No data

Do you want to know which is the better broker between FXTM and FirewoodFX ?

In the table below, you can compare the features of FXTM , FirewoodFX side by side to determine the best fit for your needs.

EURUSD: -0.2

XAUUSD: 0.3

Long: -7.62

Short: 1.97

Long: -40.54

Short: 20.56

EURUSD: 1.6

XAUUSD: 3.4

Long: -8.52

Short: 3.17

Long: -22.64

Short: 6.57

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxtm, firewoodfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FXTM | Basic Infromation |

| Registered Country/Region | United Kingdom |

| Founded in | 2011 |

| Headquarters | Cyprus, UK, Belize |

| Regulated By | FCA, CySEC, FSCA (Out of Scope Business) |

| Minimum Deposit | $10 |

| Leverage | Up to 1:2000 |

| Account Types | Micro, Advantage, and Advantage Plus |

| Demo Account | Yes |

| Trading Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader |

| Mobile Trading | Yes |

| Islamic Account | Yes |

| Payment Methods | Credit/Debit Cards, Bank Wire, E-wallets |

| Minimum Spread on EUR/USD | From 0.1 pips |

| Customer Support | 24/5 Live Chat, Email, Phone |

| Educational Resources | Yes |

| Negative Balance Protection | Yes |

FXTM, or Forex Time, is a global forex and CFD broker founded in 2011. The company is headquartered in Cyprus and is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and other regulatory bodies in various countries. FXTM offers a variety of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

FXTM is its extensive range of account types, which cater to traders of all experience levels and preferences. The broker offers five different account types, including the Micro, Advantage, and Advantage Plus accounts, as well as demo accounts and Islamic accounts. Each account type comes with its own unique features, including different leverage options, spreads, and minimum deposit requirements. In terms of trading fees, FXTM offers variable spreads on most of its instruments, with spreads starting from as low as 0.1 pips.

FXTM also offers a range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available in desktop, web, and mobile versions, allowing traders to trade on the go and from anywhere in the world.

Lastly, FXTM provides customer support in multiple languages, which is available 24/5 via live chat, email, and phone. The broker also offers a range of educational resources, including webinars, seminars, and trading guides.

FXTM is currently regulated by two reputable regulatory bodies, the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. These regulatory bodies ensure that the broker operates within strict guidelines and rules.

Forextime Ltd (Its CYSEC entity), is authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC) under regulatory license number 185/12.

Exinity UK Ltd, its UK entity, is authorized and regulated by the Financial Conduct Authority (FCA) under regulatory license number 777911.

FOREXTIME LTD is authorized by the Financial Conduct Authority (FSCA), holding a license of Financial Service Authority under license no. 46614.

FXTM is a well-known broker that offers a range of trading services to its clients, including forex, commodities, and CFDs. While there are many benefits to trading with FXTM, there are also some drawbacks to consider. In this table, we'll take a closer look at the pros and cons of trading with FXTM, so you can make the right choice about whether this broker is right for you. Some of the pros we'll cover include their range of account types, competitive spreads, and excellent customer support, while some of the cons we'll discuss include the lack of cryptocurrency trading and high withdrawal fees.

| Pros | Cons |

| Regulated by top-tier financial authorities, FCA and CYSEC | Limited product offerings compared to some competitors |

| Wide range of account types for different trading needs | High inactivity fee |

| Low minimum deposit requirements | Limited payment methods |

| Demo Accounts Available | Limited research tools and resources |

| Islamic Accounts Available | |

| Access to a variety of trading platforms, including MT4 and MT5 | |

| Multiple funding and withdrawal options | |

| Rich Eductaional Resources | |

| Rich Trading Tools | |

| High-quality customer support |

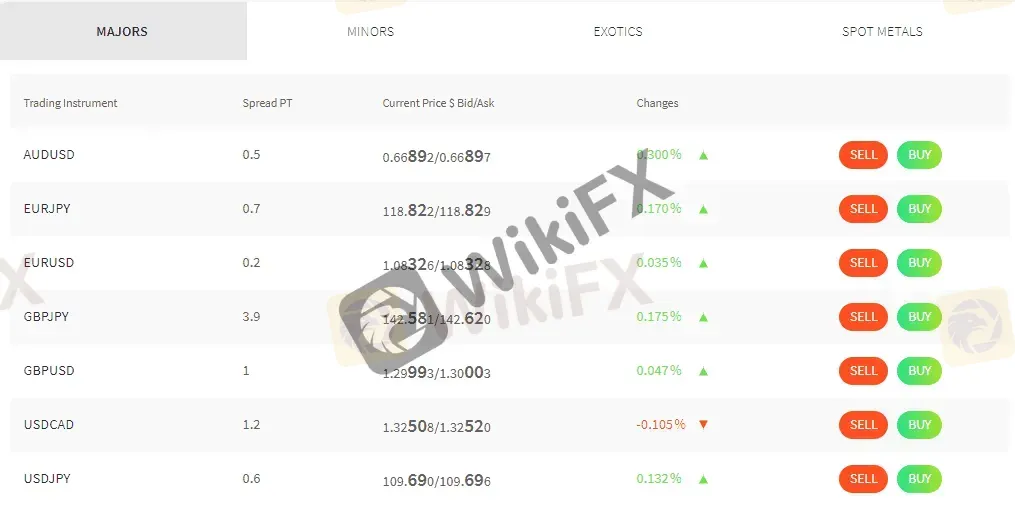

FXTM offers a diverse range of trading instruments for its clients, which includes forex, spot metals, CFD commodities, stock, stock CFDs, and CFDs on indices. The forex market is the largest financial market in the world, and FXTM provides access to a wide range of major, minor and exotic currency pairs. This means that traders have the flexibility to trade the currency pairs that best suit their trading strategies.

In addition to forex, FXTM offers trading in spot metals, which include gold, silver, and platinum. Spot metals can be a useful tool for diversifying a portfolio or hedging against inflation or geopolitical risks. FXTM also provides CFD trading in commodities, such as oil, natural gas, and agricultural commodities. CFD trading allows traders to speculate on the price movements of these commodities without having to own them physically.

FXTM also offers trading in stocks and stock CFDs. With access to global markets, traders have the opportunity to invest in some of the world's leading companies, such as Apple, Amazon, and Facebook. Moreover, traders can benefit from dividend payments when holding stock CFDs for the long term.

Finally, FXTM provides CFD trading on indices, which allows traders to speculate on the performance of a particular stock market. This is particularly useful for traders who want to take a broader view on the direction of a market, rather than focusing on individual stocks.

Overall, FXTM's range of market instruments provides traders with a wide variety of opportunities to diversify their trading portfolio and explore new trading strategies.

| Pros | Cons |

| Offers a wide range of markets to trade, including forex, spot metals, and CFDs on commodities, stocks, and indices | Limited selection of individual stocks compared to some competitors |

| Competitive spreads and commissions | Margin requirements on some instruments may be higher than other brokers |

| Access to both major and minor forex pairs, as well as exotic currency pairs | Limited cryptocurrency offerings compared to some competitors |

| Opportunity to diversify portfolio with a variety of markets | The number of CFDs on commodities may be limited compared to other brokers |

| Offers both MetaTrader 4 and MetaTrader 5 platforms for trading | Availability of certain markets may vary depending on the trader's location |

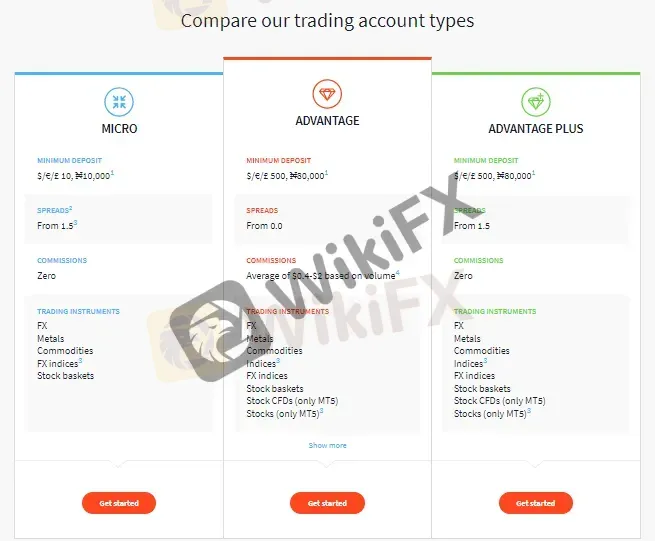

FXTM offers three different types of trading accounts, which are the Micro account, the Advantage account, and the Advantage Plus account. The Micro account requires a minimum deposit of $10, the Advantage account requires a minimum deposit of $100, and the Advantage Plus account requires a minimum deposit of $500.These account types are designed to cater to the varying needs and preferences of traders, ranging from beginner traders with limited capital to experienced traders looking for more advanced trading features. Each account type has its own unique features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads, allowing traders to choose the one that suits them best. The Micro account is ideal for novice traders with a limited budget, while the Advantage account is suitable for experienced traders who require advanced trading tools and a competitive trading environment. The Advantage Plus account is designed for professional traders who require high-volume trading and personalized support from a dedicated account manager.

| Pros | Cons |

| Micro account has low initial deposit | Micro account has higher spreads compared to other types |

| Advantage account has low spreads | Advantage account has a higher minimum deposit |

| Advantage Plus account offers lower commissions | Advantage Plus account has the highest minimum deposit |

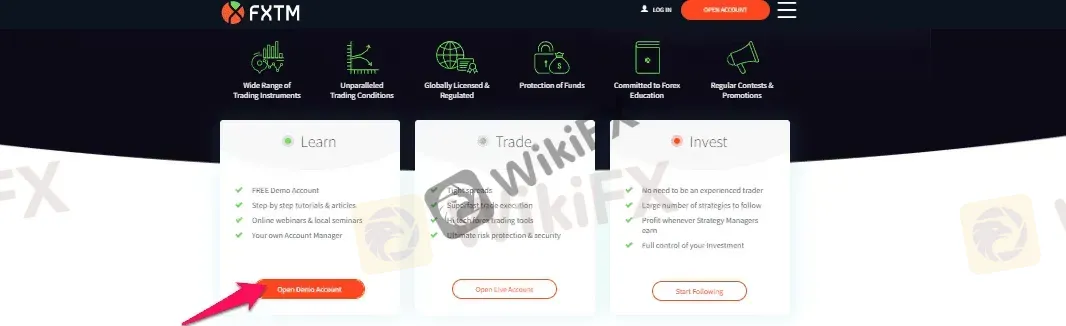

FXTM offers demo accounts for all its account types, including Micro, Advantage, and Advantage Plus. These demo accounts allow traders to test their trading strategies in a risk-free environment using virtual funds. Demo accounts are also useful for new traders who want to learn how to trade before committing real money to live trading. With FXTM's demo accounts, traders can access all the trading tools and features available in the live trading platform. The demo accounts are also available in multiple languages, making it accessible for traders from different countries. However, it's important to note that demo trading doesn't completely simulate the emotional and psychological aspects of real trading, which could affect a trader's performance in the live markets.

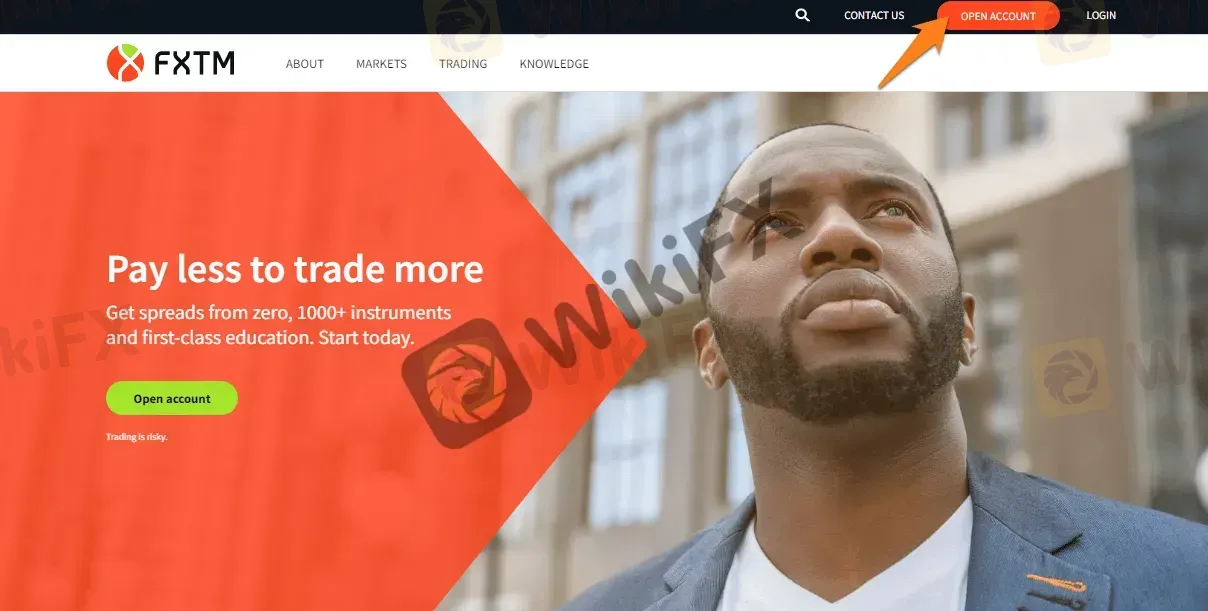

To open an account with FXTM, you first need to visit their website and click on the “OPEN ACCOUNT” button on the top right-hand corner of the page.

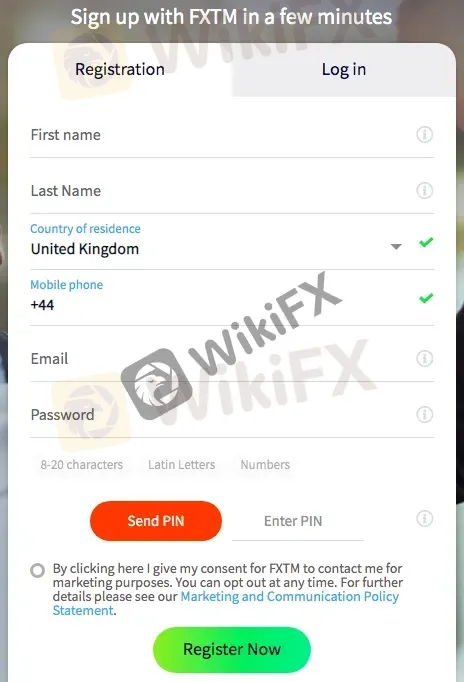

This will take you to the account registration page where you will need to fill out some basic personal information like your name, email address, and phone number.

Next, you will be asked to choose the type of account you want to open. FXTM offers three main account types - Micro, Advantage, and Advantage Plus, each with its own features and benefits. You will also need to select the base currency of your account and agree to the terms and conditions of the broker.

Once you have selected your account type and base currency, you will be prompted to provide some additional personal information like your date of birth, occupation, and address. You will also need to answer a few questions about your trading experience and investment goals.

After you have completed the registration process, you will need to verify your account by providing some additional documents like a copy of your ID or passport and a proof of address like a utility bill or bank statement.

Finally, once your account is verified, you can then make your first deposit and start trading.

FXTM offers leverage of up to 1:2000, depending on the account type and trading instrument. The highest leverage is available for forex trading on the FXTM Pro account, while the other account types offer leverage up to 1:30 for EU traders and up to 1:2000 for non-EU traders. It's important to note that while high leverage can increase potential profits, it also increases the risk of losses. Therefore, it's recommended to use leverage wisely and only trade with funds you can afford to lose. FXTM also offers negative balance protection, which ensures that traders can not lose more than their account balance. This feature can provide additional peace of mind when trading with high leverage.

The spreads and commissions vary depending on the account type. For the Micro account, the spreads start from 1.5 pips, and no commission is charged. For the Advantage account, the spreads start from 1.1 pips, and a commission of $2 is charged per lot. For the Advantage Plus account, the spreads start from 0.0 pips, and a commission of $4 is charged per lot. It's important to note that the spreads are floating and may widen during periods of high market volatility.

The spreads offered by FXTM are typically lower than those offered by many other brokers in the industry, particularly on the Advantage and Advantage Plus accounts. The Micro account, however, has slightly higher spreads, which is to be expected due to the smaller minimum deposit requirement.

Here we have created a comparison table of the average spreads and commissions offered by FXTM and some other popular forex brokers such as IC Markets, Exness, and FP Markets:

| Broker | EUR/USD Spread | Commission | Minimum Deposit |

| FXTM (Micro) | 1.5 pips | No commission | $10 |

| FXTM (Advantage) | 0.5 pips | No commission | $100 |

| FXTM (Advantage Plus) | 0.1 pips | No commission | $500 |

| IC Markets (Raw Spread) | 0.1 pips | $7 round turn | $200 |

| Exness (Raw Spread) | 0.3 pips | No commission | $1 |

| FP Markets (Raw Spread) | 0.0 pips | $7 round turn | $100 |

Apart from trading fees, FXTM charges some non-trading fees that traders should also consider before choosing this broker. Some of the non-trading fees charged by FXTM include inactivity fee, withdrawal fee, deposit fee, and overnight fee. The inactivity fee is charged when a trader does not perform any trading activity on their account for a period of 6 months. The fee charged is $5 per month. Withdrawal fees vary depending on the method used, with bank transfers attracting a higher fee compared to e-wallets. Deposit fees are not charged for most methods, but a 2.5% fee is charged when depositing via Neteller. Overnight fees are charged when a position is held open overnight, and they vary depending on the instrument being traded

Here is a table showing the comparison of non-trading fees charged by FXTM and some other popular forex brokers:

| Broker | Inactivity Fee | Deposit Fee | Withdrawal Fee |

| FXTM | $5/month after 6 months of inactivity | Free | Fees may occur |

| Avatrade | $50/quarter after 3 months of inactivity | Free | Fees may occur |

| IC Markets | $0 | Free | Fees may occur |

| Exness | $0 | Free | Fees may occur |

| FP Markets | $0 | Free | Fees may occur |

FXTM offers a range of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as their proprietary trading platform called FXTM Trader. The MetaTrader 4 and 5 platforms are known for their ease of use, comprehensive charting tools, and customizability, while FXTM Trader offers advanced features such as price alerts, multiple chart types, and a news feed.

One of the main advantages of using MetaTrader 4 and 5 is the vast community of traders who have developed and shared custom indicators and trading strategies, making it easy to find and use powerful tools that can help improve your trading performance.

Another advantage of FXTM's trading platforms is their compatibility with a range of devices, including desktop, mobile, and web-based platforms, making it easy to trade on the go or from any device.

Here's a table comparing the trading platforms offered by FXTM, IC Markets, Avatrade, and Exness

| Broker | Platform Types | Desktop | Web-Based | Mobile |

| FXTM | MT4, MT5, FXTM Trader | ✔ | ✔ | ✔ |

| IC Markets | MT4, MT5, cTrader | ✔ | ✔ | ✔ |

| Avatrade | MT4, AvaTradeGO, WebTrader | ✔ | ✔ | ✔ |

| Exness | MT4, MT5 | ✔ | ✔ | ✔ |

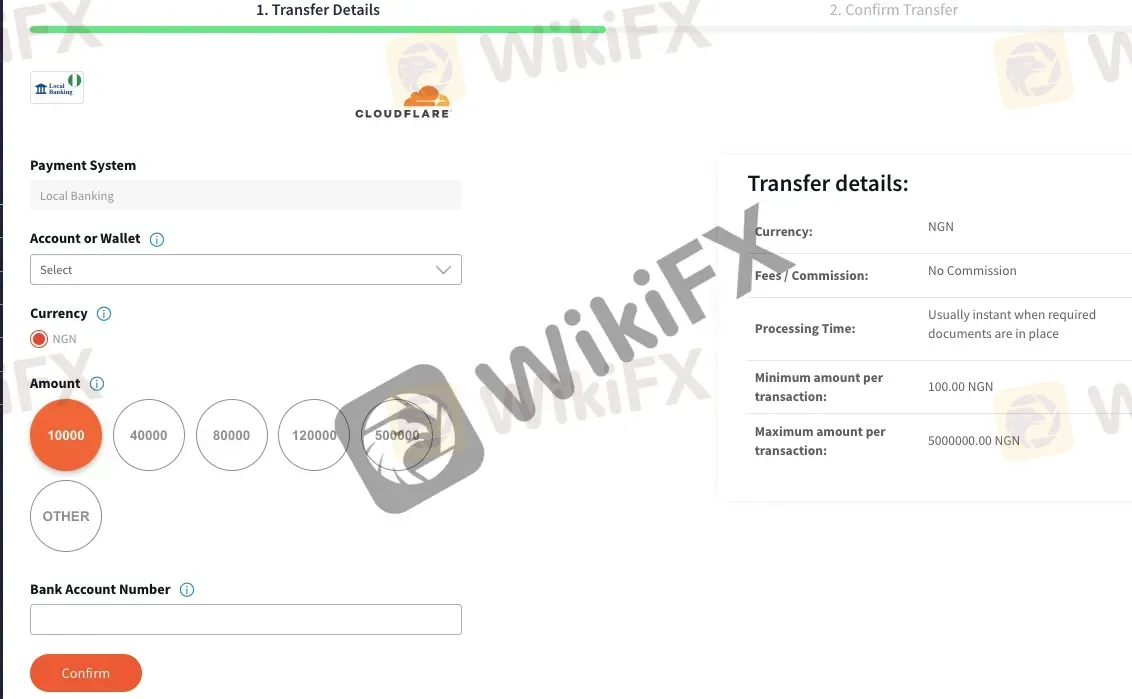

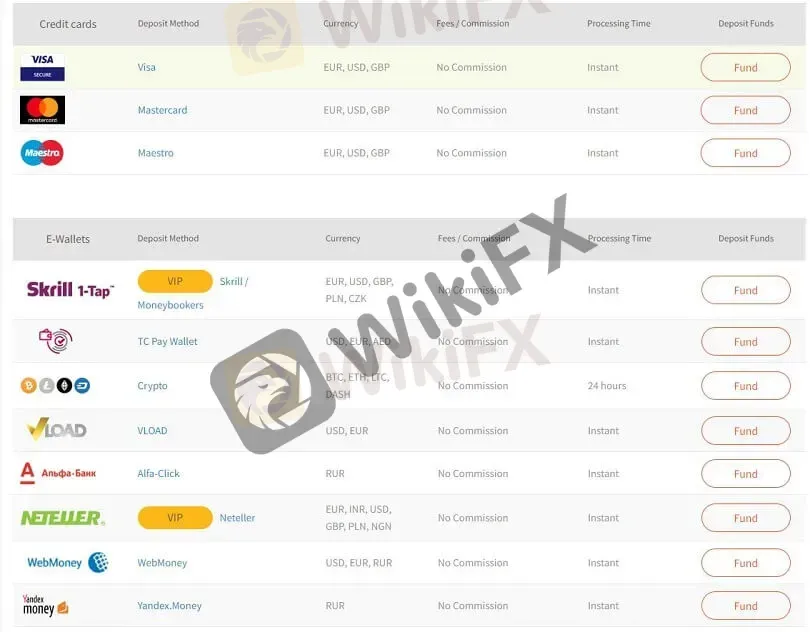

FXTM offers a variety of deposit and withdrawal options for its clients. Traders can deposit funds into their trading account using credit/debit cards, bank wire transfers, e-wallets, and other online payment methods. The minimum deposit amount varies depending on the account type selected by the trader.

For credit/debit card deposits, FXTM accepts Visa, Mastercard, and Maestro. There are no deposit fees for credit/debit card transactions, and funds are usually credited to the trading account instantly.

Bank wire transfers are also available as a deposit option. This method takes longer to process compared to other deposit methods and may incur charges from the bank. The minimum deposit amount for bank wire transfers varies depending on the currency selected, and it may take up to five business days for funds to appear in the trading account.

E-wallets such as Skrill, Neteller, and WebMoney are also accepted by FXTM. Deposits made through e-wallets are usually credited to the trading account instantly and are free of charge. The minimum deposit amount for e-wallet transactions varies depending on the selected e-wallet.

Withdrawals can be made using the same methods as deposits, with the exception of Mastercard. Withdrawals made through credit/debit cards may take up to three business days, while withdrawals made through e-wallets are usually processed within 24 hours. Bank wire transfers may take up to five business days for the funds to be credited to the trader's bank account.

FXTM may charge withdrawal fees for some methods. Traders are advised to check the fees and processing times associated with each method before making a deposit or withdrawal.

| Pros | Cons |

| Multiple deposit and withdrawal methods | Some withdrawal methods may have higher fees |

| No deposit fees | Minimum withdrawal amounts may be higher than other brokers |

| Fast deposit and withdrawal processing times | Some deposit methods may not be available in certain regions |

| Supports various currencies for transactions |

FXTM is known for providing excellent customer support to its clients. The broker offers various channels for clients to contact their support team, including live chat, email, and phone support. The customer support team is available 24/5 and is multilingual, which means clients can communicate with them in their preferred language.

FXTM also provides an extensive FAQ section on their website that covers various topics, such as account opening, deposit and withdrawal methods, trading platforms, and more. This section is helpful for clients who prefer to find answers to their questions without contacting the support team.

| Pros | Cons |

| Live chat support available | No 24/7 customer support |

| Fast response times | No phone support for some countries |

| Knowledgeable and helpful staff | Limited educational resources for clients |

| Various support channels available | |

| A FAQs section |

FXTM offers various educational resources to its clients to enhance their trading skills and knowledge. These resources include webinars, seminars, articles, e-books, educational videos, and more.

Webinars and seminars are live sessions conducted by market experts and analysts who provide insights and analysis on market trends and trading strategies. The sessions cover a wide range of topics, including technical and fundamental analysis, risk management, and trading psychology. The webinars and seminars are interactive, allowing clients to ask questions and get feedback from experts.

FXTM also provides a wide range of educational articles and e-books that cover a variety of trading topics. These resources are available to all clients, regardless of their account type, and can be accessed on the FXTM website.

In addition to these resources, FXTM offers educational videos that cover various aspects of trading, including market analysis, trading strategies, and risk management. These videos are designed to be engaging and informative, making them a useful tool for traders at all levels of experience.

| Pros | Cons |

| Wide range of educational resources available | Some resources may be outdated or not relevant |

| Multiple formats available (webinars, articles, etc.) | Limited in-depth educational resources |

| Demo account available for practice trading | Educational resources may not be suitable for all levels of traders |

| Educational resources available in multiple languages | Some resources may require a subscription or additional fees |

FXTM is a well-regulated and respected forex broker with a wide range of market instruments, competitive trading conditions, and user-friendly trading platforms. They offer various account types with reasonable minimum deposits and leverage options. FXTM's customer support is also responsive and helpful, while their educational resources can be useful for both novice and experienced traders.

However, there are also some potential drawbacks to consider. FXTM's non-trading fees, such as withdrawal fees, can be high, and their spreads can be wider than some of their competitors. Additionally, some traders may find their educational resources lacking in depth or variety.

Q: Is FXTM regulated?

A: Yes, FXTM is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Q: What trading instruments are available on FXTM?

A: FXTM offers a range of trading instruments including forex, spot metals, CFD commodities, stock CFDs, and CFDs on indices.

Q: What types of trading accounts are available on FXTM?

A: FXTM offers three main types of trading accounts: the Micro account, Advantage account, and Advantage Plus account.

Q: What is the minimum deposit required to open an account on FXTM?

A: The minimum deposit required for each account type on FXTM is as follows: Micro account - $10, Advantage account - $100, and Advantage Plus account - $500.

Q: What trading platforms are available on FXTM?

A: FXTM offers a range of trading platforms including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Q: What are the deposit and withdrawal options on FXTM?

A: FXTM offers a variety of deposit and withdrawal options including bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and more.

Q: What are the deposit and withdrawal options on FXTM?

A: FXTM offers a variety of deposit and withdrawal options including bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and more.

| FirewoodFX Review Summary | |

| Founded | 2014 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex, Gold, Crypto, Oil and more |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/ USD Spread | From 2.0 pips (Std) |

| Trading Platforms | MT4 |

| Minimum Deposit | $10 |

| Customer Support | Phone, email, online messaging |

FirewoodFX, established in 2014 and headquartered in Saint Vincent and the Grenadines, operates as an unregulated entity in the financial markets. FirewoodFX offers a wide array of market instruments. The platform extends the option for users to familiarize themselves with its services through a demo account.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

| Pros | Cons |

|

|

|

|

|

|

|

- Demo Account Availability: FirewoodFX provides a demo account option, enabling traders to practice trading strategies and familiarize themselves with the platforms features without risking real funds.

- MT4 Trading Platform: Trading occurs through the widely acclaimed MetaTrader 4 (MT4) platform, known for its stability, versatility, and extensive range of trading tools, providing traders with a seamless trading experience.

- Multiple Account Options: FirewoodFX caters to traders of different experience levels by offering various types of trading accounts, each tailored to meet specific preferences and objectives.

- Convenient Deposit and Withdrawal Methods: The platform offers a variety of deposit and withdrawal methods, including bank transfers, e-wallets, cryptocurrencies, credit cards, and e-payment systems, providing clients with flexibility and convenience in managing their funds.

- Lack of Regulation: One of the most significant drawbacks of FirewoodFX is its unregulated status, which exposes traders to increased risks due to the absence of oversight from governmental or financial authorities.

- Regional Restrictions: FirewoodFX does not accept clients from the United States of America, North Korea, Iraq, Iran, Saint Lucia and Saint Vincent and the Grenadines. These restrictions will stem from regulatory compliance issues or other factors specific to those regions.

FirewoodFX's current lack of valid regulation signifies a concerning absence of oversight from governmental or financial authorities, heightening the inherent risks associated with investing through their platform. Without regulatory supervision, there exists a substantial potential for malfeasance, where the operators of the platform hold no accountability for their actions.

This absence of oversight leaves investors vulnerable to various forms of misconduct, including misappropriation of funds and fraudulent practices. Essentially, the absence of regulation exposes investors to significant risks, as there are no safeguards in place to protect their investments.

Moreover, the lack of regulatory oversight means that FirewoodFX's operators have the autonomy to dissolve the platform abruptly, leaving investors with no recourse or means of recovering their investments.

Therefore, engaging with FirewoodFX carries inherent risks that every investor should be cognizant of before committing any funds to the platform.

FirewoodFX offers forex, gold, crypto, oil and more.

- Forex (Foreign Exchange): This includes major currency pairs like EUR/USD, GBP/USD, USD/JPY, as well as minor and exotic currency pairs such as EUR/GBP, USD/TRY, and many others.

- Gold (XAU/USD): Trading in gold allows investors to speculate on the price movements of this precious metal against the US dollar.

- Crypto: FirewoodFX likely offers trading in various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and others. Investors can trade cryptocurrency pairs against major fiat currencies like USD or EUR.

- Oil (Crude Oil): This typically involves trading contracts for difference (CFDs) on the price of crude oil, allowing traders to speculate on its price movements without owning the physical commodity.

FirewoodFX offers various types of trading accounts tailored to meet the needs of different types of traders.

- Cent Account: This account is suitable for beginners or those who want to trade with smaller amounts of capital. With a minimum deposit of USD 10 (or equivalent in USC), traders can start trading with micro-lot sizes, allowing for precise risk management and lower exposure to the market.

- Micro Account: Similar to the Cent Account, the Micro Account is designed for traders who prefer smaller trade sizes. It also requires a minimum deposit of USD 10 and offers micro-lot trading, but the base currency is USD instead of USC.

- Standard Account: The Standard Account is suitable for intermediate traders who are comfortable with standard lot sizes and require more flexibility in their trading. It requires a minimum deposit of USD 10 and offers standard lot trading.

- Premium Account: The Premium Account is designed for more experienced traders who may require additional features or benefits. It also requires a minimum deposit of USD 10 and offers standard lot trading like the Standard Account.

- ECN Account: The ECN (Electronic Communication Network) Account is tailored for advanced traders who require direct access to liquidity providers and prefer tighter spreads and faster execution. It requires a higher minimum deposit of USD 200 but offers the same standard lot trading as the Premium Account.

| Account Type | Minimum Deposit | Base Currency | Contract Size per 1 lot | Value 1 lot per pip/point | Minimum Trade Size | Maximum Open Position |

| Cent | USD 10 (or equivalent in USC) | USC (1 USD = 100 USC) | USC 100,000 | USC 10 per pip / USC 1 per point | 0.01 lot (1000) | 200 positions |

| Micro | USD 10 | USD | USD 10,000 | USD 1 per pip / USD 0.1 per point | ||

| Standard | USD 100,000 | USD 10 per pip / USD 1 per point | ||||

| Premium | ||||||

| ECN | USD 200 |

Furthermore, FirewoodFX offers demo accounts for traders who want to practice trading strategies and familiarize themselves with the platform's features without risking real funds. Demo accounts replicate real market conditions, providing a risk-free environment for learning and honing trading skills.

To open an account with FirewoodFX, please follow these steps:

| Step | |

| 1 | Provide your full name |

| 2 | Enter your email address |

| 3 | Choose a password and confirm it |

| 4 | Select your country (Indonesia in this case) |

| 5 | Provide your mobile phone number |

| 6 | Choose the type of account you want to open: |

| - Premium Account | |

| - Cent Account | |

| - Micro Account | |

| - Standard 5-Digit Account | |

| - Standard 4-Digit Account | |

| - ECN Account | |

| 7 | Read and agree to FirewoodFXs Customer Agreement |

| 8 | Complete the registration process |

FirewoodFX offers a maximum leverage of 1:1000, which means traders can control positions up to 1000 times the amount of their initial investment. Leverage allows traders to amplify their potential returns by using borrowed capital, enabling them to enter larger positions with a relatively smaller amount of capital. This can be advantageous for traders looking to maximize their profit potential with limited funds. However, it's important to note that leverage magnifies both profits and losses, making it a double-edged sword.

FirewoodFX offers competitive spreads across its range of account types. The spreads are variable and start from as low as 1 pip for certain account types. Variable spreads mean they fluctuate according to market conditions, providing traders with the opportunity to benefit from tighter spreads during times of high market liquidity. Additionally, FirewoodFX doesn't charge any commissions for standard trading accounts, making it attractive for traders who prefer not to pay additional fees per trade.

However, for the Micro account, FirewoodFX imposes a commission of $7 per lot traded. While this commission might seem nominal, it's essential for traders to factor it into their overall trading costs, especially if they engage in high-volume trading. The commission structure ensures that traders using the Micro account are aware of the costs associated with their trades upfront, allowing for better transparency and informed decision-making.

| Account Type | Spreads | Commission |

| Cent | Floating from 1 Pip | None |

| Micro | Fix from 3 Pips | |

| Standard | Fix from 2 Pips | |

| Premium | Floating from 0.3 Pip | |

| ECN | Floating from 0 Pip | $7/lot |

FirewoodFX provides its clients with the popular MetaTrader 4 (MT4) trading platform, renowned for its user-friendly interface and comprehensive features. With MT4, FirewoodFX users gain access to a powerful trading environment equipped with advanced charting tools, technical indicators, and analytical resources, empowering traders to make informed decisions.

The platform offers a seamless trading experience across various devices, including desktops, laptops, smartphones, and tablets, allowing traders to access their accounts and execute trades anytime, anywhere. MT4's compatibility with different operating systems ensures flexibility for traders who prefer trading on their preferred devices.

FirewoodFX offers a variety of convenient deposit and withdrawal methods to cater to the diverse needs of its clients. Clients can fund their accounts via bank transfer, QRIS, internet banking, virtual accounts (e-wallets), BIDR BEP20, BUSD BEP20, USD Tether TRC20/BEP20, credit card, Perfect Money, and Fasapay.

For deposits, clients can choose from options such as bank transfer, QRIS, internet banking, virtual accounts, and various cryptocurrencies like BIDR BEP20, BUSD BEP20, and USD Tether TRC20/BEP20. For different ways, minimum amount and fees vary. For example, through Internet Banking, $10 of minimum amount is required. More details can be learned by clicking: https://www.firewoodfx.com/trading/deposit.

Withdrawals from FirewoodFX accounts are also straightforward, with options including bank transfer, internet banking, and cryptocurrency withdrawals like BIDR BEP20, BUSD BEP20, and USD Tether TRC20/BEP20. Withdrawals are typically processed within 24 to 48 hours, depending on the chosen method. Similarly, for different ways, minimum amount and fees vary. For example, through Internet Banking, IDR 50,000 of minimum amount is required. More details can be learned by clicking: https://www.firewoodfx.com/trading/deposit.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +442036083558

Email: support@firewoodfx.com

Address: Suite 305, Griffith Corporate Centre, Beachmont. St. Vincent and the Grenadines

FirewoodFX offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

In conclusion, FirewoodFX offers a range of products and services, catering to traders seeking diversification in their investment portfolios. However, it operates without regulatory oversight, which poses inherent risks for traders. While the platform provides competitive leverage and a user-friendly MT4 trading platform, the absence of regulation raises concerns about the safety and reliability of the service.

| Q 1: | Is FirewoodFX regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at FirewoodFX? |

| A 2: | You can contact via telephone: +442036083558, mail: support@firewoodfx.com and online messaging. |

| Q 3: | Does FirewoodFX offer demo accounts? |

| A 3: | Yes. |

| Q 4: | What platform does FirewoodFX offer? |

| A 4: | It offers MT4. |

| Q 5: | What is the minimum deposit for FirewoodFX? |

| A 5: | The minimum initial deposit to open an account is $10. |

| Q 6: | At FirewoodFX, are there any regional restrictions for traders? |

| A 6: | Yes. FirewoodFX does not accept clients from the United States of America, North Korea, Iraq, Iran, Saint Lucia and Saint Vincent and the Grenadines. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxtm and firewoodfx are, we first considered common fees for standard accounts. On fxtm, the average spread for the EUR/USD currency pair is From 1.5 pips, while on firewoodfx the spread is From 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxtm is regulated by CYSEC,FCA,FSC,FSCA. firewoodfx is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxtm provides trading platform including ADVANTAGE PLUS,ADVANTAGE and trading variety including FX Metals Commodities Indices FX indices Stock baskets Stock CFDs (only MT5) Stocks (only MT5). firewoodfx provides trading platform including ECN,Micro,Standard,Premium,Cent and trading variety including --.