No data

Do you want to know which is the better broker between Tradeview and Binary.com ?

In the table below, you can compare the features of Tradeview , Binary.com side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of tradeview, binary-com lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | Cayman Islands |

| Found | 2004 |

| Regulation | LFSA |

| Market Instrument | Forex, Indices CFDs, Commodities, and Cryptocurrencies |

| Account Type | X leverage account and Innovative Liquidity Connector account |

| Demo Account | yes |

| Maximum Leverage | 1:400 |

| Spread (EUR/USD) | Floating around 0.3 pips |

| Commission | X Leverage account: no; Innovative Liquidity Connector account: $5 per lot |

| Trading Platform | MT4, MT5, cTrader and Currenex |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | bank wire transfers, credit cards, Skrill, Neteller, STICPAY, Fasapay, etc. |

Tradeview is an online ECN broker based in the Cayman Islands, founded in 2004. Tradeview is a regulated brokerage firm operating in the Cayman Islands and regulated in Malaysia.The company offers Straight Through Processing (STP) and holds a full license for MT4/5, providing traders with access to various financial markets. Tradeview allows trading in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and XRP, as well as major stock market indices and commodities like gold, silver, and crude oil. The brokerage offers two trading account options: the X leverage account and the Innovative Liquidity Connector account, catering to different types of traders.

Tradeview supports multiple trading platforms, including Metatrader 4, Metatrader 5, cTrader, and Currenex. These platforms offer advanced features, charting capabilities, and a wide range of technical indicators. The company also provides a comprehensive trading platform, an economic calendar, and educational resources such as a glossary and financial blogs.

Tradeview offers various payment methods, including bank wire transfers, credit cards, and alternative options. However, there have been concerns raised by customers, including difficulties with fund withdrawals, server errors, suspicious trading practices, and lackluster customer support. Some users have also reported discrepancies in payment methods and fees.

Here is the home page of this brokers official site:

Tradeview, a regulated brokerage based in the Cayman Islands, offers a diverse range of market instruments, including cryptocurrencies, stock market indices, commodities, and currency pairs. However, there are some drawbacks to consider. The spread values for trading are not provided in the available information, and there is a lack of detailed information on leverage, margin requirements, trading hours, and specific contract specifications. Additionally, there is limited information on trading fees, commissions, and the features and advantages of certain account types and trading platforms. There have been concerns raised by customers regarding difficulties in withdrawing funds, server errors, abnormal trading practices, and poor customer support. These factors indicate a need for further research and caution before engaging with Tradeview as a trading platform.

| Pros | Cons |

| Diverse range of market instruments | Spread values not provided in the table |

| Access to multiple trading platforms | Lack of detailed information on the Innovative Liquidity Connector account |

| Demo account available for practice trading | Limited information on account features |

| Opportunity for traders with limited funds | Limited information on the specific features and capabilities of the trading platforms |

| Wide range of deposit options | Bank wire withdrawal fee |

| No fees for most withdrawal methods | Fees for Skrill and Neteller |

| Reviews highlighting concerns related to withdrawal issues, |

Based on the information provided, Tradeview Ltd is regulated by the Cayman Islands Monetary Authority (CIMA) with license number 585163. However, the provided information indicates that Tradeview Ltd has exceeded its business scope regulated by CIMA and has received a risk alert from WikiFX. The alert suggests that Tradeview Ltd is operating with a license that does not cover its current business activities.

Tradeview currently offers investors trading in Forex, Indices CFDs, Commodities, and Cryptocurrencies like Litecoin, Bitcoin, Ethereum, Ripple and more.

Cryptos:

Tradeview offers several cryptocurrencies for trading, including BTCUSD (Bitcoin to US Dollar), BTCJPY (Bitcoin to Japanese Yen), ETHUSD (Ethereum to US Dollar), LTCUSD (Litecoin to US Dollar), and XBNUSD (XRP to US Dollar). These instruments allow traders to speculate on the price movements of various cryptocurrencies.

Indices:

Tradeview provides trading opportunities in different indices such as GDAXI (German DAX 30), NDX (NASDAQ 100), AUS200 (Australian 200), FCHI (French CAC 40), SPXm (S&P 500 mini), and WS30 (Dow Jones Industrial Average). Traders can take positions based on the performance of these stock market indices.

Commodities:

The commodities available for trading on Tradeview include GOLD (Gold), SILVER (Silver), CRUDE (Crude Oil), NGAS (Natural Gas), GOLDEUR (Gold to Euro), and UKOIL (UK Brent Crude Oil). Traders can speculate on the price fluctuations of these commodities

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments | Spread values not provided in the table |

| Opportunity to trade popular cryptocurrencies | Lack of information on leverage, margin requirements, and trading hours |

| Access to major stock market indices | Limited information on specific commodity contracts |

| Ability to trade in commodities | Limited information on cryptocurrency trading pairs |

| Wide selection of currency pairs | No information on trading fees or commissions |

There are two trading account options available at Tradeview: the X leverage account and the Innovative Liquidity Connector account. The minimum deposit to open an X leverage account is $100, which sounds quite reasonable for most regular traders to have a try.

Tradeview also offers a free live demo account where users can trade across MT4, MT5, cTrader and CurreneX platforms. Users can learn to trade in real-time, and practice trading strategies with technical indicators while avoiding money risks.

To open an account with Tradeview, follow these steps:

Go to the Tradeview website.

Look for the “Open Account” button on the homepage and click on it.

3. On the account types page, you will see different options. To start with a demo account, click on the “Demo Account” option. If you want to open a live trading account, proceed to the next step.

4. Select the type of account you want to open. Tradeview offers three options: “Individual Application,” “Joint Account Application,” and “Corporate Account Application.” Choose the one that suits your needs and click on it.

5. Fill out the basic information form. Provide accurate details such as your name, email address, phone number, country of residence, and desired account currency.

6. Next, you need to choose a trading platform. Tradeview offers several platforms, such as MT4, MT5, cTrader, and Currenex. Select the platform you prefer for trading.

7. Select the currency type for your account. You can choose between USD (United States Dollar) and EUR (Euro).

8. Proceed to fill in the primary account holder information. This includes personal details like your full name, date of birth, residential address, and occupation.

9. Read and review the Individual Agreement carefully. This document outlines the terms and conditions for opening and using an individual trading account with Tradeview. Make sure you understand and agree to the terms before proceeding.

10. Once you have completed all the required information, click on the “Submit” or “Open Account” button to submit your application.

After submitting your application, Tradeview may require additional documentation to verify your identity and address. This typically includes providing a copy of your identification documents (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement). Make sure to follow any instructions provided by Tradeview to complete the verification process.

Leverage differs for each account. For ILC (Innovative Liquidity Connector) accounts, the maximum trading leverage is 1:100 while on X Leverage accounts, it is up to 1:400. The minimum trade size is 0.1 lots on the ILC account and 0.01 lots on the X leverage account.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

All spreads with Tradeview are a floating type and scaled with the asset class. For example, the EUR/USD spread is floating around 0.3 pips. There is no commission on the X Leverage account, while the Innovative Liquidity Connector account has to pay a commission of $5 per lot.

Traders are free to choose from four different trading platforms, Metatrader4, Metatrader5, cTrader, and Currenex, depending on their trading experience and trading needs.

Tradeview offers four trading platforms to choose from: Metatrader 4, Metatrader 5, cTrader, and Currenex. These platforms provide traders with advanced tools and features to enhance their forex trading experience.

Metatrader 4 (MT4) is a widely recognized platform in the forex industry. It offers a user-friendly interface, extensive charting capabilities, and a wide range of technical indicators. Traders can execute trades, set up automated trading strategies, and access a vast marketplace of third-party plugins and expert advisors.

Metatrader 5 (MT5) is the successor to MT4 and offers enhanced features and functionality. It provides an improved trading environment, additional order types, advanced analytical tools, and more options for customization. MT5 also allows traders to access various financial markets, including cryptocurrencies.

cTrader is a powerful and innovative trading platform known for its advanced order execution capabilities and comprehensive charting tools. It provides direct market access (DMA) and enables traders to execute trades quickly. cTrader also offers a range of features such as depth of market (DOM), detachable charts, and customizable layouts.

Currenex is a platform designed specifically for institutional and professional traders. It offers deep liquidity, fast order execution, and advanced trading tools. Currenex provides access to a wide range of currency pairs and allows for high-volume trading.

| Pros | Cons |

| User-friendly interface of MT4 and MT5 | Limited information on the specific features and capabilities of the platforms |

| Extensive charting capabilities on MT4 and MT5 | No information on the features and advantages of cTrader and Currenex |

| Access to a wide range of technical indicators on MT4 and MT5 | Lack of details on the execution speed and order types offered by each platform |

| Availability of third-party plugins and expert advisors on MT4 | Limited information on the customization options and tools provided by each platform |

| Direct market access and advanced order execution on cTrader | Insufficient information on the platform's compatibility with different devices and operating systems |

| Currenex platform tailored for institutional and professional traders | No information on the pricing structure or fees associated with using the platforms |

Tradeview offers two trading tools that provide valuable features and functionality for traders. These tools are designed to assist traders in making informed decisions and executing their trading strategies.

Trading Platform: Tradeview provides a comprehensive trading platform that allows traders to access various financial markets and instruments. The platform offers a user-friendly interface with advanced charting capabilities, real-time market data, and a range of order types for executing trades. Traders can analyze price movements, monitor positions, and implement trading strategies directly from the platform. The trading platform is accessible on desktop computers, as well as mobile devices, enabling traders to stay connected to the markets at all times.

Economic Calendar: Tradeview offers an economic calendar, which is a vital tool for traders to stay updated on important economic events and their potential impact on the financial markets. The economic calendar provides a schedule of upcoming economic indicators, such as GDP releases, interest rate decisions, employment reports, and more. Traders can use this information to anticipate market movements, identify trading opportunities, and manage their risk accordingly. The economic calendar offered by Tradeview is comprehensive and provides relevant data for various regions and countries.

Pros and Cons

| Pros | Cons |

| Comprehensive trading platform | Limited information on contract specifications |

| User-friendly interface | Lack of information on trading fees |

| Advanced charting capabilities | Limited availability of trading tools and indicators |

| Real-time market data | Limited customization options for the trading platform |

Tradeview opens on Sunday at 5 pm EST and closes on Friday at 4:55 EST. Each market is subject to specific trading hours. Forex, Indices and commodities markets are open 24/5 from Monday to Friday. Trading hours for each market can also be viewed on MT4 and MT5 platforms.

Tradeview supports bank wire transfers, credit cards, Skrill, Neteller, STICPAY, Fasapay, and many other deposit and withdrawal methods.

Note that losses can exceed the initial amount invested. Third-party payments will NOT be accepted. All deposits MUST be from the original account owner.

Withdrawals are only released via the same method in which the payment was originally submitted. Tradeview does not charge fees for withdrawals. However, a hefty $35 is charged with the bank wire option and a 1%-1.5% fee for Skrill and Neteller. To submit a request for withdrawals, users have to complete a form on the website with supporting documentation.

Tradeview offers some educational materials in the form of a glossary list. They also have a website called Surf Up!, which is dedicated to educating about the FX market. The website is updated with daily news and regular financial blogs.

Tradeview operates during specific trading hours, which are as follows: The trading week starts on Sunday at 5 pm EST and ends on Friday at 4:55 pm EST. The Forex, Indices, and commodities markets are open 24 hours a day, five days a week, from Monday to Friday. For more detailed trading hour information, users can refer to the MT4 and MT5 platforms provided by Tradeview.

Tradeview provides customer support services through various channels. Traders can reach out to their customer service desk 24/5 via instant web chat. Additionally, there is a 'contact us' form available for submitting inquiries, and the support team responds to these queries via email. For direct assistance, traders can contact Tradeview by telephone at the provided numbers. Tradeview is also active on popular social media platforms such as Facebook, Twitter, LinkedIn, and Instagram. Their physical address is located at 4th Floor Harbour Place, 103 South Church St, PO Box 1105.

The reviews on WikiFX about Tradeview suggest several concerns and issues raised by customers. One user reported difficulties in withdrawing funds, encountering server errors, and expressing suspicions about the legitimacy of the platform. Another user mentioned experiencing forced liquidation and losses due to abnormal quotations and insufficient margin. Additionally, a customer complained about the broker converting their EURO deposit to RUB without their knowledge and the lack of response from customer support. Another review accused Tradeview of charging BitPay fees but paying clients via Uphold, resulting in delayed transactions and potential losses. Finally, a customer claimed that Tradeview took several days to process their BTC transaction, charged BitPay fees despite using Uphold, and suggested the company intentionally delayed transactions when the Bitcoin price was rising. These reviews highlight concerns related to withdrawal issues, abnormal trading practices, poor customer support, and potential discrepancies in payment methods and fees.

In conclusion, Tradeview has both advantages and disadvantages to consider. On the positive side, Tradeview offers a diverse range of market instruments, including cryptocurrencies, stock market indices, and commodities, providing traders with various trading opportunities. They also offer multiple trading platforms, such as Metatrader 4, Metatrader 5, cTrader, and Currenex, each with its own set of features. Additionally, Tradeview provides educational resources to help users learn about the FX market. However, there are several concerns raised by customers, including difficulties with fund withdrawals, server errors, suspicions about the platform's legitimacy, forced liquidation, and potential discrepancies in payment methods and fees. It is important for potential traders to carefully evaluate these factors before deciding to engage with Tradeview.

| Q 1: | Is Tradeview regulated? |

| A 1: | Yes. It is regulated by LFSA. |

| Q 2: | At Tradeview, are there any regional restrictions for traders? |

| A 2: | Yes. The services and products offered by Tradeview are not being offered within the United States (US) and are not being offered to US Persons, as defined under US law. The information on this website is not directed to residents of any country where FX and/or CFD trading is restricted or prohibited by local laws or regulations. |

| Q 3: | Does Tradeview offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Tradeview offer the industry-standard MT4 & MT5? |

| A 4: | Yes. Tradeview supports MT4, MT5, cTrader and Currenex. |

| Q 5: | What is the minimum deposit for Tradeview? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is Tradeview a good broker for beginners? |

| A 6: | Yes. Tradeview is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | 5-10 years |

| Company Name | Binary.com |

| Regulation | Regulated in Malaysia, Offshore Regulatory (Vanuatu) |

| Minimum Deposit | $5 |

| Maximum Leverage | Dynamic (range from 1:300 to 1:1000) |

| Spreads | Not specified |

| Trading Platforms | Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, Binary Bot |

| Tradable assets | Forex, CFDs, Derivatives, Stocks & Indices, Cryptocurrencies, Commodities |

| Account Types | Real trading and demo trading |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Phone (English, German, French), Email |

| Payment Methods | Credit/Debit Cards, E-wallets, Online Banking, Cryptocurrencies, Fiat Onramp |

Binary.com is a regulated trading platform based in the United Kingdom and has been in operation for 5-10 years. It operates under a Straight Through Processing (STP) license in Malaysia but has had its retail Forex license revoked in Vanuatu. The broker has a global business presence and is known for its high potential risk. It is important to note that Binary.com's regulatory status is classified as offshore.

Binary.com offers a wide range of market instruments, including Forex, CFDs, derivatives, stocks, indices, cryptocurrencies, and commodities. Traders can participate in various financial markets and take advantage of opportunities in different asset classes. However, it is crucial to be aware of the potential risks associated with trading on this platform, especially given the offshore regulatory status.

The broker provides several trading types, including CFDs, Multipliers, and Options, each offering unique benefits and risks. Traders can choose the trading type that aligns with their strategies and risk tolerance. It is important to note that trading with high leverage amplifies both potential profits and losses, and caution should be exercised when using leverage.

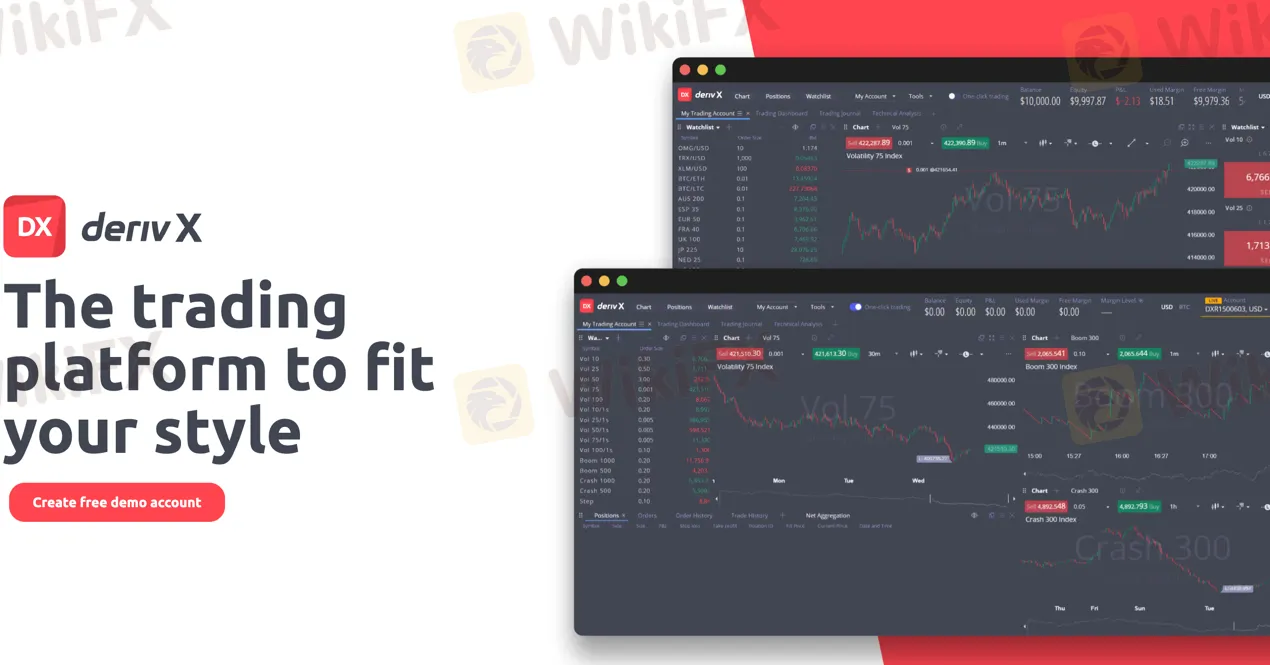

Binary.com offers a range of trading platforms, including Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, and Binary Bot. These platforms provide different features and functionalities to cater to the diverse needs of traders. However, detailed information about platform fees is not readily available, and traders should consider this aspect before choosing a specific platform.

Overall, traders considering Binary.com should be cautious due to the high potential risk associated with the broker's offshore regulatory status and the reported complaints. It is advisable to thoroughly research and understand the risks involved before engaging in trading activities on this platform.

Binary.com is a regulated broker by the Labuan Financial Services Authority in Malaysia, but its licenses in Vanuatu and the British Virgin Islands are currently revoked, raising concerns about its offshore regulatory status. The broker claims to be regulated by the Financial Services Agency in Japan, but there are suspicions that it may be a clone. WikiFX has reported 21 complaints against Binary.com in the past 3 months, indicating potential risks and scams. On the positive side, Binary.com offers a wide range of market instruments, including forex, CFDs, derivatives, stocks, indices, cryptocurrencies, and commodities, providing traders with diverse trading opportunities. However, high leverage levels can increase the risk of potential losses, and multipliers amplify both gains and losses, which can be risky. Additionally, there is limited information available on expiry dates and the website for licensed institutions. The broker offers various trading platforms, including Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, and Binary Bot, each with its own features and capabilities. However, some platforms may have limited customization options and lack advanced trading features. Overall, traders should exercise caution and consider the potential risks associated with Binary.com before engaging in trading activities.

| Pros | Cons |

| Wide range of market instruments | Revoked licenses in Vanuatu and the British Virgin Islands |

| Regulated by Labuan Financial Services Authority in Malaysia | Suspicions of being a clone regulator in Japan |

| Diverse trading opportunities | 21 complaints reported in the past 3 months |

| Regulation claimed in Japan | High leverage levels and multipliers increase risk |

| Multiple trading platforms | Limited information on expiry dates and licensed institutions' website |

Binary.com is regulated by the Labuan Financial Services Authority in Malaysia under license number MB/18/0024. It operates as Deriv (FX) Ltd with a Straight Through Processing (STP) license. However, its licenses in Vanuatu and the British Virgin Islands are currently revoked and classified as offshore regulatory. The broker also claims to be regulated by the Financial Services Agency in Japan, but it is suspected to be a clone. WikiFX has reported 21 complaints against Binary.com in the past 3 months, raising concerns about potential risks and scams.

Binary.com offers a diverse range of market instruments for traders, providing them with various opportunities to participate in financial markets.

Forex and CFDs:

Binary.com offers trading in Forex and Contract for Difference (CFDs). CFD trading allows you to speculate on the price movement of an asset without owning the underlying asset. With high leverage, you can trade CFDs by paying only a fraction of the contract's value. This amplifies potential gains but also increases potential losses.

Derivatives:

Derivatives trading allows traders to speculate on the price movements of various financial instruments without owning the underlying assets. It offers flexibility and the opportunity to trade on indices that represent specific markets or sectors. Traders can benefit from the volatility of these instruments and potentially profit from both upward and downward price movements.

Stocks & Indices:

Binary.com allows trading in global stocks of well-known brands and international stock market indices. This provides traders with access to a wide range of stocks and indices at competitive prices, expanding their trading opportunities.

Cryptocurrencies:

Binary.com offers trading in popular cryptocurrencies, taking advantage of the highly liquid cryptocurrency market. Traders can profit from predicting the movement of cryptocurrencies such as Bitcoin, Ethereum, and more.

Commodities:

Binary.com allows trading in commodities such as Metals and Energy. Traders can speculate on the price movements of these assets without owning them, benefiting from high leverage and competitive spreads.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments available | High leverage can lead to increased risk and potential losses |

| Access to global stocks, indices, and cryptocurrencies | Multipliers amplify gains and losses, increasing risk |

| CFD trading allows speculation on price movements | Regulatory status in some jurisdictions is revoked or offshore |

Binary.com offers two types of accounts: real trading and demo trading. Real trading accounts are for traders who want to engage in live trading with real money, allowing them to access various financial instruments and participate in global markets. On the other hand, demo trading accounts provide a risk-free environment for traders to practice their strategies and explore the platform using virtual funds.

Binary.com offers three exciting trade types: CFDs, Multipliers, and Options.

CFDs:

Trade CFDs on Binary.com to take advantage of leverage and low spreads, which can result in better returns on successful trades. With high leverage, you can open larger positions with a smaller balance in your trading account. It's important to keep in mind that CFDs are traded on margin, meaning you need a deposit to open a leveraged position. Trading CFDs increases both potential profit and loss, as it amplifies market exposure. Stop loss, stop out, and margin call features are available to manage risk.

Multipliers:

Multipliers on Binary.com combine leverage trading benefits with limited risk. By predicting market movements, you can multiply potential profits when the market moves in your favor. Losses are limited to your stake amount. Customizable features such as stop loss, take profit, and deal cancellation enhance risk management. With increased market exposure, you can trade multipliers 24/7 on forex and synthetics. The platform provides a responsive trading experience, with expert and friendly support available.

Options:

Binary.com offers options trading, which allows you to predict market movements and earn payouts without owning the underlying asset. You can trade digital options that offer fixed payouts based on correct predictions or lookbacks that provide payouts based on the optimum high or low achieved by the market during the contract's duration. Options trading requires minimal capital investment, making it accessible to a wide range of traders.

Pros and Cons

| Pros | Cons |

| CFDs offer leverage and low spreads | CFDs amplify potential profit and loss |

| Multipliers combine leverage and risk | Multipliers have limited losses to stake |

| Options allow participation with minimal investment | Options have fixed payouts based on correct predictions |

| Trade 24/7 on forex and synthetics | Margin requirements and market exposure |

| Risk management features available | Sudden market fluctuations can affect stop loss levels |

| Swap rates and overnight funding charges |

To open an account with Binary.com, follow these simple steps:

Visit the Binary.com website and click on the “Create a New Account” button to access the login page.

On the login page, click on the “Sign Up” option to begin the account creation process.

3. Enter your email address in the provided field to initiate the signup process.

4. Review the information regarding the creation of a demo account and confirm your age as 18 or older.

5. By clicking “Create demo account,” you acknowledge that Binary.com may use your email address to send you information about their products, services, and market news. You can unsubscribe from these emails at any time within your account settings.

6. Alternatively, you may have the option to sign up using alternative methods specified on the page.

Binary.com offers different types of leverage depending on various factors. The leverage used at Binary.com is dynamic, with a range from 1:300 to 1:1000. It's important to note that such high leverage levels may not be suitable for inexperienced traders. The use of high leverage carries significant risk, as it amplifies both profits and losses. Traders should exercise caution and consider their risk tolerance before utilizing high leverage ratios.

Binary.com offers flexibility in deposit and withdrawal options. The minimum deposit and withdrawal amounts vary depending on the payment method, with e-wallets allowing as low as 5 to 10 USD/EUR/GBP/AUD. Notably, Binary.com stands out with a minimum deposit requirement of just $5, making it more accessible compared to other brokers that typically require a minimum deposit of $250.

Binary.com offers a wide range of payment and withdrawal methods for its users. The specific fees for deposit and withdrawal are not provided by Binary.com.

Credit/Debit Cards: Binary.com accepts various credit/debit cards such as Visa, Visa Electron, Mastercard, Maestro, Diners Club International, and JCB. The minimum and maximum deposit and withdrawal amounts vary, and instant processing is available for deposits. Withdrawals may take up to 15 working days to reflect on the card, and Mastercard and Maestro withdrawals are limited to UK clients.

E-wallets: E-wallet options supported by Binary.com include Fasapay, Perfect Money, Skrill, Neteller, Webmoney, Paysafecard, Jeton, Sticpay, Airtm, Boleto, Paylivre, Online Naira, Trustly, Astropay, OneForYou, and Advcash. The deposit and withdrawal limits vary for each method, and instant processing is available for deposits. Withdrawal processing time is typically 1 working day, but may vary depending on the specific e-wallet provider.

Online Banking: Binary.com supports instant bank transfers, PayTrust, Help2Pay, ZingPay, and NganLuong for online banking transactions. The minimum and maximum deposit and withdrawal amounts vary for each method. Deposit processing time is usually 1 working day, while withdrawal processing time may vary from 1 to 3 working days.

Cryptocurrencies: Binary.com accepts deposits in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Usd Coin, and Tether. There is no minimum deposit requirement for cryptocurrencies, and the minimum withdrawal amounts are specified for each cryptocurrency. Deposit processing time is based on confirmation, and withdrawal processing time is subject to internal checks.

Fiat Onramp: Binary.com provides a fiat onramp option where users can buy cryptocurrencies on popular exchanges. The supported methods include Changelly, and Banxa, allowing users to purchase cryptocurrencies with USD, EUR, GBP, AUD, BTC, LTC, USDT, and USDC. The minimum deposit amount and deposit processing time vary depending on the chosen method.

Also, Binary.com offers a Deposit and Withdrawal process with varying minimum amounts depending on the chosen payment method. The minimum deposit and withdrawal amount can range from 5 to 10 USD/EUR/GBP/AUD when using e-wallets. It is important to note that the specific minimum amounts may vary for different payment methods. To obtain comprehensive information about the minimum deposit and withdrawal amounts for each payment method, it is advisable to refer to the Payment Methods page provided by Binary.com.

| Pros | Cons |

| Wide range of payment and withdrawal methods | Lack of detailed information on fees |

| Instant processing for many deposit methods | Longer withdrawal processing times |

| Fiat onramp options for crypto purchase | Limited availability of certain withdrawal methods for specific regions |

| No minimum deposit requirement for cryptocurrencies | Minimum withdrawal amounts may vary depending on exchange rates |

| Multiple fiat currencies available |

Deriv MT5: Deriv MT5 is an all-in-one CFD trading platform that provides access to various asset classes, including forex, stocks & indices, cryptocurrencies, commodities, and derived indices. It offers 24/7 trading and multiple trading assets on a single platform. With its quick demo account sign-up and regulation by a trusted industry pioneer, Deriv MT5 is suitable for both new and experienced traders.

Deriv X: Deriv X is a customisable multi-asset trading platform that allows trading of CFDs on forex, commodities, stocks & indices, cryptocurrencies, and derived indices. It offers a versatile trading experience with features designed to fit individual trading styles. Traders can trade on multiple markets simultaneously, customise their trading environment, and access intuitive tools such as dashboards, custom watchlists, and feature-rich charts.

Deriv EZ: Deriv EZ is a user-friendly CFDs trading platform that offers instant access to a wide variety of assets, including forex, stocks and indices, commodities, cryptocurrencies, and derived indices. It provides a seamless trading experience with no additional account ID or password required. With 24/7 trading availability, Deriv EZ allows traders to easily start trading, trade their favorite assets on a single platform, and access trading tools and indicators for informed decision-making.

Deriv GO: Deriv GO is a mobile app designed for trading multipliers on the go. It offers 24/7 trading of forex, derived indices, and cryptocurrencies. With user-friendly features, easy access to trades, and the ability to amplify profits up to 1000x with multipliers, Deriv GO provides a trading experience for traders who prefer trading on mobile devices.

SmartTrader: SmartTrader is an all-in-one CFD trading platform that offers a wide range of tradable assets, zero commissions, and 24/7 trading. It provides a simple and user-friendly interface for traders to make informed decisions.

Deriv Trader: Deriv Trader is a user-friendly trading platform offered by Binary.com. It allows traders to engage in forex, commodities, cryptocurrencies, and indices markets. The platform offers customizable chart types and trade types, with trade durations and a minimum stake of $0.35. Traders can make informed decisions using technical indicators and widgets. Overall, Deriv Trader provides a simple and versatile trading experience.

Deriv Bot: Deriv Bot is a platform that allows traders to automate their trading ideas without the need for coding. Traders can build their own trading robots using pre-built strategies or create their own from scratch. With a variety of assets to choose from, zero cost to build bots, and performance tracking features, Deriv Bot offers a solution for traders interested in algorithmic trading.

Binary Bot: Binary Bot is a platform that enables traders to automate their trading ideas without coding. It offers a range of assets to create trading bots, including pre-built strategies and the option to build custom strategies visually. Traders can use analysis tools, indicators, and logic such as take profit and stop loss to optimize their bot's performance. Binary Bot allows traders to track the bot's profitability and offers integrated help, tutorials, saving strategies on Google Drive.

| Pros | Cons |

| Wide range of assets and markets available | Limited information provided about trading platform fees |

| User-friendly interfaces and intuitive tools | Limited customization options for some platforms |

| 24/7 trading availability | Lack of advanced trading features in certain platforms |

| Quick demo account sign-up | Limited access to educational resources in some platforms |

| Regulated and trusted industry pioneer | Mobile app may have limited functionality compared to web-based platforms |

Margin Calculator:

The margin calculator provided by Binary.com allows traders to estimate the margin required to hold their positions. This calculation takes into account factors such as leverage, volume lot, and the trader's Deriv MT5 account balance. By using the margin calculator, traders can have a better understanding of the margin requirements for their trades.

Swap Calculator:

The swap calculator helps traders calculate the overnight fees associated with holding open positions. These fees can be positive or negative, depending on the swap rate. By using the swap calculator, traders can assess the potential costs or earnings from holding positions overnight, allowing for better risk management.

Pip Calculator:

The pip calculator is a useful tool for determining the value of pips in trades. It helps traders manage their risk by providing insight into the potential profits or losses based on pip movements. This information is valuable for setting appropriate stop-loss and take-profit levels.

PnL for Margin:

The PnL (Profit and Loss) margin calculator helps traders estimate the stop-loss and take-profit levels, as well as the pip value for their contracts. This information assists in mitigating risk when entering buy or sell positions. By using the PnL margin calculator, traders can plan their trades with a better understanding of potential risks and rewards.

PnL Multipliers:

The PnL multipliers calculator is specifically designed for traders using multipliers. It estimates the level and amount of the stop-loss and take-profit orders for contracts, helping traders manage their risk in case the market price moves against their predictions. This tool is particularly useful when trading with leveraged products.

| Pros | Cons |

| Provides essential tools for risk management | Limited in-depth analysis capabilities |

| Helps traders estimate margin requirements | Lacks advanced technical analysis tools |

| Facilitates calculating overnight swap fees | Does not offer extensive charting features |

| Enables pip value calculation | May not meet the needs of advanced traders |

| Assists in setting stop-loss and take-profit levels | Lack of customization options for the tools |

Binary.com offers customer support in various languages, as their website is translated into multiple languages. Traders can contact the support team through live chat, with the necessary details available in the “Contact Us” section of the website. Additionally, Binary.com provides contact information for different regions and countries.

For English support, traders can reach out via the phone number 08000119847. German support is available at +44(0)1666 800042, and French support can be contacted at +44(0)1666 800042. Traders can also connect with Binary.com through email at support@binary.com or via their Facebook page.

Binary.com has multiple offices located worldwide. In Europe, their offices are in the United Kingdom, France, Malta, Cyprus, and Guernsey. In Asia, Binary.com has offices in Malaysia, including Cyberjaya and Labuan, as well as in Ipoh, Melaka, and Singapore. They also have offices in Dubai, Jordan, Belarus, Rwanda, Paraguay, the Cayman Islands in the Caribbean, and Port Vila in Vanuatu.

These various support channels and office locations allow traders to seek assistance and get in touch with Binary.com according to their specific needs and geographical location.

In conclusion, Binary.com is a regulated broker operating under the Labuan Financial Services Authority in Malaysia with a Straight Through Processing (STP) license. However, its licenses in Vanuatu and the British Virgin Islands are currently revoked, raising concerns about its offshore regulatory status. The broker has also been reported for 21 complaints in the past 3 months, indicating potential risks and scams. While Binary.com offers a wide range of market instruments, including forex, CFDs, derivatives, stocks, indices, cryptocurrencies, and commodities, traders should be cautious of the high leverage that can lead to increased risk and potential losses. The platform lacks transparency regarding fees and expiry dates, and there is limited information available about licensed institutions. Overall, it is important for traders to carefully consider the potential disadvantages and risks associated with Binary.com before engaging in trading activities.

Q: Is Binary.com regulated?

A: Yes, Binary.com is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under license number MB/18/0024. However, its licenses in Vanuatu and the British Virgin Islands are currently revoked and classified as offshore regulatory.

Q: What market instruments does Binary.com offer?

A: Binary.com offers a diverse range of market instruments, including Forex and CFDs, derivatives, stocks & indices, cryptocurrencies, and commodities.

Q: What types of accounts does Binary.com offer?

A: Binary.com offers two types of accounts: real trading accounts for live trading with real money and demo trading accounts for practicing strategies with virtual funds.

Q: What are the trading types offered by Binary.com?

A: Binary.com offers CFDs, Multipliers, and Options trading. CFDs allow leverage trading with low spreads, multipliers combine leverage with limited risk, and options trading allows predictions and earnings without owning the underlying asset.

Q: How can I open an account with Binary.com?

A: To open an account with Binary.com, visit their website, click on “Create a New Account,” and follow the signup process by entering your email address and confirming your age.

Q: What leverage does Binary.com offer?

A: Binary.com offers dynamic leverage ranging from 1:300 to 1:1000, depending on various factors. However, high leverage levels may not be suitable for inexperienced traders, and caution should be exercised.

Q: What is the minimum deposit at Binary.com?

A: The minimum deposit at Binary.com depends on the payment method used and can vary. E-wallets allow as low as 5 to 10 USD/EUR/GBP/AUD, while other methods may have different minimums. Binary.com stands out with a minimum deposit requirement of just $5.

Q: What payment and withdrawal methods does Binary.com offer?

A: Binary.com offers a wide range of payment and withdrawal methods, including credit/debit cards, e-wallets, online banking, cryptocurrencies, and fiat onramp options. The specific fees for deposit and withdrawal are not provided by Binary.com.

Q: What trading platforms are available on Binary.com?

A: Binary.com offers several trading platforms, including Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, and Binary Bot. Each platform provides different features and trading options.

Q: What trading tools does Binary.com provide?

A: Binary.com provides trading tools such as a margin calculator to estimate margin requirements, a swap calculator to calculate overnight fees, and a pip calculator for precise pip value calculations.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive tradeview and binary-com are, we first considered common fees for standard accounts. On tradeview, the average spread for the EUR/USD currency pair is From 0 PIPS pips, while on binary-com the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

tradeview is regulated by LFSA,CIMA. binary-com is regulated by LFSA,VFSC,FSC,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

tradeview provides trading platform including Innovative Liquidity Connector,X Leverage Account and trading variety including --. binary-com provides trading platform including -- and trading variety including --.