No data

Do you want to know which is the better broker between AvaTrade and CXC ?

In the table below, you can compare the features of AvaTrade , CXC side by side to determine the best fit for your needs.

Long: -2.53

Short: 0.34

Long: -6.5

Short: 1.08

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of ava-trade, cxc-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| AvaTrade | Basic Information |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, CBI, FSA, FSCA, FSC, CBI, FFAJ |

| Type of Broker | Market Maker |

| Minimum Deposit | $100 |

| Tradable Assets | Forex, CFDs, Stocks, Indices, Commodities, Cryptocurrencies |

| Leverage | 1:30 (for retail clients), 1:400 (for professional accounts) |

| Min. Spreads | 0.9 pips on the EUR/USD pair |

| Trading Platforms | AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, DupliTrade |

| Mobile Trading | Yes |

| Payment Methods | Credit/Debit Card, Bank Transfer, E-wallets, Rapid Transfer |

| Customer Support | Live Chat, Phone, Email, Knowledge Base |

| Educational Material | Webinars, E-books, Trading Videos, Articles, Academy |

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, CBI, FSA, FSCA, FSC, CBI, FFAJ.

As a market maker broker, Avatrade offers a range of tradable assets including forex, CFDs, stocks, indices, commodities, and cryptocurrencies. The broker provides clients with access to multiple trading platforms, including AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, and DupliTrade. Mobile trading is also available.

Avatrade requires a minimum deposit of $100 to open an account, and clients can choose from a variety of payment methods including credit/debit card, bank transfer, e-wallets, and Rapid Transfer.

Customer support is available via live chat, phone, email, and a knowledge base. The broker also provides a range of educational resources for traders, including webinars, e-books, trading videos, and articles.

Avatrade is regulated by multiple financial regulatory authorities, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Services Commission (FSC) of the British Virgin Islands, and the Financial Services Authority (FSA) and The Financial Futures Association of Japan (FFAJ). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

Ava Capital Markets Australia Pty Ltd - authorized by ASIC (Australia) registration no. 406684

AVA Trade EU Ltd - authorized by Central Bank of Ireland (CBI)

Ava Capital Markets Pty Ltd - authorized by FSCA (South Africa) registration no. 45984

Ava Trade Japan K.K. - authorized by FSA (Japan) registration no. 2010401081157 and FFAJ registration no. 1574

Ava Trade Middle East Ltd - authorized by FRSA (Abu Dhabi Global Markets) registration no. 190018

AVA Trade EU Limited - authorized by the Financial Conduct Authority (FCA), holding a license of European Authorized Representative (EEA), registration no. 504072

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you. Some potential advantages of a broker may include competitive fees and spreads, a user-friendly platform, and a wide range of deposit and withdrawal options. Additionally, a regulated broker can provide peace of mind knowing that your funds are protected.

However, there may also be potential downsides to consider, such as limited trading instruments, customer support options, and research tools. A high minimum deposit requirement and limited bonus offers may also be a drawback for some traders.

| Pros | Cons |

| Regulated by reputable financial authorities | Avatrade's minimum deposit requirements are relatively high compared to other brokers, which may make it difficult for some traders to get started. |

| Competitive spreads and fees | Limited bonus and promotional offers |

| Multiple trading platforms | No online chat supported |

| Wide range of deposit and withdrawal options | Limited trading instruments |

| Acceptable minimum deposit | Limited customer support options |

| Rich and Free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Avatrade offers a wide range of trading instruments across various markets, including forex, stocks, commodities, cryptocurrencies, spread betting, FX OPtions. Here's a breakdown of the market instruments available:

Forex: Avatrade offers more than 50 currency pairs, including major, minor, and exotic pairs.

Stocks: Traders can trade stocks from major global exchanges, such as NASDAQ, NYSE, LSE, and more.

Commodities: Avatrade offers trading in precious metals like gold and silver, energy commodities like oil and gas, and agricultural commodities like wheat and coffee.

Cryptocurrencies: This broker offers trading in popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and Litecoin, as well as lesser-known coins like Dash, Monero, and NEO.

Indices: Avatrade provides access to major indices, including the S&P 500, NASDAQ, FTSE 100, and more.

FX options allow traders to take advantage of currency movements while limiting their risk. With FX options, traders can set a specific strike price at which they want to buy or sell a currency pair, and the option will be exercised only if the market reaches that price. This allows traders to potentially profit from market movements while limiting their potential losses.

Spread betting is a tax-free way to speculate on the direction of various financial markets, including forex, commodities, and indices. With spread betting, traders can bet on whether the market will rise or fall and potentially profit from both upward and downward movements.

| Pros | Cons |

| Wide range of instruments including forex, stocks, commodities, and cryptocurrencies | No trading in futures or options |

| Trading available in CFDs, spread betting, and options | Spread betting only available for UK and Irish residents |

| Access to FX options for forex traders | Limited leverage on certain instruments |

| Competitive spreads on major forex pairs | Overnight fees on positions held past market hours |

| No commission fees on trades | Limited availability of certain instruments during non-market hours |

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

The standard account provides access to all of Avatrade's trading instruments, including forex, stocks, commodities, and cryptocurrencies. This means that traders can diversify their portfolio and take advantage of different market conditions, all within the same account.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. For example, brokers like IG and Saxo Bank have a minimum deposit requirement of $300 and $10,000, respectively. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, Pepperstone and XM have a minimum deposit requirement of $0 and $5, respectively.

| Pros | Cons |

| Low minimum deposit requirement of $100 | Only offers one account type (Standard Account) |

| Negative balance protection for all accounts | Limited account funding options |

| Wide range of payment methods available | Inactivity fee charged after 12 months of no trading |

| No commission charges on trades | Limited customization options for account settings |

| Access to a wide range of trading instruments | No Islamic accounts available for Muslim traders |

| Dedicated account manager for high depositors | Limited educational resources for beginner traders |

| Demo Accounts Available | Demo accounts valid for 21 days only |

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

First, you need to visit the Avatrade website and click on the “Register” button, which is prominently displayed on the homepage.

Then, you will then be taken to a registration form where you will need to provide your personal information, such as your name, email address, and phone number. You will also need to create a password and select your account currency.

After filling out the registration form, you will need to verify your identity by submitting a copy of your government-issued ID and a recent utility bill or bank statement. This is a standard requirement for all regulated brokers and is done to ensure the security and integrity of the trading platform.

Once your account is verified, you can fund your account using one of the many payment options available, such as credit/debit card, bank transfer, or electronic wallets like Neteller or Skrill. After funding your account, you can download the Avatrade trading platform or use the web-based version to start trading.

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

Overall, Avatrade's leverage offerings are competitive with other brokers in the industry and can provide traders with greater trading opportunities. However, traders should always consider their risk management strategies and use leverage responsibly.

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading. Traders should compare the spreads and commission rates of Avatrade with other brokers to determine if it meets their trading needs and preferences.

| Pros | Cons |

| Competitive spreads on major currency pairs such as EUR/USD | Wide spreads on some exotic currency pairs |

| Fixed spreads available on certain account types | Higher spreads on CFDs compared to some other brokers |

| No commission fees charged on trades | Overnight and weekend rollover fees charged on positions held for more than 1 day |

| No deposit or withdrawal fees | Inactivity fee charged after 12 months of no trading activity |

| No hidden fees | Minimum deposit of $100 may be considered high for some traders |

Non-trading fees are the fees that a broker charges for activities other than trading, such as deposit and withdrawal fees, inactivity fees, and account closure fees. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker.

Avatrade has several non-trading fees that traders should be aware of. Here's a breakdown of the fees:

| Fee type | Amount | Description |

| Deposit fee | Free | Avatrade does not charge any fees for deposits. |

| Withdrawal fee | $25-$50 | The withdrawal fee depends on the payment method used. |

| Inactivity fee | $50 per quarter | Charged if there is no trading activity for three months. |

| Account closure fee | Free | Avatrade does not charge a fee for closing an account. |

Overall, Avatrade's non-trading fees are reasonable compared to other brokers in the industry. The deposit fee is free, which is a significant advantage, but the withdrawal fee can be relatively high, depending on the payment method used. The inactivity fee is also something to keep in mind, as it can add up quickly if there is no trading activity. However, it's important to note that the inactivity fee is only charged after 12 months of inactivity, which is longer than some other brokers.

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

AvatradeGO: This is a mobile app that is available on both iOS and Android platforms. It allows traders to access their accounts and trade on the go.

MT4: Avatrade offers the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its user-friendly interface, advanced charting tools, and a range of custom indicators and expert advisors.

MT5: Avatrade also offers the MetaTrader 5 (MT5) platform, which is the successor to MT4. MT5 has several new features, including more advanced charting tools, a wider range of order types, and improved back-testing capabilities.

WebTrader: Avatrade's WebTrader platform allows traders to access their accounts and trade directly from their web browser. The platform is easy to use and offers a range of trading tools and indicators.

AvaOptions: This is Avatrade's platform for trading options. It offers a range of options trading tools, including risk management tools, and a range of customizable trading strategies.

Avatrade offers a variety of deposit and withdrawal options to its clients. The methods available may vary depending on the client's location and the currency used.

Deposit options include bank wire transfer, credit/debit card, Neteller, Skrill, WebMoney, and others. The processing time for deposits is usually instant or up to one business day.

Withdrawal options include bank wire transfer, credit/debit card, Neteller, Skrill, WebMoney, and others. Withdrawals usually take 1-2 business days to process.

Avatrade does not charge any deposit or withdrawal fees, but clients may incur fees from their payment provider or bank.

To withdraw funds from your Avatrade account, you need to follow these steps:

Log in to your Avatrade account.

Click on the “Withdraw Funds” tab located in the main menu.

Choose your preferred withdrawal method from the list of available options, such as bank wire, credit card, or electronic payment systems like Skrill or Neteller.

Enter the amount you want to withdraw and any necessary payment details.

Review and confirm the transaction details.

Submit your withdrawal request.

It's important to note that Avatrade requires you to withdraw funds using the same payment method that you used to deposit funds into your account. The processing time for withdrawals varies depending on the payment method, but Avatrade strives to process all withdrawal requests within 24 hours.

Avatrade offers customer support through multiple channels, including live chat, phone support, email, and an online contact form. They have customer support available in multiple languages, including English, Spanish, French, German, Italian, Portuguese, Arabic, and Chinese.

Their customer support team is available 24/5, meaning that they are available Monday through Friday to help with any questions or concerns that traders may have. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Avatrade's customer support has received positive reviews for their responsiveness and helpfulness. They also offer free educational resources to help traders improve their skills and knowledge.

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as e-books, video tutorials, webinars, and trading courses.

The e-books cover a range of topics, from basic trading concepts to advanced strategies. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management.

Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter. Additionally, they offer a range of trading courses for beginners, intermediate and advanced traders.

Conclusion

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, commodities, and cryptocurrencies, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and a demo account for traders to practice their strategies. However, there are some downsides to consider, such as higher non-trading fees and limited account options.

Q: Is Avatrade regulated?

A: Yes, Avatrade is regulated by multiple reputable authorities, including the Central Bank of Ireland, the Financial Services Commission in the British Virgin Islands, and the Australian Securities and Investments Commission.

Q: Does Avatrade offer a demo account?

A: Yes, Avatrade offers a free demo account for traders to practice and test their strategies before trading with real money.

Q: What is the minimum deposit requirement for Avatrade?

A: The minimum deposit requirement for Avatrade is $100.

Q: What trading instruments are available on Avatrade's platform?

A: Avatrade offers a wide range of trading instruments including forex, stocks, commodities, indices, cryptocurrencies, and more.

Q: What is the maximum leverage offered by Avatrade?

A: The maximum leverage offered by Avatrade is 1:400.

Q: Does Avatrade charge any trading fees?

A: Yes, Avatrade charges spreads and commissions on certain trading instruments.

Q: What deposit and withdrawal methods are available on Avatrade's platform?

A: Avatrade offers a variety of deposit and withdrawal methods including credit/debit cards, bank transfers, and e-wallets such as PayPal, Skrill, and Neteller.

Q: Does Avatrade provide educational resources for traders?

A: Yes, Avatrade provides a range of educational resources including webinars, e-books, trading courses, and more.

Q: What kind of customer support does Avatrade offer?

A: Avatrade offers 24/5 customer support through phone, email, as well as an extensive FAQ section on their website.

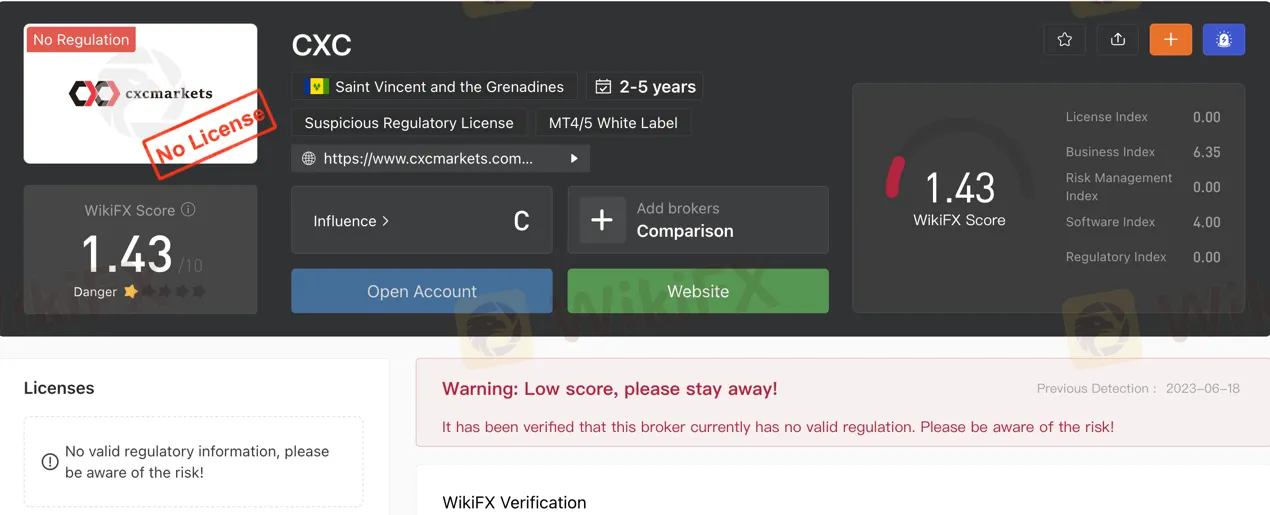

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | CXCMarkets Group |

| Regulation | No valid regulatory information, please be aware of the risk! |

| Minimum Deposit | $100 for Micro account |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Micro Account: From 1.3 pips, Zero Account: From 0 pips, Standard Account: From 1.3 pips |

| Trading Platforms | MetaTrader 4, Web Trader |

| Tradable Assets | Forex currency pairs, precious metals, cryptocurrencies, stock index CFDs |

| Account Types | Micro Account, Zero Account, Standard Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Online support available 24/7 in multiple languages; Email support |

| Payment Methods | Bank cards, Bitwallet (including Bitcoin, Litecoin, Ripple) |

CXC is a trading platform known as CXCMarkets and Tech-FX, which recently underwent a brand merger and upgrade. However, it's important to note that CXC is not regulated by any financial regulatory authority, which means there is no government oversight or customer protection. This lack of regulation poses a higher risk of fraud or financial losses for traders.

CXC offers a range of market instruments, including forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs. Forex currency pairs allow traders to speculate on exchange rate fluctuations, while precious metals and cryptocurrencies provide opportunities to benefit from price movements and global events. Stock index CFDs offer exposure to broader market trends.

CXC provides different account types, such as the Micro Account, Zero Account, and Standard Account, each with its own features and benefits. The leverage offered by CXC is up to 1:1000, allowing traders to control larger positions with a smaller initial investment. Spreads and commissions vary across account types, and the minimum deposit starts at $100 for the Micro Account.

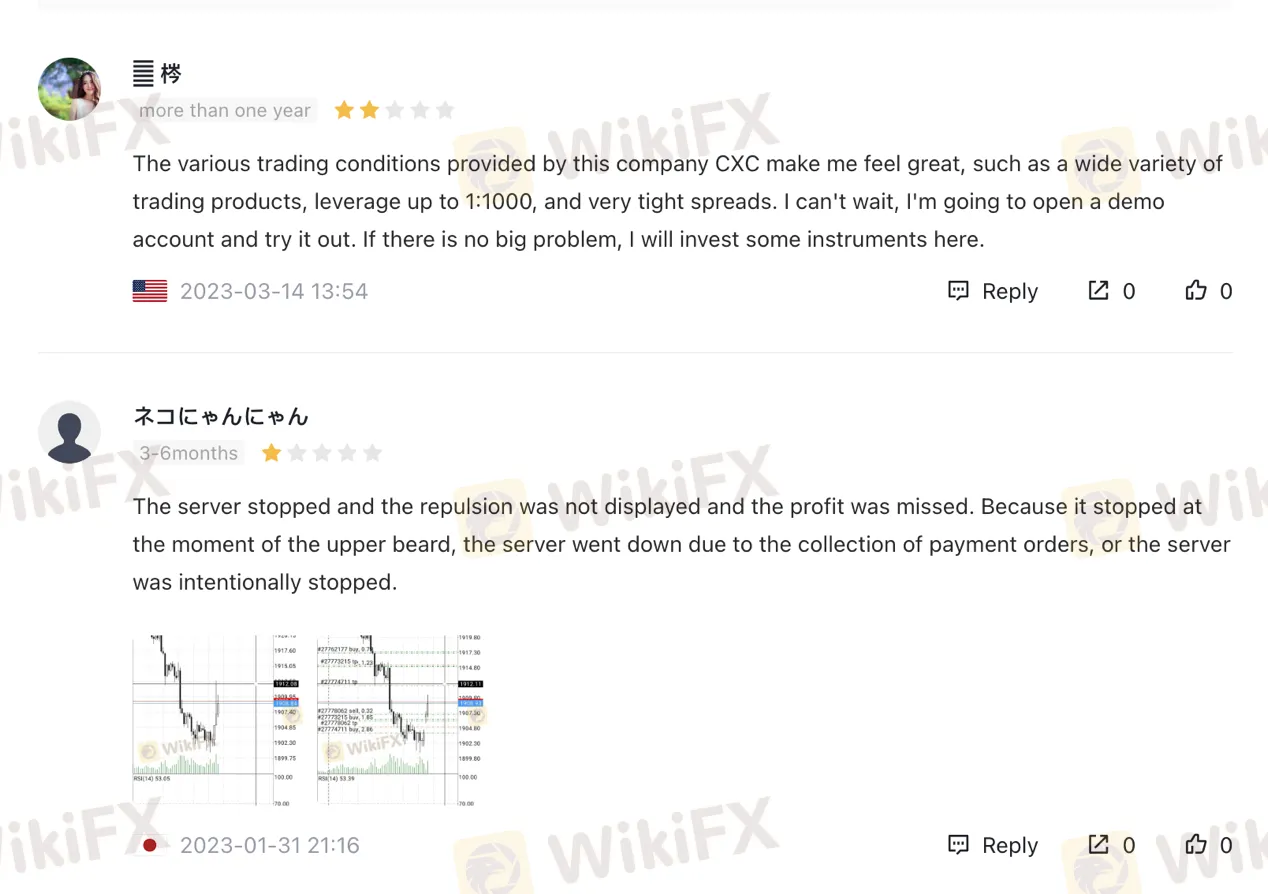

CXC offers the MetaTrader 4 platform and a web trader platform for trading activities. Customer support is available online through email, but no telephone number is provided for inquiries. Reviews about CXC are mixed, with some users expressing satisfaction with trading conditions and others reporting server issues and problems with payments.

In conclusion, CXC is an unregulated trading platform that offers various market instruments and account types. Traders should be cautious due to the lack of regulation and the associated risks. It's advisable to consider other factors and conduct thorough research when evaluating a broker.

CXC, operating as CXCMarkets and Tech-FX, presents a range of pros and cons for potential traders to consider. On the positive side, CXC offers a diverse selection of market instruments and different account types, along with leverage of up to 1:1000. Traders can access MetaTrader 4 and a web trader platform, benefiting from online customer support available around the clock. Additionally, CXC provides various deposit and withdrawal methods, accommodating different trader preferences. However, there are significant drawbacks to consider. Notably, CXC lacks regulation from any financial authority, increasing the risk of fraud or financial losses. Additionally, the absence of an official website raises transparency concerns, limiting access to essential information. Mixed user reviews and a suspicious regulatory license further contribute to the overall evaluation of CXC's potential as a reliable broker.

| Pros | Cons |

| Offers a variety of market instruments | Not regulated by any financial regulatory authority |

| Different account types available | Higher risk of fraud or financial losses |

| Leverage of up to 1:1000 | Limited deposit and withdrawal options |

| Customer support available in multiple languages | No official website available |

| Online customer support available 24/7 | No telephone customer support |

| Provides access to MetaTrader 4 platform | Mixed user reviews |

| Offers a web trader platform for browser-based trading | Lack of transparency due to no regulatory information |

CXC. is not regulated by any financial regulatory authority. This means that there is no government agency that oversees CXC.'s activities or protects its customers. As a result, there is a higher risk of fraud or other financial losses when trading with CXC.

CXC Markets is a trading platform that offers a variety of market instruments for investors. These instruments include forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs.

FOREX CURRENCY PAIRS: CXC Markets provides trading services for forex currency pairs. Forex, also known as foreign exchange, involves the buying and selling of different currencies. Traders can speculate on the exchange rate fluctuations between currency pairs, such as EUR/USD or GBP/JPY. The forex market is known for its high liquidity and round-the-clock trading, allowing investors to take advantage of global economic trends.

PRECIOUS METALS: CXC Markets also offers trading opportunities in precious metals. Precious metals, including gold, silver, platinum, and palladium, are valued for their rarity and industrial uses. Traders can speculate on the price movements of these metals, taking advantage of market fluctuations and global events that impact supply and demand. Precious metals are often considered a safe haven investment during times of economic uncertainty.

CRYPTOCURRENCY: CXC Markets enables trading in cryptocurrencies, which are digital or virtual currencies. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have gained significant popularity in recent years. Traders can participate in the price movements of cryptocurrencies, taking advantage of their volatility. Cryptocurrency markets operate 24/7 and provide opportunities for both short-term trading and long-term investment.

STOCK INDEX CFD: CXC Markets offers trading in stock index contracts for difference (CFD). A stock index represents the performance of a group of stocks from a specific market or sector. With stock index CFDs, traders can speculate on the price movements of the entire index without owning the underlying assets. This allows for greater ability to take both long and short positions. Stock index CFDs provide exposure to broader market trends and are popular among traders seeking diversification.

| Pros | Cons |

| Offers diverse market instruments | Not regulated by any financial regulatory authority |

| Access to forex currency pairs | Higher risk of fraud or financial losses |

| Availability of precious metals trading | Limited information on risk management and regulatory index |

| Enables trading in cryptocurrencies | Lack of transparency due to no regulatory information |

| Offers stock index CFDs for broader market exposure | Limited information on software index and licenses |

CXC offers a range of account types to cater to the diverse needs of traders. These accounts include the Micro Account, Zero Account, and Standard Account. Each account type has its own unique features and benefits.

MICRO ACCOUNT:

The Micro account offered by CXC is designed for traders who prefer smaller trading volumes. With a maximum leverage of 1:500, traders can amplify their trading positions. The minimum deposit required for this account is 10,000 JPY, and the minimum spread starts from 1.3 pips. Traders can trade various products, particularly focusing on currency trading. The minimum position size is 0.01 lots, and the account supports the use of Expert Advisors (EAs). CXC provides deposit and withdrawal methods for this account type, although specific methods are not mentioned. No commission is charged for trades executed in the Micro account.

ZERO ACCOUNT:

With a maximum leverage of 1:500, traders can have increased trading power. The minimum deposit required for this account is 100 USD, and the minimum spread starts from 0 pips. Similar to the Micro account, traders can access a wide range of products, mainly focusing on currency trading. The minimum position size is 0.01 lots, and Expert Advisors (EAs) are supported. Traders using the Zero account will be charged a commission of 8 USD per trade.

STANDARD ACCOUNT:

The Standard account offered by CXC caters to traders looking for a more flexible trading experience. With a maximum leverage of 1:500, traders can enhance their trading potential. The minimum deposit required for this account is 100 USD, and the minimum spread starts from 1.3 pips. Traders can access a variety of products, particularly focusing on currency trading. The minimum position size is 0.01 lots, and the account supports the use of Expert Advisors (EAs). No commission is charged for trades executed in the Standard account.

| Pros | Cons |

| No commission charged in Micro and Standard accounts | Lack of transparency on deposit and withdrawal methods |

| Access to a wide range of trading products | Limited information on specific deposit/withdrawal methods |

| Support for Expert Advisors (EAs) | Commission charged for trades in Zero account |

Leverage refers to the borrowing of funds to increase the potential return on an investment. CXC Markets offers a maximum leverage of 1:1000 for forex trading, which provides traders with the opportunity to control larger positions with a smaller initial investment. This high leverage allows traders to potentially magnify their profits.

CXC offers varying spreads and commission structures across its account types. The Micro Account has a minimum spread of 1.3 pips with no commission, while the Zero Account provides spreads starting from 0 pips but charges a commission of 8 USD per trade. The Standard Account also has a minimum spread of 1.3 pips but does not charge any commission. Traders can choose the account type that aligns with their trading preferences and cost considerations.

The Trading Platform offered by CXC provides an accessible and user-friendly interface for traders. It caters to various account types, with the minimum deposit set at $100 for the Micro account. The platform ensures that traders can engage in their preferred trading activities. Additionally, different account tiers are available, requiring deposits of $500, $1,000, and $10,000, respectively, offering a range of options to suit individual trading preferences.

Deposit and withdrawal options at CXC Markets are straightforward but limited. Traders can fund their accounts using two main methods: bank cards and Bitwallet, which includes cryptocurrencies such as Bitcoin, Litecoin, and Ripple. While these options provide a means of transferring funds, it is important to note that using cryptocurrencies for funding comes with inherent risks. Unlike traditional payment methods, such as bank cards, there is no possibility of initiating a chargeback in case of an issue or error. Therefore, caution should be exercised when choosing to use cryptocurrencies for depositing and withdrawing funds from CXC Markets.

| Pros | Cons |

| Supports Bit wallet for cryptocurrency transfers | Limited deposit and withdrawal options |

| Availability of bank card payments | Using cryptocurrencies for funding carries inherent risks |

| No possibility of initiating a chargeback with cryptocurrency transactions |

CXC Markets offers a range of trading platforms to meet the diverse needs of its users.

META TRADER 4 PLATFORM: CXC Markets provides access to the MetaTrader 4 trading platform, a highly regarded and widely used platform in the brokerage industry. This platform offers numerous trading tools and instruments that enhance the trading experience. Some notable features include a financial calendar, virtual private server (VPS) capabilities, trading signals (available for a subscription fee), a code base with customizable scripts, and a demo account for practice.

WEB TRADER: In addition to MetaTrader 4, CXC Markets also offers a web trader platform. This web-based platform allows traders to access their accounts and execute trades directly through a web browser. It provides an option for traders who prefer not to download and install trading software on their devices. The web trader platform offers similar functionality to the MetaTrader 4 platform, allowing for seamless trading experiences.

Pros and Cons

| Pros | Cons |

| MetaTrader 4 platform, widely used in the brokerage industry | No mention of specific innovative features or advanced tools |

| Web trader platform for browser-based trading | Lack of information on additional platform functionalities |

| Demo account for practice and testing | No mention of integrated educational resources or tutorials |

| Virtual private server (VPS) capabilities for enhanced trading | Limited information on platform customization options |

CXC Markets provides customer support through various channels to cater to the needs of their clients. Their online support is available 24/7, 365 days a year, and can be accessed in multiple languages such as Japanese, English, French, Chinese, and Korean. Clients can reach out to them via email at support@cxcmarkets.com. However, they do not provide a telephone number for customer inquiries. This approach ensures that clients can easily communicate with CXC Markets and receive assistance promptly.

Based on the reviews on WikiFX, there are mixed opinions about CXC. One user expressed satisfaction with the various trading conditions provided by CXC, such as a wide variety of trading products, high leverage of up to 1:1000. They were eager to open a demo account and potentially invest in instruments offered by the broker. However, another user had a negative experience, mentioning server issues that resulted in missed profits. They suspected intentional server shutdowns or problems with payment orders. It is important to note that these reviews reflect individual experiences and should be considered alongside other factors when evaluating a broker.

In conclusion, CXC is a trading platform that offers various market instruments such as forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs. However, it is important to note that CXC is not regulated by any financial regulatory authority, which means there is no government oversight or customer protection. This lack of regulation increases the risk of fraud or financial losses for traders. While CXC provides different account types with features like leverage and low spreads, the limited deposit and withdrawal options and mixed user reviews raise concerns about the reliability and quality of their services. Traders should carefully consider these factors and exercise caution when dealing with CXC.

Q: Is CXC a regulated broker?

A: No, CXC is not regulated by any financial regulatory authority, which increases the risk of trading with them.

Q: What market instruments are available on CXC?

A: CXC offers trading in forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs.

Q: What are the account types offered by CXC?

A: CXC offers Micro, Zero, and Standard accounts, each with its own features and benefits.

Q: What is the maximum leverage offered by CXC?

A: CXC provides a maximum leverage of 1:1000 for forex trading.

Q: What are the deposit and withdrawal methods supported by CXC?

A: CXC supports deposits through bank cards and Bitwallet, including cryptocurrencies like Bitcoin, Litecoin, and Ripple.

Q: What trading platforms are available on CXC?

A: CXC offers the MetaTrader 4 platform and a web trader platform.

Q: How can I contact CXC's customer support?

A: You can contact CXC's customer support through email at support@cxcmarkets.com.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive ava-trade and cxc-markets are, we first considered common fees for standard accounts. On ava-trade, the average spread for the EUR/USD currency pair is -- pips, while on cxc-markets the spread is 1.3~.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

ava-trade is regulated by ASIC,FSA,FFAJ,ADGM,CBI,FSCA,ISA,KNF. cxc-markets is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

ava-trade provides trading platform including -- and trading variety including --. cxc-markets provides trading platform including Micro account,Zero Account,Standard Account and trading variety including --.