No data

Do you want to know which is the better broker between Saxo and instaforex ?

In the table below, you can compare the features of Saxo , instaforex side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: --

Long: -6.23

Short: 0.8

Long: -21.82

Short: -7.01

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of saxo, instaforex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Saxo Review Summary in 10 Points | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS |

| Market Instruments | Forex, stocks, futures, options, bonds, ETFs and CFDs |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/USD Spread | 0.4 pips |

| Trading Platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Minimum deposit | HKD10,000 |

| Customer Support | 24/5 phone, email |

Saxo is a Danish investment bank founded in 1992. It provides online trading and investment services in multiple assets, including stocks, bonds, forex, options, futures, and CFDs, through its proprietary trading platforms. The bank operates in over 100 countries and has offices in major financial centers worldwide, including Copenhagen, London, Singapore, and Tokyo. Saxo Bank is regulated by several financial authorities, including the Danish Financial Supervisory Authority, the UK Financial Conduct Authority, and the Monetary Authority of Singapore. The bank also has a banking license and is a member of the Danish guarantee fund for depositors and investors.

Saxo is a multi-asset broker that offers access to a wide range of financial instruments, including forex, stocks, bonds, ETFs, futures, options, and more. The broker provides trading services through its advanced trading platforms and caters to both retail and institutional clients. Saxo operates as a hybrid broker, offering both direct market access (DMA) and market making services.

Saxo is a well-established and reputable broker with a range of trading platforms, instruments, and research tools.

However, the broker's high fees, minimum deposit requirement, and lack of negative balance protection may not be suitable for all traders. Additionally, some users have reported poor customer service experiences.

| Pros | Cons |

| • Wide range of financial instruments available | • High minimum deposit requirement |

| • Access to multiple markets and exchanges | • Fees and commissions may be higher than competitors |

| • User-friendly trading platforms | • Inactivity fee for dormant accounts |

| • Advanced trading tools and research | • Limited educational resources |

| • Regulated by top-tier financial authorities | • Limited customer support options |

Overall, it is important for traders to carefully consider their own needs and preferences before choosing Saxo or any other broker.

There are many alternative brokers to Saxo, each with their own unique features and benefits. Some popular alternatives include:

Interactive Brokers: A well-established broker with a wide range of trading instruments and low commissions.

TD Ameritrade: Offers a powerful trading platform and a variety of educational resources.

E*TRADE: A popular broker with a user-friendly platform and no account minimums.

IG: A global leader in online trading, offering a wide range of markets and advanced trading tools.

Plus500: A broker known for its user-friendly platform and tight spreads.

Ultimately, the best alternative broker for you will depend on your specific trading needs and preferences. It's important to research and compare different brokers to find the one that best fits your individual needs.

Saxo is a legitimate and reputable broker with a long track record of providing reliable trading services. It is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Danish Financial Supervisory Authority (DFSA). Additionally, Saxo is a member of several investor protection funds, such as the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients' funds up to a certain amount in case of the broker's insolvency. Therefore, based on its regulation and investor protection measures, Saxo can be considered a legitimate broker.

Saxo is a regulated broker, with licenses from multiple reputable regulatory authorities and a long-standing history of providing financial services. The broker takes extensive measures to protect client funds, including segregating them from the company's assets and offering negative balance protection.

Additionally, Saxo offers various security features, such as two-factor authentication and encryption, to ensure secure trading.

More details can be found in the table below:

| Security Measures | Description |

| Regulation | FSA, FINMA, FCA, ASIC, DFSA |

| Segregated Accounts | Client funds are held in segregated bank accounts to protect them in case of insolvency. |

| Two-Factor Authentication | As an extra layer of security for client accounts |

| SSL Encryption | The Saxo website and platform are secured with SSL encryption to protect user data |

| Investor Compensation Scheme | A member of the Danish Investor Compensation Scheme, which provides additional protection to clients in case of insolvency |

It's important to note that while these measures provide some level of protection for clients, there is always some level of risk involved in trading financial instruments, and clients should always be aware of the risks before making any trades.

Based on the information available, Saxo appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years. However, we also find that some users complain about their bad experience with Saxo. Take care!

Saxo offers a wide range of trading instruments across multiple asset classes, including

Forex: More than 180 currency pairs, including majors, minors, and exotics.

Stocks: Over 40,000 stocks from 36 global exchanges, including NYSE, NASDAQ, LSE, and more.

Futures: Over 200 futures and options across a variety of asset classes such as commodities, indices, and bonds.

Options: A wide range of options on stocks, indices, and futures.

Bonds: Trade a wide range of government and corporate bonds, including sovereign bonds from developed and emerging markets.

ETFs and CFDs: Access to over 3,000 ETFs and CFDs on indices, commodities, and stocks.

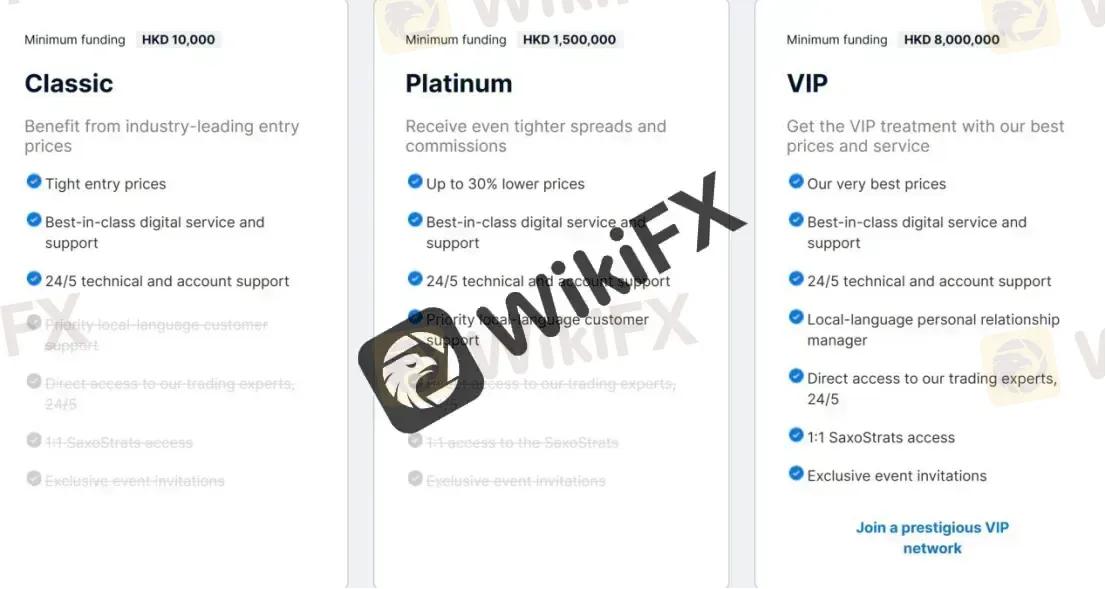

Saxo offers a range of account types designed to suit the different needs of its clients. The account types offered by Saxo are:

Classic Account: A traditional account with minimum funding of HKD10,000, which offers a range of trading tools and resources.

Platinum Account: A premium account for high-net-worth individuals, with a minimum funding requirement of HKD 1,500,000.

VIP Account: An exclusive account for ultra-high-net-worth individuals, with a minimum funding requirement of HKD 8,000,000.

Islamic Account: A Sharia-compliant account for clients who follow Islamic finance principles.

Corporate Account: An account for companies, partnerships, and other legal entities.

Joint Account: An account for two or more individuals who want to trade together.

Each account type has its own unique features and benefits, such as lower pricing, higher leverage, and dedicated account managers. Saxo also offers a free demo account for clients to practice trading before committing to a live account.

It takes only about five minutes and a short online form to open an account. Clients will need to submit the standard verification documents required by KYC and AML rules, but the procedure should be quick and easy, and they will have access to their account in minutes.

Saxo offers leverage up to 1:100 for forex trading. Professional clients are entitled to leverage of 1:40 for the primary index, 1:33 for the secondary index, 1:33 for gold, 1:10 for equities, and 1:25 for commodities. Retail clients are entitled to leverage of 1:20 for the primary index, 1:10 for the secondary index, 1:20 for gold, 1:5 for equities and 1:10 for commodities.

However, the maximum leverage may vary depending on the instrument being traded and the client's location. It is important to note that trading with high leverage carries a higher level of risk, and traders should always exercise caution and use risk management strategies.

Saxo offers variable spreads, which means that the spreads can change depending on market conditions. The typical minimum spreads for popular instruments are as follows:

EUR/USD: 0.4 pips

USD/JPY: 0.6 pips

GBP/USD: 0.9 pips

AUD/USD: 0.6 pips

USD/CHF: 1.2 pips

USD/CAD: 1.5 pips

Saxo also charges commissions on some products, including stocks, ETFs, and futures. The commission fees vary depending on the specific market and the size of the trade. Commissions start at $3 per share for equities, as low as $0.85 per lot for commodities, and $3 per share for ETFs. Futures commissions start as low as $0.85 per lot, bonds commissions start at 0.05%, listed options commissions start as low as $1.25 per lot, and mutual funds commissions are $0 for custody and platform fees.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per lot |

| Saxo | 0.4 pips | $3 |

| Interactive Brokers | 0.1 pips | $2 |

| TD Ameritrade | 0.7 pips | free |

| E*TRADE | 1.0 pips | free |

| IG | 0.75 pips | free |

| Plus500 | 0.8 pips | free |

Please note that commission rates may vary depending on the specific account type and trading volume. Additionally, some brokers may offer different spreads and commissions for other currency pairs or financial instruments. It's important to do your own research and carefully consider the costs and fees of each broker before making a decision.

Saxo offers its own proprietary trading platform called SaxoTraderGO. It is a web-based platform that can be accessed from any device with an internet connection. In addition to SaxoTraderGO, Saxo also offers SaxoTraderPRO, a desktop-based trading platform that is designed for advanced traders who require additional functionality.

SaxoTraderGO is highly customizable, allowing traders to arrange the interface to suit their preferences. It provides access to a wide range of trading tools and features, including charting tools, technical analysis indicators, and news feeds. The platform also includes a comprehensive range of order types, including market, limit, stop, and trailing stop orders.

SaxoTraderPRO is a professional-grade trading platform that offers advanced trading tools and features. It is designed for active traders and includes a range of tools that allow traders to monitor multiple markets and instruments simultaneously. The platform also includes advanced charting tools and a range of order types, including conditional orders and algorithmic trading capabilities.

Saxo also offers SaxoInvestor, which is a user-friendly trading platform suitable for beginner investors who are interested in a wide range of asset classes. It provides a simple and intuitive interface with basic research tools and features, making it easy for investors to buy and sell stocks, ETFs, bonds, and mutual funds. However, advanced traders may find the platform's lack of advanced tools and customization options limiting.

Overall, Saxo's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| Saxo | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

| Interactive Brokers | Trader Workstation, WebTrader, IBKR Mobile |

| TD Ameritrade | Thinkorswim, Web Platform, TD Ameritrade Mobile App |

| E*TRADE | Power E*TRADE, E*TRADE Web, E*TRADE Mobile |

| IG | IG Trading Platform, IG Web Platform, IG Trading App |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

Saxo Bank supports several deposit and withdrawal methods, including Visa, MasterCard, Visa Debit, Visa Electron, MasterCard Debit, Maestro (for UK residents), Visa Dankort (for Denmark residents), Carte Bleue (for France residents). The company does not charge any fees for deposits and withdrawals, but if an investor makes a withdrawal request via manual withdrawal, a processing fee of 40 EUR will be charged.

Saxo has different minimum deposit requirements depending on the type of account you open and your country of residence. For example, the minimum deposit for the Classic account is HKD10,000.

However, these amounts can vary depending on your location and the specific account type. It's important to check with Saxo directly or on their website for the most up-to-date information on minimum deposit requirements.

| Saxo | Most other | |

| Minimum Deposit | HKD10,000 | $100 |

To withdraw funds from your Saxo account, you need to follow these steps:

Step 1: Log in to your Saxo account using your credentials.

Step 2: Click on the “Account” tab located on the top right corner of the screen.

Step 3: Click on “Withdraw Funds” from the account menu options.

Step 4: Select the account you wish to withdraw funds from, enter the amount you want to withdraw, and select the currency you want to withdraw in.

Step 5: Choose the preferred withdrawal method from the available options and provide the necessary details such as bank account information or credit/debit card information.

Step 6: Review the details of your withdrawal request and click on “Submit.”

Note that Saxo may require additional verification or documentation before processing your withdrawal request. The processing time for withdrawals may vary depending on the chosen method and your bank's processing time.

Swap costs, sometimes called overnight fees, are assessed on overnight open positions at Saxo Bank. These are expressed as interest and, depending on the trader's position, might be either charged to or credited to his or her account.

Traders of the Muslim faith, for whom the payment of interest is forbidden, are out of luck with Saxo Bank because they don't have the option of opening an Islamic account. With the wide variety of deposit currencies offered by Saxo Bank, customers will have a decreased chance of incurring conversion fees.

Amounts credited to your account are converted from their original currency at the mid-point FX Spot rate plus/minus the margins and spreads indicated below. This includes both trading fees and profits/losses incurred as a result of your trading activities.

Fees for account inactivity are also a reality for inactive accounts. After the initial six months, the rate increased to $150, which is quite a bit.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Saxo | Free | Free | $150 after six months of inactivity |

| Interactive Brokers | Free | $0-$10 | $20/month if account balance < $2,000 |

| TD Ameritrade | Free | Free | Free |

| E*TRADE | Free | $0-$25 | Free |

| IG | Free | Free | $18/month after 24 months of inactivity |

| Plus500 | Free | Free | $10/month after 3 months of inactivity |

Saxo provides customer support through several channels, including phone, email, and social media (Facebook, LinkedIn, Twitter and YouTube). The broker offers 24/5 customer service in multiple languages, including English, Chinese, French, German, Italian, Japanese, Portuguese, and Spanish.

Saxo also provides a comprehensive help center on its website that includes an extensive knowledge base, FAQs, trading guides, and video tutorials. The broker's customer service is generally considered to be of high quality, with knowledgeable representatives who are responsive and helpful.

| Pros | Cons |

| • 24/5 customer service through multiple channels | • No 24/7 support service |

| • Dedicated support for VIP clients | • Phone support may have long wait times |

| • Extensive FAQ section on the website | • No dedicated account manager for non-VIP clients |

| • Personalized support for complex trading needs | • No local offices in some countries |

| • Multilingual support available for non-English users |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Saxo's customer service.

Saxo Bank provides excellent market research in addition to a wealth of instructional resources like video courses, webinars, and events. Saxo Bank's SaxoStrats Experts group consists of eight analysts and strategists who are tasked with providing coverage of the various asset classes available to customers. It's apparent that this broker places a high value on its research team and recognizes the significance of this service, both for its clients and as a global investment bank. The classes are a wonderful way for newcomers to get their feet wet and become acquainted with the resources that are at their disposal. Videos are easy to follow and understand, helping novice traders quickly get up to speed and lay a solid groundwork from which to expand their knowledge. Saxo Bank specialists will be hosting webinars.

In conclusion, Saxo is a well-established broker. The broker offers a wide range of trading instruments, including forex, stocks, options, futures, and CFDs, and provides access to various markets worldwide. Saxo also offers an advanced trading platform and a user-friendly mobile app, making it easy for traders to access the markets on the go.

While Saxo has some of the highest fees in the industry, the broker's competitive spreads and tight execution make it a popular choice for traders. Additionally, Saxo's robust educational resources and customer support make it an ideal choice for traders of all skill levels who want to improve their knowledge and skills in trading.

Overall, Saxo is a multi-asset broker that offers a comprehensive suite of trading tools and services to help traders achieve their investment goals. However, potential clients should carefully consider the fees and minimum deposit requirements before opening an account. Also, dont forget check their user reviews on the Internet.

| Q 1: | Is Saxo regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS. |

| Q 2: | Does Saxo offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Saxo offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, it offers SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. |

| Q 4: | What is the minimum deposit for Saxo? |

| A 4: | The minimum initial deposit to open an account isHKD10,000. |

| Q 5: | Is Saxo a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Bank wire transfer and many other methods |

| Customer Service | Email/phone number/address/live chat/more |

| Fraud Complaints Exposure | No for now |

General information and regulations of InstaForex

InstaForex brand was founded in 2007 and claims to be the choice of more than 7 million brokers. InstaForex website may be very complex at first glance, but if you take a moment to look at it closely, you will find a wealth of content. The information bar on both sides of the page is full of attractive content, such as news, widgets, real-time charts, customer service and much more.

In the following article, we will analyze the features of this merchant in all its dimensions, providing you with easy and well-organized information. If you are interested, read on. Reading this article will take you approximately 7 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

Market instruments

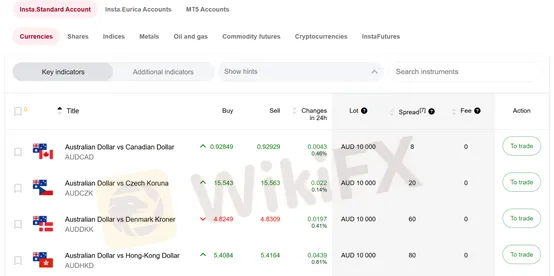

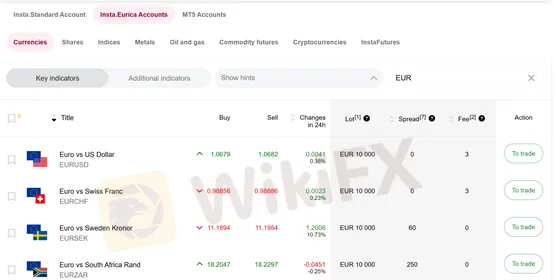

As we have said before, InstaForex web pages are very informative. On this trading products page you can see not only the trading products, but also the difference in commissions and spreads between different accounts. We can trade currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures.

Spreads and commissions for trading with InstaForex

Let's take currency pairs as an example. Spreads and commissions vary on different accounts. On the MT5 and Standard accounts the spread is about 3 pips and there is no commission, while on the Eurica account the spread is 0 and the commission varies from 3-12 USD.

We can venture to conclude that Eurica is suitable for long-term traders who trade less frequently, while the other two accounts are suitable for short-term traders who trade more frequently.

Account Types for InstaForex

Demo account: InstaForex offers a demo account for testing a little on the financial market without the risk of losing money. Opening a demo account, according to the company, is as easy as ABC.

Live account: there are in total 4 types of accounts: insta standard, insta eurica, cent standard and cent eurica. The minimum deposit for opening an account at InstaForex is just 1 USD, and the trading conditions also seem to be quite favorable.

Trading platforms offered by InstaForex

As for trading platforms, clients can choose from the market leaders MetaTrader4 and MetaTrader5, which can be accessed from any device.

However, have you ever wondered or are you wondering which platform you should use? Our team has the corresponding article for your reference. The article details the similarities and differences between the two and gives specific advice.

https://www.wikifx.com/es/wikishow/202207208464173722.html

Leverage offered by InstaForex

InstaForex offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

Unlike some brokers that lack information, InstaForex is very generous in providing information. If you carefully browse their website, you can find a wealth of information. As for deposits and withdrawals, InstaForex shows all methods, required fees and arrival times clearly on a single page.

Educational resources

InstaForex educational resources are extensive. Online charts, market analysis, Forex calculators, indicators, articles, questions and answers, glossary... Whether you choose InstaForex as your broker or not, you can make the most of the resources available here.

Customer support of InstaForex

Call back, live chat, WhatsApp, email...with numerous channels and 24/7 service, clients could get help whenever they have trading-related problem.

Here are more details about the customer service.

Languages: there are total sixteen languages on InstaForex website, which could meet the needs of most of its customers.

Service hours: 24/7

Phone: you could fill in a form, indicating your country, your preferred language and time, the team will call you whenever you want, and the service is totally free of charge.

Email: support@mail.instaforex.com

Social networks: Facebook, Twitter, YouTube, Telegram, Instagram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of InstaForex

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

Low leverage

Frequent asked questions about InstaForex

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

Does this broker offer MT4/MT5?

Yes, InstaForex offers both MT4 and MT5 for you to choose from.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive saxo and instaforex are, we first considered common fees for standard accounts. On saxo, the average spread for the EUR/USD currency pair is -- pips, while on instaforex the spread is Fixed 2-7.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

saxo is regulated by ASIC,FCA,FSA,SFC,AMF,CONSOB,FINMA,MAS,AMF,DFSA,ASIC. instaforex is regulated by CYSEC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

saxo provides trading platform including VIP account,Classic account,Platinum account and trading variety including --. instaforex provides trading platform including Standard Trading Accounts,Eurica Trading Accounts,ECN Trading Account,ECN Pro Trading Account,Scalping trading account and trading variety including --.