WikiFX Review: Plz Watch Out For GRIC FX!!!

Abstract:Stay away from brokerage firms like GRIC FX that was not licensed by national financial institutions.

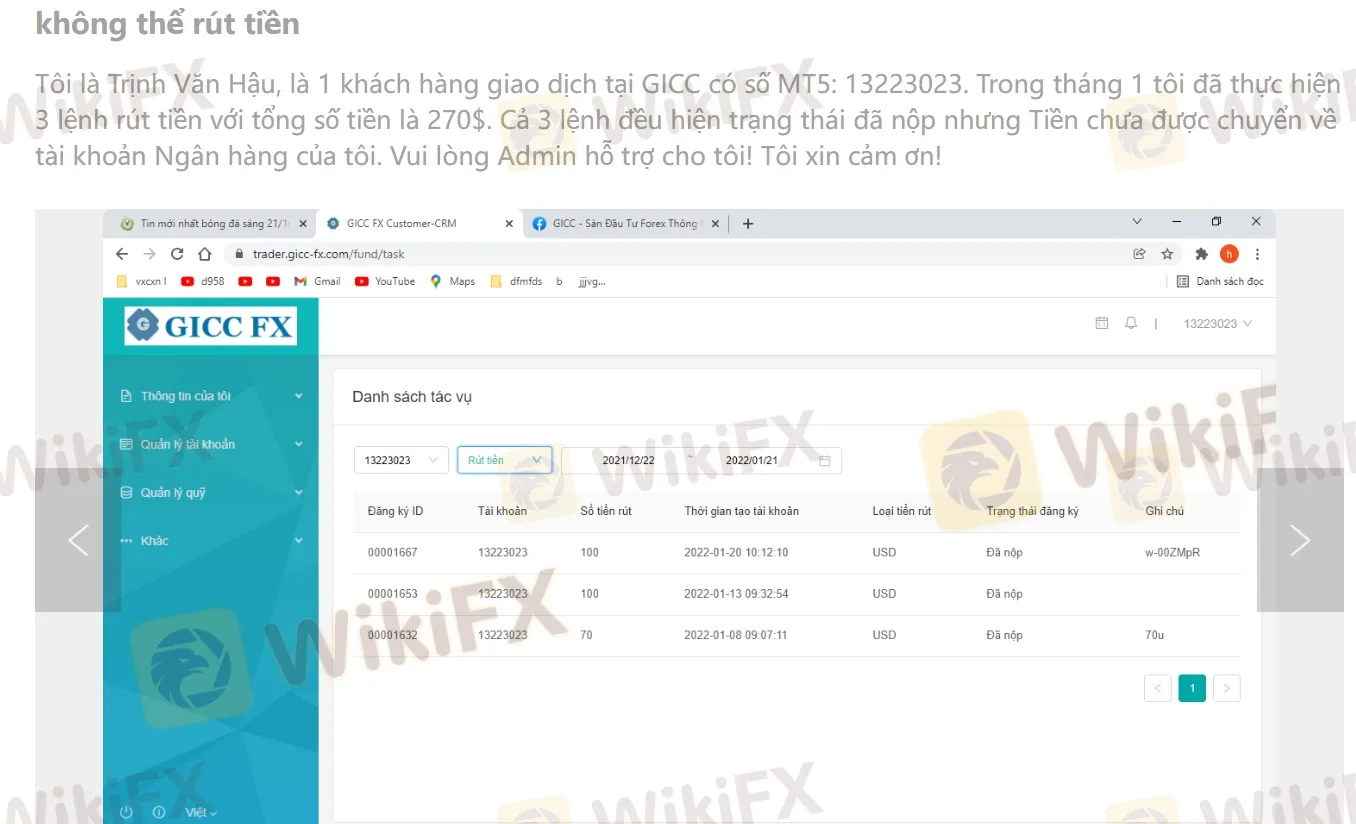

Just few days ago, WikiFX received another exposure from an investor in Vietnam, who said that the trader could not withdraw money from his account. Here is a screenshot of his remarks.

The complainant alleged that all his money was in GRIC FX, which prevented him from accessing it by various means and reasons. In fact, we recently received more than 14 requests from investors seeking help from WikiFX, complaining that GRIC FX is nothing but a totally “forex scam”.

Is this a reliable forex trader? Many people who want to invest in this trader have asked us. When faced with suspicious brokers, we can totally trust and use WikiFX to learn more about forex broker. It is certainly the most convenient and quick inquiry mode for investors.

About GRIC FX

GRIC FX said that they are dedicated to giving investors the very best of Service for Forex, Commodities, Stocks and Crypto Currencies. The company added that it is based in the United States and licensed by the country financial institute. To find out if a forex broker is trustworthy, check first that it is registered and authorized with a local financial institution.

As we can learn from the CFTC's query results, GRIC FX is registered with the Commodity Futures Trading Commission (CFTC) but is not a member of the National Futures Association (NFA). It is well known that NFA membership provides assurance to the investing public that all companies, if they do not follow the rules, the NFA will take disciplinary action against members. In other words, if GRIC FX breaks the rules or violates financial laws, the NFA will not take any punitive action against it because it is not a member of the NFA. If something goes wrong, your investment will go down the drain.

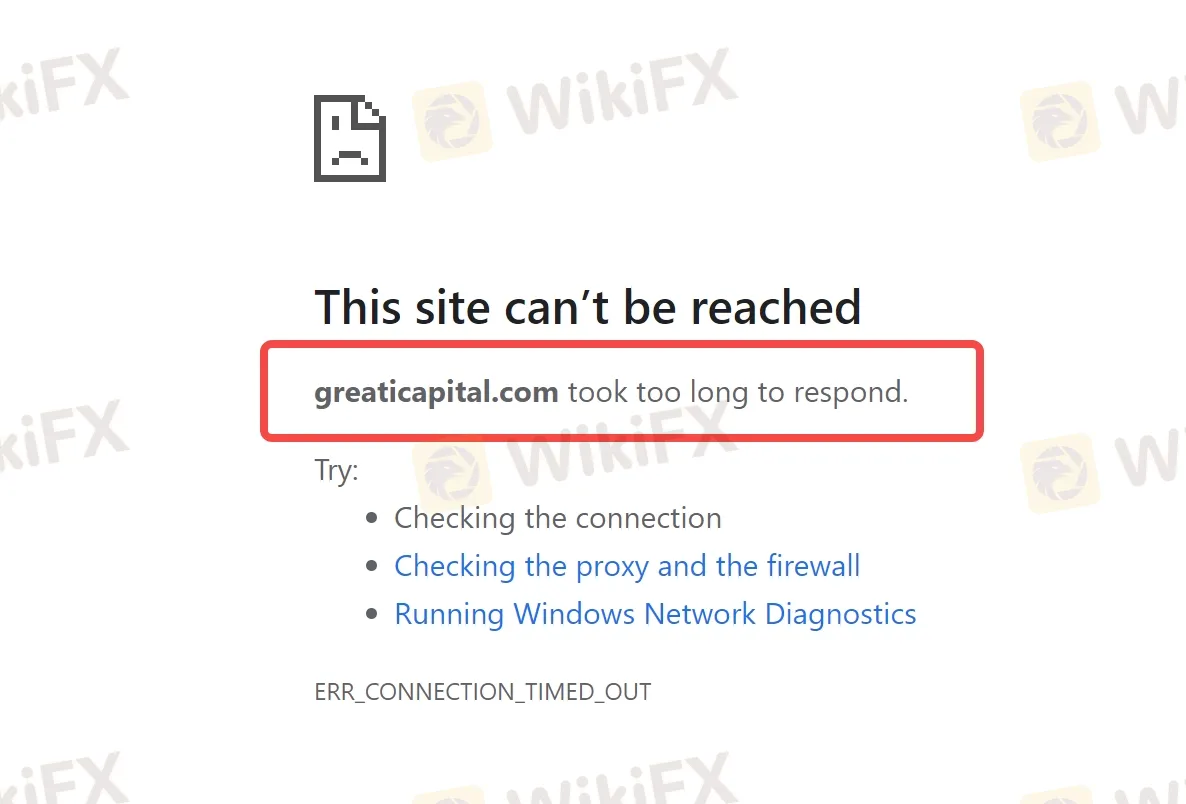

WikiFX also paid a visit to the brokers official website to learn more. However, the outcome was disappointed,the official website can‘t be reached and greaticapital.com’s server IP address could not be found.

Without access to the website, we cannot see for ourselves if it holds up to something like industry. As a broker who claims to be a professional trader, but does not show even the most basic information to users. Obviously, it's covering up something shady.

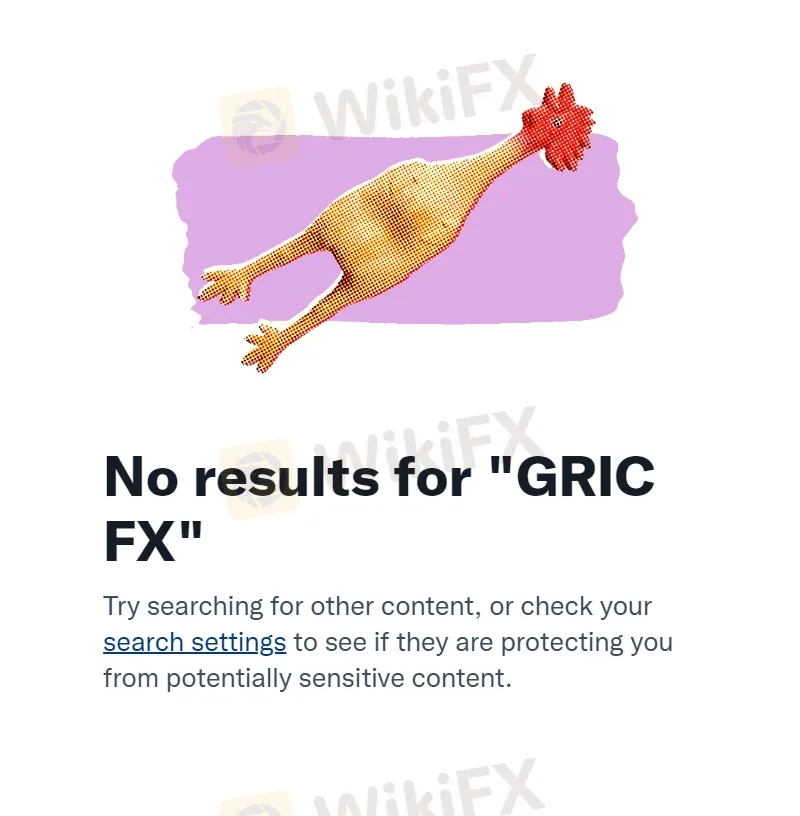

In addition, to learn more about GRIC FX, WikiFX tried to connect with its social media. But a search of the entire web did not find GRIC FX 's social media account. As it stands now, GRIC FX 's scam appears to have been busted and can no longer to operate its official website and social media, so it has run away with clients' money.

Now let's search “GRIC FX” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

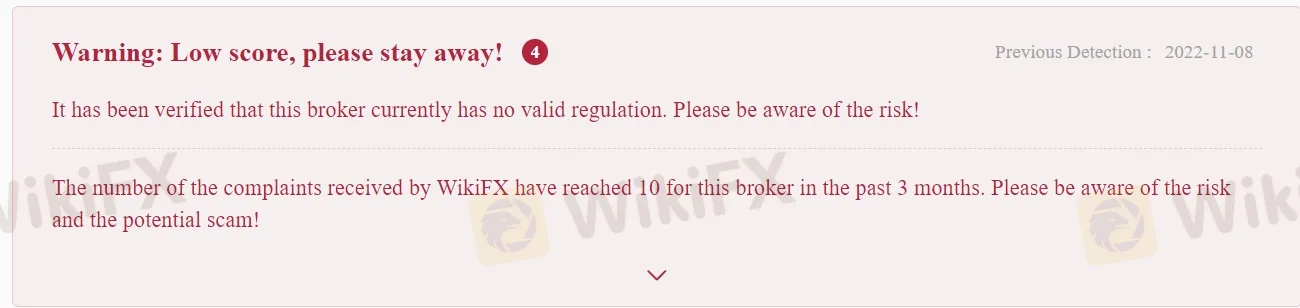

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/4114697965.html), GRIC FX currently has no valid regulatory license and the score is rather negative - only 1.67/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Please note that WikiFX is also reminding the majority of users: low scores, please stay away!

From all the above information we can know that trusting a broker like GRIC FX is simply not worth it – you will certainly end up robbed. The so-called brokerage is nothing more than an outright scam, which was not authorized by national financial institutions.

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing.You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed. In addition, scam victims are advised to seek help directly from the local police or a lawyer.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Now Allows 22-Hour Treasury Bond Trading

Interactive Brokers has expanded trading hours for US Treasury bonds, now allowing trading for 22 hours daily.

Are Prop Firms Worth the Hype?

Proprietary trading firms, commonly known as prop firms, have been gaining attention in the forex and cryptocurrency industry. These firms recruit traders to trade with their capital, offering potentially lucrative opportunities. However, the question arises: Are prop firms truly worth the hype?

CFI Collaborates with TradingView for Enhanced Trading Experience

CFI Financial Group integrates with TradingView, offering clients access to 4,000 trading instruments and a community of 50M+ traders, along with advanced charting tools for an improved trading journey.

WikiFX Global Supervisors Gathering! Participate to win cash prizes!

A major event is coming! The "WikiFX Global Supervisors Gathering" event has officially launched, and participants will have the chance to win USDT rewards!

WikiFX Broker

Latest News

FCAA warns Investors against Fintech Market

CFI Collaborates with TradingView for Enhanced Trading Experience

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

WikiFX Global Supervisors Gathering! Participate to win cash prizes!

Are Prop Firms Worth the Hype?

Interactive Brokers Now Allows 22-Hour Treasury Bond Trading

Beware of Rising Recovery Room Scams, Warns Belgian FSMA

Indian authorities accuse OctaFX, broker denies

SEC Accuses Hedge Fund Founder of Multi-Million Dollar Fraud

Currency Calculator