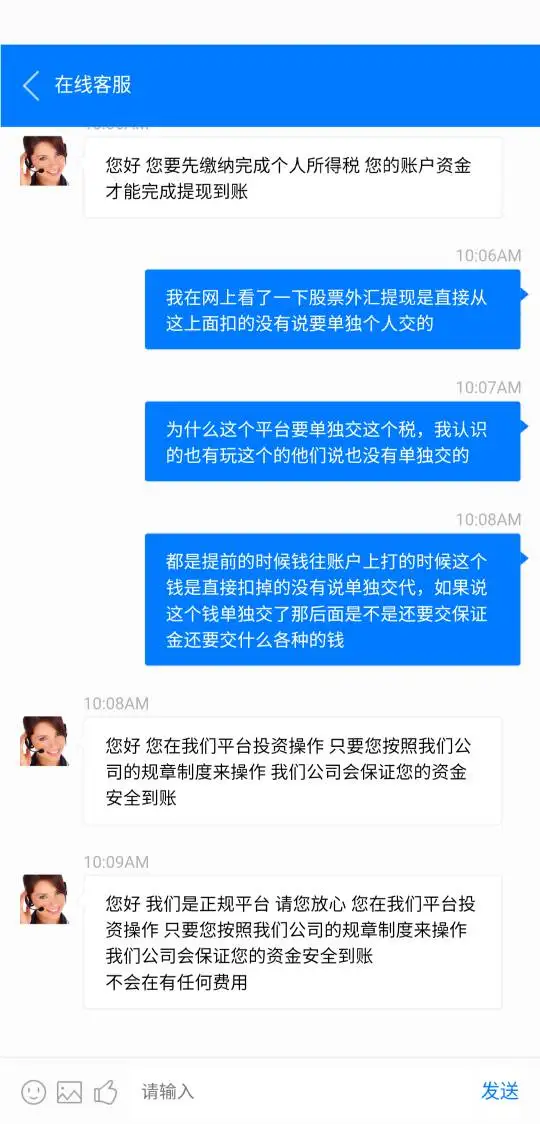

When I was to withdraw fund on April 14th, the platform asked me to pay 10% individual tax to the appointed account. It could deduct the fee off my balance. As of today, I still couldn’t withdraw my fund. The online service is unavailable. Who can give me a shoulder?

Exposure

袁修强

Hong Kong

2019.2.27 How big is the fluctuation of gold today? My this reached 1750 points.

Exposure

FX6469792798

Hong Kong

Serious slippage—over 800 pips! 800 pips slippage on the same platform!

Exposure