No data

Do you want to know which is the better broker between Plus500 and Bell Potter ?

In the table below, you can compare the features of Plus500 , Bell Potter side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of plus500, bell-potter lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Plus500 Review Summary of 10 Points | |

| Founded | 2008 |

| Headquarters | Israel |

| Regulation | FCA, CySEC, ASIC, FMA, MAS |

| Market Instruments | forex, cryptocurrencies, stocks, indices, commodities, and options |

| Demo Account | Available |

| Leverage | 1:30 (forex), 1:20 (indices), 1:10 (commodities), 1:2 (cryptocurrencies), 1:5 (stocks) |

| EUR/USD Spread | 0.5 pips |

| Trading Platforms | own proprietary trading platform (desktop, web, and mobile) |

| Minimum deposit | $/€/£100 |

| Customer Support | 24/7 email, WhatsApp and live chat |

Plus500 is an online trading platform that offers Contracts for Difference (CFDs) on a range of financial instruments including stocks, forex, commodities, cryptocurrencies, options, and indices. The platform was founded in 2008 and is headquartered in Israel, with additional offices in the UK, Cyprus, Australia, and Singapore. Plus500 is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia. The platform is available in more than 50 countries and supports over 30 languages.

Plus500 is a CFD (Contracts for Difference) broker, which means that it offers trading on derivatives based on various financial assets without actually owning the underlying assets. Traders can speculate on the price movements of assets such as stocks, forex, commodities, cryptocurrencies, and indices without having to buy or sell the assets themselves. As a CFD broker, Plus500 allows traders to take both long and short positions, and offers leverage which can increase potential profits (and losses).

Plus500 is a good option for traders looking for a user-friendly platform to trade a wide range of markets and instruments, with competitive spreads and no commissions.

However, traders who require advanced charting tools, educational resources, and alternative trading platforms may need to consider other brokers.

| Pros | Cons |

| • Simple and easy-to-use trading platform | • Limited product offering |

| • Commission-free trading | • Limited research and educational tools |

| • Tight spreads | • No support for MetaTrader platform |

| • Negative balance protection | • Limited customer support options |

| • Regulated by reputable financial authorities | • No phone support |

| • Free demo account | • Withdrawal fees for some payment methods |

| • Limited trading tools and features |

Note that the information presented in the table is based on general observations and may vary depending on individual circumstances and preferences.

There are many alternative brokers to Plus500, and the best one for you will depend on your individual trading needs and preferences. Here are some popular alternatives to Plus500:

eToro: eToro is a social trading platform that allows you to copy the trades of other traders. It offers a wide range of trading instruments and has a user-friendly platform.

IG: IG is a well-established broker that offers a wide range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

XM: XM is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

Pepperstone: Pepperstone is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

IC Markets: IC Markets is a popular broker that offers competitive spreads and a range of trading instruments, including forex, stocks, and commodities. It also offers a range of educational resources and has a user-friendly platform.

It's important to do your own research and compare the features and fees of different brokers before making a decision.

Plus500 is considered legitimate as it is authorized and regulated by several top-tier financial authorities, including the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Plus500 is also publicly traded on the London Stock Exchange, which provides additional transparency and accountability. The broker has been in operation since 2008 and has a large and established customer base. However, it is worth noting that no broker is entirely risk-free, and traders should always do their own due diligence before depositing funds with any broker.

Plus500 takes several measures to ensure the safety and protection of its clients, and the fact that it is a regulated broker provides additional reassurance to clients. Here is a table outlining how Plus500 protects its clients:

| Protection Measure | Detail |

| Segregated Funds | Client funds are kept separate from company funds |

| Negative Balance Protection | Clients can't lose more than their account balance |

| Risk Management Tools | Stop loss, limit order and other tools to help manage risk |

| Account Verification | Rigorous account verification process to prevent fraud and unauthorized access |

| SSL Encryption | Secure Socket Layer (SSL) encryption used for all communication and data transfer |

| Regulatory Oversight | Regulated by multiple reputable financial authorities |

| Investor Compensation Fund | Eligible clients may receive compensation in the event of insolvency or bankruptcy |

Note: This table provides a brief overview of Plus500's client protection measures and is not exhaustive. Clients should always refer to Plus500's official website and legal documents for complete and up-to-date information.

Overall, Plus500 appears to be a reliable broker with a strong emphasis on client protection. The company is regulated by multiple reputable financial authorities, has a robust risk management system in place, and offers negative balance protection to clients. Plus500 also uses encryption technology to protect clients' personal and financial information.

However, it is important to note that no broker is completely risk-free, and clients should always carefully consider their investment goals and risk tolerance before trading with any broker.

Plus500 offers a wide range of trading instruments including:

Forex pairs - major, minor, and exotic currency pairs

Stocks - CFDs on stocks from various international markets

Indices - CFDs on major stock indices like S&P 500, Nasdaq, FTSE 100, and more

Commodities - CFDs on precious metals, energies, and agricultural products

Cryptocurrencies - CFDs on popular digital currencies like Bitcoin, Ethereum, Litecoin, and more

Plus500 offers two types of accounts: a live trading account and a demo account.

The live trading account requires a minimum deposit of $100 and provides access to real-time market prices and trading in over 2,000 instruments. Traders can use leverage of up to 1:30 for retail clients and up to 1:300 for professional clients. The live account offers various features such as stop loss, take profit, and guaranteed stop loss orders. There are no commissions charged on trades. Instead, the company earns money through the bid-ask spread.

The demo account is free and allows traders to practice trading using virtual funds with access to the same trading instruments as the live account. It is a great way for traders to learn how the platform works, practice trading strategies, and get familiar with trading instruments before investing real money. The demo account is available for unlimited time and can be used to test new trading strategies without the risk of losing real money.

Plus500 offers leverage for different financial instruments. The maximum leverage offered depends on the instrument and the jurisdiction where the trader is located. In general, the leverage for forex trading can be up to 1:30 for retail clients in the European Union, and up to 1:300 for professional clients.

For other instruments, such as stocks, commodities, and cryptocurrencies, the leverage can vary between 1:5 and 1:30 for retail clients, and up to 1:300 for professional clients.

It's important to note that higher leverage can amplify both profits and losses, and traders should use it with caution and proper risk management.

Plus500 offers floating spreads on all trading instruments, meaning the spreads can fluctuate based on market conditions. The spreads can start from as low as 0.5 pips for major currency pairs like EUR/USD. Plus500 does not charge any commission on trades, and their revenue comes solely from the spreads offered.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Plus500 | 0.5 pips | No |

| eToro | 1.0 pips | No |

| IG | 0.75 pips | Yes |

| XM | 1.6 pips | No |

| Pepperstone | 0.16 pips | Yes |

| IC Markets | 0.1 pips | Yes |

Note that spreads and commissions are subject to change and can vary depending on the account type, trading platform, and other factors. Traders should always check the broker's website for the most up-to-date and accurate information.

The Plus500 trading platform is an in-house developed web-based platform that can be accessed directly from the Plus500 website. The platform is user-friendly and intuitive, making it easy for traders to navigate and trade various financial instruments. It is also available in several languages.

The Plus500 trading platform offers several advanced features, including price alerts, real-time charts, and technical analysis tools. The platform also includes a demo account that traders can use to practice trading without risking any real money.

Overall, the Plus500 trading platform is well-designed and functional, but it may lack some of the advanced features found in other trading platforms. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Plus500 | Plus500 WebTrader, Plus500 Windows Trader, Plus500 mobile app |

| eToro | eToro WebTrader, eToro mobile app |

| IG | IG Trading Platform, IG mobile app |

| XM | MetaTrader 4, MetaTrader 5, XM WebTrader, XM mobile app |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, Pepperstone mobile app |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, IC Markets mobile app |

Plus500 offers several deposit and withdrawal methods, including:

Credit/debit card (Visa or Mastercard)

PayPal

Bank transfer

Electronic wallets (Skrill, Neteller)

It's worth noting that the availability of certain payment methods may vary depending on your location.

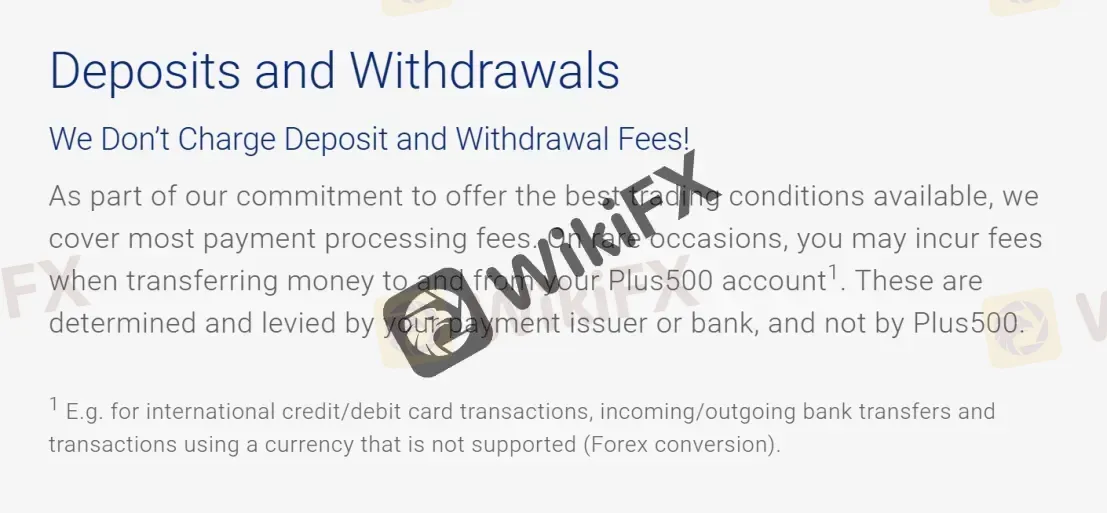

Plus500 does not charge deposit or withdrawal fees, but some payment providers may charge transaction fees, which should be checked with the provider directly. Plus500 also requires users to withdraw funds using the same payment method that was used for depositing funds, up to the deposited amount. Any excess profits can be withdrawn using any other payment method supported by Plus500.

The minimum deposit requirement for Plus500 varies depending on the jurisdiction and the account type. In general, the minimum deposit ranges from $100 to $1,000. For example, in the UK, the minimum deposit is £100. In Australia, it is AUD 100, and in the EU, it is €100. It is recommended to check the specific minimum deposit requirement for your country and account type on the Plus500 website.

| Plus500 | Most other | |

| Minimum Deposit | $/€/£100 | $/€/£100 |

To withdraw funds from Plus500, you need to follow these steps:

Step 1: Log in to your Plus500 account and click on the “Funds Management” tab.

Step 2: Click on “Withdrawal” and select your preferred withdrawal method.

Step 3: Enter the amount you wish to withdraw and any additional information required for the withdrawal method you have chosen.

Step 4: Click on “Submit” to initiate the withdrawal process.

It is worth noting that Plus500 may require additional documentation or information to verify your identity before processing your withdrawal request. The processing time for withdrawals may also vary depending on your chosen withdrawal method.

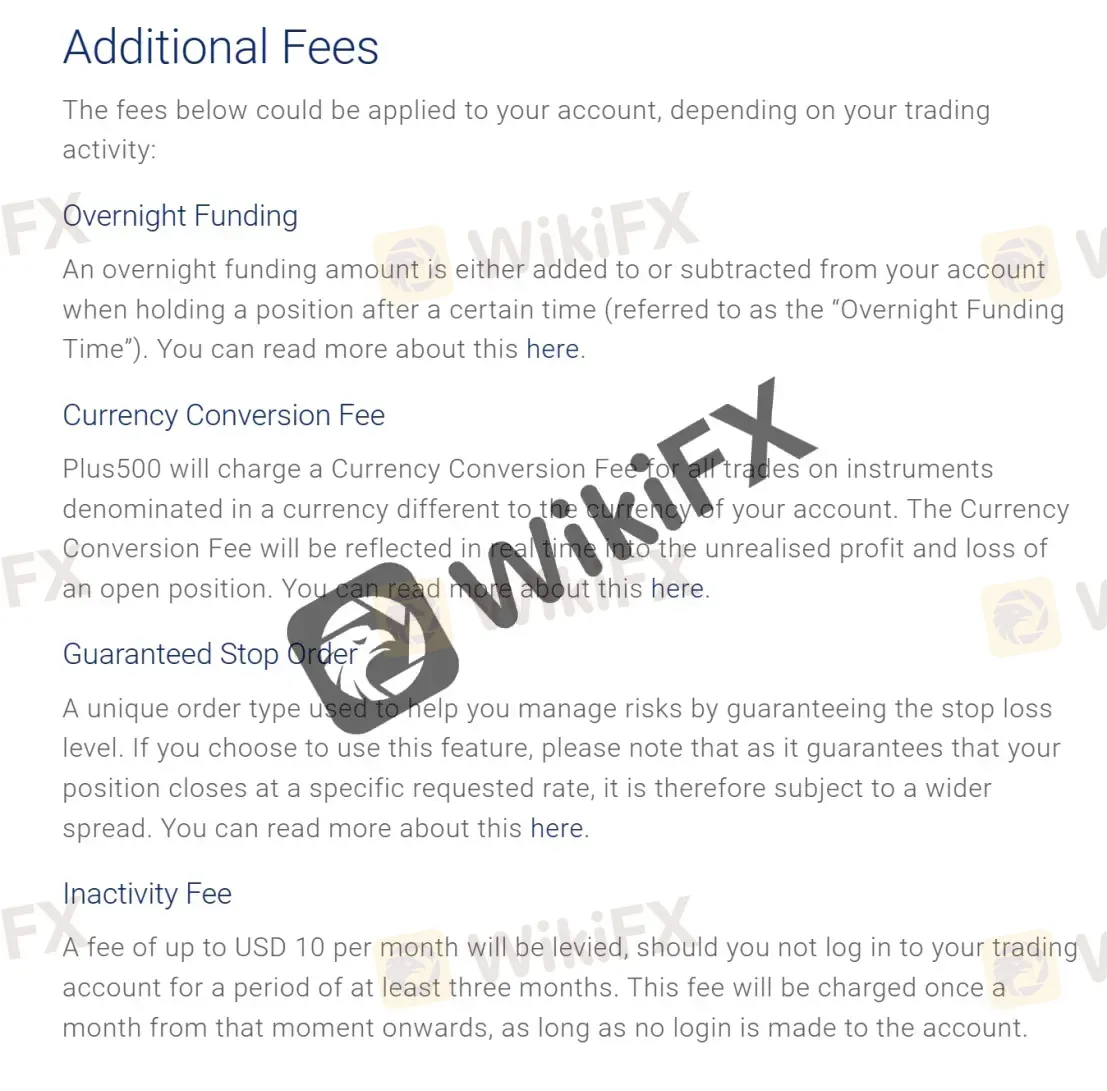

Plus500 charges overnight funding fees for holding positions overnight. There are no fees for deposits and withdrawals, and inactivity fees only apply after three months of inactivity.

The overnight funding fee is a cost incurred for holding positions overnight and can be a credit or debit to your account depending on the direction of the position and the prevailing interest rates. The funding rate varies based on the instrument traded.

It is important to note that Plus500 may also charge additional fees for certain actions like guaranteed stop-loss orders or currency conversions.

Overall, while the fees for Plus500 are relatively low, traders should be aware of the potential for higher overnight funding fees, as well as any additional fees that may apply for certain actions.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Plus500 | Free | $5-$10 | $10/month |

| eToro | Free | $5 | $10/month |

| IG | Free | Free | $18/month |

| XM | Free | Free | $5/month |

| Pepperstone | Free | Free | $0 |

| IC Markets | Free | $3.5 | $0 |

Plus500 offers customer service through email, WhatsApp and live chat. The live chat is available 24/7, while email and WhatsApp support is available during business hours. Plus500 also provides an extensive FAQ section on their website, which covers many commonly asked questions about their services and trading platform.

You can also follow Plus500 on some social networks such as Facebook, Twitter and Instagram.

Overall, Plus500's customer service is considered to be adequate, with prompt responses and helpful support staff. However, some users have reported difficulty reaching support during busy times or experiencing long wait times for responses to their queries.

| Pros | Cons |

| • 24/7 customer support via live chat | • No phone support available |

| • Multilingual support | • Sometimes response is not prompt |

| • User-friendly help center and FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Plus500's customer service.

Plus500 provides an educational section on their website, which includes video tutorials, a demo account, and a FAQ section. The educational resources cover topics such as trading basics, technical analysis, and risk management. However, the educational content is relatively limited compared to some other brokers and may not be sufficient for beginners looking to learn about trading.

Overall, Plus500 is a reputable and reliable online broker that offers a user-friendly trading platform, competitive spreads, and a wide range of trading instruments. It has a strong regulatory framework and offers various measures to protect its clients. Plus500 also provides excellent customer service with a 24/7 support team available via live chat.

However, Plus500 does have some drawbacks, such as limited educational resources, lack of a dedicated account manager, and a relatively high inactivity fee. Additionally, the broker's trading platform may not be suitable for advanced traders who require advanced charting tools and features.

In summary, Plus500 is an excellent option for beginner traders who are looking for a straightforward and easy-to-use trading platform with a low minimum deposit requirement. It is also a good choice for experienced traders who prioritize a strong regulatory framework and reliable customer service over advanced trading features.

| Q 1: | Is Plus500 regulated? |

| A 1: | Yes. Plus500 is regulated by FCA, CySEC, ASIC, FMA, and MAS. |

| Q 2: | Does Plus500 offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Plus500 offer industry-standard MT4 & MT5? |

| A 3: | No. Instead, Plus500 offers its own proprietary trading platform (desktop, web, and mobile). |

| Q 4: | What is the minimum deposit for Plus500? |

| A 4: | The minimum initial deposit to open an account is $/€/£100. |

| Q 5: | Is Plus500 a good broker for beginners? |

| A 5: | Yes. Plus500 is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Basic | Information |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Founding Time | 2015 |

| Minimum Deposit | $5 |

| Maximum Leverage | N/A |

| Minimum Spreads | N/A |

| Trading Platform | Non-MT4 & MT5 |

| Products & Services | Stocking, Fixed Interest, Portfolio Administration, Technical financial advice, Foreign Exchange, Portfolio Lending, Super Lending |

| Payment Methods | Visa, Diners, MasterCard, Visa Electron, PayPal |

| Customer Support | 5 /24 Phone, Emails |

Based in Australia, Bell Potter Securities is a full-service internet trading broker that offers a wide variety of financial instruments. They pioneered the e-commerce space when they launched in 2015 and have been at the forefront ever since. Currency, indices, metals, equities, and commodities are the primary areas of focus of Bell Potter Securities, which is home to a highly regarded and feature-rich trading platform.

Bell Potter Securities is a broker dedicated to empowering investors and traders with tailored financial solutions. It is a full-service internet trading broker. Since their 2015 inception, they've amassed a clientele of over 10,000 users. Bell Potter Securities currently holds a full license authorized by the Australian Securities and Investments Commission (license number: 243480). The minimum deposit to open an account is $5. Bell Potter Securities provides customer support to assist traders with various channels and traders can typically contact customer support through email or phone.

One of the main considerations in evaluating a brokerage, such as Bell Porter Securities, is to assess the broker's regulatory status and administrative body. Brokers operating without supervision from a regulatory authority are free to make their own rules, which may pose a risk to investors.

Instead, brokers operating under the supervision of regulators are bound by strict guidelines that prohibit them from manipulating market prices for their own benefit. Regulatory oversight ensures that brokers operate in an honest, fair, and transparent manner, protecting investors' deposits.

Established in 2015, and in operation for 8 years Bell Potter Securities Limited have a head office in Australia. Bell Potter Securities Limited are supervised by and is checked for conduct by the Australian Securities and Investments Commission (ASIC) regulatory bodies under license number 243480.

Bell Potter Securities Limited are held accountable for their actions and may face severe consequences if they violate any financial regulations. By partnering with a trustworthy broker like Bell Potter Securities Limited, you can enjoy peace of mind and focus on your trading activities without worrying about the safety of your funds. If Bell Potter Securities Limited violate any regulatory rules their regulated status could be stripped.

Some advantages and disadvantages of Bell Potter are clearly listed below:

Bell Potter offers several advantages as a regulated brokerage firm. Firstly, being regulated by ASIC (Australian Securities and Investments Commission) provides a level of assurance and protection for clients, ensuring that the company operates in compliance with industry standards and regulations. Additionally, Bell Potter offers competitive commissions for trading, allowing clients to execute trades at a reasonable cost. The brokerage also provides a diversified range of services, including access to various financial instruments, which enables clients to diversify their investment portfolios. Moreover, Bell Potter maintains tight spreads, which can benefit traders by reducing their trading costs.

However, there are a few drawbacks to consider. Bell Potter does not provide negative balance protection, meaning that in the event of significant market volatility, clients may be responsible for any losses beyond their initial investment. Another limitation is the absence of guaranteed stop-loss orders. Additionally, Bell Potter Securities imposes high withdrawal fees, which may be a consideration for clients who frequently need to access their funds. Finally, it's worth noting that Bell Potter Securities does not offer cryptocurrency trading, limiting the investment options available for those interested in digital assets.

| Pros | Cons |

| ASIC-regulated | No negative balance protection |

| Commissions for trading not high | Guaranteed stop loss not provided |

| Diversified range of services | High withdrawal fees |

| Tight Spreads | No cryptocurrency trading |

Bell Potter Securities is a stockbroking firm, which provides a full service offering to retail, corporate, and institutional clients. The business comprises Retail Equities, Institutional Equities, International Equities, Equity Capital Markets, Portfolio Administration and Super Solutions, and Research. The foreign exchange service includes spot and forward foreign exchange, foreign currency options, tailored forwards, research and foreign currency accounts. Specific product information is as follows:

To open an account with Bell Potter Securities, you can follow the steps outlined below:

1. Research and Gather Information: Before opening an account, it is essential to familiarize yourself with Bell Potter Securities and their services. Visit their official website or contact their customer service to gather information about the account types they offer, fees, requirements, and any specific documentation you may need to provide.

2. Contact Bell Potter Securities: Reach out to Bell Potter Securities through their customer service channels, which may include phone, email, or an online contact form. Request information about opening an account and express your interest in becoming a client. The customer service representatives will guide you through the process and provide any necessary forms or documents.3. Complete the Application: Bell Potter Securities will provide you with an account application form. Fill out the application accurately and provide all requested information. This typically includes personal details such as your name, contact information, date of birth, and tax identification number.

4. Submit Required Documents: Along with the application form, you will likely need to submit certain documents to verify your identity and comply with regulatory requirements. Commonly requested documents include a copy of your identification (such as a passport or driver's license), proof of address (e.g., utility bill or bank statement), and sometimes financial statements or employment information.

5. Review and Sign the Agreement: Carefully review all the terms and conditions, as well as any contractual agreements presented by Bell Potter Securities. Ensure you understand the rights, responsibilities, and obligations associated with opening an account. If you have any questions or concerns, seek clarification from the company's representatives before proceeding. Once satisfied, sign the necessary agreements.

6. Fund Your Account: To start trading or investing, you will need to fund your account. Bell Potter Securities will provide you with instructions on how to deposit funds into your account, which may include bank transfers or other accepted payment methods. Follow these instructions and transfer the desired amount to your newly opened account.

In order to get started with Bell Potter Securities, a $5 minimum deposit is required. For a person just getting started, this is a reasonable sum. With more coordination, you can make deposits of greater complexity. Before investing a substantial sum of money, though, make sure you know how to maximize its potential.

Brokerage firms like Bell Potter Securities Limited may charge commission fees as compensation for executing trades on behalf of traders on their trading platforms. Commission fees can vary depending on the type of financial asset being traded and the Bell Potter Securities Limited trading account level held by the trader.

Generally, Bell Potter Securities doesn't charge high fees in comparison to other online brokers. For operations other brokers charge for, they do not charge a brokerage fee, or they charge a lesser amount. This is beneficial for those who regularly exchange, such as weekly or daily trading.

Bell Potter Securities Limited may charge commission fees for fulfilling, modifying, or canceling an order on behalf of its clients. However, if a market order is not fulfilled, no commission fee is usually charged. Reviewing Bell Potter Securities Limited terms and conditions to understand the commission fees and any other charges that may apply is essential.

When a client of Bell Potter Securities does not make a trade for a certain period of time, the broker will assess an inactivity fee. You should close your Bell Potter Securities account if it is dormant, even if the brokerage has not yet notified you of any fees. Many financial services, not only brokerages, include inactivity fees.

The inactivity cost on other trading platforms will vary based on the type of account you have. There are a number of caveats that apply to the inactivity fee that the broker should make plain to the client before they agree to pay it.

Bell Potter uses the most popular MT4 trading platform for traders today, with powerful charting tools, a large number of technical analysis indicators, with expert advisors to run automated trading, which can help traders get ahead in the financial markets.

Bell Potter supports traders to fund their investment accounts via credit/debit cards of Visa, Diners, MasterCard, Visa Electron, PayPal, etc. Usually, it takes a few business days to withdraw funds from Bell Potter Securities. It may take up to 7 business days before the funds show up in the investor's account based on the chosen withdrawal method.

Withdrawals are free of charge at Bell Potter Securities. From your Bell Potter Securities account, you can withdraw money at any time. With the margin set aside, you can withdraw amounts up to your account balance. Keep in mind that you can get by without actually having any cash in your account.

The funds withdrawn will be transferred instantly to the deposit accounts you specify. Because of this, withdrawals made using a credit card will also be made using the same card, though Bell Potter Securities may request other withdrawal methods if your information has changed. For each withdrawal, a minimum quantity must be met. A currency conversion fee is also relevant if you intend to withdraw funds in a currency other than US dollars. Your withdrawal will be subject to a currency conversion fee based on the currency you select.

If clients have any inquiries, they can get in touch with Bell Potter by calling them, or just visiting their office. besides, There is also a contact form for clients to fill ip their questions. or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Linkedin, and Youtube.

To summarize, Bell Potter Securities is a renowned online brokerage firm that provides a diverse range of account options catering to various trading requirements. The broker offers an extensive range of tradable instruments and competitive trading fees. The user-friendly trading platforms come equipped with advanced trading tools, enabling traders to make informed trading decisions. The broker also offers excellent customer support, with multiple channels available for assistance.

While Bell Potter Securities presents an excellent trading opportunity, it is crucial to exercise caution and implement proper risk management strategies.

Q: Can I try Bell Potter Securities before I buy?

A: Yes, you can most definitely try Bell Potter Securities before you buy. Bell Potter Securities offers demo accounts for the ease of beginner traders.

Q: Is Bell Potter Securities safe?

A: You can drop all of your worries since we believe that Bell Potter Securities is totally safe to use. It's in compliance with all the rules of Australian Securities and Investment Commission (ASIC).

Q: What funding methods do Bell Potter Securities accept?

A: There are a number of methods to finance your accounts with Bell Potter Securities. You can use debit or credit cards ranging from Visa, Diners, and Maestro to MasterCard and Visa Electron. Other deposit methods you can adopt are Neteller, Skrill, Rapid Transfer, and iDeal.

Q: Which Countries do Bell Potter Securities support?

A: Bell Potter Securities operates across the world. However, due to regulations Bell Potter Securities can't accept clients from Brazil, Republic of Korea, Iran, Iraq, Syrian Arab Republic, Japan, and United States of America.

Q: What is the minimum deposit for Bell Potter Securities?

A: The minimum deposit to open a live account with Bell Potter Securities is $5

Q: How long do Bell Potter Securities withdrawals take?

A: Normally, withdrawal of money from Bell Potter Securities is completed within a couple of working days but depending on the withdrawal method chosen, it could take up to 7 working days for a withdrawal from Bell Potter Securities to show in your bank account.

Q: When was Bell Potter Securities founded?

A: Bell Potter Securities was founded in 2015 in Australia. Bell Potter Securities is regulated by Australian Securities and Investment Commission (ASIC).

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive plus500 and bell-potter are, we first considered common fees for standard accounts. On plus500, the average spread for the EUR/USD currency pair is -- pips, while on bell-potter the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

plus500 is regulated by ASIC,FSA,CYSEC,FCA,FMA,MAS. bell-potter is regulated by ASIC,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

plus500 provides trading platform including -- and trading variety including --. bell-potter provides trading platform including -- and trading variety including --.