No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between instaforex and FOREX EXCHANGE ?

In the table below, you can compare the features of instaforex , FOREX EXCHANGE side by side to determine the best fit for your needs.

EURUSD: 0.4

XAUUSD: --

Long: -5.74

Short: 0.73

Long: -21.82

Short: -7.01

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of instaforex, forex-exchange lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 5-10 years |

| Trading instruments | currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Bank wire transfer and many other methods |

| Customer Service | Email/phone number/address/live chat/more |

| Fraud Complaints Exposure | No for now |

General information and regulations of InstaForex

InstaForex brand was founded in 2007 and claims to be the choice of more than 7 million brokers. InstaForex website may be very complex at first glance, but if you take a moment to look at it closely, you will find a wealth of content. The information bar on both sides of the page is full of attractive content, such as news, widgets, real-time charts, customer service and much more.

In the following article, we will analyze the features of this merchant in all its dimensions, providing you with easy and well-organized information. If you are interested, read on. Reading this article will take you approximately 7 minutes.

At the end of the article, we will also briefly extract the most significant advantages and disadvantages so that you can get an idea of the broker's features at a glance.

Market instruments

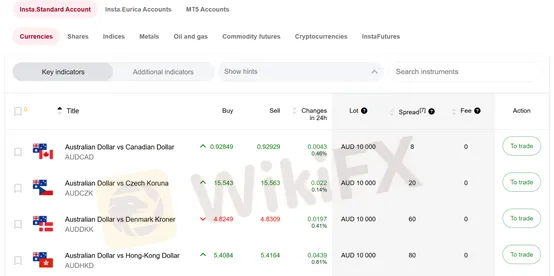

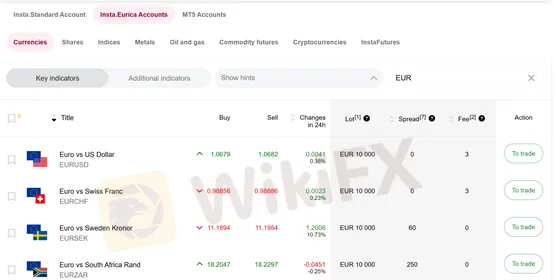

As we have said before, InstaForex web pages are very informative. On this trading products page you can see not only the trading products, but also the difference in commissions and spreads between different accounts. We can trade currency pairs, stocks, indices, precious metals, energies, commodities, cryptocurrencies and futures.

Spreads and commissions for trading with InstaForex

Let's take currency pairs as an example. Spreads and commissions vary on different accounts. On the MT5 and Standard accounts the spread is about 3 pips and there is no commission, while on the Eurica account the spread is 0 and the commission varies from 3-12 USD.

We can venture to conclude that Eurica is suitable for long-term traders who trade less frequently, while the other two accounts are suitable for short-term traders who trade more frequently.

Account Types for InstaForex

Demo account: InstaForex offers a demo account for testing a little on the financial market without the risk of losing money. Opening a demo account, according to the company, is as easy as ABC.

Live account: there are in total 4 types of accounts: insta standard, insta eurica, cent standard and cent eurica. The minimum deposit for opening an account at InstaForex is just 1 USD, and the trading conditions also seem to be quite favorable.

Trading platforms offered by InstaForex

As for trading platforms, clients can choose from the market leaders MetaTrader4 and MetaTrader5, which can be accessed from any device.

However, have you ever wondered or are you wondering which platform you should use? Our team has the corresponding article for your reference. The article details the similarities and differences between the two and gives specific advice.

https://www.wikifx.com/es/wikishow/202207208464173722.html

Leverage offered by InstaForex

InstaForex offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Deposit and withdrawal methods and fees

Unlike some brokers that lack information, InstaForex is very generous in providing information. If you carefully browse their website, you can find a wealth of information. As for deposits and withdrawals, InstaForex shows all methods, required fees and arrival times clearly on a single page.

Educational resources

InstaForex educational resources are extensive. Online charts, market analysis, Forex calculators, indicators, articles, questions and answers, glossary... Whether you choose InstaForex as your broker or not, you can make the most of the resources available here.

Customer support of InstaForex

Call back, live chat, WhatsApp, email...with numerous channels and 24/7 service, clients could get help whenever they have trading-related problem.

Here are more details about the customer service.

Languages: there are total sixteen languages on InstaForex website, which could meet the needs of most of its customers.

Service hours: 24/7

Phone: you could fill in a form, indicating your country, your preferred language and time, the team will call you whenever you want, and the service is totally free of charge.

Email: support@mail.instaforex.com

Social networks: Facebook, Twitter, YouTube, Telegram, Instagram

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time.

Advantages and disadvantages of InstaForex

Advantages:

Well regulated

MT4, MT5

Sufficient information

Educational resources

Many instruments available

Demo account

Disadvantages:

Low leverage

Frequent asked questions about InstaForex

Is this broker well regulated?

Yes, it is currently effectively regulated by CYSEC in Cyprus.

Does this broker offer MT4/MT5?

Yes, InstaForex offers both MT4 and MT5 for you to choose from.

| Basic | Information |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Founding Time | 2004 |

| Minimum Deposit | No limitation |

| Maximum Leverage | 1:25 |

| Minimum Spreads | From 0.7 pips on EUR/USD |

| Trading Platform | MT4 trading platfom |

| Trading Assets | Currency pairs, commodity futures and stock futures |

| Payment Methods | Regular bank transfers and quick transfers |

| Customer Support | 5 /24 Live Chat, Phone, Emails |

General Information & Regulation

FOREX EXCHANGE was established in 2004, registered for financial futures trading business in January 2006, joined the Financial Futures Trading Association in February 2006, and registered for first-class financial instruments business in September 2007. In 2008, FOREX EXCHANGE moved its headquarters to Tokyo, and in November of the same year, it registered for the second financial instruments business, and in 2009, it registered for investment advice/institutions, and in April of the same year, it joined the Japan Investment Advisors Association. FOREX EXCHANGE's business also includes forex margin trading in accordance with the Financial Instruments and Exchange Act and all related businesses. FOREX EXCHANGE currently holds a retail foreign exchange license authorized by the Japan Financial Services Agency (Regulatory No. 2010001141146).

Market Instruments

Investors on the FOREX EXCHANGE platform can trade popular currency pairs in the foreign exchange market, as well as commodity futures and stock futures.

Minimum Deposit

There is no initial minimum deposit requirement, but investors are advised to deposit at 100,000 JPY into their MT4 account.

Spreads & Commissions

The EURUSD spread is 0.7 pips, the USDJPY spread is 0.6 pips, the minimum spread for EURJPY is 0.7 pips, the minimum spread for GBPJPY is 1.4 pips, and the spread for AUDJPY is 1 pip.

Trading Platforms Available

Traders trading with FOREX EXCHANGE can apply the MT4 trading platform, which is currently the most popular platform in the market. Since its release in 2005, the MT4 trading platform has become a popular platform for financial institutions and investors worldwide due to the convenience of the trading system and the ability to customize charts freely. The most attractive aspect of MT4 is that it can automatically buy and sell, and users can view exchange rates to buy and sell, and by pre-determining trading rules, trades can be made automatically.

Deposit and Withdrawal

Traders can make deposits to their investment accounts via regular bank transfers and quick transfers. A regular bank transfer is a method of transferring funds to the company's designated account at Internet banking, ATMs, or over-the-counter at financial institutions. The quick transfer is a method of transferring funds from a trader's computer or smartphone to [My MT4]. The client is responsible for transfer fees when transferring funds to the bank account designated by FOREX EXCHANGE. Withdrawals are, in principle, free of charge, but if the withdrawal amount is less than 10,000 yen and the withdrawal amount exceeds 5 times per month, a fee of 540 yen will be charged for each withdrawal.

Pros & Cons of FOREX EXCHANGE

| Pros | Cons |

| FSA-regulated | ONLY MT4 supported |

| MT4 trading platform available | Conservative leverage |

| Competive spreads | |

| No minimum deposit requirements | |

| Commodities & Stocks also available |

Customer Support

If clients have any inquiries or trading-related issues, they can get in touch with FOREX EXCHANGE through the following contact channels:

Telephone: +81 03-3537-2311

Email: support@forex-exchange.com

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive instaforex and forex-exchange are, we first considered common fees for standard accounts. On instaforex, the average spread for the EUR/USD currency pair is Fixed 2-7 pips, while on forex-exchange the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

instaforex is regulated by CYSEC. forex-exchange is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

instaforex provides trading platform including Standard Trading Accounts,Eurica Trading Accounts,ECN Trading Account,ECN Pro Trading Account,Scalping trading account and trading variety including --. forex-exchange provides trading platform including -- and trading variety including --.