No data

Do you want to know which is the better broker between Saxo and AvaTrade ?

In the table below, you can compare the features of Saxo , AvaTrade side by side to determine the best fit for your needs.

Long: -2.53

Short: 0.34

Long: -6.5

Short: 1.08

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of saxo, ava-trade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Saxo Review Summary in 10 Points | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS |

| Market Instruments | Forex, stocks, futures, options, bonds, ETFs and CFDs |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/USD Spread | 0.4 pips |

| Trading Platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Minimum deposit | HKD10,000 |

| Customer Support | 24/5 phone, email |

Saxo is a Danish investment bank founded in 1992. It provides online trading and investment services in multiple assets, including stocks, bonds, forex, options, futures, and CFDs, through its proprietary trading platforms. The bank operates in over 100 countries and has offices in major financial centers worldwide, including Copenhagen, London, Singapore, and Tokyo. Saxo Bank is regulated by several financial authorities, including the Danish Financial Supervisory Authority, the UK Financial Conduct Authority, and the Monetary Authority of Singapore. The bank also has a banking license and is a member of the Danish guarantee fund for depositors and investors.

Saxo is a multi-asset broker that offers access to a wide range of financial instruments, including forex, stocks, bonds, ETFs, futures, options, and more. The broker provides trading services through its advanced trading platforms and caters to both retail and institutional clients. Saxo operates as a hybrid broker, offering both direct market access (DMA) and market making services.

Saxo is a well-established and reputable broker with a range of trading platforms, instruments, and research tools.

However, the broker's high fees, minimum deposit requirement, and lack of negative balance protection may not be suitable for all traders. Additionally, some users have reported poor customer service experiences.

| Pros | Cons |

| • Wide range of financial instruments available | • High minimum deposit requirement |

| • Access to multiple markets and exchanges | • Fees and commissions may be higher than competitors |

| • User-friendly trading platforms | • Inactivity fee for dormant accounts |

| • Advanced trading tools and research | • Limited educational resources |

| • Regulated by top-tier financial authorities | • Limited customer support options |

Overall, it is important for traders to carefully consider their own needs and preferences before choosing Saxo or any other broker.

There are many alternative brokers to Saxo, each with their own unique features and benefits. Some popular alternatives include:

Interactive Brokers: A well-established broker with a wide range of trading instruments and low commissions.

TD Ameritrade: Offers a powerful trading platform and a variety of educational resources.

E*TRADE: A popular broker with a user-friendly platform and no account minimums.

IG: A global leader in online trading, offering a wide range of markets and advanced trading tools.

Plus500: A broker known for its user-friendly platform and tight spreads.

Ultimately, the best alternative broker for you will depend on your specific trading needs and preferences. It's important to research and compare different brokers to find the one that best fits your individual needs.

Saxo is a legitimate and reputable broker with a long track record of providing reliable trading services. It is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Danish Financial Supervisory Authority (DFSA). Additionally, Saxo is a member of several investor protection funds, such as the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients' funds up to a certain amount in case of the broker's insolvency. Therefore, based on its regulation and investor protection measures, Saxo can be considered a legitimate broker.

Saxo is a regulated broker, with licenses from multiple reputable regulatory authorities and a long-standing history of providing financial services. The broker takes extensive measures to protect client funds, including segregating them from the company's assets and offering negative balance protection.

Additionally, Saxo offers various security features, such as two-factor authentication and encryption, to ensure secure trading.

More details can be found in the table below:

| Security Measures | Description |

| Regulation | FSA, FINMA, FCA, ASIC, DFSA |

| Segregated Accounts | Client funds are held in segregated bank accounts to protect them in case of insolvency. |

| Two-Factor Authentication | As an extra layer of security for client accounts |

| SSL Encryption | The Saxo website and platform are secured with SSL encryption to protect user data |

| Investor Compensation Scheme | A member of the Danish Investor Compensation Scheme, which provides additional protection to clients in case of insolvency |

It's important to note that while these measures provide some level of protection for clients, there is always some level of risk involved in trading financial instruments, and clients should always be aware of the risks before making any trades.

Based on the information available, Saxo appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years. However, we also find that some users complain about their bad experience with Saxo. Take care!

Saxo offers a wide range of trading instruments across multiple asset classes, including

Forex: More than 180 currency pairs, including majors, minors, and exotics.

Stocks: Over 40,000 stocks from 36 global exchanges, including NYSE, NASDAQ, LSE, and more.

Futures: Over 200 futures and options across a variety of asset classes such as commodities, indices, and bonds.

Options: A wide range of options on stocks, indices, and futures.

Bonds: Trade a wide range of government and corporate bonds, including sovereign bonds from developed and emerging markets.

ETFs and CFDs: Access to over 3,000 ETFs and CFDs on indices, commodities, and stocks.

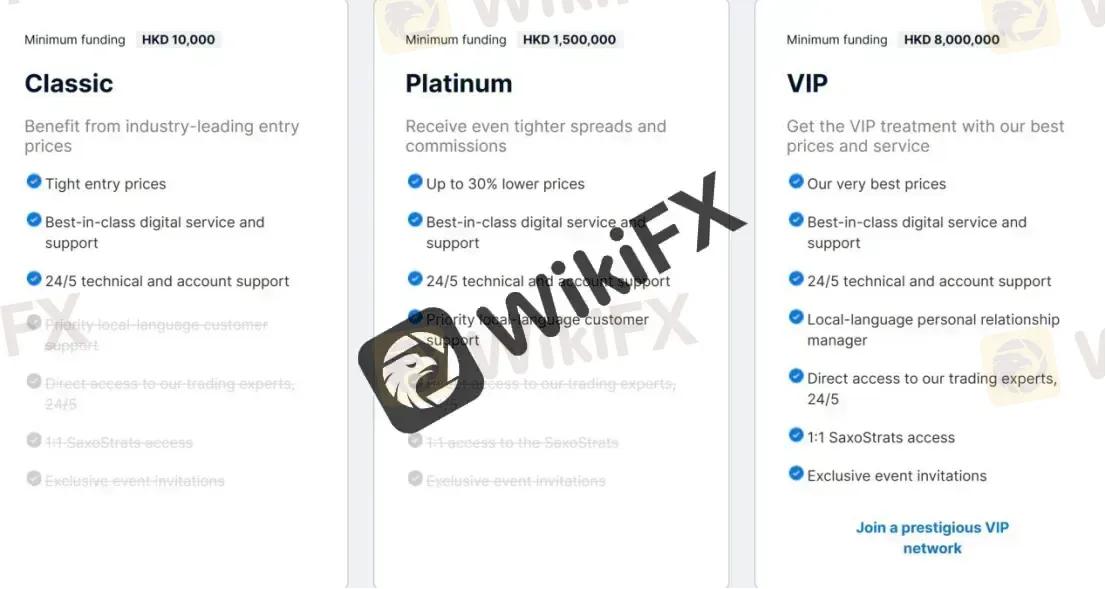

Saxo offers a range of account types designed to suit the different needs of its clients. The account types offered by Saxo are:

Classic Account: A traditional account with minimum funding of HKD10,000, which offers a range of trading tools and resources.

Platinum Account: A premium account for high-net-worth individuals, with a minimum funding requirement of HKD 1,500,000.

VIP Account: An exclusive account for ultra-high-net-worth individuals, with a minimum funding requirement of HKD 8,000,000.

Islamic Account: A Sharia-compliant account for clients who follow Islamic finance principles.

Corporate Account: An account for companies, partnerships, and other legal entities.

Joint Account: An account for two or more individuals who want to trade together.

Each account type has its own unique features and benefits, such as lower pricing, higher leverage, and dedicated account managers. Saxo also offers a free demo account for clients to practice trading before committing to a live account.

It takes only about five minutes and a short online form to open an account. Clients will need to submit the standard verification documents required by KYC and AML rules, but the procedure should be quick and easy, and they will have access to their account in minutes.

Saxo offers leverage up to 1:100 for forex trading. Professional clients are entitled to leverage of 1:40 for the primary index, 1:33 for the secondary index, 1:33 for gold, 1:10 for equities, and 1:25 for commodities. Retail clients are entitled to leverage of 1:20 for the primary index, 1:10 for the secondary index, 1:20 for gold, 1:5 for equities and 1:10 for commodities.

However, the maximum leverage may vary depending on the instrument being traded and the client's location. It is important to note that trading with high leverage carries a higher level of risk, and traders should always exercise caution and use risk management strategies.

Saxo offers variable spreads, which means that the spreads can change depending on market conditions. The typical minimum spreads for popular instruments are as follows:

EUR/USD: 0.4 pips

USD/JPY: 0.6 pips

GBP/USD: 0.9 pips

AUD/USD: 0.6 pips

USD/CHF: 1.2 pips

USD/CAD: 1.5 pips

Saxo also charges commissions on some products, including stocks, ETFs, and futures. The commission fees vary depending on the specific market and the size of the trade. Commissions start at $3 per share for equities, as low as $0.85 per lot for commodities, and $3 per share for ETFs. Futures commissions start as low as $0.85 per lot, bonds commissions start at 0.05%, listed options commissions start as low as $1.25 per lot, and mutual funds commissions are $0 for custody and platform fees.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per lot |

| Saxo | 0.4 pips | $3 |

| Interactive Brokers | 0.1 pips | $2 |

| TD Ameritrade | 0.7 pips | free |

| E*TRADE | 1.0 pips | free |

| IG | 0.75 pips | free |

| Plus500 | 0.8 pips | free |

Please note that commission rates may vary depending on the specific account type and trading volume. Additionally, some brokers may offer different spreads and commissions for other currency pairs or financial instruments. It's important to do your own research and carefully consider the costs and fees of each broker before making a decision.

Saxo offers its own proprietary trading platform called SaxoTraderGO. It is a web-based platform that can be accessed from any device with an internet connection. In addition to SaxoTraderGO, Saxo also offers SaxoTraderPRO, a desktop-based trading platform that is designed for advanced traders who require additional functionality.

SaxoTraderGO is highly customizable, allowing traders to arrange the interface to suit their preferences. It provides access to a wide range of trading tools and features, including charting tools, technical analysis indicators, and news feeds. The platform also includes a comprehensive range of order types, including market, limit, stop, and trailing stop orders.

SaxoTraderPRO is a professional-grade trading platform that offers advanced trading tools and features. It is designed for active traders and includes a range of tools that allow traders to monitor multiple markets and instruments simultaneously. The platform also includes advanced charting tools and a range of order types, including conditional orders and algorithmic trading capabilities.

Saxo also offers SaxoInvestor, which is a user-friendly trading platform suitable for beginner investors who are interested in a wide range of asset classes. It provides a simple and intuitive interface with basic research tools and features, making it easy for investors to buy and sell stocks, ETFs, bonds, and mutual funds. However, advanced traders may find the platform's lack of advanced tools and customization options limiting.

Overall, Saxo's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| Saxo | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

| Interactive Brokers | Trader Workstation, WebTrader, IBKR Mobile |

| TD Ameritrade | Thinkorswim, Web Platform, TD Ameritrade Mobile App |

| E*TRADE | Power E*TRADE, E*TRADE Web, E*TRADE Mobile |

| IG | IG Trading Platform, IG Web Platform, IG Trading App |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

Saxo Bank supports several deposit and withdrawal methods, including Visa, MasterCard, Visa Debit, Visa Electron, MasterCard Debit, Maestro (for UK residents), Visa Dankort (for Denmark residents), Carte Bleue (for France residents). The company does not charge any fees for deposits and withdrawals, but if an investor makes a withdrawal request via manual withdrawal, a processing fee of 40 EUR will be charged.

Saxo has different minimum deposit requirements depending on the type of account you open and your country of residence. For example, the minimum deposit for the Classic account is HKD10,000.

However, these amounts can vary depending on your location and the specific account type. It's important to check with Saxo directly or on their website for the most up-to-date information on minimum deposit requirements.

| Saxo | Most other | |

| Minimum Deposit | HKD10,000 | $100 |

To withdraw funds from your Saxo account, you need to follow these steps:

Step 1: Log in to your Saxo account using your credentials.

Step 2: Click on the “Account” tab located on the top right corner of the screen.

Step 3: Click on “Withdraw Funds” from the account menu options.

Step 4: Select the account you wish to withdraw funds from, enter the amount you want to withdraw, and select the currency you want to withdraw in.

Step 5: Choose the preferred withdrawal method from the available options and provide the necessary details such as bank account information or credit/debit card information.

Step 6: Review the details of your withdrawal request and click on “Submit.”

Note that Saxo may require additional verification or documentation before processing your withdrawal request. The processing time for withdrawals may vary depending on the chosen method and your bank's processing time.

Swap costs, sometimes called overnight fees, are assessed on overnight open positions at Saxo Bank. These are expressed as interest and, depending on the trader's position, might be either charged to or credited to his or her account.

Traders of the Muslim faith, for whom the payment of interest is forbidden, are out of luck with Saxo Bank because they don't have the option of opening an Islamic account. With the wide variety of deposit currencies offered by Saxo Bank, customers will have a decreased chance of incurring conversion fees.

Amounts credited to your account are converted from their original currency at the mid-point FX Spot rate plus/minus the margins and spreads indicated below. This includes both trading fees and profits/losses incurred as a result of your trading activities.

Fees for account inactivity are also a reality for inactive accounts. After the initial six months, the rate increased to $150, which is quite a bit.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Saxo | Free | Free | $150 after six months of inactivity |

| Interactive Brokers | Free | $0-$10 | $20/month if account balance < $2,000 |

| TD Ameritrade | Free | Free | Free |

| E*TRADE | Free | $0-$25 | Free |

| IG | Free | Free | $18/month after 24 months of inactivity |

| Plus500 | Free | Free | $10/month after 3 months of inactivity |

Saxo provides customer support through several channels, including phone, email, and social media (Facebook, LinkedIn, Twitter and YouTube). The broker offers 24/5 customer service in multiple languages, including English, Chinese, French, German, Italian, Japanese, Portuguese, and Spanish.

Saxo also provides a comprehensive help center on its website that includes an extensive knowledge base, FAQs, trading guides, and video tutorials. The broker's customer service is generally considered to be of high quality, with knowledgeable representatives who are responsive and helpful.

| Pros | Cons |

| • 24/5 customer service through multiple channels | • No 24/7 support service |

| • Dedicated support for VIP clients | • Phone support may have long wait times |

| • Extensive FAQ section on the website | • No dedicated account manager for non-VIP clients |

| • Personalized support for complex trading needs | • No local offices in some countries |

| • Multilingual support available for non-English users |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Saxo's customer service.

Saxo Bank provides excellent market research in addition to a wealth of instructional resources like video courses, webinars, and events. Saxo Bank's SaxoStrats Experts group consists of eight analysts and strategists who are tasked with providing coverage of the various asset classes available to customers. It's apparent that this broker places a high value on its research team and recognizes the significance of this service, both for its clients and as a global investment bank. The classes are a wonderful way for newcomers to get their feet wet and become acquainted with the resources that are at their disposal. Videos are easy to follow and understand, helping novice traders quickly get up to speed and lay a solid groundwork from which to expand their knowledge. Saxo Bank specialists will be hosting webinars.

In conclusion, Saxo is a well-established broker. The broker offers a wide range of trading instruments, including forex, stocks, options, futures, and CFDs, and provides access to various markets worldwide. Saxo also offers an advanced trading platform and a user-friendly mobile app, making it easy for traders to access the markets on the go.

While Saxo has some of the highest fees in the industry, the broker's competitive spreads and tight execution make it a popular choice for traders. Additionally, Saxo's robust educational resources and customer support make it an ideal choice for traders of all skill levels who want to improve their knowledge and skills in trading.

Overall, Saxo is a multi-asset broker that offers a comprehensive suite of trading tools and services to help traders achieve their investment goals. However, potential clients should carefully consider the fees and minimum deposit requirements before opening an account. Also, dont forget check their user reviews on the Internet.

| Q 1: | Is Saxo regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS. |

| Q 2: | Does Saxo offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Saxo offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, it offers SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. |

| Q 4: | What is the minimum deposit for Saxo? |

| A 4: | The minimum initial deposit to open an account isHKD10,000. |

| Q 5: | Is Saxo a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| AvaTrade | Basic Information |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, CBI, FSA, FSCA, FSC, CBI, FFAJ |

| Type of Broker | Market Maker |

| Minimum Deposit | $100 |

| Tradable Assets | Forex, CFDs, Stocks, Indices, Commodities, Cryptocurrencies |

| Leverage | 1:30 (for retail clients), 1:400 (for professional accounts) |

| Min. Spreads | 0.9 pips on the EUR/USD pair |

| Trading Platforms | AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, DupliTrade |

| Mobile Trading | Yes |

| Payment Methods | Credit/Debit Card, Bank Transfer, E-wallets, Rapid Transfer |

| Customer Support | Live Chat, Phone, Email, Knowledge Base |

| Educational Material | Webinars, E-books, Trading Videos, Articles, Academy |

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, CBI, FSA, FSCA, FSC, CBI, FFAJ.

As a market maker broker, Avatrade offers a range of tradable assets including forex, CFDs, stocks, indices, commodities, and cryptocurrencies. The broker provides clients with access to multiple trading platforms, including AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, and DupliTrade. Mobile trading is also available.

Avatrade requires a minimum deposit of $100 to open an account, and clients can choose from a variety of payment methods including credit/debit card, bank transfer, e-wallets, and Rapid Transfer.

Customer support is available via live chat, phone, email, and a knowledge base. The broker also provides a range of educational resources for traders, including webinars, e-books, trading videos, and articles.

Avatrade is regulated by multiple financial regulatory authorities, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Services Commission (FSC) of the British Virgin Islands, and the Financial Services Authority (FSA) and The Financial Futures Association of Japan (FFAJ). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

Ava Capital Markets Australia Pty Ltd - authorized by ASIC (Australia) registration no. 406684

AVA Trade EU Ltd - authorized by Central Bank of Ireland (CBI)

Ava Capital Markets Pty Ltd - authorized by FSCA (South Africa) registration no. 45984

Ava Trade Japan K.K. - authorized by FSA (Japan) registration no. 2010401081157 and FFAJ registration no. 1574

Ava Trade Middle East Ltd - authorized by FRSA (Abu Dhabi Global Markets) registration no. 190018

AVA Trade EU Limited - authorized by the Financial Conduct Authority (FCA), holding a license of European Authorized Representative (EEA), registration no. 504072

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you. Some potential advantages of a broker may include competitive fees and spreads, a user-friendly platform, and a wide range of deposit and withdrawal options. Additionally, a regulated broker can provide peace of mind knowing that your funds are protected.

However, there may also be potential downsides to consider, such as limited trading instruments, customer support options, and research tools. A high minimum deposit requirement and limited bonus offers may also be a drawback for some traders.

| Pros | Cons |

| Regulated by reputable financial authorities | Avatrade's minimum deposit requirements are relatively high compared to other brokers, which may make it difficult for some traders to get started. |

| Competitive spreads and fees | Limited bonus and promotional offers |

| Multiple trading platforms | No online chat supported |

| Wide range of deposit and withdrawal options | Limited trading instruments |

| Acceptable minimum deposit | Limited customer support options |

| Rich and Free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Avatrade offers a wide range of trading instruments across various markets, including forex, stocks, commodities, cryptocurrencies, spread betting, FX OPtions. Here's a breakdown of the market instruments available:

Forex: Avatrade offers more than 50 currency pairs, including major, minor, and exotic pairs.

Stocks: Traders can trade stocks from major global exchanges, such as NASDAQ, NYSE, LSE, and more.

Commodities: Avatrade offers trading in precious metals like gold and silver, energy commodities like oil and gas, and agricultural commodities like wheat and coffee.

Cryptocurrencies: This broker offers trading in popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and Litecoin, as well as lesser-known coins like Dash, Monero, and NEO.

Indices: Avatrade provides access to major indices, including the S&P 500, NASDAQ, FTSE 100, and more.

FX options allow traders to take advantage of currency movements while limiting their risk. With FX options, traders can set a specific strike price at which they want to buy or sell a currency pair, and the option will be exercised only if the market reaches that price. This allows traders to potentially profit from market movements while limiting their potential losses.

Spread betting is a tax-free way to speculate on the direction of various financial markets, including forex, commodities, and indices. With spread betting, traders can bet on whether the market will rise or fall and potentially profit from both upward and downward movements.

| Pros | Cons |

| Wide range of instruments including forex, stocks, commodities, and cryptocurrencies | No trading in futures or options |

| Trading available in CFDs, spread betting, and options | Spread betting only available for UK and Irish residents |

| Access to FX options for forex traders | Limited leverage on certain instruments |

| Competitive spreads on major forex pairs | Overnight fees on positions held past market hours |

| No commission fees on trades | Limited availability of certain instruments during non-market hours |

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

The standard account provides access to all of Avatrade's trading instruments, including forex, stocks, commodities, and cryptocurrencies. This means that traders can diversify their portfolio and take advantage of different market conditions, all within the same account.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. For example, brokers like IG and Saxo Bank have a minimum deposit requirement of $300 and $10,000, respectively. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, Pepperstone and XM have a minimum deposit requirement of $0 and $5, respectively.

| Pros | Cons |

| Low minimum deposit requirement of $100 | Only offers one account type (Standard Account) |

| Negative balance protection for all accounts | Limited account funding options |

| Wide range of payment methods available | Inactivity fee charged after 12 months of no trading |

| No commission charges on trades | Limited customization options for account settings |

| Access to a wide range of trading instruments | No Islamic accounts available for Muslim traders |

| Dedicated account manager for high depositors | Limited educational resources for beginner traders |

| Demo Accounts Available | Demo accounts valid for 21 days only |

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

First, you need to visit the Avatrade website and click on the “Register” button, which is prominently displayed on the homepage.

Then, you will then be taken to a registration form where you will need to provide your personal information, such as your name, email address, and phone number. You will also need to create a password and select your account currency.

After filling out the registration form, you will need to verify your identity by submitting a copy of your government-issued ID and a recent utility bill or bank statement. This is a standard requirement for all regulated brokers and is done to ensure the security and integrity of the trading platform.

Once your account is verified, you can fund your account using one of the many payment options available, such as credit/debit card, bank transfer, or electronic wallets like Neteller or Skrill. After funding your account, you can download the Avatrade trading platform or use the web-based version to start trading.

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

Overall, Avatrade's leverage offerings are competitive with other brokers in the industry and can provide traders with greater trading opportunities. However, traders should always consider their risk management strategies and use leverage responsibly.

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading. Traders should compare the spreads and commission rates of Avatrade with other brokers to determine if it meets their trading needs and preferences.

| Pros | Cons |

| Competitive spreads on major currency pairs such as EUR/USD | Wide spreads on some exotic currency pairs |

| Fixed spreads available on certain account types | Higher spreads on CFDs compared to some other brokers |

| No commission fees charged on trades | Overnight and weekend rollover fees charged on positions held for more than 1 day |

| No deposit or withdrawal fees | Inactivity fee charged after 12 months of no trading activity |

| No hidden fees | Minimum deposit of $100 may be considered high for some traders |

Non-trading fees are the fees that a broker charges for activities other than trading, such as deposit and withdrawal fees, inactivity fees, and account closure fees. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker.

Avatrade has several non-trading fees that traders should be aware of. Here's a breakdown of the fees:

| Fee type | Amount | Description |

| Deposit fee | Free | Avatrade does not charge any fees for deposits. |

| Withdrawal fee | $25-$50 | The withdrawal fee depends on the payment method used. |

| Inactivity fee | $50 per quarter | Charged if there is no trading activity for three months. |

| Account closure fee | Free | Avatrade does not charge a fee for closing an account. |

Overall, Avatrade's non-trading fees are reasonable compared to other brokers in the industry. The deposit fee is free, which is a significant advantage, but the withdrawal fee can be relatively high, depending on the payment method used. The inactivity fee is also something to keep in mind, as it can add up quickly if there is no trading activity. However, it's important to note that the inactivity fee is only charged after 12 months of inactivity, which is longer than some other brokers.

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

AvatradeGO: This is a mobile app that is available on both iOS and Android platforms. It allows traders to access their accounts and trade on the go.

MT4: Avatrade offers the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its user-friendly interface, advanced charting tools, and a range of custom indicators and expert advisors.

MT5: Avatrade also offers the MetaTrader 5 (MT5) platform, which is the successor to MT4. MT5 has several new features, including more advanced charting tools, a wider range of order types, and improved back-testing capabilities.

WebTrader: Avatrade's WebTrader platform allows traders to access their accounts and trade directly from their web browser. The platform is easy to use and offers a range of trading tools and indicators.

AvaOptions: This is Avatrade's platform for trading options. It offers a range of options trading tools, including risk management tools, and a range of customizable trading strategies.

Avatrade offers a variety of deposit and withdrawal options to its clients. The methods available may vary depending on the client's location and the currency used.

Deposit options include bank wire transfer, credit/debit card, Neteller, Skrill, WebMoney, and others. The processing time for deposits is usually instant or up to one business day.

Withdrawal options include bank wire transfer, credit/debit card, Neteller, Skrill, WebMoney, and others. Withdrawals usually take 1-2 business days to process.

Avatrade does not charge any deposit or withdrawal fees, but clients may incur fees from their payment provider or bank.

To withdraw funds from your Avatrade account, you need to follow these steps:

Log in to your Avatrade account.

Click on the “Withdraw Funds” tab located in the main menu.

Choose your preferred withdrawal method from the list of available options, such as bank wire, credit card, or electronic payment systems like Skrill or Neteller.

Enter the amount you want to withdraw and any necessary payment details.

Review and confirm the transaction details.

Submit your withdrawal request.

It's important to note that Avatrade requires you to withdraw funds using the same payment method that you used to deposit funds into your account. The processing time for withdrawals varies depending on the payment method, but Avatrade strives to process all withdrawal requests within 24 hours.

Avatrade offers customer support through multiple channels, including live chat, phone support, email, and an online contact form. They have customer support available in multiple languages, including English, Spanish, French, German, Italian, Portuguese, Arabic, and Chinese.

Their customer support team is available 24/5, meaning that they are available Monday through Friday to help with any questions or concerns that traders may have. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Avatrade's customer support has received positive reviews for their responsiveness and helpfulness. They also offer free educational resources to help traders improve their skills and knowledge.

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as e-books, video tutorials, webinars, and trading courses.

The e-books cover a range of topics, from basic trading concepts to advanced strategies. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management.

Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter. Additionally, they offer a range of trading courses for beginners, intermediate and advanced traders.

Conclusion

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, commodities, and cryptocurrencies, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and a demo account for traders to practice their strategies. However, there are some downsides to consider, such as higher non-trading fees and limited account options.

Q: Is Avatrade regulated?

A: Yes, Avatrade is regulated by multiple reputable authorities, including the Central Bank of Ireland, the Financial Services Commission in the British Virgin Islands, and the Australian Securities and Investments Commission.

Q: Does Avatrade offer a demo account?

A: Yes, Avatrade offers a free demo account for traders to practice and test their strategies before trading with real money.

Q: What is the minimum deposit requirement for Avatrade?

A: The minimum deposit requirement for Avatrade is $100.

Q: What trading instruments are available on Avatrade's platform?

A: Avatrade offers a wide range of trading instruments including forex, stocks, commodities, indices, cryptocurrencies, and more.

Q: What is the maximum leverage offered by Avatrade?

A: The maximum leverage offered by Avatrade is 1:400.

Q: Does Avatrade charge any trading fees?

A: Yes, Avatrade charges spreads and commissions on certain trading instruments.

Q: What deposit and withdrawal methods are available on Avatrade's platform?

A: Avatrade offers a variety of deposit and withdrawal methods including credit/debit cards, bank transfers, and e-wallets such as PayPal, Skrill, and Neteller.

Q: Does Avatrade provide educational resources for traders?

A: Yes, Avatrade provides a range of educational resources including webinars, e-books, trading courses, and more.

Q: What kind of customer support does Avatrade offer?

A: Avatrade offers 24/5 customer support through phone, email, as well as an extensive FAQ section on their website.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive saxo and ava-trade are, we first considered common fees for standard accounts. On saxo, the average spread for the EUR/USD currency pair is -- pips, while on ava-trade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

saxo is regulated by ASIC,FCA,FSA,SFC,AMF,CONSOB,FINMA,MAS,AMF,DFSA,ASIC. ava-trade is regulated by ASIC,FSA,FFAJ,ADGM,CBI,FSCA,ISA,KNF.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

saxo provides trading platform including VIP account,Classic account,Platinum account and trading variety including --. ava-trade provides trading platform including -- and trading variety including --.