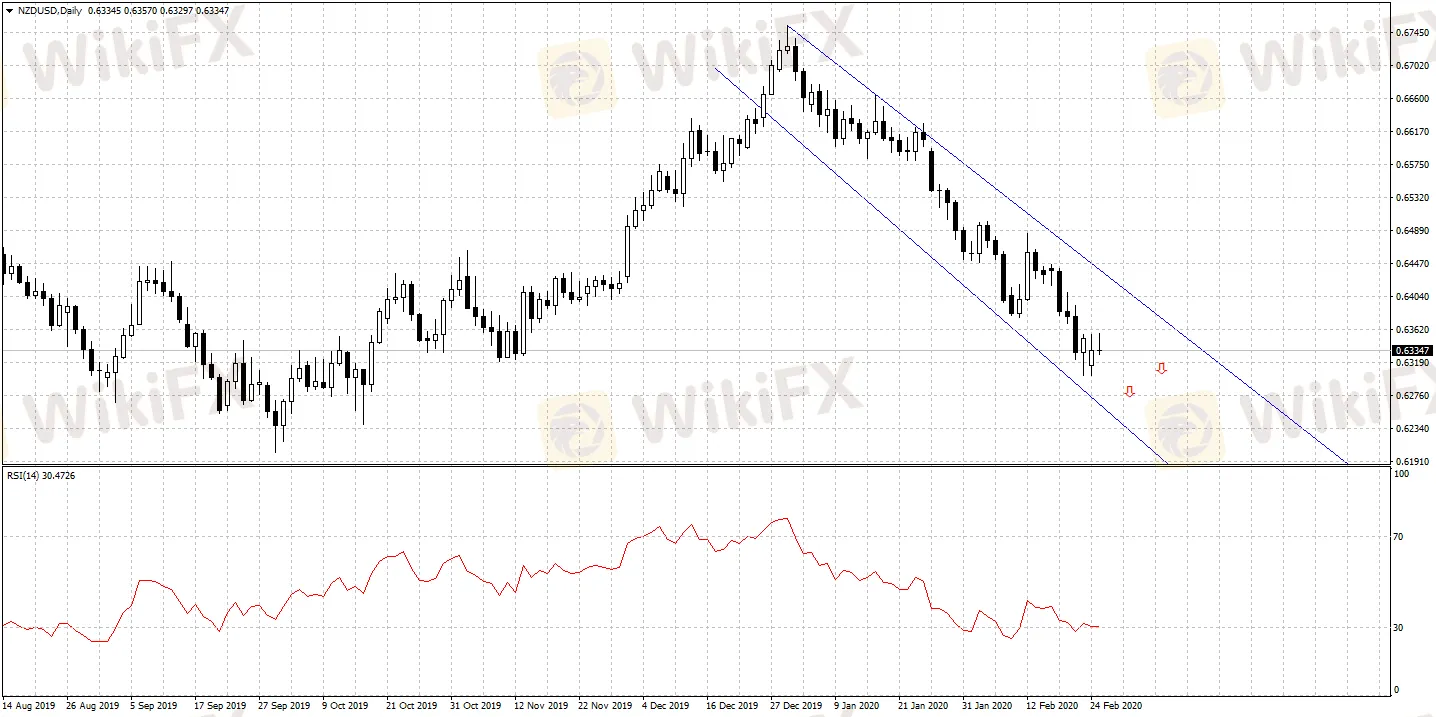

New Zealand May Cut Rates in Gloomy Environment

Abstract:ANZ Bank has revised its outlook on New Zealand’s economic growth due to risks posted by public health emergency.

ANZ Bank has revised its outlook on New Zealands economic growth due to risks posted by public health emergency.

ANZ Bank previously expected New Zealands economy to grow by 0.8% in the first half of 2020, and later revised to 0.1% shrinkage in Q1 and 0.5% growth in Q2. The bank observed that New Zealand is quite resilient against the risks of public health emergency, with the only challenge right now being pressure over its supply chains. But if the risks remain, New Zealand may face a larger problem.

Market estimates that the Reserve Bank of New Zealand will reduce interest rate to 0.75% by September.

New Zelands economy is highly dependent over the international community, while its global debts have also reached a record high. Currently, both businesses and consumers in New Zealand are facing signs of possible recession. The last time New Zealand was caught in a recession was during the global financial crisis in 2008 and by the end of the crisis in 2009, at least 67 local financial companies closed down while home sales fell by 42%, and the official cash rate was also cut by RBNZ from a record high 8.25% to 2.5%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CLSA Premium NZ to Pay NZ$770K in Fine for AML Breaches

The broker and the regulator were fighting in court for months to settle for the penalty amount

New Zealand healthcare worker's struggle with wait for the coronavirus - Business Insider

Intensive care specialist Chris Poynter said waiting for cases was like watching the tide go out before a tsunami. And then the tsunami never came.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator