Company Summary

| Aspect | Information |

| Company Name | Glory Sun Securities |

| Registered Country/Area | Hong Kong |

| Founded Year | 2007 |

| Regulation | No regulated licenses |

| Maximum Leverage | N/A |

| Spreads | Online trading: 0.05%, min HK$50Phone trading: 0.15%, min HK$100Dark pool trading: 0.15%, min HK$100 |

| Trading Platforms | Glory Sun Transaction app, iTrade (desktop) |

| Tradable Assets | Hong Kong stocks, China Connect (SH/SZ-HK), U.S. stocks, other overseas securities, ETFs, REITs, Private Equity funds, Alternative Investment Funds |

| Account Types | Cash Account, Margin Account |

| Demo Account | N/A |

| Customer Support | Phone: (852) 2813 6828<br>WeChat: HK1282SEC2<br>Email: cs.sec@hk1282.com |

| Deposit & Withdrawal | Various methods with different processing times and fees (e.g., eDDA, FPS, online banking, ATM/counter, checks) |

| Educational Resources | Daily Tips, Glory Sun Online Academy, Research Reports, Glory Sun Investment Encyclopedia |

Overview of Glory Sun

Glory Sun Securities, established in 2007 and headquartered in Hong Kong, operates as a brokerage firm providing a diverse range of financial products. Notably, the company lacks regulated licenses, necessitating cautious consideration by potential clients. Glory Sun offers competitive spreads across different trading scenarios, with online trading commissions as low as 0.05%, requiring a minimum of HK$50.

Glory Sun provides a broad spectrum of tradable assets, including Hong Kong and U.S. stocks, China Connect, ETFs, REITs, Private Equity funds, and Alternative Investment Funds. Clients can choose between Cash and Margin Accounts, each with its features and risk considerations.

The company's customer support channels include phone, WeChat, and email, facilitating direct communication. Glory Sun supports various deposit and withdrawal methods, each with different processing times and associated fees. Educational resources encompass Daily Tips, Glory Sun Online Academy, Research Reports, and the Glory Sun Investment Encyclopedia, aiming to empower clients with market insights and knowledge.

Pros and Cons

| Pros | Cons |

| Competitive spreads and commissions for online trading. | Absence of regulation |

| Diverse range of tradable assets | Information on maximum leverage is not provided |

| Multiple channels for customer support | Demo account not available |

| Various methods for fund transfers | |

| Comprehensive educational resources |

Pros:

Competitive Spreads and Commissions for Online Trading:

Glory Sun Securities offers competitive spreads and commissions for online trading, allowing clients to potentially reduce transaction costs and enhance their overall profitability.

Diverse Range of Tradable Assets:

Clients have access to a diverse range of tradable assets, providing investors with ample opportunities to diversify their portfolios.

Multiple Channels for Customer Support:

Glory Sun Securities provides customer support through multiple channels, ensuring that clients can choose the most convenient and efficient method to address their inquiries or concerns.

Various Methods for Fund Transfers:

The availability of various methods for fund transfers offers flexibility to clients, allowing them to choose a convenient and efficient way to deposit or withdraw funds.

Comprehensive Educational Resources:

Glory Sun Securities offers a comprehensive suite of educational resources, it can empower clients with the knowledge needed to make informed investment decisions.

Cons:

Absence of Regulation:

The lack of regulated licenses raises concerns about client protection, adherence to industry standards, and overall transparency in the operations of the brokerage.

Information on Maximum Leverage Not Provided:

The lack of information on the maximum leverage available poses a challenge for clients as they may not have a clear understanding of the potential risk exposure associated with their trades.

Demo Account Not Available:

The absence of a demo account restricts clients from practicing and familiarizing themselves with the trading platform in a risk-free environment. A demo account is a valuable tool for new and experienced traders to test strategies and explore features.

Regulatory Status

Glory Sun does not have any regulated licenses, it implies that the entity may not be subject to oversight by a financial regulatory authority. In the absence of regulatory licenses, clients should exercise caution and carefully evaluate the broker's credibility and trustworthiness.

Investors are advised to prioritize brokers with proper licenses from reputable regulatory authorities to mitigate risks and ensure a secure trading environment.

Market Instruments

Glory Sun offers a diverse range of financial products in the Hong Kong securities market.

Firstly, the company provides individual stocks, which are classified into various categories such as blue chip, red chip, state-owned enterprise, market maker, and others. The Hong Kong stock market includes the Main Board and the Growth Enterprise Market, with institutional and overseas investors playing a dominant role. Notably, some core blue chip stocks are traded on international exchanges like the NYSE and the London Stock Exchange.

Certified shares are also part of Glory Sun's product offerings. These represent ownership in a company and can be traded on the Hong Kong securities market.

Additionally, Glory Sun deals with Complex Structured Products like Callable Bull/Bear Contracts (CBBCs). CBBCs are leveraged investment tools with a validity period of 3 months to 5 years, settled in cash, and subject to conditions, including early expiration if the underlying asset reaches a predetermined call price.

Exchange trading encompasses various investment options such as Exchange Traded Funds (ETFs), which are passively managed open-end funds traded on the Hong Kong Stock Exchange. These funds closely track the performance of benchmarks, providing investors with cost-effective exposure to different markets.

Real Estate Investment Trusts (REITs) are another product offered by Glory Sun. These passively managed open-end funds primarily invest in real estate projects, providing investors with regular income from rents and real estate price appreciation.

For investors seeking private investment opportunities, Glory Sun provides access to Private Equity funds. These funds raise capital privately and can operate as contract-type collective investment funds or corporate-type collective investment funds, offering a range of investment strategies.

Furthermore, Glory Sun extends its product portfolio to include Alternative Investment Funds.These funds, such as private equity funds, hedge funds, and funds of funds, offer alternative assets and strategies to diversify risks, reduce volatility, and enhance returns in the investment portfolio.

Account Types

Glory Sun provides two types of accounts to satisfy the diverse needs of investors: Cash Accounts and Margin Accounts.

Cash Account:The Cash Account offered by Glory Sun ensures that transactions are settled on T + 2 (two business days after the trade execution). This account involves actual buying and selling without the inclusion of securities mortgage lending. To initiate trades, clients are required to deposit sufficient book balances for buy instructions or securities holdings for sell instructions before executing any transactions. This account structure emphasizes the importance of having available funds or securities to cover trading activities, promoting a straightforward and secure approach to investment.

Margin Account:Also referred to as a margin account, this option provides investors with flexibility in managing their transactions. Unlike the Cash Account, investors utilizing a Margin Account may not be required to pay the total transaction amount in full on the settlement date after the transaction, depending on the position value of individual securities. This feature allows for leveraged transactions, enabling investors to magnify the rate of return on their investments. However, it is important to note that with increased leverage comes amplified risk, and investors should be mindful of potential losses. Additionally, in the case of a book balance being in arrears, margin interest will be incurred, highlighting the importance of responsible and strategic use of leverage within this account type.

How to Open an Account?

Glory Sun provides two account opening methods: Open an account online and Open an account by mail

Open an account online

Complete the online account opening form and upload the required documents

Call customer service to confirm

Email confirmation of successful account opening

Deposit funds into your account in Baoxin to start trading

Open an account by mail

Complete the account opening form and prepare account opening documents

Mail or call the customer service officer to arrange door-to-door collection of account opening documents

The customer service officer will call to confirm the account opening procedure.

After completing the account opening, you will receive your customer number, password and deposit information immediately.

Deposit enough funds to start trading

Spreads & Commissions

Glory Sun Securities offers competitive spreads and commissions across various trading scenarios.

For online trading, commissions can go as low as 0.05%, with a minimum charge of HK$50. Phone trading incurs slightly higher commissions, starting at 0.15% with a minimum charge of HK$100. Additionally, dark pool trading through phone transactions follows a similar structure with a commission as low as 0.15% and a minimum charge of HK$100.

Interest rates on cash and custody account balances are calculated at P+6%, while margin account interest rates can go as low as 4.88%. Stamp duty is set at 0.1%, with a minimum calculation of HK$1 for amounts below HK$1.

Other fees include SFC transaction levy (0.0027%), trading fee (0.00565%), and CCASS fee (0.004%) with minimum and maximum charges. For Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect, online commissions start at 0.05%, with a minimum charge of RMB 50.

In the case of U.S. stocks, online commissions begin at 0.15%, with minimum charges based on either per share (minimum $0.008 per share) or per transaction (minimum $15 per trade). Phone trading for U.S. stocks incurs a commission as low as 0.25%, with minimum charges based on similar criteria.

Other overseas securities may have commissions ranging from 0.25% to 0.5%, and the details can be obtained by contacting the company. Dark pool trading for new stocks through phone transactions follows a commission structure with a minimum charge of HK$100.

| Trading Type | Commission Rates | Minimum Charge | Additional Fees |

| Online Trading | As low as 0.05% | HK$50 | Stamp Duty (0.1%), SFC Levy (0.0027%), Trading Fee (0.00565%), CCASS Fee (0.004%) with minimum and maximum charges |

| Phone Trading | As low as 0.15% | HK$100 | Stamp Duty (0.1%), SFC Levy (0.0027%), Trading Fee (0.00565%), CCASS Fee (0.004%) with minimum and maximum charges |

| Dark Pool Trading (Phone) | As low as 0.15% | HK$100 | Stamp Duty (0.1%), SFC Levy (0.0027%), Trading Fee (0.00565%), CCASS Fee (0.004%) with minimum and maximum charges |

| Cash/Custody Account Interest | P+6% | - | - |

| Margin Account Interest | As low as 4.88% | - | - |

| Shanghai-Hong Kong Stock Connect | Online: As low as 0.05% | RMB 50 | Additional fees as per local regulations |

| U.S. Stocks (Online) | As low as 0.15% | Minimum: $0.008 per share or $15 per trade (whichever is higher) | Additional fees as per U.S. regulations |

| U.S. Stocks (Phone) | As low as 0.25% | Minimum: $0.015 per share or $25 per trade (whichever is higher) | Additional fees as per U.S. regulations |

| Other Overseas Securities | 0.25% - 0.5% | Varies | Additional fees as per respective regulations |

| New Stock Dark Pool Trading (Phone) | As low as 0.15% | HK$100 | Stamp Duty (0.1%), SFC Levy (0.0027%), Trading Fee (0.00565%), CCASS Fee (0.004%) with minimum and maximum charges |

Instant Quotation System Plan

Glory Sun Securities not only provides various free trading systems but also offers enhanced services through AA Stocks and ET NET's real-time quote systems, allowing clients to subscribe for a monthly fee and access additional functionalities.

For the International version, clients can choose AA Stocks for HK$438 per month or ETNET for HK$330 per month, gaining real-time quotes and trading capabilities. Similarly, for the Mainland China version, clients can opt for AA Stocks at HK$298 per month or ETNET at the same rate, providing access to market information related to Mainland China stocks.

Additionally, Glory Sun Securities offers the Trading Treasure platform for both Hong Kong and U.S. stocks, with a monthly fee of HK$298 for Hong Kong stocks and HK$36 for U.S. stocks. These value-added services empower clients with diverse options to tailor their trading experience and stay well-informed in the dynamic financial markets.

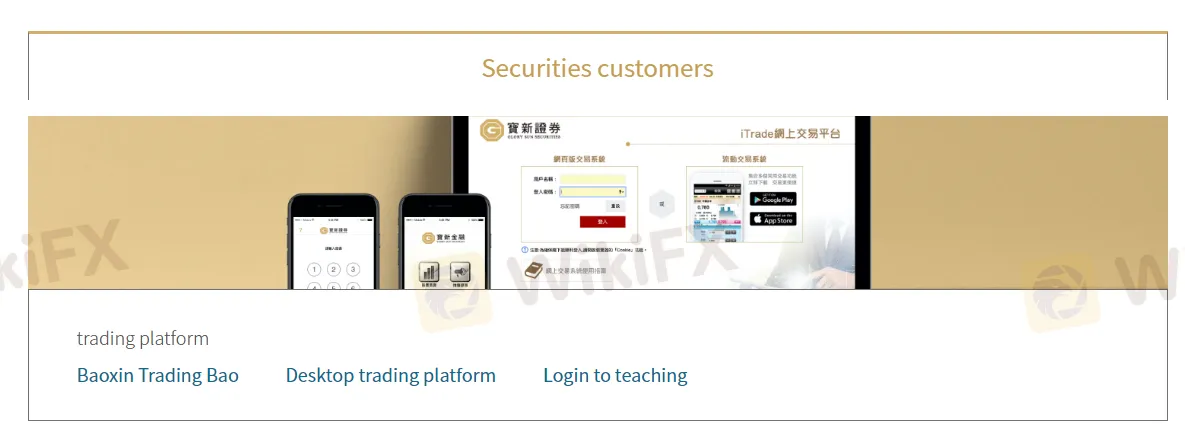

Trading Platform

Glory Sun Securities offers a Mobile platform known as the “Glory Sun Transaction” app, designed to empower investors in navigating the dynamic financial markets. In the fast-paced world of investments, having real-time support is crucial, and this platform provides just that. The app connects users to a newly designed trading system through innovative application technology, enabling them to execute trades swiftly anytime, anywhere.

With a focus on accessibility and efficiency, Glory Sun Securities allows clients to open and fund their accounts entirely online, with the added convenience of the eDDA quick deposit feature. The platform provides comprehensive account information, including profit and loss analysis and fund flow tracking. Investors can stay well-informed with up-to-the-minute quotes for Hong Kong, U.S., and A-shares, along with streaming news and information on new stock subscriptions.

Additionally, the platform offers customization features such as personalized stock portfolios, watchlists, and favorites. Through a dual authentication system ensures the overall safety of the trading system.

For those preferring a desktop experience, Glory Sun Securities also offers the iTrade desktop trading platform, providing a robust and secure environment for traders. Overall, the trading platform reflects Glory Sun's dedication to providing advanced, user-friendly, and secure tools for investors to navigate and capitalize on global markets effectively.

Deposit & Withdrawal

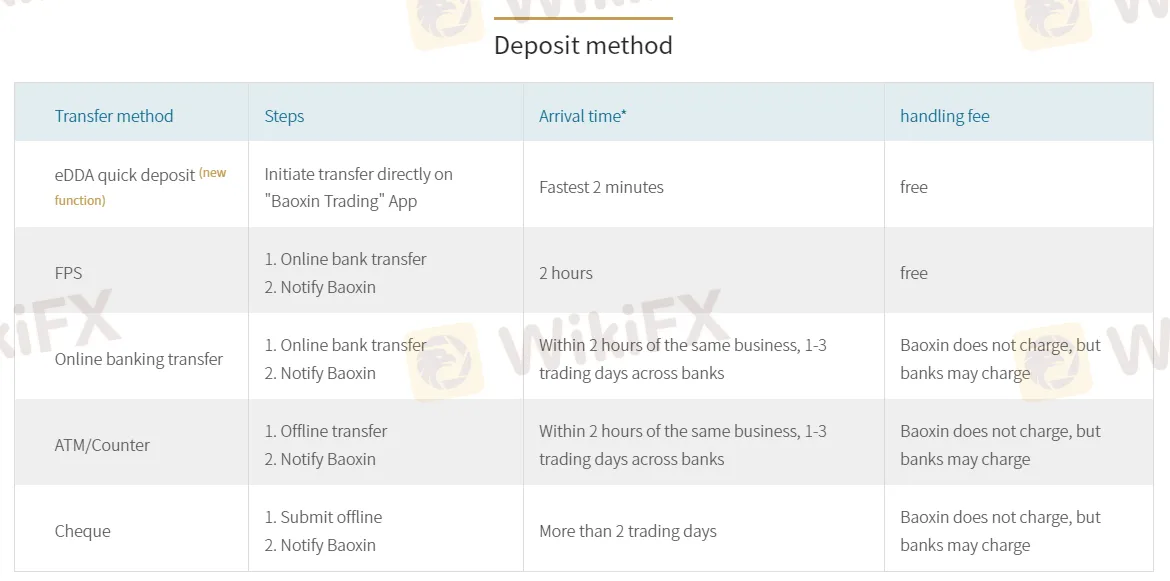

Glory Sun offers various payment methods for fund transfers, each with its own set of procedures, processing times, and associated fees.

The eDDA quick deposit feature, a new addition to the platform, allows users to initiate transfers directly through the “Glory Sun Transaction” app, with the advantage of the fastest processing time, as quick as 2 minutes, and no additional charges.

For transfers via FPS (Faster Payment System), users can choose to transfer funds through online banking, with a notification to Glory Sun. This method takes approximately 2 hours for processing and is free of charge.

Similarly, online banking transfers and ATM/counter transfers, both involving notifying Glory Sun, have processing times of within 2 hours for same-bank transfers and 1-3 business days for interbank transfers, with Glory Sun not imposing fees, although the user may incur bank charges.

Lastly, using checks for fund transfers requires offline submission and notification to Glory Sun, with a longer processing time of at least 2 business days and potential bank fees, while Glory Sun itself does not charge for this service.

Customer Support

Glory Sun Securities prioritizes customer support and stands ready to assist clients whenever needed. Clients can easily reach out to the customer support team through various channels.

For direct communication, clients can contact Glory Sun Securities at (852) 2813 6828. Additionally, the company is accessible on WeChat through the handle HK1282SEC2, providing another convenient avenue for communication. For written inquiries and assistance, clients can send emails to cs.sec@hk1282.com.

Educational Resources

Glory Sun Securities offers a comprehensive array of educational resources to empower and inform its clients. The Daily Tips provides timely insights to navigate market trends effectively. The Glory Sun Online Academy serves as a valuable platform for clients to enhance their financial knowledge and trading skills. Research reports provide in-depth analyses of market conditions and investment opportunities. The Glory Sun Investment Encyclopedia serves as a knowledge hub, offering a wealth of information on various investment topics. These resources equip clients with the tools and insights needed to make informed investment decisions in the dynamic financial landscape.

Conclusion

In conclusion, Glory Sun Securities, founded in 2007 and headquartered in Hong Kong, offers a diverse range of financial products with competitive spreads and commissions. However, the absence of regulated licenses raises concerns about regulatory oversight and client protection. The brokerage provides a variety of tradable assets and account types, satisfying to different investor needs. While the company excels in customer support, offering multiple channels for communication, the lack of a demo account limits client opportunities for hands-on practice.

The educational resources provided by Glory Sun, including Daily Tips, the Online Academy, Research Reports, and the Investment Encyclopedia, contribute to empowering clients with market insights. Potential clients should carefully weigh the advantages of competitive pricing and comprehensive resources against the disadvantages of regulatory uncertainty and the absence of a demo account, ensuring their decision aligns with their individual preferences and risk tolerance.

FAQs

Q: What types of accounts does Glory Sun Securities offer?

A: Glory Sun Securities provides two account types to satisfy diverse investor needs: the Cash Account and the Margin Account.

Q: How can I contact Glory Sun Securities for support?

A: Clients can reach Glory Sun Securities through various channels, including phone, WeChat, and email.

Q: What educational resources does Glory Sun Securities offer?

A: Glory Sun Securities provides a range of educational resources, including Daily Tips, the Glory Sun Online Academy, Research Reports, and the Glory Sun Investment Encyclopedia.

Q: Can I open an account with Glory Sun Securities online?

A: Yes, Glory Sun Securities facilitates online account opening, clients can complete the online account opening form.

Q: What are the fees associated with fund transfers at Glory Sun Securities?

A: Glory Sun Securities offers various methods for fund transfers, each with different processing times and potential fees.