No data

Do you want to know which is the better broker between GMI and Windsor Brokers ?

In the table below, you can compare the features of GMI , Windsor Brokers side by side to determine the best fit for your needs.

Long: -5.22

Short: 1.52

Long: -0.02

Short: 0.01

EURUSD: 0.5

XAUUSD: -0.4

Long: -7.51

Short: 1.61

Long: -33.73

Short: 18.35

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of gmi, windsor-brokers lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| GMI Review Summary in 10 Points | |

| Founded in | 2009 |

| Headquarters | UK |

| Regulation | FCA |

| Market Instruments | forex, indices, gold, oil, silver |

| Demo Account | Available |

| Social Trading | Yes |

| Leverage | 1:2000 |

| EUR/USD Spread | 0.0 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $15 |

| Customer Support | 24/5 email and live chat |

GMI (Global Market Index) is a forex and CFD broker that offers trading services to retail and institutional clients. It was established in 2009 and is headquartered in the United Kingdom with offices in Cyprus and the UAE. The broker is regulated by the Financial Conduct Authority (FCA) in the UK. GMI offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. It also provides the popular MetaTrader4 (MT4) platform.

GMI (Global Market Index) is a forex and CFD (contract for difference) broker, operating as a No Dealing Desk (NDD) broker with Straight Through Processing (STP) and Electronic Communication Network (ECN) execution models.

GMI appears to have a number of strengths, including its low minimum deposit requirement, tight spreads, various account types, social trading solution, and competitive leverage. However, a limited range of trading instruments, educational resources, research and analysis tools may concern some traders.

| Pros | Cons |

| • Regulated by FCA | • Limited range of trading instruments |

| • Wide range of account types | • Inactivity fee after 90 days of inactivity |

| • Commission-free trading | • Limited educational resources |

| • Negative balance protection | • Limited research and analysis tools |

| • Social trading feature supported |

Note: The pros and cons listed above are not exhaustive and may vary based on individual preferences and circumstances.

Overall, potential clients of GMI should conduct their own research and carefully consider the advantages and disadvantages before deciding to trade with this broker.

GMI is a regulated forex broker, licensed by Financial Conduct Authority (FCA), which provides some level of safety and security for traders. However, it is important to note that regulation does not guarantee the complete safety of funds and trading with any broker carries a level of risk. It is important for traders to do their own research and due diligence before deciding to trade with any broker.

In the table below, these measures show that GMI takes the safety and security of its clients seriously and works to provide a secure trading environment.

| Protection Measures | Description |

| Regulation | FCA |

| Client Fund Segregation | GMI holds client funds in separate accounts from its operational funds to ensure that they are protected in case of bankruptcy or insolvency |

| Negative Balance Protection | Clients can not lose more than their account balance |

| Security Protocols | Protect clients' personal and financial information, including SSL encryption, two-factor authentication, and firewalls |

| Investor Compensation Fund | Provides up to £85,000 of compensation to eligible clients in case of GMI's insolvency |

Based on the information available, GMI is regulated by the Financial Conduct Authority (FCA) in the UK, which oversees the company's compliance with financial regulations and standards. The company also claims to implement safety measures, such as negative balance protection and the use of segregated client accounts, to ensure the safety of its clients' funds.

As with any financial services provider, there is always a level of risk involved, and it is essential to do your due diligence and conduct thorough research before choosing a broker.

GMI offers a variety of trading instruments across different asset classes, including:

Forex: GMI offers a wide range of forex currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

Indices: GMI offers trading on major stock market indices such as the S&P 500, NASDAQ, and FTSE 100, as well as a range of other international indices.

Gold: GMI offers spot trading in gold, which allows traders to speculate on the price of the precious metal without taking physical delivery.

Oil: GMI offers spot trading in oil, including Brent Crude and US Crude.

Silver: GMI offers spot trading in silver, which is another popular precious metal among traders.

However, other popular asset classes such as stocks and cryptocurrencies seem to be not available. Overall, GMI provides traders with many trading instruments to choose from, enabling them to diversify their portfolios and potentially capitalize on different market conditions.

GMI offers four types of live trading accounts: Cent, Standard, Standard Bonus, and ECN accounts.

Cent Account: This account is ideal for beginner traders who want to start with a small investment. The minimum deposit requirement for this account is just $15.

Standard Account: This account is suitable for more experienced traders. The minimum deposit requirement for this account is $25.

Standard Bonus Account: This account is similar to the standard account but comes with an additional bonus on deposits. The minimum deposit requirement for this account is also $25.

ECN Account: This account is designed for professional traders who want to trade with the lowest spreads possible. It offers raw spreads starting from 0 pips. The minimum deposit requirement for this account is $100.

Risk-free demo accounts and swap-free Islamic accounts are also available at GMI.

According to the GMI website, the maximum leverage offered is up to 1:2000. It's important to note that using high leverage comes with higher risks, and traders should always understand the potential risks and manage their trades accordingly.

GMI offers spreads from 0.0 pips. It's important to note that spreads may vary depending on market conditions and liquidity. Traders may also be subject to additional fees such as swaps and overnight financing charges.

Regarding the commission, it varies depending on the type of account. There is no commission charged on the Cent, Standard, Standard Bonus accounts, while the commission for the ECN account is $4 per lot.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| GMI | 0.0 pips | No ($4 per lot for the ECN account) |

| XM | 0.6 pips | No |

| FXTM | 0.1 pips | No |

| HotForex | 1.2 pips | No |

| Pepperstone | 0.1 pips | AUD $7 per lot (round turn) |

| IG | 0.6 pips | No |

Note: Spreads can vary depending on market conditions and volatility. It's always a good idea to check with the broker directly for the latest information on their spreads and commissions.

GMI offers its clients the popular MetaTrader 4 trading platform, which is available for Windows, Mac, iOS, Android and Web. The platform includes a variety of tools and features for technical analysis, order management, and customization. It also supports automated trading with the use of Expert Advisors (EAs).

See the trading platform comparison table below:

| Broker | Trading Platforms |

| GMI | MetaTrader4 |

| XM | MetaTrader4, MetaTrader5, XM WebTrader |

| FXTM | MetaTrader4, MetaTrader5, FXTM Trader |

| HotForex | MetaTrader4, MetaTrader5, HotForex WebTrader |

| Pepperstone | MetaTrader4, MetaTrader5, cTrader |

| IG | MetaTrader4 |

Note: The information in this table is subject to change and may not be exhaustive. It is recommended to visit each broker's website for the latest information on their trading platforms.

GMI offers social trading features that allow traders to copy the strategies of successful traders. This enables traders to learn from experienced individuals and potentially benefit from their proven track records. GMI's social trading platform promotes knowledge sharing and community-driven trading in a simple and accessible manner.

Users from different countries can fund with different methods. Just take an example of Malaysian users, they can fund their accounts via Local Bank Transfer, Neteller and Skrill.

The minimum deposit is $15 for Local Bank Transfer, and $10 for Neteller and Skrill. The minimum withdrawal is 50 MYR for Local Bank Transfer, and $10 for Neteller and Skrill.

No deposit fees are charged while withdrawal fees vary on the payment method. For example, there is no withdrawal fee for Local Bank Transfer, while a 4% withdrawal fee for Neteller and Skrill.

As for the processing time, all deposits and most withdrawals are instant, while Local Bank Transfer withdrawals may be slower, usually can be processed between 8am to 6pm daily.

| GMI | Most other | |

| Minimum Deposit | $15 | $/€/£100 |

The process for withdrawing funds from GMI may vary depending on the method used for the deposit. However, in general, you can follow these steps:

Step 1: Log in to your GMI account.

Step 2: Click on the “Withdrawal” option in the menu.

Step 3: Select the preferred withdrawal method from the available options.

Step 4: Fill out the withdrawal form with the required details.

Step 5: Submit the withdrawal request.

GMI may require additional verification documents before processing the withdrawal request. The time it takes for the withdrawal to be processed and the funds to be received may also depend on the chosen withdrawal method.

GMI charges various fees to its clients, including:

Overnight Financing: GMI also charges an overnight financing fee on positions held overnight. This fee varies based on the instrument traded, the account type, and the prevailing interest rates in the market.

Inactivity Fee: GMI charges an inactivity fee of $50 per quarter for accounts that have been inactive for more than 90 days.

Other Fees: GMI may charge other fees related to account maintenance, data feeds, and other services. These fees are disclosed in the account agreement and may vary depending on the client's location and account type.

It's always recommended to review the complete fee schedule and terms and conditions on the broker's website or by contacting their customer support team.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| GMI | Free | Free | $50/quarter if no activity for 90 days |

| XM | Free | Free | $15/month after one year of inactivity |

| FXTM | Free | Free (except bank wire) | $5/month after six months of inactivity |

| HotForex | Free | Free (except bank wire) | $5/month after six months of inactivity |

| Pepperstone | Free (except credit card) | Free (except bank wire) | $0 after 12 months of inactivity |

| IG | Free (except bank transfer) | Free | $18/month after two years of inactivity |

Please note that fees may vary based on account type, payment method, and other factors. It's important to check with each broker directly for the most up-to-date and accurate fee information.

GMI provides customer support to its clients through various channels, including email and live chat. Customer service is available 24/5, which means that traders can get in touch with the company's representatives during business days. GMI's customer support team is multilingual, which is helpful for clients who speak languages other than English.

You can also fill in the online contact form to get in touch with GMI. However, the availability and quality of customer support may vary depending on the specific region and the volume of inquiries.

| Pros | Cons |

| • 24/5 customer support via phone, email, chat | • No 24/7 customer support |

| • Personal account managers | • No physical offices in some regions |

| • Multilingual support | • No social media support |

| • Quick response time |

Note: Pros and cons may vary based on individual experiences and opinions.

Based on the analysis of GMI, it is a regulated and reputable broker that offers the low minimum deposit requirement, competitive spreads and commissions, and a choice of different account types, as well as good customer support.

One potential downside of GMI is its limited range of trading instruments and educational resources. Additionally, it offers only one trading platform-MetaTrader4. MetaTrader5 is not available.

Overall, GMI is a solid option for traders who prioritize MT4, demo trading and competitive pricing.

| Q 1: | Is GMI regulated? |

| A 1: | Yes. GMI is regulated by Financial Conduct Authority - FCA. |

| Q 2: | Does GMI offer demo accounts? |

| A 2: | Yes. GMI offers demo accounts with $10,000 virtual capital. |

| Q 3: | Does GMI offer industry-standard MT4 & MT5? |

| A 3: | Yes. GMI supports MT4. |

| Q 4: | What is the minimum deposit for GMI? |

| A 4: | The minimum initial deposit at GMI to open a Cent account is just $15. |

| Q 5: | Is GMI a good broker for beginners? |

| A 5: | Yes. GMI is a good choice for beginners because it offers a wide variety of trading assets with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Windsor Brokers Review Summary in 10 Points | |

| Founded | 1988 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

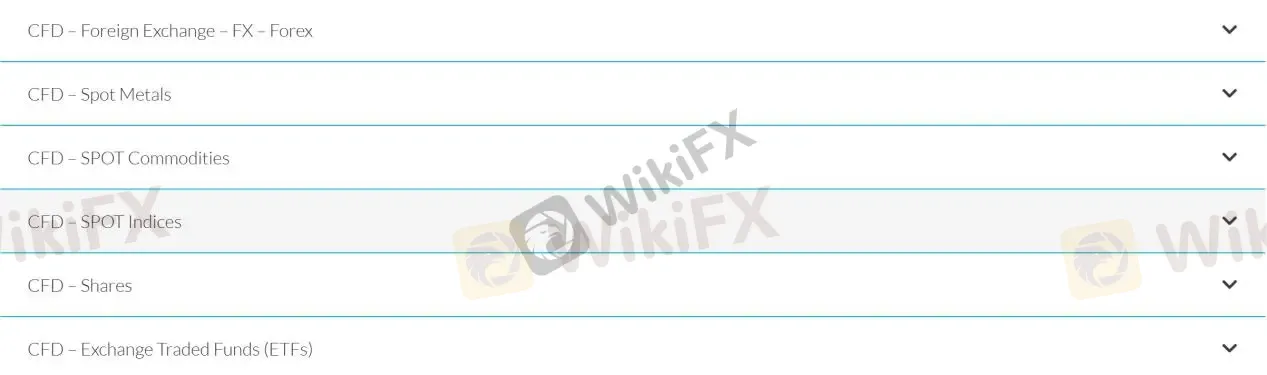

| Market Instruments | CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs |

| Account Types | Prime account, Zero account |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Windsor Broker Ltd, founded in 1988 and headquartered in Limassol, Cyprus, is an European brokerage firm that has been providing financial services to retail, corporate and institutional investors worldwide for many years, offering a wide range of financial instruments, including Forex, commodities, indices, and shares, as well as a variety of trading platforms and trading tools. Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC, No. 030/04).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by CySEC | • Limited payment methods |

| • Negative balance protection | • Clients from the USA, Japan and Belgium are not accepted |

| • Wide range of trading tools | • Limited info on accounts |

| • MT4 for all devices | |

| • Low spreads and commissions | |

| • Wide product portfolios | |

| • Demo accounts available |

Regulation by a reputable authority like Cyprus Securities and Exchange Commission (CySEC) is a positive factor indicating that Windsor Brokers is a legitimate broker. Additionally, the fact that they offer negative balance protection is also a plus for traders.

CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs are all available at Windsor Brokers. The broker allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade with Windsor Brokers.

Demo Account: Windsor Brokers provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Windsor Brokers offers two types of real trading accounts: the Prime Account and the Zero Account. The Prime Account, geared towards support-oriented traders, has a lower $50 minimum deposit and spreads starting from 1.0 pips on major pairs. It provides zero commission on forex CFDs, an $8 commission per lot for crypto CFDs, and includes training resources.The Zero Account targets heavy traders with a $1,000 minimum deposit, zero spreads on major currency pairs, and a maximum leverage of 1:1000. It charges an $8 commission per lot for forex, metals, and crypto CFDs, with no commission on other CFDs. Both accounts offer negative balance protection, personal account managers, a 0.01 minimum trade volume, a 50 lot restriction per ticket, hedging allowance, and a 20% stop-out level with a 100% margin call. Notably, the Zero Account does not support Islamic/swap-free accounts.

The maximum leverage offered by Windsor Brokers is only 1:30, which may seem too low to you. Margin requirements for professional clients based on 1:100 leveraged accounts. Other leverages are available to Professional Clients only.

In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

It is commendable that in the trading instruments interface, Windsor Brokers provides a detailed table showing the spreads, margin requirement, pip value, and stop levels of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Windsor Brokers | 0.2 pips | $0 |

| BlackBull Markets | 0.8 pips | $6 |

| Eightcap | 0.6 pips | $3.50 |

| FOREX TB | 0.7 pips | $0 |

Note: Spreads can vary depending on market conditions and volatility.

Windsor Brokers offers traders the popular MT4 trading platform for PC, Mac, WebTrader, Android, iPhone, Android Tablet and iPad, which is ideal for all traders, whether they are professional traders or beginners. MT4 trading platform features powerful charting capabilities, a large number of indicators and algorithmic trading features, a user-friendly interface, a dynamic security system, and multi-terminal functionality.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Windsor Brokers | MT4, WebTrader |

| BlackBull Markets | MT4, MT5, WebTrader |

| Eightcap | MT4, MT5, WebTrader |

| FOREX TB | MetaTrader 4 |

Windsor Brokers provides a variety of trading tools to its clients to help them make informed trading decisions. These tools include market analysis and commentary, an economic calendar, and information on market holidays. Additionally, the broker offers several Forex calculators, such as Profit, Margin, Pip, Fibonacci, and Pivots calculators, which can be useful in managing risk and determining potential profits. By providing these trading tools, Windsor Brokers aims to empower traders with the necessary knowledge and resources to navigate the financial markets.

In terms of deposits and withdrawals, Windsor Brokers offers these payment methods: Credit/debit cards (Visa/MasterCard), WebMoney, Wire Transfer, Neteller and Skrill.

| Windsor Brokers | Most other | |

| Minimum Deposit | $100 | $100 |

The broker does charges fees for deposits and withdrawals, which vary on the payment method. All deposits are processed on the same day, while most withdrawals can be processed on the same day with the exception of wire transfer withdrawal.

More details concerning deposit/withdrawal fees and processing time can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Credit/debit cards (Visa/MasterCard) | 3% | $/€/£3/transaction | Same day | Same day |

| WebMoney | 0.8% | 0.8% | ||

| Wire Transfer | Vary | Vary $0-30 | Vary | |

| Neteller | 3% | $/€/£3/transaction | Same day | |

| Skrill | 3% | 1% - min $/€/£3£ | ||

| Broker | Deposit Fees | Withdrawal Fees |

| Windsor Brokers | Vary on the method | Vary on the method |

| BlackBull Markets | None | None |

| Eightcap | None | None |

| FOREX TB | None | None |

Note: Fees may vary based on the payment method and currency used. Please refer to the broker's website for the most up-to-date information.

Below are the details about the customer service.

Service Hour: 24/5

Live Chat/Fill in Contact Form

Email: support@windsorbrokers.eu

Phone: +357 25 500 700

Fax: +357 25 500 555

Address: Spyrou Kyprianou 53, Windsor Business Center, 3rd Floor, Mesa Geitonia, 4003 Limassol, Cyprus,

Or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Overall, Windsor Brokers' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual customer support | • No 24/7 customer support |

| • Multi-channel support | |

| • Live chat available | |

| • Quick response time for customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Windsor Brokers' customer service.

Windsor Brokers offers a variety of educational resources to help traders improve their skills and knowledge. They have a video library that covers topics such as technical analysis, risk management, and trading strategies. They also have a glossary of trading terms and an ebook library that covers a range of topics such as trading psychology, fundamental analysis, and more. These educational resources are available for free to all clients of Windsor Brokers.

On our website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Windsor Brokers is a regulated broker that offers access to multiple markets and trading platforms, as well as a range of trading tools and educational resources. The broker's negative balance protection is a positive feature that helps protect traders from incurring losses beyond their deposited funds.

However, some users have reported difficulties with withdrawals, which may raise concerns about the broker's reliability. Overall, Windsor Brokers appears to be a reputable broker that offers a good range of services, but potential traders should carefully consider the reported withdrawal issues before deciding to open an account.

| Q 1: | Is Windsor Brokers regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Windsor Brokers, are there any regional restrictions for traders? |

| A 2: | Yes. It does not accept clients from the USA, Japan and Belgium. |

| Q 3: | Does Windsor Brokers offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Windsor Brokers offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Windsor Brokers? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is Windsor Brokers a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive gmi and windsor-brokers are, we first considered common fees for standard accounts. On gmi, the average spread for the EUR/USD currency pair is -- pips, while on windsor-brokers the spread is 0.1.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

gmi is regulated by FCA. windsor-brokers is regulated by CYSEC,FSC,FSA,BaFin.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

gmi provides trading platform including Standard Bonus,Standard,Cent,ECN and trading variety including --. windsor-brokers provides trading platform including Standard account,ECN VIP,ECN Standard and trading variety including Foreign exchange, precious metals, CFDs.