Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is Blackrock?

BlackRock is a globally recognized investment management corporation that provides a comprehensive range of services and products to its clients. With a strong regulatory framework overseen by MAS and SFC, which serves as the integrated regulator and supervisor of financial institutions in Singapore, BlackRock maintains compliance with industry standards. While it is important to note that there have been reports of license exceedances with regulatory bodies such as ASIC and FCA. BlackRock offers various means of contact tailored to different regions and services. Traders are encouraged to select their respective locations from the BlackRock or iShares tab on the company's website to gain access to the appropriate products, tools, insights, and avenues for communication relevant to their specific regions.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Blackrock Alternative Brokers

There are many alternative brokers to Blackrock depending on the specific needs and preferences of the trader. Some popular options include:

PI Financial - An independent investment dealer founded in 1982 that offers a wide range of investment products and services to individual, corporate and institutional investors

LONGRUN FINANCIAL - A global securities company that provides traders with access to financial products and services.

Lydya Financial – A company providing unparalleled financial services and up-to-date investment opportunities in the capital markets.

Is Blackrock Safe or Scam?

Blackrock is regulated by Monetary Authority of Singapore (MAS) which is the integrated regulator and supervisor of financial institutions in Singapore and the Securities and Futures Commission (SFC, No. AFF275), which is an independent statutory body set up in 1989 to regulate Hong Kong's securities and futures markets.

But The broker exceeds the business scope regulated by Australia ASIC (license number: 230523) and by United Kingdom FCA (license number: 178638). Also, there are reports of being unable to withdraw. Therefore, though Blackrock is regulated, traders should be careful because of its negative reports.

As with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

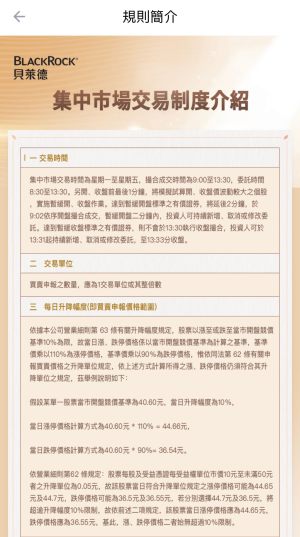

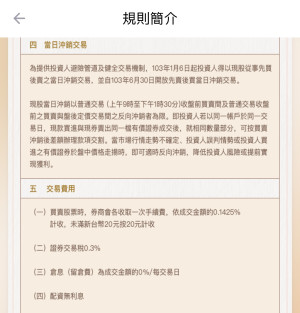

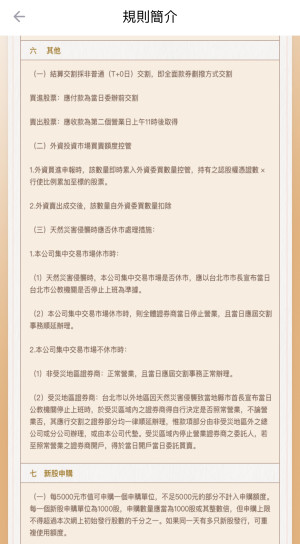

Services & Products

Blackrock is a global investment management corporation that offers a wide range of services and products to its clients. Here are the key offerings provided by BlackRock:

BlackRock is primarily known for its expertise in investment management. They offer a diverse set of investment strategies across various asset classes, including equities, fixed income, multi-asset, alternatives, and index funds. They manage portfolios for institutional clients, such as pension funds, insurance companies, and sovereign wealth funds, as well as individual investors.

BlackRock provides advisory services to institutions, governments, and individual clients. They offer customized investment advice based on clients' unique goals, risk tolerance, and time horizon. Their advisory services cover areas like asset allocation, portfolio construction, and manager selection.

BlackRock offers risk management solutions to help clients mitigate and manage investment risks. They provide comprehensive risk analytics, portfolio stress testing, and risk assessment tools. These solutions assist clients in understanding potential risks, optimizing their investment strategies, and ensuring compliance with regulatory requirements.

BlackRock's Aladdin platform is a cutting-edge technology platform that provides investment professionals with tools for portfolio management, risk analysis, trading, and operational efficiency. It integrates data, analytics, and technology to enable better decision-making and streamline investment processes.

BlackRock offers wealth management solutions to individual investors through various channels. They provide financial planning services, investment products, and digital platforms to help clients achieve their financial goals and optimize their wealth.

BlackRock is a leading provider of exchange-traded funds (ETFs) and index funds. They offer a wide range of funds that track various indices across different asset classes and investment themes. These passive investment products provide investors with efficient and cost-effective access to diversified portfolios.

Last but not least, Blackrocks services and products are vary according to regions. Traders can visit the website and choose their regions to learn about the specific services and products provided by Blackrock.

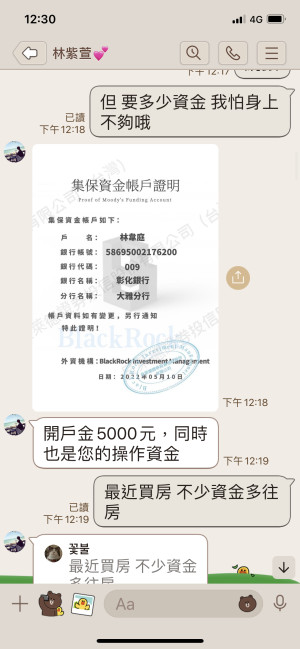

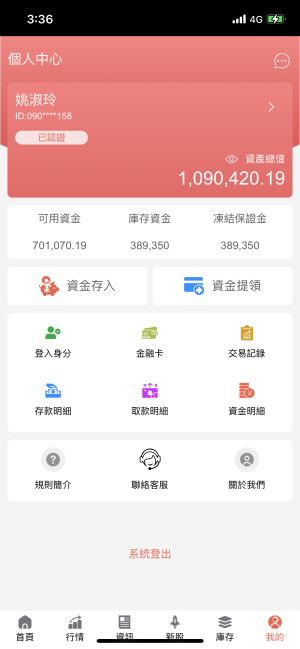

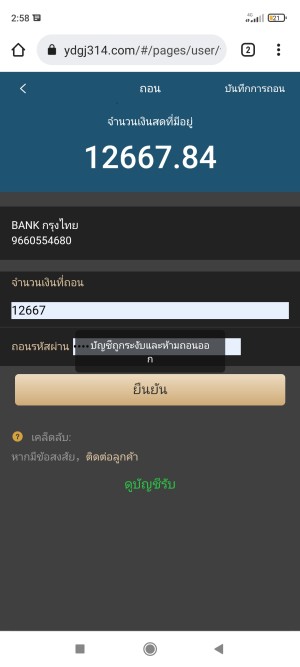

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

BlackRock offers different contact ways according to different regions and services. Traders can choose their locations from the BlackRock or iShares tab to access the right products, tools, insights and ways to contact in their regions.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: 470-520-5000 (English)

02-751-0500 (Korean)

03 - 6703 - 4 100 (Japanese)

01 56 43 29 00 (French)

+49(0)69 50 500 3111 (German)

Email: clientservice.asiapac@blackrock.com

france@blackrock.com

germany@blackrock.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, and YouTube.

Twitter: https://twitter.com/blackrockhttps://twitter.com/blackrockDE

Facebook: https://www.facebook.com/blackrock

YouTube: https://www.youtube.com/channel/UC4mxyB0DHnJlqlDUq0aGtDw

Conclusion

In conclusion, BlackRock is an investment management corporation that offers a wide range of services and products to its clients. Despite being regulated by MAS and SFC, there have been reports of license exceedances with regulatory bodies such as ASIC and FCA. While BlackRock provides various means of contact based on different regions and services. The company emphasizes its commitment to acting as a fiduciary for its clients, investing for the future, inspiring its employees, and supporting local communities.

Frequently Asked Questions (FAQs)

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX