No data

Do you want to know which is the better broker between Saxo and Binary.com ?

In the table below, you can compare the features of Saxo , Binary.com side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of saxo, binary-com lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Saxo Review Summary in 10 Points | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS |

| Market Instruments | Forex, stocks, futures, options, bonds, ETFs and CFDs |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/USD Spread | 0.4 pips |

| Trading Platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Minimum deposit | HKD10,000 |

| Customer Support | 24/5 phone, email |

Saxo is a Danish investment bank founded in 1992. It provides online trading and investment services in multiple assets, including stocks, bonds, forex, options, futures, and CFDs, through its proprietary trading platforms. The bank operates in over 100 countries and has offices in major financial centers worldwide, including Copenhagen, London, Singapore, and Tokyo. Saxo Bank is regulated by several financial authorities, including the Danish Financial Supervisory Authority, the UK Financial Conduct Authority, and the Monetary Authority of Singapore. The bank also has a banking license and is a member of the Danish guarantee fund for depositors and investors.

Saxo is a multi-asset broker that offers access to a wide range of financial instruments, including forex, stocks, bonds, ETFs, futures, options, and more. The broker provides trading services through its advanced trading platforms and caters to both retail and institutional clients. Saxo operates as a hybrid broker, offering both direct market access (DMA) and market making services.

Saxo is a well-established and reputable broker with a range of trading platforms, instruments, and research tools.

However, the broker's high fees, minimum deposit requirement, and lack of negative balance protection may not be suitable for all traders. Additionally, some users have reported poor customer service experiences.

| Pros | Cons |

| • Wide range of financial instruments available | • High minimum deposit requirement |

| • Access to multiple markets and exchanges | • Fees and commissions may be higher than competitors |

| • User-friendly trading platforms | • Inactivity fee for dormant accounts |

| • Advanced trading tools and research | • Limited educational resources |

| • Regulated by top-tier financial authorities | • Limited customer support options |

Overall, it is important for traders to carefully consider their own needs and preferences before choosing Saxo or any other broker.

There are many alternative brokers to Saxo, each with their own unique features and benefits. Some popular alternatives include:

Interactive Brokers: A well-established broker with a wide range of trading instruments and low commissions.

TD Ameritrade: Offers a powerful trading platform and a variety of educational resources.

E*TRADE: A popular broker with a user-friendly platform and no account minimums.

IG: A global leader in online trading, offering a wide range of markets and advanced trading tools.

Plus500: A broker known for its user-friendly platform and tight spreads.

Ultimately, the best alternative broker for you will depend on your specific trading needs and preferences. It's important to research and compare different brokers to find the one that best fits your individual needs.

Saxo is a legitimate and reputable broker with a long track record of providing reliable trading services. It is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Danish Financial Supervisory Authority (DFSA). Additionally, Saxo is a member of several investor protection funds, such as the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients' funds up to a certain amount in case of the broker's insolvency. Therefore, based on its regulation and investor protection measures, Saxo can be considered a legitimate broker.

Saxo is a regulated broker, with licenses from multiple reputable regulatory authorities and a long-standing history of providing financial services. The broker takes extensive measures to protect client funds, including segregating them from the company's assets and offering negative balance protection.

Additionally, Saxo offers various security features, such as two-factor authentication and encryption, to ensure secure trading.

More details can be found in the table below:

| Security Measures | Description |

| Regulation | FSA, FINMA, FCA, ASIC, DFSA |

| Segregated Accounts | Client funds are held in segregated bank accounts to protect them in case of insolvency. |

| Two-Factor Authentication | As an extra layer of security for client accounts |

| SSL Encryption | The Saxo website and platform are secured with SSL encryption to protect user data |

| Investor Compensation Scheme | A member of the Danish Investor Compensation Scheme, which provides additional protection to clients in case of insolvency |

It's important to note that while these measures provide some level of protection for clients, there is always some level of risk involved in trading financial instruments, and clients should always be aware of the risks before making any trades.

Based on the information available, Saxo appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years. However, we also find that some users complain about their bad experience with Saxo. Take care!

Saxo offers a wide range of trading instruments across multiple asset classes, including

Forex: More than 180 currency pairs, including majors, minors, and exotics.

Stocks: Over 40,000 stocks from 36 global exchanges, including NYSE, NASDAQ, LSE, and more.

Futures: Over 200 futures and options across a variety of asset classes such as commodities, indices, and bonds.

Options: A wide range of options on stocks, indices, and futures.

Bonds: Trade a wide range of government and corporate bonds, including sovereign bonds from developed and emerging markets.

ETFs and CFDs: Access to over 3,000 ETFs and CFDs on indices, commodities, and stocks.

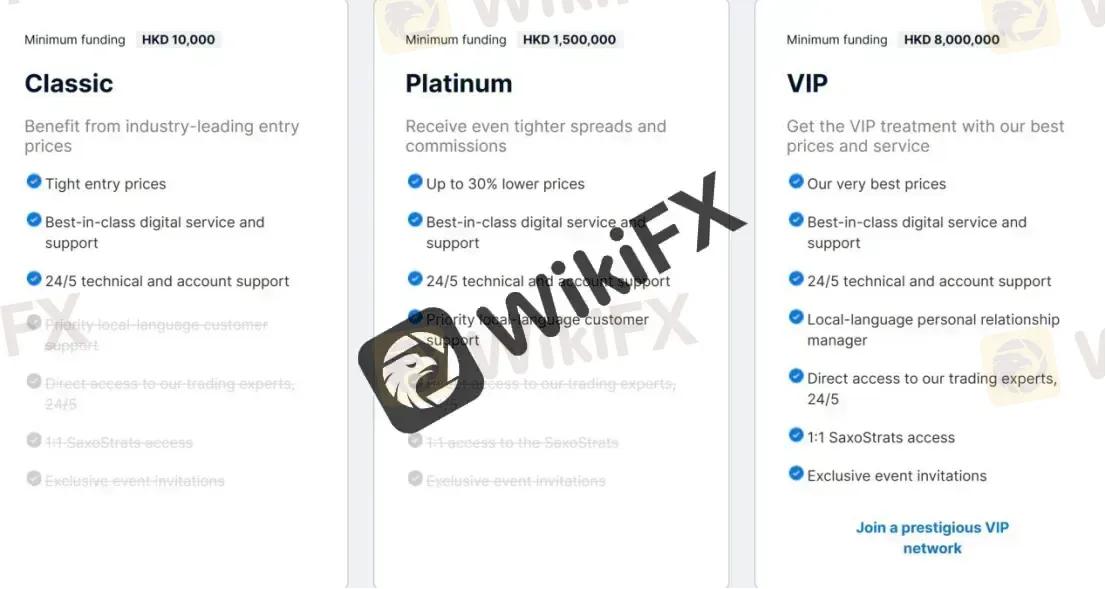

Saxo offers a range of account types designed to suit the different needs of its clients. The account types offered by Saxo are:

Classic Account: A traditional account with minimum funding of HKD10,000, which offers a range of trading tools and resources.

Platinum Account: A premium account for high-net-worth individuals, with a minimum funding requirement of HKD 1,500,000.

VIP Account: An exclusive account for ultra-high-net-worth individuals, with a minimum funding requirement of HKD 8,000,000.

Islamic Account: A Sharia-compliant account for clients who follow Islamic finance principles.

Corporate Account: An account for companies, partnerships, and other legal entities.

Joint Account: An account for two or more individuals who want to trade together.

Each account type has its own unique features and benefits, such as lower pricing, higher leverage, and dedicated account managers. Saxo also offers a free demo account for clients to practice trading before committing to a live account.

It takes only about five minutes and a short online form to open an account. Clients will need to submit the standard verification documents required by KYC and AML rules, but the procedure should be quick and easy, and they will have access to their account in minutes.

Saxo offers leverage up to 1:100 for forex trading. Professional clients are entitled to leverage of 1:40 for the primary index, 1:33 for the secondary index, 1:33 for gold, 1:10 for equities, and 1:25 for commodities. Retail clients are entitled to leverage of 1:20 for the primary index, 1:10 for the secondary index, 1:20 for gold, 1:5 for equities and 1:10 for commodities.

However, the maximum leverage may vary depending on the instrument being traded and the client's location. It is important to note that trading with high leverage carries a higher level of risk, and traders should always exercise caution and use risk management strategies.

Saxo offers variable spreads, which means that the spreads can change depending on market conditions. The typical minimum spreads for popular instruments are as follows:

EUR/USD: 0.4 pips

USD/JPY: 0.6 pips

GBP/USD: 0.9 pips

AUD/USD: 0.6 pips

USD/CHF: 1.2 pips

USD/CAD: 1.5 pips

Saxo also charges commissions on some products, including stocks, ETFs, and futures. The commission fees vary depending on the specific market and the size of the trade. Commissions start at $3 per share for equities, as low as $0.85 per lot for commodities, and $3 per share for ETFs. Futures commissions start as low as $0.85 per lot, bonds commissions start at 0.05%, listed options commissions start as low as $1.25 per lot, and mutual funds commissions are $0 for custody and platform fees.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per lot |

| Saxo | 0.4 pips | $3 |

| Interactive Brokers | 0.1 pips | $2 |

| TD Ameritrade | 0.7 pips | free |

| E*TRADE | 1.0 pips | free |

| IG | 0.75 pips | free |

| Plus500 | 0.8 pips | free |

Please note that commission rates may vary depending on the specific account type and trading volume. Additionally, some brokers may offer different spreads and commissions for other currency pairs or financial instruments. It's important to do your own research and carefully consider the costs and fees of each broker before making a decision.

Saxo offers its own proprietary trading platform called SaxoTraderGO. It is a web-based platform that can be accessed from any device with an internet connection. In addition to SaxoTraderGO, Saxo also offers SaxoTraderPRO, a desktop-based trading platform that is designed for advanced traders who require additional functionality.

SaxoTraderGO is highly customizable, allowing traders to arrange the interface to suit their preferences. It provides access to a wide range of trading tools and features, including charting tools, technical analysis indicators, and news feeds. The platform also includes a comprehensive range of order types, including market, limit, stop, and trailing stop orders.

SaxoTraderPRO is a professional-grade trading platform that offers advanced trading tools and features. It is designed for active traders and includes a range of tools that allow traders to monitor multiple markets and instruments simultaneously. The platform also includes advanced charting tools and a range of order types, including conditional orders and algorithmic trading capabilities.

Saxo also offers SaxoInvestor, which is a user-friendly trading platform suitable for beginner investors who are interested in a wide range of asset classes. It provides a simple and intuitive interface with basic research tools and features, making it easy for investors to buy and sell stocks, ETFs, bonds, and mutual funds. However, advanced traders may find the platform's lack of advanced tools and customization options limiting.

Overall, Saxo's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| Saxo | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

| Interactive Brokers | Trader Workstation, WebTrader, IBKR Mobile |

| TD Ameritrade | Thinkorswim, Web Platform, TD Ameritrade Mobile App |

| E*TRADE | Power E*TRADE, E*TRADE Web, E*TRADE Mobile |

| IG | IG Trading Platform, IG Web Platform, IG Trading App |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

Saxo Bank supports several deposit and withdrawal methods, including Visa, MasterCard, Visa Debit, Visa Electron, MasterCard Debit, Maestro (for UK residents), Visa Dankort (for Denmark residents), Carte Bleue (for France residents). The company does not charge any fees for deposits and withdrawals, but if an investor makes a withdrawal request via manual withdrawal, a processing fee of 40 EUR will be charged.

Saxo has different minimum deposit requirements depending on the type of account you open and your country of residence. For example, the minimum deposit for the Classic account is HKD10,000.

However, these amounts can vary depending on your location and the specific account type. It's important to check with Saxo directly or on their website for the most up-to-date information on minimum deposit requirements.

| Saxo | Most other | |

| Minimum Deposit | HKD10,000 | $100 |

To withdraw funds from your Saxo account, you need to follow these steps:

Step 1: Log in to your Saxo account using your credentials.

Step 2: Click on the “Account” tab located on the top right corner of the screen.

Step 3: Click on “Withdraw Funds” from the account menu options.

Step 4: Select the account you wish to withdraw funds from, enter the amount you want to withdraw, and select the currency you want to withdraw in.

Step 5: Choose the preferred withdrawal method from the available options and provide the necessary details such as bank account information or credit/debit card information.

Step 6: Review the details of your withdrawal request and click on “Submit.”

Note that Saxo may require additional verification or documentation before processing your withdrawal request. The processing time for withdrawals may vary depending on the chosen method and your bank's processing time.

Swap costs, sometimes called overnight fees, are assessed on overnight open positions at Saxo Bank. These are expressed as interest and, depending on the trader's position, might be either charged to or credited to his or her account.

Traders of the Muslim faith, for whom the payment of interest is forbidden, are out of luck with Saxo Bank because they don't have the option of opening an Islamic account. With the wide variety of deposit currencies offered by Saxo Bank, customers will have a decreased chance of incurring conversion fees.

Amounts credited to your account are converted from their original currency at the mid-point FX Spot rate plus/minus the margins and spreads indicated below. This includes both trading fees and profits/losses incurred as a result of your trading activities.

Fees for account inactivity are also a reality for inactive accounts. After the initial six months, the rate increased to $150, which is quite a bit.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Saxo | Free | Free | $150 after six months of inactivity |

| Interactive Brokers | Free | $0-$10 | $20/month if account balance < $2,000 |

| TD Ameritrade | Free | Free | Free |

| E*TRADE | Free | $0-$25 | Free |

| IG | Free | Free | $18/month after 24 months of inactivity |

| Plus500 | Free | Free | $10/month after 3 months of inactivity |

Saxo provides customer support through several channels, including phone, email, and social media (Facebook, LinkedIn, Twitter and YouTube). The broker offers 24/5 customer service in multiple languages, including English, Chinese, French, German, Italian, Japanese, Portuguese, and Spanish.

Saxo also provides a comprehensive help center on its website that includes an extensive knowledge base, FAQs, trading guides, and video tutorials. The broker's customer service is generally considered to be of high quality, with knowledgeable representatives who are responsive and helpful.

| Pros | Cons |

| • 24/5 customer service through multiple channels | • No 24/7 support service |

| • Dedicated support for VIP clients | • Phone support may have long wait times |

| • Extensive FAQ section on the website | • No dedicated account manager for non-VIP clients |

| • Personalized support for complex trading needs | • No local offices in some countries |

| • Multilingual support available for non-English users |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Saxo's customer service.

Saxo Bank provides excellent market research in addition to a wealth of instructional resources like video courses, webinars, and events. Saxo Bank's SaxoStrats Experts group consists of eight analysts and strategists who are tasked with providing coverage of the various asset classes available to customers. It's apparent that this broker places a high value on its research team and recognizes the significance of this service, both for its clients and as a global investment bank. The classes are a wonderful way for newcomers to get their feet wet and become acquainted with the resources that are at their disposal. Videos are easy to follow and understand, helping novice traders quickly get up to speed and lay a solid groundwork from which to expand their knowledge. Saxo Bank specialists will be hosting webinars.

In conclusion, Saxo is a well-established broker. The broker offers a wide range of trading instruments, including forex, stocks, options, futures, and CFDs, and provides access to various markets worldwide. Saxo also offers an advanced trading platform and a user-friendly mobile app, making it easy for traders to access the markets on the go.

While Saxo has some of the highest fees in the industry, the broker's competitive spreads and tight execution make it a popular choice for traders. Additionally, Saxo's robust educational resources and customer support make it an ideal choice for traders of all skill levels who want to improve their knowledge and skills in trading.

Overall, Saxo is a multi-asset broker that offers a comprehensive suite of trading tools and services to help traders achieve their investment goals. However, potential clients should carefully consider the fees and minimum deposit requirements before opening an account. Also, dont forget check their user reviews on the Internet.

| Q 1: | Is Saxo regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS. |

| Q 2: | Does Saxo offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Saxo offer the industry-standard MT4 & MT5? |

| A 3: | No. Instead, it offers SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. |

| Q 4: | What is the minimum deposit for Saxo? |

| A 4: | The minimum initial deposit to open an account isHKD10,000. |

| Q 5: | Is Saxo a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | 5-10 years |

| Company Name | Binary.com |

| Regulation | Regulated in Malaysia, Offshore Regulatory (Vanuatu) |

| Minimum Deposit | $5 |

| Maximum Leverage | Dynamic (range from 1:300 to 1:1000) |

| Spreads | Not specified |

| Trading Platforms | Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, Binary Bot |

| Tradable assets | Forex, CFDs, Derivatives, Stocks & Indices, Cryptocurrencies, Commodities |

| Account Types | Real trading and demo trading |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Phone (English, German, French), Email |

| Payment Methods | Credit/Debit Cards, E-wallets, Online Banking, Cryptocurrencies, Fiat Onramp |

Binary.com is a regulated trading platform based in the United Kingdom and has been in operation for 5-10 years. It operates under a Straight Through Processing (STP) license in Malaysia but has had its retail Forex license revoked in Vanuatu. The broker has a global business presence and is known for its high potential risk. It is important to note that Binary.com's regulatory status is classified as offshore.

Binary.com offers a wide range of market instruments, including Forex, CFDs, derivatives, stocks, indices, cryptocurrencies, and commodities. Traders can participate in various financial markets and take advantage of opportunities in different asset classes. However, it is crucial to be aware of the potential risks associated with trading on this platform, especially given the offshore regulatory status.

The broker provides several trading types, including CFDs, Multipliers, and Options, each offering unique benefits and risks. Traders can choose the trading type that aligns with their strategies and risk tolerance. It is important to note that trading with high leverage amplifies both potential profits and losses, and caution should be exercised when using leverage.

Binary.com offers a range of trading platforms, including Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, and Binary Bot. These platforms provide different features and functionalities to cater to the diverse needs of traders. However, detailed information about platform fees is not readily available, and traders should consider this aspect before choosing a specific platform.

Overall, traders considering Binary.com should be cautious due to the high potential risk associated with the broker's offshore regulatory status and the reported complaints. It is advisable to thoroughly research and understand the risks involved before engaging in trading activities on this platform.

Binary.com is a regulated broker by the Labuan Financial Services Authority in Malaysia, but its licenses in Vanuatu and the British Virgin Islands are currently revoked, raising concerns about its offshore regulatory status. The broker claims to be regulated by the Financial Services Agency in Japan, but there are suspicions that it may be a clone. WikiFX has reported 21 complaints against Binary.com in the past 3 months, indicating potential risks and scams. On the positive side, Binary.com offers a wide range of market instruments, including forex, CFDs, derivatives, stocks, indices, cryptocurrencies, and commodities, providing traders with diverse trading opportunities. However, high leverage levels can increase the risk of potential losses, and multipliers amplify both gains and losses, which can be risky. Additionally, there is limited information available on expiry dates and the website for licensed institutions. The broker offers various trading platforms, including Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, and Binary Bot, each with its own features and capabilities. However, some platforms may have limited customization options and lack advanced trading features. Overall, traders should exercise caution and consider the potential risks associated with Binary.com before engaging in trading activities.

| Pros | Cons |

| Wide range of market instruments | Revoked licenses in Vanuatu and the British Virgin Islands |

| Regulated by Labuan Financial Services Authority in Malaysia | Suspicions of being a clone regulator in Japan |

| Diverse trading opportunities | 21 complaints reported in the past 3 months |

| Regulation claimed in Japan | High leverage levels and multipliers increase risk |

| Multiple trading platforms | Limited information on expiry dates and licensed institutions' website |

Binary.com is regulated by the Labuan Financial Services Authority in Malaysia under license number MB/18/0024. It operates as Deriv (FX) Ltd with a Straight Through Processing (STP) license. However, its licenses in Vanuatu and the British Virgin Islands are currently revoked and classified as offshore regulatory. The broker also claims to be regulated by the Financial Services Agency in Japan, but it is suspected to be a clone. WikiFX has reported 21 complaints against Binary.com in the past 3 months, raising concerns about potential risks and scams.

Binary.com offers a diverse range of market instruments for traders, providing them with various opportunities to participate in financial markets.

Forex and CFDs:

Binary.com offers trading in Forex and Contract for Difference (CFDs). CFD trading allows you to speculate on the price movement of an asset without owning the underlying asset. With high leverage, you can trade CFDs by paying only a fraction of the contract's value. This amplifies potential gains but also increases potential losses.

Derivatives:

Derivatives trading allows traders to speculate on the price movements of various financial instruments without owning the underlying assets. It offers flexibility and the opportunity to trade on indices that represent specific markets or sectors. Traders can benefit from the volatility of these instruments and potentially profit from both upward and downward price movements.

Stocks & Indices:

Binary.com allows trading in global stocks of well-known brands and international stock market indices. This provides traders with access to a wide range of stocks and indices at competitive prices, expanding their trading opportunities.

Cryptocurrencies:

Binary.com offers trading in popular cryptocurrencies, taking advantage of the highly liquid cryptocurrency market. Traders can profit from predicting the movement of cryptocurrencies such as Bitcoin, Ethereum, and more.

Commodities:

Binary.com allows trading in commodities such as Metals and Energy. Traders can speculate on the price movements of these assets without owning them, benefiting from high leverage and competitive spreads.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments available | High leverage can lead to increased risk and potential losses |

| Access to global stocks, indices, and cryptocurrencies | Multipliers amplify gains and losses, increasing risk |

| CFD trading allows speculation on price movements | Regulatory status in some jurisdictions is revoked or offshore |

Binary.com offers two types of accounts: real trading and demo trading. Real trading accounts are for traders who want to engage in live trading with real money, allowing them to access various financial instruments and participate in global markets. On the other hand, demo trading accounts provide a risk-free environment for traders to practice their strategies and explore the platform using virtual funds.

Binary.com offers three exciting trade types: CFDs, Multipliers, and Options.

CFDs:

Trade CFDs on Binary.com to take advantage of leverage and low spreads, which can result in better returns on successful trades. With high leverage, you can open larger positions with a smaller balance in your trading account. It's important to keep in mind that CFDs are traded on margin, meaning you need a deposit to open a leveraged position. Trading CFDs increases both potential profit and loss, as it amplifies market exposure. Stop loss, stop out, and margin call features are available to manage risk.

Multipliers:

Multipliers on Binary.com combine leverage trading benefits with limited risk. By predicting market movements, you can multiply potential profits when the market moves in your favor. Losses are limited to your stake amount. Customizable features such as stop loss, take profit, and deal cancellation enhance risk management. With increased market exposure, you can trade multipliers 24/7 on forex and synthetics. The platform provides a responsive trading experience, with expert and friendly support available.

Options:

Binary.com offers options trading, which allows you to predict market movements and earn payouts without owning the underlying asset. You can trade digital options that offer fixed payouts based on correct predictions or lookbacks that provide payouts based on the optimum high or low achieved by the market during the contract's duration. Options trading requires minimal capital investment, making it accessible to a wide range of traders.

Pros and Cons

| Pros | Cons |

| CFDs offer leverage and low spreads | CFDs amplify potential profit and loss |

| Multipliers combine leverage and risk | Multipliers have limited losses to stake |

| Options allow participation with minimal investment | Options have fixed payouts based on correct predictions |

| Trade 24/7 on forex and synthetics | Margin requirements and market exposure |

| Risk management features available | Sudden market fluctuations can affect stop loss levels |

| Swap rates and overnight funding charges |

To open an account with Binary.com, follow these simple steps:

Visit the Binary.com website and click on the “Create a New Account” button to access the login page.

On the login page, click on the “Sign Up” option to begin the account creation process.

3. Enter your email address in the provided field to initiate the signup process.

4. Review the information regarding the creation of a demo account and confirm your age as 18 or older.

5. By clicking “Create demo account,” you acknowledge that Binary.com may use your email address to send you information about their products, services, and market news. You can unsubscribe from these emails at any time within your account settings.

6. Alternatively, you may have the option to sign up using alternative methods specified on the page.

Binary.com offers different types of leverage depending on various factors. The leverage used at Binary.com is dynamic, with a range from 1:300 to 1:1000. It's important to note that such high leverage levels may not be suitable for inexperienced traders. The use of high leverage carries significant risk, as it amplifies both profits and losses. Traders should exercise caution and consider their risk tolerance before utilizing high leverage ratios.

Binary.com offers flexibility in deposit and withdrawal options. The minimum deposit and withdrawal amounts vary depending on the payment method, with e-wallets allowing as low as 5 to 10 USD/EUR/GBP/AUD. Notably, Binary.com stands out with a minimum deposit requirement of just $5, making it more accessible compared to other brokers that typically require a minimum deposit of $250.

Binary.com offers a wide range of payment and withdrawal methods for its users. The specific fees for deposit and withdrawal are not provided by Binary.com.

Credit/Debit Cards: Binary.com accepts various credit/debit cards such as Visa, Visa Electron, Mastercard, Maestro, Diners Club International, and JCB. The minimum and maximum deposit and withdrawal amounts vary, and instant processing is available for deposits. Withdrawals may take up to 15 working days to reflect on the card, and Mastercard and Maestro withdrawals are limited to UK clients.

E-wallets: E-wallet options supported by Binary.com include Fasapay, Perfect Money, Skrill, Neteller, Webmoney, Paysafecard, Jeton, Sticpay, Airtm, Boleto, Paylivre, Online Naira, Trustly, Astropay, OneForYou, and Advcash. The deposit and withdrawal limits vary for each method, and instant processing is available for deposits. Withdrawal processing time is typically 1 working day, but may vary depending on the specific e-wallet provider.

Online Banking: Binary.com supports instant bank transfers, PayTrust, Help2Pay, ZingPay, and NganLuong for online banking transactions. The minimum and maximum deposit and withdrawal amounts vary for each method. Deposit processing time is usually 1 working day, while withdrawal processing time may vary from 1 to 3 working days.

Cryptocurrencies: Binary.com accepts deposits in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Usd Coin, and Tether. There is no minimum deposit requirement for cryptocurrencies, and the minimum withdrawal amounts are specified for each cryptocurrency. Deposit processing time is based on confirmation, and withdrawal processing time is subject to internal checks.

Fiat Onramp: Binary.com provides a fiat onramp option where users can buy cryptocurrencies on popular exchanges. The supported methods include Changelly, and Banxa, allowing users to purchase cryptocurrencies with USD, EUR, GBP, AUD, BTC, LTC, USDT, and USDC. The minimum deposit amount and deposit processing time vary depending on the chosen method.

Also, Binary.com offers a Deposit and Withdrawal process with varying minimum amounts depending on the chosen payment method. The minimum deposit and withdrawal amount can range from 5 to 10 USD/EUR/GBP/AUD when using e-wallets. It is important to note that the specific minimum amounts may vary for different payment methods. To obtain comprehensive information about the minimum deposit and withdrawal amounts for each payment method, it is advisable to refer to the Payment Methods page provided by Binary.com.

| Pros | Cons |

| Wide range of payment and withdrawal methods | Lack of detailed information on fees |

| Instant processing for many deposit methods | Longer withdrawal processing times |

| Fiat onramp options for crypto purchase | Limited availability of certain withdrawal methods for specific regions |

| No minimum deposit requirement for cryptocurrencies | Minimum withdrawal amounts may vary depending on exchange rates |

| Multiple fiat currencies available |

Deriv MT5: Deriv MT5 is an all-in-one CFD trading platform that provides access to various asset classes, including forex, stocks & indices, cryptocurrencies, commodities, and derived indices. It offers 24/7 trading and multiple trading assets on a single platform. With its quick demo account sign-up and regulation by a trusted industry pioneer, Deriv MT5 is suitable for both new and experienced traders.

Deriv X: Deriv X is a customisable multi-asset trading platform that allows trading of CFDs on forex, commodities, stocks & indices, cryptocurrencies, and derived indices. It offers a versatile trading experience with features designed to fit individual trading styles. Traders can trade on multiple markets simultaneously, customise their trading environment, and access intuitive tools such as dashboards, custom watchlists, and feature-rich charts.

Deriv EZ: Deriv EZ is a user-friendly CFDs trading platform that offers instant access to a wide variety of assets, including forex, stocks and indices, commodities, cryptocurrencies, and derived indices. It provides a seamless trading experience with no additional account ID or password required. With 24/7 trading availability, Deriv EZ allows traders to easily start trading, trade their favorite assets on a single platform, and access trading tools and indicators for informed decision-making.

Deriv GO: Deriv GO is a mobile app designed for trading multipliers on the go. It offers 24/7 trading of forex, derived indices, and cryptocurrencies. With user-friendly features, easy access to trades, and the ability to amplify profits up to 1000x with multipliers, Deriv GO provides a trading experience for traders who prefer trading on mobile devices.

SmartTrader: SmartTrader is an all-in-one CFD trading platform that offers a wide range of tradable assets, zero commissions, and 24/7 trading. It provides a simple and user-friendly interface for traders to make informed decisions.

Deriv Trader: Deriv Trader is a user-friendly trading platform offered by Binary.com. It allows traders to engage in forex, commodities, cryptocurrencies, and indices markets. The platform offers customizable chart types and trade types, with trade durations and a minimum stake of $0.35. Traders can make informed decisions using technical indicators and widgets. Overall, Deriv Trader provides a simple and versatile trading experience.

Deriv Bot: Deriv Bot is a platform that allows traders to automate their trading ideas without the need for coding. Traders can build their own trading robots using pre-built strategies or create their own from scratch. With a variety of assets to choose from, zero cost to build bots, and performance tracking features, Deriv Bot offers a solution for traders interested in algorithmic trading.

Binary Bot: Binary Bot is a platform that enables traders to automate their trading ideas without coding. It offers a range of assets to create trading bots, including pre-built strategies and the option to build custom strategies visually. Traders can use analysis tools, indicators, and logic such as take profit and stop loss to optimize their bot's performance. Binary Bot allows traders to track the bot's profitability and offers integrated help, tutorials, saving strategies on Google Drive.

| Pros | Cons |

| Wide range of assets and markets available | Limited information provided about trading platform fees |

| User-friendly interfaces and intuitive tools | Limited customization options for some platforms |

| 24/7 trading availability | Lack of advanced trading features in certain platforms |

| Quick demo account sign-up | Limited access to educational resources in some platforms |

| Regulated and trusted industry pioneer | Mobile app may have limited functionality compared to web-based platforms |

Margin Calculator:

The margin calculator provided by Binary.com allows traders to estimate the margin required to hold their positions. This calculation takes into account factors such as leverage, volume lot, and the trader's Deriv MT5 account balance. By using the margin calculator, traders can have a better understanding of the margin requirements for their trades.

Swap Calculator:

The swap calculator helps traders calculate the overnight fees associated with holding open positions. These fees can be positive or negative, depending on the swap rate. By using the swap calculator, traders can assess the potential costs or earnings from holding positions overnight, allowing for better risk management.

Pip Calculator:

The pip calculator is a useful tool for determining the value of pips in trades. It helps traders manage their risk by providing insight into the potential profits or losses based on pip movements. This information is valuable for setting appropriate stop-loss and take-profit levels.

PnL for Margin:

The PnL (Profit and Loss) margin calculator helps traders estimate the stop-loss and take-profit levels, as well as the pip value for their contracts. This information assists in mitigating risk when entering buy or sell positions. By using the PnL margin calculator, traders can plan their trades with a better understanding of potential risks and rewards.

PnL Multipliers:

The PnL multipliers calculator is specifically designed for traders using multipliers. It estimates the level and amount of the stop-loss and take-profit orders for contracts, helping traders manage their risk in case the market price moves against their predictions. This tool is particularly useful when trading with leveraged products.

| Pros | Cons |

| Provides essential tools for risk management | Limited in-depth analysis capabilities |

| Helps traders estimate margin requirements | Lacks advanced technical analysis tools |

| Facilitates calculating overnight swap fees | Does not offer extensive charting features |

| Enables pip value calculation | May not meet the needs of advanced traders |

| Assists in setting stop-loss and take-profit levels | Lack of customization options for the tools |

Binary.com offers customer support in various languages, as their website is translated into multiple languages. Traders can contact the support team through live chat, with the necessary details available in the “Contact Us” section of the website. Additionally, Binary.com provides contact information for different regions and countries.

For English support, traders can reach out via the phone number 08000119847. German support is available at +44(0)1666 800042, and French support can be contacted at +44(0)1666 800042. Traders can also connect with Binary.com through email at support@binary.com or via their Facebook page.

Binary.com has multiple offices located worldwide. In Europe, their offices are in the United Kingdom, France, Malta, Cyprus, and Guernsey. In Asia, Binary.com has offices in Malaysia, including Cyberjaya and Labuan, as well as in Ipoh, Melaka, and Singapore. They also have offices in Dubai, Jordan, Belarus, Rwanda, Paraguay, the Cayman Islands in the Caribbean, and Port Vila in Vanuatu.

These various support channels and office locations allow traders to seek assistance and get in touch with Binary.com according to their specific needs and geographical location.

In conclusion, Binary.com is a regulated broker operating under the Labuan Financial Services Authority in Malaysia with a Straight Through Processing (STP) license. However, its licenses in Vanuatu and the British Virgin Islands are currently revoked, raising concerns about its offshore regulatory status. The broker has also been reported for 21 complaints in the past 3 months, indicating potential risks and scams. While Binary.com offers a wide range of market instruments, including forex, CFDs, derivatives, stocks, indices, cryptocurrencies, and commodities, traders should be cautious of the high leverage that can lead to increased risk and potential losses. The platform lacks transparency regarding fees and expiry dates, and there is limited information available about licensed institutions. Overall, it is important for traders to carefully consider the potential disadvantages and risks associated with Binary.com before engaging in trading activities.

Q: Is Binary.com regulated?

A: Yes, Binary.com is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under license number MB/18/0024. However, its licenses in Vanuatu and the British Virgin Islands are currently revoked and classified as offshore regulatory.

Q: What market instruments does Binary.com offer?

A: Binary.com offers a diverse range of market instruments, including Forex and CFDs, derivatives, stocks & indices, cryptocurrencies, and commodities.

Q: What types of accounts does Binary.com offer?

A: Binary.com offers two types of accounts: real trading accounts for live trading with real money and demo trading accounts for practicing strategies with virtual funds.

Q: What are the trading types offered by Binary.com?

A: Binary.com offers CFDs, Multipliers, and Options trading. CFDs allow leverage trading with low spreads, multipliers combine leverage with limited risk, and options trading allows predictions and earnings without owning the underlying asset.

Q: How can I open an account with Binary.com?

A: To open an account with Binary.com, visit their website, click on “Create a New Account,” and follow the signup process by entering your email address and confirming your age.

Q: What leverage does Binary.com offer?

A: Binary.com offers dynamic leverage ranging from 1:300 to 1:1000, depending on various factors. However, high leverage levels may not be suitable for inexperienced traders, and caution should be exercised.

Q: What is the minimum deposit at Binary.com?

A: The minimum deposit at Binary.com depends on the payment method used and can vary. E-wallets allow as low as 5 to 10 USD/EUR/GBP/AUD, while other methods may have different minimums. Binary.com stands out with a minimum deposit requirement of just $5.

Q: What payment and withdrawal methods does Binary.com offer?

A: Binary.com offers a wide range of payment and withdrawal methods, including credit/debit cards, e-wallets, online banking, cryptocurrencies, and fiat onramp options. The specific fees for deposit and withdrawal are not provided by Binary.com.

Q: What trading platforms are available on Binary.com?

A: Binary.com offers several trading platforms, including Deriv MT5, Deriv X, Deriv EZ, Deriv GO, SmartTrader, Deriv Trader, Deriv Bot, and Binary Bot. Each platform provides different features and trading options.

Q: What trading tools does Binary.com provide?

A: Binary.com provides trading tools such as a margin calculator to estimate margin requirements, a swap calculator to calculate overnight fees, and a pip calculator for precise pip value calculations.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive saxo and binary-com are, we first considered common fees for standard accounts. On saxo, the average spread for the EUR/USD currency pair is -- pips, while on binary-com the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

saxo is regulated by ASIC,FCA,FSA,SFC,AMF,CONSOB,FINMA,MAS,AMF,DFSA,ASIC. binary-com is regulated by LFSA,VFSC,FSC,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

saxo provides trading platform including VIP account,Classic account,Platinum account and trading variety including --. binary-com provides trading platform including -- and trading variety including --.