No data

Do you want to know which is the better broker between MONEY SQUARE and LIRUNEX ?

In the table below, you can compare the features of MONEY SQUARE , LIRUNEX side by side to determine the best fit for your needs.

EURUSD: -1.1

XAUUSD: 0.5

Long: -2.09

Short: 0.81

Long: -37.05

Short: 19.07

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of money-square, lirunex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered Country/Region | Japan |

| Regulation | FSA |

| Minimum Deposit | No minimum initial deposit requirement |

| Maximum Leverage | 1:25 |

| Minimum Spreads | 0.1 pips on for USD/JPY |

| Trading Platform | A Proprietary trading platform |

| Demo Account | Yes |

| Trading Assets | 15 currency pairs |

| Payment Methods | Quick deposits and Transfer Payment |

| Customer Support | Phone, Email, Online Chat |

General Information & Regulation

MONEY SQUARE, INC. was established in October 2002 as a company mainly engaged in over-the-counter foreign exchange trading. The company is authorized and regulated by the Financial Services Agency of Japan (FSA) under License No. 5010401112058. Also, MONEY SQUARE is authorized and regulated by the Securities Dealers Association of Japan under Financial Instrument Operator No. 2797 of Kanto Finance Bureau Director (Financial Instruments).

Market Instruments

Users can trade 15 currency pairs, generally 1,000 currency units at a time, except for 10,000 units for South Oran/JPY and Mexican Peso/JPY.

Spreads

MONEY SQUARE does not set transaction fees for users, but charges a certain amount of spreads, for example, from 0.1 pips for USD/JPY, 0.1 pips for GBP/JPY and 0.1 pips for NZD/JPY.

Margin & Leverage

If placing an order, individual users must guarantee at least 4% margin (25:1 leverage) on the value of each currency pair traded. However, corporate users have a slightly different margin rate, which is 0.96% for USD/JPY for example.

Open an account

MONEY SQUARE only supports online account opening, if a client needs to apply for both Forex and CFD accounts, then he/she needs to apply separately. In addition, MONEY SQUARE does not charge any account opening fees and account maintenance fees.

Trading Platform

MONEY SQUARE provides clients with access to the world financial markets through Tralipi®, a trading platform developed by the trader itself, which supports both PC and cell phones.

Deposit & Withdrawal

Users can make deposits via both quick deposit and transfer payments. MONEY SQUARE recommends the former because it is instant and free of charge, while the latter requires the client to bear the transfer fees. Note that MONEY SQUARE only accepts Japanese Yen for deposits/withdrawals.

Trading Hours

MONEY SQUARE offers forex trading hours based on the US market, including daylight saving time - Monday: 7:20am to 5:50am the next day; Tuesday to Friday: 6:20am to 5:50am the next day; winter time - Monday: 7:20am to 6:50am the next day; Tuesday to Friday: 7:20am to 6:50am the next day.

Pros & Cons

| Pros | Cons |

| FSA-regulated with long establishment | Limited currency trading |

| A series of trading tools | Conservative leverage |

| No transfer fees | Only accepting Japanese Yen for depsoits and withdrawals |

| Competitive spreads | Non-MT4/MT5 trading platform |

| No trading fees applied | |

| No account opening & maintenance fees |

Frequently Asked Questions

Does MONEY SQUARE offer leverage?

MONEY SQUARE provides leverage capped at 1:25.

What deposit and withdrawal payment does MONEY SQUARE accept ?

MONEY SQUARE support payment through quick deposit and transfer payments.

Does MONEY SQUARE offer demo accounts ?

No clear information about this part is disclosed.

Does MONEY SQUARE charge a commission?

No, MONEY SQUARE does not charge commissions, only spreads calculated.

What is trading hour set by MONEY SQUARE ?

MONEY SQUARE offers forex trading hours based on the US market, including daylight saving time - Monday: 7:20am to 5:50am the next day; Tuesday to Friday: 6:20am to 5:50am the next day; winter time - Monday: 7:20am to 6:50am the next day; Tuesday to Friday: 7:20am to 6:50am the next day.

| LIRUNEX | Basic Information |

| Registered Country/Region | Cyprus |

| Founded in | N/A |

| Regulation | CySEC, BDF, BaFin, LFSA, CNMV |

| Minimum deposit | $500 |

| Tradng Assets | Forex, Spot Metals, Indices, Shares, Energy |

| Leverage | Up to 1:500 |

| Account types | Standard, Prime and Pro accounts |

| Trading platform | MetaTrader 4 |

| Spreads | From 0.4 pips (on EUR/USD) |

| Commission | No commissions charged, only spreads |

| Demo account | Yes |

| Account Base Currencies | USD, EUR, GBP, CHF, JPY, AUD, CAD |

| Payment methods | Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort,Webmoney,and more |

| Educational | Free educational resources include ebooks, webinars, and video tutorials |

| Customer support | Phone, email, live chat, online contact form and extensive FAQ section |

LIRUNEX is a retail forex and CFD broker that is registered in Cyprus and regulated by multiple regulatory authorities. The broker offers a variety of trading instruments, including forex, indices, commodities, and cryptocurrencies, with competitive spreads and leverage up to 1:30 for forex trading.

LIRUNEX also offers multiple account types, namely Standard, Prime and Pro accounts and each with different minimum deposit requirements and features to cater to different trading styles and preferences. For example, the Standard account requires a minimum deposit of $500 or equivalent amount.

LIRUNEX's trading platform of choice is MetaTrader 4, which is available for both desktop and mobile devices. LIRUNEX supports various order types, including market orders, limit orders, stop orders, and trailing stop orders. Traders can also execute orders using the One-Click Trading feature on the MetaTrader 4 platform. In addition, LIRUNEX provides various educational resources and trading tools to assist traders in making informed decisions.

LIRUNEX offers customer support via several channels, including phone, email, as well as some social media platforms, and an online contact form. The customer support team is available 24/5 to assist traders with any queries or issues they may have. LIRUNEX's website also features a comprehensive FAQ section, which can be accessed from the “Support” tab on their website, providing answers to frequently asked questions on topics such as account opening, trading conditions, and platform features.

LIRUNEX has multiple entities that are regulated by various regulatory authorities, including CySEC, BDF, BaFin, LFSA, and CNMV. This means that LIRUNEX operates under strict guidelines and adheres to high levels of regulatory standards and consumer protection policies.

LIRUNEX LIMITED, is authorized and regulated by Federal Financial Supervisory Authority of Germany (BaFin) under regulatory license number 156748;

Lirunex Ltd, is authorized and regulated by Banque de France (BDF) under regulatory license number 83447;

Lirunex Ltd, is also authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC) under regulatory license number 338/17;

Lirunex Limited is also authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/20/0050;

LIRUNEX LTD, is authorized and regulated by the Comisión Nacional del Mercado de valores (CNMA) under regulatory license number 4829;

LIRUNEX is a forex broker that offers traders competitive trading conditions, such as low spreads and high leverage. The broker provides free educational resources, including webinars, ebooks, and video tutorials, to help traders improve their trading skills. LIRUNEX also has a range of payment options available for its clients to use.

However, LIRUNEX also has some drawbacks. The broker has a limited asset offering, as it only offers Forex and CFDs. Additionally, the minimum deposit requirements are relatively higher compared to other brokers. LIRUNEX also only provides users with the option to trade via MetaTrader 4, limiting choices for experienced traders who may prefer other trading platforms. The demo account funding is only available to users registered in certain countries, while the broker's services are only available in certain jurisdictions and not to residents of the United States. Social trading features are also not available on the LIRUNEX trading platform.

| Pros | Cons |

| Multiple regulated entities | Limited asset offering compared to some other brokers |

| Wide selection of trading instruments | Minimum deposit requirements are relatively higher compared to other brokers |

| A range of educational resources, including webinars, ebooks, and video tutorials | Trading is limited to MetaTrader 4 |

| A variety of payment options | Demo account funding is only available to users registered in certain countries |

| Multiple trading accounts to choose from | Only available in certain jurisdictions (not available to residents of the United States) |

| A series of trading tools | No social trading features are available |

| No 7/24 customer support |

LIRUNEX is a well-established online brokerage firm that caters to the needs of traders worldwide. It offers a comprehensive selection of market instruments to its clients, including Forex, Spot Metals, Indices, Shares, and Energy.

Forex: LIRUNEX offers a wide range of currency pairs for trading, including major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

Spot Metals: LIRUNEX offers spot trading of precious metals such as gold and silver. Spot trading allows traders to buy and sell these metals at the current market price.

Indices: LIRUNEX offers trading on a variety of global stock indices, including the S&P 500 index, NASDAQ index, and the Dow Jones Index. Trading indices allows traders to speculate on the performance of a whole stock market, rather than just individual stocks.

Shares: LIRUNEX offers trading of stocks from various global markets, including the US, UK, Europe, and Asia. Trading on stocks allows traders to invest in well-known companies and earn profits based on their performance.

Energy: LIRUNEX offers trading of energy products such as crude oil and natural gas. Traders can benefit from price changes in energy markets, which are known for their high volatility.

LIRUNEX offers a range of account types to suit the needs of different traders. They have carefully crafted their account types to offer a tailored experience to traders based on their trading level, experience, and financial status. The account types offered by LIRUNEX are Standard, Prime, and Pro.

The Standard account requires a minimum deposit of $/€ 500 and is suitable for novice traders who are new to the market. This type of account offers basic trading conditions, including access to all trading instruments, customer support, educational resources, and trading tools.

The Prime account requires a higher minimum deposit of $/€ 2,000 and is targeted towards traders who have more experience in the market. This account type offers tighter spreads, lower commissions, and additional perks such as exclusive trading signals and faster withdrawals.

The Pro account is the top-tier account type offered by LIRUNEX and requires a minimum deposit of $/€ 10,000. This type of account is geared towards professional traders who require a higher level of trading conditions, including dedicated account managers, advanced trading tools, priority customer support, and lower commissions and favorable market conditions.

All account types offered by LIRUNEX come with negative balance protection, and the MetaTrader 4 trading platform. Additionally, traders can choose from different currency options, EUR or USD.

Opening an account with LIRUNEX is a straightforward process and can be completed in a few simple steps. Here is a step-by-step guide on how to open an account with LIRUNEX:

Visit the LIRUNEX website and click on the “Register” button on the top right-hand corner.

Fill in the registration form by providing accurate personal details, including your name, email address, and phone number.

Select your preferred account type - Standard, Prime, or Pro - and choose your base currency.

After filling in the form, you will receive an email to confirm your registration.

Next, login to your LIRUNEX account and complete your account verification by uploading the necessary documents. The documents required for verification can be found on the website or by contacting customer support.

Once your account is verified, you can fund your account by choosing a payment method that is convenient for you. LIRUNEX provides several payment options, including bank transfers, credit/debit cards, and e-wallets.

After funding your account, you can begin trading by downloading the LIRUNEX trading platform or by using the web-based platform.

LIRUNEX provides customers with 24/5 customer support to assist with any issues that may arise during the trading process.

As per the regulations by ESMA, the default leverage for retail forex traders is set at a maximum of 1:30, while professional traders are allowed to trade with a higher leverage of up to 1:100.

Leverage refers to the amount of borrowing that a trader can use to open a position in the market. Higher leverage can increase potential profits, but it also comes with higher risk. Professional traders are considered to have a higher level of experience and knowledge of the financial markets, which is why they are often offered higher leverage options.

However, it's important to note that leverage should be used wisely, and traders should always consider the risks involved before trading with high leverage. It's also essential to have a risk management strategy in place to protect your investment in case of unfavourable market conditions.

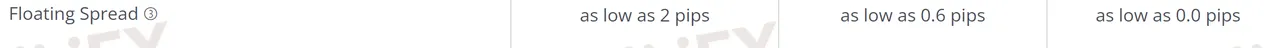

LIRUNEX offers a variety of trading account types to suit the needs of different traders. Each account type features different spreads and commission charges. Here, we will explain the available accounts and what they offer in terms of spreads and commissions.

The Standard Account is designed for those who are new to trading or who prefer lower costs. With this account, you can trade with floating spreads that start from 2 pips. The best part is that there are no commissions charged on trades. This account is ideal for beginners who want to start trading with a lower investment.

The Prime Account is designed for those who require tighter spreads and faster trade execution times. With this account, you can trade with floating spreads that start from 0.6 pips, which is significantly lower than the Standard Account. However, this account comes with a commission charge of $8 per lot traded. This account is suitable for traders who require faster trading speeds and lower spreads.

The Pro Account is designed for professional traders who require the tightest spreads possible and access to institutional-grade trading conditions. With this account, you can trade with spreads that start from 0.0 pips, which means that you can trade with almost no spreads! It is important to note that this account comes with a commission charge of $4 per lot traded. This account is ideal for high volume traders who require high-quality trading conditions.

Apart from trading fees, LIRUNEX also charges some non-trading fees that traders should be aware of. Here are some of the non-trading fees charged by LIRUNEX:

Deposit Fees - While deposits with LIRUNEX are free of charge, some payment providers may charge you fees for depositing funds. It's important to check with your payment provider to see if they charge any fees.

Withdrawal Fees - LIRUNEX does not charge any withdrawal fees. However, the payment provider you use to withdraw funds may charge fees. LIRUNEX also waives the first withdrawal fee for its clients each month.

Inactivity Fees - If there has been no trading activity in your account for a period of 90 days, an inactivity fee of $50 will be charged for each subsequent month until the account is active again.

Conversion Fees - If you deposit funds in a currency different from the one in which your LIRUNEX account is denominated, you will be charged a conversion fee of 2% of the deposit amount. This fee is charged to cover the costs of converting the funds to your account currency.

Overnight Financing Fees - LIRUNEX charges overnight financing fees for positions that are held open overnight. These fees can be either positive or negative and depend on the instrument being traded.

LIRUNEX provides MetaTrader 4 (MT4) trading platform for its clients. The MT4 platform is available in PC, iOS, and Android versions that allow traders to access their accounts and trade from anywhere, at any time.

MT4 is a well-known and widely-used trading platform globally, known for its user-friendly interface, advanced charting features, multiple order types, and the ability to support automated trading strategies like Expert Advisors (EAs). The platform also offers a vast array of technical analysis tools that traders can use to make informed decisions.

LIRUNEX provides a range of trading instruments through its MT4 platform, including forex, commodities, and indices. The platform also supports multiple account types, allowing traders to choose the one that suits their needs best.

LIRUNEX supports various payment methods for deposits and withdrawals, including Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort, and Webmoney. Deposits through most payment methods have a minimum deposit requirement of 50. However, the minimum deposit through global transfer is $300.

It is important to note that the processing time for withdrawals can vary depending on the payment method used. Withdrawal requests made through Visa and Mastercard can take up to 10 business days to process. This is due to the nature of these payment methods, which typically involve additional security checks and verification procedures to ensure that the funds are being transferred to the correct account.

LIRUNEX offers several channels of customer support to assist its traders. This includes:

Email support, which is available 24/7 and allows traders to submit their questions or concerns to LIRUNEX's support team.

Phone support, which is available during business hours and allows traders to speak to a support representative directly.

A comprehensive FAQ section on LIRUNEX's website, which provides answers to common questions and concerns about trading with LIRUNEX.

In addition to these channels of customer support, LIRUNEX also offers a personal account manager service for premium account holders, which provides dedicated assistance and support for their trading needs.

LIRUNEX offers a range of educational resources to help traders improve their trading skills and knowledge in the Forex markets. Some of these resources include a beginner's guide, an economic calendar, trading strategies, market analysis, and informative articles.

These resources are designed to help traders understand the fundamental and technical analysis of the Forex markets, as well as to give them an overview of the trading tools and features available on the LIRUNEX platform. By using these resources, traders can better navigate the Forex markets, make more informed trading decisions, and ultimately, achieve their trading objectives.

In conclusion, LIRUNEX is a reputable forex broker that offers traders a range of benefits and drawbacks. Its competitive spreads, multiple account types make it an attractive option for traders looking to improve their skills and trading outcomes. However, its limited product offerings, lack of available US trading accounts, and potentially higher withdrawal fees for certain accounts may be disadvantages for some traders. Overall, LIRUNEX provides a secure and regulated trading environment and is worth considering for traders looking for a well-rounded forex broker. As always, traders are advised to conduct thorough due diligence and weigh their options before investing their funds.

Q: What regulatory standards does LIRUNEX comply with?

A: LIRUNEX has multiple entities that are regulated by various regulatory authorities, including CySEC, BDF, BaFin, LFSA, and CNMV.

Q: What account types are available at LIRUNEX?

A: LIRUNEX offers three different account types, including Standard, Prime and Pro accounts. Each account type has different features, including minimum deposits, trading conditions, and access to additional tools.

Q: How can I fund my account with LIRUNEX?

A: LIRUNEX offers several different funding options, including Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort,Webmoney,and more.

Q: Does LIRUNEX offer educational resources?

A: Yes, LIRUNEX has a variety of educational resources available for traders of all skill levels, including webinars, video tutorials, eBooks, and more.

Q: How can I get in touch with customer support at LIRUNEX?

A: LIRUNEX customer support is available 24/7 via email, phone, or live chat.

Q: What trading platforms does LIRUNEX offer?

A: LIRUNEX offers two trading platforms, including the popular MetaTrader 4 (MT4) platform and the Lirunex Trader platform. Both platforms can be used on desktop.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive money-square and lirunex are, we first considered common fees for standard accounts. On money-square, the average spread for the EUR/USD currency pair is -- pips, while on lirunex the spread is from 0.0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

money-square is regulated by FSA. lirunex is regulated by BaFin,AMF,CYSEC,LFSA,CNMV.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

money-square provides trading platform including -- and trading variety including --. lirunex provides trading platform including LX-PRO,LX-PRIME,LX-STANDARD and trading variety including FX Pairs, Spot Metal, Energies, Shares, Indices.