No data

Do you want to know which is the better broker between FOREX.com and Dukascopy Bank ?

In the table below, you can compare the features of FOREX.com , Dukascopy Bank side by side to determine the best fit for your needs.

EURUSD: -0.1

XAUUSD: 0.1

Long: -1.32

Short: -0.49

Long: -5.4

Short: -0.68

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of forex-com, dukascopy lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex.com is a major player in forex trading, providing various options including currencies, commodities, indices, and cryptocurrencies. Their platforms, like the popular MetaTrader 4, are available worldwide to meet different trader preferences. Backed by robust regulation and a strong focus on security, Forex.com is a favored choice for professionals looking for an all-encompassing trading experience. Now, let's delve deeper to verify if Forex.com lives up to its reputation.

| Quick Forex.com Review in 10 Key Points | |

| Registered in | USA |

| Regulated by | FCA (UK), IIROC (Canada), NFA(USA), ASIC (Australia), and CySEC (Cyprus), MAS ( Singapore), CIMA ( Cayman Islands) |

| Year(s) of incorporation | More than 20 years |

| Market instruments | currency pairs, precious metals, energies, indices, bonds, cryptocurrencies and equities |

| Minimum initial deposit | $100 |

| Maximum leverage | Variant |

| Minimum spread | Floating |

| Trading platform | Forex.com and MT5 |

| Deposit and withdrawal methods | credit card (Visa, Mastercard, Maestro), bank wire transfer, Skrill and Neteller |

| Customer Service | E-mail address/live chat |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Forex.com is one of the most respected and trusted forex brokers in the foreign exchange trading industry. Founded in 2001, Forex.com is a global company licensed and regulated by several reputable regulatory authorities, including ASIC in Australia, FCA in the United Kingdom, FSA in Japan, NFA in the United States, IIROC in Canada, CIMA in the Cayman Islands and MAS in Singapore. These regulators are known for their strict compliance and oversight requirements, which means that Forex.com is required to meet high ethical and operational standards to protect its clients and ensure the safety of their funds.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

| Pros | Cons |

| Offers tighter spreads | Acts as counterparty in the operations of its customers |

| Guarantees the execution of operations under normal market conditions. | There may be conflicts of interest |

| Can offer a greater amount of liquidity and depth in the marketplace | Traders do not have direct access to the interbank market. |

| Offers an easy to use and customizable trading platform | Traders may prefer ECN or STP brokers. |

Forex.com is a worldwide forex broker offering online trading services in multiple markets, including forex, indices, commodities, cryptocurrencies and stocks.

Forex.com is a Market Maker broker, which means that it acts as a counterparty to its clients' trades, rather than sending trades to the interbank market. As such, Forex.com can offer tighter spreads and guarantee execution of trades under normal market conditions. However, some traders may prefer ECN or STP brokers, which send trades directly to the interbank market and do not act as a counterparty to their clients.

Yes, Forex.com operates legally. Forex.com, a globally recognized broker, is part of an international holding company regulated by reputable authorities worldwide, including the FCA (UK), IIROC (Canada), NFA(USA), ASIC (Australia), and CySEC (Cyprus), MAS ( Singapore), CIMA ( Cayman Islands).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

|

ASIC | STONEX FINANCIAL PTY LTD | Market Making(MM) | 345646 |

|

FCA | Gain Capital UK Limited | Market Making(MM) | 113942 |

|

FSA | GAIN Capital Japan Co., Ltd | Retail Forex License | 関東財務局長(金商)第291号 |

|

NFA | GAIN CAPITAL GROUP LLC | Market Making(MM) | 0339826 |

|

IIROC | GAIN Capital - FOREX.com Canada Ltd. | Market Making(MM) | Unreleased |

|

CIMA | GAIN Global Markets, Inc | Market Making(MM) | 25033 |

|

MAS | STONEX FINANCIAL PTE. LTD. | Retail Forex License | Unreleased |

Forex.com's Australian entity, STONEX FINANCIAL PTY LTD, regulated by the ASIC in Asutralia under regulatory number 345646, holding a license for Market Making(MM).

Forex.com's UK entity, Gain Capital UK Limited, regulated by tier-one regulatory FCA under regulatory number 113942, holding a license for Market Making(MM).

The entity based in Japan, GAIN Capital Japan Co., Ltd, regulated by FCA under regulatory number 関東財務局長(金商)第291号, holding a license for Retail Forex License.

GAIN CAPITAL GROUP LLC, the US entity, regulated by the NFA under regulatory number0339826, holding a license for Market Making(MM).

Candian entity, GAIN Capital - FOREX.com Canada Ltd., is regulated by the IIROC, holding a license for Market Making (MM), with license unreleased.

GAIN Global Markets, Inc, another entity in the Cayman Islands, regulated by CIMA under regulatory number 25033, holding a license for Market Making (MM).

STONEX FINANCIAL PTE. LTD., the entity in Singapore, regulated by the MAS in Singapore, holding a license for retail forex.

| Pros | Cons |

| It offers a wide variety of trading instruments, allowing traders to find opportunities in different markets. | Offering a wide variety of trading instruments, it can be overwhelming for traders who are new to the market and do not have experience in all available markets. |

| Diversification of trading instruments can help traders manage the risk of their portfolios. | Some trading instruments may have higher costs in terms of spreads or commissions, which may reduce the profitability of trades. |

| Forex.com offers a variety of market analysis and education tools to help traders make informed decisions about trading instruments. | Traders may find that the variety of trading instruments may be too wide, making it difficult to identify profitable trading opportunities. |

Forex.com offers a wide variety of trading instruments, including currency pairs, precious metals, indices, futures and options, stocks. Traders have a wide range of options to choose from and can find opportunities in a variety of markets.

The minimum deposit amount required to register a Forex.com Standard live trading account is $100 USD, which is quite friendly to most investors.

Here is the table showing the comparison of Forex.com minimum deposit with other brokers:

| Broker | Minimum Deposit |

|

$100 |

|

$10 |

|

$5 |

|

$200 |

| Pros | Cons |

| Demo account available for risk-free practice | No Islamic account offered for traders who follow Shariah law |

| Offers two account types to suit different trading needs | The standard account has wider spreads compared to the MT5 account. |

| The standard account is ideal for traders looking for a wide variety of advanced charting tools and a wide selection of markets. | MT5 account can be more complex for beginner traders |

| Both accounts offer access to Forex.com's award-winning, technologically advanced and easy-to-use trading platform. | The MT5 account has a more limited selection of markets to trade compared to the standard account. |

| Customers can switch between the two accounts at any time to meet their business needs. | The standard account does not offer multi-asset class trading, like the MT5 account. |

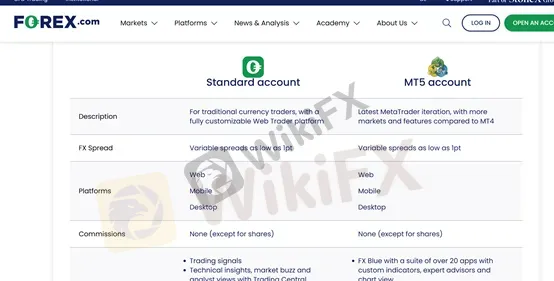

Forex.com offers its clients two types of trading accounts: the standard account and the MT5 account. The standard account is ideal for traders looking for a wide range of advanced charting tools with more than 80 technical indicators and a wide selection of markets to trade with competitive spreads starting from 0.8 pips on the EUR/USD currency pair. In addition, this account does not charge commissions on over 300 markets. On the other hand, the MT5 account is ideal for traders looking for up-to-date tools and analysis, multi-asset class trading, expert advisors and custom indicators. Both accounts offer access to Forex.com's award-winning, technologically advanced and easy-to-use trading platform. In addition, clients can switch between the two accounts at any time to suit their trading needs.

Forex.com provides beginners with demo accounts, allowing them to practice in a real trading setting without any financial risks. Demo accounts come with $50,000 in virtual funds and are active for 30 days from the time of registration. Please be aware that once this period ends, you won't be able to access the demo account with the same login details. Notably, each email address can only be used to open one demo account for each type, whether it's on FOREX.com platforms or MetaTrader.

With Forex.com demo accounts, you can enjoy the following features:

$50,000 virtual funds

Demo accounts active for 30 days

Access to 80+ tradable FX pairs, plus gold and silver

Using customizable charts

Here is the simple demo account sign-up process for you to follow:

Step 1: click the “Free Demo Account” button on the “Account” Navigation section;

Step 2: Fill in your full name, email and phone number in the form, and then click “ I'm not a robot” for verification.

Step 3: After a simple registration, you can use the demo account and start trading.

| Pros | Cons |

| Low spreads on a wide range of instruments | Spreads can be variable and can widen during periods of high volatility. |

| Low commissions for stock trading | Forex.com is a Market Maker broker, which means that there may be a conflict of interest. |

| Average speed of fast execution | It does not offer trading accounts with variable spreads. |

| Very low spreads on the EUR/USD currency pair | Some traders may prefer ECN or STP brokers that send trades directly to the market. |

| Low spreads for spot oil trading | |

| Low spreads for gold trading |

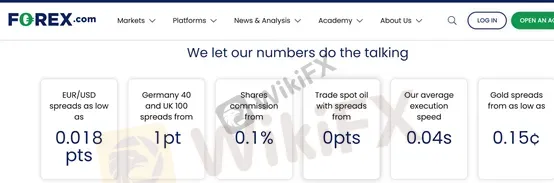

Forex.com offers competitive spreads and low commissions on a wide range of trading instruments. Spreads for the EUR/USD currency pair start from as low as 0.018 pips, which is very low compared to other brokers. In addition, spreads for the Germany 40 and UK 100 indices start from 1 pip, and commissions for trading stocks start from 0.1%. Traders can also trade spot oil with spreads starting from 0 pips, which can be very attractive for those interested in commodity trading. In addition, the average trade execution speed on Forex.com is 0.04 seconds, which means that traders can expect fast execution of their trades. Finally, spreads for gold start as low as 0.15 cents, which can be very attractive for traders looking to trade the precious metals markets.

| Pros | Cons |

| Forex.com's MT5 platform is fast and offers a wide range of technical analysis tools and resources. | Some traders may prefer other popular platforms such as MetaTrader 4. |

| The MT5 platform can be customized to each trader's preferences. | Traders who prefer a simpler platform may find the Forex.com platform a bit overwhelming. |

| The Forex.com platform is easy to use and designed to provide an intuitive trading experience. | The Forex.com platform is not as advanced as MT5 and may not be suitable for more experienced traders looking for more advanced tools. |

Forex.com offers its clients the MT5 trading platform, one of the most popular and advanced trading platforms on the market. MT5 is known for its fast order execution and wide range of technical analysis tools and resources. In addition, traders can customize the platform according to their needs and preferences.

In addition to MT5, Forex.com also offers its own trading platform, the Forex.com platform. This platform is easy to use and is designed to provide an intuitive and customizable trading experience. The Forex.com platform features advanced trading tools, real-time charting and a wide range of technical indicators, making it a good choice for traders of all experience levels.

Margin on Forex.com is a financial requirement that traders must meet in order to maintain their open positions. The margin requirement varies by platform (FOREX.com or MetaTrader), market, asset class and position size. Each instrument on Forex.com has its own margin information that can be found on the market information sheet on the FOREX.com platforms. To calculate the margin required to open a position, simply multiply the total nominal value of the trade (quantity x instrument price) by the margin factor. Traders can use the platform's margin calculator to find out the margin required before opening a position. In addition, Forex.com allows monitoring the margin requirements of each position individually and reviewing the total margin requirement of the account through the Margin Indicator. It is important to remember that the margin requirement may change over time as market prices fluctuate.

Forex.com offers negative balance protection on all of its trading accounts. This means that clients cannot lose more money than they have in their account, providing an additional layer of security and peace of mind in trading. In the event that an extreme market situation occurs and a position moves against the client, Forex.com will automatically close the position before the account balance falls below zero. This protection helps limit risk for clients and is an important feature to consider when choosing a forex broker.

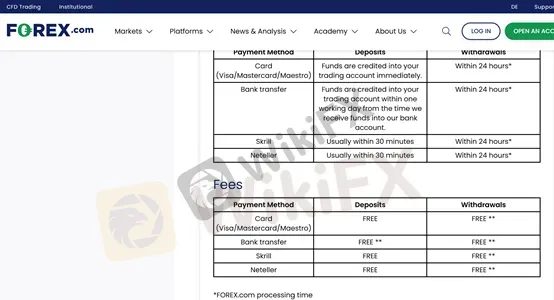

Forex.com offers several payment methods for depositing and withdrawing funds, such as credit card (Visa, Mastercard, Maestro), wire transfer, Skrill and Neteller. Deposits are processed within 24 hours, which means traders can start trading quickly. Withdrawals are also fast, usually taking 1-2 business days to process. It is important to note that Forex.com does not charge any additional fees for deposits or withdrawals, but payment service providers may impose their own fees.

Forex.com offers a wide variety of tools and resources to help traders make informed decisions, including technical analysis, economic calendars, real-time news, free webinars and seminars, and a free demo account to practice and improve trading skills.

Forex.com offers exceptional customer service, with 24-hour support in multiple languages via live chat, email and address. In addition, the broker has an extensive online help center covering topics from account opening to trade execution and risk management. It also offers a news and analysis section, which includes an economic calendar and real-time market news, allowing clients to stay informed and make informed decisions. Overall, Forex.com demonstrates a strong commitment to customer satisfaction and provides all the tools necessary for traders to succeed in their trading experience.

E-mail: support@forex.com

Address: 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA

In summary, Forex.com is a well-regulated and respected broker with a wide variety of trading instruments and easy-to-use trading platforms. With its solid reputation in the industry and its focus on security and protection of client funds, Forex.com is an attractive option for traders looking for a reliable and secure broker.

Q: Does Forex.com offer a demo account for practice?

A: Yes, Forex.com offers a free demo account for traders who want to practice before trading with real money. The demo account offers full access to the trading platforms and market analysis tools for a limited period of time.

Q: What is the minimum deposit to open an account at Forex.com?

A: The minimum deposit to open a Forex.com account varies depending on the type of account the trader chooses and the trader's location. In some cases, it can be as low as 10 0 dollars.

Q: Does Forex.com charge commissions for trades?

A: Forex.com charges commissions for some trades, such as stock trading. However, it does not charge commissions in most markets. Instead, Forex.com earns profits through the spread between the bid and ask prices of assets.

Q: Does Forex.com have any kind of training or education program for traders?

A: Yes, Forex.com offers a wide variety of educational resources for traders of all levels, including live webinars, seminars, trading guides, articles and educational videos.

Q: What payment methods does Forex.com accept?

A: Forex.com accepts various payment methods, including credit and debit cards, bank transfers, as well as electronic payment systems such as Skrill and Neteller. Processing times and deposit and withdrawal limits may vary depending on the method chosen and the trader's location.

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland. The bank specializes in providing cutting-edge internet-based and mobile trading services, with a strong focus on foreign exchange, CFDs, and binary options. Additionally, the bank offers a wide range of banking and financial services, all supported by their in-house technological solutions.

Dukascopy Bank was established on November 2, 2004, in Geneva by Andre and Veronika Duka, both Swiss nationals residing in Geneva who continue to maintain a 99% ownership stake in the company. Dukascopy Bank is regulated by the Swiss Financial Market Supervisory Authority FINMA both as a bank and a securities firm.

Dukascopy Bank fully owns Dukascopy Europe IBS AS, a European licensed brokerage company based in Riga and Dukascopy Japan, a Type-1 licensed broker located in Tokyo. In addition to its Geneva Headquarters, Dukascopy Bank has offices in Riga, Tokyo and Hong Kong. Currently, Dukascopy Group employs over 300 staff.

The Dukascopy Group primarily offers online and mobile trading services through the SWFX - Swiss FX Marketplace, which is Dukascopy's proprietary ECN (Electronic Communication Network) technological solution and a registered trademark.

Dukascopy main features | |

☑️Regulations | FINMA (Switzerland), JFSA (Japan), FCMC (Latvia) |

💰 Account currency | USD, CHF, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, CNH, SEK, SGD, TRY, XAU and ZAR |

🗺 Supported Languages | English, Spanish, German, French, Arabic, Russian, Portuguese, Japanese, Chinese, Slovak, Czech, Polish, Italian, Hungarian |

📊 Accounts | ECN accounts with a minimum deposit requirement of $100 - JForex4, MT4, PAMM, Binary options (all available for demo testing). |

💰 Products (CFD) | Currencies, Commodities, Indices, ETFs, Stocks, Bonds, Crypto |

💵 Min Deposit | $100 (Dukascopy Bank SA), $100 (Dukascopy Europe IBS AS) |

💹 Margin Call / Stop Out: | 100%/200% |

📈️ Min Order | 0.01 |

💱 Spread | From 0.1 pips for EUR/USD |

💹 Max Leverage | From 1:1 to 1:200 on weekdays/ from 1:1 to 1:60 on weekends (JForex4 platform - limitations may apply), 1:25 (Dukascopy Japan) |

🖥 Trading Desk Type | All trading orders are executed fully automatically by the trading system. Order execution is STP (Straight-Through Processing) without any human intervention |

📊 Trading Platforms | JForex4 and MT4 platform, both are available for desktop and mobile. |

💳 Deposit Options | Wire Transfer (SWIFT, SEPA), Debit/Credit Card, Cryptocurrencies, Skrill, Neteller, Bank guarantee |

💳 Withdrawal Options | Bank Transfer, Transfer to crypto exchange, Skrill, Neteller, Payment Card |

🕑 Time to Withdrawal | Withdrawal request is processed within 1 working day |

🕝 Time to Open an Account | The deposit is processed within 1 working day |

₿ Cryptocurrencies | Bitcoin, Cardano, Litecoin, Stellar, Dash, Enjin Coin, TRON, Uniswap, EOS, Ethereum, Basic Attention Token, Chainlink, Polygon |

🗓 Foundation Year | 2004 (Geneva, Switzerland) |

🎁 Contests and bonuses | Yes |

Dukascopy offers an exceptional trading experience that is worth every trader's attention. With a client-first approach, Dukascopy provides numerous advantages, making them a standout choice for anyone looking to enter the financial markets. Dukascopy's commitment to cost-efficiency is evident through their low spreads, allowing for savings on trading costs. Swift execution ensures obtaining the best possible prices, providing a competitive advantage in trades. Additionally, with deposit protection of up to CHF 100,000, you can trade with peace of mind.

The unique trading platform, JForex4, Dukascopy's proprietary solution, is user-friendly, making trading accessible even for beginners. JForex4 presents over 200 technical indicators and trading widgets to help in staying informed about potential opportunities. With support for minute timeframes like ticks and seconds, it is perfect for scalping. Dukascopy's 19 years of experience and Swiss banking license instill trust and security. With over 1200 instruments, leverage up to 1:200, and 24/7 live trading support, Dukascopy stands as a trusted partner to guide traders through their trading journey.

Moreover, Dukascopy offers a great feature – detailed historical price feed data makes it easier to develop and test trading strategies. This data covers various financial instruments, helping traders make informed decisions and reducing the risk of price manipulation. Dukascopy's extensive data archive is a useful resource for creating trading strategies, especially for high-frequency trading, and provides practical insights.

With such a comprehensive offering, Dukascopy is the go-to choice for transparent and professional trading services. Make a smart move and open an account today!

Attractive trading conditions |

Client funds protected up to CHF 100,000, with EUR 20,000 cover for Dukascopy Europe. |

Online account opening with video identification |

Accumulating liquidity from various sources (banks, brokerage companies, liquidity providers, internal liquidity pool) |

ECN accounts with a minimum deposit requirement of $100 - JForex4, MT4, PAMM, Binary options (all available for demo testing). |

A wide range of free financial information and other attractive resources is available through its website, including Dukascopy TV |

Extensive variety of trading platforms, JForex4, MT4 (available for desktop and mobile) |

Manual and automated trading and trading directly from the chart |

Hedging and scalping allowed |

Slippage control |

Swap free accounts upon request (conditions apply) |

200 indicators and chart studies and automated trading historical tester |

Wide range of trading orders: MIT, limit orders, eco and TP/SL orders |

Deposit bonus up to 100% |

Leverage up to 1:200 |

Dukascopy regulations

Dukascopy is strictly supervised and regulated by esteemed regulatory bodies. The regulatory authorities play a pivotal role in ensuring Dukascopy’s compliance with the highest standards of financial and securities industry practices.

Dukascopy's international presence is underlined by its licenses and oversight by regulatory authorities in different parts of the world:

Dukascopy Bank SA is licensed and regulated as a bank and as a securities firm by the Swiss Financial Market Supervisory Authority (FINMA), which is classified as a Tier-1 regulator.

Dukascopy Europe IBS AS is licensed and regulated by the Bank of Latvia, also recognized as a Tier-1 regulator.

Dukascopy Japan K.K. is licensed and regulated by the Financial Services Agency of Japan (JFSA), known as a Tier-1 regulator.

These regulatory bodies set specific requirements for Dukascopy, and the company has diligently complied with them since 2004. It is important to note that failure to comply with these requirements could result in the withdrawal of the bank's license. Regular audits are conducted to ensure adherence to Swiss laws. Dukascopy also ensures client security by providing deposit protection for amounts up to CHF 100,000, in line with Swiss financial service provider requirements.

Dukascopy is widely regarded as one of the safest brokerage firms. They maintain strict safety standards and hold official licenses from respected financial regulators. Routine audits by PKF for internal affairs and KPMG for financial records further solidify their commitment to safety and financial integrity.

In summary, Dukascopy's reputation as a trusted and stable entity is due to its adherence to three top-tier regulations, regular audits, stringent safety standards, and a strong commitment to transparency. These qualities make Dukascopy a reputable choice for investors around the world.

Trading terms for Dukascopy clients

Traders opt for Dukascopy due to its well-established reputation for providing a secure trading environment. Dukascopy Bank SA, headquartered in Switzerland, operates under the regulation of the Swiss Financial Market Supervisory Authority (FINMA). This regulatory oversight ensures strict adherence to financial standards and secures client accounts up to CHF 100,000.

Dukascopy takes pride in delivering favorable trading terms to its clients. By offering narrow spreads, cost-effective commissions, and access to abundant liquidity from numerous providers, Dukascopy enables traders to execute trades at competitive rates, ultimately increasing their profitability.

Dukascopy also permits traders to select from a range of trading accounts, including Standard, ECN, and Islamic accounts, to suit various trading styles and preferences.

Furthermore, in addition to the widely-used MT4 platform, Dukascopy presents its proprietary JForex4 trading platform, available for both desktop and mobile devices. This platform grants traders the flexibility to monitor and participate in the markets from anywhere, ensuring they never miss a trading opportunity. Dukascopy's JForex4 mobile platform offers real-time quotes, comprehensive order management features, and full account accessibility.

With Dukascopy, you can transfer funds directly from the JForex platform to a multi-currency banking account (MCA), without any associated fees. The MCA account supports various payment methods, including card and cryptocurrency transactions.

Trading features | |

🔧 Instruments | 1200+ instruments including: FX, Commodities (CFD), Indices (CFD), Bonds (CFD), Stocks (CFD), ETF (CFD), Crypto (CFD) |

🏛 Liquidity Provider | Liquidity providers are represented by centralized marketplaces and a number of banks which continuously provide ask and bid prices on the market. The sentiment ratio of this group is opposite to liquidity consumers data because, for each trade executed through SWFX, there are two equal and offsetting over-the-counter transactions |

⚡Lightning-fast order execution | Yes |

🎧 Customer support | 24h/7 multi-language support via chat, phone and email |

⭐ Other | A wide range of order types, including stop-loss and limit orders |

📱 Mobile trading | Yes |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive forex-com and dukascopy are, we first considered common fees for standard accounts. On forex-com, the average spread for the EUR/USD currency pair is -- pips, while on dukascopy the spread is from 0.1.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

forex-com is regulated by ASIC,FCA,FSA,NFA,IIROC,MAS. dukascopy is regulated by FSA,FINMA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

forex-com provides trading platform including STP PRO,COMMISSION,Standard and trading variety including 60 currency pairs Gold & silver. dukascopy provides trading platform including MT4,JForex and trading variety including Forex, cryptocurrencies, CFDs, metals.