No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FXGiants and BINANCE JEX ?

In the table below, you can compare the features of FXGiants , BINANCE JEX side by side to determine the best fit for your needs.

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxgiants, binance-jex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FXGiants | Basic Information |

| Registered Country/Region | Bermuda |

| Regulations | N/A |

| Tradable Assets | Forex, Metals, Indices, Commodities, Futures, Shares |

| Account Types | Live Floating Spread Account, Live Fixed Spread Account, Live Zero Fixed Spread Account, STP/ECN No Commission Account, STP/ECN Zero Spread Account, STP/ECN Absolute Zero Account |

| Minimum Deposit | N/A |

| Maximum Leverage | 1000:1 |

| Minimum spread | from 0.0 pips |

| Deposit & Withdrawal | VISA, Wire Transfer, and BTC |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Phone, Email, Live chat, |

| Education Resources | Blog |

FXGiants is an international online broker that offers retail and institutional traders across the globe access to trade over 200+ instruments from multiple asset-classes including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies & CFDs.

FXGiants, registered in Bermuda, operates as an unregulated broker. While it offers a diverse range of market instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares, investors should approach the platform with caution due to the lack of regulatory oversight. The maximum leverage ranges from 200:1 to 1000:1, providing traders with flexibility but also exposing them to higher risks. Spreads and commissions vary across different account types, with options such as fixed spreads, zero spreads, and variable spreads. The absence of regulation raises concerns about investor protection and transparency. Additionally, limited deposit options, the absence of a demo account, and unclear minimum deposit requirements can be considered disadvantages. However, FXGiants offers robust trading platforms, including MetaTrader 4 and PMAM, along with VPS hosting services for enhanced performance. The customer support team is responsive and available via phone, email, and live chat. Traders can access educational resources through the company's blog, although the offerings may be limited. In summary, FXGiants provides a wide range of trading options but requires careful consideration of the associated risks and limitations.

No, FXGiants, registered in Bermuda, operates without holding any licenses and is not subject to regulatory oversight from any governing bodies. As a result, investors should approach the platform with caution and carefully assess the risks involved. The absence of regulatory supervision means that there are no guarantees regarding the platform's compliance with industry standards and customer protection measures. It is advisable for investors to conduct thorough due diligence, seek professional advice, and consider alternative regulated options to ensure the security of their investments.

FXGiants offers a range of advantages and disadvantages for traders. One of the key advantages is the availability of diverse market instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares, allowing traders to diversify their portfolios. FXGiants also offers multiple account types, providing flexibility for traders to choose the one that aligns with their preferences. Additionally, FXGiants provides high leverage up to 1000:1. However, a significant drawback is the lack of regulation, which raises concerns about investor protection. The limited deposit options and the absence of a demo account for practice trading are also notable disadvantages. Moreover, the unclear minimum deposit requirement and limited educational resources may hinder comprehensive learning. Traders should carefully consider these factors before engaging with FXGiants.

| Pros | Cons |

| None | Lack of Regulation |

| Limited Deposit Options | |

| Lack of Demo Account | |

| Unclear Minimum Deposit Requirement | |

| Limited Educational Resources |

Forex: FXGiants offers a wide range of currency pairs for trading in the Forex market. Forex, also known as foreign exchange, involves the buying and selling of currencies. Traders can speculate on the price movements of major, minor, and exotic currency pairs, taking advantage of the volatility and liquidity of the Forex market.

Metals: FXGiants allows trading in precious metals like gold, silver, platinum, and palladium. These metals are considered as safe-haven assets and are often used as a hedge against inflation or economic uncertainty. Traders can take positions on the price movements of these metals, benefiting from both rising and falling markets.

Indices: FXGiants provides access to a variety of global stock indices, such as the S&P 500, FTSE 100, DAX 30, and Nikkei 225. Stock indices represent a basket of stocks from a specific exchange or sector and are used to gauge the overall performance of a market. Traders can speculate on the direction of these indices, capitalizing on market trends and economic indicators.

Commodities: FXGiants offers trading opportunities in popular commodities like oil, natural gas, and agricultural products. Commodity markets involve the buying and selling of physical goods, including energy products, metals, and agricultural produce. Traders can take advantage of price fluctuations in these markets, driven by factors such as supply and demand dynamics, geopolitical events, and weather conditions.

Futures: FXGiants allows trading in futures contracts, which are agreements to buy or sell an underlying asset at a predetermined price and date in the future. Futures cover a wide range of assets, including commodities, stock indices, and currencies. Traders can speculate on the future price movements of these assets, taking advantage of leverage and the ability to profit in both rising and falling markets.

Shares: FXGiants provides access to trading shares of major companies listed on global stock exchanges. Share trading allows investors to take ownership in a company and participate in its growth and profitability. Traders can speculate on the price movements of individual stocks, leveraging fundamental and technical analysis to make informed trading decisions.

These market instruments offered by FXGiants provide traders with a diverse range of opportunities to capitalize on price movements across various financial markets, catering to different trading strategies and risk preferences.

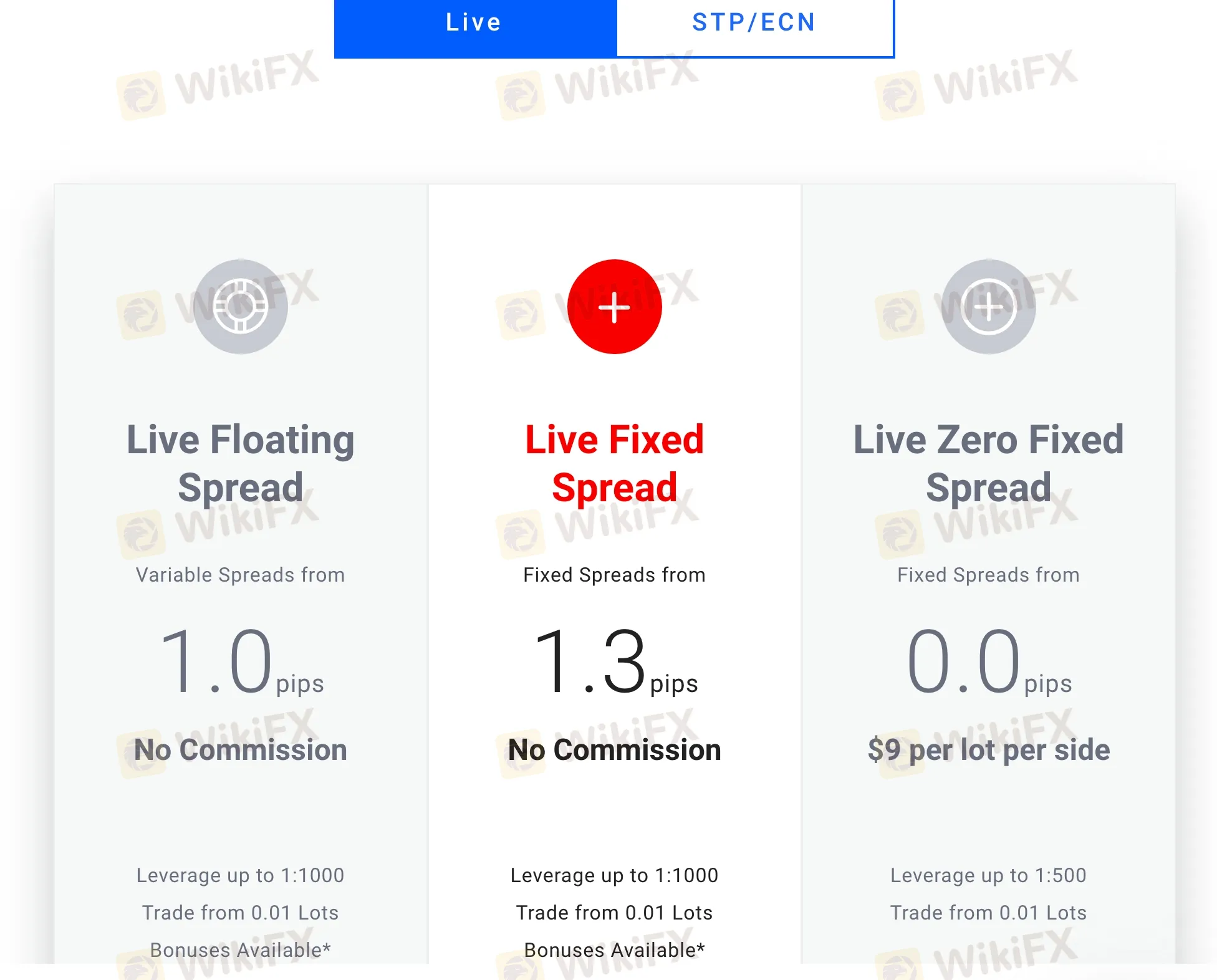

FXGiants offers a range of account types to cater to different trading preferences and strategies. Here are the details of the six account types:

Live Floating Spread Account: This account features variable spreads starting from 1.0 pips, with no commissions charged per trade. Traders can benefit from a maximum leverage of 1000:1, allowing for greater trading flexibility and potential.

Live Fixed Spread Account: With this account, traders enjoy fixed spreads starting from 1.3 pips, and there are no commissions per trade. Similar to the Live Floating Spread Account, the maximum leverage is set at 1000:1.

Live Zero Fixed Spread Account: This account type offers zero fixed spreads. Instead, traders are charged a commission of $9 per lot traded. The maximum leverage for this account is set at 500:1.

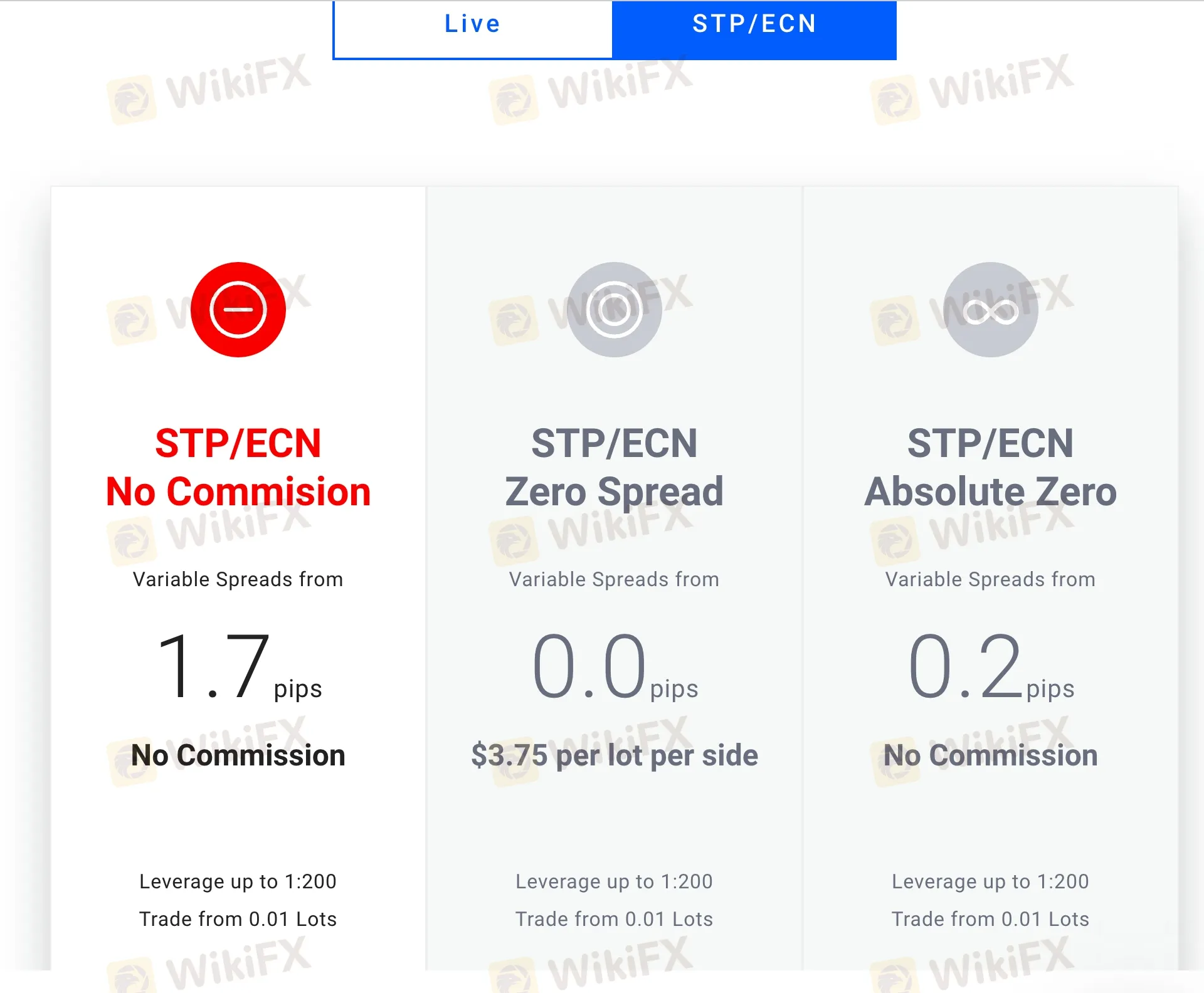

STP/ECN No Commission Account: Designed for traders who prefer straight-through processing (STP) and electronic communication network (ECN) execution, this account provides variable spreads starting from 1.7 pips without any commissions. The maximum leverage is set at 200:1.

STP/ECN Zero Spread Account: Traders opting for this account enjoy zero spreads, meaning there is no markup on the raw interbank spreads. However, a commission of $3.75 per lot is charged. The maximum leverage for this account type is 200:1.

STP/ECN Absolute Zero Account: This account features extremely low spreads starting from 0.2 pips, with no commissions charged per trade. Traders can leverage up to 200:1 in this account type.

These various account types offered by FXGiants allow traders to choose the one that aligns with their trading style, risk tolerance, and specific requirements, ensuring a customized trading experience.

Here are the steps involved in the account opening process with FXGiants:

Registration: Visit the FXGiants website and click on the “Open Account” or “Register” button. Fill in the required personal information such as name, email address, phone number, and country of residence.

Verification: After submitting your registration details, you will need to complete the verification process. This typically involves providing identification documents such as a valid passport or driver's license and proof of address, such as a utility bill or bank statement. FXGiants may require additional documents based on regulatory requirements.

Account Type Selection: Choose the type of trading account that suits your trading preferences and needs. FXGiants typically offers different account types, such as Standard, Premium, or VIP, each with varying features and trading conditions. Select the account type that aligns with your trading goals.

Deposit Funds: Once your account is verified, you can proceed to deposit funds into your trading account. FXGiants offers various deposit methods such as credit/debit card, wire transfer, or online payment systems. Choose the preferred method and follow the instructions to deposit the desired amount.

Start Trading: After successfully depositing funds, you can log in to your FXGiants trading account using the provided credentials. Download the trading platform (such as MetaTrader 4) or access the web-based platform. You are now ready to start trading by selecting financial instruments and executing trades.

It's worth noting that the specific steps and requirements may vary slightly based on your location and regulatory guidelines. FXGiants typically provides clear instructions and guidance throughout the account opening process to ensure a smooth and hassle-free experience for their clients.

When it comes to trading leverage, the maximum leverage offered by FXGiant is super high, reaching up to 1:1000. Generous leverage is not necessarily a good thing,e especially offered by unregulated brokers, so traders should take extra care to use it.

FXGiants offers varying spreads and commissions across different account types, providing traders with flexibility and choice. Here are the details:

Live Floating Spread Account: This account features spreads starting from 1.0 pip with no commissions charged per trade. Traders can benefit from floating spreads while enjoying commission-free trading.

Live Fixed Spread Account: With this account, traders can take advantage of fixed spreads starting from 1.3 pips without any commissions. The absence of commissions ensures transparent trading costs.

Live Zero Fixed Spread Account: This account type offers traders the benefit of zero fixed spreads, meaning there is no markup on the raw interbank spreads. However, a commission of $9 per lot is charged for each trade.

STP/ECN No Commission Account: Traders who opt for this account type enjoy variable spreads starting from 1.7 pips without any commissions. This account offers direct market access with no additional commission charges.

STP/ECN Zero Spread Account: With this account, traders benefit from zero spreads, while a commission of $3.75 per lot is charged. This ensures traders have access to raw interbank spreads with low-cost trading.

STP/ECN Absolute Zero Account: This account features incredibly low spreads starting from 0.2 pips with no additional commission charges.

FXGiants' diverse account types allow traders to choose the spreads and commissions structure that aligns with their trading style and preferences, providing flexibility and transparency in trading costs.

FXGiants offers a robust trading platform that caters to the needs of traders. The platform primarily supports MetaTrader 4 (MT4), a widely acclaimed and popular trading platform in the industry. MT4 provides a comprehensive set of tools and features for traders to execute trades, perform technical analysis, and access real-time market data. It offers a user-friendly interface, customizable charts, and a wide range of technical indicators for advanced analysis.

In addition to MT4, FXGiants also provides the PMAM (Percentage Allocation Management Module) platform. This platform allows traders to easily manage multiple forex investment portfolios. With PMAM, traders can allocate and distribute funds among different trading accounts, monitor performance, and efficiently manage their investment strategies.

FXGiants also offers VPS hosting services. By connecting their trading accounts to FXGiants' free MT4 VPS (Virtual Private Server), traders can benefit from enhanced trading performance, reduced latency, and uninterrupted trading even during power outages or Internet disruptions. VPS hosting ensures that traders can fully utilize the potential of their trading strategies without worrying about technical issues.

Overall, FXGiants' trading platforms, including MetaTrader 4 and PMAM, coupled with their VPS hosting service, provide traders with advanced tools, convenience, and reliability to optimize their trading experience.

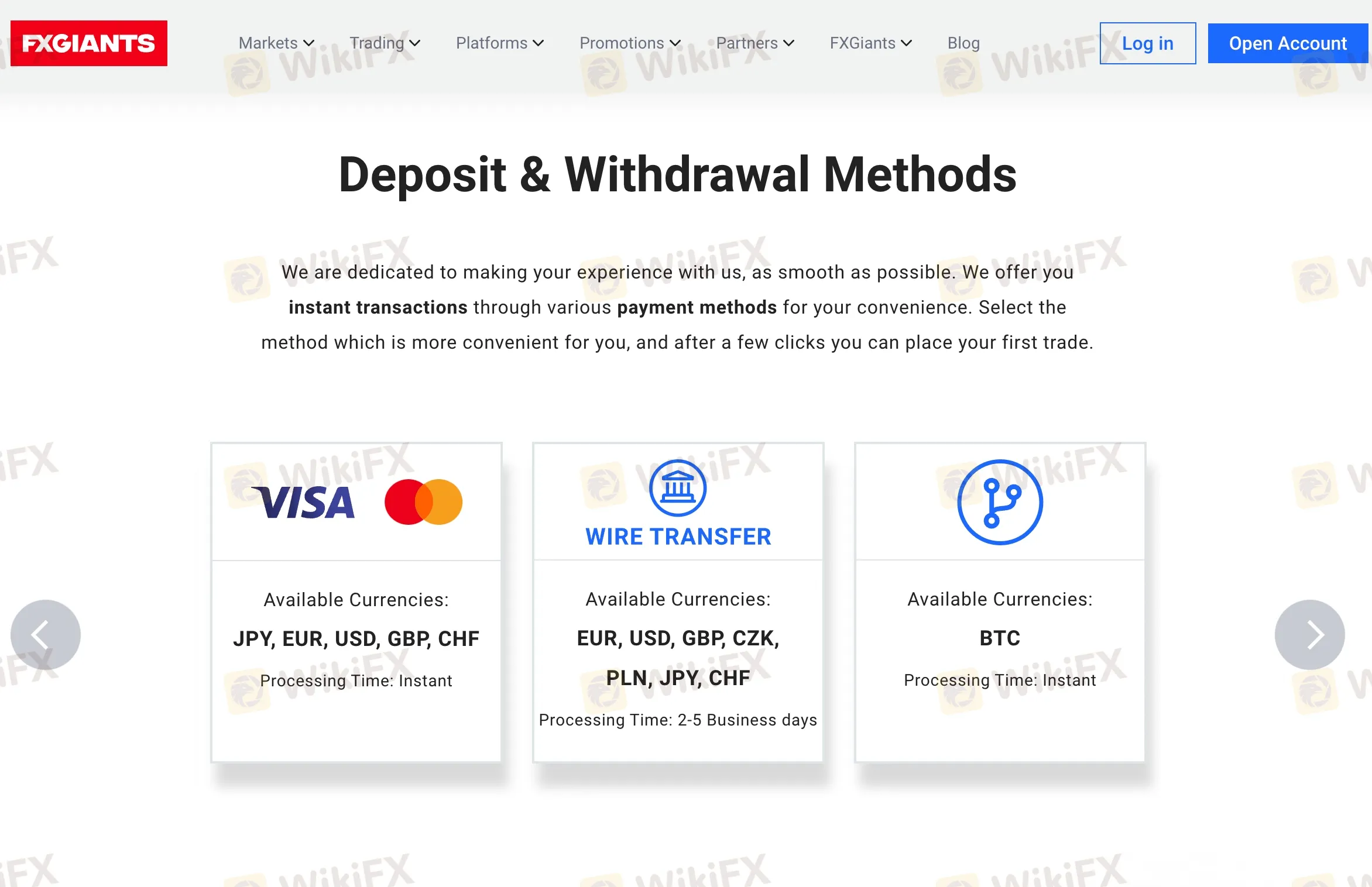

FXGiants offers convenient options for depositing and withdrawing funds. Clients can choose from various methods, including VISA, Wire Transfer, and BTC. VISA provides a quick and easy way to transfer funds using a credit or debit card. Wire Transfer allows for direct bank-to-bank transactions. Additionally, FXGiants supports BTC, enabling cryptocurrency enthusiasts to deposit and withdraw funds using Bitcoin. While FXGiants' official website does not specify the minimum deposit amount, clients can contact their customer support for more information.

FXGiants provides excellent customer support to assist traders in every possible way. Their dedicated staff is available 24/5, ensuring prompt assistance during trading hours. Clients can reach out to FXGiants' customer support through various channels. Alternatively, clients can reach out via email, allowing them to provide detailed information and receive a timely response. Additionally, FXGiants offers a convenient live chat feature on their website, enabling real-time communication with a support agent for quick resolutions to any issues.

FXGiants offers educational resources to help traders gain knowledge about the financial markets. While their official website primarily provides a blog for accessing trading market information, it serves as a valuable resource for traders to stay informed about market trends, analysis, and insights. Traders can leverage these resources to enhance their understanding of the markets and make informed trading decisions. While FXGiants' educational offerings may be primarily focused on their blog, the availability of valuable market information can still contribute to traders' learning and development.

In summary, FXGiants is an unregulated broker registered in Bermuda. It offers a wide range of market instruments, including Forex, Metals, Indices, Commodities, Futures, and Shares. The platform provides multiple account types with varying spreads, commissions, and leverage options. FXGiants' trading platforms, including MetaTrader 4 and PMAM, offer advanced tools and features for traders. However, the lack of regulation raises concerns about investor protection. The limited deposit options, absence of a demo account, and unclear minimum deposit requirement are notable drawbacks. The customer support is responsive, and educational resources are available through the company's blog. Traders should carefully consider the risks and limitations associated with FXGiants before engaging with the platform.

Q: Is FXGiants a regulated broker?

A: No, FXGiants is not a regulated broker.

Q: What trading instruments are available at FXGiants?

A:FXGiants offers a wide range of trading instruments, including Forex, Metals, Indices, Commodities, Futures, Shares

Q: Does FXGiants offer a demo account?

A: No, FXGiants does offer a demo account.

Q: What payment methods does FXGiants accept?

A: FXGiants accepts three kinds of payment methods, including VISA, Wire Transfer, and BTC

Q: What trading platforms does FXGiants offer?

A:FXGiants offers trading platform MetaTrader 4

Q: What is the minimum deposit required to open an account withFXGiants?

A: The minimum deposit required to open an account withFXGiants is $100 for all account types.

Q: Does FXGiants offer any bonuses or promotions?

A: Yes, FXGiants offers bonuses or promotions and the information is provided on their website.

Q: What is the maximum leverage offered by FXGiants?

A: The maximum leverage offered by FXGiants is 1:1000.

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2-5 years |

| Company Name | BINANCE JEX |

| Regulation | No Regulation |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Spreads | N/A |

| Trading Platforms | App (iOS and Android), Desktop Client, API integration |

| Tradable Assets | Cryptocurrencies, Spot, Options, Futures |

| Account Types | N/A |

| Customer Support | 24/7 Chat Support, Email Support, Twitter, Facebook |

| Payment Methods | P2P Trading, Credit/Debit Card, Bank Transfer, Third-Party Payment Channels |

| Trading Tools | Binance Convert, Conversion History, Futures Grid, Trading Bots, Spot Grid, Binance OTC |

General Information

Binance JEX is an unregulated cryptocurrency exchange that operates without valid regulatory licenses. As a result, it lacks the oversight and regulatory protection usually provided by authorized entities. This absence of regulation increases the potential risk for users, as there may be a higher likelihood of market manipulation and fraudulent activities. It is important for users to exercise caution and be aware of the associated risks when trading on an unregulated platform like Binance JEX.

The platform offers a range of market instruments for trading, with fees varying depending on the type of trading instrument and discounts available for JEX token holders. Binance JEX supports multiple payment methods, including P2P trading, credit/debit card payments, bank transfers, and third-party payment channels. However, users should be aware of the risks and exercise due diligence when engaging in financial transactions on the platform.

Binance JEX provides trading platforms for both mobile and desktop devices, allowing users to trade on the go and stay informed about market updates. The exchange also offers API integration for third-party trading applications. To enhance security, Binance JEX provides the Binance Authenticator for 2-Step verification.

The platform offers various trading tools such as Binance Convert, Futures Grid, Trading Bots, Spot Grid, and an OTC trading service. These tools aim to enhance the trading experience and provide users with options to automate their trades and benefit from market fluctuations.

Customer support is available through 24/7 chat support, email communication, Twitter, and Facebook. Users can reach out to Binance JEX for assistance or inquiries regarding the platform.

While Binance JEX offers trading opportunities and a range of tools, users should be cautious due to the lack of regulatory oversight, the reported complaints, and the potential risks associated with unregulated exchanges.

Binance JEX, as a cryptocurrency exchange, has both advantages and disadvantages. In terms of pros, it offers a wide range of market instruments, including over 500 cryptocurrencies, options, ETFs, and futures. Traders may engage with buy and sell offers from other users, and the fee structure is relatively low. Additionally, the integration of JEX has expanded the platform's offerings. However, there are notable cons to consider. Binance JEX operates without regulatory oversight, which poses potential risks such as market manipulation and fraudulent activities. Limited information on less-known cryptocurrencies and the lack of customer protection and legal recourse options are also concerning. To make informed decisions, users should carefully weigh these pros and cons before engaging in trading activities on Binance JEX.

| Pros | Cons |

| Wide range of market instruments | Lack of regulatory oversight |

| Access to over 500 cryptocurrencies | Potential for market manipulation and fraudulent activities |

| Options, ETFs, and futures availability | Limited information on lesser-known cryptocurrencies |

| Ability to engage with buy/sell offers | Relatively low fee structure |

| Integration of JEX for expanded offerings | Limited customer protection and legal recourse options |

Binance JEX Exchange is currently not regulated by any valid regulatory authority. This means that the platform does not operate under the oversight and regulations that are typically in place to protect investors and ensure fair trading practices.

It's important to note that trading on an unregulated exchange carries inherent risks. Without regulatory oversight, there is a higher likelihood of fraudulent activities, market manipulation, and inadequate security measures. Additionally, in the event of any disputes or issues with the exchange, there may be limited avenues for legal recourse or protection of investors' rights.

Furthermore, it is worth mentioning that there have been complaints received by WikiFX regarding Binance JEX Exchange. Specifically, eight complaints have been reported within the past three months. These complaints and reports should serve as a warning and raise caution about the potential risks and possible fraudulent activities associated with the platform.

Binance JEX provides access to a range of market instruments, primarily focusing on cryptocurrency pairs. Traders can choose from over 500 cryptocurrencies, including popular options like BTC, ETH, and XRP, as well as lesser-known cryptos such as NEO, IOTA, and NavCoin.

The platform offers options for trading crypto coins like ETH/BTC, LTC/BTC, JEX/BTC, DASH/BTC, and others. Additionally, traders have access to options, ETFs, and futures. Binance JEX expanded its offerings through the acquisition of JEX, which is now integrated and rebranded as Binance Jex.

To facilitate trading, Binance JEX allows users to view and engage with buy and sell offers from other traders or create their own trade offers. A fee is charged for each trade, although the specific fee structure is relatively low.

Traders interested in utilizing Binance JEX's services are required to register on the platform before engaging in any trading activities.

| Pros | Cons |

| Wide range of over 500 cryptocurrencies | Lack of regulation and oversight |

| Availability of popular cryptocurrencies | Potential for market manipulation |

| Access to options, ETFs, and futures | Limited information on less-known cryptocurrencies |

| Ability to view and engage with buy/sell offers | Relatively low fee structure |

| Integration of JEX for expanded offerings | Risk of fraudulent activities |

| User registration required for trading | Limited customer protection and legal recourse options |

Binance JEX has a pricing schedule for transaction fees, which can be found on its website. The fees vary depending on the type of trading instrument.

For crypto coin pairs like ETH/BTC, the maker fee is 0.10% and the taker fee is 0.10%. Users who hold JEX tokens receive a 50% discount on these fees.

When it comes to option trading, both makers and takers are charged a fee of 0.20%. Again, JEX token holders enjoy a 50% discount on these fees. The fees for ETF trading are the same as for options.

For futures trading, the fees differ based on the trading pairs. For BTCUSDT, the maker fee is 0.00% and the taker fee is 0.04%. For ETHUSDT, the maker fee is 0.01% and the taker fee is 0.06%.

| Pros | Cons |

| Pricing schedule for transaction fees | Fees vary depending on the type of trading instrument |

| Clear fee structure available on the website | Non-JEX token holders do not receive fee discounts |

| Discounted fees for JEX token holders | Higher fees for option trading compared to coin pairs |

| Consistent fees for ETF trading and options | Different fee structure for different futures trading |

| Zero maker fee for BTCUSDT futures trading | Potential for confusion due to varying fee percentages |

Binance JEX offers trading platforms that cater to the needs of traders on various devices. Users can trade on the go and stay informed about market updates with the Binance JEX app and desktop client.

The trading platforms are available for download on different operating systems. For mobile trading, the Binance JEX app can be downloaded from the App Store for iOS devices or from Google Play for Android devices. The app allows traders to access all the features and functionality of Binance JEX on their smartphones or tablets.

For desktop trading, Binance JEX provides a powerful crypto trading platform that is compatible with Windows, MacOS, and Linux. Traders who prefer to conduct their trading activities on a computer can download the desktop client to enjoy a tailored trading experience.

Binance JEX also offers API integration, helping traders to connect their own trading applications to the platform. The Binance API is designed to provide a way to integrate trading functionality into third-party applications.

To enhance account security, Binance JEX provides the Binance Authenticator. This app generates 2-Step verification codes, adding an extra layer of protection to user accounts. The Binance Authenticator can be downloaded for both iPhone and Android devices.

| Pros | Cons |

| Wide range of market instruments, including over 500 cryptocurrencies | The platform primarily focuses on cryptocurrency pairs, limiting options for traders interested in other asset classes |

| Access to popular cryptocurrencies like BTC, ETH, and XRP, as well as lesser-known cryptos | Limited variety in trading options beyond cryptocurrencies |

| Integration of JEX platform expands the offerings available on Binance JEX | The fee structure for trades is relatively low, but specific details are not provided |

| Ability to view and engage with buy and sell offers from other traders | Registration on the platform is required before engaging in trading activities |

| API integration allows traders to connect their own applications to the platform | The Binance Authenticator app adds an extra layer of security to user accounts |

Binance JEX offers a range of trading tools designed to enhance the trading experience and provide users with various strategies and options. Here are some of the trading tools available on Binance JEX:

1. Binance Convert: Binance Convert allows users to instantly convert one cryptocurrency into another within their Binance JEX account. This tool helps exchange cryptocurrencies without the need for placing separate buy and sell orders.

2. Conversion History: Binance JEX keeps a record of users' conversion history, allowing them to track their previous cryptocurrency conversions. This feature provides a reference for users to review their conversion transactions.

3. Futures Grid: Binance JEX offers Grid Trading applied to COIN-M and USD-M contracts in the futures market. Grid Trading enables users to amplify their purchasing power by deploying long/short strategies and taking advantage of sideways markets. This tool helps users automate their futures trading and potentially benefit from market fluctuations.

4. Trading Bots: Binance JEX provides automation tools for trading cryptocurrencies. Users can deploy trading bots to execute trades based on predefined strategies. These bots help users identify and replicate trending strategies and take advantage of the liquidity available on Binance JEX. By using trading bots, users can trade crypto like professional traders.

5. Spot Grid: Spot Grid is a tool that allows users to place buying and selling orders at set intervals across a configured price range. By automating trades using Spot Grid, users can take advantage of volatile markets and potentially optimize their trading outcomes.

6. Binance OTC: Binance JEX offers an over-the-counter (OTC) trading service. OTC trading allows users to trade large volumes of cryptocurrencies directly with Binance, without going through the traditional order book. The OTC trading service provides a more personalized way to execute large trades.

7. OTC Trading History: Binance JEX keeps a record of users' OTC trading history, allowing them to track their previous OTC transactions and review the details of their trades.

| Pros | Cons |

| Binance Convert allows instant cryptocurrency conversion within the account | Lack of information on the effectiveness of trading tools |

| Conversion History enables users to track previous cryptocurrency conversions | Limited information on the success rate of Grid Trading |

| Futures Grid helps automate futures trading and potentially benefit from market fluctuations | Limited transparency on the performance of trading bots |

| Trading Bots assist in identifying and replicating trending strategies | Lack of detailed information on the effectiveness of Spot Grid |

| Spot Grid enables automated trading based on configured price ranges | Limited information on the success rate of OTC trading |

| Binance OTC offers personalized trading for large volumes | Lack of transparency regarding the OTC trading process |

| OTC Trading History allows users to track and review previous OTC transactions | Limited insight into the historical performance of OTC trades |

Binance JEX offers several payment methods for users to facilitate trading and transactions. These methods include:

1.P2P Trading: Binance JEX provides a peer-to-peer (P2P) trading platform where users can buy and sell cryptocurrencies directly with other users. P2P trading allows for the use of various payment methods, such as bank transfers, mobile payment apps, and online payment systems, depending on the preferences of the trading parties.

2. Credit/Debit Card: Binance JEX supports credit and debit card payments, allowing users to purchase cryptocurrencies using their cards. By linking their cards to their Binance JEX accounts, users can make instant purchases and quickly access the cryptocurrencies they desire.

3. Bank Transfer: Users can also make deposits and withdrawals on Binance JEX via bank transfers. This payment method enables users to transfer funds from their bank accounts to their Binance JEX accounts or vice versa.

4. Third-Party Payment Channels: Binance JEX may collaborate with third-party payment channels to provide additional payment options to its users. These channels can include various online payment systems, e-wallets, and mobile payment apps. By integrating with trusted third-party platforms, Binance JEX aims to offer users a wider range of payment choices and enhance the accessibility of cryptocurrency trading.

Binance JEX offers an advanced technology called GSLB, featuring Distributed server cluster, distributed storage high-speed memory trading engine with alternation of several machines, cold e-wallet, hot e-wallet with the offline private key.

Customer Support

Binance JEX provides customer support through multiple channels to assist users with their inquiries and concerns. Here are the customer support options available:

24/7 Chat Support: Binance JEX offers 24/7 chat support to provide real-time assistance to users. Users can access the chat support feature on the Binance JEX website or platform, allowing them to interact with support representatives and receive prompt responses to their queries.

Email Support: Users can also reach out to Binance JEX customer support by sending an email to service@email.jex.com. This email address serves as a direct communication channel for users to raise their concerns, ask questions, or seek assistance.

Twitter: Binance JEX maintains an official Twitter account where users can find the latest updates, announcements, and news related to the platform. Users can also reach out to Binance JEX through Twitter by mentioning or direct messaging their queries to the official Binance JEX Twitter handle: https://twitter.com/BinanceJEX/.

Facebook: Binance JEX has a Facebook page where users can find information about the platform and engage with the community. Users can visit the Binance JEX Facebook page to access updates, announcements, and relevant content. The Facebook page also serves as a platform for users to communicate with Binance JEX: https://www.facebook.com/JEX-1915721362076725/?modal=admin_todo_tour.

In conclusion, Binance JEX is an unregulated cryptocurrency exchange that offers a range of trading tools and platforms for users to trade and invest in cryptocurrencies. The advantages of using Binance JEX include pricing listed in tables, availability of mobile and desktop trading platforms, and various trading tools such as Binance Convert and Futures Grid. However, the platform's lack of regulation raises concerns about investor protection, potential fraudulent activities, and limited legal recourse in case of disputes. Additionally, the presence of complaints reported to WikiFX further highlights potential risks associated with Binance JEX. It is crucial for users to carefully consider these disadvantages and exercise caution when using the platform.

Q: Is Binance JEX a regulated exchange?

A: No, Binance JEX is currently not regulated by any valid regulatory authority. Trading on an unregulated exchange carries inherent risks.

Q: What are the pros and cons of using Binance JEX?

A: The pros of using Binance JEX include availability of trading platforms for different devices, and a range of trading tools. However, the cons include the lack of regulation and the presence of complaints reported to WikiFX.

Q: What fees does Binance JEX charge?

A: Binance JEX has a pricing schedule for transaction fees. The fees vary depending on the type of trading instrument, such as crypto coin pairs, options, ETFs, and futures.

Q: How does deposit and withdrawal work on Binance JEX?

A: Binance JEX does not charge any deposit fees, but users are required to pay a flat fee for each withdrawal to cover transaction costs. The withdrawal fees vary depending on the blockchain network and can change due to factors like network congestion.

Q: What trading platforms does Binance JEX offer?

A: Binance JEX offers a mobile app for iOS and Android devices, a desktop client for Windows, MacOS, and Linux, and API integration for connecting third-party trading applications.

Q: What trading tools are available on Binance JEX?

A: Binance JEX offers tools such as Binance Convert for instant cryptocurrency conversion, Conversion History for tracking previous conversions, Futures Grid for automated futures trading, Trading Bots for executing predefined strategies, Spot Grid for automated trading in volatile markets, and Binance OTC for personalized large-volume trades.

Q: What payment methods are accepted on Binance JEX?

A: Binance JEX supports P2P trading, credit/debit card payments, bank transfers, and may collaborate with third-party payment channels to offer additional options.

Q: How can I contact customer support for Binance JEX?

A: You can reach Binance JEX customer support through 24/7 chat support on their website, via email at service@email.jex.com, or through their official Twitter and Facebook accounts.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxgiants and binance-jex are, we first considered common fees for standard accounts. On fxgiants, the average spread for the EUR/USD currency pair is from 0.2 pips, while on binance-jex the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxgiants is regulated by FCA. binance-jex is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxgiants provides trading platform including STP/ECN Absolute Zero,STP/ECN Zero Spread,STP/ECN No Commision,Live Zero Fixed Spread,Live Fixed Spread,Live Floating Spread and trading variety including --. binance-jex provides trading platform including -- and trading variety including --.