No data

Do you want to know which is the better broker between Plus500 and GMI Edge ?

In the table below, you can compare the features of Plus500 , GMI Edge side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of plus500, gmi-edge lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Plus500 Review Summary of 10 Points | |

| Founded | 2008 |

| Headquarters | Israel |

| Regulation | FCA, CySEC, ASIC, FMA, MAS |

| Market Instruments | forex, cryptocurrencies, stocks, indices, commodities, and options |

| Demo Account | Available |

| Leverage | 1:30 (forex), 1:20 (indices), 1:10 (commodities), 1:2 (cryptocurrencies), 1:5 (stocks) |

| EUR/USD Spread | 0.5 pips |

| Trading Platforms | own proprietary trading platform (desktop, web, and mobile) |

| Minimum deposit | $/€/£100 |

| Customer Support | 24/7 email, WhatsApp and live chat |

Plus500 is an online trading platform that offers Contracts for Difference (CFDs) on a range of financial instruments including stocks, forex, commodities, cryptocurrencies, options, and indices. The platform was founded in 2008 and is headquartered in Israel, with additional offices in the UK, Cyprus, Australia, and Singapore. Plus500 is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia. The platform is available in more than 50 countries and supports over 30 languages.

Plus500 is a CFD (Contracts for Difference) broker, which means that it offers trading on derivatives based on various financial assets without actually owning the underlying assets. Traders can speculate on the price movements of assets such as stocks, forex, commodities, cryptocurrencies, and indices without having to buy or sell the assets themselves. As a CFD broker, Plus500 allows traders to take both long and short positions, and offers leverage which can increase potential profits (and losses).

Plus500 is a good option for traders looking for a user-friendly platform to trade a wide range of markets and instruments, with competitive spreads and no commissions.

However, traders who require advanced charting tools, educational resources, and alternative trading platforms may need to consider other brokers.

| Pros | Cons |

| • Simple and easy-to-use trading platform | • Limited product offering |

| • Commission-free trading | • Limited research and educational tools |

| • Tight spreads | • No support for MetaTrader platform |

| • Negative balance protection | • Limited customer support options |

| • Regulated by reputable financial authorities | • No phone support |

| • Free demo account | • Withdrawal fees for some payment methods |

| • Limited trading tools and features |

Note that the information presented in the table is based on general observations and may vary depending on individual circumstances and preferences.

There are many alternative brokers to Plus500, and the best one for you will depend on your individual trading needs and preferences. Here are some popular alternatives to Plus500:

eToro: eToro is a social trading platform that allows you to copy the trades of other traders. It offers a wide range of trading instruments and has a user-friendly platform.

IG: IG is a well-established broker that offers a wide range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

XM: XM is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

Pepperstone: Pepperstone is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

IC Markets: IC Markets is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

It's important to do your own research and compare the features and fees of different brokers before making a decision.

Plus500 is considered legitimate as it is authorized and regulated by several top-tier financial authorities, including the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Plus500 is also publicly traded on the London Stock Exchange, which provides additional transparency and accountability. The broker has been in operation since 2008 and has a large and established customer base. However, it is worth noting that no broker is entirely risk-free, and traders should always do their own due diligence before depositing funds with any broker.

Plus500 takes several measures to ensure the safety and protection of its clients, and the fact that it is a regulated broker provides additional reassurance to clients. Here is a table outlining how Plus500 protects its clients:

| Protection Measure | Detail |

| Segregated Funds | Client funds are kept separate from company funds |

| Negative Balance Protection | Clients can't lose more than their account balance |

| Risk Management Tools | Stop loss, limit order and other tools to help manage risk |

| Account Verification | Rigorous account verification process to prevent fraud and unauthorized access |

| SSL Encryption | Secure Socket Layer (SSL) encryption used for all communication and data transfer |

| Regulatory Oversight | Regulated by multiple reputable financial authorities |

| Investor Compensation Fund | Eligible clients may receive compensation in the event of insolvency or bankruptcy |

Note: This table provides a brief overview of Plus500's client protection measures and is not exhaustive. Clients should always refer to Plus500's official website and legal documents for complete and up-to-date information.

Overall, Plus500 appears to be a reliable broker with a strong emphasis on client protection. The company is regulated by multiple reputable financial authorities, has a robust risk management system in place, and offers negative balance protection to clients. Plus500 also uses encryption technology to protect clients' personal and financial information.

However, it is important to note that no broker is completely risk-free, and clients should always carefully consider their investment goals and risk tolerance before trading with any broker.

Plus500 offers a wide range of trading instruments including:

Forex pairs - major, minor, and exotic currency pairs

Stocks - CFDs on stocks from various international markets

Indices - CFDs on major stock indices like S&P 500, Nasdaq, FTSE 100, and more

Commodities - CFDs on precious metals, energies, and agricultural products

Cryptocurrencies - CFDs on popular digital currencies like Bitcoin, Ethereum, Litecoin, and more

Plus500 offers two types of accounts: a live trading account and a demo account.

The live trading account requires a minimum deposit of $100 and provides access to real-time market prices and trading in over 2,000 instruments. Traders can use leverage of up to 1:30 for retail clients and up to 1:300 for professional clients. The live account offers various features such as stop loss, take profit, and guaranteed stop loss orders. There are no commissions charged on trades. Instead, the company earns money through the bid-ask spread.

The demo account is free and allows traders to practice trading using virtual funds with access to the same trading instruments as the live account. It is a great way for traders to learn how the platform works, practice trading strategies, and get familiar with trading instruments before investing real money. The demo account is available for unlimited time and can be used to test new trading strategies without the risk of losing real money.

Plus500 offers leverage for different financial instruments. The maximum leverage offered depends on the instrument and the jurisdiction where the trader is located. In general, the leverage for forex trading can be up to 1:30 for retail clients in the European Union, and up to 1:300 for professional clients.

For other instruments, such as stocks, commodities, and cryptocurrencies, the leverage can vary between 1:5 and 1:30 for retail clients, and up to 1:300 for professional clients.

It's important to note that higher leverage can amplify both profits and losses, and traders should use it with caution and proper risk management.

Plus500 offers floating spreads on all trading instruments, meaning the spreads can fluctuate based on market conditions. The spreads can start from as low as 0.5 pips for major currency pairs like EUR/USD. Plus500 does not charge any commission on trades, and their revenue comes solely from the spreads offered.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Plus500 | 0.5 pips | No |

| eToro | 1.0 pips | No |

| IG | 0.75 pips | Yes |

| XM | 1.6 pips | No |

| Pepperstone | 0.16 pips | Yes |

| IC Markets | 0.1 pips | Yes |

Note that spreads and commissions are subject to change and can vary depending on the account type, trading platform, and other factors. Traders should always check the broker's website for the most up-to-date and accurate information.

The Plus500 trading platform is an in-house developed web-based platform that can be accessed directly from the Plus500 website. The platform is user-friendly and intuitive, making it easy for traders to navigate and trade various financial instruments. It is also available in several languages.

The Plus500 trading platform offers several advanced features, including price alerts, real-time charts, and technical analysis tools. The platform also includes a demo account that traders can use to practice trading without risking any real money.

Overall, the Plus500 trading platform is well-designed and functional, but it may lack some of the advanced features found in other trading platforms. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Plus500 | Plus500 WebTrader, Plus500 Windows Trader, Plus500 mobile app |

| eToro | eToro WebTrader, eToro mobile app |

| IG | IG Trading Platform, IG mobile app |

| XM | MetaTrader 4, MetaTrader 5, XM WebTrader, XM mobile app |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, Pepperstone mobile app |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, IC Markets mobile app |

Plus500 offers several deposit and withdrawal methods, including:

Credit/debit card (Visa or Mastercard)

PayPal

Bank transfer

Electronic wallets (Skrill, Neteller)

It's worth noting that the availability of certain payment methods may vary depending on your location.

Plus500 does not charge deposit or withdrawal fees, but some payment providers may charge transaction fees, which should be checked with the provider directly. Plus500 also requires users to withdraw funds using the same payment method that was used for depositing funds, up to the deposited amount. Any excess profits can be withdrawn using any other payment method supported by Plus500.

The minimum deposit requirement for Plus500 varies depending on the jurisdiction and the account type. In general, the minimum deposit ranges from $100 to $1,000. For example, in the UK, the minimum deposit is £100. In Australia, it is AUD 100, and in the EU, it is €100. It is recommended to check the specific minimum deposit requirement for your country and account type on the Plus500 website.

| Plus500 | Most other | |

| Minimum Deposit | $/€/£100 | $/€/£100 |

To withdraw funds from Plus500, you need to follow these steps:

Step 1: Log in to your Plus500 account and click on the “Funds Management” tab.

Step 2: Click on “Withdrawal” and select your preferred withdrawal method.

Step 3: Enter the amount you wish to withdraw and any additional information required for the withdrawal method you have chosen.

Step 4: Click on “Submit” to initiate the withdrawal process.

It is worth noting that Plus500 may require additional documentation or information to verify your identity before processing your withdrawal request. The processing time for withdrawals may also vary depending on your chosen withdrawal method.

Plus500 charges overnight funding fees for holding positions overnight. There are no fees for deposits and withdrawals, and inactivity fees only apply after three months of inactivity.

The overnight funding fee is a cost incurred for holding positions overnight and can be a credit or debit to your account depending on the direction of the position and the prevailing interest rates. The funding rate varies based on the instrument traded.

It is important to note that Plus500 may also charge additional fees for certain actions like guaranteed stop-loss orders or currency conversions.

Overall, while the fees for Plus500 are relatively low, traders should be aware of the potential for higher overnight funding fees, as well as any additional fees that may apply for certain actions.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Plus500 | Free | $5-$10 | $10/month |

| eToro | Free | $5 | $10/month |

| IG | Free | Free | $18/month |

| XM | Free | Free | $5/month |

| Pepperstone | Free | Free | $0 |

| IC Markets | Free | $3.5 | $0 |

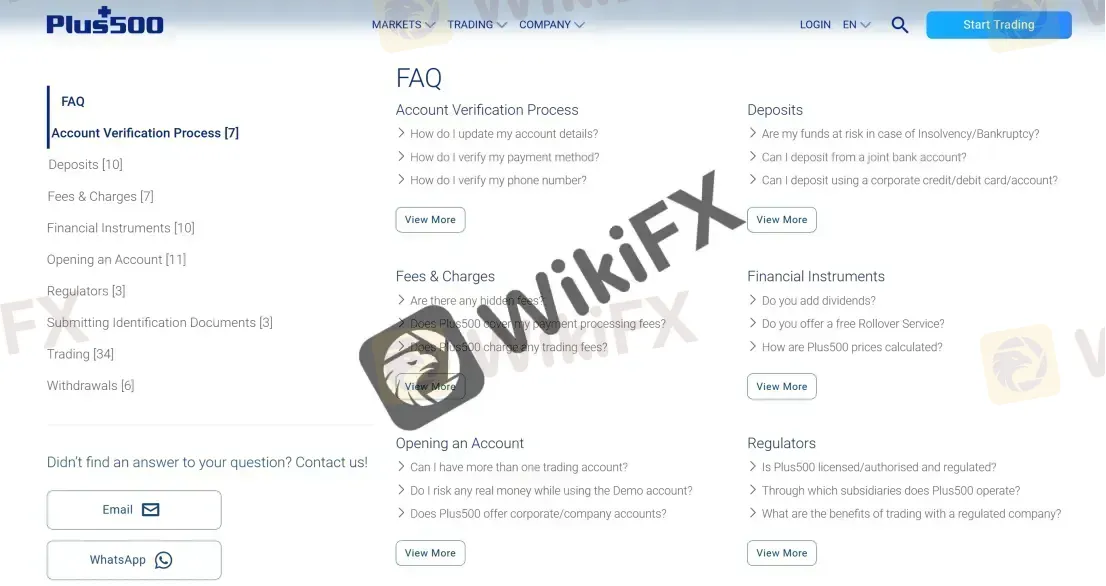

Plus500 offers customer service through email, WhatsApp and live chat. The live chat is available 24/7, while email and WhatsApp support is available during business hours. Plus500 also provides an extensive FAQ section on their website, which covers many commonly asked questions about their services and trading platform.

You can also follow Plus500 on some social networks such as Facebook, Twitter and Instagram.

Overall, Plus500's customer service is considered to be adequate, with prompt responses and helpful support staff. However, some users have reported difficulty reaching support during busy times or experiencing long wait times for responses to their queries.

| Pros | Cons |

| • 24/7 customer support via live chat | • No phone support available |

| • Multilingual support | • Sometimes response is not prompt |

| • User-friendly help center and FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Plus500's customer service.

Plus500 provides an educational section on their website, which includes video tutorials, a demo account, and a FAQ section. The educational resources cover topics such as trading basics, technical analysis, and risk management. However, the educational content is relatively limited compared to some other brokers and may not be sufficient for beginners looking to learn about trading.

Overall, Plus500 is a reputable and reliable online broker that offers a user-friendly trading platform, competitive spreads, and a wide range of trading instruments. It has a strong regulatory framework and offers various measures to protect its clients. Plus500 also provides excellent customer service with a 24/7 support team available via live chat.

However, Plus500 does have some drawbacks, such as limited educational resources, lack of a dedicated account manager, and a relatively high inactivity fee. Additionally, the broker's trading platform may not be suitable for advanced traders who require advanced charting tools and features.

In summary, Plus500 is an excellent option for beginner traders who are looking for a straightforward and easy-to-use trading platform with a low minimum deposit requirement. It is also a good choice for experienced traders who prioritize a strong regulatory framework and reliable customer service over advanced trading features.

| Q 1: | Is Plus500 regulated? |

| A 1: | Yes. Plus500 is regulated by FCA, CySEC, ASIC, FMA, and MAS. |

| Q 2: | Does Plus500 offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Plus500 offer industry-standard MT4 & MT5? |

| A 3: | No. Instead, Plus500 offers its own proprietary trading platform (desktop, web, and mobile). |

| Q 4: | What is the minimum deposit for Plus500? |

| A 4: | The minimum initial deposit to open an account is $/€/£100. |

| Q 5: | Is Plus500 a good broker for beginners? |

| A 5: | Yes. Plus500 is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Information |

| Registered Country/Region | Vanuatu |

| Found | 2018 |

| Regulation | Suspicious clone |

| Market Instrument | Gold, oil, Silver, forex and indices |

| Account Type | Cent, Standard, Standard Bonus and ECN |

| Demo Account | yes |

| Maximum Leverage | 1:2000 |

| Spread (EUR/USD) | Above 2 pips |

| Commission | Vary on the account type |

| Trading Platform | MT4 for Windows, MacOS, Android and Web |

| Minimum Deposit | $15 |

| Deposit & Withdrawal Method | Local Banks Transfer, Neteller and Skrill |

Founded in 2018, GMI Edge is an offshore trading broker that provides online trading via MetaTrader4 (MT4) on a variety of different asset classes including forex, indices, precious metals, energies and CFDs. GMI Edge is the trading name of Global Prime Limited, a regulated and licensed dealer in securities by the Vanuatu Financial Services Commission (VFSC, suspicious clone), with regulatory license number: 14647. GMI Edge is part of the GMI Group of companies. The GMI brand was established in 2009.

Traders can access leverage ratios ranging from 1:500 to 1:2000, depending on the account type. However, explicit information about spreads is not readily available on the GMI Edge website. The broker offers the popular MetaTrader 4 (MT4) trading platform, which allows traders to customize their strategies, utilize expert advisors, and access a wide range of analytical tools. GMI Edge also provides the Multi-Account Manager (MAM) platform for money managers to trade multiple accounts.

Deposits and withdrawals can be made through various methods, including local bank transfers, Neteller, and Skrill. The minimum deposit requirement varies based on the chosen method. GMI Edge has a mobile app for convenient account management and trading on the go. However, customer support contact information is limited to email and live chat, with no disclosed telephone numbers or company address.

Considering the lack of regulatory oversight and transparency, it is advisable for traders to approach GMI Edge with caution and consider alternative brokers with a solid regulatory status and more transparent operations.

Here is the home page of this brokers official site:

GMI Edge has both advantages and disadvantages that traders should consider. One of the pros is the availability of a wide range of market instruments, including commodities, major currency pairs, and indices, providing traders with diverse trading opportunities. Additionally, the broker offers different types of trading accounts with varying leverage options, catering to the individual preferences and risk tolerance of traders. The provision of the popular MetaTrader 4 (MT4) platform and the additional Multi-Account Manager (MAM) platform for money managers enhance the trading experience. Furthermore, GMI Edge provides a mobile app for convenient account management and trading on the go.

On the downside, GMI Edge lacks proper regulatory oversight, as it is not regulated by a recognized financial regulatory authority. The claimed regulatory license from the Vanuatu Financial Services Commission (VFSC) is suspicious and not considered valid, which raises concerns about the level of investor protection and oversight provided by the broker. Moreover, the broker does not disclose explicit information about spreads, which makes it difficult for traders to assess the trading costs upfront. Limited customer support options, with only email and live chat available and no disclosed telephone numbers or company address, can also be a drawback for some traders.

| Pros | Cons |

| Wide range of market instruments | Lack of proper regulatory oversight |

| Different types of trading accounts | Suspicious and questionable regulatory license |

| Variety of leverage options | Lack of transparency regarding spreads |

| Availability of MetaTrader 4 (MT4) platform | Limited customer support options |

| Additional Multi-Account Manager (MAM) platform | No disclosed telephone numbers or company address |

| Mobile app for account management |

GMI Edge is not regulated by a recognized financial regulatory authority. The claimed regulation by the Vanuatu Financial Services Commission (VFSC) with license number 14647 is suspected to be a clone and is not considered valid. The VFSC is an offshore regulatory body, and trading with an unregulated broker carries significant risks. It is important to note that unregulated brokers may not provide the same level of investor protection and oversight as regulated brokers. Therefore, it is advisable to exercise caution and consider alternative regulated brokers with a solid regulatory status when choosing a trading partner.

GMI Edge offers a selection of market instruments for trading. These instruments include:

1. Gold, Oil, Silver: Traders have the opportunity to trade in commodities such as Gold, Oil, and Silver. These instruments are available for trading 23 hours a day, and GMI Edge aims to provide competitive costs in this regard.

2. Forex: GMI Edge enables traders to participate in the foreign exchange market. Major currency pairs such as the US Dollar, Japanese Yen, Euro, British Pound, Swiss Franc, Australian Dollar, and Canadian Dollar are available for trading. GMI Edge offers high leverage and the option of Swap Free accounts.

3. Indices: GMI Edge allows traders to access global financial markets through Contracts for Difference (CFDs) on various indices. Some of the indices available for trading include Dow Jones, NASDAQ, S&P, FTSE, DAX, CAC, NIKKEI, Hang Seng, and China A50.

| Pros | Cons |

| Wide selection of commodities, including Gold, Oil, and Silver | Lack of transparency regarding trading costs |

| Availability of major currency pairs for forex trading | Limited information about spreads |

| Access to global financial markets through various indices | |

| Opportunity to trade 23 hours a day |

GMI Edge offers four different types of trading accounts: ECN, Cent, Standard, and Standard Bonus. Each account type has its own minimum deposit requirement, contract size, leverage options, and other features.

ECN ACCOUNT

The ECN account requires a minimum deposit of $100 and offers leverage up to 1:500. It has a commission fee of $4 per lot and allows for a maximum order size of 500 lots on MT4 and 1,000 lots on GMI Edge. The ECN account does not offer a swap-free option.

CENT ACCOUNT

The Cent account has a minimum deposit requirement of $15 and provides leverage up to 1:1000. It does not charge any commission and allows a maximum order size of 200 lots on MT4. The Cent account also offers a swap-free option.

STANDARD ACCOUNT

The Standard account requires a minimum deposit of $25 and offers leverage up to 1:2000. It does not charge any commission and allows a maximum order size of 500 lots on MT4 and 1,000 lots on GMI Edge. The Standard account does not provide a swap-free option.

STANDARD BONUS ACCOUNT

The Standard Bonus account also requires a minimum deposit of $25 and provides leverage up to 1:2000. It does not charge any commission and allows a maximum order size of 500 lots on MT4. The Standard Bonus account does not offer a swap-free option.

Traders should carefully consider their trading preferences and risk tolerance when choosing the most suitable account type for their needs.

| Pros | Cons |

| Multiple account options with varying features | Lack of a dedicated swap-free option for all account types |

| Different leverage options to suit individual preferences | Commission fee of $4 per lot for ECN account |

| Low minimum deposit requirement for Cent account | Limited maximum order size for Cent account (200 lots) |

| No commission charges for Standard and Standard Bonus accounts | Lack of swap-free option for Standard and Standard Bonus accounts |

| High leverage of up to 1:2000 available for Standard and Standard Bonus accounts | Limited maximum order size for Standard and Standard Bonus accounts (500 lots on MT4 and 1,000 lots on GMI Edge) |

| Variety of account types cater to different risk tolerances and trading preferences |

The specified leverage for different account types at GMI Edge varies between 1:500 and 1:2000. Clients on the Cent account can experience leverage of 1:1000, the Standard and Standard Bonus accounts can enjoy the maximum leverage of 1:2000, while the ECN accounts have a leverage ratio of 1:500.

Keep in mind that using leverage ratios that high is very dangerous, especially for inexperienced traders. Margin trading is risky, so make sure you understand how leverage works before you lose everything.

Unlike most decent brokers who present their pricing and trading conditions, GMI Edge has not disclosed its spreads on the website. So, we had to register a demo account to see the trading costs with this broker. The benchmark EUR/USD spread of GMI Edge is well above 2 pips, which is not competitive pricing.

As for the commission, there is no commission on the Cent, Standard and Standard Bonus accounts, while 4 per lot on the ECN account.

GMI Edge provides its traders with the popular MetaTrader 4 (MT4) trading platform. This widely recognized platform is available for all types of GMI Edge accounts. Traders can take advantage of the features and functionality offered by MT4 to enhance their trading experience.

MT4

With MT4, traders have the option to create their own algorithms or utilize expert advisors (EAs) to automate their trades. This allows for customized trading strategies and the ability to follow other traders. Traders can seamlessly connect to the trading platform through the GMI Edge app, ensuring a smooth trading experience across different devices. The GMI Edge app also provides a convenient way to fund trading accounts that use MT4.

MT4 offers a comprehensive range of analytical tools that traders can utilize to analyze various aspects of the markets they trade. These tools enable traders to perform in-depth market analysis and make informed trading decisions.

Multi-Account Manager (MAM) platform.

In addition to MT4, GMI Edge also offers the Multi-Account Manager (MAM) platform. This platform is designed for money managers who wish to trade multiple accounts with ease. With MAM, money managers can execute trades across multiple accounts with just one click. The platform also allows for automated performance fees billing and offers trade allocation options based on lot size, equity, or balance.

GMI Edge mobile app

To further enhance accessibility and convenience, GMI Edge has developed the GMI Edge mobile app. This app allows traders to access their trading accounts anytime and anywhere. Traders can trade various instruments including forex, gold, silver, and indices, among others, using the app. The GMI Edge app also offers easy ways to deposit, withdraw, and transfer funds, providing traders with comprehensive account management capabilities in one place.

| Pros | Cons |

| Availability of popular MetaTrader 4 (MT4) platform | Potential learning curve for beginners |

| Ability to create custom algorithms and use expert advisors (EAs) | Limited to MT4 platform, no alternative platforms offered |

| Seamless trading experience across different devices through GMI Edge app | Mobile app may have limited functionality compared to desktop version |

| Comprehensive range of analytical tools for market analysis | Lack of advanced features compared to other platforms |

| Multi-Account Manager (MAM) platform for easy management of multiple accounts | Limited information available on MAM platform features and capabilities |

GMI Edge provides various options for depositing and withdrawing funds from your trading account. These options include Local Banks Transfer, Neteller, and Skrill. The minimum initial deposit requirement is $10 for Neteller and Skrill, while it is $15 for Local Banks Transfer.

The deposit processing time is typically instant, allowing you to quickly start trading after funding your account.

For withdrawals, the minimum withdrawal amount is 50 MYR for bank transfers, and the processing time is between 8am to 6pm daily. There is a 4% fee for withdrawals via Neteller and Skrill, with a minimum withdrawal amount of $10. Withdrawals made through these methods are also processed instantly.

| Pros | Cons |

| Various deposit and withdrawal options | Minimum withdrawal amount for bank transfers |

| Instant deposit processing time | 4% fee for withdrawals via Neteller and Skrill |

| Minimum initial deposit requirement of $10 for Neteller and Skrill | Withdrawal processing time limited to specific hours |

| Instant withdrawals via Neteller and Skrill | |

| Minimum withdrawal amount of $10 for Neteller and Skrill |

GMI Edge provides customer support through various channels. Traders can reach out to their customer support team via email at cs.global@gmimarkets.com. Additionally, a live chat option is available for immediate assistance. For those who prefer to send a direct message, an online contact form is provided. However, it is worth noting that GMI Edge does not disclose additional contact information such as telephone numbers or a company address, which is commonly shared by more transparent brokers.

In conclusion, GMI Edge is an unregulated broker with a suspicious regulatory license and is not considered a legitimate trading option. Trading with an unregulated broker carries significant risks, as they may lack investor protection and oversight. Although GMI Edge offers a variety of market instruments and different types of trading accounts with varying leverage options, their lack of transparency regarding spreads and trading conditions is a disadvantage. Additionally, the absence of a recognized financial regulatory authority and limited customer support contact information further raise concerns. Traders are advised to exercise caution and consider alternative regulated brokers with a solid regulatory status and transparent practices when choosing a trading partner.

| Q 1: | Is GMI Edge regulated? |

| A 1: | No. GMI Edge holds a suspicious clone Vanuatu Financial Services Commission (VFSC) license. |

| Q 2: | At GMI Edge, are there any regional restrictions for traders? |

| A 2: | Yes. GMI Edge does not accept clients from the United Kingdom and the United States among other countries. |

| Q 3: | Does GMI Edge offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does GMI Edge offer the industry-standard MT4 & MT5? |

| A 4: | Yes. GMI Edge supports MT4. |

| Q 5: | What is the minimum deposit for GMI Edge? |

| A 5: | The minimum initial deposit to open an account is $15. |

| Q 6: | Is GMI Edgea good broker for beginners? |

| A 6: | No. GMI Edge is not a good choice for beginners. Though it advertises very well, it lacks legitimate regulations. Take care! |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive plus500 and gmi-edge are, we first considered common fees for standard accounts. On plus500, the average spread for the EUR/USD currency pair is -- pips, while on gmi-edge the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

plus500 is regulated by ASIC,FSA,CYSEC,FCA,FMA,MAS. gmi-edge is regulated by VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

plus500 provides trading platform including -- and trading variety including --. gmi-edge provides trading platform including Standard (Bonus),ECN,Cent,Standard and trading variety including --.