Note: CP Markets's official website - https://cp-markets.com/ is currently inaccessible normally.

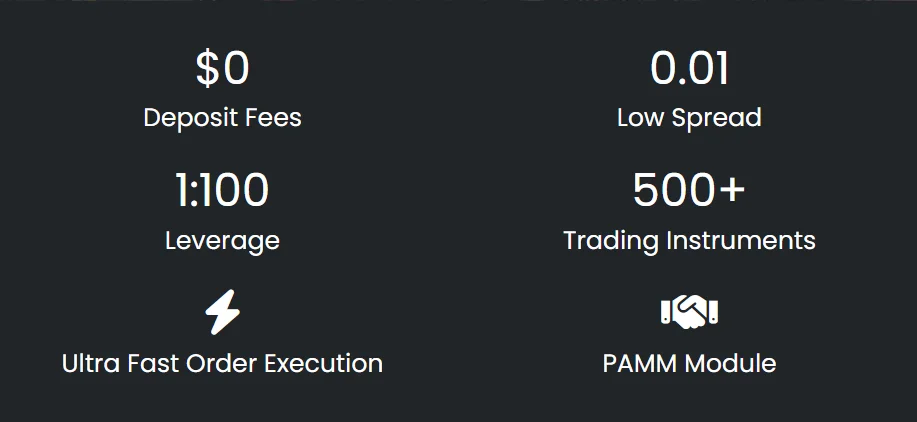

CP Markets is a Forex and CFD broker registered in 2021 with its headquarters in London. It offers trading services for Forex, Commodities, Shares, Futures and Indices. CP Markets claims to provide access to over 500 assets on the MetaTrader5 platform, along with four account types. However, this broker does not hold a legal regulatory license.

Pros and Cons

Is CP Markets Legit?

No, CP Markets is not a legitimate broker as it holds no license from any legal authorities. Furthermore, our investigation has revealed that the company's physical address is fake, and no office was found at that location.

What Can I Trade on CP Markets?

CP Markets claims to offer more than 500 trading instruments across three classes, including 70+ Forex, Commodities (Spot metals), Shares, Futures and Indices.

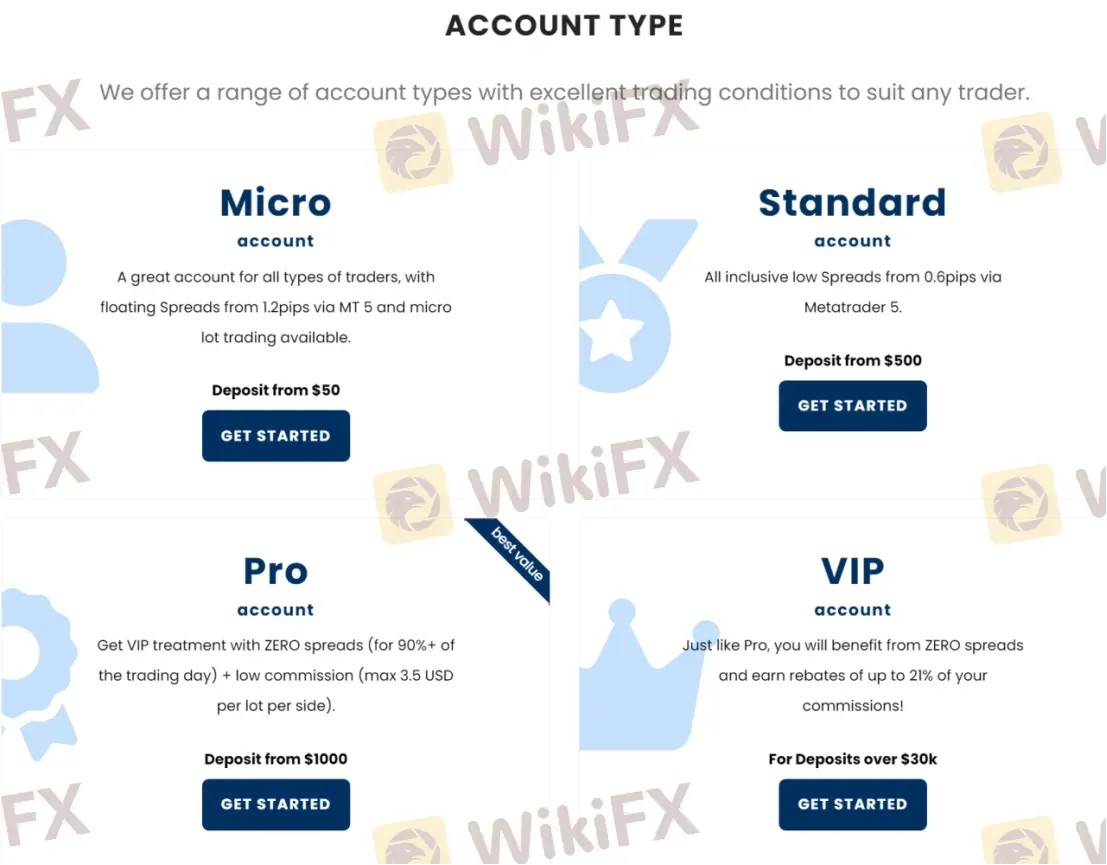

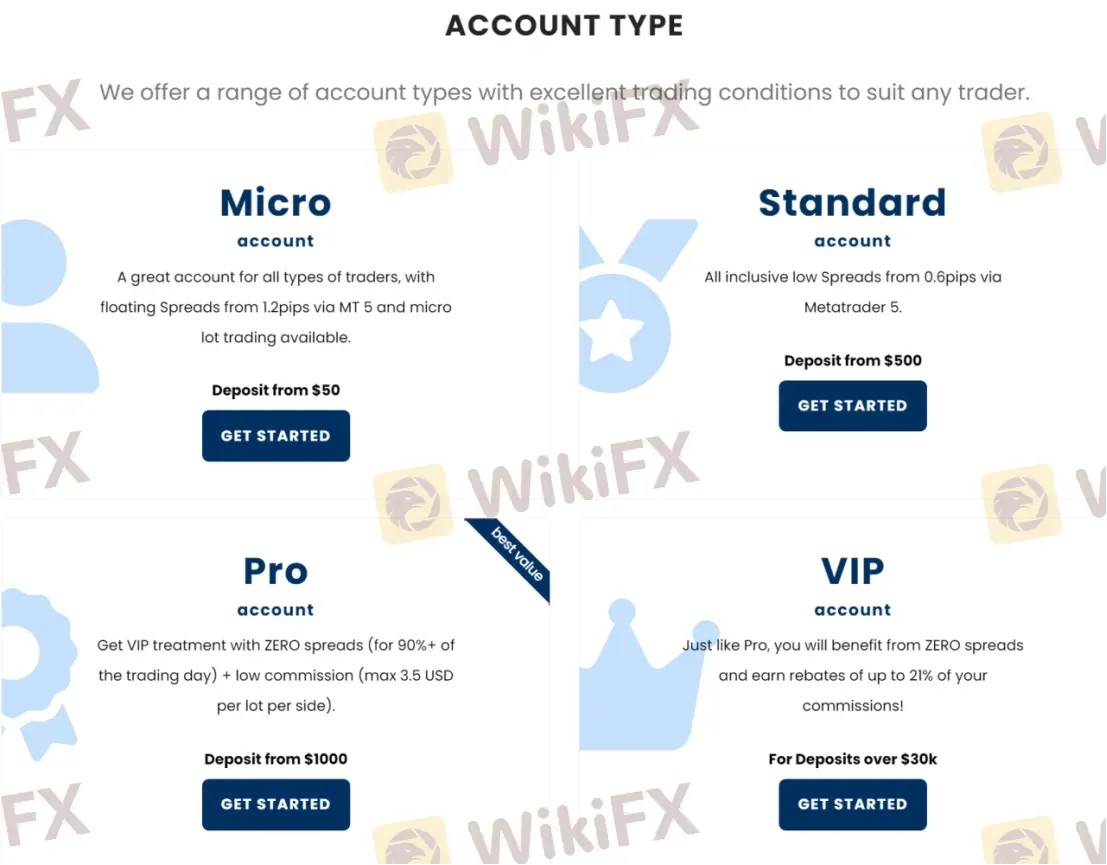

Account Type

Leverage

CP Markets offers leverage up to 1:100. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread and Commission

Trading Platform

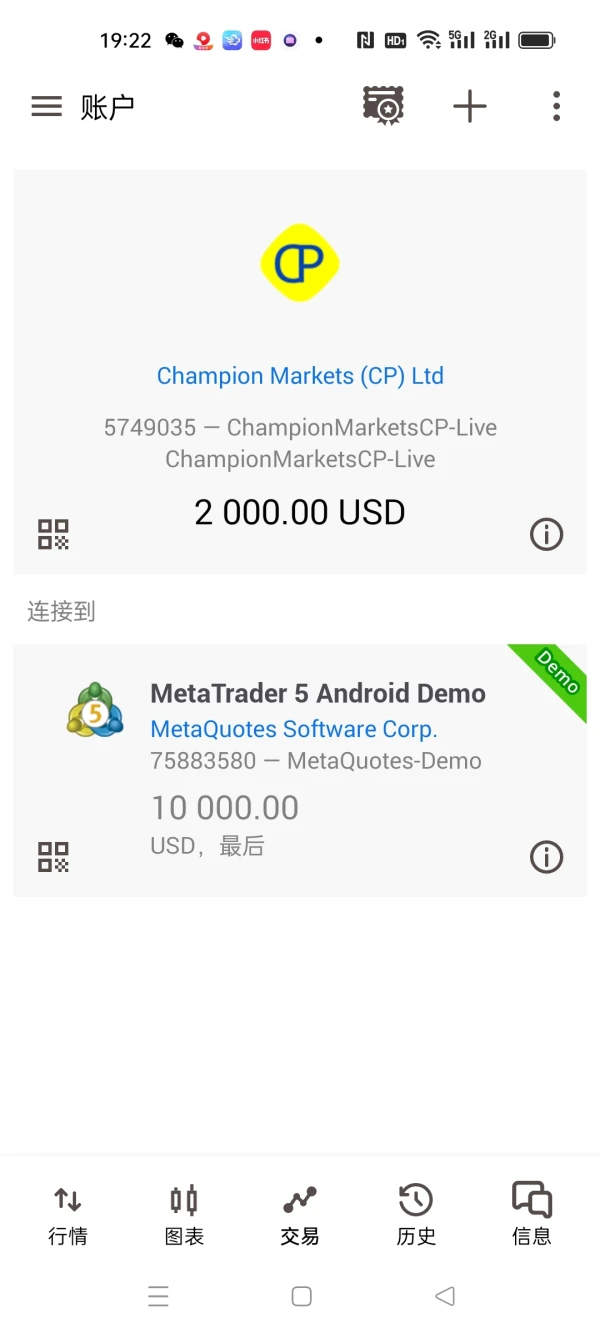

yang105

Hong Kong

cpMarkets cooperates with Fuchuang. Fuchuang has stopped trading and no withdrawals allowed. Our money is in the cpMarkets MT5 wallet. Now I request cpMarkets to return the principal of the investment.

Exposure

Kk4554

Macao

Requested to do KYC, it has been almost a month since I submitted the information, no reply, no money withdrawn. What do you mean, what happened? Please give a reasonable process or explanation. Thanks.

Exposure

Sarre

United States

Leverage levels are generous, but managing risk becomes more challenging at higher levels. Need to be disciplined.

Neutral

EXOKAY

Kazakhstan

Very easy enrolling process. Powerful platform. Low commissions. A lot of added value through the training material. Having Pablo Gil as an analyst is something amazing. Very good customer service.

Positive

RtyuD

Pakistan

The account manager was very helpful, friendly and patient with me as a beginner. He also offered a lot of material to help me get started, Really appreciate the fantastic customer service.

Positive

Lorelei St. James

Malaysia

While CP Markets offers a wide array of trading products, and their platform options are impressive, the fact that they are not regulated does raise some potential concerns regarding fund security and transparency. Many traders, especially beginners, prefer to work with regulated brokers for added peace of mind, and unfortunately CP Markets does not offer that assurance.

Neutral

Jacqueliner

Argentina

As a user of CP Markets, I've been pleased with their diverse trading options and competitive spreads. Moreover, the inclusion of the advanced MetaTrader5 platform, as well as their own desktop and mobile applications, has provided me a seamless trading experience. However, the lack of regulatory oversight is a concern, and for that reason, I urge potential traders to carry out their research before making a commitment.

Neutral

propfirm

Italy

This is the fastest withdrawal trading software I've used in years, and it's convenience has made me fall in love...

Positive

FX1501890546

Nigeria

Listen up, folks, I've got a bone to pick with CP Markets. First off, their customer support is straight-up MIA. I sent them an email weeks ago, and I still haven't heard back. It's like they don't even care about their customers. And don't even get me started on their leverage. Yeah, it's high and all, but it's a double-edged sword. One wrong move, and you can get wiped out faster than a cheetah chasing its prey. CP Markets needs to step up their game and start prioritizing their customers' needs, or else they're gonna lose us real quick.

Neutral

FX1501701504

Philippines

Hey there, gotta give props to CP Markets for their killer spreads! I've been trading with them for a while now, and those tight spreads have been putting a smile on my face. It's like they're hooking us up with some sweet deals, bro. And let's not forget their trading platforms, they're smooth as butter. Whether I'm on my phone or desktop, the experience is seamless. CP Markets knows how to keep a trader happy, and I'm loving every minute of it!

Positive