Company Summary

| BRK Financial Group Review Summary | |

| Founded Year | 2-5 years |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Shares, bonds, futures, CFDs, ETFs, options, mutual funds |

| Demo Account | ✔ |

| Trading Platform | Romanian trading platform |

| Customer Support | Phone: (+4) 0364401709 |

| Email: office@brk.ro | |

BRK Financial Group Information

BRK Financial Group, founded in 1997, is a brokerage registered in the United States. The trading instruments it provides cover more than 50 types of forex , more than 70 types of shares, indices, metals, and commodities.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | Unregulated |

| Demo account available | No account type information offered |

| Romanian trading platform supported | No Islamic account |

| No clear information on the minimum deposit |

Is BRK Financial Group Legit?

It is clear that BRK Financial Group is currently unregulated.

What Can I Trade on BRK Financial Group?

BRK Finaancncial Group offers traders shares, bonds, futures, CFDs, ETFs, mutual fumutual funds to trade.

| Tradable Instruments | Supported |

| Shares | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| CFDs | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Mutual funds | ✔ |

| Commodities | ❌ |

| Metals | ❌ |

| Indices | ❌ |

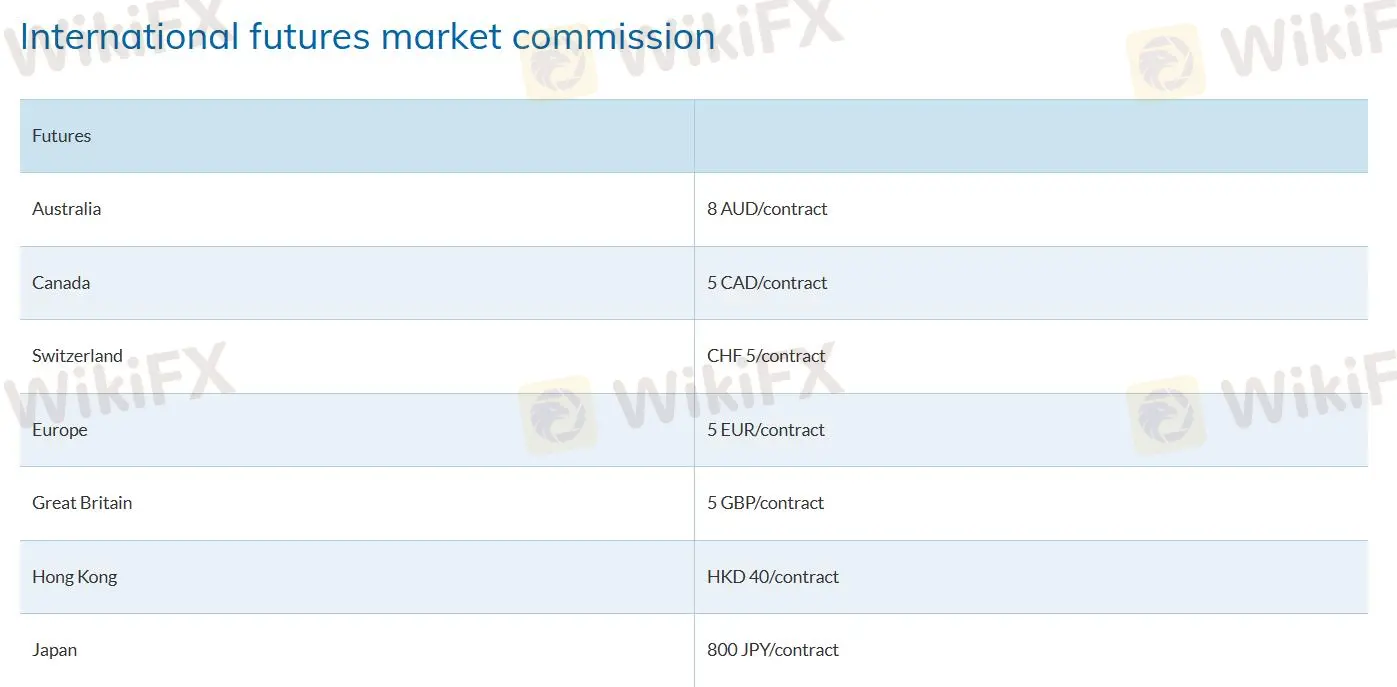

BRK Financial Group Fees

BRK Financial Group charges different commissions in different countries. For futures, it charges 8 AUD per contract in Australia, but it charges 5 CAD per contract in Canada.

| Futures | Commissions |

| Australia | 8 AUD/contract |

| Canada | 5 CAD/contract |

| Switzerland | CHF 5/contract |

| Europe | 5 EUR/contract |

| Great Britain | 5 GBP/contract |

| Hong Kong | HKD 40/contract |

| Japan | 800 JPY/contract |

Trading Platform

BRK Financial Group's trading platform is Romanian trading platform, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| Romanian trading platform | ✔ | Web, Mobile |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |