No data

Do you want to know which is the better broker between Saxo and Charles Schwab ?

In the table below, you can compare the features of Saxo , Charles Schwab side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of saxo, td-ameritrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Saxo Review Summary in 10 Points | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS |

| Market Instruments | Forex, stocks, futures, options, bonds, ETFs and CFDs |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/USD Spread | 0.4 pips |

| Trading Platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Minimum deposit | HKD10,000 |

| Customer Support | 24/5 phone, email |

Saxo is a Danish investment bank founded in 1992. It provides online trading and investment services in multiple assets, including stocks, bonds, forex, options, futures, and CFDs, through its proprietary trading platforms. The bank operates in over 100 countries and has offices in major financial centers worldwide, including Copenhagen, London, Singapore, and Tokyo. Saxo Bank is regulated by several financial authorities, including the Danish Financial Supervisory Authority, the UK Financial Conduct Authority, and the Monetary Authority of Singapore. The bank also has a banking license and is a member of the Danish guarantee fund for depositors and investors.

Saxo is a multi-asset broker that offers access to a wide range of financial instruments, including forex, stocks, bonds, ETFs, futures, options, and more. The broker provides trading services through its advanced trading platforms and caters to both retail and institutional clients. Saxo operates as a hybrid broker, offering both direct market access (DMA) and market making services.

Saxo is a well-established and reputable broker with a range of trading platforms, instruments, and research tools.

However, the broker's high fees, minimum deposit requirement, and lack of negative balance protection may not be suitable for all traders. Additionally, some users have reported poor customer service experiences.

| Pros | Cons |

| • Wide range of financial instruments available | • High minimum deposit requirement |

| • Access to multiple markets and exchanges | • Fees and commissions may be higher than competitors |

| • User-friendly trading platforms | • Inactivity fee for dormant accounts |

| • Advanced trading tools and research | • Limited educational resources |

| • Regulated by top-tier financial authorities | • Limited customer support options |

Overall, it is important for traders to carefully consider their own needs and preferences before choosing Saxo or any other broker.

There are many alternative brokers to Saxo, each with their own unique features and benefits. Some popular alternatives include:

Interactive Brokers: A well-established broker with a wide range of trading instruments and low commissions.

TD Ameritrade: Offers a powerful trading platform and a variety of educational resources.

E*TRADE: A popular broker with a user-friendly platform and no account minimums.

IG: A global leader in online trading, offering a wide range of markets and advanced trading tools.

Plus500: A broker known for its user-friendly platform and tight spreads.

Ultimately, the best alternative broker for you will depend on your specific trading needs and preferences. It's important to research and compare different brokers to find the one that best fits your individual needs.

Saxo is a legitimate and reputable broker with a long track record of providing reliable trading services. It is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Danish Financial Supervisory Authority (DFSA). Additionally, Saxo is a member of several investor protection funds, such as the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients' funds up to a certain amount in case of the broker's insolvency. Therefore, based on its regulation and investor protection measures, Saxo can be considered a legitimate broker.

Saxo is a regulated broker, with licenses from multiple reputable regulatory authorities and a long-standing history of providing financial services. The broker takes extensive measures to protect client funds, including segregating them from the company's assets and offering negative balance protection.

Additionally, Saxo offers various security features, such as two-factor authentication and encryption, to ensure secure trading.

More details can be found in the table below:

| Security Measures | Description |

| Regulation | FSA, FINMA, FCA, ASIC, DFSA |

| Segregated Accounts | Client funds are held in segregated bank accounts to protect them in case of insolvency. |

| Two-Factor Authentication | As an extra layer of security for client accounts |

| SSL Encryption | The Saxo website and platform are secured with SSL encryption to protect user data |

| Investor Compensation Scheme | A member of the Danish Investor Compensation Scheme, which provides additional protection to clients in case of insolvency |

It's important to note that while these measures provide some level of protection for clients, there is always some level of risk involved in trading financial instruments, and clients should always be aware of the risks before making any trades.

Based on the information available, Saxo appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years. However, we also find that some users complain about their bad experience with Saxo. Take care!

Saxo offers a wide range of trading instruments across multiple asset classes, including

Forex: More than 180 currency pairs, including majors, minors, and exotics.

Stocks: Over 40,000 stocks from 36 global exchanges, including NYSE, NASDAQ, LSE, and more.

Futures: Over 200 futures and options across a variety of asset classes such as commodities, indices, and bonds.

Options: A wide range of options on stocks, indices, and futures.

Bonds: Trade a wide range of government and corporate bonds, including sovereign bonds from developed and emerging markets.

ETFs and CFDs: Access to over 3,000 ETFs and CFDs on indices, commodities, and stocks.

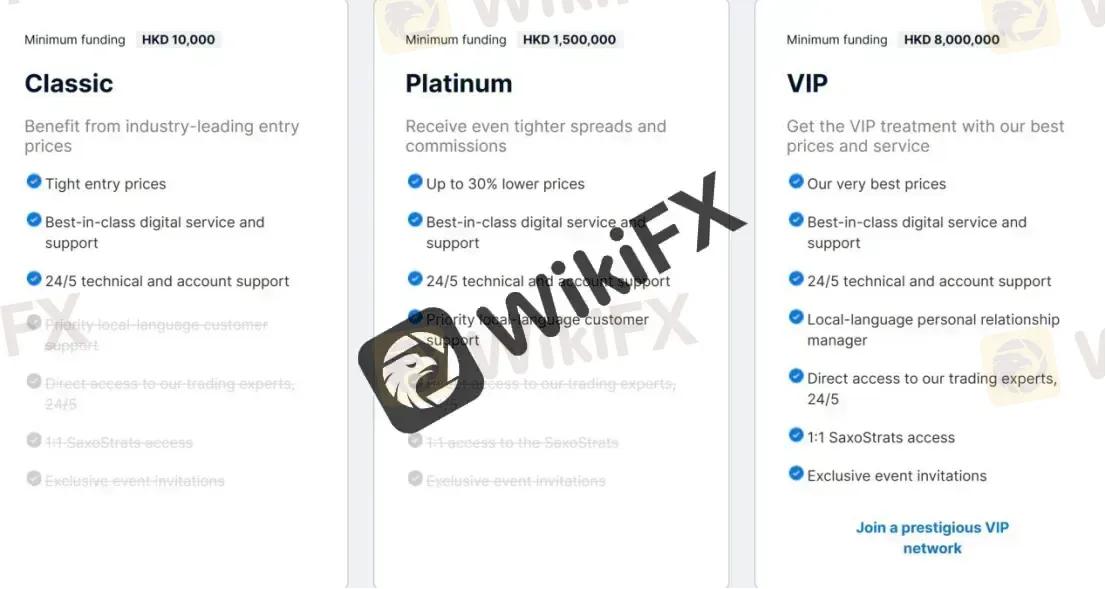

Saxo offers a range of account types designed to suit the different needs of its clients. The account types offered by Saxo are:

Classic Account: A traditional account with minimum funding of HKD10,000, which offers a range of trading tools and resources.

Platinum Account: A premium account for high-net-worth individuals, with a minimum funding requirement of HKD 1,500,000.

VIP Account: An exclusive account for ultra-high-net-worth individuals, with a minimum funding requirement of HKD 8,000,000.

Islamic Account: A Sharia-compliant account for clients who follow Islamic finance principles.

Corporate Account: An account for companies, partnerships, and other legal entities.

Joint Account: An account for two or more individuals who want to trade together.

Each account type has its own unique features and benefits, such as lower pricing, higher leverage, and dedicated account managers. Saxo also offers a free demo account for clients to practice trading before committing to a live account.

It takes only about five minutes and a short online form to open an account. Clients will need to submit the standard verification documents required by KYC and AML rules, but the procedure should be quick and easy, and they will have access to their account in minutes.

Saxo offers leverage up to 1:100 for forex trading. Professional clients are entitled to leverage of 1:40 for the primary index, 1:33 for the secondary index, 1:33 for gold, 1:10 for equities, and 1:25 for commodities. Retail clients are entitled to leverage of 1:20 for the primary index, 1:10 for the secondary index, 1:20 for gold, 1:5 for equities and 1:10 for commodities.

However, the maximum leverage may vary depending on the instrument being traded and the client's location. It is important to note that trading with high leverage carries a higher level of risk, and traders should always exercise caution and use risk management strategies.

Saxo offers variable spreads, which means that the spreads can change depending on market conditions. The typical minimum spreads for popular instruments are as follows:

EUR/USD: 0.4 pips

USD/JPY: 0.6 pips

GBP/USD: 0.9 pips

AUD/USD: 0.6 pips

USD/CHF: 1.2 pips

USD/CAD: 1.5 pips

Saxo also charges commissions on some products, including stocks, ETFs, and futures. The commission fees vary depending on the specific market and the size of the trade. Commissions start at $3 per share for equities, as low as $0.85 per lot for commodities, and $3 per share for ETFs. Futures commissions start as low as $0.85 per lot, bonds commissions start at 0.05%, listed options commissions start as low as $1.25 per lot, and mutual funds commissions are $0 for custody and platform fees.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per lot |

| Saxo | 0.4 pips | $3 |

| Interactive Brokers | 0.1 pips | $2 |

| TD Ameritrade | 0.7 pips | free |

| E*TRADE | 1.0 pips | free |

| IG | 0.75 pips | free |

| Plus500 | 0.8 pips | free |

Please note that commission rates may vary depending on the specific account type and trading volume. Additionally, some brokers may offer different spreads and commissions for other currency pairs or financial instruments. It's important to do your own research and carefully consider the costs and fees of each broker before making a decision.

Saxo offers its own proprietary trading platform called SaxoTraderGO. It is a web-based platform that can be accessed from any device with an internet connection. In addition to SaxoTraderGO, Saxo also offers SaxoTraderPRO, a desktop-based trading platform that is designed for advanced traders who require additional functionality.

SaxoTraderGO is highly customizable, allowing traders to arrange the interface to suit their preferences. It provides access to a wide range of trading tools and features, including charting tools, technical analysis indicators, and news feeds. The platform also includes a comprehensive range of order types, including market, limit, stop, and trailing stop orders.

SaxoTraderPRO is a professional-grade trading platform that offers advanced trading tools and features. It is designed for active traders and includes a range of tools that allow traders to monitor multiple markets and instruments simultaneously. The platform also includes advanced charting tools and a range of order types, including conditional orders and algorithmic trading capabilities.

Saxo also offers SaxoInvestor, which is a user-friendly trading platform suitable for beginner investors who are interested in a wide range of asset classes. It provides a simple and intuitive interface with basic research tools and features, making it easy for investors to buy and sell stocks, ETFs, bonds, and mutual funds. However, advanced traders may find the platform's lack of advanced tools and customization options limiting.

Overall, Saxo's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| Saxo | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

| Interactive Brokers | Trader Workstation, WebTrader, IBKR Mobile |

| TD Ameritrade | Thinkorswim, Web Platform, TD Ameritrade Mobile App |

| E*TRADE | Power E*TRADE, E*TRADE Web, E*TRADE Mobile |

| IG | IG Trading Platform, IG Web Platform, IG Trading App |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

Saxo Bank supports several deposit and withdrawal methods, including Visa, MasterCard, Visa Debit, Visa Electron, MasterCard Debit, Maestro (for UK residents), Visa Dankort (for Denmark residents), Carte Bleue (for France residents). The company does not charge any fees for deposits and withdrawals, but if an investor makes a withdrawal request via manual withdrawal, a processing fee of 40 EUR will be charged.

Saxo has different minimum deposit requirements depending on the type of account you open and your country of residence. For example, the minimum deposit for the Classic account is HKD10,000.

However, these amounts can vary depending on your location and the specific account type. It's important to check with Saxo directly or on their website for the most up-to-date information on minimum deposit requirements.

| Saxo | Most other | |

| Minimum Deposit | HKD10,000 | $100 |

To withdraw funds from your Saxo account, you need to follow these steps:

Step 1: Log in to your Saxo account using your credentials.

Step 2: Click on the “Account” tab located on the top right corner of the screen.

Step 3: Click on “Withdraw Funds” from the account menu options.

Step 4: Select the account you wish to withdraw funds from, enter the amount you want to withdraw, and select the currency you want to withdraw in.

Step 5: Choose the preferred withdrawal method from the available options and provide the necessary details such as bank account information or credit/debit card information.

Step 6: Review the details of your withdrawal request and click on “Submit.”

Note that Saxo may require additional verification or documentation before processing your withdrawal request. The processing time for withdrawals may vary depending on the chosen method and your bank's processing time.

Swap costs, sometimes called overnight fees, are assessed on overnight open positions at Saxo Bank. These are expressed as interest and, depending on the trader's position, might be either charged to or credited to his or her account.

Traders of the Muslim faith, for whom the payment of interest is forbidden, are out of luck with Saxo Bank because they don't have the option of opening an Islamic account. With the wide variety of deposit currencies offered by Saxo Bank, customers will have a decreased chance of incurring conversion fees.

Amounts credited to your account are converted from their original currency at the mid-point FX Spot rate plus/minus the margins and spreads indicated below. This includes both trading fees and profits/losses incurred as a result of your trading activities.

Fees for account inactivity are also a reality for inactive accounts. After the initial six months, the rate increased to $150, which is quite a bit.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Saxo | Free | Free | $150 after six months of inactivity |

| Interactive Brokers | Free | $0-$10 | $20/month if account balance < $2,000 |

| TD Ameritrade | Free | Free | Free |

| E*TRADE | Free | $0-$25 | Free |

| IG | Free | Free | $18/month after 24 months of inactivity |

| Plus500 | Free | Free | $10/month after 3 months of inactivity |

Saxo provides customer support through several channels, including phone, email, and social media (Facebook, LinkedIn, Twitter and YouTube). The broker offers 24/5 customer service in multiple languages, including English, Chinese, French, German, Italian, Japanese, Portuguese, and Spanish.

Saxo also provides a comprehensive help center on its website that includes an extensive knowledge base, FAQs, trading guides, and video tutorials. The broker's customer service is generally considered to be of high quality, with knowledgeable representatives who are responsive and helpful.

| Pros | Cons |

| • 24/5 customer service through multiple channels | • No 24/7 support service |

| • Dedicated support for VIP clients | • Phone support may have long wait times |

| • Extensive FAQ section on the website | • No dedicated account manager for non-VIP clients |

| • Personalized support for complex trading needs | • No local offices in some countries |

| • Multilingual support available for non-English users |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Saxo's customer service.

Saxo Bank provides excellent market research in addition to a wealth of instructional resources like video courses, webinars, and events. Saxo Bank's SaxoStrats Experts group consists of eight analysts and strategists who are tasked with providing coverage of the various asset classes available to customers. It's apparent that this broker places a high value on its research team and recognizes the significance of this service, both for its clients and as a global investment bank. The classes are a wonderful way for newcomers to get their feet wet and become acquainted with the resources that are at their disposal. Videos are easy to follow and understand, helping novice traders quickly get up to speed and lay a solid groundwork from which to expand their knowledge. Saxo Bank specialists will be hosting webinars.

In conclusion, Saxo is a well-established broker. The broker offers a wide range of trading instruments, including forex, stocks, options, futures, and CFDs, and provides access to various markets worldwide. Saxo also offers an advanced trading platform and a user-friendly mobile app, making it easy for traders to access the markets on the go.

While Saxo has some of the highest fees in the industry, the broker's competitive spreads and tight execution make it a popular choice for traders. Additionally, Saxo's robust educational resources and customer support make it an ideal choice for traders of all skill levels who want to improve their knowledge and skills in trading.

Overall, Saxo is a multi-asset broker that offers a comprehensive suite of trading tools and services to help traders achieve their investment goals. However, potential clients should carefully consider the fees and minimum deposit requirements before opening an account. Also, dont forget check their user reviews on the Internet.

| Q 1: | Is Saxo regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS. |

| Q 2: | Does Saxo offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Saxo offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, it offers SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. |

| Q 4: | What is the minimum deposit for Saxo? |

| A 4: | The minimum initial deposit to open an account isHKD10,000. |

| Q 5: | Is Saxo a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Minimum Deposit | $2,000 (Margin account) |

| Maximum Leverage | N/A |

| Minimum Spreads | N/A |

| Trading Platform | Thinkorswim |

| Demo Account | Yes |

| Trading Assets | Stocks, ETFs, Bonds |

| Payment Methods | FPS transfers, a cheque deposit, telegraphic transfer (international wire), ACAT |

| Customer Support | Phone, Email |

TD Ameritrade Hong Kong Limited is a regulated brokerage firm authorized by the Securities and Futures Commission (SFC) of Hong Kong. Holding a license for dealing in futures contracts, TD Ameritrade operates within the legal and regulatory framework of Hong Kong's financial markets. With an address at Room 1211-13, Two Exchange Square, 8 Connaught Place, Central, Hong Kong, the company can be contacted via email at help@tdameritrade.com.hk. The regulatory oversight provided by the SFC ensures that TD Ameritrade Hong Kong adheres to the established standards and practices in the industry.

TD Ameritrade offers a diverse range of market instruments to cater to the investment needs of its users. Investors can trade listed stocks online without any commissions, benefiting from real-time trade analysis and expert insights. The platform enables options trading at a cost of US$0.65 per contract, providing specialized tools and the assistance of U.S.-licensed options trading specialists. Additionally, TD Ameritrade provides access to over 2,000 ETFs across various asset classes and fund companies, along with U.S. Treasury bonds, corporate bonds, offshore mutual funds, American Depositary Receipts (ADRs), and foreign ordinaries.

TD Ameritrade provides various account types, including Individual, Joint, Trust, Corporate, and U.S. Retirement accounts. These accounts cater to different investment preferences and goals. The Individual Account is suitable for individuals who want to manage their portfolios independently, while the Joint Account is designed for opening accounts with another person. Trust Accounts are available for establishing trusts for investment purposes, and Corporate Accounts cater to companies and organizations. U.S. Retirement Accounts are specifically tailored for those interested in opening retirement accounts in the United States. TD Ameritrade also offers Demo accounts for users to test the platform's features and functionalities.

TD Ameritrade Hong Kong Limited, as a regulated brokerage firm operating within the legal and regulatory framework of Hong Kong's financial markets, offers a range of advantages and disadvantages for investors. On the positive side, the company holds a license from Hong Kong's Securities and Futures Commission (SFC), providing a sense of trust and assurance. They provide a diverse selection of market instruments, including stocks, options, ETFs, bonds, offshore mutual funds, ADRs, and foreign ordinaries. TD Ameritrade also offers various account types, multiple trading platforms with robust tools, and educational resources to enhance investors' knowledge. Moreover, clients have access to various funding methods for account deposits. However, there are also limitations. TD Ameritrade primarily operates within Hong Kong's market framework, which may restrict its services for investors outside Hong Kong. Additionally, their focus on futures contracts may not appeal to investors seeking broader investment options. The availability of trading platforms and customer support channels is relatively limited compared to other brokerage firms.

| Pros | Cons |

| Regulated brokerage firm with license from Hong Kong's Securities and Futures Commission (SFC) | Limited to operating within Hong Kong's market framework |

| Wide range of market instruments available, including stocks, options, ETFs, bonds, offshore mutual funds, ADRs, and foreign ordinaries | Limited availability of other investment options |

| Offers multiple account types (individual, joint, trust, corporate, U.S. retirement, and demo accounts) | Limited accessibility for non-Hong Kong residents or investors |

| Provides multiple trading platforms (web trading, StreetSmart Edge®, Schwab Mobile) and robust trading tools | Limited trading platforms compared to some other brokerage firms |

| Offers educational resources (workshops, webinars, market commentary, investing education) | Limited to dealing in futures contracts |

| Various funding methods available for account deposits | Customer support limited to phone, email, and online channels |

On 28 February 2022, TD Ameritrade Hong Kong will close and will no longer maintain accounts.

TD Ameritrade Hong Kong Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. The company holds a license for dealing in futures contracts, with license number BJO462. The regulatory oversight provided by the SFC ensures that TD Ameritrade Hong Kong operates within the established legal and regulatory framework of Hong Kong's financial markets. The license was issued on October 17, 2017, and there is no specified expiry date mentioned. The address of TD Ameritrade Hong Kong Limited is Room 1211-13, Two Exchange Square, 8 Connaught Place, Central, Hong Kong. The company can be contacted via email at help@tdameritrade.com.hk. Further information about TD Ameritrade Hong Kong Limited can be found on their website at www.tdameritrade.com.hk.

TD Ameritrade clients can trade a wide variety of assets on the web platform as well as the mobile apps. This includes exchanged-traded funds (ETFs), stocks, options, futures, and cryptocurrency.

Stocks: TD Ameritrade allows users to trade listed stocks online with no commissions. They provide tools and research informed by Schwab experts to simplify stock selection. Users can benefit from real-time trade analysis provided by Schwab professionals.

Options: TD Ameritrade enables online options trading with a cost of just US$0.65 per contract and no base commission. They offer platforms and tools specifically designed for options traders, aiding in navigating the market. U.S.-licensed options trading specialists are also available to provide support.

Exchange-Traded Funds (ETFs): TD Ameritrade provides access to over 2,000 ETFs across various asset classes and fund companies. Users can utilize the Schwab Personalized Portfolio Builder tool to easily create a diversified ETF portfolio. Additionally, European-domiciled UCITS ETFs are available for residents of the European Economic Area (EEA).

Bonds: TD Ameritrade offers access to a wide range of investments, including U.S. Treasury bonds and corporate bonds. Their Schwab BondSource® tool allows users to screen through 36,000+ bonds. Pricing is straightforward and easy to understand, ensuring users know what they are paying for.

Offshore mutual funds: TD Ameritrade provides a broad selection of funds that have been carefully screened by Schwab experts. Users can access premium independent research and analysis from Morningstar®. The platform also offers an advanced online screener tool that allows users to compare up to five funds simultaneously.

American Depositary Receipts (ADRs) and foreign ordinaries: TD Ameritrade offers trading of ADRs and foreign ordinaries, providing users with insights into the benefits, risks, and considerations associated with these international stock types. Advanced platforms and tools are available for trading stocks in local markets.

| Pros | Cons |

| Diverse range of market instruments | Limited mention of fees and costs |

| No-commission online trading for listed stocks | Lack of emphasis on specific stock selection criteria |

| Availability of European-domiciled UCITS ETFs for EEA residents | Limited information on options trading support |

| Low-cost options trading with U.S.-licensed specialists | No mention of the options trading platform's features |

| Access to over 2,000 ETFs across various asset classes | Limited information on the Schwab Personalized Portfolio Builder tool |

Individual Account:

TD Ameritrade offers an Individual Account option for clients who wish to trade and invest on their own. This account type is suitable for individuals who want to manage their own portfolios and make independent investment decisions. The Individual Account does not have any specific minimum deposit requirements, although to open an Individual or Joint account, a minimum of US$25,000 is needed. Within the Individual Account category, there are two subtypes: Margin account and Cash account. The Margin account requires an initial deposit of at least 2000 USD, whereas the Cash account has no minimum deposit requirement.

Joint Account:

For clients who want to open an account with another person, TD Ameritrade offers a Joint Account option. The online application process is available for joint accounts with two account holders. However, if there are more than two account holders, it is necessary to contact TD Ameritrade to initiate the account-opening process.

Trust Account:

TD Ameritrade provides a Trust Account option for clients who want to establish a trust for investment purposes. Opening a Trust Account requires a minimum deposit of US$100,000. The online application process is available for trusts with two or fewer individual trustees and/or beneficiaries. If the trust has more than two individual trustees, a company trustee, or if the beneficiaries are greater than two and include a company or undisclosed parties, it is recommended to contact TD Ameritrade for further information.

Corporate Account:

TD Ameritrade offers a Corporate Account option for companies and organizations. To learn more about opening a Charles Schwab International corporate account, it is necessary to contact TD Ameritrade directly.

U.S. Retirement Account:

For clients interested in opening a retirement account in the United States, TD Ameritrade provides the U.S. Retirement Account option. To obtain more information about opening a U.S. retirement account with TD Ameritrade, it is advised to contact them directly. The U.S. Retirement Account includes Individual and Joint Account options.

TD Ameritrade also offers the option of Demo accounts, which allow both beginners and experienced traders to test the functionalities and features of the trading platform.

| Pros | Cons |

| Diverse range of account options | Account opening requirements may be restrictive |

| Individual account allows independent investing | Limited online application process for joint accounts |

| Trust account option for investment trusts | Trust account minimum deposit requirement |

| Corporate account option for companies | Limited information available on corporate accounts |

| U.S. Retirement account for retirement planning | Limited information on opening a U.S. retirement account |

| Demo accounts for testing platform functionalities | Lack of specific details on account benefits |

Demo accounts are available for both beginners and professionals to test trading platform's functionalities and features in a 100% risk-free trading environment.

To open an account with TD Ameritrade, follow these steps:

Visit the TD Ameritrade website and click on the “Open Your Account” button.

Select your country or region of residence from the provided list. This will connect you to the appropriate page for your location.

Begin the online application process, which typically takes around 15 minutes to complete.

Prepare the necessary documents for the application. These may include:

Tax ID Number or Social Security Number: Provide your tax identification number or social security number, depending on your country's requirements.

Passport or government ID: Have a valid passport or government-issued identification document ready for verification purposes.

Recent utility bill or proof of residency: Gather a recent utility bill (such as gas, electric, water, or cable) or any other document that serves as proof of your residency.

Employer's name and mailing address: If applicable, provide the name and mailing address of your employer.

Ensure you have access to a printer and scanner. You will need these to print, sign, and upload any required documents during the application process.

Select the Account Types.

Review the terms and conditions, disclosures, and any other relevant documents carefully before submitting your application.

After submitting your application, wait for confirmation and further instructions from TD Ameritrade regarding the status of your account.

To open an Individual/Joint account, a minimum deposit of US$25,000 is required. Detailed information about fees and commissions can be found in the Charles Schwab Pricing Guide for Individual Investors.

For stocks and ETFs, the commission per trade for online trades is US$0, while broker-assisted trades incur a fee of US$25. Non-U.S. ETFs are not available for online trades and are subject to a transaction fee of US$50 for broker-assisted trades.

Regarding offshore mutual funds, there is no transaction fee for broker-assisted trades. However, a short-term redemption fee of US$49.95 may apply.

Options trading entails a commission per executed trade of US$0 plus US$0.65 per contract for online trades, while broker-assisted trades are subject to online pricing plus a fee of US$25.

In terms of fixed income, the transaction fee per trade for new issues is included in the offering price for both online and broker-assisted trades. For Treasuries, including Auction and Secondary, such as Treasury Bonds, Treasury Bills, Treasury Notes, and TIPS, the transaction fee is US$0 for online trades and US$25 for broker-assisted trades. Corporate Bonds, Municipal Bonds, Government Agencies, Zero-Coupon Treasuries (including STRIPS), incur a fee of US$1 per bond with a minimum of US$10 and a maximum of US$250 for online trades. Broker-assisted trades in this category are subject to online pricing plus a fee of US$25. Specialty products like Commercial Paper, Foreign Bonds, Asset-Backed Securities, Mortgage-Backed Securities, Collateralized Mortgage Obligations, and Unit Investment Trusts require contacting TD Ameritrade for specific information. For Preferred listed stocks and REITs, there is no commission for online trades, while broker-assisted trades incur a fee of US$25.

| Pros | Cons |

| No commission for online stock and ETF trades | Minimum deposit of US$25,000 for Individual/Joint accounts |

| No commission for online Preferred listed stocks and REIT trades | US$25 fee for broker-assisted stock trades |

| No transaction fee for offshore mutual fund broker-assisted trades | Short-term redemption fee of US$49.95 may apply for offshore mutual funds |

| US$0 commission for options trades | US$25 fee for broker-assisted options trades |

| No transaction fee for online Treasury trades | US$25 fee for broker-assisted Treasury trades |

| US$1 per bond fee for online fixed income trades | US$25 fee for broker-assisted fixed income trades |

| US$25 fee for broker-assisted Preferred listed stocks and REIT trades |

TD Ameritrade Hong Kong Limited requires a minimum deposit of US$25,000 to open a brokerage account(Individual or Joint account).

Also, TD Ameritrade has a minimum deposit requirement of US$100,000 for its Trust Account.

TD Ameritrade offers a comprehensive trading platform that provides users with access to the U.S. market.

One of their platforms is web trading, accessible through International.Schwab.com. This platform allows users to trade easily from anywhere with an internet connection. The website provides a user-friendly interface for accessing the U.S. market. Additionally,

StreetSmart Edge®.

One of the primary trading platforms provided by TD Ameritrade is StreetSmart Edge®. This platform is designed to cater to the needs of traders, offering powerful features and functionalities. It can be accessed either through downloadable software or online via the cloud.

Schwab Mobile.

In addition to the desktop platform, TD Ameritrade also offers mobile trading through Schwab Mobile. This mobile app enables users to stay connected to their U.S. investments on the go. It is available for Android™, iPhone®, iPad®, and Apple Watch™, allowing traders to access their accounts and make informed decisions wherever they are.

TD Ameritrade's trading platform is equipped with robust trading tools that help users translate insights into action. These tools are designed to assist traders in analyzing market trends and making informed trading decisions. The platform's features provide users with the necessary tools and resources to navigate the complexities of the U.S. market.

| Pros | Cons |

| Comprehensive trading platform | Minimum deposit requirement of US$25,000 for individual/joint accounts and US$100,000 for trust accounts |

| Web trading accessible | Limited availability of trading platforms compared to some competitors |

| Schwab Mobile app for on-the-go trading | Possible fees and commissions associated with trading activities |

| StreetSmart Edge® platform with powerful features | Limited customization options for trading platform layout and settings |

| Robust trading tools for market analysis and informed decision-making |

TD Ameritrade offers a range of educational resources to help investors deepen their understanding of U.S. investing. These resources include workshops, webinars, U.S. market commentary, investing education, and daily updates.

The workshops and webinars provided by TD Ameritrade are designed specifically for international investors, catering to individuals at all levels of experience. These sessions offer the opportunity to learn directly from seasoned investment experts at TD Ameritrade. Whether attending an in-person workshop or participating in a live webinar, investors can benefit from the expertise shared during these educational events.

U.S. Market Commentary

To enhance U.S. investing intelligence, TD Ameritrade offers market commentary that provides insights into the U.S. and global markets. Through the Schwab Market Perspective, investors can gain valuable information to stay informed about the daily fluctuations of the stock market. This helps investors make informed decisions regarding U.S. investment opportunities.

Investing Education

TD Ameritrade's investing education aims to help investors apply their skills to U.S. markets. They provide resources that cover various aspects of investing, such as identifying favorable trends, conducting technical and fundamental analysis, and applying investment strategies. These educational materials can assist investors in making informed investment decisions in the U.S. market.

Additionally, TD Ameritrade offers daily updates, including the closing market update, which provides a summary of market movements and key events impacting the U.S. stock market. These updates help investors stay up-to-date with the latest developments and trends in the market, enabling them to make more informed investment decisions.

Pros and Cons

| Pros | Cons |

| Wide range of educational resources available in many different formats | Some resources can be outdated or inaccurate |

| Workshops and webinars designed specifically for international investors | Not all resources are available in all languages |

| Market commentary provides insights into the U.S. and global markets | Market commentary can be biased or subjective |

| Investing education covers various aspects of investing | Some educational materials can be complex or difficult to understand |

| Daily updates help investors stay up-to-date with the latest market developments | Daily updates can be overwhelming or too frequent |

TD Ameritrade provides a range of funding options for clients to deposit funds into their accounts. These options include FPS transfers, cheque deposits, telegraphic transfers (international wire), and account transfers from another broker (ACAT). It is important to note that all deposits must be made in U.S dollars.

In addition to these methods, TD Ameritrade accepts various payment options for clients to fund their accounts. These include Mastercard, Visa, Metro, Skrill, Neteller, AstroPay, eBay.bg, GiroPay, Neosurf, Euteller, SOFORT, ToditoCash, and others.

TD Ameritrade provides customer support through various channels to assist clients with their inquiries and concerns. To reach customer service by phone, clients can call +1-415-667-7870 if they are outside the United States, or 1-877-853-1802 if they are within the U.S. The customer service hours are from 5:30 p.m. on Sunday to 1:00 a.m. on Saturday, following the U.S. Eastern Standard Time (EST).

Clients can also contact TD Ameritrade's customer support via email by writing to the provided email address. For mailing purposes, applications, deposits, and other materials can be sent to the following address:

Charles Schwab & Co., Inc.

Attn: International Operations

1945 Northwestern Drive

El Paso, TX 79912-1108, USA

Additionally, TD Ameritrade offers phone-based services. Clients can use Schwab by Phone™ by calling 1-800-435-4000 to reach an investment professional or utilize automated phone services. TeleBroker® provides access to automated touch-tone services, and it can be reached at 1-800-2SCHWAB (1-800-272-4922). For specific services in different languages, clients can contact the respective numbers provided, such as 1-800-662-6068 for 中文 (Chinese) services and 1-800-786-5174 for servicios en español (Spanish services). International clients can call 1-415-667-8400 for services in English, 中文, or español.

To access customer support online, clients can visit the official TD Ameritrade website at schwab.com, chinese.schwab.com, or international.schwab.com. For those using web-enabled phones, they can find Schwab on their phone's web menu. Additionally, PDA users can consult schwab.com/wireless on their desktop for further assistance.

In conclusion, TD Ameritrade Hong Kong Limited is a regulated brokerage firm authorized by the Securities and Futures Commission (SFC) of Hong Kong. It offers a diverse range of market instruments, including stocks, options, ETFs, bonds, offshore mutual funds, and ADRs/foreign ordinaries. The company provides various account types, such as Individual, Joint, Trust, Corporate, and U.S. Retirement Accounts, with different minimum deposit requirements. TD Ameritrade offers multiple trading platforms, including web trading, StreetSmart Edge®, and Schwab Mobile, to provide access to the U.S. market. They also offer educational resources, workshops, webinars, and market commentary to help investors enhance their understanding of U.S. investing. Payment methods include FPS transfers, cheque deposits, telegraphic transfers, and account transfers. Customer support is available through phone, email, and online channels.

Q: Is TD Ameritrade regulated?

A: Yes, TD Ameritrade is regulated by the Securities and Futures Commission (SFC) of Hong Kong.

Q: What market instruments does TD Ameritrade offer?

A: TD Ameritrade offers a diverse range of market instruments including stocks, options, exchange-traded funds (ETFs), bonds, offshore mutual funds, American Depositary Receipts (ADRs), and foreign ordinaries.

Q: What are the minimum deposit requirements for TD Ameritrade?

A: TD Ameritrade requires a minimum deposit of US$25,000 for Individual and Joint accounts, and US$100,000 for Trust accounts.

Q: What trading platforms does TD Ameritrade provide?

A: TD Ameritrade offers web trading, StreetSmart Edge®, and Schwab Mobile as its primary trading platforms.

Q: What educational resources are available at TD Ameritrade?

A: TD Ameritrade offers workshops, webinars, U.S. market commentary, investing education, and daily updates to help investors enhance their understanding of U.S. investing.

Q: What are the payment methods accepted by TD Ameritrade?

A: TD Ameritrade accepts FPS transfers, cheque deposits, telegraphic transfers, and account transfers from another broker. It also accepts payment options such as Mastercard, Visa, and various other methods.

Q: How can I contact TD Ameritrade's customer support?

A: You can contact TD Ameritrade's customer support via phone, email, or by mailing your inquiries to their designated address. They also offer phone-based services and online customer support through their official website.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive saxo and td-ameritrade are, we first considered common fees for standard accounts. On saxo, the average spread for the EUR/USD currency pair is -- pips, while on td-ameritrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

saxo is regulated by ASIC,FCA,FSA,SFC,AMF,CONSOB,FINMA,MAS,AMF,DFSA,ASIC. td-ameritrade is regulated by SFC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

saxo provides trading platform including VIP account,Classic account,Platinum account and trading variety including --. td-ameritrade provides trading platform including -- and trading variety including --.