No data

Do you want to know which is the better broker between Windsor Brokers and BDSWISS ?

In the table below, you can compare the features of Windsor Brokers , BDSWISS side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: -0.4

Long: -7.51

Short: 1.61

Long: -33.73

Short: 18.35

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of windsor-brokers, bdswiss lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Windsor Brokers Review Summary in 10 Points | |

| Founded | 1988 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

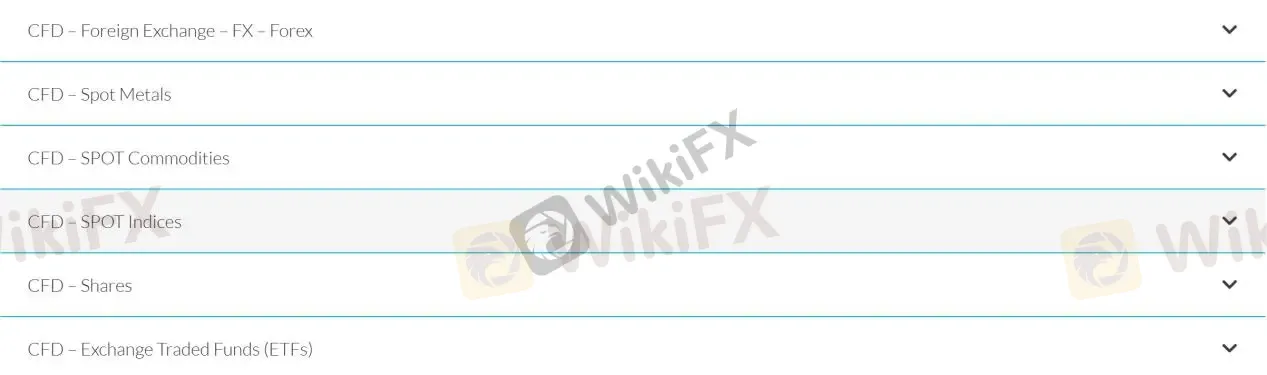

| Market Instruments | CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs |

| Account Types | Prime account, Zero account |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Windsor Broker Ltd, founded in 1988 and headquartered in Limassol, Cyprus, is an European brokerage firm that has been providing financial services to retail, corporate and institutional investors worldwide for many years, offering a wide range of financial instruments, including Forex, commodities, indices, and shares, as well as a variety of trading platforms and trading tools. Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC, No. 030/04).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by CySEC | • Limited payment methods |

| • Negative balance protection | • Clients from the USA, Japan and Belgium are not accepted |

| • Wide range of trading tools | • Limited info on accounts |

| • MT4 for all devices | |

| • Low spreads and commissions | |

| • Wide product portfolios | |

| • Demo accounts available |

Regulation by a reputable authority like Cyprus Securities and Exchange Commission (CySEC) is a positive factor indicating that Windsor Brokers is a legitimate broker. Additionally, the fact that they offer negative balance protection is also a plus for traders.

CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs are all available at Windsor Brokers. The broker allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade with Windsor Brokers.

Demo Account: Windsor Brokers provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Windsor Brokers offers two types of real trading accounts: the Prime Account and the Zero Account. The Prime Account, geared towards support-oriented traders, has a lower $50 minimum deposit and spreads starting from 1.0 pips on major pairs. It provides zero commission on forex CFDs, an $8 commission per lot for crypto CFDs, and includes training resources.The Zero Account targets heavy traders with a $1,000 minimum deposit, zero spreads on major currency pairs, and a maximum leverage of 1:1000. It charges an $8 commission per lot for forex, metals, and crypto CFDs, with no commission on other CFDs. Both accounts offer negative balance protection, personal account managers, a 0.01 minimum trade volume, a 50 lot restriction per ticket, hedging allowance, and a 20% stop-out level with a 100% margin call. Notably, the Zero Account does not support Islamic/swap-free accounts.

The maximum leverage offered by Windsor Brokers is only 1:30, which may seem too low to you. Margin requirements for professional clients based on 1:100 leveraged accounts. Other leverages are available to Professional Clients only.

In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

It is commendable that in the trading instruments interface, Windsor Brokers provides a detailed table showing the spreads, margin requirement, pip value, and stop levels of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Windsor Brokers | 0.2 pips | $0 |

| BlackBull Markets | 0.8 pips | $6 |

| Eightcap | 0.6 pips | $3.50 |

| FOREX TB | 0.7 pips | $0 |

Note: Spreads can vary depending on market conditions and volatility.

Windsor Brokers offers traders the popular MT4 trading platform for PC, Mac, WebTrader, Android, iPhone, Android Tablet and iPad, which is ideal for all traders, whether they are professional traders or beginners. MT4 trading platform features powerful charting capabilities, a large number of indicators and algorithmic trading features, a user-friendly interface, a dynamic security system, and multi-terminal functionality.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Windsor Brokers | MT4, WebTrader |

| BlackBull Markets | MT4, MT5, WebTrader |

| Eightcap | MT4, MT5, WebTrader |

| FOREX TB | MetaTrader 4 |

Windsor Brokers provides a variety of trading tools to its clients to help them make informed trading decisions. These tools include market analysis and commentary, an economic calendar, and information on market holidays. Additionally, the broker offers several Forex calculators, such as Profit, Margin, Pip, Fibonacci, and Pivots calculators, which can be useful in managing risk and determining potential profits. By providing these trading tools, Windsor Brokers aims to empower traders with the necessary knowledge and resources to navigate the financial markets.

In terms of deposits and withdrawals, Windsor Brokers offers these payment methods: Credit/debit cards (Visa/MasterCard), WebMoney, Wire Transfer, Neteller and Skrill.

| Windsor Brokers | Most other | |

| Minimum Deposit | $100 | $100 |

The broker does charges fees for deposits and withdrawals, which vary on the payment method. All deposits are processed on the same day, while most withdrawals can be processed on the same day with the exception of wire transfer withdrawal.

More details concerning deposit/withdrawal fees and processing time can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Credit/debit cards (Visa/MasterCard) | 3% | $/€/£3/transaction | Same day | Same day |

| WebMoney | 0.8% | 0.8% | ||

| Wire Transfer | Vary | Vary $0-30 | Vary | |

| Neteller | 3% | $/€/£3/transaction | Same day | |

| Skrill | 3% | 1% - min $/€/£3£ | ||

| Broker | Deposit Fees | Withdrawal Fees |

| Windsor Brokers | Vary on the method | Vary on the method |

| BlackBull Markets | None | None |

| Eightcap | None | None |

| FOREX TB | None | None |

Note: Fees may vary based on the payment method and currency used. Please refer to the broker's website for the most up-to-date information.

Below are the details about the customer service.

Service Hour: 24/5

Live Chat/Fill in Contact Form

Email: support@windsorbrokers.eu

Phone: +357 25 500 700

Fax: +357 25 500 555

Address: Spyrou Kyprianou 53, Windsor Business Center, 3rd Floor, Mesa Geitonia, 4003 Limassol, Cyprus,

Or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Overall, Windsor Brokers' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual customer support | • No 24/7 customer support |

| • Multi-channel support | |

| • Live chat available | |

| • Quick response time for customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Windsor Brokers' customer service.

Windsor Brokers offers a variety of educational resources to help traders improve their skills and knowledge. They have a video library that covers topics such as technical analysis, risk management, and trading strategies. They also have a glossary of trading terms and an ebook library that covers a range of topics such as trading psychology, fundamental analysis, and more. These educational resources are available for free to all clients of Windsor Brokers.

On our website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Windsor Brokers is a regulated broker that offers access to multiple markets and trading platforms, as well as a range of trading tools and educational resources. The broker's negative balance protection is a positive feature that helps protect traders from incurring losses beyond their deposited funds.

However, some users have reported difficulties with withdrawals, which may raise concerns about the broker's reliability. Overall, Windsor Brokers appears to be a reputable broker that offers a good range of services, but potential traders should carefully consider the reported withdrawal issues before deciding to open an account.

| Q 1: | Is Windsor Brokers regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Windsor Brokers, are there any regional restrictions for traders? |

| A 2: | Yes. It does not accept clients from the USA, Japan and Belgium. |

| Q 3: | Does Windsor Brokers offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Windsor Brokers offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Windsor Brokers? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is Windsor Brokers a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| BDSWISS Review Summary in 10 Points | |

| Founded | 2012 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (offshore) |

| Market Instruments | Forex, commodities, shares, indices and cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | MT4, MT5, BDSwiss Mobile APP, BDSwiss WebTrader |

| Minimum deposit | $10 |

| Customer Support | 24/5 multilingual live chat, phone, email |

BDSwiss is an offshore-regulated forex and CFD broker that was established in 2012 and is registered in Seychelles. The broker offers a range of trading instruments across multiple asset classes, including forex, commodities, shares, indices, and cryptocurrencies.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

BDSWISS offers a wide range of trading instruments across multiple asset classes, making it a versatile platform for traders. The absence of deposit and withdrawal fees is a definite advantage for those who prioritize low-cost trading. Additionally, the broker's extensive educational resources can be beneficial for novice traders who want to improve their trading skills.

However, some traders may find the offshore Seychelles Financial Services Authority (FSA) license to be a drawback. Overall, BDSWISS appears to be a reliable broker with several advantages for traders, but it's important to consider the potential drawbacks before deciding to trade with them.

| Pros | Cons |

| • Wide range of trading instruments across multiple asset classes | • Offshore FSA license |

| • Various account types to suit different trading needs | • Negative reviews from their clients |

| • Multiple trading platforms and tools | • Overnight charges, currency conversion, and inactivity fee |

| • No deposit and withdrawal fees | |

| • Rich educational resources for traders of all levels |

Note that this table is not exhaustive and there may be additional pros and cons to consider.

There are many alternative brokers to BDSWISS depending on the specific needs and preferences of the trader. Some popular options include:

FxPro - A reputable broker with a variety of trading platforms and competitive pricing.

Trade Nation - A user-friendly broker with a focus on education and customer satisfaction.

Go Markets - A reliable broker with competitive spreads and a range of trading instruments.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

| Protection Measures | Detail |

| Regulation | FSA (offshore) |

| Segregated Accounts | Separate from the company's operating funds, protecting clients' funds in case of bankruptcy |

| Negative Balance Protection | Ensuring that clients cannot lose more than their account balance |

| SSL Encryption | To protect its clients' personal and financial information during transmission |

| Two-Factor Authentication | As an extra layer of security to protect clients' accounts from unauthorized access |

| Investor Compensation Fund | Provides additional protection to clients in the event of BDSWISS's insolvency |

These measures help to ensure that BDSWISS provides a safe and secure trading environment for its clients.

Based on the information provided, BDSWISS appears to be a reliable and reputable online broker. It is offshore regulated by Seychelles Financial Services Authority (FSA), offers negative balance protection and segregates client funds. However, it is important to note that all trading carries risks, and clients should always do their own research and take appropriate precautions.

BDSwiss offers 250+ trading instruments across various asset classes, providing traders with numerous options for diversification. Forex traders can access over 50 currency pairs, including major, minor, and exotic pairs. The platform also offers CFD trading on precious metals such as gold, silver, and platinum, as well as energy products like crude oil and natural gas. Additionally, traders can choose from a range of popular stock CFDs, including shares of leading companies in the US, Europe, and Asia. BDSwiss also provides access to a range of global stock indices, such as the S&P 500, FTSE 100, DAX 30, and Nikkei 225. Finally, the platform offers trading on popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Demo Account: BDSWISS provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: BDSWISS offers a total of 3 account types: Classic, VIP, and Raw. The minimum deposit to open an account is $10, $500 and $500 respectively. The threshold to open an account at BDSWISS is quite low. However, we should also realize that too little capital not only reduces losses, but also reduces profitability. Therefore, you may find it “unexciting” or unprofitable. In addition, accounts with smaller initial deposits tend to have poorer trading conditions.

BDSWISS offers a maximum leverage of up to 1:500 for all account types, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

BDSwiss offers variable spreads and commissions based on the type of trading account. Classic accounts have a minimum spread of 1.5 pips with no commission, while VIP accounts have a lower minimum spread of 1.1 pips and are also commission-free. Raw accounts, on the other hand, offer raw spreads starting from 0.0 pips but have to pay a commission of $5 per traded lot. Overall, BDSwiss' spreads and commissions are competitive compared to other brokers in the market. It's essential to note that spreads can fluctuate depending on market volatility, trading volumes, and other market conditions.

It is commendable that in the trading instruments interface, BDSWISS provides a detailed table showing the spreads, swaps, commissions and pip value of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| BDSWISS | 1.5 pips | Free |

| FxPro | 1.4 pips | Free |

| Trade Nation | 0.6 pips | Free |

| GO Markets | 0.5 pips | Free |

Note: Spreads can vary depending on market conditions and volatility.

As for the trading platform, BDSWISS provides its clients with many options. There are public platforms such as MT4 and MT5 that have served many clients worldwide, also BDSWISS's own platforms - BDSwiss Mobile APP, BDSwiss WebTrader. If you didn't want to spend time familiarizing yourself with a new platform, you could choose MT5 and MT4. But BDSWISS's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

Overall, BDSWISS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| BDSWISS | MetaTrader 4, MetaTrader 5, BDSWISS WebTrader, BDSWISS Mobile App |

| FxPro | MetaTrader 4, MetaTrader 5, FxPro cTrader, FxPro Edge |

| Trade Nation | Proprietary Trading Platform |

| Go Markets | MetaTrader 4, MetaTrader 5, Go Trader, WebTrader |

Note: It's worth mentioning that brokers may offer additional trading platforms or withdraw some trading platforms over time.

BDSWISS provides a range of trading tools to help its clients in their trading activities.

The economic calendar allows traders to keep track of important upcoming events that can affect the markets.

The VPS service provides fast and reliable connection to BDSWISS servers for traders who use automated trading strategies.

The Trade Companion is a trading assistant that provides users with insights and trading signals.

The Trends Analysis tool helps traders to identify trends and make better trading decisions.

Trading Central provides technical analysis and market insights.

The Autochartist tool analyzes charts and helps traders to identify trading opportunities.

Trading Alerts notify users of important market events.

The Currency Heatmap tool allows traders to see the relative strength of different currencies.

Finally, the Trading Calculators help traders to manage their risk and calculate their potential profits and losses.

BDSWISS offers a wide range of deposit and withdrawal options, including Visa, MasterCard, Skrill, Neteller, Bank Wire, Pay Retailers, cryptocurrencies, AstroPay, Globepay, MPESA, airtel tiGo, korapay, and more.

The broker does not charge any fees for deposits or withdrawals via credit card, while for bank wire withdrawals equal to or less than €100, BDSwiss will charge a €10 flat fee.

| BDSWISS | Most other | |

| Minimum Deposit | $10 | $100 |

Most deposits are processed instantly. For withdrawals, BDSWISS strives to process most requests within 24 hours, although the processing time may vary depending on the payment method used and the verification requirements. Overall, BDSWISS offers convenient and cost-effective deposit and withdrawal options for its clients.

To withdraw funds from BDSWISS, you need to follow these steps:

Step 1: Log in to your BDSWISS account

Step 2: Click on the “Withdrawal” option in the main menu.

Step 3: Select your preferred withdrawal method from the available options.

Step 4: Enter the amount you want to withdraw and provide any additional information requested.

Step 5: Click on the “Submit” button to process the withdrawal request.

BDSWISS charges overnight fees on all positions that are held open overnight, and the rates depend on the instrument being traded. The broker also charges a currency conversion fee for deposits made in a currency different from the account currency. Moreover, if no trading activity occurs for over 90 days, a monthly fee of $30 will be deducted from your account balance, until the account balance is 0. This charges covers the maintenance/administration expenses of such inactive accounts. It is important for traders to keep these fees in mind when planning their trading activities, as they can impact the overall profitability of their trades.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| BDSWISS | None | None | Yes, after 90 days |

| FxPro | None | None | None |

| Trade Nation | None | None | None |

| Go Markets | None | None | Yes, after 6 months |

Below are the details about the customer service.

Languages: English, polish, German, Italian, French, Arabic, Thai, Filipino, Chinese, Indonesian, Portuguese, Romanian, Russian, Turkish, Danish, Norwegian, Korean, Czech, Malay, Vietnamese, etcetera.

Service Hours: 24/5 multilingual live chat

Phone Number: +44 2036705890

Email: support@global.bdswiss.com

Social media: Facebook, Instagram, LinkedIn, YouTube, Twitter, Telegram

Address: Suite 3, Global Village, Jivans Complex, Mont Fleuri, Mahe, Seychelles.

Help/Support Centre are also available.

| Pros | Cons |

| • 24/5 Multilingual customer support available | • No 24/7 customer support |

| • Live chat, phone, and email support | |

| • Personal account manager for VIP accounts | |

| • Help/Support Centre available on the website |

Note: These pros and cons are based on our research and analysis of BDSWISS' customer service. Your personal experience may vary.

Overall, BDSWISS' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

BDSWISS provides a range of educational resources to assist traders in improving their trading knowledge and skills. They offer a variety of educational materials, including Forex eBooks, LIVE Education, Forex Basic Lessons, Forex Glossary, Educational Videos, and Seminars.

Their Forex eBooks cover various topics, such as trading psychology, technical analysis, and risk management, to help traders develop a well-rounded understanding of the Forex market.

They also provide live education through webinars, which are hosted by industry experts, and interactive training sessions.

The Forex Basic Lessons are designed to help beginner traders learn the basics of Forex trading.

Additionally, they offer educational videos that cover different aspects of trading, and traders can attend in-person seminars held in different locations globally.

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

All in all, BDSWISS offers a diverse range of trading instruments with competitive spreads and commissions on different account types. The broker provides a variety of deposit and withdrawal options with no fees charged, and fast processing times. BDSWISS also offers various educational resources and trading tools to enhance clients trading experience. However, is offshore regulated by Seychelles Financial Services Authority (FSA) and there are some negative reviews from their clients saying that they have met severe slippage and unable to withdraw. Every trader should be cautious before trading or investing with a broker.

| Q 1: | Is BDSWISS regulated? |

| A 1: | No. The Seychelles Financial Services Authority (FSA) license BDSWISS holds is offshore. |

| Q 2: | Does BDSWISS offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does BDSWISS offer the industry-standard MT4 & MT5? |

| A 3: | Yes. It supports MT4, MT5, BDSwiss Mobile APP, and BDSwiss WebTrader. |

| Q 4: | What is the minimum deposit for BDSWISS? |

| A 4: | The minimum initial deposit to open an account is only $10. |

| Q 5: | Is BDSWISS a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it offers demo MT4 and MT5 accounts that allow traders to practice trading without risking any real money, and it also offers rich educational resources. However, their FSA license seems to be offshore, take care! |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive windsor-brokers and bdswiss are, we first considered common fees for standard accounts. On windsor-brokers, the average spread for the EUR/USD currency pair is 0.1 pips, while on bdswiss the spread is From 1.5.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

windsor-brokers is regulated by CYSEC,FSC,FSA,BaFin. bdswiss is regulated by CYSEC,FSA,NFA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

windsor-brokers provides trading platform including Standard account,ECN VIP,ECN Standard and trading variety including Foreign exchange, precious metals, CFDs. bdswiss provides trading platform including Classic,Cent,Premium,Raw,VIP and trading variety including Forex CFDs, Stocks CFDs, Indices CFDs, Commodities CFDs, Cryptocurrencies CFDs.