No data

Do you want to know which is the better broker between instaforex and Dukascopy Bank ?

In the table below, you can compare the features of instaforex , Dukascopy Bank side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: --

Long: -6.23

Short: 0.8

Long: -21.82

Short: -7.01

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of instaforex, dukascopy lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Bank wire transfer and many other methods |

| Customer Service | Email/phone number/address/live chat/more |

| Fraud Complaints Exposure | No for now |

General information and regulations of InstaForex

InstaForex brand was founded in 2007 and claims to be the choice of more than 7 million brokers. InstaForex website may be very complex at first glance, but if you take a moment to look at it closely, you will find a wealth of content. The information bar on both sides of the page is full of attractive content, such as news, widgets, real-time charts, customer service and much more.

In the following article, we will analyze the features of this merchant in all its dimensions, providing you with easy and well-organized information. If you are interested, read on. Reading this article will take you approximately 7 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

Market instruments

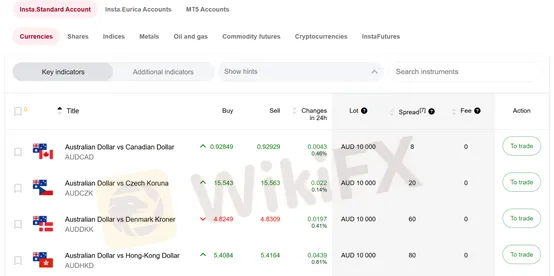

As we have said before, InstaForex web pages are very informative. On this trading products page you can see not only the trading products, but also the difference in commissions and spreads between different accounts. We can trade currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures.

Spreads and commissions for trading with InstaForex

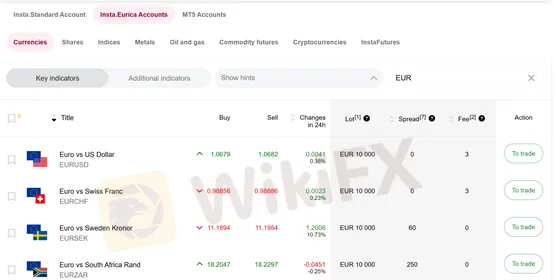

Let's take currency pairs as an example. Spreads and commissions vary on different accounts. On the MT5 and Standard accounts the spread is about 3 pips and there is no commission, while on the Eurica account the spread is 0 and the commission varies from 3-12 USD.

We can venture to conclude that Eurica is suitable for long-term traders who trade less frequently, while the other two accounts are suitable for short-term traders who trade more frequently.

Account Types for InstaForex

Demo account: InstaForex offers a demo account for testing a little on the financial market without the risk of losing money. Opening a demo account, according to the company, is as easy as ABC.

Live account: there are in total 4 types of accounts: insta standard, insta eurica, cent standard and cent eurica. The minimum deposit for opening an account at InstaForex is just 1 USD, and the trading conditions also seem to be quite favorable.

Trading platforms offered by InstaForex

As for trading platforms, clients can choose from the market leaders MetaTrader4 and MetaTrader5, which can be accessed from any device.

However, have you ever wondered or are you wondering which platform you should use? Our team has the corresponding article for your reference. The article details the similarities and differences between the two and gives specific advice.

https://www.wikifx.com/es/wikishow/202207208464173722.html

Leverage offered by InstaForex

InstaForex offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

Unlike some brokers that lack information, InstaForex is very generous in providing information. If you carefully browse their website, you can find a wealth of information. As for deposits and withdrawals, InstaForex shows all methods, required fees and arrival times clearly on a single page.

Educational resources

InstaForex educational resources are extensive. Online charts, market analysis, Forex calculators, indicators, articles, questions and answers, glossary... Whether you choose InstaForex as your broker or not, you can make the most of the resources available here.

Customer support of InstaForex

Call back, live chat, WhatsApp, email...with numerous channels and 24/7 service, clients could get help whenever they have trading-related problem.

Here are more details about the customer service.

Languages: there are total sixteen languages on InstaForex website, which could meet the needs of most of its customers.

Service hours: 24/7

Phone: you could fill in a form, indicating your country, your preferred language and time, the team will call you whenever you want, and the service is totally free of charge.

Email: support@mail.instaforex.com

Social networks: Facebook, Twitter, YouTube, Telegram, Instagram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of InstaForex

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

Low leverage

Frequent asked questions about InstaForex

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

Does this broker offer MT4/MT5?

Yes, InstaForex offers both MT4 and MT5 for you to choose from.

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland. The bank specializes in providing cutting-edge internet-based and mobile trading services, with a strong focus on foreign exchange, CFDs, and binary options. Additionally, the bank offers a wide range of banking and financial services, all supported by their in-house technological solutions.

Dukascopy Bank was established on November 2, 2004, in Geneva by Andre and Veronika Duka, both Swiss nationals residing in Geneva who continue to maintain a 99% ownership stake in the company. Dukascopy Bank is regulated by the Swiss Financial Market Supervisory Authority FINMA both as a bank and a securities firm.

Dukascopy Bank fully owns Dukascopy Europe IBS AS, a European licensed brokerage company based in Riga and Dukascopy Japan, a Type-1 licensed broker located in Tokyo. In addition to its Geneva Headquarters, Dukascopy Bank has offices in Riga, Tokyo and Hong Kong. Currently, Dukascopy Group employs over 300 staff.

The Dukascopy Group primarily offers online and mobile trading services through the SWFX - Swiss FX Marketplace, which is Dukascopy's proprietary ECN (Electronic Communication Network) technological solution and a registered trademark.

Dukascopy main features | |

☑️Regulations | FINMA (Switzerland), JFSA (Japan), FCMC (Latvia) |

💰 Account currency | USD, CHF, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, CNH, SEK, SGD, TRY, XAU and ZAR |

🗺 Supported Languages | English, Spanish, German, French, Arabic, Russian, Portuguese, Japanese, Chinese, Slovak, Czech, Polish, Italian, Hungarian |

📊 Accounts | ECN accounts with a minimum deposit requirement of $100 - JForex4, MT4, PAMM, Binary options (all available for demo testing). |

💰 Products (CFD) | Currencies, Commodities, Indices, ETFs, Stocks, Bonds, Crypto |

💵 Min Deposit | $100 (Dukascopy Bank SA), $100 (Dukascopy Europe IBS AS) |

💹 Margin Call / Stop Out: | 100%/200% |

📈️ Min Order | 0.01 |

💱 Spread | From 0.1 pips for EUR/USD |

💹 Max Leverage | From 1:1 to 1:200 on weekdays/ from 1:1 to 1:60 on weekends (JForex4 platform - limitations may apply), 1:25 (Dukascopy Japan) |

🖥 Trading Desk Type | All trading orders are executed fully automatically by the trading system. Order execution is STP (Straight-Through Processing) without any human intervention |

📊 Trading Platforms | JForex4 and MT4 platform, both are available for desktop and mobile. |

💳 Deposit Options | Wire Transfer (SWIFT, SEPA), Debit/Credit Card, Cryptocurrencies, Skrill, Neteller, Bank guarantee |

💳 Withdrawal Options | Bank Transfer, Transfer to crypto exchange, Skrill, Neteller, Payment Card |

🕑 Time to Withdrawal | Withdrawal request is processed within 1 working day |

🕝 Time to Open an Account | The deposit is processed within 1 working day |

₿ Cryptocurrencies | Bitcoin, Cardano, Litecoin, Stellar, Dash, Enjin Coin, TRON, Uniswap, EOS, Ethereum, Basic Attention Token, Chainlink, Polygon |

🗓 Foundation Year | 2004 (Geneva, Switzerland) |

🎁 Contests and bonuses | Yes |

Dukascopy offers an exceptional trading experience that is worth every trader's attention. With a client-first approach, Dukascopy provides numerous advantages, making them a standout choice for anyone looking to enter the financial markets. Dukascopy's commitment to cost-efficiency is evident through their low spreads, allowing for savings on trading costs. Swift execution ensures obtaining the best possible prices, providing a competitive advantage in trades. Additionally, with deposit protection of up to CHF 100,000, you can trade with peace of mind.

The unique trading platform, JForex4, Dukascopy's proprietary solution, is user-friendly, making trading accessible even for beginners. JForex4 presents over 200 technical indicators and trading widgets to help in staying informed about potential opportunities. With support for minute timeframes like ticks and seconds, it is perfect for scalping. Dukascopy's 19 years of experience and Swiss banking license instill trust and security. With over 1200 instruments, leverage up to 1:200, and 24/7 live trading support, Dukascopy stands as a trusted partner to guide traders through their trading journey.

Moreover, Dukascopy offers a great feature – detailed historical price feed data makes it easier to develop and test trading strategies. This data covers various financial instruments, helping traders make informed decisions and reducing the risk of price manipulation. Dukascopy's extensive data archive is a useful resource for creating trading strategies, especially for high-frequency trading, and provides practical insights.

With such a comprehensive offering, Dukascopy is the go-to choice for transparent and professional trading services. Make a smart move and open an account today!

Attractive trading conditions |

Client funds protected up to CHF 100,000, with EUR 20,000 cover for Dukascopy Europe. |

Online account opening with video identification |

Accumulating liquidity from various sources (banks, brokerage companies, liquidity providers, internal liquidity pool) |

ECN accounts with a minimum deposit requirement of $100 - JForex4, MT4, PAMM, Binary options (all available for demo testing). |

A wide range of free financial information and other attractive resources is available through its website, including Dukascopy TV |

Extensive variety of trading platforms, JForex4, MT4 (available for desktop and mobile) |

Manual and automated trading and trading directly from the chart |

Hedging and scalping allowed |

Slippage control |

Swap free accounts upon request (conditions apply) |

200 indicators and chart studies and automated trading historical tester |

Wide range of trading orders: MIT, limit orders, eco and TP/SL orders |

Deposit bonus up to 100% |

Leverage up to 1:200 |

Dukascopy regulations

Dukascopy is strictly supervised and regulated by esteemed regulatory bodies. The regulatory authorities play a pivotal role in ensuring Dukascopy’s compliance with the highest standards of financial and securities industry practices.

Dukascopy's international presence is underlined by its licenses and oversight by regulatory authorities in different parts of the world:

Dukascopy Bank SA is licensed and regulated as a bank and as a securities firm by the Swiss Financial Market Supervisory Authority (FINMA), which is classified as a Tier-1 regulator.

Dukascopy Europe IBS AS is licensed and regulated by the Bank of Latvia, also recognized as a Tier-1 regulator.

Dukascopy Japan K.K. is licensed and regulated by the Financial Services Agency of Japan (JFSA), known as a Tier-1 regulator.

These regulatory bodies set specific requirements for Dukascopy, and the company has diligently complied with them since 2004. It is important to note that failure to comply with these requirements could result in the withdrawal of the bank's license. Regular audits are conducted to ensure adherence to Swiss laws. Dukascopy also ensures client security by providing deposit protection for amounts up to CHF 100,000, in line with Swiss financial service provider requirements.

Dukascopy is widely regarded as one of the safest brokerage firms. They maintain strict safety standards and hold official licenses from respected financial regulators. Routine audits by PKF for internal affairs and KPMG for financial records further solidify their commitment to safety and financial integrity.

In summary, Dukascopy's reputation as a trusted and stable entity is due to its adherence to three top-tier regulations, regular audits, stringent safety standards, and a strong commitment to transparency. These qualities make Dukascopy a reputable choice for investors around the world.

Trading terms for Dukascopy clients

Traders opt for Dukascopy due to its well-established reputation for providing a secure trading environment. Dukascopy Bank SA, headquartered in Switzerland, operates under the regulation of the Swiss Financial Market Supervisory Authority (FINMA). This regulatory oversight ensures strict adherence to financial standards and secures client accounts up to CHF 100,000.

Dukascopy takes pride in delivering favorable trading terms to its clients. By offering narrow spreads, cost-effective commissions, and access to abundant liquidity from numerous providers, Dukascopy enables traders to execute trades at competitive rates, ultimately increasing their profitability.

Dukascopy also permits traders to select from a range of trading accounts, including Standard, ECN, and Islamic accounts, to suit various trading styles and preferences.

Furthermore, in addition to the widely-used MT4 platform, Dukascopy presents its proprietary JForex4 trading platform, available for both desktop and mobile devices. This platform grants traders the flexibility to monitor and participate in the markets from anywhere, ensuring they never miss a trading opportunity. Dukascopy's JForex4 mobile platform offers real-time quotes, comprehensive order management features, and full account accessibility.

With Dukascopy, you can transfer funds directly from the JForex platform to a multi-currency banking account (MCA), without any associated fees. The MCA account supports various payment methods, including card and cryptocurrency transactions.

Trading features | |

🔧 Instruments | 1200+ instruments including: FX, Commodities (CFD), Indices (CFD), Bonds (CFD), Stocks (CFD), ETF (CFD), Crypto (CFD) |

🏛 Liquidity Provider | Liquidity providers are represented by centralized marketplaces and a number of banks which continuously provide ask and bid prices on the market. The sentiment ratio of this group is opposite to liquidity consumers data because, for each trade executed through SWFX, there are two equal and offsetting over-the-counter transactions |

⚡Lightning-fast order execution | Yes |

🎧 Customer support | 24h/7 multi-language support via chat, phone and email |

⭐ Other | A wide range of order types, including stop-loss and limit orders |

📱 Mobile trading | Yes |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive instaforex and dukascopy are, we first considered common fees for standard accounts. On instaforex, the average spread for the EUR/USD currency pair is Fixed 2-7 pips, while on dukascopy the spread is from 0.1.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

instaforex is regulated by CYSEC. dukascopy is regulated by FSA,FINMA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

instaforex provides trading platform including Standard Trading Accounts,Eurica Trading Accounts,ECN Trading Account,ECN Pro Trading Account,Scalping trading account and trading variety including --. dukascopy provides trading platform including MT4,JForex and trading variety including Forex, cryptocurrencies, CFDs, metals.