Company Summary

| SXHJASReview Summary | |

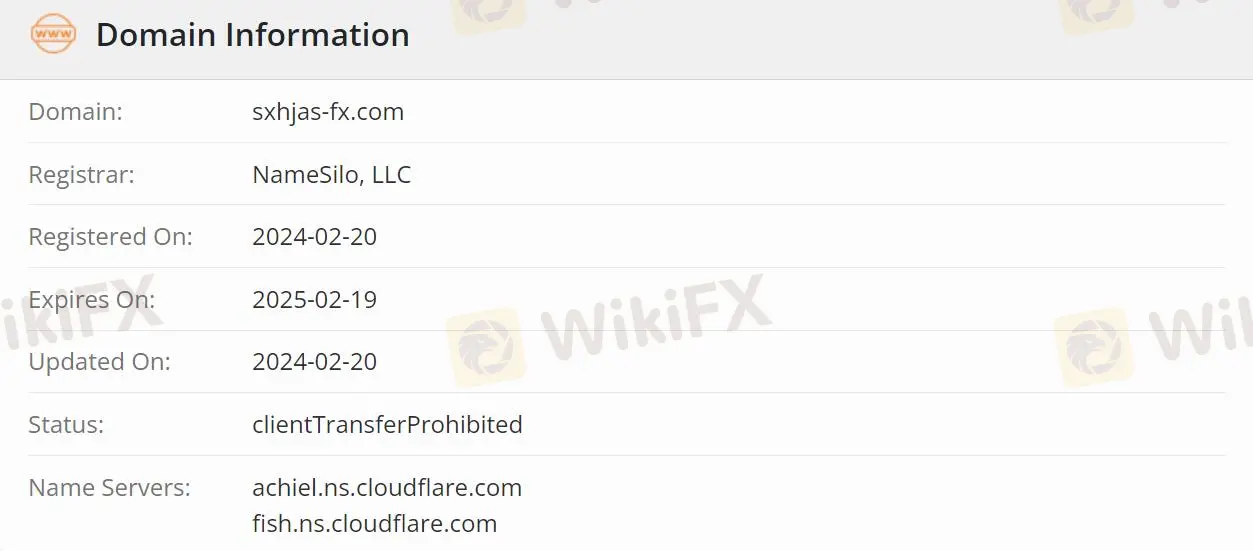

| Founded | 2024-02-20 |

| Registered Country/Region | United Kingdom |

| Regulation | Suspicious Clone |

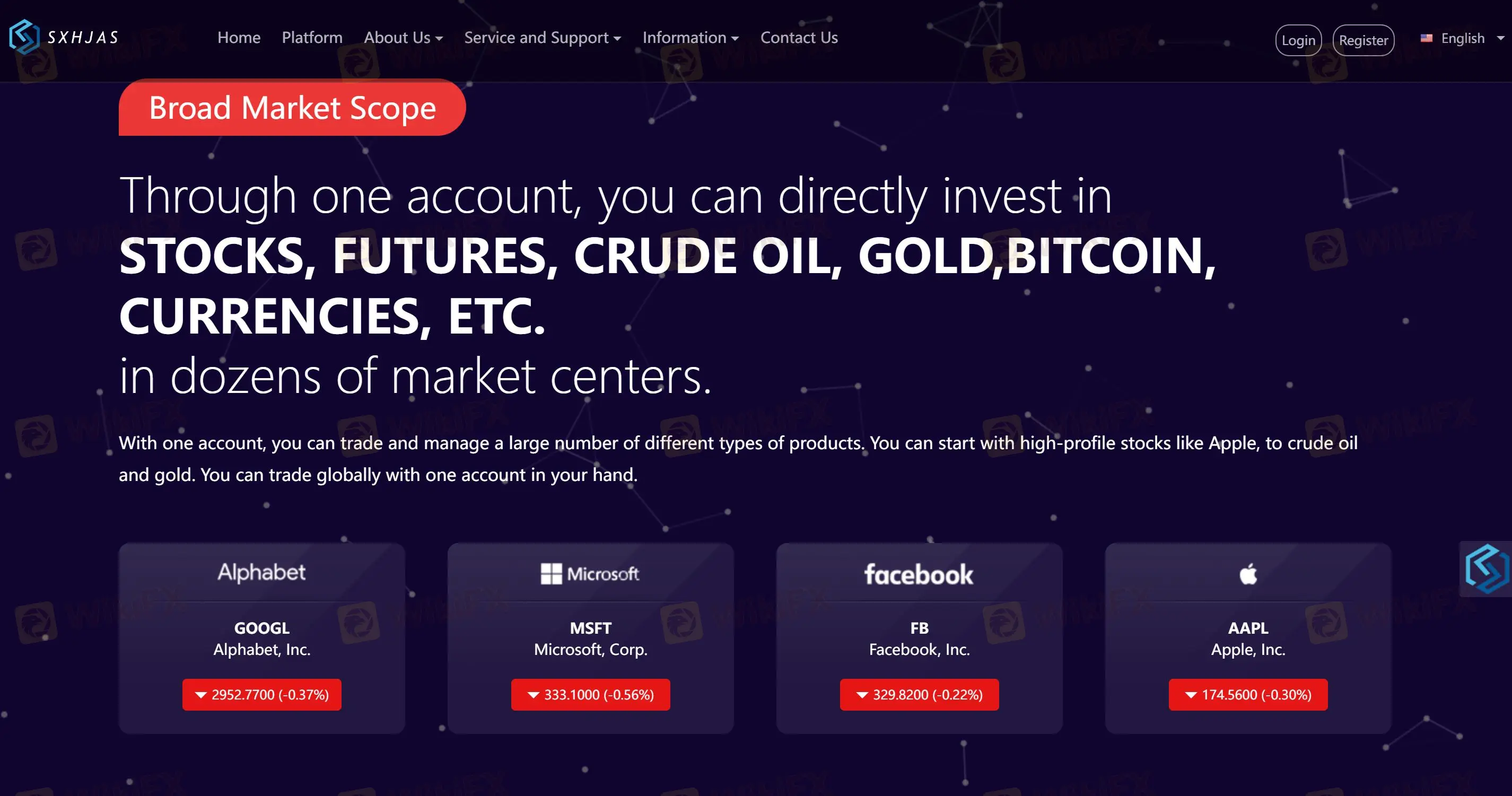

| Market Instruments | Forex, Stocks, Futures, Indices, Crude Oil, Precious Metals(Gold and Silver), Cryptocurrency(Bitcoin) |

| Demo Account | ✅ |

| Leverage | Not mentioned |

| Spread | As low as 0 |

| Trading Platform | SXHJAS(PC(Windows) & Mobile(iPhone & Android)) |

| Min Deposit | Not mentioned |

| Customer Support | Email: info@sxhjas.emai |

SXHJAS Information

SXHJAS is a broker. SXHJAS provides 24/7 customer support and offers various tradable instruments, including forex, stocks, futures, indices, crude oil, precious metals(gold and silver), cryptocurrency(bitcoin), etc. In addition, SXHJAS sets a spread from 0.

Pros and Cons

| Pros | Cons |

| 24/7 Customer Support | Suspicious Clone |

| Demo account available | Missing cost information |

| Various trading instruments: Forex, Stocks, Futures, etc. | Only email contact |

| Restricted deposit and withdrawal information |

Is SXHJAS Legit?

SXHJAS is not regulated, even though it claims to be regulated by the FCA and MSB. However, an unregulated broker is not as safe as a regulated one.

What Can I Trade on SXHJAS?

Forex, stocks, futures, indices, crude oil, precious metals(gold and silver), cryptocurrency(bitcoin), etc. are SXHJAS' trading instruments.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Futures | ✔ |

| Indices | ✔ |

| Crude Oil | ✔ |

| Precious Metals(Gold and Silver) | ✔ |

| Cryptocurrency(Bitcoin) | ✔ |

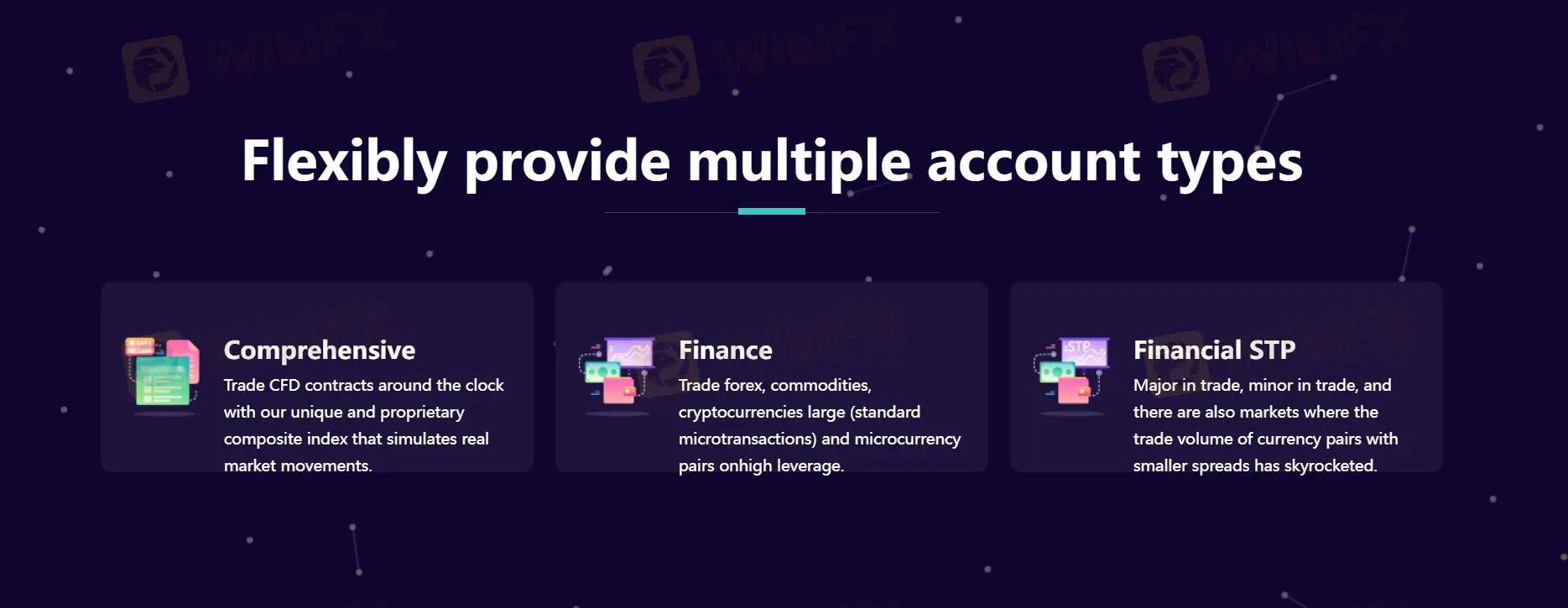

Account Type

SXHJAS has three types of accounts: comprehensive, finance, and financial STP. The three accounts are suitable for different products. For example, comprehensive is for investing in CFD contracts, finance is for high-leverage micro-currency pairs, and financial STP is for currency pairs with small spreads.

| Account Type | Comprehensive | Finance | Financial STP |

| Product | CFD contracts | Trade forex, commodities, cryptocurrencies large (standard microtransactions), and micro currency pairs on high leverage. | Major, minor, and currency pairs with smaller spreads |

SXHJAS Fees

The spread is as low as 0, but the commission is unclear. Traders need to be careful about hidden fees.

Leverage

The official website has no relevant information. Traders should be aware that leverage will magnify profits and losses.

Trading Platform

SXHJAS provides a proprietary trading platform rather than the authoritative MT4 or MT5. Traders can use SXHJASs PC(Windows) and Mobile(iPhone & Android) versions.

| Trading Platform | Supported | Available Devices |

| SXHJAS | ✔ | PC(Windows), Mobile(iPhone & Android) |

Deposit and Withdrawal

The minimum deposit and offering payment methods for deposits and withdrawals are unknown.

Customer Support Options

SXHJAS provides 24/7 customer support, and traders can communicate via email. Customer service can answer questions for traders. However, email is not as fast as a phone call, especially in emergencies.

| Contact Options | Details |

| info@sxhjas.email | |

| Supported Language | English |

| Website Language | English |

| Physical Address | Not mentioned |