EURUSD Rate Rebound Unravels as Attention Turns to ECB Meeting

Abstract:EURUSD gives back the rebound from earlier this month, with the Euro at risk of exhibiting a more bearish behavior as the ECB is expected to deliver a rate cut.

EUR/USD Rate Talking Points

EURUSD gives back the rebound from earlier this month as attention turns to the European Central Bank (ECB) meeting, and the Euro may come under increased pressure over the next 24-hours of trade as the Governing Council is widely expected to deliver a rate cut.

EURUSD Forecast: Monthly Opening Range on Radar Ahead of ECB Meeting

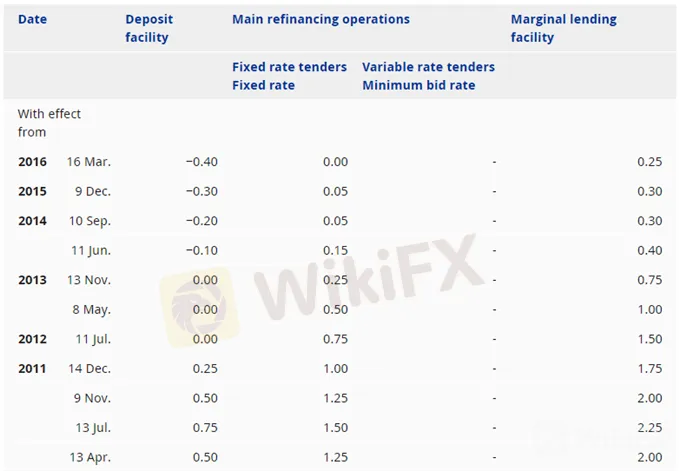

EURUSD appears to be on track to test the monthly-low (1.0926) as the ECB launches another round of Targeted Long-Term Refinance Operations (TLTRO), with the central bank also expected to reduce the Deposit Facility Rate by 10bp to -0.50%.

The ECB may deem the new measures sufficient to insulate the Euro area as “members generally concurred that incoming information had remained broadly consistent with the June staff projections,” but the updated forecasts coming out of the ECB may fuel speculation for additional monetary support as the central bank struggles to achieve its one and only mandate for price stability.

In turn, the Governing Council may continue to endorse a dovish forward guidance for monetary policy as the central bank “stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner,” and it remains to be seen if the central bank will take additional steps ahead of President Mario Draghis departure at the end of October as “the balance of risks remained tilted to the downside.”

With that said, the ECB may come under pressure to reestablish its asset purchase program, but recent remarks from Governing Council officials suggest the central bank is in no rush to further expand the balance sheet as “market-based measures of inflation expectations had been broadly unchanged amid some notable intra-period volatility.”

Nevertheless, a slew of new measures may drag on the Euro, with EURUSD at risk of facing a more bearish fate over the remainder of the year as the ECB continues to push monetary policy into uncharted territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

Source: Trading View

Keep in mind, the broader outlook for EURUSD is becoming more bearish as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

Will keep a close eye on the Relative Strength Index (RSI) as the oscillator continues to track the downward trend from June, with the monthly-low (1.0926) on the radar as the exchange rate initiates a series of lower highs and lows.

Need a break/close below the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) to open up the next downside hurdle around 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement).

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

EURUSD Forecast: Monthly Opening Range on Radar Ahead of ECB Meeting

EURUSD holds the monthly opening range ahead of the ECB meeting, but fresh updates from the Governing Council are likely to alter the near-term outlook for the Euro.

EURUSD Rebound in Focus Amid Dismal ISM Survey, Mixed Fed Rhetoric

EURUSD may stage a larger rebound over the coming days as signs of a slowing economy puts pressure on the Federal Reserve to reverse the four rate hikes from 2018.

EURUSD Rate Reverses Ahead of Monthly-Low Following Fed Symposium

EURUSD reverses course following the Fed Economic Symposium, with the failed attempt to test the August-low (1.1027) raising the scope for a larger rebound.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

PH SEC Warns Against TRADE 13.0 SERAX

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Financial Watchdog FinCom Alerts Against Eplanet Brokers

Crypto Exchange CoinW Launches Prop Trading in Dubai

SEC Pursues Terraform Labs: $5.3B Verdict

Philippines SEC Takes Aim at Binance, App Store Ban

Maya Bank & Tala Join Forces: ₱2.75B Loan Boost

Currency Calculator