Company Summary

| Aspect | Information |

| Registered Country/Area | Mauritius |

| Company Name | YS GLOBAL Capital |

| Regulation | Accusations of using fake licenses |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:300 |

| Spreads | Starting at 0.1 pips on major pairs |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Precious metals, crude oil, forex |

| Account Types | Live Accounts, Demo Accounts |

| Demo Account | Available for practice |

| Customer Support | Issues with responsiveness and professionalism |

| Payment Methods | Bank Wire Transfer, Credit/Debit Cards |

| Educational Tools | Not provided |

Overview

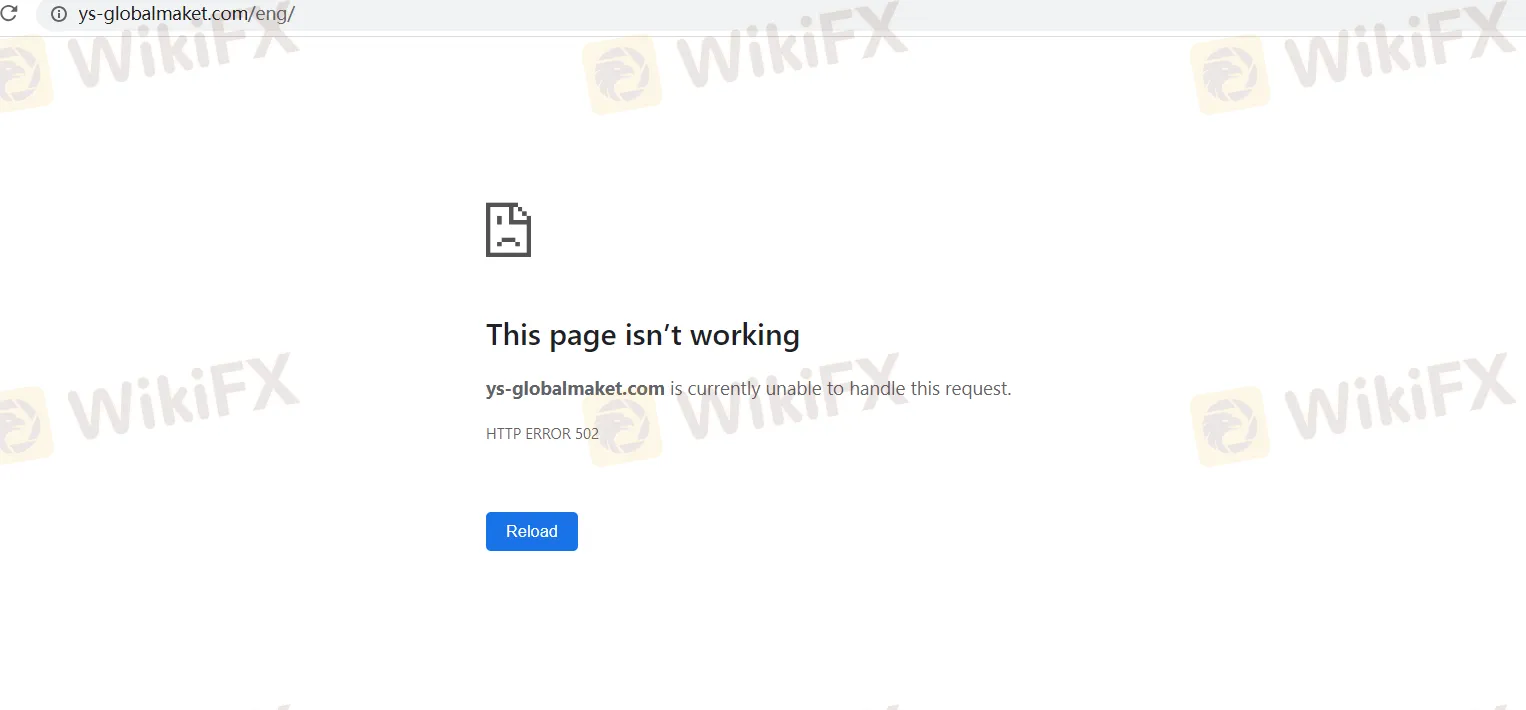

YS GLOBAL Capital, based in Mauritius, faces grave allegations of operating with counterfeit licenses, casting a long shadow of mistrust over its legitimacy. The absence of specified minimum deposit requirements leaves potential traders uncertain about the financial commitment needed. While offering a maximum leverage of up to 1:300 may seem enticing, it significantly escalates the risk of substantial losses. Despite marketing competitive spreads starting at 0.1 pips, traders should exercise caution as actual cost efficiency may differ. The broker relies on the standard MetaTrader 4 (MT4) platform, and its limited range of tradable assets falls short of industry standards. The company's poor customer support, plagued by unresponsiveness and unprofessionalism, and the lack of educational resources, further erode its appeal. The reported issues with the broker's website being down raise concerns about its operational reliability. Traders should be extremely cautious when considering YS GLOBAL Capital.

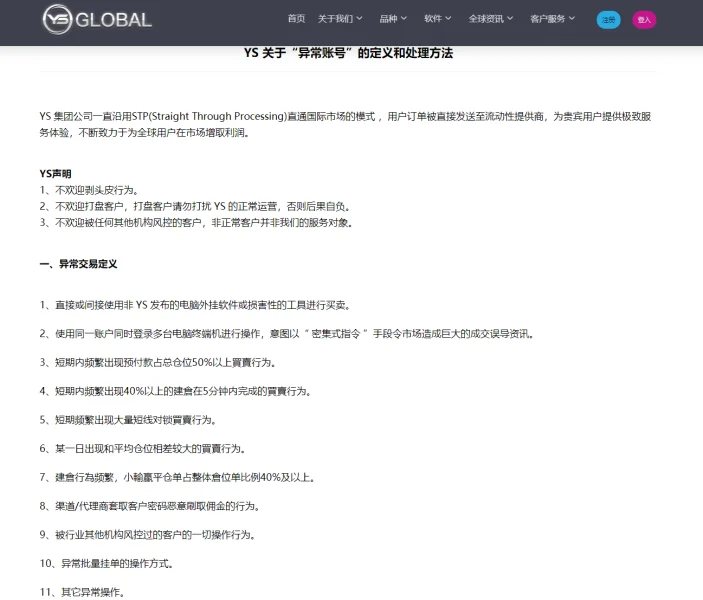

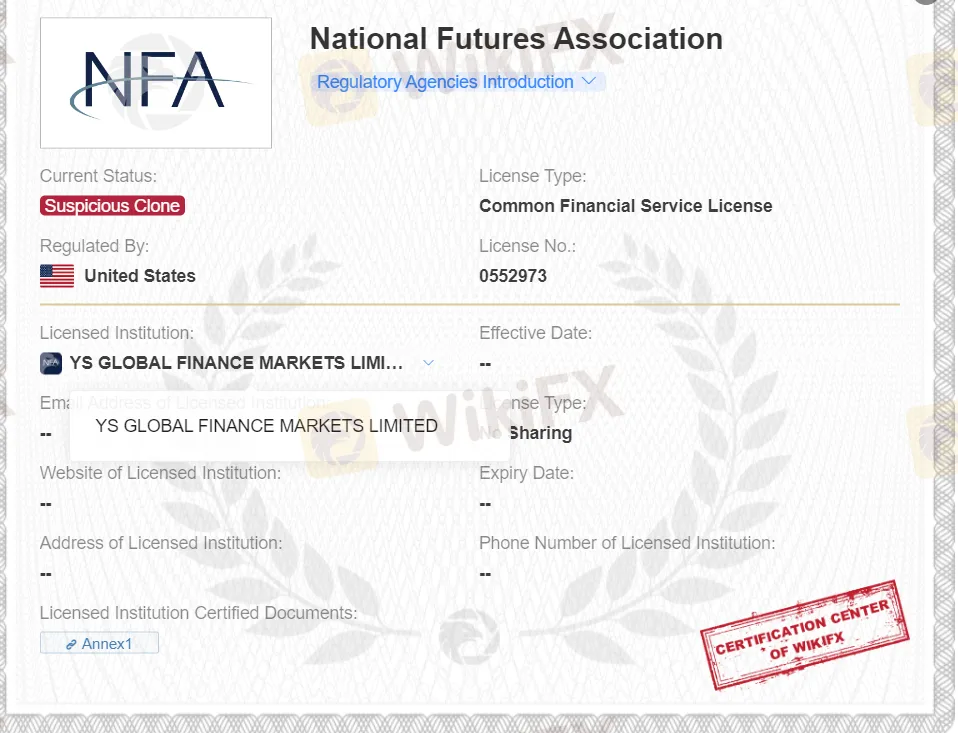

Regulation

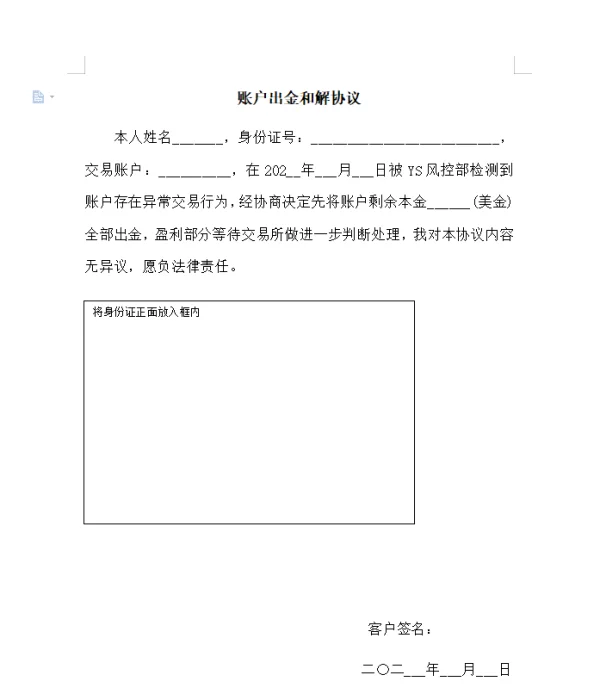

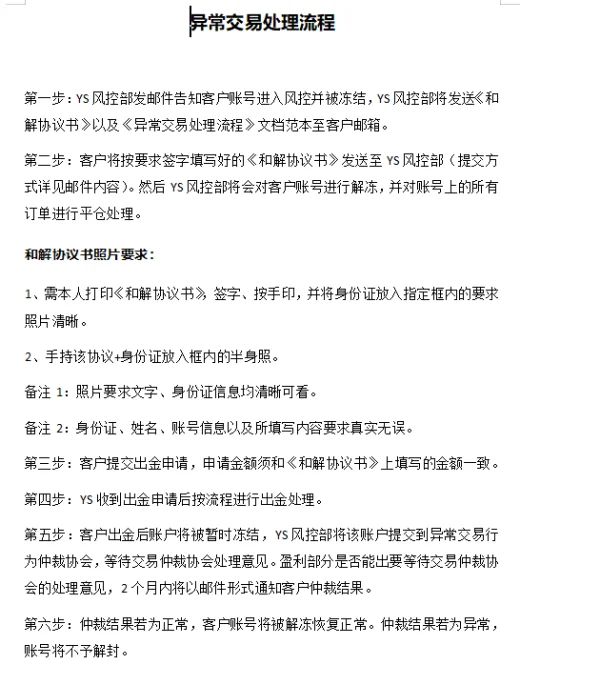

YS GLOBAL, a forex broker, has faced accusations of operating with counterfeit or cloned licenses. These allegations raise significant concerns in the financial industry and among potential investors. Forex trading relies on trust and transparency, and using fake licenses undermines these principles. Such practices can lead to regulatory scrutiny and put investors at risk of financial loss. It is crucial for anyone considering forex trading to thoroughly research brokers, verify their licenses, and stay informed about industry developments to avoid potential scams.

Pros and Cons

YS GLOBAL Capital faces concerning allegations of operating with counterfeit or cloned licenses, raising significant doubts about its legitimacy and trustworthiness in the financial industry. This, coupled with the absence of educational resources and subpar customer support, makes it a less-than-ideal choice for traders seeking a reputable and supportive trading environment.

| Pros | Cons |

| Offers a diverse range of trading instruments, including precious metals, crude oil, and forex, allowing for diversification and catering to various trading strategies and financial goals. | Accusations of operating with counterfeit or cloned licenses, raising concerns about regulatory compliance and legitimacy. |

| Generous leverage of up to 1:300, enabling traders to control larger positions with a smaller capital investment. | Lack of educational resources for traders, hindering their ability to learn and improve their trading skills. |

| Competitive spreads starting at 0.1 pips on major currency pairs. | Poor customer support characterized by slow responsiveness, inefficiency, limited availability, unprofessionalism, and a lack of expertise. |

| “Transparent” commission structure, although additional fees or charges may be hidden. | Limited language support and communication challenges with support agents due to language barriers. |

| Multiple deposit and withdrawal methods, including bank wire transfer and credit/debit cards. | Ignoring client feedback and failing to make improvements based on suggestions or complaints. |

In summary, while YS GLOBAL Capital offers a range of trading instruments and competitive spreads, it is marred by allegations of operating with counterfeit licenses, lacks educational resources, and provides subpar customer support. These concerns should be carefully considered by traders when evaluating the broker.

Market Instruments

YS GLOBAL Capital offers a diverse range of trading instruments, including precious metals, crude oil, and forex. Precious metals like gold and silver act as safe-haven assets, valuable for stability and long-term growth. Crude oil's price movements have significant global impacts, making it an attractive option for traders. YS GLOBAL Capital's forex market, the largest and most liquid globally, allows traders to speculate on currency pair movements across various time zones. These offerings provide opportunities for diversification and risk management, catering to a broad spectrum of investors and traders with varying financial goals.

| Trading Instruments | Description |

| Precious Metals | YS GLOBAL Capital offers a range of precious metals, including gold, silver, platinum, and palladium. These metals are considered safe-haven assets, sought after during economic uncertainty. They serve as hedges against inflation and currency devaluation, making them attractive for stability and long-term growth in a trader's portfolio. |

| Crude Oil | Crude oil is a vital trading instrument provided by YS GLOBAL Capital. Its price movements have significant impacts on various industries and global economies. Traders can capitalize on oil price fluctuations by aligning their strategies with geopolitical events, supply and demand dynamics, and global economic trends. |

| Foreign Exchange (Forex) | YS GLOBAL Capital includes forex trading as a core offering. The forex market is the world's largest and most liquid market, involving currency exchange. Traders can speculate on the relative strengths and weaknesses of different currencies, taking advantage of currency pairs' price movements. The forex market operates 24/5, providing continuous trading opportunities across various time zones. |

Account Types:

YS GLOBAL Capital provides a variety of account types tailored to meet the diverse needs and objectives of traders. These account options encompass Live Accounts and Demo Accounts, each serving distinct purposes in the trading journey. With a commitment to accommodating its clients' unique requirements, YS GLOBAL Capital ensures that traders can select the account type that aligns best with their goals.

Live Accounts: Live Accounts are designed for traders who are ready to engage with real funds in the markets. These accounts provide a platform for traders to put their strategies into action, make real-time decisions, and experience the dynamics of live market conditions. They are suitable for traders who have confidence in their trading skills and are prepared to commit actual capital. Live account holders can access and trade a wide range of instruments, including precious metals, crude oil, and forex, thereby capitalizing on the opportunities these markets present.

Demo Accounts: YS GLOBAL Capital offers Demo Accounts for traders who are new to the trading world or wish to test their strategies without financial risk. These accounts replicate real market conditions, allowing traders to practice their trading strategies, refine their skills, and become familiar with the trading platform. Demo accounts are invaluable tools for learning the intricacies of trading and building confidence before transitioning to live trading. They provide access to the same array of trading instruments as live accounts, enabling traders to explore and experiment with different markets.

Leverage

Leverage at YS GLOBAL Capital offers traders a substantial opportunity, allowing for leverages of up to 1:300. This generous leverage enables traders to command larger positions with a relatively modest capital investment, potentially resulting in amplified returns. However, it's vital to acknowledge that higher leverage also heightens the potential for significant losses. With a 1:300 leverage, traders can control positions 300 times the amount of their initial capital, magnifying both the possibilities for gains and the risks of losses. YS GLOBAL Capital places great emphasis on responsible risk management, underscoring the importance of comprehending and effectively managing the associated risks for traders utilizing such leverage.

Spreads & Commissions

YS GLOBAL Capital offers spreads that start at 0.1 pips for major currency pairs. While these spreads are marketed as competitive, traders should exercise caution. The seemingly attractive spreads may not necessarily translate to the cost efficiency they promise.

Additionally, the broker emphasizes a “transparent” commission structure, suggesting that trading costs are clear and predictable. However, this transparency could potentially hide additional fees or charges that traders might not be fully aware of.

As always, careful scrutiny and a thorough understanding of the fine print are essential when evaluating such offers to ensure they align with traders' best interests. It's crucial to consider all potential costs associated with trading to make informed decisions.

Deposit & Withdrawal

Deposit Methods:

Bank Wire Transfer: YS GLOBAL Capital accepts bank wire transfers as a secure method for depositing funds. This method allows clients to transfer money directly from their bank accounts to their trading accounts with the broker. While it may take some time for the funds to be processed and credited to the trading account, bank wire transfers are a reliable and widely used option for larger deposits.

Credit/Debit Cards: YS GLOBAL Capital also facilitates deposits through credit and debit cards. Clients can use their Visa or Mastercard to fund their trading accounts. This method offers the advantage of immediate fund availability, allowing traders to start trading almost instantly. It's a convenient option for those looking to get started quickly.

Withdrawal Methods:

Bank Wire Transfer: Similar to deposits, clients can use bank wire transfers to withdraw funds from their trading accounts. This method provides a secure way to transfer funds directly to their bank accounts. Withdrawal processing times may vary, depending on the broker's policies and banking procedures.

Credit/Debit Cards: Depending on the broker's policies and regulations, clients may be able to withdraw funds back to the same credit or debit card used for deposits. This method is convenient for smaller withdrawals and can also offer a relatively quick turnaround.

It's important to note that the availability of specific deposit and withdrawal methods, as well as associated fees and processing times, can vary depending on the broker's policies and regulations. Clients should review YS GLOBAL Capital's terms and conditions and contact their customer support for precise details regarding deposit and withdrawal methods. Additionally, clients should ensure they comply with any Know Your Customer (KYC) and anti-money laundering (AML) requirements when conducting financial transactions with the broker.

Trading Platforms

MetaTrader 4 (MT4) is a highly regarded and widely used trading platform in the financial industry. It offers traders a comprehensive set of features and tools designed to facilitate efficient and effective trading across various asset classes, with a primary focus on forex. Here's a description of MT4's key characteristics:

User-Friendly Interface: MT4 boasts a user-friendly and intuitive interface, making it accessible to traders of all experience levels. Its straightforward design allows for easy navigation and quick adaptation, particularly for beginners.

Advanced Charting Tools: MT4 provides a robust charting package with various timeframes, technical indicators, and drawing tools. Traders can conduct in-depth technical analysis and customize charts to suit their preferences.

Automated Trading: One of MT4's standout features is its support for algorithmic trading through Expert Advisors (EAs). Traders can create, backtest, and deploy EAs to automate their trading strategies. This functionality is valuable for executing trades 24/7 without constant manual supervision.

Custom Indicators: MT4 allows traders to develop and incorporate custom indicators using its proprietary MetaQuotes Language (MQL4). This feature enhances analytical capabilities and allows for the creation of unique trading strategies.

Mobile Trading: MT4 offers mobile applications for iOS and Android devices, enabling traders to monitor markets and execute trades on the go. This mobile flexibility ensures traders stay connected and responsive to market developments.

One-Click Trading: MT4 includes one-click trading options, streamlining the execution of trades with minimal latency. This feature is particularly beneficial for scalpers and day traders who require rapid order placement.

Built-in News and Alerts: The platform features a news feed and alert system, keeping traders informed about important market events and economic news releases. This information is vital for fundamental analysis and timely decision-making.

Security: MT4 prioritizes the security of traders' data and transactions. It employs encryption protocols to safeguard sensitive financial information and ensure a secure trading environment.

Multiple Order Types: MT4 supports various order types, including market orders, pending orders, and stop orders, allowing traders to implement their preferred trading strategies effectively.

Multi-Language Support: The platform is available in multiple languages, accommodating traders from diverse backgrounds and regions.

In summary, MetaTrader 4 (MT4) is renowned for its user-friendly interface, advanced charting tools, support for automated trading through EAs, and mobile trading capabilities. Its versatility and widespread use in the industry make it a go-to choice for traders looking for a reliable and feature-rich trading platform, primarily in the forex market.

Customer Support:

The customer support provided by YS GLOBAL Capital, as indicated by their email contacts Safeguard@ys-fx.com and Service@ys-fx.com, leaves much to be desired.

Lack of Responsiveness: Traders often experience frustratingly long response times when reaching out to these email addresses. This delayed communication can be particularly vexing when urgent issues arise, leaving clients in the dark for extended periods.

Inefficiency in Issue Resolution: YS GLOBAL's customer support team falls short when it comes to resolving client issues effectively. Instead of promptly addressing concerns, they often seem more interested in passing the buck or providing generic responses that do little to solve the problem.

Limited Availability: Customer support's availability is questionable, often leaving traders struggling to find assistance when they need it most. The lack of around-the-clock support can be especially problematic in the fast-paced world of financial markets.

Unprofessionalism: The professionalism of YS GLOBAL's support team leaves much to be desired. Traders have reported encounters with unhelpful, unresponsive, and even rude support representatives who do little to instill confidence in the company.

Lack of Expertise: Traders often encounter support agents who appear to have a limited understanding of the financial markets and the services offered by YS GLOBAL. This lack of expertise can leave clients feeling frustrated and uninformed.

Language Barriers: YS GLOBAL's support team struggles with language barriers, making effective communication a challenge for clients from diverse backgrounds. This issue further exacerbates clients' frustration and hinders problem resolution.

Ignored Feedback: The company seems disinterested in client feedback and rarely makes improvements based on suggestions or complaints. This indifference to client concerns reflects a lack of commitment to providing a satisfactory customer experience.

In sum, YS GLOBAL Capital's customer support is a glaring weak point, characterized by poor responsiveness, inefficiency, limited availability, unprofessionalism, and a general lack of client-centricity. Traders should be prepared for a frustrating experience when seeking assistance or resolution to issues with this broker.

Educational Resources

Regrettably, YS GLOBAL Capital does not offer any educational resources to assist traders in their journey. Educational materials play a crucial role in enhancing trading knowledge and skills, providing valuable insights into strategies, market analysis, and risk management. They empower traders to make informed decisions and adapt to evolving market conditions. The absence of such resources at YS GLOBAL Capital may constrain traders' opportunities for learning and impede their progress. Traders looking for a more comprehensive learning experience might want to explore brokers that provide extensive educational content to foster their growth and expertise.

Summary

YS GLOBAL Capital faces concerning allegations of operating with counterfeit or cloned licenses, which casts a shadow over its legitimacy and trustworthiness in the financial industry. This raises significant red flags and poses substantial risks for potential investors. The absence of educational resources further hinders traders' ability to develop and refine their skills, indicating a lack of commitment to their success. Additionally, the customer support provided by the broker appears inadequate, characterized by poor responsiveness, inefficiency, unprofessionalism, and a general disregard for client concerns. These shortcomings collectively paint a bleak picture of YS GLOBAL Capital as a broker, making it a less-than-ideal choice for traders seeking a reputable and supportive trading environment.

FAQs

Q1: Is YS GLOBAL Capital a regulated forex broker?

A1: YS GLOBAL Capital has faced accusations of operating with counterfeit or cloned licenses, raising concerns about its regulatory status and legitimacy. Traders are advised to exercise caution and thoroughly research the broker's regulatory compliance.

Q2: What trading instruments are offered by YS GLOBAL Capital?

A2: YS GLOBAL Capital provides a range of trading instruments, including precious metals, crude oil, and forex. These instruments allow for diversification and cater to a variety of trading strategies and financial goals.

Q3: Does YS GLOBAL Capital offer educational resources for traders?

A3: Unfortunately, YS GLOBAL Capital does not provide educational resources to assist traders in their learning journey. Traders seeking educational materials may need to explore alternative brokers with comprehensive educational offerings.

Q4: What is the leverage offered by YS GLOBAL Capital?

A4: YS GLOBAL Capital offers significant leverage of up to 1:300, enabling traders to control larger positions with a smaller capital investment. However, traders should be aware that higher leverage also increases the potential for substantial losses.

Q5: How can I contact customer support at YS GLOBAL Capital?

A5: You can contact YS GLOBAL Capital's customer support through email at Safeguard@ys-fx.com for security-related inquiries and Service@ys-fx.com for general customer service. However, it's essential to be aware of potential issues with responsiveness and support quality based on previous user experiences.