No data

Do you want to know which is the better broker between eToro and Tradeview ?

In the table below, you can compare the features of eToro , Tradeview side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of etoro, tradeview lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| eToro | Basic Information |

| Founded in | 2007 |

| Headquarters | United Kingdom |

| Regulations | CySEC, FCA, ASIC |

| Tradable Assets | Stocks, Cryptocurrencies, Currencies, Commodities, ETFs |

| Minimum Deposit | $10 |

| Trading Fees | Commission-free trading, Spreads from 0.75 pips on EUR/USD |

| Non-Trading Fees | Withdrawal fee of $5, Inactivity fee of $10/month after 12 months of inactivity |

| Leverage | Up to 1:30 for retail clients, up to 1:400 for professional clients |

| Trading Platforms | eToro proprietary platform, MetaTrader 4 |

| Mobile Trading | Yes, available on iOS and Android |

| Customer Support | 24/5 live chat, email support |

| Educational Resources | Social trading, educational videos, blog articles, eToro Academy |

| Demo Account | Yes, unlimited time |

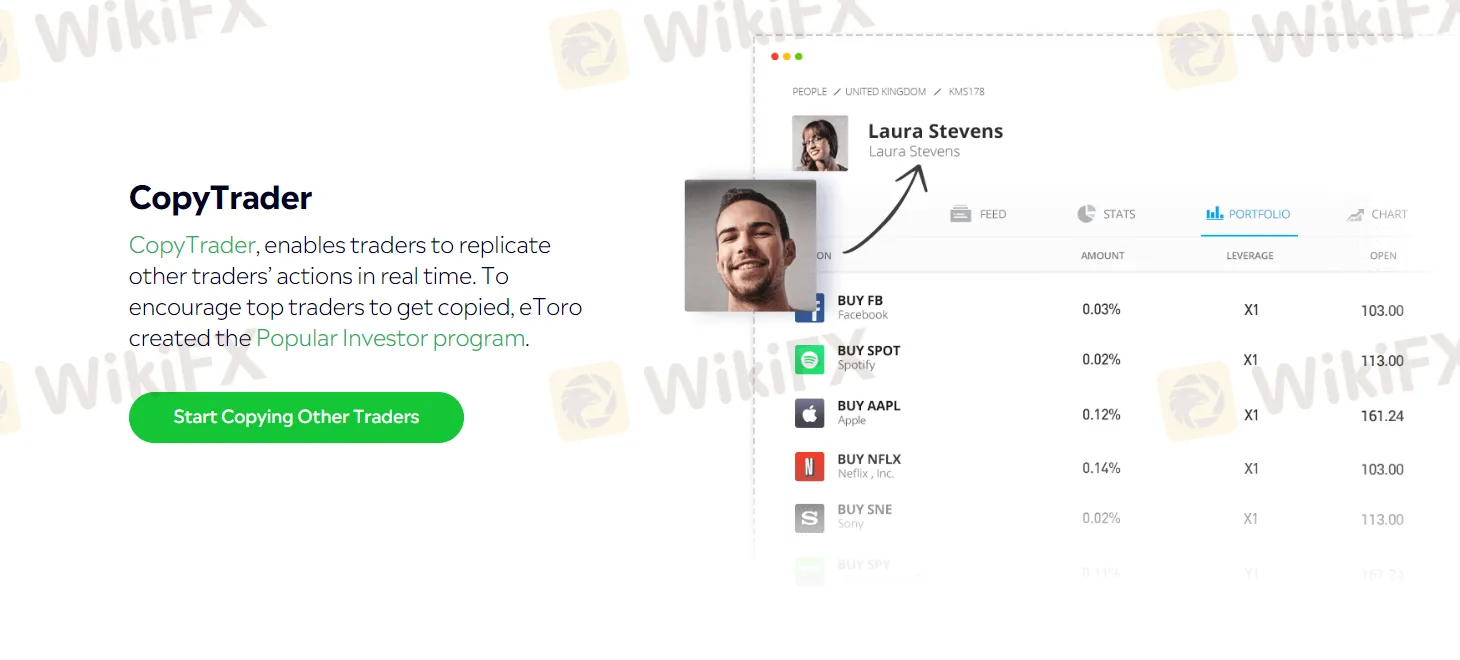

| Other Features | CopyTrader, Popular Investor Program, eToro Wallet |

eToro is a multi-asset social trading platform that has gained widespread popularity among investors, traders, and social media enthusiasts since its inception in 2007. It offers users access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, indices, and commodities, among others. The platform provides a user-friendly interface that caters to both novice and experienced traders alike, making it one of the most popular trading platforms on the market.

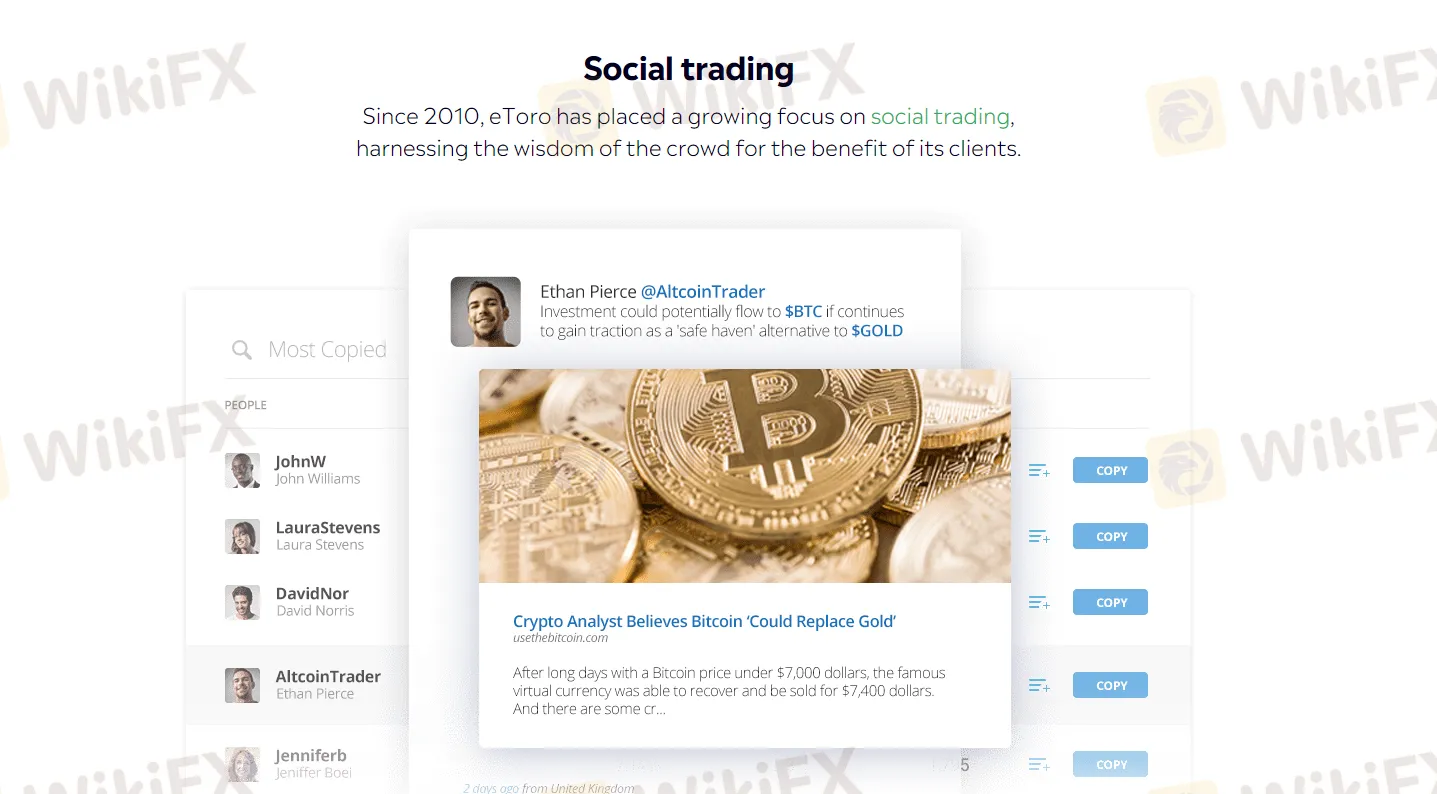

One of eToro's standout features is its social trading capabilities, which allow users to copy the trades of successful traders and build their investment portfolios. The platform has a large community of traders who share insights, strategies, and knowledge, making it an excellent learning resource for traders looking to improve their skills.

eToro is a legitimate and regulated online brokerage firm that has been operating since 2007. It is licensed and regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). The company is also a member of the Investor Compensation Fund, which provides additional protection for traders' funds. However, as with any investment platform, there are risks involved in trading, and traders should always be aware of the potential risks and take steps to protect their investments.

eToro's user-friendly interface, range of trading assets, and social trading features have made it popular among both beginner and experienced traders. However, as with any trading platform, eToro has its pros and cons, which potential users should consider before signing up. In this section, we will discuss the advantages and disadvantages of using eToro as a trading platform.

| Pros | Cons |

| User-friendly and easy-to-use platform | Higher spreads compared to some other brokers |

| Regulated by reputable financial authorities | Limited range of tradable assets |

| Copy trading and social trading features | Limited research and analysis tools |

| Wide range of payment methods | Inactivity fee charged after 12 months of inactivity |

| Commission-free trading on stocks and ETFs | Withdrawal fee of $5 |

| Demo account available for practice | Limited customer support options |

Market Instruments

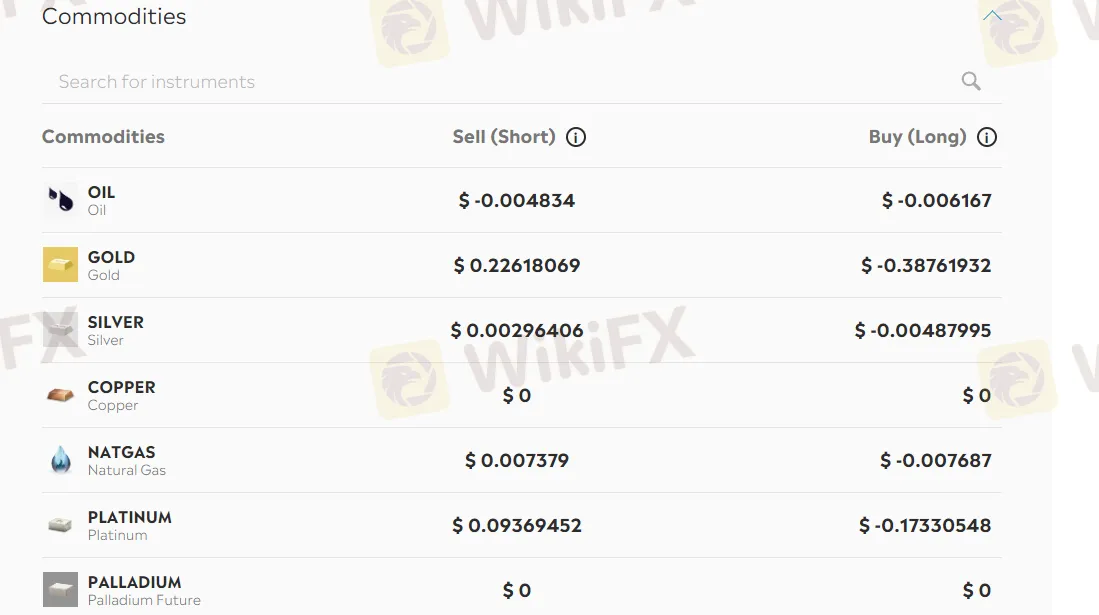

eToro offers a wide range of financial instruments for traders to choose from, covering various markets globally. Traders can access more than 2,400 assets, including popular currencies, commodities, indices, and stocks from exchanges around the world. Furthermore, eToro enables traders to trade cryptocurrency, such as Bitcoin and Ethereum, which has become a popular asset class in recent years due to its high volatility and potential for substantial profits. With this wide range of instruments available, traders can diversify their portfolios and explore various markets to find the best investment opportunities.

| Pros | Cons |

| Wide variety of assets including stocks, cryptocurrencies, commodities, forex, and more | Limited selection of options and futures contracts |

| Commission-free trading on most instruments | Limited research tools for fundamental analysis |

| Availability of social trading, allowing for copy trading and following other traders' strategies | Limited access to less popular or niche assets |

| Option to trade fractional shares for stocks, making it accessible to investors with small capital | Limited trading hours on certain assets, such as cryptocurrencies |

| Lack of transparency in pricing structure for some assets |

eToro provides traders with two primary types of accounts to choose from, namely the Retail and Professional accounts. These account types differ in various aspects, such as trading features, account requirements, leverage limits, and the level of regulatory protection they offer.

eToro's Retail account is suitable for most traders and investors. This account type requires a minimum deposit of $500 and provides access to all eToro's trading instruments, including cryptocurrencies, stocks, ETFs, commodities, and more. Retail account holders can also benefit from eToro's social trading features, which allow users to follow and copy other successful traders on the platform. However, retail account holders are limited to a maximum leverage of 1:30, as per regulatory requirements.

eToro's Professional account is designed for experienced traders who meet certain criteria, such as having a minimum of two years of trading experience and meeting certain financial thresholds. This account type provides access to higher leverage of up to 1:400, and allows users to benefit from reduced margin requirements and negative balance protection. However, professional account holders are not eligible for certain investor protection rights, such as compensation schemes, as they are deemed to have a higher level of trading knowledge and experience.

| Aspects | Pros | Cons |

| Account Types | Offers both retail and professional accounts | Professional accounts require certain qualifications |

| Minimum Deposit | Low minimum deposit requirement for retail account | High minimum deposit requirement for professional account |

| Commission | No commission on trades for most assets | Higher spreads compared to other brokers |

| Leverage | Up to 1:30 for major currency pairs | Limited leverage options for professional accounts |

| Platform | User-friendly platform with social trading features | Limited customization options |

| Customer Support | 24/7 customer support in multiple languages | Phone support only available during market hours |

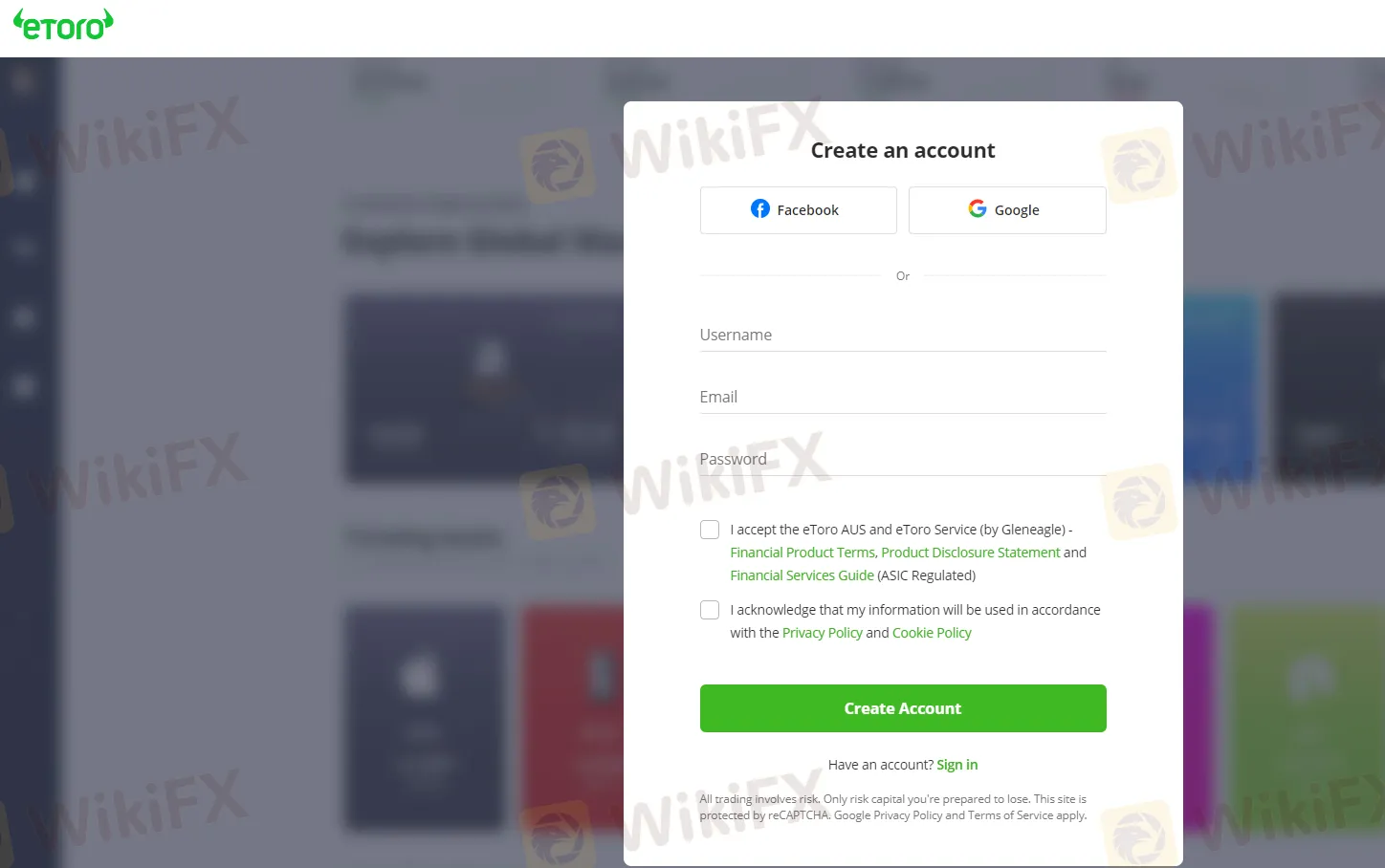

To open an account with eToro, you need to follow these steps:

Go to the eToro website and click on the “Join Now” button.

Enter your personal information, including your name, email address, and phone number.

Verify your email address by clicking on the verification link sent to your email. Provide additional information, including your date of birth, address, and tax ID number. Agree to the terms and conditions and submit your application.

Wait for eToro to review and approve your account, which usually takes a few minutes to a few business days.

After approval, you can fund your account with preferable payment methods and then start your real trading with this broker.

eToro offers a demo account for traders who want to practice trading strategies without risking real money. The eToro demo account provides $100,000 in virtual money and is valid for an unlimited amount of time, allowing traders to familiarize themselves with the platform and practice their trading skills.

To open a demo account, traders can simply sign up for an eToro account and select the option to use the demo account. It's important to note that the eToro demo account does not require any deposit or funding, making it a risk-free way to test out the platform.

When using the demo account, traders should keep in mind that the virtual money provided is not real, and any profits or losses made are also not real. It's also important to note that while the demo account provides a good introduction to the platform, it may not accurately reflect the actual market conditions and trading experience.

eToro offers leverage for trading various financial instruments. The maximum leverage provided by eToro varies depending on the instrument and the jurisdiction of the client. For example, for major forex pairs, eToro offers leverage up to 1:30 for retail clients and up to 1:400 for professional clients. For commodities such as gold and silver, leverage can be up to 1:20 for retail clients and up to 1:100 for professional clients. For stocks, eToro offers leverage up to 1:5 for both retail and professional clients. It is noted that high leverage can amplify your potential returns, but more importantly, it can increase your risks.

eToro's spreads vary depending on the asset being traded. The platform charges variable spreads, which means that the spread can widen or narrow depending on market conditions. The typical spread for major currency pairs such as EUR/USD and GBP/USD is around 3 pips during normal market conditions. However, this can vary depending on market volatility and liquidity.

For other assets, such as cryptocurrencies and commodities, eToro's spreads are generally higher. For example, the spread for Bitcoin can range from 0.75% to 5% depending on market conditions.

| Pros | Cons |

| Zero commission on stock and ETF trading | Wider spreads compared to other brokers |

| Competitive spreads on major forex pairs | Overnight fees charged on leveraged positions |

| No hidden fees or surprises | Limited selection of exotic currency pairs |

| Transparent pricing | Higher spreads on cryptocurrencies |

| Tight spreads on commodities and indices | Spreads can widen during volatile market conditions |

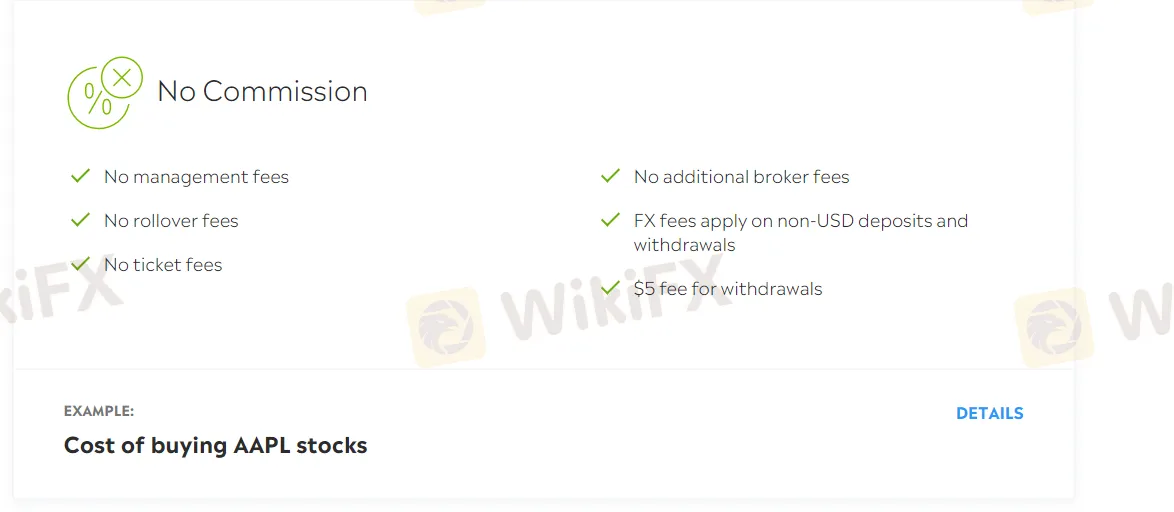

In addition to spreads and commissions, eToro also imposes a few non-trading fees that traders should take into consideration before trading on this platform. These fees include:

Withdrawal fee: eToro charges a withdrawal fee of $5 per withdrawal. This fee is relatively low compared to other brokers.

Inactivity fee: If you don't log in to your eToro account for 12 months, an inactivity fee of $10 per month will be charged to your account. This fee is charged until you log in again or until your account balance reaches zero.

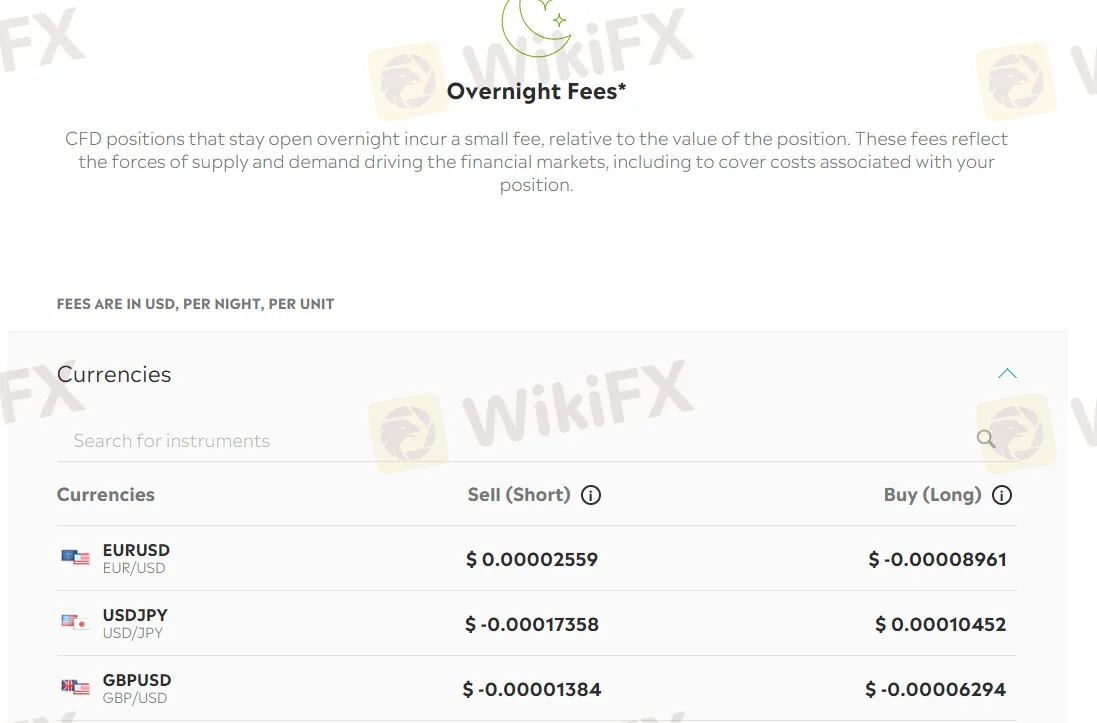

Overnight fees: eToro charges overnight fees or rollover fees for positions held open overnight. The amount of the fee depends on the instrument traded, the direction of the position, and the size of the position.

Currency conversion fee: If you deposit funds in a currency different from the base currency of your account, eToro charges a currency conversion fee. The fee is 0.5% of the deposited amount, and it's calculated based on the exchange rate at the time of the conversion.

| Pros | Cons |

| No commissions on stock and ETF trading | Higher spreads compared to other brokers |

| No deposit fees | High withdrawal fees |

| No account maintenance fees | Inactivity fee after 12 months of inactivity |

| No fees for using the CopyTrader feature | Limited payment methods |

| No fees for currency conversion | Overnight fees for positions held overnight |

| High fees for using PayPal as a payment method |

eToro offers its proprietary trading platform, which is designed to be user-friendly and intuitive, particularly for novice traders. The platform provides a variety of tools and features, including real-time market data, advanced charting tools, and an easy-to-use order entry system.

One of the most notable features of the eToro platform is its social trading functionality, which allows users to follow and copy the trades of successful traders. This feature is particularly appealing to new traders who may lack the knowledge or experience to make their own trades.

In addition to its proprietary platform, eToro also supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its advanced charting capabilities, extensive library of technical indicators, and the ability to automate trading strategies through the use of Expert Advisors (EAs).

Here is a comparison table of the trading platform offered by eToro, FP Markets and Exness:

| Broker | Trading Platform | Desktop | Web-based | Mobile |

| eToro | eToro Platform | ✔️ | ✔️ | ✔️ |

| FP Markets | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

| Exness | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

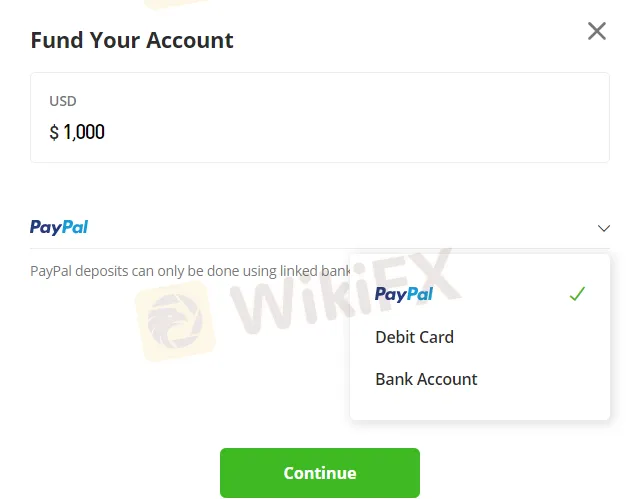

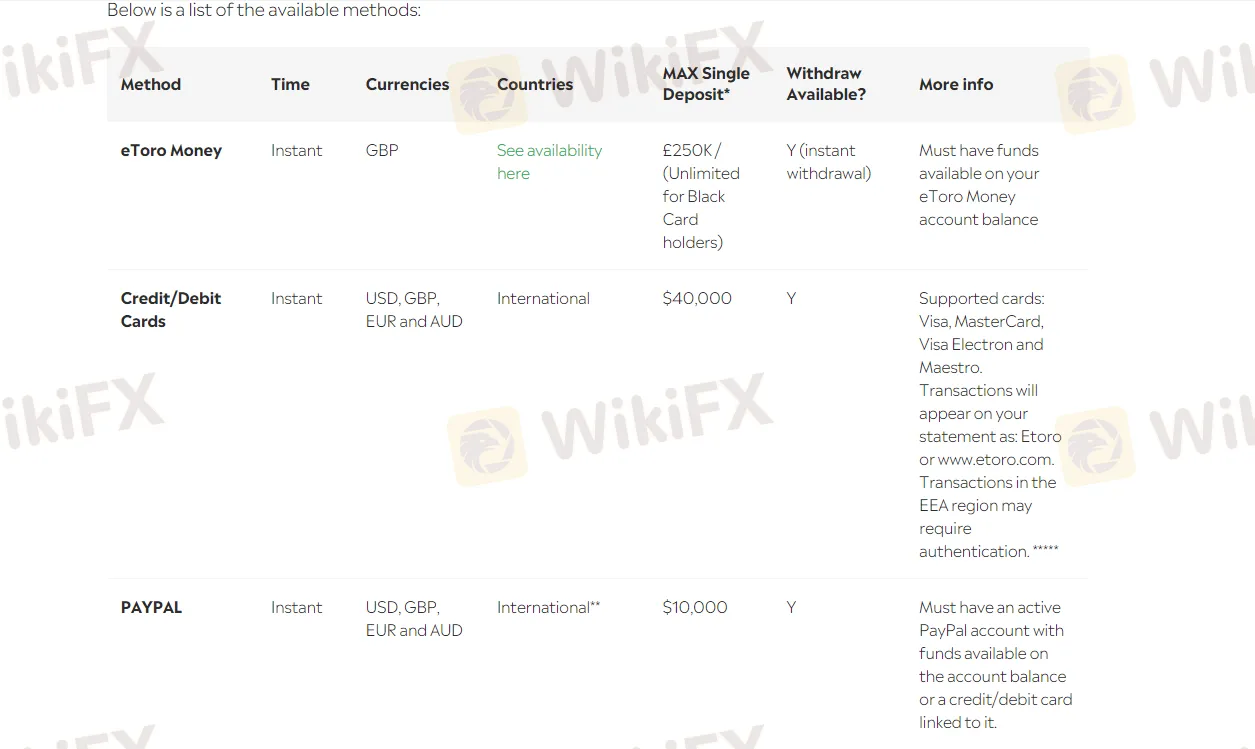

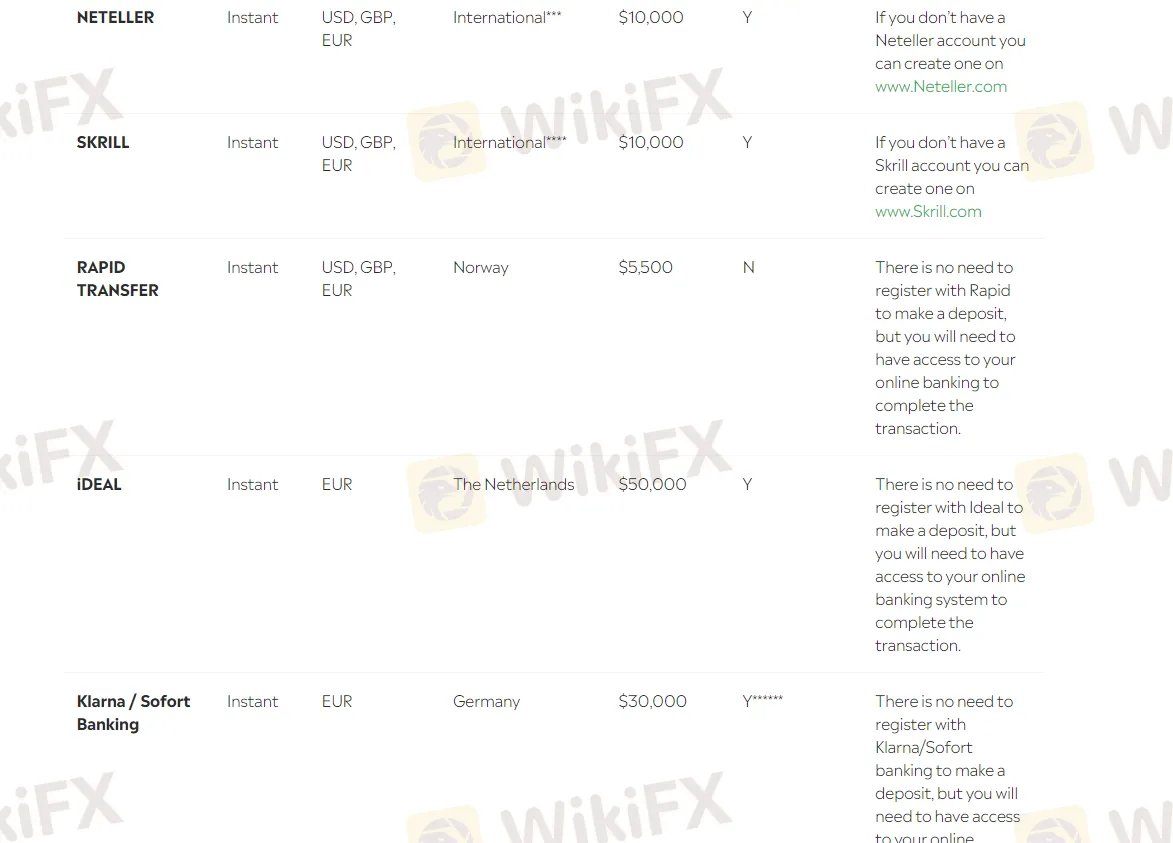

eToro accepts multiple payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill. The minimum deposit amount is $10, which is relatively low compared to other brokers in the industry. Deposits are usually processed instantly or within one business day, depending on the payment method. eToro does not charge any deposit fees, but some payment providers may have their own fees.

eToro allows you to withdraw funds using the same payment methods as deposits.The minimum withdrawal amount is $30, and there is a withdrawal fee of $5.Withdrawals are usually processed within one business day, but it may take longer for bank transfers.Before making a withdrawal, you need to verify your identity and complete the necessary KYC (Know Your Customer) procedures. eToro also has a policy of returning funds to the original payment method used for deposits, whenever possible.

| Pros | Cons |

| Wide range of payment methods available including credit/debit cards, PayPal, and bank transfer | Withdrawal fee of $5 per transaction |

| Quick and easy deposit process with most methods being processed instantly | Minimum withdrawal amount of $30 |

| No deposit fees charged by eToro | Limited number of currencies available for deposits and withdrawals |

| Supports deposits and withdrawals in multiple currencies | Withdrawal processing time can take up to 7 business days |

| Allows users to set up multiple payment methods for convenience | Third-party fees may be charged by payment processors |

| Negative balance protection ensures that users cannot lose more than they have deposited | Users may need to provide additional verification documents for withdrawals |

Customer support is an important aspect of any online brokerage firm, and eToro is no exception. eToro offers various channels for customers to get in touch with its support team. These channels include:

Live chat: This is available 24/5, Monday to Friday. It is the fastest and most efficient way to get support.

Email: Customers can send an email to the eToro support team. The response time is usually within 24 hours.

Phone: Customers can also call the support team during office hours. eToro provides local phone numbers for various countries.

Social media: eToro has a presence on various social media platforms, including Twitter and Facebook. Customers can use these platforms to get in touch with the support team.

FAQ section: eToro offers a comprehensive FAQ section on their website that covers a wide range of topics related to their services, trading, account management, and more. The FAQ section is organized into categories, making it easy for users to find answers to their questions quickly.

When it comes to educational resources, Toro offers a variety of educational content to help traders improve their skills and knowledge of the financial markets.

These resources include:

eToro Academy: This is an online education portal that provides traders with a wide range of educational materials, including articles, videos, webinars, and courses on various topics such as trading strategies, market analysis, risk management, and more.

Trading Guides: eToro also offers a series of trading guides that provide in-depth information on various trading topics, including stocks, commodities, currencies, and indices.

Market News and Analysis: eToro provides traders with up-to-date news and analysis on the financial markets. This includes daily market updates, weekly market analysis, and other educational content.

Blog: eToro has a blog that provides traders with the latest news, market analysis, and trading tips.

Virtual Portfolio: eToro offers a virtual portfolio feature that allows traders to practice trading without risking real money. This is a great way for beginners to gain experience and test out their trading strategies before trading with real money. Here is an instructional video for users to know clearly what Virtual Portfolio is:https://www.youtube.com/watch?v=GWK7uQ98KpM.

Overall, eToro is a reputable and user-friendly online trading platform that offers a wide range of financial instruments and trading options to its clients. Its innovative social trading features, intuitive platform, and excellent customer service make it an attractive choice for both beginner and experienced traders. However, it does have some drawbacks, such as relatively high fees, limited research tools, and a lack of advanced charting capabilities.

FAQs

Q: Is eToro a regulated broker?

A: Yes, eToro is a regulated broker. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

Q: What trading instruments are available on eToro?

A: eToro offers a wide range of trading instruments, including stocks, ETFs, cryptocurrencies, forex, commodities, and indices.

Q: What is the minimum deposit required to open an account on eToro?

A: The minimum deposit required to open an account on eToro varies depending on your location and the type of account you choose. For most countries, the minimum deposit is $500.

Q: Does eToro offer a demo account?

A: Yes, eToro offers a demo account that allows you to practice trading with virtual funds. The demo account is free and can be used for an unlimited period of time.

Q: What is eToro's customer support like?

A: eToro's customer support is available 24/5 and can be reached through email, live chat, and phone. They also have a comprehensive help center and a community forum where you can get answers to common questions and connect with other traders.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | Cayman Islands |

| Found | 2004 |

| Regulation | LFSA |

| Market Instrument | Forex, Indices CFDs, Commodities, and Cryptocurrencies |

| Account Type | X leverage account and Innovative Liquidity Connector account |

| Demo Account | yes |

| Maximum Leverage | 1:400 |

| Spread (EUR/USD) | Floating around 0.3 pips |

| Commission | X Leverage account: no; Innovative Liquidity Connector account: $5 per lot |

| Trading Platform | MT4, MT5, cTrader and Currenex |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | bank wire transfers, credit cards, Skrill, Neteller, STICPAY, Fasapay, etc. |

Tradeview is an online ECN broker based in the Cayman Islands, founded in 2004. Tradeview is a regulated brokerage firm operating in the Cayman Islands and regulated in Malaysia.The company offers Straight Through Processing (STP) and holds a full license for MT4/5, providing traders with access to various financial markets. Tradeview allows trading in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and XRP, as well as major stock market indices and commodities like gold, silver, and crude oil. The brokerage offers two trading account options: the X leverage account and the Innovative Liquidity Connector account, catering to different types of traders.

Tradeview supports multiple trading platforms, including Metatrader 4, Metatrader 5, cTrader, and Currenex. These platforms offer advanced features, charting capabilities, and a wide range of technical indicators. The company also provides a comprehensive trading platform, an economic calendar, and educational resources such as a glossary and financial blogs.

Tradeview offers various payment methods, including bank wire transfers, credit cards, and alternative options. However, there have been concerns raised by customers, including difficulties with fund withdrawals, server errors, suspicious trading practices, and lackluster customer support. Some users have also reported discrepancies in payment methods and fees.

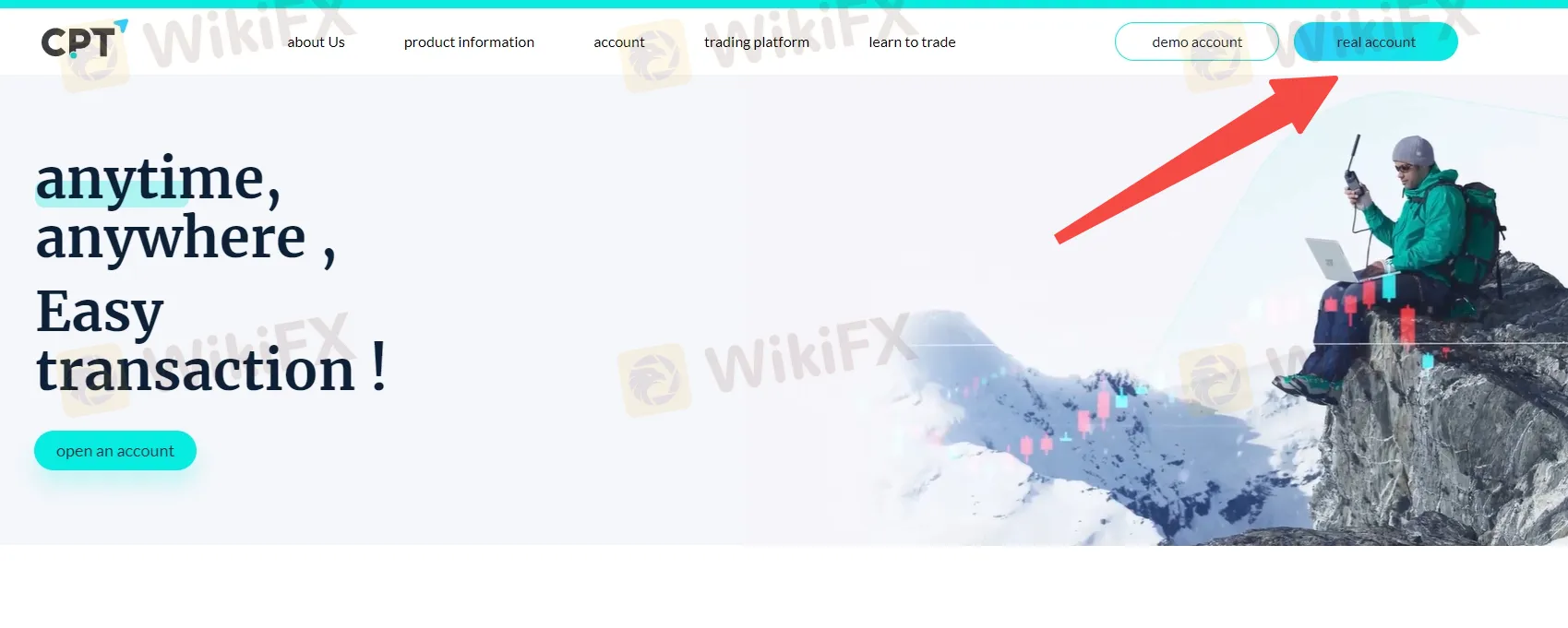

Here is the home page of this brokers official site:

Tradeview, a regulated brokerage based in the Cayman Islands, offers a diverse range of market instruments, including cryptocurrencies, stock market indices, commodities, and currency pairs. However, there are some drawbacks to consider. The spread values for trading are not provided in the available information, and there is a lack of detailed information on leverage, margin requirements, trading hours, and specific contract specifications. Additionally, there is limited information on trading fees, commissions, and the features and advantages of certain account types and trading platforms. There have been concerns raised by customers regarding difficulties in withdrawing funds, server errors, abnormal trading practices, and poor customer support. These factors indicate a need for further research and caution before engaging with Tradeview as a trading platform.

| Pros | Cons |

| Diverse range of market instruments | Spread values not provided in the table |

| Access to multiple trading platforms | Lack of detailed information on the Innovative Liquidity Connector account |

| Demo account available for practice trading | Limited information on account features |

| Opportunity for traders with limited funds | Limited information on the specific features and capabilities of the trading platforms |

| Wide range of deposit options | Bank wire withdrawal fee |

| No fees for most withdrawal methods | Fees for Skrill and Neteller |

| Reviews highlighting concerns related to withdrawal issues, |

Based on the information provided, Tradeview Ltd is regulated by the Cayman Islands Monetary Authority (CIMA) with license number 585163. However, the provided information indicates that Tradeview Ltd has exceeded its business scope regulated by CIMA and has received a risk alert from WikiFX. The alert suggests that Tradeview Ltd is operating with a license that does not cover its current business activities.

Tradeview currently offers investors trading in Forex, Indices CFDs, Commodities, and Cryptocurrencies like Litecoin, Bitcoin, Ethereum, Ripple and more.

Cryptos:

Tradeview offers several cryptocurrencies for trading, including BTCUSD (Bitcoin to US Dollar), BTCJPY (Bitcoin to Japanese Yen), ETHUSD (Ethereum to US Dollar), LTCUSD (Litecoin to US Dollar), and XBNUSD (XRP to US Dollar). These instruments allow traders to speculate on the price movements of various cryptocurrencies.

Indices:

Tradeview provides trading opportunities in different indices such as GDAXI (German DAX 30), NDX (NASDAQ 100), AUS200 (Australian 200), FCHI (French CAC 40), SPXm (S&P 500 mini), and WS30 (Dow Jones Industrial Average). Traders can take positions based on the performance of these stock market indices.

Commodities:

The commodities available for trading on Tradeview include GOLD (Gold), SILVER (Silver), CRUDE (Crude Oil), NGAS (Natural Gas), GOLDEUR (Gold to Euro), and UKOIL (UK Brent Crude Oil). Traders can speculate on the price fluctuations of these commodities

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments | Spread values not provided in the table |

| Opportunity to trade popular cryptocurrencies | Lack of information on leverage, margin requirements, and trading hours |

| Access to major stock market indices | Limited information on specific commodity contracts |

| Ability to trade in commodities | Limited information on cryptocurrency trading pairs |

| Wide selection of currency pairs | No information on trading fees or commissions |

There are two trading account options available at Tradeview: the X leverage account and the Innovative Liquidity Connector account. The minimum deposit to open an X leverage account is $100, which sounds quite reasonable for most regular traders to have a try.

Tradeview also offers a free live demo account where users can trade across MT4, MT5, cTrader and CurreneX platforms. Users can learn to trade in real-time, and practice trading strategies with technical indicators while avoiding money risks.

To open an account with Tradeview, follow these steps:

Go to the Tradeview website.

Look for the “Open Account” button on the homepage and click on it.

3. On the account types page, you will see different options. To start with a demo account, click on the “Demo Account” option. If you want to open a live trading account, proceed to the next step.

4. Select the type of account you want to open. Tradeview offers three options: “Individual Application,” “Joint Account Application,” and “Corporate Account Application.” Choose the one that suits your needs and click on it.

5. Fill out the basic information form. Provide accurate details such as your name, email address, phone number, country of residence, and desired account currency.

6. Next, you need to choose a trading platform. Tradeview offers several platforms, such as MT4, MT5, cTrader, and Currenex. Select the platform you prefer for trading.

7. Select the currency type for your account. You can choose between USD (United States Dollar) and EUR (Euro).

8. Proceed to fill in the primary account holder information. This includes personal details like your full name, date of birth, residential address, and occupation.

9. Read and review the Individual Agreement carefully. This document outlines the terms and conditions for opening and using an individual trading account with Tradeview. Make sure you understand and agree to the terms before proceeding.

10. Once you have completed all the required information, click on the “Submit” or “Open Account” button to submit your application.

After submitting your application, Tradeview may require additional documentation to verify your identity and address. This typically includes providing a copy of your identification documents (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement). Make sure to follow any instructions provided by Tradeview to complete the verification process.

Leverage differs for each account. For ILC (Innovative Liquidity Connector) accounts, the maximum trading leverage is 1:100 while on X Leverage accounts, it is up to 1:400. The minimum trade size is 0.1 lots on the ILC account and 0.01 lots on the X leverage account.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

All spreads with Tradeview are a floating type and scaled with the asset class. For example, the EUR/USD spread is floating around 0.3 pips. There is no commission on the X Leverage account, while the Innovative Liquidity Connector account has to pay a commission of $5 per lot.

Traders are free to choose from four different trading platforms, Metatrader4, Metatrader5, cTrader, and Currenex, depending on their trading experience and trading needs.

Tradeview offers four trading platforms to choose from: Metatrader 4, Metatrader 5, cTrader, and Currenex. These platforms provide traders with advanced tools and features to enhance their forex trading experience.

Metatrader 4 (MT4) is a widely recognized platform in the forex industry. It offers a user-friendly interface, extensive charting capabilities, and a wide range of technical indicators. Traders can execute trades, set up automated trading strategies, and access a vast marketplace of third-party plugins and expert advisors.

Metatrader 5 (MT5) is the successor to MT4 and offers enhanced features and functionality. It provides an improved trading environment, additional order types, advanced analytical tools, and more options for customization. MT5 also allows traders to access various financial markets, including cryptocurrencies.

cTrader is a powerful and innovative trading platform known for its advanced order execution capabilities and comprehensive charting tools. It provides direct market access (DMA) and enables traders to execute trades quickly. cTrader also offers a range of features such as depth of market (DOM), detachable charts, and customizable layouts.

Currenex is a platform designed specifically for institutional and professional traders. It offers deep liquidity, fast order execution, and advanced trading tools. Currenex provides access to a wide range of currency pairs and allows for high-volume trading.

| Pros | Cons |

| User-friendly interface of MT4 and MT5 | Limited information on the specific features and capabilities of the platforms |

| Extensive charting capabilities on MT4 and MT5 | No information on the features and advantages of cTrader and Currenex |

| Access to a wide range of technical indicators on MT4 and MT5 | Lack of details on the execution speed and order types offered by each platform |

| Availability of third-party plugins and expert advisors on MT4 | Limited information on the customization options and tools provided by each platform |

| Direct market access and advanced order execution on cTrader | Insufficient information on the platform's compatibility with different devices and operating systems |

| Currenex platform tailored for institutional and professional traders | No information on the pricing structure or fees associated with using the platforms |

Tradeview offers two trading tools that provide valuable features and functionality for traders. These tools are designed to assist traders in making informed decisions and executing their trading strategies.

Trading Platform: Tradeview provides a comprehensive trading platform that allows traders to access various financial markets and instruments. The platform offers a user-friendly interface with advanced charting capabilities, real-time market data, and a range of order types for executing trades. Traders can analyze price movements, monitor positions, and implement trading strategies directly from the platform. The trading platform is accessible on desktop computers, as well as mobile devices, enabling traders to stay connected to the markets at all times.

Economic Calendar: Tradeview offers an economic calendar, which is a vital tool for traders to stay updated on important economic events and their potential impact on the financial markets. The economic calendar provides a schedule of upcoming economic indicators, such as GDP releases, interest rate decisions, employment reports, and more. Traders can use this information to anticipate market movements, identify trading opportunities, and manage their risk accordingly. The economic calendar offered by Tradeview is comprehensive and provides relevant data for various regions and countries.

Pros and Cons

| Pros | Cons |

| Comprehensive trading platform | Limited information on contract specifications |

| User-friendly interface | Lack of information on trading fees |

| Advanced charting capabilities | Limited availability of trading tools and indicators |

| Real-time market data | Limited customization options for the trading platform |

Tradeview opens on Sunday at 5 pm EST and closes on Friday at 4:55 EST. Each market is subject to specific trading hours. Forex, Indices and commodities markets are open 24/5 from Monday to Friday. Trading hours for each market can also be viewed on MT4 and MT5 platforms.

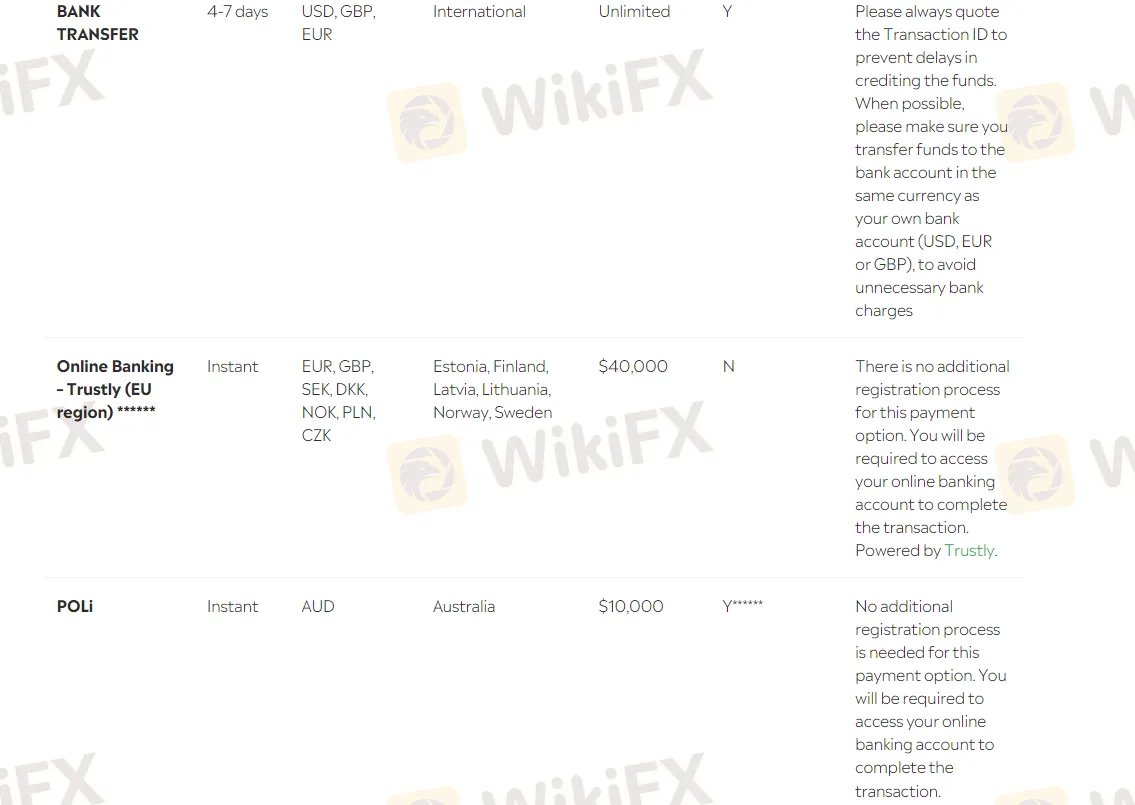

Tradeview supports bank wire transfers, credit cards, Skrill, Neteller, STICPAY, Fasapay, and many other deposit and withdrawal methods.

Note that losses can exceed the initial amount invested. Third-party payments will NOT be accepted. All deposits MUST be from the original account owner.

Withdrawals are only released via the same method in which the payment was originally submitted. Tradeview does not charge fees for withdrawals. However, a hefty $35 is charged with the bank wire option and a 1%-1.5% fee for Skrill and Neteller. To submit a request for withdrawals, users have to complete a form on the website with supporting documentation.

Tradeview offers some educational materials in the form of a glossary list. They also have a website called Surf Up!, which is dedicated to educating about the FX market. The website is updated with daily news and regular financial blogs.

Tradeview operates during specific trading hours, which are as follows: The trading week starts on Sunday at 5 pm EST and ends on Friday at 4:55 pm EST. The Forex, Indices, and commodities markets are open 24 hours a day, five days a week, from Monday to Friday. For more detailed trading hour information, users can refer to the MT4 and MT5 platforms provided by Tradeview.

Tradeview provides customer support services through various channels. Traders can reach out to their customer service desk 24/5 via instant web chat. Additionally, there is a 'contact us' form available for submitting inquiries, and the support team responds to these queries via email. For direct assistance, traders can contact Tradeview by telephone at the provided numbers. Tradeview is also active on popular social media platforms such as Facebook, Twitter, LinkedIn, and Instagram. Their physical address is located at 4th Floor Harbour Place, 103 South Church St, PO Box 1105.

The reviews on WikiFX about Tradeview suggest several concerns and issues raised by customers. One user reported difficulties in withdrawing funds, encountering server errors, and expressing suspicions about the legitimacy of the platform. Another user mentioned experiencing forced liquidation and losses due to abnormal quotations and insufficient margin. Additionally, a customer complained about the broker converting their EURO deposit to RUB without their knowledge and the lack of response from customer support. Another review accused Tradeview of charging BitPay fees but paying clients via Uphold, resulting in delayed transactions and potential losses. Finally, a customer claimed that Tradeview took several days to process their BTC transaction, charged BitPay fees despite using Uphold, and suggested the company intentionally delayed transactions when the Bitcoin price was rising. These reviews highlight concerns related to withdrawal issues, abnormal trading practices, poor customer support, and potential discrepancies in payment methods and fees.

In conclusion, Tradeview has both advantages and disadvantages to consider. On the positive side, Tradeview offers a diverse range of market instruments, including cryptocurrencies, stock market indices, and commodities, providing traders with various trading opportunities. They also offer multiple trading platforms, such as Metatrader 4, Metatrader 5, cTrader, and Currenex, each with its own set of features. Additionally, Tradeview provides educational resources to help users learn about the FX market. However, there are several concerns raised by customers, including difficulties with fund withdrawals, server errors, suspicions about the platform's legitimacy, forced liquidation, and potential discrepancies in payment methods and fees. It is important for potential traders to carefully evaluate these factors before deciding to engage with Tradeview.

| Q 1: | Is Tradeview regulated? |

| A 1: | Yes. It is regulated by LFSA. |

| Q 2: | At Tradeview, are there any regional restrictions for traders? |

| A 2: | Yes. The services and products offered by Tradeview are not being offered within the United States (US) and are not being offered to US Persons, as defined under US law. The information on this website is not directed to residents of any country where FX and/or CFD trading is restricted or prohibited by local laws or regulations. |

| Q 3: | Does Tradeview offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Tradeview offer the industry-standard MT4 & MT5? |

| A 4: | Yes. Tradeview supports MT4, MT5, cTrader and Currenex. |

| Q 5: | What is the minimum deposit for Tradeview? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is Tradeview a good broker for beginners? |

| A 6: | Yes. Tradeview is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive etoro and tradeview are, we first considered common fees for standard accounts. On etoro, the average spread for the EUR/USD currency pair is -- pips, while on tradeview the spread is From 0 PIPS.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

etoro is regulated by ASIC,CYSEC,FCA,FSC. tradeview is regulated by LFSA,CIMA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

etoro provides trading platform including -- and trading variety including --. tradeview provides trading platform including Innovative Liquidity Connector,X Leverage Account and trading variety including --.