No data

Do you want to know which is the better broker between XM and FXDD ?

In the table below, you can compare the features of XM , FXDD side by side to determine the best fit for your needs.

EURUSD: -0.2

XAUUSD: -0.1

Long: -7.26

Short: 1.04

Long: -44.42

Short: 19.6

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of xm, fxdd lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulatory status | ASIC, CYSEC, FSA, FSC and DFSA |

| Year(s) of incorporation | 10-15 years |

| Market instruments | Currency pairs, stocks, commodities, precious metals, energies, indices... |

| Minimum initial deposit | $5 |

| Maximum leverage | 1:1000 |

| Minimum spread | From 0.6 pips |

| Trading platform | MT5, MT4, own platform |

| Deposit and withdrawal methods | credit or debit card, Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay |

| Customer Service | Email/phone number/address/live chat |

| Fraud allegations | Not yet |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide variety of financial instruments to operate.

It offers popular platforms such as MT4 and MT5, as well as its own APP.

Demo account available to practice before trading with real money.

It offers educational resources such as market analysis, economic calendars and courses.

24/7 customer service via live chat, email and telephone.

Cons:

The $10,000 minimum deposit for the stock account may be prohibitive for some traders.

Spreads on some accounts may be higher than those offered by other brokers.

Commissions are applied to the share account.

The maximum leverage of 1:1000 may increase risk for inexperienced traders.

Regulation in Cyprus may be less stringent than in other European countries.

| Dimension | Advantages | Disadvantages |

| Broker Model | XM offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' operations, XM has a potential conflict of interest that can lead to decisions that are not in the best interest of its clients. |

XM is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, XM acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of offering leverage. However, this also means that XM has a certain conflict of interest with its clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interest of their clients. It is important for traders to be aware of this dynamic when trading with XM or any other MM broker.

Regulation is a key dimension to consider when choosing a forex broker, as it offers some protection to the client in terms of security of funds, transparency and fairness of operations. XM is a Cyprus registered company and regulated by several major regulatory bodies, including ASIC, CYSEC, FSA, FSC and DFSA.

ASIC is the Australian Financial Services Authority and is responsible for regulating the financial sector in Australia. CYSEC is the Cyprus Securities and Exchange Commission and is the financial regulatory authority in Cyprus. The FSA is the Financial Services Authority of the United Kingdom and regulates the financial sector in the United Kingdom. The FSC is the Financial Services Commission of Mauritius, which regulates the financial sector in Mauritius. The DFSA is the Dubai Financial Services Authority and is the financial regulatory authority in Dubai.

Multi-entity regulation provides greater customer protection, as it means that the broker is subject to multiple sets of regulations and standards. In addition, this can enhance the broker's reputation in the industry.

In summary, XM is a forex broker regulated by several entities, which provides clients with greater protection and transparency in their operations.

XM is a Forex and CFD broker based in Cyprus and regulated by several internationally renowned financial authorities, including ASIC, CYSEC, FSA, FSC and DFSA. It offers a wide variety of financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies, etc. Clients have access to several trading platforms, including MT4, MT5 and the XM mobile app, and can choose from four different account types. XM also offers a free demo account, educational resources and 24/7 customer support.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of financial instruments to choose from | It can be overwhelming for new or inexperienced traders. |

| Traders can diversify their portfolio | Some financial instruments may have limited liquidity |

| Opportunities to take advantage of different markets | Traders may need to perform additional analysis of the different markets and their influencing factors. |

| Greater flexibility to implement different strategies | Some traders may not be interested in certain financial instruments. |

XM offers its traders a wide variety of over 1000 financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies and more. This variety allows traders to diversify their portfolios and take advantage of different markets to implement different trading strategies. Traders also have the flexibility to choose from a wide range of financial instruments and select the ones that best suit their trading preferences and objectives. However, for some new or inexperienced traders, the variety of financial instruments can be overwhelming, and some instruments may have limited liquidity, which can make trading them difficult.

| Advantages | Disadvantages |

| Low Spreads | Spreads can be higher during periods of high volatility |

| No commissions charged on the first three accounts | A commission is charged on the share account. |

| Highly leveraged accounts | Spreads may vary according to account type and time of day. |

In terms of spreads and commissions, XM offers low spreads on the first three commission-free accounts. However, during periods of high volatility, spreads may be higher. On the equity account, a commission is charged in addition to the spreads. The accounts offer high leverage, which means that investors can trade significantly more money than they have in their account. Spreads can vary by account type and time of day, so investors should keep an eye out for changes. In general, XM offers competitive spreads and account options to suit different investment levels.

| Advantages | Disadvantages |

| Low minimum deposit accounts | The share account has a high minimum deposit |

| Offers account options for different investment levels | A commission is charged on the share account. |

| No commissions charged on the first three accounts | There is no leverage in the share account. |

| High leverage on the first three accounts | The ultra low account has higher spreads than other accounts. |

XM offers a variety of account types to suit different investment levels. The micro, standard and ultra low accounts have no high minimum deposit and no commissions are charged. The ultra low account has higher spreads than the other accounts, but the goal is to offer even lower spreads than those offered in the micro and standard accounts. The stock account has a minimum deposit of $10,000 and a commission is charged. No leverage is offered on the share account, which means investors must invest the full amount of their trade. In general, XM offers account options for different investment levels.

The XM demo account is an excellent tool for novice traders or those who wish to test new trading strategies without risking their capital. The demo account comes with a virtual trading platform that replicates live trading conditions and can be accessed from any device. Traders can practice their trading skills and familiarize themselves with the financial instruments available at XM without having to risk their money. In addition, the XM demo account has no time restrictions, which means that traders can use it for as long as they need before they start trading with a live account. Overall, the XM demo account is a valuable tool for those who wish to improve their trading skills before getting involved in live trading.

XM, is a broker, which has an account opening with a minimum deposit of $5. The steps for account opening

How can you open an XM Broker account?

Currently, there are numerous online brokers on the market, where you can trade forex, CFDs. Each of them offers a variety of trading accounts, in a simple and fast way, where there are brokers that have an easier registration process. Below are the steps to follow for opening an XM Broker account:

a) Fill in your personal data and address in the online registration form.

b) Usually, you have to choose the leverage, to comply with regulatory bodies, in this broker does not meet the regulatory parameters. So be careful.

c) Upon completion, it is recommended to read, agree and accept the terms and conditions of the contract.

d) Sending documentation, there are brokers that request documentation, in this case, the company does not indicate the requirement of the same.

e) Proof of identity, you must send a scanned document proving your identity, e.g. passport, ID card or driver's license. Must be valid

f) Proof of Address: as to the veracity of the address, a scanned copy of the current utility bill verifying the address must be provided.

g) Make initial deposit: each Broker establishes its minimum deposit, for the opening of the trading account it offers.

h) Upon completion of the registration process, you have access to the client area with the Broker.

| Advantages | Disadvantages |

| It offers the popular MT4 and MT5 platforms, which are widely used by traders around the world. | XM's proprietary trading platform may have fewer features than MT4 and MT5. |

| MT4 and MT5 offer extensive customization possibilities and a wealth of technical indicators and analysis tools. | The learning curve can be steep for beginners using MT4 and MT5. |

| The XM mobile app is easy to use and is available for both iOS and Android. | Users may have trouble switching from one platform to another if they are used to a particular one. |

XM offers its clients a selection of trading platforms, including the popular MT4 platform and its successor, MT5. In addition, the company has also developed its own custom trading platform for those looking for something different. Both platforms offer a wide variety of technical indicators, analysis tools and customization possibilities. XM's mobile app is also easy to use and is available on iOS and Android. However, for those who are comfortable with a particular platform, it may be difficult to switch to another platform. Beginners may also find the MT4 and MT5 learning curve steep, although the customization possibilities and variety of analysis tools may make it worth the effort. Overall, XM offers a solid selection of trading platforms to meet the needs of all traders.

XM also offers a series of instructional videos, such as this one from its YouTube channel, on how to open an account using MT4.

| Advantages | Disadvantages |

| Enables operators to expand their investment capacity | Significantly increases the risk of loss |

| Possibility of obtaining higher profits with less capital | Requires greater knowledge and experience of the market |

| Allows diversification of the portfolio with larger positions | Lack of proper management can lead to large losses |

| Greater flexibility to operate different instruments | Increased exposure to the risk of market fluctuations |

Leverage is an important tool in Forex trading that allows traders to have greater exposure to the market with limited capital. At XM, the maximum leverage offered is 1:1000, which means that for every $1 of capital, the trader can control up to $1000 in the market. This can be attractive to traders looking to maximize their profits with less capital.

However, it is also important to note that high leverage carries a higher risk of loss. If the market moves against the trader's position, losses can be significant. That is why it is important for traders to have proper risk management and understand the risks associated with trading with leverage before trading XM.

In XM deposits and withdrawals are made from the user's site, and is functional on mobile devices can use mobile trading.

There are brokers that accept bank transfers and credit or debit card payments. Some brokers offer greater facilities by implementing the possibility of payment through electronic means of payment such as Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay, etc.

| Advantages | Disadvantages |

| Wide variety of educational resources, including market analysis, economic calendars, signals and online courses. | Not all educational resources are available in all languages. |

| Offers trading tools and videos to help traders improve their skills. | The quality of educational resources may vary depending on the trader's level of experience. |

| Offers regular webinars and online seminars. | Some educational resources may not be up to date with the latest market developments. |

XM strives to provide a wide variety of educational resources to help their clients improve their trading skills. They offer a wide range of tools and resources, such as market analysis, economic calendars, signals and online courses. In addition, XM regularly offers webinars and online seminars, which are an excellent way to learn from experienced traders and gain a better understanding of the markets. However, not all educational resources are available in all languages and the quality of educational resources may vary depending on the trader's level of experience. In addition, some educational resources may not be up to date with the latest developments in the markets, so traders should be careful in selecting the resources they use. Overall, XM makes a solid effort to provide a variety of useful educational resources for its clients.

| Advantages | Disadvantages |

| Live chat available 24/7 | No toll-free number |

| Multilingual customer service | |

| Registered address provided on the website | No estimated response time is mentioned |

| E-mail available for inquiries | No fax support |

| International phone numbers available | No callback service available |

XM excels in its customer service by providing a live chat available 24 hours a day, which means that customers can get real-time help at any time. In addition, XM's website offers the company's registered address, which provides greater transparency and confidence to the customer. Multi-language customer support is also a significant advantage for international customers. In addition, XM provides an international e-mail address and phone numbers for support inquiries. However, a disadvantage is the lack of a toll-free number, as well as the lack of social media and fax support. In addition, there is no mention of an estimated response time for support inquiries and no callback service is offered.

Overall, XM is a well-regulated and secure company that offers a wide range of financial instruments and a good variety of accounts. Its focus on customer education and 24/7 multilingual support is also a big plus. Disadvantages include floating spreads that can be higher than the competition and the lack of a proprietary trading platform. Overall, XM is a good choice for those looking for a regulated broker with a wide range of products and customer support services.

Question: Is XM a regulated company?

Answer: Yes, XM is regulated by multiple agencies such as ASIC, CYSEC, FSA, FSC and DFSA.

Question: What are the account types offered by XM?

Answer: XM offers four account types: micro account, standard account, ultra low account and share account.

Question: What is the minimum deposit required to open an XM account?

Answer: The minimum deposit required for the first three accounts (micro account, standard account and ultra low account) is $5, while for the share account it is $10,000.

Question: What trading platforms does XM offer?

Answer: XM offers the most popular trading platforms in the industry: MT4 and MT5, as well as its own mobile application.

Question: What is the maximum leverage offered by XM?

Answer: The maximum leverage offered by XM is 1:1000.

Question: Does XM offer a demo account?

Answer: Yes, XM offers a demo account for clients to practice without risking their own money.

Question: What educational resources does XM offer?

Answer: XM offers a wide range of educational resources such as market analysis, economic calendars, trading signals, tools, videos, courses and webinars.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| FXDD Review Summary in 10 Points | |

| Founded | 2002 |

| Registered Country/Region | Malta |

| Regulation | MFSA (Suspicious clone) |

| Market Instruments | Forex, Metals, Stocks, Energies, Indices, Stocks and Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:30/1:100 |

| EUR/USD Spread | 1.8 pips |

| Trading Platforms | MT4, MT5, WebTrader and FXDD Mobile |

| Minimum deposit | N/A |

| Customer Support | 24/5 live chat, phone, email |

FXDD, a trading name of FXDD GLOBAL, is an online trading broker established in Malta in 2002. FXDD is regulated by the Malta Financial Services Authority (MSFA, suspicious clone) (License No. C48817). The broker provides access to various financial instruments, including currencies, commodities, metals, and indices, through multiple trading platforms.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Multiple trading assets and funding options | • Suspicious clone |

| • MT4 and MT5 supported | • Regional restrictions |

| • 24/5 customer support with multiple contact options | • Some negative reviews from clients |

| • No deposit or withdrawal fees for most methods | • Inactivity fee charged after 90 days |

| • Rich educational resources |

Overall, while FXDD offers a range of benefits including a diverse range of trading instruments and various trading platforms, potential users should also consider the reported issues and fees before deciding if FXDD is the right fit for their needs.

There are many alternative brokers to FXDD depending on the specific needs and preferences of the trader. Some popular options include:

BDSwiss - a reliable and regulated broker with a user-friendly platform and a range of educational resources, but its fees and limited product offerings may not be suitable for all traders.

Darwinex - a unique broker that offers a social trading platform and innovative investment opportunities, but its high minimum deposit and limited product range may not be ideal for all traders.

Equiti - a well-regulated broker with a strong focus on transparency and client education, offering a variety of trading platforms and a wide range of instruments, but its fees may be higher than some competitors.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

The presence of a suspicious clone Malta Financial Services Authority (MFSA) license raises concerns about the legitimacy and credibility of FXDD. It also has got many negative reviews from the clients complaining about the platform. It is important for potential clients to conduct their own due diligence and research, as well as consider factors such as regulatory compliance, customer reviews, and transparency before deciding whether to engage with the company.

FXDD provides investors with access to popular tradable instruments in the financial markets across six asset classes, mainly Forex, Metals, Stocks, Energies, Indices, Stocks and Cryptocurrencies. Traders can access the forex market including majors, minors, and exotics. Metals such as Gold, Silver, and Platinum can be traded as well. Stocks of some of the world's leading companies are also available to trade with FXDD. Energies such as crude oil and natural gas, and Indices including S&P 500 and Nasdaq are also popular tradable instruments offered by FXDD. Lastly, FXDD also offers cryptocurrencies like Bitcoin, Ethereum, and Litecoin. With such a diverse range of instruments, FXDD provides traders with plenty of options to invest in the financial markets.

FXDD offers two types of accounts for traders, namely Standard accounts and ECN accounts. The Standard account is suitable for beginners or those who want to trade in smaller amounts. On the other hand, the ECN account is designed for more experienced traders who want to benefit from tighter spreads and faster execution speeds, with the added benefit of no dealing desk intervention. Standard or ECN available on MetaTrader4/5, ECN only on WebTrader. Additionally, FXDD offers a demo account for traders to practice their strategies in a risk-free environment.

Leverage depends on the instruments traded and is defined by the regulatory restrictions together with the traders level of proficiency. So the available leverage allows to trade with increased level-up to 1:30, yet the professional traders may be entitled to higher leverage of up to 1:100. However, it's important to remember that higher leverage also increases the potential risk, so traders should exercise caution and consider their risk tolerance before using high leverage ratios.

Spreads and commissions vary depending on the account type and trading instrument. Take EUR/USD pair as an example, the spread is floating around 1.8 pips on the Standard account, while floating around 0.3 pips on the ECN account. There is no commission on the Standard account, while ECN accounts do charge a commission. Specifically, $0.299 per 10,000 for EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, EUR/JPY and GBP/JPY; $0.400 per 10,000 for others.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXDD | 1.8 pips | None |

| BDSwiss | 0.3 pips | None |

| Darwinex | 0.5 pips | variable |

| Equiti | 0.0 pips | $3.50/lot |

Note: Spreads can vary depending on market conditions and volatility.

FXDD Trading provides traders with access to the popular MetaTrader 4 and MetaTrader 5 trading platforms, which are known for their user-friendly interface and powerful analytical tools. In addition to these market-leading platforms, FXDD also offers its own fully-featured WebTrader platform, which is accessible from any browser without the need to download any software. For traders who prefer to trade on-the-go, FXDD Mobile is a mobile app that is available for both iOS and Android devices, and is specifically designed for advanced traders who require real-time access to their trading accounts.

Overall, FXDD's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| FXDD | MetaTrader 4, MetaTrader 5, WebTrader, FXDD Mobile |

| BDSwiss | MetaTrader 4, MetaTrader 5, BDSwiss WebTrader |

| Darwinex | MetaTrader 4, MetaTrader 5, cTrader |

| Equiti | MetaTrader 4, MetaTrader 5, WebTrader |

FXDD works with numerous means of deposit and withdrawal choices, consisting of Visa, UnionPay, Neteller, Skrill, Bank Wire and TMI Trust Company. Most deposits and withdrawals do not incur any fees, although TMI Trust Company may charge some unspecified deposit and withdrawal fees.

| FXDD | Most other | |

| Minimum Deposit | N/A | $100 |

It is common for brokers to charge an inactivity fee to cover the costs of maintaining an account that is not being used. FXDD also applies an inactivity administrative charge to accounts that are inactive for more than 90 days.

The amount of the fee depends on how long the account has been inactive, $40 for accounts inactive for less than 1year, $50 for accounts inactive for 1-2 years, $60 for accounts inactive for 2-3 years, and $70 for accounts inactive for over 3 years. Traders should keep this in mind when considering opening an account with FXDD and ensure that they maintain regular trading activity to avoid these fees.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXDD | Free | Free | Yes |

| BDSwiss | Free | $5-$10 | Yes |

| Darwinex | Free | Free | No |

| Equiti | Free | Free | No |

FXDD follows standard trading hours typically Sunday 5 pm to Friday 5 pm (EST). Monthly trading hours may change by instrument and are posted on the latest news section of the brokers website.

FXDDs customer support can be reached 24/5 hours (Sunday 5PM to Friday 4:55PM EST) by live chat, telephone: +1 (212) 720-7200, email: support@fxddtrading.com or request a callback. You can also follow this broker on social networks such as Twitter, Facebook, and YouTube. Company address: FXDD Trading, Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda.

Overall, it appears that FXDD is committed to providing accessible and responsive customer support to its clients.

| Pros | Cons |

| • Available 24/5 | • No 24/7 customer support |

| • Multiple contact options | |

| • Active on social media platforms |

Note: These pros and cons are subjective and may vary depending on the individual's experience with FXDD's customer service.

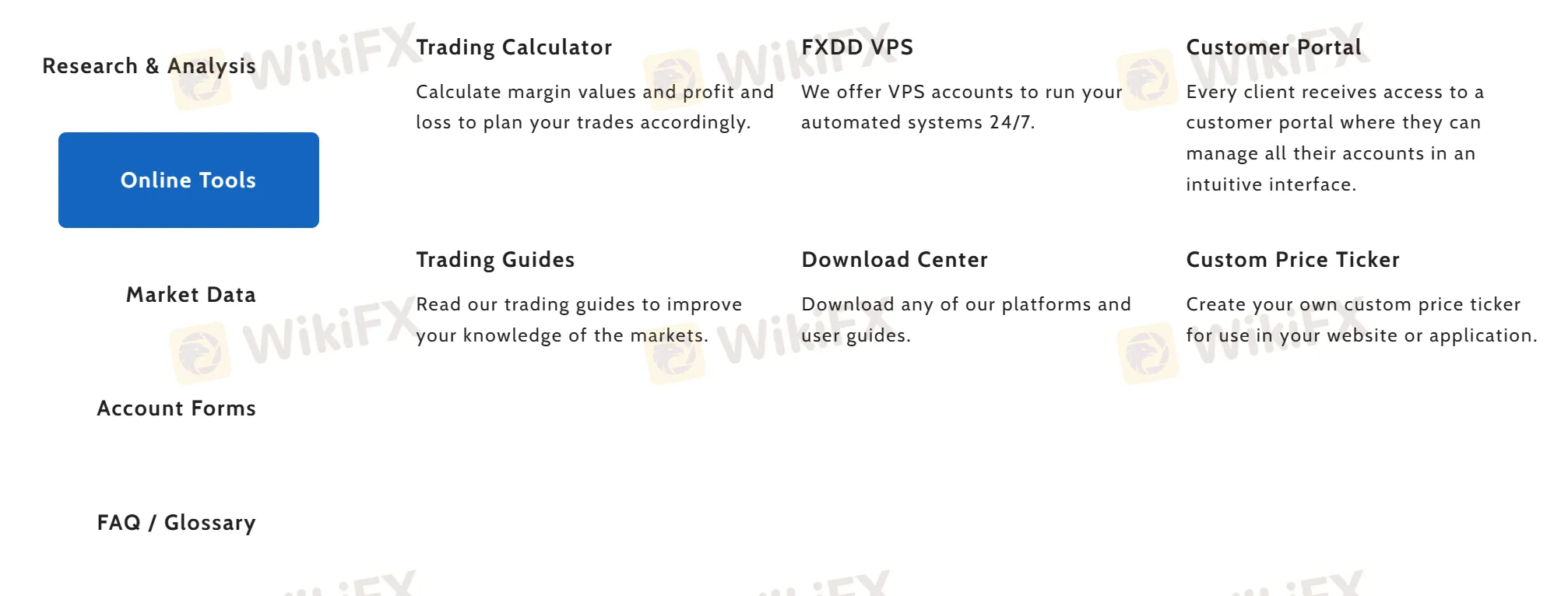

FXDD offers a range of educational resources to help traders improve their knowledge and skills. The broker provides daily market analysis and research reports, which can be accessed on their website. They also offer a variety of online tools such as trading calculator, trading guides and VPS. Traders can find a range of account forms, including account applications and funding forms, to make it easy to manage their accounts. Additionally, FXDD provides a comprehensive FAQ section and glossary of financial terms to help traders better understand the markets and trading concepts.

It is not uncommon for trading platforms to encounter technical issues or glitches from time to time, and FXDD is no exception. On our website, you can see that some users have reported many problems with their platform. While there have been some reports of users experiencing problems with the platform, it is difficult to determine the extent of these issues without further information or context. It is always recommended to thoroughly research and review a broker before deciding to invest with them.

You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Taking into account FXDD's trading conditions, customer support, and educational resources, it may be considered a potentially viable option for traders. However, the reports of a suspicious clone license and mixed reviews from clients raise some concerns that should be taken into consideration before making a decision. As with any financial service provider, it is important to do thorough research and due diligence before opening an account.

| Q 1: | Is FXDD regulated? |

| A 1: | No. It has been verified that FXDD holds a suspicious clone Malta Financial Services Authority (MFSA) license. |

| Q 2: | At FXDD, are there any regional restrictions for traders? |

| A 2: | Yes. FXDD does not accept residents of American Samoa, Angola, Belarus, Bermuda, Burundi, Cameroon, Central African Republic, Chad, Congo, Congo, Democratic Republic of Cuba, Equatorial Guinea, Gabon, Iran (Islamic Republic of), Korea (Democratic People's Republic of), Lebanon, Libya, Marshall Islands, Puerto Rico, Russian Federation, Sao Tome and Principe, Sudan, Syrian Arab Republic, United States of America, Venezuela (Bolivarian Republic of), Virgin Islands (U.S.), Yemen, Zimbabwe. |

| Q 3: | Does FXDD offer the industry-standard MT4 & MT5? |

| A 3: | Yes. FXDD supports MT4, MT5, WebTrader, and FXDD Mobile. |

| Q 4: | What is the minimum deposit for FXDD? |

| A 4: | The minimum initial deposit with FXDD is $100. |

| Q 5: | Does FXDD charge a fee? |

| A 5: | Like every forex broker, FXDD charges a fee when you trade - either in the form of a commission fee or spread fee. It also charges an inactivity fee. |

| Q 6: | Is FXDD a good broker for beginners? |

| A 6: | No. FXDD is not a good choice for beginners. Though its trading conditions are advertised well, its MFSA license is a suspicious clone, which means trading with this broker is full of danger. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive xm and fxdd are, we first considered common fees for standard accounts. On xm, the average spread for the EUR/USD currency pair is as low as 1 pips, while on fxdd the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

xm is regulated by ASIC,CYSEC,FSC,DFSA,FSCA. fxdd is regulated by MFSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

xm provides trading platform including Micro Account,Standard Account,Ultra Low Spread Standard & Micro Account,Stock Account and trading variety including Major FX pairs, Minor FX pairs, Commodities, Indices CFDs. fxdd provides trading platform including -- and trading variety including --.