No data

Do you want to know which is the better broker between WELTRADE and FBS ?

In the table below, you can compare the features of WELTRADE , FBS side by side to determine the best fit for your needs.

EURUSD: 0.3

XAUUSD: 0.4

Long: -7.5

Short: -2.5

Long: -43

Short: -30

EURUSD: 0.2

XAUUSD: 0.6

Long: -5.46

Short: 0.61

Long: -29.9

Short: 6.05

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of weltrade, fbs lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| WELTRADE Review Summary in 10 Points | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | FSCA (exceeded) |

| Market Instruments | forex, Index CFDs, commodities, stock CFDs, metals and digital currencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | Floating from 0.5 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $1 |

| Customer Support | 24/7 live chat, phone, email |

Established in 2006, WELTRADE, a trading name of Systemgates Capital Ltd, is allegedly an online CFDs broker incorporated in Saint Vincent and the Grenadines and regulated in Belarus that provides its clients with the worlds most widely-used MetaTrader4 and MetaTrader5 trading platforms, flexible leverage up to 1:1000, floating spreads on various tradable assets, a choice of four different live account types, as well as auto-trading service and 24/7 customer support service. As for regulation, WELTRADE holds an exceeded Financial Sector Conduct Authority (FSCA) license.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

WELTRADE has several advantages, such as a variety of trading instruments, flexible leverage options, and a range of account types suitable for traders at different levels. The broker also provides a range of trading platforms and tools, as well as 24/7 customer support.

However, the negative reviews from some customers regarding withdrawal issues and scams are concerning. Additionally, the lack of valid regulatory license may be a cause for caution. Traders should always exercise caution when selecting a broker and conduct thorough research before investing.

| Pros | Cons |

| • Negative balance protection | • Exceeded FSCA license |

| • Multiple account types to choose from | • Negative reviews and reports of scams |

| • Flexible leverage options | • Clients from the USA, Canada, EU, Belarus and Russia are not accepted |

| • Low spreads with no commissions | |

| • MT4 and MT5 supported | |

| • Low minimum deposit ($1) | |

| • Multiple deposit and withdrawal methods | |

| • 24/7 customer support |

There are many alternative brokers to WELTRADE depending on the specific needs and preferences of the trader. Some popular options include:

CMC Markets - A reliable broker with a long history and competitive pricing.

FOREX TB - A broker with a wide range of trading instruments and a user-friendly platform.

GMO - A well-known Japanese broker with with a strong focus on technology and innovation.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

The fact that WELTRADE is regulated by Financial Sector Conduct Authority (FSCA) in South Africa is a positive point, but the negative reviews from clients are concerning. The negative reviews, including clients saying they are unable to withdraw and accusing WELTRADE of being a scam, cannot be ignored.

The fact that WELTRADE offers negative balance protection is a good thing, but it does not necessarily guarantee the safety of the investment. It is important to exercise caution when investing with any broker, and it is recommended to thoroughly research and gather information before making any investment decisions.

WELTRADE offers a diverse range of market instruments to trade including Forex, metals, commodities, index CFDs, and CFDs for digital instruments such as Bitcoin, Litecoin, and Ethereum. The Forex instruments include a variety of major, minor, and exotic currency pairs, with competitive spreads and high leverage options available. The commodity markets available to trade include precious metals like gold and silver, as well as energy products such as oil and gas.

Furthermore, traders can also access a variety of CFDs on popular stock indices from around the world. WELTRADE's offering of digital instrument CFDs allows traders to participate in the growing cryptocurrency market with competitive conditions.

WELTRADE's account types cater to traders of all levels, with the Micro account being suitable for beginners and the Premium account for advanced traders.

The Micro account has a minimum deposit requirement of $1, making it accessible for those who want to start with a small investment. The Pro account requires a minimum deposit of $100, and it is considered the best choice according to the broker's website. The Premium account requires a minimum deposit of $25,000 and offers additional features and benefits for advanced traders.

It is worth noting that traders should carefully consider their level of experience and investment goals when choosing an account type.

| Account type | Micro | Pro | Premium |

| Minimum deposit | $1 | $100 | $25 |

| Average speed of deal execution | from 0.9 second | from 0.5 second | from 0.8 second |

| Account currency | cents USD / cents EUR | USD | USD / EUR |

| Spread | Floatingfrom 1.5 pips | Floatingfrom 0.5 pips | Floatingfrom 1.5 pips |

| Minimum volume of one order | 0.01 lots | ||

| Maximum volume of one order | 1000 lots | 100 lots | 100 lots |

| Leverage | 1:33 - 1:1000 | 1:1-1:1000 | 1:33 - 1:1000 |

| Margin Call Level | 100% | ||

| Stop Out Level | 10%, 20% for digital instruments | ||

| Interest rate | / | 5% | 3.5% |

| Interest rate | No | ||

| Trading platform | MetaTrader 4 / MetaTrader 5 | ||

| Automatic trading | Yes | ||

| Swap | |||

Traders holding different account types can enjoy different maximum leverage ratios. Clients on the Micro or Premium account can enjoy flexible leverage ranging from 1:33 to 1:1000, while the Pro account with the leverage of 1:1-1:1000. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads are influenced by what type of accounts traders are holding. WELTRADE reveals that the spread on the Micro and Premium accounts is floating from 1.5 pips, while the clients on the Pro account can experience floating spreads from 0.5 pips. All charging no commissions. It is important for traders to understand the different spread and commission structures before opening an account with WELTRADE.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| WELTRADE | From 0.5 pips | None |

| CMC Markets | From 0.7 pips | None |

| FOREX TB | From 0.5 pips | None |

| GMO | From 0.8 pips | None |

Note: Spreads can vary depending on market conditions and volatility.

When it comes to trading platforms available, WELTRADE gives a variety of trading platforms to suit different traders' needs. The popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are available for download on iOS and Android devices, as well as on desktop and Mac OS. These platforms are well-known in the industry for their user-friendly interface, advanced charting tools, and the ability to support automated trading through the use of Expert Advisors.

In addition, WELTRADE also offers the Web Terminal platform, which is accessible through a web browser, allowing traders to trade from any device with an internet connection.

Overall, WELTRADE's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| WELTRADE | MT4, MT5 |

| CMC Markets | CMC Next Generation, MT4, MT5, Stockbroking platform |

| FOREX TB | MT4, MT5, WebTrader, MobileTrader |

| GMO | Z.com Trader, MT4, FXBook Mobile, Z.com Trader Mobile, FXBook Web |

Note: This table is subject to change as brokers may add or remove trading platforms over time.

In addition to its trading platforms, WELTRADE provides traders with some trading tools to assist with their trading decisions. One of these tools is the Trading Calculator, which enables traders to estimate their potential profits or losses on a trade before executing it.

The Economic Calendar is also available to traders, which shows upcoming economic events and releases and their expected impact on the markets. These tools can be useful for traders who want to keep up with the latest market news and make informed trading decisions.

WELTRADE accepts deposits and withdrawals with credit/debit cards, like Visa and MasterCard Skrill, Neteller, digital currencies, Perfect Money, Indonesia Local Bank, and Fasapay,making it convenient for traders from different countries. The minimum deposit amount depends on the terms of the payment system.

| WELTRADE | Most other | |

| Minimum Deposit | $1 | $100 |

Deposits via Indonesia Local Bank can be processed in 24 hours, while other deposits are instant. All withdrawal requests are said to be processed within 30 minutes and the broker supports 24/7 withdrawals. More details can be found in the below screenshots.

However, it is important for traders to carefully review the terms and conditions of each payment method, as well as any potential fees or limitations that may apply. More details can be found in the below screenshots.

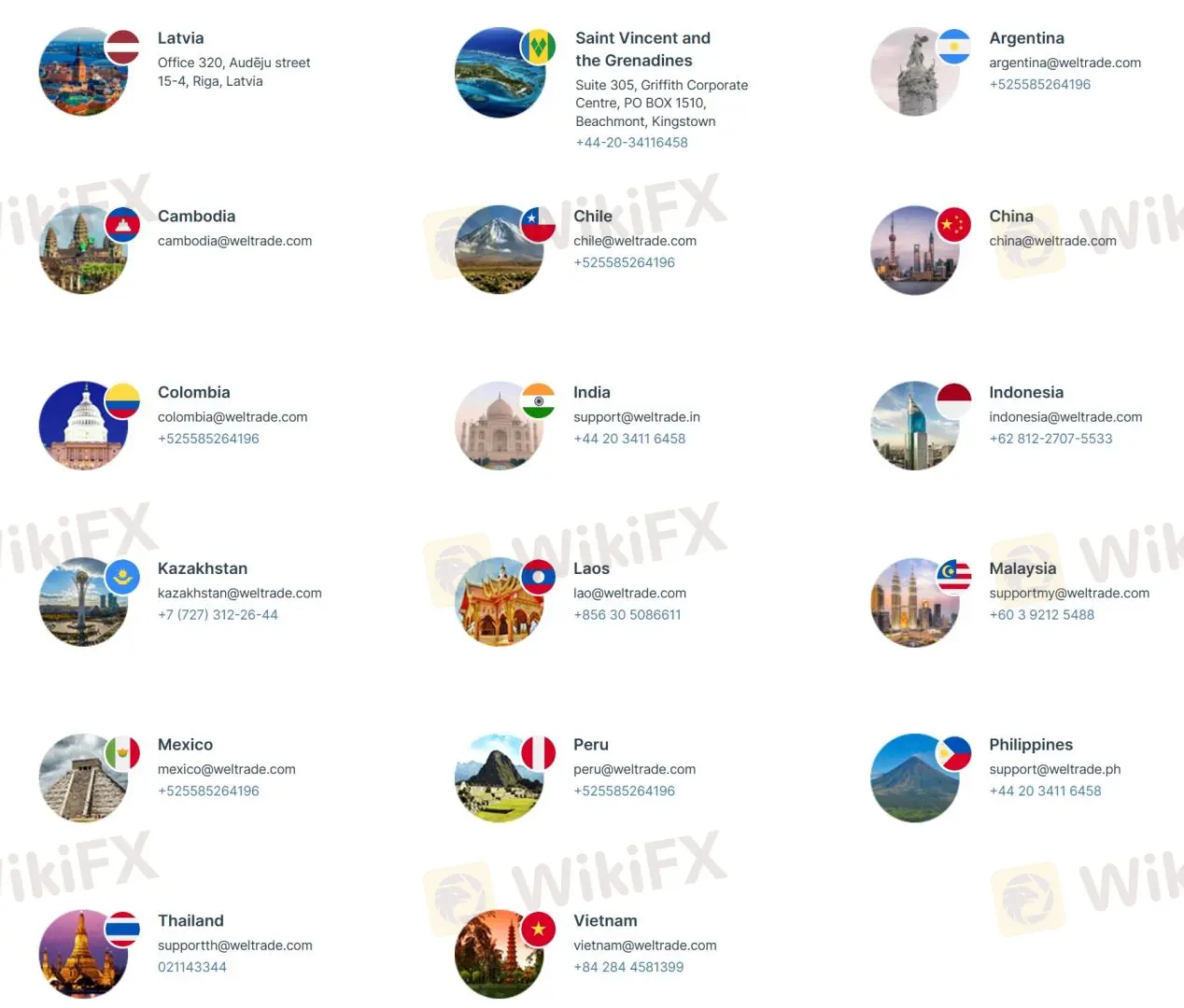

It is a good sign that WELTRADE offers multiple ways to get in touch with their customer support team, including 24/7 Live chat, phone, email, online messaging, or request a callback. The broker also has a presence on popular social media platforms, including Twitter, Facebook, Instagram and Line, which may be convenient for some traders. It should be noted that the broker is registered in Saint Vincent and the Grenadines, which is not a heavily regulated jurisdiction, so traders should exercise caution and do their due diligence before investing.

Overall, WELTRADE's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/7 multi-channel support available | • Registered address is shady |

| • Active presence on social media platforms for easy communication | |

| • Support for multiple languages |

Note: These pros and cons are subjective and may vary depending on the individual's experience with WELTRADE's customer service.

WELTRADE offers a range of educational resources to help traders improve their knowledge and skills. The broker provides market news and analytics to keep clients updated on the latest market trends and developments. In addition, WELTRADE offers training and seminars to help traders learn the basics of trading, as well as more advanced strategies. The MetaTrader guide is also available for traders to learn how to use the trading platform effectively. These educational resources can help traders make better-informed trading decisions and improve their overall trading performance.

It is important to exercise caution when investing with any broker, and this includes WELTRADE. It is concerning to see reports of scams and issues with withdrawals from some users. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Based on the information available, WELTRADE is a Forex and CFD broker offering a range of trading instruments, account types, and platforms. It has some attractive features such as competitive spreads, a wide range of payment methods, and negative balance protection.

However, there are also some concerns raised by clients regarding withdrawal issues and scams. Additionally, the broker is registered in Saint Vincent and the Grenadines, which is a less regulated jurisdiction compared to major financial centers. Traders should exercise caution and conduct their own research before investing with WELTRADE or any other broker.

| Q 1: | Is WELTRADE regulated? |

| A 1: | No. WELTRADE holds an exceeded Financial Sector Conduct Authority (FSCA) license. |

| Q 2: | At WELTRADE, are there any regional restrictions for traders? |

| A 2: | Yes. Not for residents of the USA, Canada, EU, Belarus and Russia and other not-supported (restricted) countries. |

| Q 3: | Does WELTRADE offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does WELTRADE offer the industry-standard MT4 & MT5? |

| A 4: | Yes. Both MT4 and MT5 are supportable. |

| Q 5: | What is the minimum deposit for WELTRADE? |

| A 5: | The minimum initial deposit to open an account is only $1. |

| Q 6: | Is WELTRADE a good broker for beginners? |

| A 6: | No. WELTRADE is not a good choice for beginners. Though it seems to offer competitive trading conditions, it lacks legitimate regulation. |

| FBS | Basic Information |

| Registered Country/Area | Cyprus |

| Founded in | 2009 |

| Company Name | Tradestone Limited |

| Regulatory Authority | CySEC, FSC (Offshore) |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:30 (retail), 1:500 (professional) |

| Spreads | Spreads from 0.0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, FBS Trader (proprietary) |

| Tradable Assests | Forex, CFDs, Stocks, Cryptocurrencies, Metals, Energies |

| Account Types | Cent, Micro, Standard, Zero Spread, ECN, Crypto |

| Demo Account | Yes |

| Customer Support | 24/7 Live Chat, Phone, Email, Telegram, Viber, WhatsApp |

| Deposit/Withdrawal Methods | Credit/debit cards, Bank wire transfer, Electronic wallets |

| Educational Tools | Articles, Video Tutorials, Webinars, Courses, Glossary |

FBS is a forex and CFD broker established in 2009. With its headquarters situated in Cyprus, the company maintains a global presence through offices in various countries such as China, Indonesia, Malaysia, and Thailand.

Catering to a diverse clientele, FBS offers an array of account types suitable for traders of varying experience levels and preferences. Whether you're a novice or a seasoned trader, FBS provides tailored account options to align with your requirements. The broker boasts an extensive selection of trading instruments encompassing over 40 currency pairs, precious metals, CFDs on stocks, and cryptocurrencies.

FBS equips its clients with the widely acclaimed MetaTrader 4 and MetaTrader 5 trading platforms, recognized as industry benchmarks. These platforms are accessible across desktop, web, and mobile devices, empowering traders to manage their accounts and execute trades on the move. Additionally, FBS introduces its proprietary mobile trading app, FBS Trader, catering to both iOS and Android users.

Ensuring top-notch client assistance, FBS is committed to delivering round-the-clock multilingual support via phone, email, and live chat. Complementing its support system, the broker extends an array of educational resources encompassing trading courses, video tutorials, webinars, and market analysis.

No, FBS is not a fraudulent entity. FBS is authorized and regulated by the Cyprus Securities and Exchange Commission(CySEC) in Cyprus under regulatory license number: 331/17.

This FBS is operated by FBS Markets Inc., and it is authorized and offshore regulated by the Financial Services Commission (FSC) in Belize under regulatory license number: IFSC/60/230/TS/17.

FBS offers a wide range of trading instruments, including Forex currency pairs, stocks, commodities, indices, and cryptocurrencies. Forex traders can access a total of 40 currency pairs, including major, minor, and exotic pairs.

In addition to currency pairs, traders can also access CFDs on various global stocks such as Amazon, Apple, and Facebook, as well as commodities like gold, silver, and oil. Furthermore, FBS offers CFDs on several popular indices, including the S&P 500, NASDAQ, and the FTSE 100. Finally, traders can also access cryptocurrency CFDs on Bitcoin, Ethereum, Litecoin, and Ripple.

Overall, FBS offers a diverse range of trading instruments for traders to choose from.

FBS offers a range of account types to cater to the different needs and trading styles of its clients.

The Standard account is the most popular choice, offering competitive spreads and no commission fees. It's ideal for both new and experienced traders who want to trade with a relatively low initial deposit and enjoy the benefits of FBS's trading conditions.

For those who prefer to trade with smaller amounts, the Cent account is a good option. It allows traders to trade with cents instead of dollars, so they can better manage their risks and test different trading strategies. The Cent account has the same features as the Standard account, but with smaller contract sizes.

FBS also offers a Pro account, which allows traders to trade with cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. This account type is suitable for those who want to take advantage of the volatility of the cryptocurrency market and speculate on their price movements.

Each account type has its pros and cons. The Standard account offers more trading instruments and requires a higher minimum deposit, but it has competitive spreads and no commission fees. The Cent account is ideal for those who want to start trading in smaller amounts, but it has wider spreads and fewer trading instruments. The Crypto account has a lower minimum deposit yet wider spreads.

FBS provides demo trading accounts, enabling traders to refine their skills and acquaint themselves with the broker's trading platforms without financial risk. These demo accounts are complimentary and feature virtual funds, allowing users to replicate actual market conditions.

A key benefit of FBS's demo trading accounts lies in their ability to offer insight into the broker's trading conditions and execution speeds. They also facilitate the testing of various trading strategies and techniques. This feature proves particularly advantageous for novice traders who are still mastering the intricacies of trading and desire increased self-assurance prior to committing real capital.

Furthermore, FBS's demo trading accounts offer the advantage of global accessibility, requiring only an internet connection. This convenience is especially beneficial for traders without access to a physical trading station or those who prefer the flexibility of trading on the move.

Registering an account with FBS is a straightforward process that ensures a hassle-free start to your trading journey. Here's a step-by-step overview:

Visit FBS Website: Begin by visiting the FBS website.

Open an Account: Locate and click on the “Open an account” button on the website. This initiates the registration process.

Provide Personal Information: You will be prompted to enter some essential personal details, including your name, address, and email. This information helps establish your identity.

Financial Information: Additionally, FBS will require some financial information. You'll be asked about your trading experience and investment goals. This helps tailor your trading experience to your needs and objectives.

Application Submission: Once you've completed the necessary steps and filled in the required information, submit your application. FBS will receive your application and review it meticulously.

Identity Verification: FBS will verify your identity, a standard procedure to ensure the security of your account. This verification process typically takes a few business days.

Funding Your Account: After your application has been successfully processed and your identity verified, you can proceed to fund your trading account. FBS offers a range of convenient deposit methods, including credit/debit cards, bank transfers, and e-wallets.

In summary, FBS offers a user-friendly and secure registration process that ensures traders can quickly get started with their preferred trading account. Whether you're looking to trade with real funds or practice in a risk-free environment, FBS caters to your needs.

The maximum leverage offered to retail clients with FBS is 1:30. This is in compliance with the regulations set forth by regulatory bodies like CySEC and the European Securities and Markets Authority (ESMA) to protect traders from the risks associated with high leverage.

However, professional clients with FBS have access to higher leverage up to 1:500, which can be beneficial for those who have a deeper understanding of the markets and are comfortable with taking on more risks.

It's important to have a solid understanding of leverage and risk management before engaging in high-leverage trading.

FBS offers a wide range of trading opportunities with their motto, “Narrow spreads – wide trading opportunities.” They provide traders with the advantage of incredibly tight spreads, starting from 0 pips.

When it comes to choosing a spread that suits their trading strategy, FBS offers flexibility. Traders can select from various spread types, including floating spreads starting from as low as 0.2 pips, fixed spreads starting from 3 pips, and even the option to trade without any spread (fixed spread of 0 pips). The choice of spread type and its associated value is determined by the specific account type a trader uses.

To enhance precision and accuracy in trading, FBS provides up to 5-digit quotes on all account types. This high level of precision is especially crucial for traders who engage in short-term orders. With this precision, traders can confidently select and execute their trading strategies, ensuring they have the most accurate information about the market to make the most of their trading endeavors.

Here is a table comparing the spreads on EUR/USD, Gold, and Indices by FBS, eToro, Exness, and IC Markets:

| Broker | EUR/USD Spread | Gold Spread | Indices Spread |

| FBS | 0.5 pips | From 0.3 pips | From 0.3 pips |

| eToro | 1 pip | From 45 pips | From 75 pips |

| Exness | 0.1 pips | From 25 cents | From 0.8 pips |

| IC Markets | 0.1 pips | From 20 cents | From 0.5 pips |

Apart from trading fees, there may be other charges that traders should be aware of when using FBS. Here are some non-trading fees to consider:

Deposit and Withdrawal Fees: FBS offers various payment methods for deposits and withdrawals, including credit cards, e-wallets, and bank transfers. While most of these methods are free, some may incur fees depending on the payment provider and currency used.

Inactivity Fee: FBS charges an inactivity fee of $10 per month if the trading account has been inactive for 180 days or more. This fee is taken from the account balance and continues until the account becomes active again.

Conversion Fees: If a trader deposits funds in a currency different from their trading account currency, FBS may charge a conversion fee to convert the funds to the trading account currency. The conversion fee varies depending on the payment method and currency.

VPS Hosting Fees: FBS offers VPS hosting services for traders who want to use automated trading strategies. The fee for VPS hosting varies depending on the plan chosen and the billing cycle.

FBS offers its clients a variety of trading platforms to choose from, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both platforms are widely used by traders all around the world, and they offer a range of advanced tools and features to help traders analyze the markets and execute trades.

MT4 is a widely-used trading platform that is known for its reliability and ease of use. It offers a range of advanced charting tools, customizable indicators, and the ability to use expert advisors (EAs) to automate trading strategies. MT4 is available in both desktop and mobile versions, making it accessible to traders on-the-go.

MT5 is an upgraded version of MT4 and offers even more advanced features and tools. It has a more advanced charting package, as well as more timeframes and order types available. MT5 also allows traders to trade on the exchange markets, in addition to Forex.

In addition to these two popular platforms, FBS also offers a proprietary trading platform called FBS Trader, which is designed for mobile trading.

The platform is available for both Android and iOS devices and offers traders access to over 50 markets, including Forex, stocks, and commodities.

FBS offers a variety of deposit and withdrawal methods, including:

As for withdrawals, there are also no fees charged by FBS, but certain payment methods may have their own fees, such as bank wire transfer. The processing time for withdrawals may vary depending on the payment method chosen, but FBS aims to process withdrawals as quickly as possible.

FBS offers customer support through various channels, including email, phone, live chat, and social media. Their website is also available in multiple languages, making it more accessible to traders worldwide. The broker's customer support team is available 24/7, and they have received positive reviews from traders for their quick and helpful responses.

FBS offers a range of educational resources for traders of all skill levels. These resources include:

Trading courses: FBS provides free educational courses on various trading topics, including technical analysis, fundamental analysis, and risk management.

Webinars: The broker regularly hosts webinars on different aspects of trading. These webinars are conducted by experts in the field and cover a wide range of topics.

Video tutorials: FBS offers a collection of video tutorials that cover various aspects of trading. These tutorials are designed to help traders learn the basics of trading as well as advanced strategies.

Economic calendar: FBS provides an economic calendar that includes all major economic events that can impact financial markets. This helps traders stay informed about upcoming events and make informed trading decisions.

Trading tools: FBS offers a range of trading tools, including an economic news feed, a currency converter, and a trading calculator. These tools can help traders make better trading decisions.

Market analysis: FBS provides daily market analysis that covers major currency pairs, commodities, and indices. The analysis includes technical and fundamental analysis as well as trading recommendations.

FBS is a well-established online forex and CFD broker that offers a wide range of trading instruments, account types, and educational resources. The broker is regulated by reputable authorities and provides excellent customer support services to its clients. FBS also offers various trading platforms, including the popular MetaTrader 4 and 5, as well as a proprietary mobile application, FBS Trader.

While FBS has several advantages, such as a diverse range of trading instruments and low minimum deposit requirements, it also has some drawbacks, such as higher spreads and commissions than some of its competitors, as well as some limitations on the availability of certain account types in specific regions.

Q: Is FBS a regulated broker?

A: Yes, FBS is a regulated broker. It is licensed by the Cyprus Securities and Exchange Commission (CySEC) and offshore regulated by the Financial Services Commission (FSC) in Belize.

Q: What trading instruments are available on FBS?

A: FBS offers a variety of trading instruments, including forex currency pairs, metals, energies, stocks, and cryptocurrencies.

Q: What are the account types available on FBS?

A: FBS offers three main account types - Standard, Cent, and Zero Spread. There is also an ECN account type available for professional traders.

Q: What is the minimum deposit required to open an account with FBS?

A: The minimum deposit required to open a Standard or Cent account with FBS is $1.

Q: What leverage does FBS offer?

A: FBS offers flexible leverage options, up to 1:500 for professional traders, 1:30 for retail clients.

Q: What trading platforms are available on FBS?

A: FBS offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as a proprietary mobile trading app called FBS Trader.

Q: What are the deposit and withdrawal methods available on FBS?

A: FBS offers a variety of deposit and withdrawal methods, including bank wire transfer, credit/debit cards, electronic payment systems such as Skrill, Neteller, and Perfect Money, and local payment methods.

Q: Does FBS offer any educational resources for traders?

A: Yes, FBS offers a range of educational resources, including video tutorials, webinars, e-books, market analysis, and a comprehensive FAQ section on their website.

Q: What are the customer support options available on FBS?

A: FBS offers customer support via live chat, phone, email, and social media channels. The support team is available 24/7 to assist traders with any questions or issues they may have.

Q: Is FBS a good broker for beginners?

A: FBS can be a good option for beginners due to its low minimum deposit requirement, flexible leverage options, and educational resources. However, traders should always do their own research and due diligence before choosing a broker.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive weltrade and fbs are, we first considered common fees for standard accounts. On weltrade, the average spread for the EUR/USD currency pair is from 0.5 pips, while on fbs the spread is from 0.5 .

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

weltrade is regulated by NBRB,FSC,FSCA. fbs is regulated by ASIC,CYSEC,FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

weltrade provides trading platform including Pro,Premium,Micro and trading variety including --. fbs provides trading platform including Pro Account,Cent account,Standard account and trading variety including 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs.