Score

CH Markets

Saint Lucia|2-5 years|

Saint Lucia|2-5 years| https://chmarkets.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

Bulgaria

BulgariaContact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+92 212 271 00 62

Other ways of contact

Broker Information

More

CH Markets

CH Markets

Saint Lucia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 12 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | -- |

| Minimum Spread | 0.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $0 |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | -- |

| Minimum Spread | 1.3 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $0 |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | -- |

| Minimum Spread | 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $0-$10 |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | -- |

| Minimum Spread | 1.1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $0 |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed CH Markets also viewed..

XM

MiTRADE

GO MARKETS

FBS

CH Markets · Company Summary

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| CH Markets Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, stocks, indices, commodities, cryptocurrencies |

| Demo Account | N/A |

| Leverage | 1:1000 |

| EUR/USD Spread | 1.1 pips (Std) |

| Trading Platforms | MT5 |

| Minimum Deposit | N/A |

| Customer Support | telephone, 24/7 live chat, email, online messaging |

What is CH Markets?

CH Markets is a brokerage firm that offers a variety of trading instruments across different asset classes, including Forex, stocks, indices, commodities, and cryptocurrencies. With a range of account types and competitive trading conditions, CH Markets aims to provide a comprehensive trading experience for clients. The brokerage offers the MetaTrader 5 (MT5) platform as its primary trading platform and provides access to tools like an Economic Calendar to keep traders informed about important events that may impact the markets.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

Pros & Cons

| Pros | Cons |

| • Wide Range of Trading Instruments | • Limited Account Types |

| • Competitive Spreads and Commission | • Limited Educational Resources |

| • Multiple Customer Support Channels | |

| • 24/7 Customer Service |

CH Markets Alternative Brokers

There are many alternative brokers to CH Markets depending on the specific needs and preferences of the trader. Some popular options include:

Degiro - Particularly popular in Europe, Degiro offers low-cost trading and a user-friendly platform, making it a good choice for cost-conscious investors in the European market.

IG - A globally recognized broker known for its competitive spreads, extensive market coverage, and user-friendly platforms - recommended for traders of all levels seeking a reliable and feature-rich trading environment.

Avatrade - A well-regulated broker with a comprehensive range of trading instruments and multiple trading platforms - recommended for traders looking for a diverse range of markets and advanced trading tools.

Is CH Markets Safe or Scam?

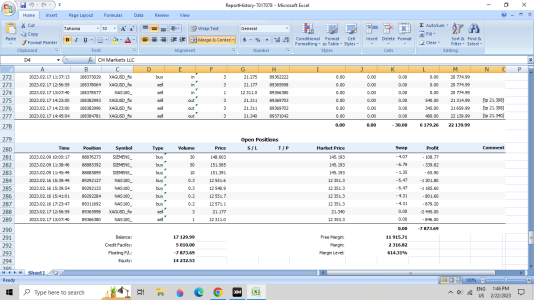

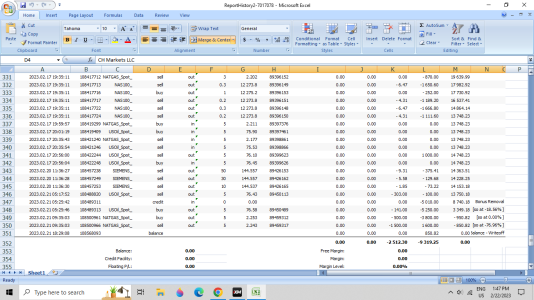

Based on the information provided, there are some concerning aspects regarding CH Markets. It is worth noting that CH Markets is stated to have no valid regulation, which can raise questions about the security and oversight of their operations. Additionally, there are reports of difficulties in withdrawing funds and instances of potential scams associated with CH Markets.

While CH Markets offers a variety of trading instruments, competitive trading conditions, and customer support channels, the absence of valid regulation and reports of withdrawal issues and scams are significant red flags that cannot be ignored. These factors cast doubt on the reliability and trustworthiness of the brokerage.

Given the potential risks and the importance of ensuring the safety of funds and a fair trading environment, it is advisable for traders to exercise caution when considering CH Markets as a brokerage option. Conducting thorough research, seeking reputable alternatives with proper regulatory oversight, and consulting with experienced traders or financial professionals would be prudent steps to take before engaging with CH Markets or any similar brokerage firm.

Market Instruments

CH Markets provides access to the foreign exchange market, where traders can trade currency pairs. Forex trading allows participants to speculate on the exchange rate fluctuations between different currencies, aiming to profit from these price movements.

CH Markets enables traders to invest in individual stocks of publicly traded companies. Stocks represent ownership in a company and trading them provides opportunities to benefit from changes in their prices, as well as dividends and other corporate actions.

Moreover, CH Markets also offers trading on indices, which are composed of a basket of stocks representing a specific market or sector. Traders can speculate on the overall performance of an index, such as the S&P 500 or the FTSE 100, without the need to trade individual stocks.

In addition, CH Markets provides access to various commodities, including precious metals (gold, silver), energy resources (crude oil, natural gas), agricultural products (corn, wheat), and more. Trading commodities allows investors to take advantage of price movements driven by factors like supply and demand, geopolitical events, and weather conditions.

Lastly, CH Markets supports trading in cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, and others. Cryptocurrencies are digital assets that utilize cryptographic technology for secure transactions and operate independently of central banks. Trading in cryptocurrencies can be highly volatile and provides opportunities for traders to profit from their price fluctuations.

Account

CH Markets offers various types of trading accounts to cater to the diverse needs and preferences of traders. The following are the four types of accounts offered by the broker:

The CH Standard account is designed for traders who prefer a standard trading experience. It typically offers competitive spreads, access to a wide range of trading instruments, and various trading platforms to execute trades. This account type is suitable for both beginner and experienced traders looking for a straightforward trading environment.

The CH Zero account is tailored for traders who prioritize low spreads and fast execution. It offers tighter spreads compared to the standard account, which can be beneficial for traders focused on scalping or short-term trading strategies. The CH Zero account may also have certain trading commissions associated with it.

The CH Fixed account is characterized by fixed spreads, meaning the spread remains constant regardless of market volatility. This account type is suitable for traders who prefer stability and want to know their trading costs upfront. It can be particularly useful during times of high market volatility when spreads tend to widen.

The CH VIP account is designed for high-volume and experienced traders who require personalized services and additional features. It often includes benefits like dedicated account managers, premium support, custom trading conditions, and priority access to new features and promotions. The CH VIP account may have specific requirements, such as higher minimum deposit amounts or trading volumes.

Leverage

CH Markets offers a maximum leverage of 1:1000 for all types of trading accounts. Leverage is a financial tool that allows traders to control positions in the market that exceed their initial investment. It essentially amplifies the potential profits or losses of a trade.

With a leverage ratio of 1:1000, traders can trade with a position size up to 1000 times their account balance. For example, if a trader has a $1,000 account balance, they can potentially control a position worth up to $1,000,000. This high leverage can provide traders with the opportunity to make significant gains from relatively small market movements.

Traders should also consider their trading experience, risk tolerance, and the volatility of the chosen market when deciding on the appropriate leverage level. While high leverage can offer potential rewards, it is essential to be aware of the associated risks and use leverage responsibly.

Spreads & Commissions

CH Markets offers competitive spreads and commission structures across its different account types.

For CH Standard account, the broker typically offers spreads starting from 1.1 pips. Spreads represent the difference between the bid and ask price of a trading instrument, and lower spreads generally indicate better trading conditions. The CH Standard account usually does not charge any commissions per trade. This means that traders can execute trades without incurring additional fees beyond the spread.

The CH Zero account, on the other hand, is designed for traders who prefer tight spreads. It offers spreads as low as 0.0 pips, which means that traders can enter the market for certain trading instruments at a cost close to zero. However, it is important to note that CH Zero accounts may have commissions associated with them, as described below. The CH Zero account may have associated commissions, typically ranging from $0 to $10 per lot traded. The specific commission structure may depend on the trading instrument and trading volume. Traders should carefully review the details provided by CH Markets to understand the commission charges applicable to the CH Zero account.

In addition, the broker provides CH Fixed accounts with fixed spreads that typically start at 1.3 pips. Fixed spreads don't change regardless of the state of the market, giving traders predictable and open trading costs. Similar to the CH Standard account, the CH Fixed account generally does not impose any commissions on trades. Traders can execute trades with confidence, knowing that they are not subject to additional commission fees.

Lastly, the broker also offers competitive spreads for CH VIP accounts, usually starting at 0.5 pips. Traders with CH VIP accounts can enjoy tighter spreads than other account types, enhancing their potential trading advantage. The CH VIP account typically does not charge any commissions per trade, similar to the CH Standard and CH Fixed accounts. Traders with a CH VIP account can enjoy the benefits and features of the account type without incurring separate commission charges.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| CH Markets | 1.1 pips (Std) | $0 (CH Standard, CH Fixed, CH VIP), $0-$10 (CH Zero) |

| Degiro | Variable | €0 (Free ETF trading) |

| IG | From 0.6 pips | $0 (Some accounts may have custody fees) |

| Avatrade | From 0.9 pips | $0 (Spreads may vary depending on the account type) |

Trading Platform

CH Markets offers the MetaTrader 5 (MT5) trading platform to its clients, which is a widely recognized and popular trading platform in the financial industry. The MT5 platform offers a wide range of trading instruments across various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies, providing traders with ample opportunities to diversify their portfolios.

The platform also supports mobile trading, allowing clients to trade on-the-go using their smartphones or tablets. The MT5 mobile app offers a user-friendly interface, full trading functionality, and real-time account monitoring, enabling traders to stay connected to the markets wherever they are.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| CH Markets | MetaTrader 5 (MT5) |

| Degiro | WebTrader, Mobile app |

| IG | IG Trading Platform, MetaTrader 4 (MT4) |

| Avatrade | AvaTradeGo, MetaTrader 4 (MT4), AvaOptions |

Trading Tools

CH Markets provides an Economic Calendar as one of its trading tools, which is a valuable resource for traders to stay informed about upcoming economic events and their potential impact on the financial markets.

The CH Markets Economic Calendar may offer additional features to enhance its functionality. These features may include filtering options to customize the calendar view based on specific countries, economic indicators, or event types. Traders can also set up alerts or notifications to receive reminders about important upcoming events. The availability of historical data and analysis related to past economic events may further assist traders in assessing their potential impact on the markets.

Using the CH Markets Economic Calendar, traders can align their trading strategies with major economic events and data releases, enabling them to take advantage of potential market opportunities while managing their risk effectively. By staying informed about upcoming events and their potential impact on the markets, traders can enhance their understanding of market dynamics and make more informed trading decisions.

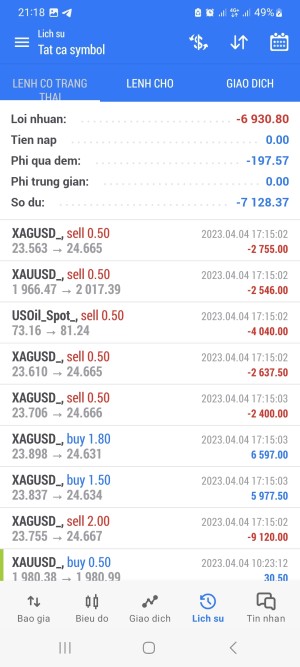

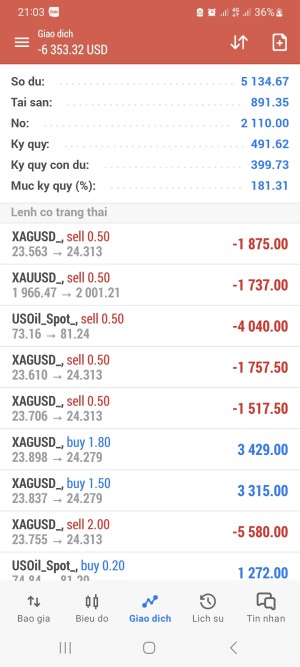

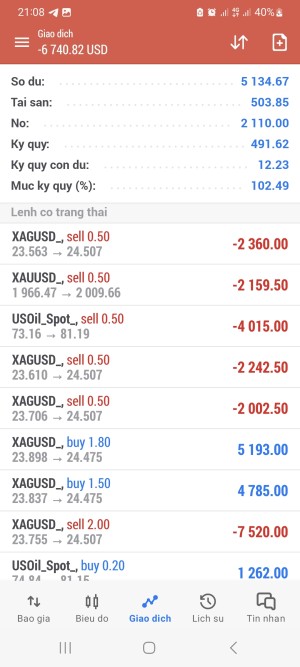

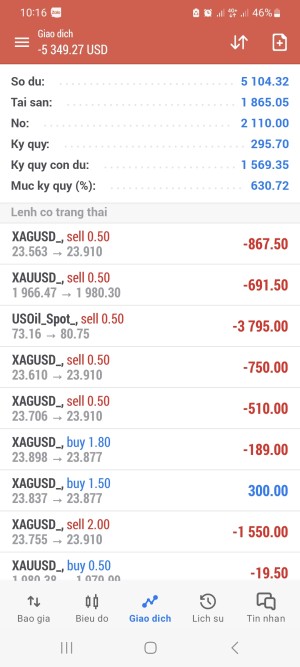

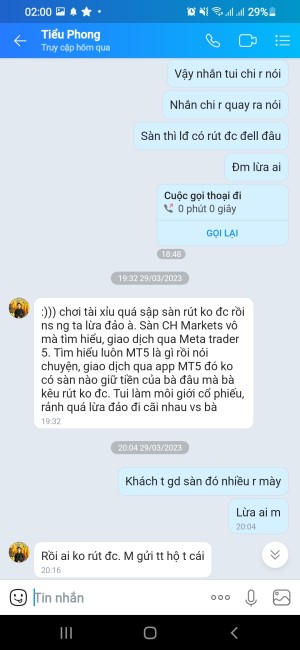

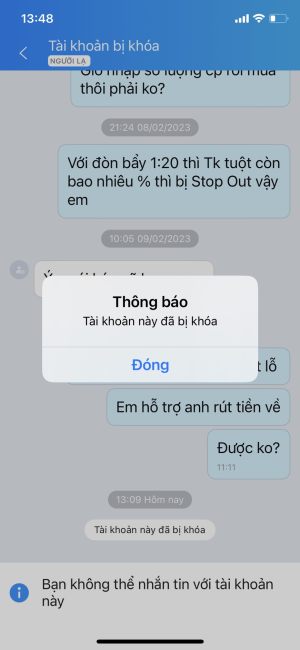

User Exposure on WikiFX

You may find reports of frauds and withdrawal issues on our website. Investors are urged to evaluate the risks involved with trading on an unregulated platform and carefully study the information offered. Before trading, you may check the information on our site. Please let us know in the Exposure area if you come across any such dishonest brokers or if you have been the victim of one. We would appreciate that, and our team of professionals will make every effort to help you solve the problem.

Customer Service

CH Markets provides telephone support to clients via a dedicated phone line:+902122710062. The availability of telephone support allows clients to directly communicate with customer service representatives, enabling them to receive immediate assistance, ask questions, and address any concerns they may have. The 24/7 availability of telephone support ensures that clients can reach out for help at any time, regardless of their location or time zone.

CH Markets offers a 24/7 live chat feature, allowing clients to engage in real-time conversations with customer service representatives. Live chat provides a convenient and efficient way for clients to seek assistance, receive quick responses to their queries, and resolve any issues they may encounter. The live chat feature is especially beneficial for clients who prefer instant messaging and prefer a more interactive support experience.

Clients can also contact CH Markets' customer service team via email: support@chmarkets.com. By sending an email to the provided support email address, clients can articulate their questions, concerns, or requests in a written format. Email support allows clients to provide detailed information, attach relevant documents if necessary, and receive responses directly in their inbox. While email support may have a slightly longer response time compared to live chat or telephone support, it is a reliable channel for non-urgent inquiries or when clients prefer written communication.

Registered Address: Fortgate Offshore Investment and Legal Services Ltd. Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucla

Operational Address: Maslak Mahallesi, Sumer Sokak, Ayazaga Ticaret Merkezi, No:3/14, Sisli, Sariyer, Istanbul

You can also get in touch with this broker on social media of LinkedIn, Twitter, Facebook, Instagram, and YouTube.

Pros and cons of customer service of CH Markets make a table:

| Pros | Cons |

| • 24/7 Availability | N/A |

| • Multiple Contact Channels | |

| • Interactive Support |

Conclusion

In conclusion, CH Markets presents itself as a brokerage firm with a diverse range of trading instruments and competitive trading conditions. Its offering includes various account types, maximum leverage of 1:1000, and competitive spreads and commissions. CH Markets' customer service offers 24/7 support through multiple channels, enabling clients to seek assistance conveniently. While there are limitations in terms of account types and trading platforms, as well as the availability of educational resources and language support, CH Markets strives to cater to the needs of traders and provide a positive trading experience overall. However, it's necessary to consider that the broker is not regulated as well as some user exposure issues.

Frequently Asked Questions (FAQs)

Q1: What trading instruments are available at CH Markets?

A1: CH Markets offers a variety of trading instruments across different asset classes, including Forex, stocks, indices, commodities, and cryptocurrencies.

Q2: What is the maximum leverage offered by CH Markets?

A2: CH Markets provides a maximum leverage of 1:1000 for all types of accounts.

Q3: Which trading platform does CH Markets offer?

A3: CH Markets offers the MetaTrader 5 (MT5) platform as its primary trading platform.

Q4: Does CH Markets have any regional restrictions?

A4: CH Markets LTD. does not offer its services to residents of certain jurisdictions such as North Korea, United States, Puerto Rico, Canada, Japan, Iran, Iraq, Lebanon, Turkey.

Q5: What are the customer service options available at CH Markets?

A5: CH Markets provides customer service through telephone, live chat (24/7), and email support.

Q6: Is CH Markets customer service available 24/7?

A6: Yes, CH Markets offers round-the-clock customer service, ensuring clients can seek assistance at any time.

Review 20

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now