No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between WELTRADE and Justforex ?

In the table below, you can compare the features of WELTRADE , Justforex side by side to determine the best fit for your needs.

EURUSD: 0.2

XAUUSD: 1.6

Long: -11.75

Short: -5

Long: -43

Short: -30

EURUSD: 2.2

XAUUSD: 1.4

Long: -5.8

Short: -0.09

Long: -42.79

Short: --

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of weltrade, justforex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| WELTRADE Review Summary in 10 Points | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | FSCA (exceeded) |

| Market Instruments | forex, Index CFDs, commodities, stock CFDs, metals and digital currencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | Floating from 0.5 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $1 |

| Customer Support | 24/7 live chat, phone, email |

Established in 2006, WELTRADE, a trading name of Systemgates Capital Ltd, is allegedly an online CFDs broker incorporated in Saint Vincent and the Grenadines and regulated in Belarus that provides its clients with the worlds most widely-used MetaTrader4 and MetaTrader5 trading platforms, flexible leverage up to 1:1000, floating spreads on various tradable assets, a choice of four different live account types, as well as auto-trading service and 24/7 customer support service. As for regulation, WELTRADE holds an exceeded Financial Sector Conduct Authority (FSCA) license.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

WELTRADE has several advantages, such as a variety of trading instruments, flexible leverage options, and a range of account types suitable for traders at different levels. The broker also provides a range of trading platforms and tools, as well as 24/7 customer support.

However, the negative reviews from some customers regarding withdrawal issues and scams are concerning. Additionally, the lack of valid regulatory license may be a cause for caution. Traders should always exercise caution when selecting a broker and conduct thorough research before investing.

| Pros | Cons |

| • Negative balance protection | • Exceeded FSCA license |

| • Multiple account types to choose from | • Negative reviews and reports of scams |

| • Flexible leverage options | • Clients from the USA, Canada, EU, Belarus and Russia are not accepted |

| • Low spreads with no commissions | |

| • MT4 and MT5 supported | |

| • Low minimum deposit ($1) | |

| • Multiple deposit and withdrawal methods | |

| • 24/7 customer support |

There are many alternative brokers to WELTRADE depending on the specific needs and preferences of the trader. Some popular options include:

CMC Markets - A reliable broker with a long history and competitive pricing.

FOREX TB - A broker with a wide range of trading instruments and a user-friendly platform.

GMO - A well-known Japanese broker with with a strong focus on technology and innovation.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

The fact that WELTRADE is regulated by Financial Sector Conduct Authority (FSCA) in South Africa is a positive point, but the negative reviews from clients are concerning. The negative reviews, including clients saying they are unable to withdraw and accusing WELTRADE of being a scam, cannot be ignored.

The fact that WELTRADE offers negative balance protection is a good thing, but it does not necessarily guarantee the safety of the investment. It is important to exercise caution when investing with any broker, and it is recommended to thoroughly research and gather information before making any investment decisions.

WELTRADE offers a diverse range of market instruments to trade including Forex, metals, commodities, index CFDs, and CFDs for digital instruments such as Bitcoin, Litecoin, and Ethereum. The Forex instruments include a variety of major, minor, and exotic currency pairs, with competitive spreads and high leverage options available. The commodity markets available to trade include precious metals like gold and silver, as well as energy products such as oil and gas.

Furthermore, traders can also access a variety of CFDs on popular stock indices from around the world. WELTRADE's offering of digital instrument CFDs allows traders to participate in the growing cryptocurrency market with competitive conditions.

WELTRADE's account types cater to traders of all levels, with the Micro account being suitable for beginners and the Premium account for advanced traders.

The Micro account has a minimum deposit requirement of $1, making it accessible for those who want to start with a small investment. The Pro account requires a minimum deposit of $100, and it is considered the best choice according to the broker's website. The Premium account requires a minimum deposit of $25,000 and offers additional features and benefits for advanced traders.

It is worth noting that traders should carefully consider their level of experience and investment goals when choosing an account type.

| Account type | Micro | Pro | Premium |

| Minimum deposit | $1 | $100 | $25 |

| Average speed of deal execution | from 0.9 second | from 0.5 second | from 0.8 second |

| Account currency | cents USD / cents EUR | USD | USD / EUR |

| Spread | Floatingfrom 1.5 pips | Floatingfrom 0.5 pips | Floatingfrom 1.5 pips |

| Minimum volume of one order | 0.01 lots | ||

| Maximum volume of one order | 1000 lots | 100 lots | 100 lots |

| Leverage | 1:33 - 1:1000 | 1:1-1:1000 | 1:33 - 1:1000 |

| Margin Call Level | 100% | ||

| Stop Out Level | 10%, 20% for digital instruments | ||

| Interest rate | / | 5% | 3.5% |

| Interest rate | No | ||

| Trading platform | MetaTrader 4 / MetaTrader 5 | ||

| Automatic trading | Yes | ||

| Swap | |||

Traders holding different account types can enjoy different maximum leverage ratios. Clients on the Micro or Premium account can enjoy flexible leverage ranging from 1:33 to 1:1000, while the Pro account with the leverage of 1:1-1:1000. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads are influenced by what type of accounts traders are holding. WELTRADE reveals that the spread on the Micro and Premium accounts is floating from 1.5 pips, while the clients on the Pro account can experience floating spreads from 0.5 pips. All charging no commissions. It is important for traders to understand the different spread and commission structures before opening an account with WELTRADE.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| WELTRADE | From 0.5 pips | None |

| CMC Markets | From 0.7 pips | None |

| FOREX TB | From 0.5 pips | None |

| GMO | From 0.8 pips | None |

Note: Spreads can vary depending on market conditions and volatility.

When it comes to trading platforms available, WELTRADE gives a variety of trading platforms to suit different traders' needs. The popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are available for download on iOS and Android devices, as well as on desktop and Mac OS. These platforms are well-known in the industry for their user-friendly interface, advanced charting tools, and the ability to support automated trading through the use of Expert Advisors.

In addition, WELTRADE also offers the Web Terminal platform, which is accessible through a web browser, allowing traders to trade from any device with an internet connection.

Overall, WELTRADE's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| WELTRADE | MT4, MT5 |

| CMC Markets | CMC Next Generation, MT4, MT5, Stockbroking platform |

| FOREX TB | MT4, MT5, WebTrader, MobileTrader |

| GMO | Z.com Trader, MT4, FXBook Mobile, Z.com Trader Mobile, FXBook Web |

Note: This table is subject to change as brokers may add or remove trading platforms over time.

In addition to its trading platforms, WELTRADE provides traders with some trading tools to assist with their trading decisions. One of these tools is the Trading Calculator, which enables traders to estimate their potential profits or losses on a trade before executing it.

The Economic Calendar is also available to traders, which shows upcoming economic events and releases and their expected impact on the markets. These tools can be useful for traders who want to keep up with the latest market news and make informed trading decisions.

WELTRADE accepts deposits and withdrawals with credit/debit cards, like Visa and MasterCard Skrill, Neteller, digital currencies, Perfect Money, Indonesia Local Bank, and Fasapay,making it convenient for traders from different countries. The minimum deposit amount depends on the terms of the payment system.

| WELTRADE | Most other | |

| Minimum Deposit | $1 | $100 |

Deposits via Indonesia Local Bank can be processed in 24 hours, while other deposits are instant. All withdrawal requests are said to be processed within 30 minutes and the broker supports 24/7 withdrawals. More details can be found in the below screenshots.

However, it is important for traders to carefully review the terms and conditions of each payment method, as well as any potential fees or limitations that may apply. More details can be found in the below screenshots.

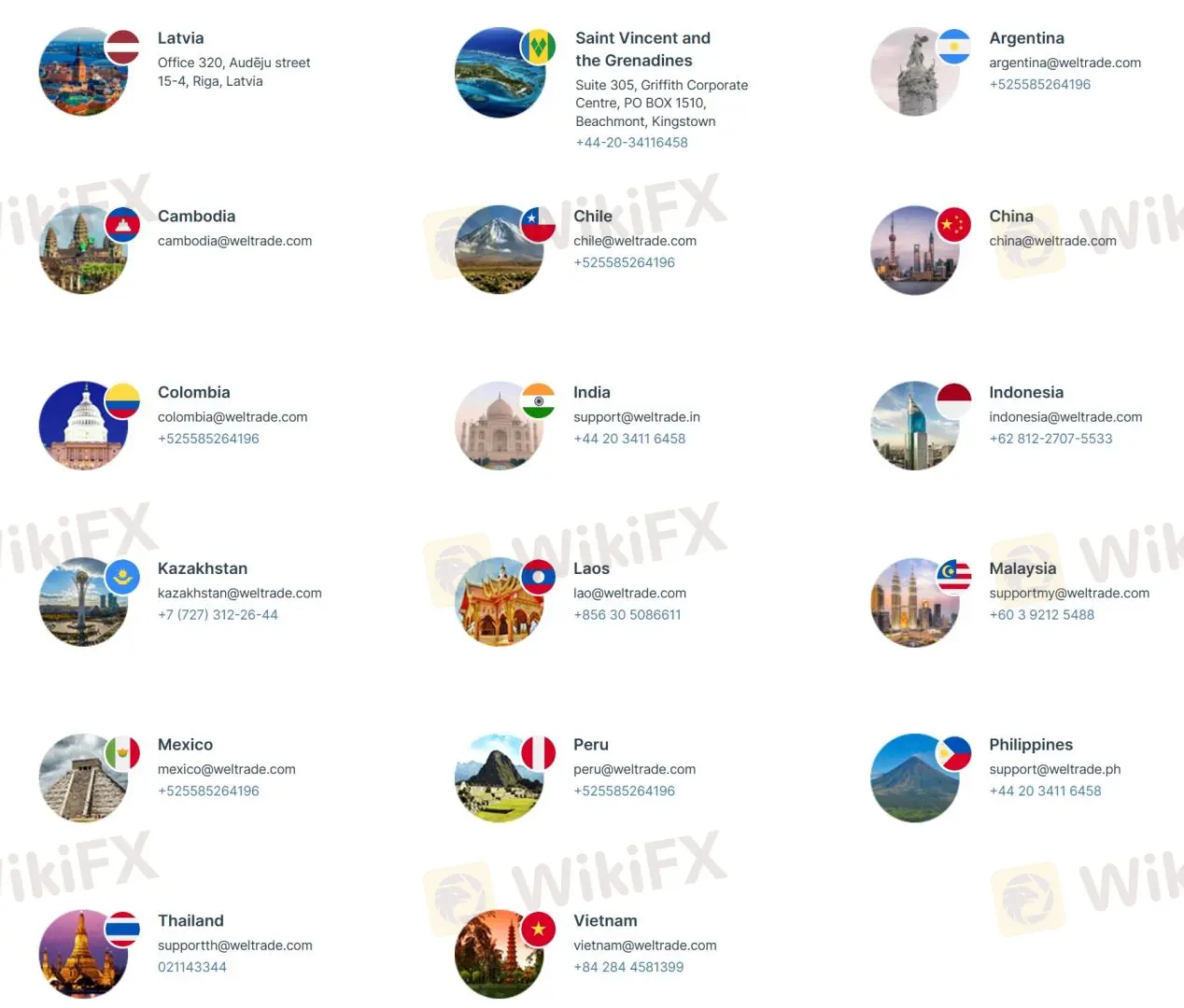

It is a good sign that WELTRADE offers multiple ways to get in touch with their customer support team, including 24/7 Live chat, phone, email, online messaging, or request a callback. The broker also has a presence on popular social media platforms, including Twitter, Facebook, Instagram and Line, which may be convenient for some traders. It should be noted that the broker is registered in Saint Vincent and the Grenadines, which is not a heavily regulated jurisdiction, so traders should exercise caution and do their due diligence before investing.

Overall, WELTRADE's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/7 multi-channel support available | • Registered address is shady |

| • Active presence on social media platforms for easy communication | |

| • Support for multiple languages |

Note: These pros and cons are subjective and may vary depending on the individual's experience with WELTRADE's customer service.

WELTRADE offers a range of educational resources to help traders improve their knowledge and skills. The broker provides market news and analytics to keep clients updated on the latest market trends and developments. In addition, WELTRADE offers training and seminars to help traders learn the basics of trading, as well as more advanced strategies. The MetaTrader guide is also available for traders to learn how to use the trading platform effectively. These educational resources can help traders make better-informed trading decisions and improve their overall trading performance.

It is important to exercise caution when investing with any broker, and this includes WELTRADE. It is concerning to see reports of scams and issues with withdrawals from some users. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Based on the information available, WELTRADE is a Forex and CFD broker offering a range of trading instruments, account types, and platforms. It has some attractive features such as competitive spreads, a wide range of payment methods, and negative balance protection.

However, there are also some concerns raised by clients regarding withdrawal issues and scams. Additionally, the broker is registered in Saint Vincent and the Grenadines, which is a less regulated jurisdiction compared to major financial centers. Traders should exercise caution and conduct their own research before investing with WELTRADE or any other broker.

| Q 1: | Is WELTRADE regulated? |

| A 1: | No. WELTRADE holds an exceeded Financial Sector Conduct Authority (FSCA) license. |

| Q 2: | At WELTRADE, are there any regional restrictions for traders? |

| A 2: | Yes. Not for residents of the USA, Canada, EU, Belarus and Russia and other not-supported (restricted) countries. |

| Q 3: | Does WELTRADE offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does WELTRADE offer the industry-standard MT4 & MT5? |

| A 4: | Yes. Both MT4 and MT5 are supportable. |

| Q 5: | What is the minimum deposit for WELTRADE? |

| A 5: | The minimum initial deposit to open an account is only $1. |

| Q 6: | Is WELTRADE a good broker for beginners? |

| A 6: | No. WELTRADE is not a good choice for beginners. Though it seems to offer competitive trading conditions, it lacks legitimate regulation. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Justforex Review Summary in 10 Points | |

| Founded | 2012 |

| Registered Country/Region | Seychelles |

| Regulation | FSC (revoked), FSA (suspicious clone) |

| Market Instruments | Forex currency pairs, Gold, Silver, indices, stocks, and CFDs |

| Demo Account | Available |

| Leverage | 1:3000 |

| EUR/USD Spread | 0.1 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $1 |

| Customer Support | 24/7 live chat, phone, email |

Justforex is a forex and CFD broker founded in 2012 and registered in Seychelles that offers a wide range of trading instruments, including currency pairs, precious metals, stocks, and indices. The company provides various account types and trading platforms, as well as competitive spreads and leverage options. Justforex also offers a range of educational materials and customer support options.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Justforex offers a wide range of trading instruments, multiple account types with no commission, and 24/7 customer support through various channels. They also provide various educational resources for traders. However, they are currently unregulated, which may pose some risks to traders.

| Pros | Cons |

| • Wide range of financial instruments | • No regulation |

| • Low minimum deposit requirement ($1) | • Clients from Australia, Canada, the EU and EEA, Japan, the United Kingdom, the United States are not accepted |

| • Demo accounts available | • Negative reviews |

| • Multiple account types | |

| • MT4 & MT5 supported | |

| • Multiple payment methods | |

| • No fees for deposits and withdrawals | |

| • Social trading feature available |

There are many alternative brokers to Justforex depending on the specific needs and preferences of the trader. Some popular options include:

Tickmill - With its competitive trading conditions, comprehensive educational resources, and reliable customer support, Tickmill is a popular choice among traders looking for a trustworthy and feature-rich forex broker.

Axi - As a regulated and award-winning broker, Axi offers traders a wide range of trading instruments, cutting-edge trading platforms, and excellent customer support, making it a top choice for both novice and experienced traders.

FXOpen - With its user-friendly trading platforms, low trading fees, and excellent customer service, FXOpen is a popular choice for traders looking for a reliable and well-regulated forex broker.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

The fact that Justforex is unregulated and its Financial Services Commission (FSC) license is revoked and Seychelles Financial Services Authority (FSA) license is a suspicious clone raises some concerns about its safety and legitimacy. Additionally, there are some complaints and negative reviews from their clients saying that they are unable to withdraw. However, the broker does offer various protection measures to its clients, such as segregated accounts and protection from negative balance. It is important to thoroughly research and consider these factors before deciding to trade with Justforex.

Justforex offers a diverse range of 170+ financial instruments that include Forex currency pairs, precious metals, stock indices, popular stocks, and CFDs. With such a diverse range of instruments, Justforex provides ample trading opportunities for investors of different levels and preferences.

To meet the needs and trading experience of different investors, Justforex offers four different types of accounts: Standard Cent Accounts (minimum deposit of $1), Standard Accounts (minimum deposit of $1), Pro Accounts (minimum deposit of $100), and Raw Spreads Accounts (minimum deposit of $100).

The Standard Cent account is ideal for novice traders who want to start trading with a small amount of money, while the Standard and Pro accounts are suitable for more experienced traders who want to access additional features and trading tools. The Raw Spreads account type offers tight spreads and is designed for high-volume traders.

It's worth noting that all account types are swap-free, which is especially important for traders who follow Islamic finance principles. Additionally, demo accounts are available for all account types, which is a great way to test the platform and trading strategies before investing real money.

Surprisingly, the maximum trading leverage offered by Justforex is super high, reaching up to 1:3000, which allows traders to open larger positions with smaller amounts of capital. Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders. Inexperienced traders are not advised to use such high leverage level. Additionally, it is worth noting that some financial instruments may have lower maximum leverage levels due to market conditions and regulatory requirements.

Justforex offers different spreads and commissions depending on the account type. Standard Cent and Standard accounts have spreads starting from 0.3 pips, while Pro accounts have spreads starting from 0.1 pips. Raw Spread accounts offer raw spreads starting from 0 pips, but a commission of 3 units of the base currency per lot is charged. No commission is charged for trading on Standard Cent, Standard, and Pro accounts. It is important to note that the spreads and commissions may vary depending on market conditions and liquidity.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Justforex | 0.3 pips | None |

| Tickmill | 0.0 pips | $2/lot RT |

| Axi | 0.2 pips | None |

| FXOpen | 0.5 pips | $3.5/lot RT |

Justforex offers MT4, MT4 PC, MT4 Android, MT4 iPhone, MT4 Web, MT5, MT5 PC, MT5 Android, MT5 iPhone, MT5 Web to meet a wide range of user needs. MT4 offers 9 timeframes, the ability to trade via charts, automated trading, and MT5 is the latest version of MT4, which is more intuitive and offers significant improvements in copy trading, mobile trading, and other innovative features for more efficient trading account management.

Overall, Justforex's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Justforex | MetaTrader 4, MetaTrader 5, WebTrader |

| Tickmill | MetaTrader 4, MetaTrader 5, WebTrader |

| Axi | MetaTrader 4, MetaTrader 5 |

| FXOpen | MetaTrader 4, MetaTrader 5, WebTrader, TickTrader (mobile) |

Justforex offers several trading tools to help its clients trade more efficiently and effectively. One of these tools is social trading, which allows traders to follow and copy the trades of successful and experienced traders. This feature is available on both MT4 and MT5 platforms and is facilitated through the MQL5 community. Traders can browse through the profiles of different signal providers, assess their performance, and subscribe to their trading signals. By copying the trades of successful traders, traders can learn from their strategies, improve their own trading skills, and potentially increase their profits.

Just Forex supports traders to deposit and withdraw funds to their accounts via Bank cards (Visa/MasterCard), Skrill, Neteller, Perfect Money, STICPAY, AIRTM, cryptocurrencies of bitcoin, Bitcoin Cash, Ethereum, USD Coin, Tether, BUSD, BINANCE, DOGECOIN, Litecoin and XRP, local banks, and Fasapay.

Minimum deposit and withdrawal amount vary on the payment method. No fees for deposits and withdrawals. Deposits are instant, while withdrawals can be processed within 1-2 hours.

| Justforex | Most other | |

| Minimum Deposit | $1 | $100 |

See the deposit & withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| Justforex | None | None |

| Tickmill | None | None for certain methods, fees up to $25 for others |

| Axi | None | None |

| FXOpen | None | None for certain methods, fees up to $50 for others |

Please note that the fees listed above are subject to change and may vary depending on the payment method and other factors. It's always best to check with the broker directly for the most up-to-date and accurate fee information.

The Justforex customer support is available 24/7, accessible via live chat, e-mail, phone, request a callback, live chat, Telegram, Viber, Messenger, Line, Instagram, WhatsApp and iMessage. Additionally, the FAQ section can be helpful for clients who prefer to find answers on their own.

| Pros | Cons |

| • Available 24/7 through multiple channels | • Some complex issues may require longer resolution time |

| • FAQ section available for quick solutions | |

| • Trained and knowledgeable support staff | |

| • Multilingual support available |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Justforex's customer service.

Justforex offers a comprehensive Learning Center with a range of educational resources that cater to the needs of both beginner and experienced traders. The center features a series of online webinars that cover a range of topics, including trading strategies, risk management, technical analysis, and more. Traders can also access a wide range of forex articles that cover market news, trends, and analysis. Additionally, the center provides a forex glossary that includes definitions of common trading terms and jargon. To further support trader education, Justforex also offers educational videos that cover a range of topics and can help traders to improve their trading skills and knowledge.

On our website, you can see that some users have reported scams and unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

All things considered, Justforex is an online broker offering a wide range of financial instruments, account types, and trading platforms. They provide 24/7 customer support, educational resources, and convenient deposit and withdrawal options with no fees.

However, the lack of proper regulation and the suspicious nature of their licenses may be concerning for some investors. In addition, there have been some negative reviews from their clients. Overall, Justforex may be a suitable choice for experienced traders who prioritize a wide range of instruments and trading platforms and do not mind the lack of regulation and negative reviews.

| Q 1: | Is Justforex regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At Justforex, are there any regional restrictions for traders? |

| A 2: | Yes. Justforex does not offer and does not provide services to residents and citizens of certain jurisdictions, including Australia, Canada, the EU and EEA, Japan, the United Kingdom, the United States, and countries sanctioned by the EU. |

| Q 3: | Does Justforex offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Justforex offer the industry-standard MT4 & MT5? |

| A 4: | Yes. Both MT4 and MT5 are available. |

| Q 5: | What is the minimum deposit for Justforex? |

| A 5: | The minimum initial deposit to open an account is only $1. |

| Q 6: | Is Justforex a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Thought is advertises well, dont forget that they are unregulated. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive weltrade and justforex are, we first considered common fees for standard accounts. On weltrade, the average spread for the EUR/USD currency pair is from 0.5 pips, while on justforex the spread is 0.3.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

weltrade is regulated by NBRB,FSC,FSCA. justforex is regulated by FSC,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

weltrade provides trading platform including Pro,Premium,Micro and trading variety including --. justforex provides trading platform including Standard Cent,Raw Spread,Pro,Standard and trading variety including --.