No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FXTM and Spreadex ?

In the table below, you can compare the features of FXTM , Spreadex side by side to determine the best fit for your needs.

Long: -7.04

Short: 2.53

Long: -37.89

Short: 19.3

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxtm, spreadex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FXTM | Basic Infromation |

| Registered Country/Region | United Kingdom |

| Founded in | 2011 |

| Headquarters | Cyprus, UK, Belize |

| Regulated By | FCA, CySEC, FSCA (Out of Scope Business) |

| Minimum Deposit | $10 |

| Leverage | Up to 1:2000 |

| Account Types | Micro, Advantage, and Advantage Plus |

| Demo Account | Yes |

| Trading Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader |

| Mobile Trading | Yes |

| Islamic Account | Yes |

| Payment Methods | Credit/Debit Cards, Bank Wire, E-wallets |

| Minimum Spread on EUR/USD | From 0.1 pips |

| Customer Support | 24/5 Live Chat, Email, Phone |

| Educational Resources | Yes |

| Negative Balance Protection | Yes |

FXTM, or Forex Time, is a global forex and CFD broker founded in 2011. The company is headquartered in Cyprus and is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and other regulatory bodies in various countries. FXTM offers a variety of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

FXTM is its extensive range of account types, which cater to traders of all experience levels and preferences. The broker offers five different account types, including the Micro, Advantage, and Advantage Plus accounts, as well as demo accounts and Islamic accounts. Each account type comes with its own unique features, including different leverage options, spreads, and minimum deposit requirements. In terms of trading fees, FXTM offers variable spreads on most of its instruments, with spreads starting from as low as 0.1 pips.

FXTM also offers a range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available in desktop, web, and mobile versions, allowing traders to trade on the go and from anywhere in the world.

Lastly, FXTM provides customer support in multiple languages, which is available 24/5 via live chat, email, and phone. The broker also offers a range of educational resources, including webinars, seminars, and trading guides.

FXTM is currently regulated by two reputable regulatory bodies, the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. These regulatory bodies ensure that the broker operates within strict guidelines and rules.

Forextime Ltd (Its CYSEC entity), is authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC) under regulatory license number 185/12.

Exinity UK Ltd, its UK entity, is authorized and regulated by the Financial Conduct Authority (FCA) under regulatory license number 777911.

FOREXTIME LTD is authorized by the Financial Conduct Authority (FSCA), holding a license of Financial Service Authority under license no. 46614.

FXTM is a well-known broker that offers a range of trading services to its clients, including forex, commodities, and CFDs. While there are many benefits to trading with FXTM, there are also some drawbacks to consider. In this table, we'll take a closer look at the pros and cons of trading with FXTM, so you can make the right choice about whether this broker is right for you. Some of the pros we'll cover include their range of account types, competitive spreads, and excellent customer support, while some of the cons we'll discuss include the lack of cryptocurrency trading and high withdrawal fees.

| Pros | Cons |

| Regulated by top-tier financial authorities, FCA and CYSEC | Limited product offerings compared to some competitors |

| Wide range of account types for different trading needs | High inactivity fee |

| Low minimum deposit requirements | Limited payment methods |

| Demo Accounts Available | Limited research tools and resources |

| Islamic Accounts Available | |

| Access to a variety of trading platforms, including MT4 and MT5 | |

| Multiple funding and withdrawal options | |

| Rich Eductaional Resources | |

| Rich Trading Tools | |

| High-quality customer support |

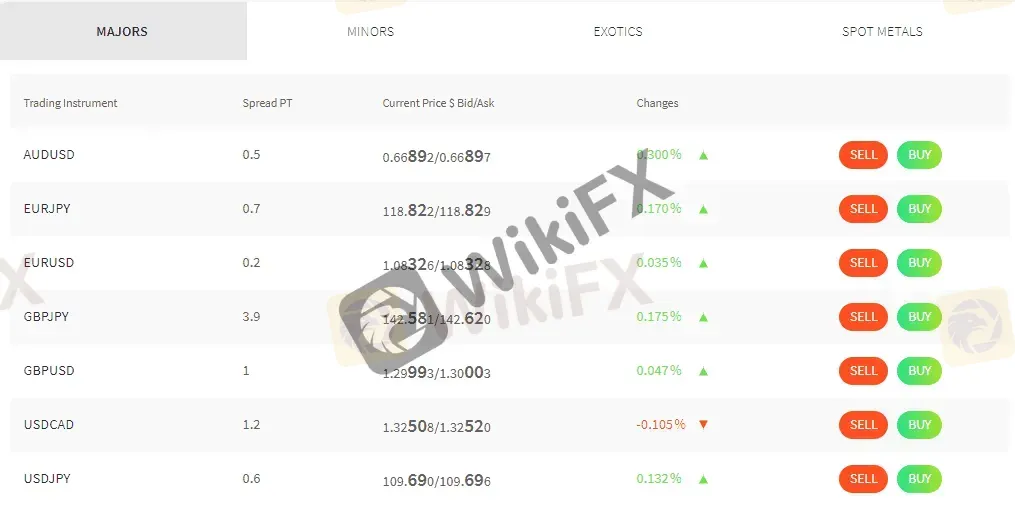

FXTM offers a diverse range of trading instruments for its clients, which includes forex, spot metals, CFD commodities, stock, stock CFDs, and CFDs on indices. The forex market is the largest financial market in the world, and FXTM provides access to a wide range of major, minor and exotic currency pairs. This means that traders have the flexibility to trade the currency pairs that best suit their trading strategies.

In addition to forex, FXTM offers trading in spot metals, which include gold, silver, and platinum. Spot metals can be a useful tool for diversifying a portfolio or hedging against inflation or geopolitical risks. FXTM also provides CFD trading in commodities, such as oil, natural gas, and agricultural commodities. CFD trading allows traders to speculate on the price movements of these commodities without having to own them physically.

FXTM also offers trading in stocks and stock CFDs. With access to global markets, traders have the opportunity to invest in some of the world's leading companies, such as Apple, Amazon, and Facebook. Moreover, traders can benefit from dividend payments when holding stock CFDs for the long term.

Finally, FXTM provides CFD trading on indices, which allows traders to speculate on the performance of a particular stock market. This is particularly useful for traders who want to take a broader view on the direction of a market, rather than focusing on individual stocks.

Overall, FXTM's range of market instruments provides traders with a wide variety of opportunities to diversify their trading portfolio and explore new trading strategies.

| Pros | Cons |

| Offers a wide range of markets to trade, including forex, spot metals, and CFDs on commodities, stocks, and indices | Limited selection of individual stocks compared to some competitors |

| Competitive spreads and commissions | Margin requirements on some instruments may be higher than other brokers |

| Access to both major and minor forex pairs, as well as exotic currency pairs | Limited cryptocurrency offerings compared to some competitors |

| Opportunity to diversify portfolio with a variety of markets | The number of CFDs on commodities may be limited compared to other brokers |

| Offers both MetaTrader 4 and MetaTrader 5 platforms for trading | Availability of certain markets may vary depending on the trader's location |

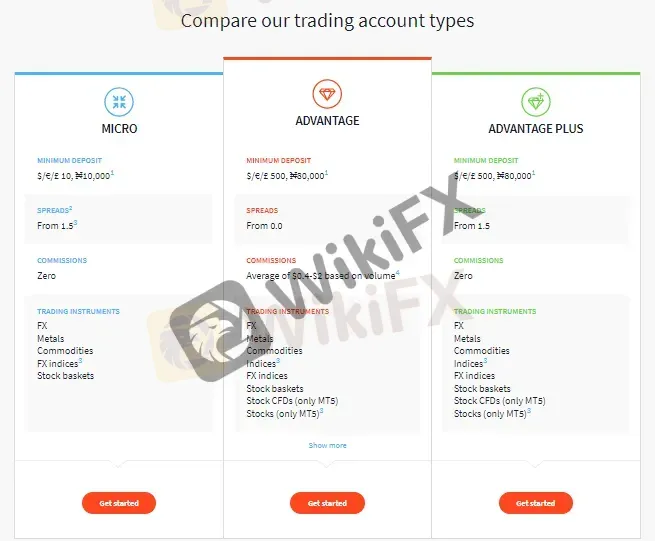

FXTM offers three different types of trading accounts, which are the Micro account, the Advantage account, and the Advantage Plus account. The Micro account requires a minimum deposit of $10, the Advantage account requires a minimum deposit of $100, and the Advantage Plus account requires a minimum deposit of $500.These account types are designed to cater to the varying needs and preferences of traders, ranging from beginner traders with limited capital to experienced traders looking for more advanced trading features. Each account type has its own unique features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads, allowing traders to choose the one that suits them best. The Micro account is ideal for novice traders with a limited budget, while the Advantage account is suitable for experienced traders who require advanced trading tools and a competitive trading environment. The Advantage Plus account is designed for professional traders who require high-volume trading and personalized support from a dedicated account manager.

| Pros | Cons |

| Micro account has low initial deposit | Micro account has higher spreads compared to other types |

| Advantage account has low spreads | Advantage account has a higher minimum deposit |

| Advantage Plus account offers lower commissions | Advantage Plus account has the highest minimum deposit |

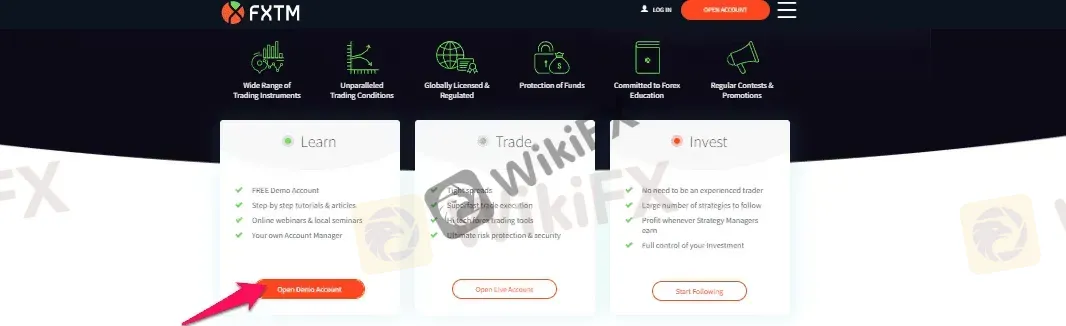

FXTM offers demo accounts for all its account types, including Micro, Advantage, and Advantage Plus. These demo accounts allow traders to test their trading strategies in a risk-free environment using virtual funds. Demo accounts are also useful for new traders who want to learn how to trade before committing real money to live trading. With FXTM's demo accounts, traders can access all the trading tools and features available in the live trading platform. The demo accounts are also available in multiple languages, making it accessible for traders from different countries. However, it's important to note that demo trading doesn't completely simulate the emotional and psychological aspects of real trading, which could affect a trader's performance in the live markets.

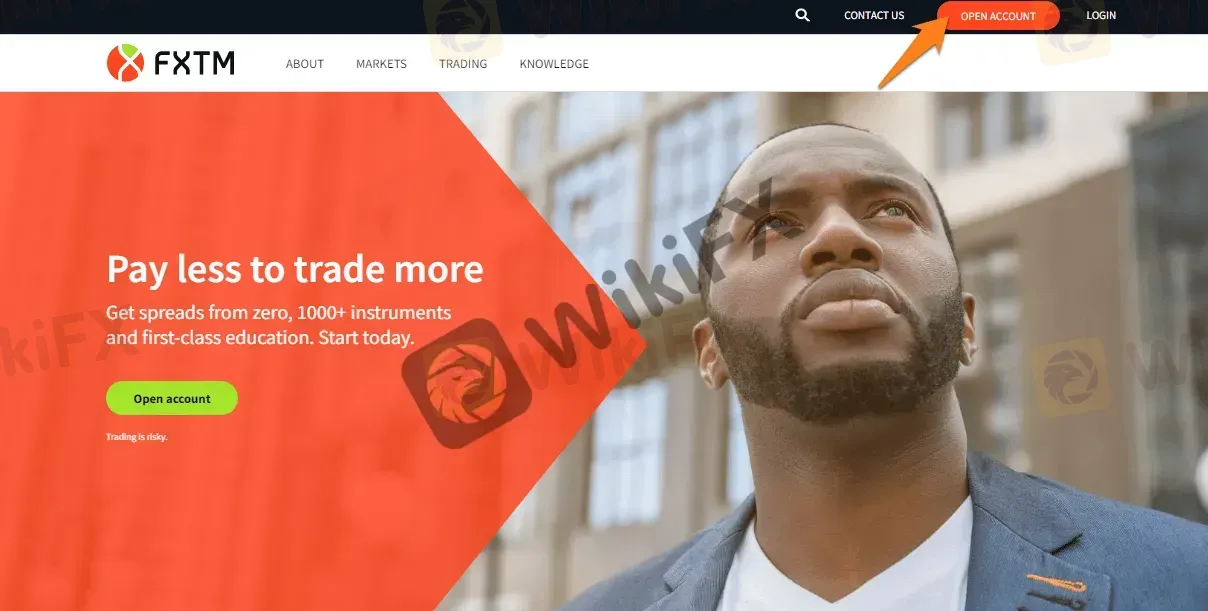

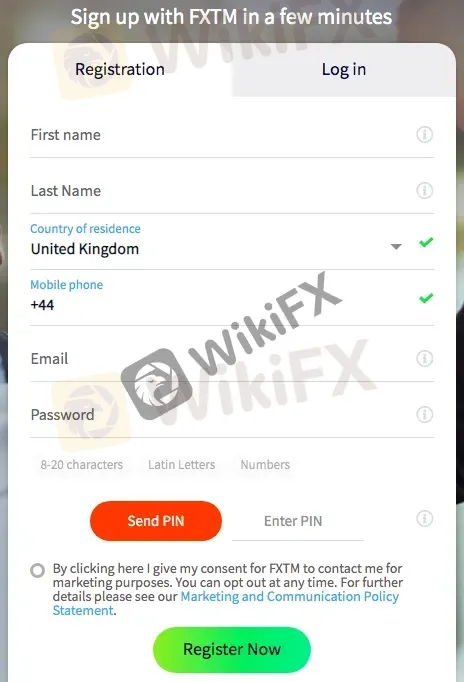

To open an account with FXTM, you first need to visit their website and click on the “OPEN ACCOUNT” button on the top right-hand corner of the page.

This will take you to the account registration page where you will need to fill out some basic personal information like your name, email address, and phone number.

Next, you will be asked to choose the type of account you want to open. FXTM offers three main account types - Micro, Advantage, and Advantage Plus, each with its own features and benefits. You will also need to select the base currency of your account and agree to the terms and conditions of the broker.

Once you have selected your account type and base currency, you will be prompted to provide some additional personal information like your date of birth, occupation, and address. You will also need to answer a few questions about your trading experience and investment goals.

After you have completed the registration process, you will need to verify your account by providing some additional documents like a copy of your ID or passport and a proof of address like a utility bill or bank statement.

Finally, once your account is verified, you can then make your first deposit and start trading.

FXTM offers leverage of up to 1:2000, depending on the account type and trading instrument. The highest leverage is available for forex trading on the FXTM Pro account, while the other account types offer leverage up to 1:30 for EU traders and up to 1:2000 for non-EU traders. It's important to note that while high leverage can increase potential profits, it also increases the risk of losses. Therefore, it's recommended to use leverage wisely and only trade with funds you can afford to lose. FXTM also offers negative balance protection, which ensures that traders can not lose more than their account balance. This feature can provide additional peace of mind when trading with high leverage.

The spreads and commissions vary depending on the account type. For the Micro account, the spreads start from 1.5 pips, and no commission is charged. For the Advantage account, the spreads start from 1.1 pips, and a commission of $2 is charged per lot. For the Advantage Plus account, the spreads start from 0.0 pips, and a commission of $4 is charged per lot. It's important to note that the spreads are floating and may widen during periods of high market volatility.

The spreads offered by FXTM are typically lower than those offered by many other brokers in the industry, particularly on the Advantage and Advantage Plus accounts. The Micro account, however, has slightly higher spreads, which is to be expected due to the smaller minimum deposit requirement.

Here we have created a comparison table of the average spreads and commissions offered by FXTM and some other popular forex brokers such as IC Markets, Exness, and FP Markets:

| Broker | EUR/USD Spread | Commission | Minimum Deposit |

| FXTM (Micro) | 1.5 pips | No commission | $10 |

| FXTM (Advantage) | 0.5 pips | No commission | $100 |

| FXTM (Advantage Plus) | 0.1 pips | No commission | $500 |

| IC Markets (Raw Spread) | 0.1 pips | $7 round turn | $200 |

| Exness (Raw Spread) | 0.3 pips | No commission | $1 |

| FP Markets (Raw Spread) | 0.0 pips | $7 round turn | $100 |

Apart from trading fees, FXTM charges some non-trading fees that traders should also consider before choosing this broker. Some of the non-trading fees charged by FXTM include inactivity fee, withdrawal fee, deposit fee, and overnight fee. The inactivity fee is charged when a trader does not perform any trading activity on their account for a period of 6 months. The fee charged is $5 per month. Withdrawal fees vary depending on the method used, with bank transfers attracting a higher fee compared to e-wallets. Deposit fees are not charged for most methods, but a 2.5% fee is charged when depositing via Neteller. Overnight fees are charged when a position is held open overnight, and they vary depending on the instrument being traded

Here is a table showing the comparison of non-trading fees charged by FXTM and some other popular forex brokers:

| Broker | Inactivity Fee | Deposit Fee | Withdrawal Fee |

| FXTM | $5/month after 6 months of inactivity | Free | Fees may occur |

| Avatrade | $50/quarter after 3 months of inactivity | Free | Fees may occur |

| IC Markets | $0 | Free | Fees may occur |

| Exness | $0 | Free | Fees may occur |

| FP Markets | $0 | Free | Fees may occur |

FXTM offers a range of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as their proprietary trading platform called FXTM Trader. The MetaTrader 4 and 5 platforms are known for their ease of use, comprehensive charting tools, and customizability, while FXTM Trader offers advanced features such as price alerts, multiple chart types, and a news feed.

One of the main advantages of using MetaTrader 4 and 5 is the vast community of traders who have developed and shared custom indicators and trading strategies, making it easy to find and use powerful tools that can help improve your trading performance.

Another advantage of FXTM's trading platforms is their compatibility with a range of devices, including desktop, mobile, and web-based platforms, making it easy to trade on the go or from any device.

Here's a table comparing the trading platforms offered by FXTM, IC Markets, Avatrade, and Exness

| Broker | Platform Types | Desktop | Web-Based | Mobile |

| FXTM | MT4, MT5, FXTM Trader | ✔ | ✔ | ✔ |

| IC Markets | MT4, MT5, cTrader | ✔ | ✔ | ✔ |

| Avatrade | MT4, AvaTradeGO, WebTrader | ✔ | ✔ | ✔ |

| Exness | MT4, MT5 | ✔ | ✔ | ✔ |

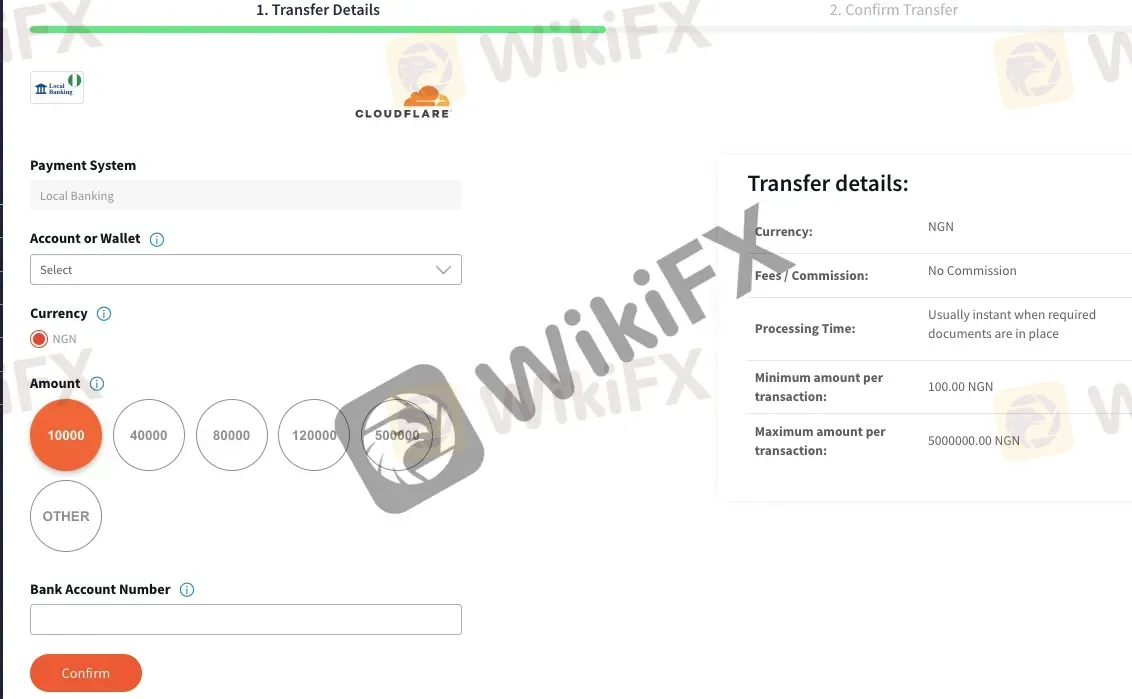

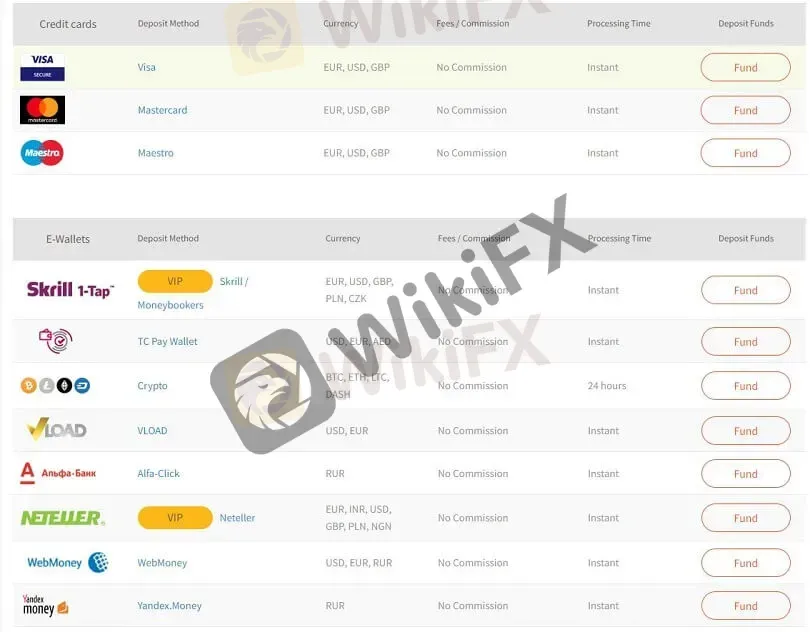

FXTM offers a variety of deposit and withdrawal options for its clients. Traders can deposit funds into their trading account using credit/debit cards, bank wire transfers, e-wallets, and other online payment methods. The minimum deposit amount varies depending on the account type selected by the trader.

For credit/debit card deposits, FXTM accepts Visa, Mastercard, and Maestro. There are no deposit fees for credit/debit card transactions, and funds are usually credited to the trading account instantly.

Bank wire transfers are also available as a deposit option. This method takes longer to process compared to other deposit methods and may incur charges from the bank. The minimum deposit amount for bank wire transfers varies depending on the currency selected, and it may take up to five business days for funds to appear in the trading account.

E-wallets such as Skrill, Neteller, and WebMoney are also accepted by FXTM. Deposits made through e-wallets are usually credited to the trading account instantly and are free of charge. The minimum deposit amount for e-wallet transactions varies depending on the selected e-wallet.

Withdrawals can be made using the same methods as deposits, with the exception of Mastercard. Withdrawals made through credit/debit cards may take up to three business days, while withdrawals made through e-wallets are usually processed within 24 hours. Bank wire transfers may take up to five business days for the funds to be credited to the trader's bank account.

FXTM may charge withdrawal fees for some methods. Traders are advised to check the fees and processing times associated with each method before making a deposit or withdrawal.

| Pros | Cons |

| Multiple deposit and withdrawal methods | Some withdrawal methods may have higher fees |

| No deposit fees | Minimum withdrawal amounts may be higher than other brokers |

| Fast deposit and withdrawal processing times | Some deposit methods may not be available in certain regions |

| Supports various currencies for transactions |

FXTM is known for providing excellent customer support to its clients. The broker offers various channels for clients to contact their support team, including live chat, email, and phone support. The customer support team is available 24/5 and is multilingual, which means clients can communicate with them in their preferred language.

FXTM also provides an extensive FAQ section on their website that covers various topics, such as account opening, deposit and withdrawal methods, trading platforms, and more. This section is helpful for clients who prefer to find answers to their questions without contacting the support team.

| Pros | Cons |

| Live chat support available | No 24/7 customer support |

| Fast response times | No phone support for some countries |

| Knowledgeable and helpful staff | Limited educational resources for clients |

| Various support channels available | |

| A FAQs section |

FXTM offers various educational resources to its clients to enhance their trading skills and knowledge. These resources include webinars, seminars, articles, e-books, educational videos, and more.

Webinars and seminars are live sessions conducted by market experts and analysts who provide insights and analysis on market trends and trading strategies. The sessions cover a wide range of topics, including technical and fundamental analysis, risk management, and trading psychology. The webinars and seminars are interactive, allowing clients to ask questions and get feedback from experts.

FXTM also provides a wide range of educational articles and e-books that cover a variety of trading topics. These resources are available to all clients, regardless of their account type, and can be accessed on the FXTM website.

In addition to these resources, FXTM offers educational videos that cover various aspects of trading, including market analysis, trading strategies, and risk management. These videos are designed to be engaging and informative, making them a useful tool for traders at all levels of experience.

| Pros | Cons |

| Wide range of educational resources available | Some resources may be outdated or not relevant |

| Multiple formats available (webinars, articles, etc.) | Limited in-depth educational resources |

| Demo account available for practice trading | Educational resources may not be suitable for all levels of traders |

| Educational resources available in multiple languages | Some resources may require a subscription or additional fees |

FXTM is a well-regulated and respected forex broker with a wide range of market instruments, competitive trading conditions, and user-friendly trading platforms. They offer various account types with reasonable minimum deposits and leverage options. FXTM's customer support is also responsive and helpful, while their educational resources can be useful for both novice and experienced traders.

However, there are also some potential drawbacks to consider. FXTM's non-trading fees, such as withdrawal fees, can be high, and their spreads can be wider than some of their competitors. Additionally, some traders may find their educational resources lacking in depth or variety.

Q: Is FXTM regulated?

A: Yes, FXTM is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Q: What trading instruments are available on FXTM?

A: FXTM offers a range of trading instruments including forex, spot metals, CFD commodities, stock CFDs, and CFDs on indices.

Q: What types of trading accounts are available on FXTM?

A: FXTM offers three main types of trading accounts: the Micro account, Advantage account, and Advantage Plus account.

Q: What is the minimum deposit required to open an account on FXTM?

A: The minimum deposit required for each account type on FXTM is as follows: Micro account - $10, Advantage account - $100, and Advantage Plus account - $500.

Q: What trading platforms are available on FXTM?

A: FXTM offers a range of trading platforms including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Q: What are the deposit and withdrawal options on FXTM?

A: FXTM offers a variety of deposit and withdrawal options including bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and more.

Q: What are the deposit and withdrawal options on FXTM?

A: FXTM offers a variety of deposit and withdrawal options including bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and more.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Spreadex Review Summary in 10 Points | |

| Founded | 1999 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | indices, shares, forex, commodities, bonds, interest rates, exchange traded funds, options, and cryptocurrencies |

| Demo Account | N/A |

| Leverage | 1:30 |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | Online platform, Mobile trading, and TradingView |

| Minimum Deposit | $1 |

| Customer Support | Live chat, phone, email |

Spreadex is a UK-based brokerage firm, established back in 1999 and focused on a financial trading service providing, as well spread betting and sports betting, through its maintained office in London. Spreadex first moved into the online market in 2006 when it launched its website. Spreadex is regulated by the Financial Conduct Authority (FCA, registration number 190941) in relation to the spread betting services it offers.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • FCA-regulated | • No MT4/5 trading platform |

| • Offers a range of financial spread betting and trading services to retail and professional clients | • Limited deposit and withdrawal options compared to other brokers |

| • Operates within regulatory restrictions for leverage levels | |

| • Offers a range of educational resources | |

| • Multi-channel customer support | |

| • Many years experience in the indus | |

| • Quick account opening and easy to use platform |

There are many alternative brokers to Spreadex depending on the specific needs and preferences of the trader. Some popular options include:

FP Markets - for traders seeking access to a wide range of trading platforms, advanced charting tools, and competitive pricing across various financial markets.

LiteForex - for traders looking for user-friendly MetaTrader platforms, a variety of analysis tools, and a range of trading instruments to choose from.

Global Prime - for traders who prioritize institutional-grade execution, access to multiple trading platforms, and a focus on transparent and reliable trading conditions.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Spreadex appears to be a legitimate broker for individuals interested in trading. The company is regulated by the United Kingdom Financial Conduct Authority (FCA, No. 190941), which adds a layer of safety and transparency for investors. Additionally, the fact that Spreadex offers clients segregated bank accounts can further enhance safety and security for their funds.Having many years of experience in the industry can also be seen as a positive sign, as it suggests that the company has a solid track record and established reputation.

However, it is always recommended for traders to do their own due diligence and research any potential broker before investing funds. Reviews and feedback from other traders can be helpful in determining the safety and legitimacy of a broker, as well as checking for any past incidents of fraud or other issues. Additionally, testing out the available trading platforms and customer support options can help to determine if a broker is a good fit for your individual trading needs and preferences.

Spreadex offers a diverse range of over 15,000 tradable assets, covering a wide variety of markets and instruments. This includes popular markets such as indices, shares, forex, commodities, and bonds, as well as interest rates, exchange traded funds, options, and cryptocurrencies.

Index trading is a popular market on Spreadex, with access to indices such as the FTSE 100, S&P 500, and NASDAQ. This can provide traders with broad exposure to the performance of the overall market, as well as specific sectors or industries.

Forex trading is also available on Spreadex, offering access to the world's largest financial market by trading volume. With access to major and minor currency pairs, traders can take advantage of currency fluctuations and volatility to seek out profits.

Commodity trading is another popular option on Spreadex, with access to gold, silver, oil, and other commodities. This can provide traders with a way to hedge against inflation or geopolitical risks, as well as potentially profiting from market movements.

There seems only one single account available for all traders, which is the Standard account. To open a real account just with the minimum deposit of $1, which sounds a good opportunity for most traders to get started.

As a UK brokerage firm, Spreadex operates within regulatory restrictions for leverage levels. The maximum leverage offered to retail traders is 1:30 for major currency pairs and lower for other instruments. This limitation is in place to protect investors from significant losses and ensure responsible trading practices.

Professional traders, however, may have access to higher leverage ratios once their status is confirmed and specified conditions towards spread betting and trading services are met. This can provide experienced traders with the opportunity to increase their potential profits, but it should be noted that higher leverage also carries higher risk.

Overall, Spreadex's leverage offering is in line with regulatory restrictions and aims to promote responsible trading practices. Traders can still access a range of markets and instruments, but should be aware of the potential risks involved with higher leverages.

Spreadex offers variable spreads that can fluctuate throughout the day depending on market volatility. Major currency pairs such as EURUSD and GBPUSD have very low spreads of 0.6 and 0.9 pips respectively, which is competitive with other brokers in the industry. Spreads for minor and exotic currency pairs are comparable to most other brokers as well.

For all markets apart from shares, the fee is simply the spread between the buy and sell price. However, for shares, there is an interest rate charge applied to the total value of the stock. This fee typically amounts to 1.25%, but it can increase to 1.5% for smaller stocks and those with less liquidity.

There is no information available on any commissions charged by Spreadex. However, the competitive spreads and lack of hidden fees make Spreadex a potentially attractive option for traders looking to minimize their costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Spreadex | 0.6 | No commissions |

| FP Markets | 0.1 | $3 |

| LiteForex | 1.5 | No commissions |

| Global Prime | 0.0 | $7 |

Please note that this information may have changed since my last knowledge update, and it's always recommended to verify the latest details with the respective brokers directly.

Spreadex offers a range of trading platforms to cater to traders' different preferences and needs. The online platform is Spreadex's flagship trading platform, featuring a user-friendly interface and a range of tools and features. The platform allows traders to access all of Spreadex's tradable assets and markets, as well as providing access to a range of analysis tools and educational resources.

Mobile trading is available through Spreadex's mobile app, which is available for both iOS and Android devices. The app provides traders with a convenient and flexible way to access their accounts and trade on-the-go, with many of the same features and tools as the online platform.

Finally, Spreadex also offers integration with TradingView, a popular third-party charting software. This can allow traders to access advanced charting features and tools, as well as collaborate with other traders in the TradingView community.

Overall, Spreadex's range of trading platforms provides traders with a range of options to suit their individual needs and preferences, whether they prefer a desktop platform, mobile app, or third-party software integration.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Spreadex | Custom online platform, Mobile app |

| FP Markets | MetaTrader 4, MetaTrader 5, IRESS |

| LiteForex | MetaTrader 4, MetaTrader 5, WebTrader |

| Global Prime | MetaTrader 4, WebTrader, FIX API |

Spreadex accepts deposits and withdrawals via Credit Card, Bank Transfer, Cheque, and Direct Debit. However, it does not currently accept deposits from E-Wallets such as Moneybookers, Paypal, Neteller, Ukash, etc. Deposits made by debit card under £50 are subject to a £1 fee. Spreadex does not accept any third-party payments.

| Spreadex | Most other | |

| Minimum Deposit | $500 | $100 |

International bank transfers and bank transfers in currencies other than sterling will be subject to additional charges. The minimum withdrawal amount is £50 cleared funds on your trading ledger that is not being used to support the margin/NTR on any open positions. If the available amount is less than £50, you will only be able to withdraw the full amount.

Spreadex offers card withdrawals which you'll receive within 2 hours of your withdrawal being approved. However, some card issuers may be unable to accept funds through this method, and in such circumstances, payments back to these cards will take 2-5 days to be received. Bank transfers should be in your account within 2 working days.

Overall, Spreadex's deposit and withdrawal options are limited compared to some other brokers, but the available options are low-fee and relatively quick processing times. It is recommended for traders to carefully review the available deposit and withdrawal options to ensure they meet their individual needs and preferences before investing funds.

Spreadex offers a range of customer service options to cater to traders' needs and preferences. This includes live chat, phone support, and email support. The financial desk can be reached at +44 (0)1727 895 151 while general inquiries can be directed to +44 (0)1727 895 000. The email address for customer service is info@spreadex.com.

Traders can also follow Spreadex on various social networks, including Twitter, Facebook, Instagram, YouTube, and LinkedIn. This can provide a convenient way to stay up-to-date on news and updates from the broker, as well as connecting with other traders and the Spreadex community.

| Pros | Cons |

| • Multi-channel support | • No 24/7 customer support available |

| • Live chat support | • No information on multilingual support for non-English speakers |

| • Social media presence on various platforms for easy communication and updates |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Spreadex's customer service.

Spreadex offers a range of educational resources to support traders, including a video training center, account FAQs, charting FAQs, trading FAQs, and a financial spread betting glossary. These resources can provide traders with a solid foundation of knowledge and help them develop their skills and understanding of the trading markets and instruments.

The video training center offers a library of educational videos covering topics such as market analysis, technical analysis, and risk management. Traders can watch these videos at their own pace and access them at any time.

The account FAQs, charting FAQs, and trading FAQs provide answers to common questions and concerns that traders may have about using Spreadex's platform and services. These resources can provide guidance and clarity for traders who are new to the platform or may be experiencing technical issues.

Finally, the financial spread betting glossary provides definitions and explanations of key terms and concepts related to spread betting and trading. This can be a valuable resource for traders who are new to the industry or may be unfamiliar with some of the terminology and jargon used in trading.

Overall, Spreadex's educational resources can provide traders with a solid foundation of knowledge and help them develop their skills and understanding of the trading markets and instruments.

In conclusion, Spreadex is a regulated financial spread betting and CFD provider offering a range of trading instruments. With competitive spreads, a user-friendly online platform, and mobile trading capabilities, Spreadex aims to cater to traders' needs. As with any trading platform, it's essential to review the latest information, terms, and conditions to make an informed decision that suits your specific requirements.

| Q 1: | Is Spreadex regulated? |

| A 1: | Yes. It is regulated by United Kingdom Financial Conduct Authority (FCA, No. 190941). |

| Q 2: | At Spreadex, are there any regional restrictions for traders? |

| A 2: | Yes. The information on their website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any law or regulatory requirement. |

| Q 3: | Does Spreadex offer the industry leading MT4 & MT5? |

| A 3: | No. Instead, it offers Online platform, Mobile trading, and TradingView. |

| Q 4: | What is the minimum deposit for Spreadex? |

| A 4: | The minimum initial deposit to open an account is $1. |

| Q 5: | Is Spreadex a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and has many years experience in the industry, as well as offers various trading instruments with competitive trading conditions on multiple trading platforms. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxtm and spreadex are, we first considered common fees for standard accounts. On fxtm, the average spread for the EUR/USD currency pair is From 1.5 pips, while on spreadex the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxtm is regulated by CYSEC,FCA,FSC,FSCA. spreadex is regulated by FCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxtm provides trading platform including ADVANTAGE PLUS,ADVANTAGE and trading variety including FX Metals Commodities Indices FX indices Stock baskets Stock CFDs (only MT5) Stocks (only MT5). spreadex provides trading platform including -- and trading variety including --.