No data

Do you want to know which is the better broker between SBI SECURITIES and OLYMPTRADE ?

In the table below, you can compare the features of SBI SECURITIES , OLYMPTRADE side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of sbi-securities, olymptrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Japan |

| Regulated by | FSA |

| Year(s) of establishment | 15-20 years |

| Trading instruments | domestic stocks, foreign stocks, investment trusts, bonds, foreign exchange, futures/options, CFDs, gold, silver, warrants, insurance, etc. |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | 1:25 |

| Minimum spread | Information not available |

| Trading platform | own platform |

| Deposit and withdrawal method | Information not available |

| Customer Service | phone number, address, live chat |

| Fraud Complaints Exposure | No for now |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide range of financial products available for investment

Clear and specific fee structure for each financial product

User-friendly and reliable trading platform developed by the company

Efficient and helpful customer support available 24/7

Regulated by the FSA, ensuring a high level of security and trustworthiness

Cons:

Lack of transparency regarding minimum deposit amount and trading account types

Limited educational resources for investors who are new to the market

No information provided on deposit and withdrawal methods, potentially causing inconvenience for clients

Maximum leverage of 1:25, which may not be as attractive for experienced traders looking for higher leverage ratios.

| Advantages | Disadvantages |

| SBI SECURITIES offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, SBI SECURITIES has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

SBI SECURITIES is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, SBI SECURITIES acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that SBI SECURITIES has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with SBI SECURITIES or any other MM broker.

SBI Securities was founded in 1988, changed its name to E-Trade Securities Co. in 1999, and launched its Internet service in July of the same year. In 2000, SBI Securities was granted full membership of the Osaka Securities Exchange, and in 2001, its assets increased to 11,501 million yen. In 2003, SBI Securities was granted the integrated trading status of the Nagoya Stock Exchange and became a specific general member of the Tomioka Stock Exchange. In 2006, SBI Securities, as a professional online securities company, exceeded the total number of securities accounts of one million for the first time and changed its name from E-Trade Securities Ltd. to SBI E-Trad Ltd. in July. 2007, SBI E-Trad Ltd. and SBI In 2014, the platform's net securities first consolidated securities account traded over 3 million accounts. In 2010, Net Securities' first consolidated securities account traded more than 5 million accounts. SBI Securities currently hold a retail foreign exchange license (license number: 3010401049814) issued by the Financial Services Agency of Japan.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of financial products available for investment | Some financial products may not be accessible to certain types of investors |

| Access to both domestic and foreign stocks and investment trusts | Trading fees may be higher compared to some other brokers |

| Availability of futures/options, CFDs, gold, silver, and warrants | Trading certain financial products may carry higher risks for investors |

| Opportunities for diversification of investment portfolio | Lack of education and guidance for investors who are new to certain financial products |

SBI Securities offers a wide range of financial products for investors to choose from, including domestic and foreign stocks, investment trusts, bonds, foreign exchange, futures/options, CFDs, gold, silver, warrants, and insurance. This allows investors to diversify their investment portfolio and take advantage of different market conditions. SBI Securities also provides access to both domestic and foreign markets, providing a wider range of investment opportunities. However, some financial products may not be accessible to certain types of investors, and trading fees may be higher compared to some other brokers. It is also important to note that certain financial products, such as futures/options and CFDs, carry higher risks for investors. Additionally, investors who are new to certain financial products may lack education and guidance, which could potentially lead to losses.

SBI Securities offers a transparent fee structure with specific fees for different financial products, which are clearly displayed on their website. This allows investors to make informed decisions and plan their trades accordingly. Additionally, the brokerage fee for some products such as Nikkei 225 CFDs is lower than the industry average, which can save investors money in the long run. However, some fees may be higher than those of competitor brokers, which may discourage some investors from using SBI Securities. Overall, SBI Securities provides a clear and transparent fee structure with no hidden fees, which can be beneficial for investors.

| Advantages | Disadvantages |

| Possibility of multiple account types | Lack of transparency |

| Unclear minimum deposit amounts |

SBI Securities does not disclose its minimum deposit requirement for its trading accounts, which is a significant disadvantage for potential investors. However, it´s possible that the company offers flexible account types, and clients can choose from a range of accounts.

SBI Securities provides its users with a proprietary trading platform that offers advanced features such as charting tools, fast execution speed, and a user-friendly interface. The platform is compatible with both desktop and mobile devices, allowing users to trade anytime and anywhere. The advanced charting tools available on the platform enable traders to perform technical analysis efficiently and effectively, allowing them to make informed trading decisions. Although the platform is only available in Japanese, it is easy to navigate, and users who are not fluent in Japanese can use translation tools to understand the platform's functions. Overall, SBI Securities' proprietary platform is a reliable and efficient tool for traders who are looking for a feature-rich platform that is easy to use.

SBI SECURITIES offers a maximum leverage of up to 1:25, which is in line with the regulations set by the local authorities. This means that clients can trade with a much larger position size than their initial deposit, magnifying their potential profits and losses. While high leverage can be attractive to traders seeking to maximize their returns, it can also lead to significant losses if the market moves against them. Therefore, traders should exercise caution when using high leverage and have a solid risk management strategy in place to minimize potential losses.

SBI SECURITIES provides various deposit and withdrawal methods for their clients. However, the specific details and fees related to these methods are not mentioned on their website, which can make it difficult for clients to plan their transactions accordingly. The website provides limited information on the deposit and withdrawal process, requiring the client to log in to their account to access more details. While the transactions are secure and encrypted, the lack of information on the website can be a disadvantage. However, the processing time for deposits and withdrawals is quick and efficient, which is an advantage for clients. It is not mentioned on the website what the minimum deposit and withdrawal amount is, which can be a disadvantage for those who prefer to trade with a smaller amount.

SBI Securities does not offer any educational resources to its clients. There are no access to market analysis, news, forex basics or technical analysis. The lack of educational resources makes it challenging for beginners to start trading, as they would have to rely on external sources to gain knowledge about trading strategies and market trends. Moreover, advanced traders may feel limited as they have no access to research tools and data analysis. Therefore, SBI Securities should consider providing educational resources for its clients to improve their trading knowledge and skills.

| Advantages | Disadvantages |

| 24/7 live chat available | Phone support with fees |

| Prompt customer service | Limited customer service options |

| Quick response time | Limited information on website |

SBI SECURITIES provides prompt customer service through their 24/7 live chat support. The customer service representatives are known for their quick response time and efficiency in handling customer inquiries. However, their phone support incurs fees, which may be a disadvantage for clients who prefer to call for assistance. Additionally, SBI SECURITIES has limited customer service options, with live chat being the only available option for immediate assistance. There is also limited information about their customer support on their website, which may make it difficult for clients to find answers to their questions.

In conclusion, SBI Securities is a Japan-registered company that offers various financial products, including stocks, bonds, foreign exchange, futures/options, CFDs, and more. The platform has a user-friendly interface, and the website provides a clear list of fees for each financial product, which is an advantage for traders. However, the lack of transparency on account types and deposit/withdrawal methods may be a disadvantage. Another drawback is the absence of educational resources, which could be useful for beginner traders. The customer support is good with a 24-hour live chat service and a phone number, although the latter has fees. Overall, SBI Securities is a regulated broker with a strong reputation in Japan, and traders who are comfortable with the limitations mentioned may find it to be a suitable option for their trading needs.

Question: What financial products does SBI Securities offer?

Answer: SBI Securities offers a range of financial products, including domestic and foreign stocks, investment trusts, bonds, foreign exchange, futures/options, CFDs, gold, silver, warrants, insurance, and more.

Question: What is the maximum leverage offered by SBI Securities?

Answer: The maximum leverage offered by SBI Securities is up to 1:25, which complies with local laws and regulations.

Question: What customer support options are available at SBI Securities?

Answer: SBI Securities offers live chat support 24 hours a day and a phone number with fees for customer care.

Question: Does SBI Securities provide educational resources?

Answer: No, SBI Securities does not provide educational resources for clients.

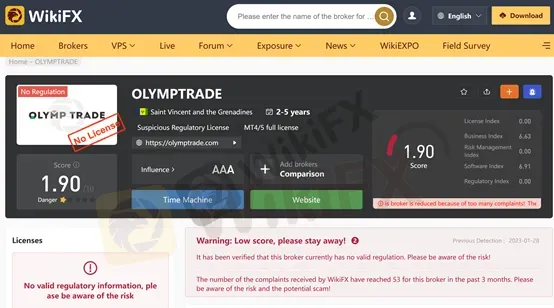

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Information not available |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | Information not available |

| Minimum spread | Information not available |

| Trading platform | MT4 |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

Note: At this time, we only have a cursory look at OLYMPTRADE as the company's official website (https://olymptrade.com/ ) does not open properly.

Screenshot time: 01/28/2023

WikiFX provides dynamic scoring, it will track the broker's dynamic real-time scoring, the current time screenshot scores do not represent past and future scoring.

OLYMPTRADE is registered in St. Vincent and the Grenadines and appears to be a fraudulent broker without any credible regulation, with a history of no more than 5 years. Unfortunately, we could not find any more detailed information about this broker on the internet.

OLYMPTRADE caters to a diverse range of traders, including beginners and experienced traders alike.The platform offers a wide range of financial instruments for trading, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC, and composites. Traders have the flexibility to choose between two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, while the Demo Account provides a risk-free environment for practice. While specific information about spreads is not available on the website, OLYMPTRADE mentions that there are no commissions charged.Traders can access the OLYMPTRADE trading platform via a downloadable application on both mobile and desktop devices. The platform offers a user-friendly interface with various trading tools, features, educational resources, market analysis reports, and customer support services available 24/7.

When choosing a forex broker, you should know that a regulatory license does not necessarily guarantee the reliability of a broker as it may be an expired or cloned regulatory license, but a broker without any regulatory license has a high probability of being unreliable.

OLYMPTRADE offers a user-friendly trading platform with a wide range of market instruments, a demo account for practice, comprehensive customer support, and educational resources. However, it is not regulated by a reputable authority, lacks transparency on leverage and spreads, provides limited information on fees and commissions, has a relatively low minimum deposit requirement, and offers limited advanced features. Traders should carefully consider these pros and cons before deciding to trade with OLYMPTRADE.

| Pros | Cons |

| User-friendly trading platform with a range of tools and features. | Not regulated by a reputable financial authority, which carries higher risk. |

| Wide selection of market instruments, including currencies, stocks, metals, cryptocurrencies, and more. | Lack of transparency regarding leverage and spreads. |

| Demo account available for practice and learning. | Limited information on trading fees and commissions. |

| Comprehensive customer support available 24/7. | Relatively low minimum deposit requirement may attract inexperienced traders. |

| Educational resources to enhance trading knowledge and skills. | Limited availability of advanced trading features and platforms. |

OLYMPTRADE offers a diverse range of market instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites, providing traders with ample opportunities to engage in various trading strategies.

Currencies: OLYMPTRADE offers a wide range of currency pairs for trading, including major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs like USD/TRY and NZD/CAD. Traders can speculate on the exchange rate movements between these currency pairs.

Stocks: OLYMPTRADE provides access to a variety of stocks from global markets. Traders can invest in individual company stocks, such as Apple, Amazon, or Google, and speculate on their price movements. Stock trading allows traders to benefit from the performance of specific companies.

Metals: OLYMPTRADE allows trading in precious metals like gold, silver, platinum, and palladium. These metals are often seen as safe-haven assets and can be used as a hedge against inflation or economic uncertainties. Traders can speculate on the price fluctuations of these metals.

Indices: OLYMPTRADE offers trading on major stock indices from around the world, including the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. Index trading allows traders to speculate on the overall performance of a specific stock market, rather than individual stocks.

Commodities: OLYMPTRADE provides access to various commodities such as oil, natural gas, and agricultural products like corn and wheat. Commodity trading allows traders to speculate on the price movements of these essential goods, which can be influenced by factors like supply and demand dynamics, weather conditions, and geopolitical events.

Cryptocurrencies: OLYMPTRADE offers trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrency trading allows traders to speculate on the price volatility of these digital assets, which have gained significant popularity in recent years.

ETFs (Exchange-Traded Funds): OLYMPTRADE allows trading in ETFs, which are investment funds traded on stock exchanges. These funds are composed of a basket of assets, such as stocks, bonds, or commodities. Traders can invest in ETFs to gain exposure to a diversified portfolio of assets.

OTC (Over-the-Counter): OLYMPTRADE provides over-the-counter trading, which refers to trading financial instruments directly between two parties without the involvement of an exchange. OTC trading allows for more flexible and customized transactions, particularly for certain derivatives and exotic instruments.

Composites: OLYMPTRADE offers composite instruments, which are synthetic assets created by combining multiple financial instruments. These composites can represent various strategies or themes, such as a basket of stocks from a particular sector or a combination of different asset classes. Traders can speculate on the performance of these composites.

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by traders all over the world. Accessing it from different devices also makes it easier for users to trade.

OLYMPTRADE offers two types of accounts: Real Account and Demo Account. The Real Account allows traders to engage in live trading with real money, providing access to the full range of market instruments and features offered by OLYMPTRADE. Traders can deposit funds into their Real Account and trade in real-time market conditions, experiencing the actual risks and rewards of trading.

On the other hand, the Demo Account is a practice account that allows traders to simulate trading without using real money. It is an excellent option for beginners or those who want to test trading strategies and explore the platform's functionalities. The Demo Account provides virtual funds, enabling traders to practice and gain confidence before venturing into live trading.

Here is a brief description of the account opening process for OLYMPTRADE:

Registration: Visit the OLYMPTRADE website and click on the “Register” button to start the registration process. Fill in the required information, such as your name, email address, and preferred password. Make sure to read and agree to the terms and conditions before proceeding.

Account Verification: After completing the registration, you may need to verify your account. OLYMPTRADE may require you to provide certain documents for verification purposes, such as a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided by OLYMPTRADE to submit the necessary documents.

Account Funding: Once your account is verified, you can proceed to fund your account. OLYMPTRADE offers various deposit methods, such as credit/debit cards, bank transfers, and electronic payment systems. Choose your preferred payment method and follow the instructions to make a deposit. Be aware of any minimum deposit requirements set by OLYMPTRADE.

Platform Access: Once your account is funded, you will gain access to the OLYMPTRADE trading platform. You can log in using your registered email address and password. The platform provides a user-friendly interface with a range of trading tools and features.

Account Configuration: Before you start trading, you may need to configure your account settings. This includes selecting your preferred language, setting up notifications, and adjusting other platform preferences according to your trading preferences. Take some time to explore the platform and familiarize yourself with its features.

It's important to note that the specific steps and requirements may vary, so it's advisable to refer to the official OLYMPTRADE website or contact their customer support for the most accurate and up-to-date information regarding the account opening process.

The official website of OLYMPTRADE does not provide specific information about leverage. However, it is common for similar types of brokers to offer leverage ratios ranging from 100:1 to 500:1. Please note that leverage allows traders to multiply their trading positions, but it also amplifies both potential profits and losses. It is important to fully understand the implications of leverage and exercise responsible risk management when trading on any platform. For accurate and up-to-date information about leverage on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

Spreads & Commissions (Trading Fees)

OLYMPTRADE's official website does not provide specific information about spreads. However, it is mentioned that there are no commissions charged. In general, similar brokers in the industry offer spreads that start from 0 to 0.1 pips. Spreads refer to the difference between the bid and ask prices of a financial instrument and can vary depending on market conditions and the specific asset being traded. For accurate and up-to-date information about spreads on OLYMPTRADE, it is recommended to refer to the broker's official website or contact their customer support.

OLYMPTRADE provides a simple and convenient deposit and withdrawal process for its traders. The minimum deposit amount is 10 USD/10 EUR, making it accessible for traders with varying budgets. OLYMPTRADE supports multiple deposit and withdrawal methods, including Bank Transfer, Credit/Debit Cards, Bank Wire Transfer, E-wallets, and Cryptocurrency.

Traders can choose to deposit funds using popular payment options such as credit or debit cards, bank transfers, and e-wallets.

Similarly, when it comes to withdrawing funds, OLYMPTRADE supports the same methods used for deposits. The withdrawal process is typically straightforward, and the platform strives to process withdrawal requests promptly. However, the processing time may vary depending on the chosen withdrawal method and the policies of the respective financial institutions involved.

The support service provided by OLYMPTRADE is not very extensive. It can only be accessed via email, address and a phone number. Since the company's website is not currently open, we do not know if it offers other services such as live chat, callback, FAQ, 24/7 or 24/5 service, etc.

Below are the details about the customer service.

Email: support@olymptrade.com

support-en@olymptrade.com

Phone Number: +356 20341634

Address: 54, Immakulata, Triq il-Mina ta Hompesch, ZABBAR ZBR 9016.

On our website, you can see that many users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

OLYMPTRADE is an online trading platform that caters to a diverse range of traders, offering a wide selection of market instruments and account types. The platform provides a user-friendly interface, downloadable on mobile and desktop devices, with access to real-time market quotes, trading tools, and educational resources. However, it is important to note that OLYMPTRADE is not regulated by a reputable financial authority, which poses a higher risk for traders. The platform lacks transparency on leverage and spreads, limited information on fees and commissions, and advanced features. Traders should carefully evaluate these pros and cons before deciding to trade with OLYMPTRADE. While OLYMPTRADE offers convenience and comprehensive customer support, traders should exercise caution and conduct thorough research before opening an account.

Q: Is OLYMPTRADE a regulated broker?

A: No, OLYMPTRADE is not a regulated broker.

Q: What is the minimum deposit required to open an account with OLYMPTRADE?

A: The minimum deposit required to open an account with OLYMPTRADE is 10 USD/10 EUR.

Q: What trading instruments are available at OLYMPTRADE?

A: OLYMPTRADE offers a wide range of trading instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC trading, and composites

Q: Does OLYMPTRADE offer a demo account?

A: Yes, OLYMPTRADE offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Q: What trading platforms does OLYMPTRADE offer?

A: OLYMPTRADE offers their our trading platform.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive sbi-securities and olymptrade are, we first considered common fees for standard accounts. On sbi-securities, the average spread for the EUR/USD currency pair is -- pips, while on olymptrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

sbi-securities is regulated by FSA. olymptrade is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

sbi-securities provides trading platform including -- and trading variety including --. olymptrade provides trading platform including -- and trading variety including --.