Company Summary

| Guardian Invest Review Summary in 10 Points | |

| Founded | 2023 |

| Registered Country/Region | China |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Stocks, Commodities |

| Demo Account | Not Available |

| Leverage | Up to 1:100 |

| EUR/USD Spread | Not disclosed |

| Trading Platforms | WebTrader |

| Minimum Deposit | USD 250 |

| Customer Support | Email, Contact us form |

What is Guardian Invest?

Guardian Invest, a brokerage firm based in China, provides traders with access to a range of instruments encompassing Forex, Indices, Stocks, and Commodities. However, a noteworthy aspect of concern is the absence of valid regulations governing the broker's operations, regulatory void of which raises concerns regarding the security, transparency, and adherence to industry standards that traders typically expect from regulated brokers.

In the upcoming article, we will thoroughly scrutinize this broker's attributes from various perspectives, aiming to provide well-structured and concise information. If this piques your interest, we encourage you to continue reading. At the conclusion of our analysis, we will provide a brief summary, offering you a quick overview of the broker's distinctive qualities.

Pros & Cons

| Pros | Cons |

| • Multiple payment methods supported | • Unregulated |

| • Trading tools and educational resources available | • Limited info on spread/ commission |

| • Negative balance protection | • No MT4/5 platforms |

| • Multiple account types | • Limited customer support options |

| • No deposit/withdrawal fees | • Not accept clients from the USA, China and Ukraine |

| • Flexible leverage ratios |

Guardian Invest presents a mix of advantages and disadvantages for traders to consider.

On the positive side, the broker offers a wide array of payment methods, ensuring flexibility for clients. It also provides comprehensive educational resources and trading tools, promoting trader development. The inclusion of negative balance protection is a notable safety feature. Additionally, Guardian Invest caters to varying trading preferences with multiple account types and offers flexible leverage ratios. Moreover, the absence of deposit/withdrawal fees is a cost-saving benefit.

However, on the downside, the broker operates without regulatory oversight, raising concerns about security and transparency. Information regarding spreads and commissions is limited, and the absence of popular trading platforms like MT4/5 might deter some traders. Limited customer support options could be a drawback for those seeking extensive assistance. Lastly, the restriction on clients from the USA, China, and Ukraine may limit its accessibility to traders from these regions.

Traders should weigh these pros and cons carefully when considering Guardian Invest as their brokerage.

Is Guardian Invest Safe or Scam?

When considering the safety of a brokerage like Guardian Invest or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: The absence of regulation by major financial authorities leaves Guardian Invest without the assurance of being a secure platform for financial services. This regulatory vacuum raises doubts about the platform's safety and adherence to industry standards when it comes to trading and financial transactions.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the brokerage. Look for reviews on reputable websites and forums.

Security measures: Guardian Invest prioritizes security with negative balance protection, safeguarding traders from potential debt, and segregated accounts to ensure that client funds remain separate from the company's operational funds, enhancing the safety of client investments and financial transactions on the platform.

Ultimately, the decision of whether or not to trade with Guardian Invest is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

Guardian Invest offers an extensive range of market instruments, catering to various trading preferences.

Firstly, in the realm of Forex, traders can engage in the dynamic currency markets, capitalizing on fluctuations in exchange rates to potentially yield profits.

Secondly, the inclusion of Indices allows traders to invest in entire stock market segments, rather than individual stocks, providing diversification and exposure to broader market trends.

Thirdly, the availability of Stocks enables traders to invest in specific publicly traded companies such as Apple, Tesla etc., benefiting from potential capital appreciation and dividends.

Fourthly, Commodities, including precious metals like gold and silver, as well as agricultural products like sugar, cocoa and cotton, offer opportunities for traders to navigate these markets, driven by global supply and demand dynamics.

Account Types

Guardian Invest caters to a range of trader preferences by offering four distinct account types: Start, Medium, Classic, and Diamond Accounts, each tailored to accommodate varying trading goals.

The Start Account comes with a modest minimum deposit requirement of $250, ideal for those beginning their trading journey.

For traders seeking more extensive opportunities, the Medium Account with a $5,000 minimum deposit offers increased access to market instruments.

The Classic Account, requiring a minimum deposit of $20,000, is suitable for experienced traders aiming for diversified portfolios.

Lastly, the Diamond Account, with a minimum deposit of $50,000, provides advanced traders with premium features and enhanced benefits.

This tiered approach ensures that traders of all levels can find an account that aligns with their financial objectives and trading proficiency.

Leverage

Guardian Invests each account type accommodates varying levels of leverage to cater to different trading preferences.

The Start Account provides a leverage of 1:20, offering a balanced approach for traders who want to manage risk while exploring the markets.

The Medium Account offers a leverage of 1:50, allowing for increased trading flexibility and potential returns.

For those seeking more extensive opportunities, the Classic Account offers a leverage of 1:80, while the Diamond Account provides the highest leverage at 1:100, making it suitable for experienced traders looking to maximize their trading potential.

However, it's crucial for traders to remain acutely aware that leverage can amplify both returns and risks in their trading endeavors. It's imperative to exercise due diligence and approach trading with caution, particularly when utilizing higher leverage ratios. A solid understanding of the associated risks and a well-defined risk management strategy are essential to navigate the markets safely and effectively.

Trading Platforms

Guardian Invest's WebTrader platform is a versatile option, accessible from any device through a web browser. This accessibility accommodates traders at various experience levels, providing opportunities for all. The platform offers an array of advanced technical analysis tools, indicators, and technologies, enabling traders to harness these resources to potentially enhance their income.

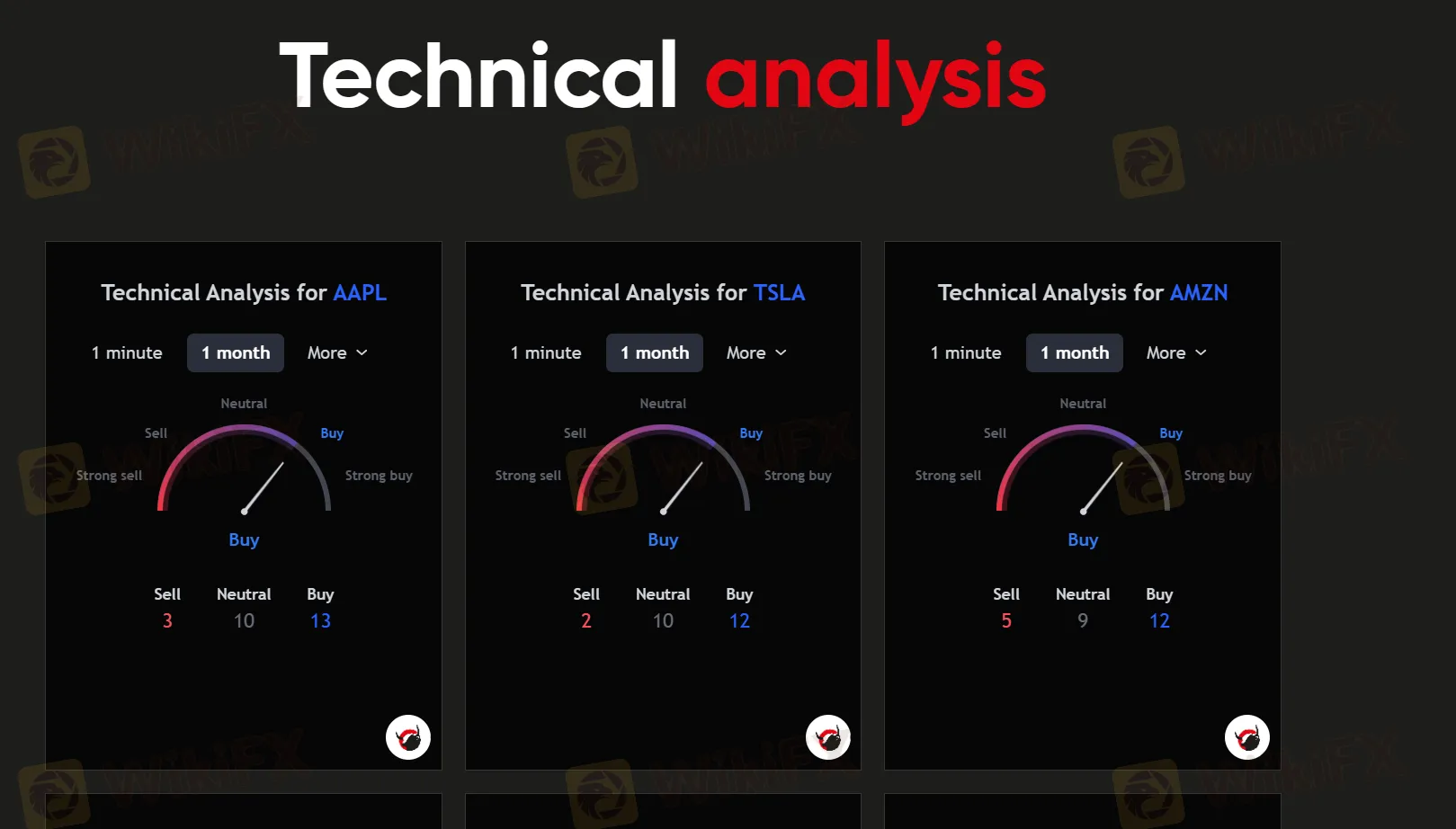

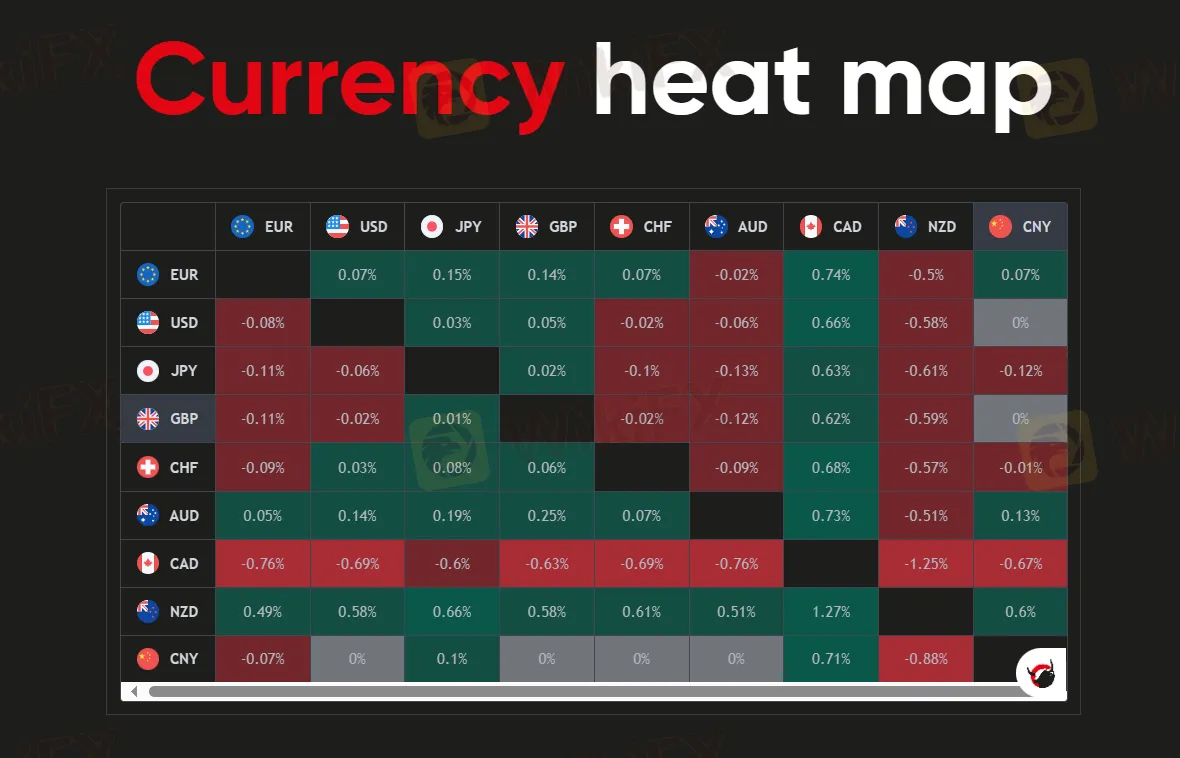

Trading Tools

Guardian Invest offers a comprehensive set of trading tools to empower traders in their financial endeavors.

These tools encompass advanced technical analysis resources, enabling traders to delve into historical price data, patterns, and various technical indicators for precise market analysis.

Additionally, the inclusion of heat maps provides a visually intuitive way to assess asset performance, aiding in the identification of trends and outliers.

Whether traders are seeking to refine their strategies or explore new opportunities, Guardian Invest's trading tools provide the necessary resources to facilitate informed decision-making and potentially enhance trading outcomes.

Deposits & Withdrawals

In Guardian Invest, clients can deposit funds through bank/wire transfers, legitimate crypto wallets, or credit/debit cards. Deposits may take up to 5 business days to appear in the trading account, and clients are encouraged to keep payment receipts for verification.

Withdrawals must generally be performed through the same bank account or credit/debit card used for deposits. The withdrawal request process involves filling out a form, signing it, and ensuring compliance documentation is approved. The withdrawal processing time typically ranges from 4-7 business days.

Here is a table summarizing the key information:

| Deposit Methods | Bank/Wire Transfer, Crypto Wallet, Credit/Debit Cards |

| Minimum Deposit (Credit/Debit) | $250 USD |

| Maximum Deposit (Credit/Debit) | Unlimited |

| Deposit Processing Time | Up to 5 business days |

| Withdrawal Methods | Same source as deposit (bank or card) |

| Withdrawal Processing Time | 4-7 business days |

| Additional Fees | Possible fees from intermediary banks or credit card issuers may apply |

| Currency | Transactions can be in various FIAT currencies, with exchange rates at the company's discretion |

Please note that clients should refer to the company's Terms and Conditions for the most up-to-date information on deposit and withdrawal policies.

Customer Service

Guardian Invest provides customer support through email and a contact us form during their operating hours from Monday to Friday, between 9:00 AM and 6:00 PM. This availability allows clients to reach out for assistance and inquiries within designated business hours for prompt responses and support.

Email: compliance@guardianinvest.co

Education

Guardian Invest offers an educational platform known as the “Academy,” providing valuable training resources for traders.

This platform is designed to equip traders, both novice and experienced, with the knowledge and skills needed to navigate financial markets successfully. Through a variety of educational materials, traders can enhance their trading strategies and deepen their understanding of the financial world.

The Academy by Guardian Invest serves as a valuable resource for those looking to improve their trading skills and make informed investment decisions.

Conclusion

In light of the available information, Guardian Invest is a China-based brokerage firm offering a diverse array of market instruments, such as Forex, Indices, Stocks, and Commodities. Nevertheless, it is important to note that the brokerage currently lacks valid regulatory oversight which is an immediate red flag. Consequently, traders considering Guardian Invest as their trading platform should exercise prudence and conduct comprehensive due diligence. Exploring alternative brokerages with established regulatory frameworks, known for their commitment to transparency, security, and accountability, is advisable to ensure a safer trading environment.

Frequently Asked Questions (FAQs)

| Q 1: | Is Guardian Invest regulated? |

| A 1: | No. It has been verified that this broker is currently under no valid regulation. |

| Q 2: | What kind of trading instruments does Guardian Invest offer? |

| A 2: | Guardian Invest is a China-based brokerage firm offers Forex, Indices, Stocks, Commodities as market instruments to traders. |

| Q 3: | Is Guardian Invest a good broker for beginners? |

| A 3: | No. It is not a good choice for beginners because of its unregulated condition. |

| Q 4: | Does Guardian Invest offer the industry leading MT4 & MT5? |

| A 4: | No. |

| Q 5: | Does Guardian Invest offer a demo account? |

| A 5: | No. |

| Q 6: | What is the minimum deposit for Guardian Invest? |

| A 6: | The minimum initial deposit to open an account is $250. |

| Q 7: | At Guardian Invest, are there any regional restrictions for traders? |

| A 7: | Yes. Guardian Invest does not work with the following jurisdiction: USA, China and Ukraine. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.