简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXCM 、Alpari 交易商比较(前端未翻译)

Do you want to know which is the better broker between FXCM and Alpari ?

在下表中,您可以并排比较 FXCM 、 Alpari 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

EURUSD: 0.5

XAUUSD: -5.7

Long: -9.55

Short: 3.12

Long: -67.42

Short: 23.45

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxcm, alpari lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

fxcm

| Quick FXCM Review Summary | |

| Founded | 1999 |

| Headquarters | London, UK |

| Regulation | ASIC, FCA, CySEC, ISA |

| Market Instruments | Forex, shares, commodities, indices, cryptocurrencies |

| Demo Account | ✅($20,000 virtual money) |

| Min Deposit | $50 |

| Leverage | 1000:1 |

| EUR/USD Spread | Floating around 1.1 pips |

| Trading Platforms | Trading Station, TradingView Pro, MT4, Capitalise AI |

| Payment Methods | Bank Transfer, Visa, MasterCard, Google Pay, Neteller, Skrill |

| Customer Support | 24/5 live chat, request a callback |

| WhatsApp: +44 7537 432259 | |

| Regional Restrictions | The United States, Canada, United Kingdom, European Union, Hong Kong, Australia, Israel and Japan |

FXCM Information

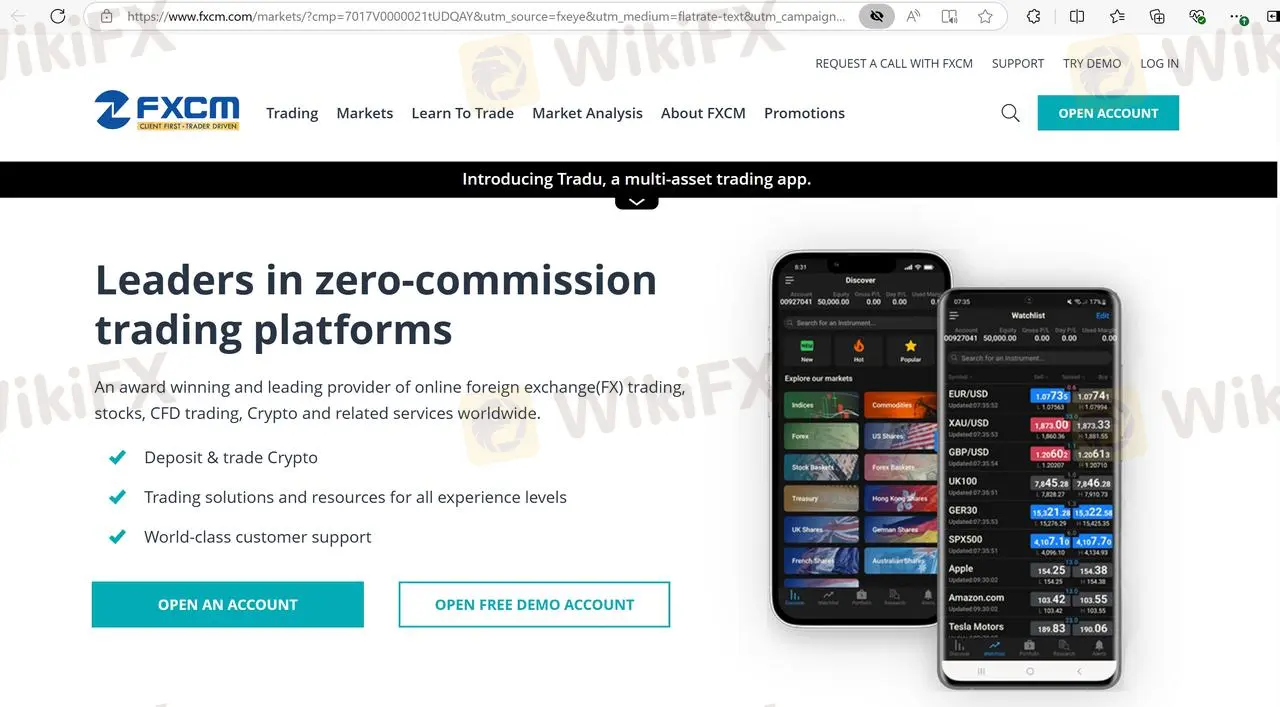

FXCM is a retail forex broker that was founded in 1999. The company is headquartered in London, UK, but has offices and affiliates in a number of other countries, including Australia, Germany, France, Italy, Greece, Hong Kong, Japan, South Africa, and the United States.

The company provides online trading services in forex, contracts for difference (CFDs), and other financial instruments. FXCM offers various trading platforms including Trading Station, TradingView Pro, MT4, and Capitalise AI.

Pros & Cons

| Pros | Cons |

| • Globally and heavily regulated | • Regional restrictions |

| • Multiple trading platforms to choose from | • Limited customer support availability on weekends |

| • Competitive spreads on forex pairs | |

| • Low minimum deposit requirement |

Is FXCM Legit?

FXCM is a legitimate broker with a long-standing reputation in the industry. The company is regulated by top-tier financial authorities, such as the FCA in the UK, the ASIC in Australia, CYSEC in Cyprus, and ISA in Israel, which ensures that it operates under strict financial and ethical guidelines. FXCM also has a solid track record of handling client funds in a secure and responsible manner.

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission (ASIC) | STRATOS TRADING PTY. LIMITED | Market Making (MM) | 000309763 |

| Financial Conduct Authority (FCA) | Stratos Markets Limited | Market Making (MM) | 217689 |

| Cyprus Securities and Exchange Commission (CySEC) | Stratos Europe Ltd | Market Making (MM) | 392/20 |

| The Israel Securities Authority (ISA) | STRATOS LIGHT LTD | Retail Forex License | 515234623 |

How are you protected?

FXCM provides negative balance protection and offers its clients access to segregated accounts, providing additional security measures. More details can be found in the table below:

| Protection Measure | Detail |

| Regulation | ASIC, FCA, CySEC, ISA |

| Segregated Funds | ✔ |

| Investor Protection | Up to £85,000 |

| Negative Balance | ✔ |

| Financial Audit | ✔ |

| Insurance | ❌ |

Our Conclusion on FXCM Reliability:

FXCM is a well-regulated and reputable broker with a long-standing history in the industry. The company is regulated by top-tier financial authorities and has multiple licenses, demonstrating a commitment to client protection.

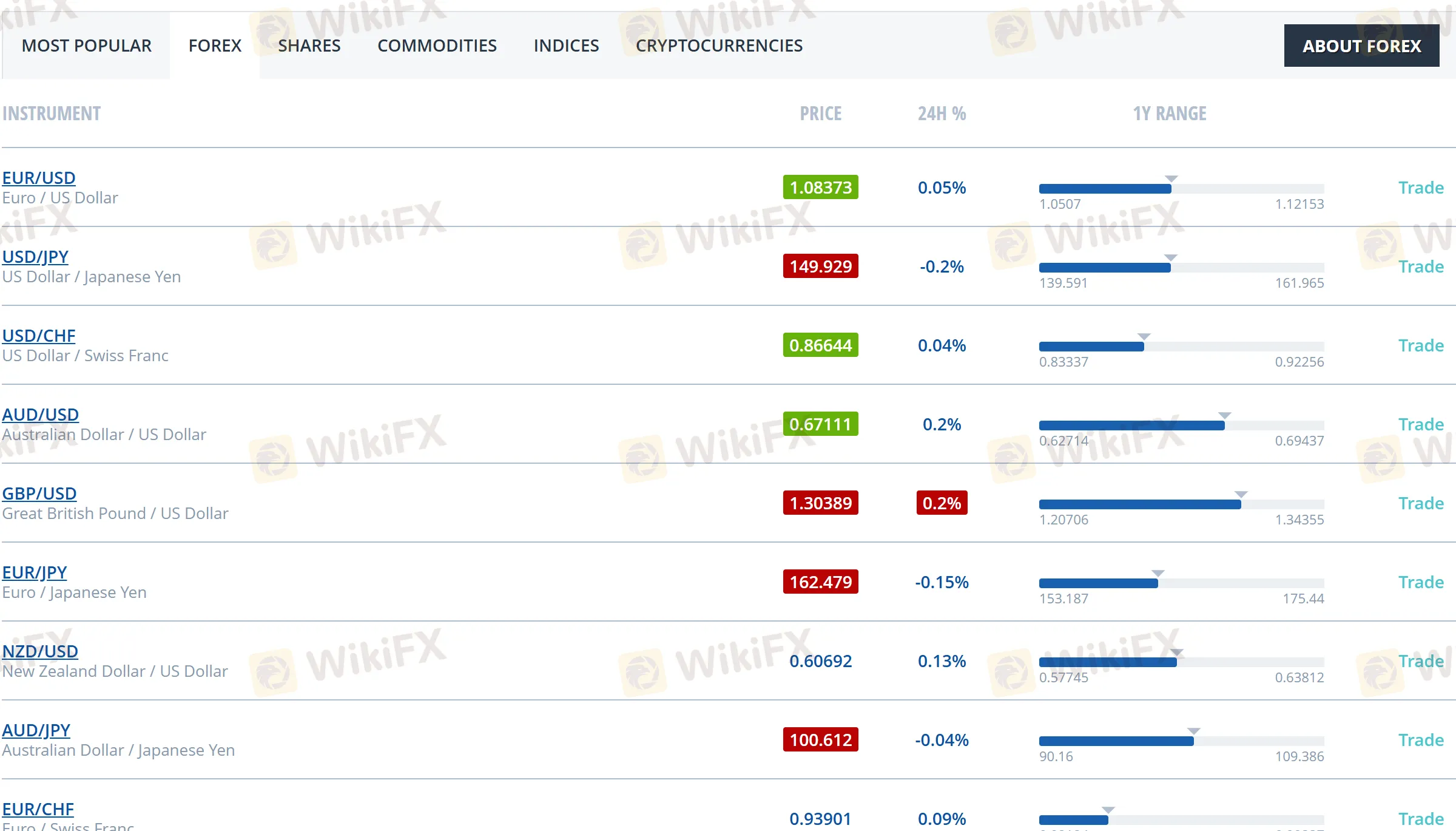

Market Instruments

FXCM offers trading in five major classes of tradable assest, including forex, shares, commodities, indices, and cryptocurrencies, which provides traders with varying interests and strategies a broader portfolio.

| Trading Assets | Available |

| Forex | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Accounts

FXCM seems to only offer a single live account type. Their website does not reveal specific info on account types.

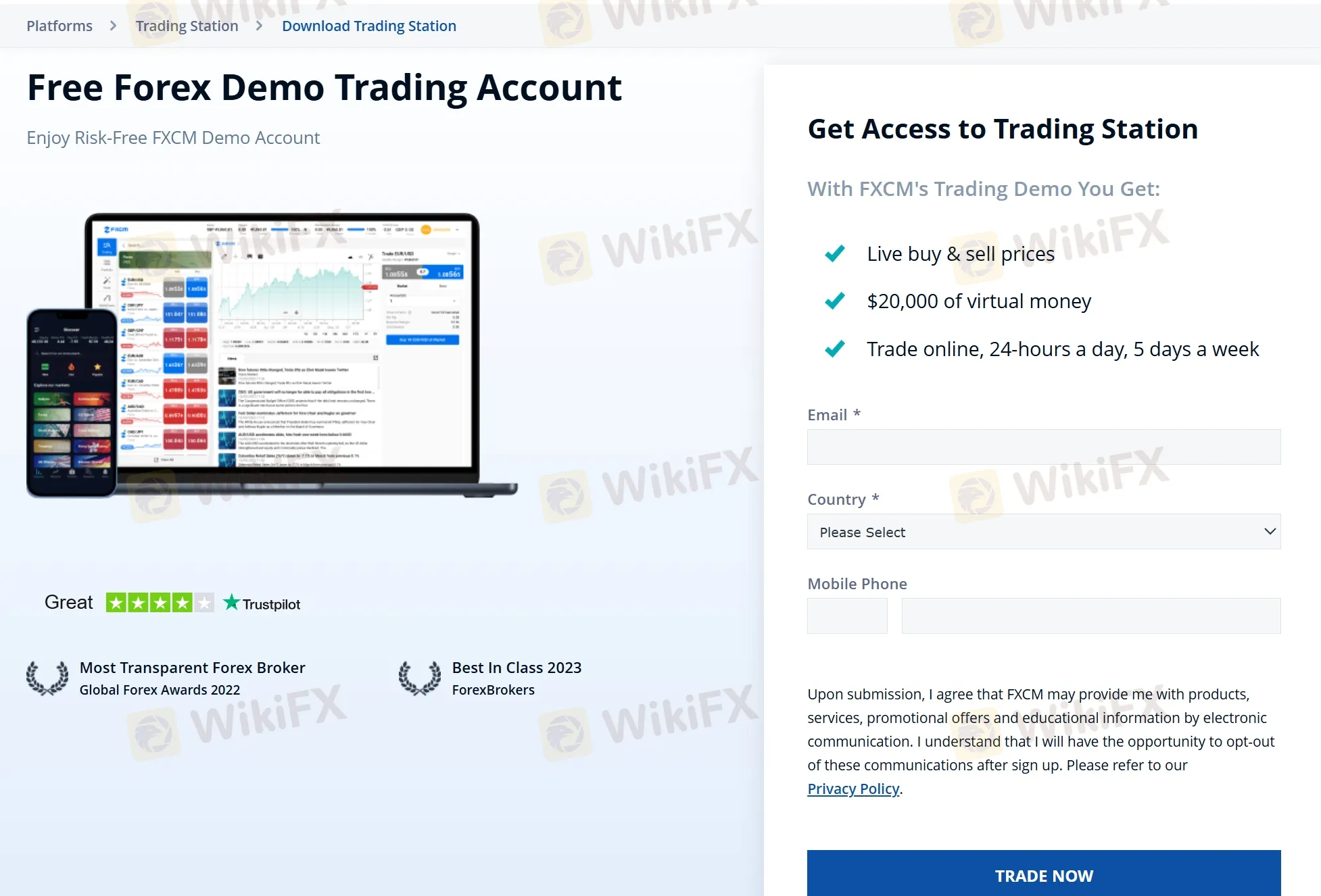

However, it offers demo account options. FXCM's demo account, elaborately, provides a realistic trading experience with access to live market prices across multiple asset classes. Traders can receive $20,000 in virtual funds to practice executing buy and sell orders on FXCM's user-friendly trading platform, available 24/5. This risk-free environment enables traders to hone their strategies and gain confidence before transitioning to a live funded account.

Leverage

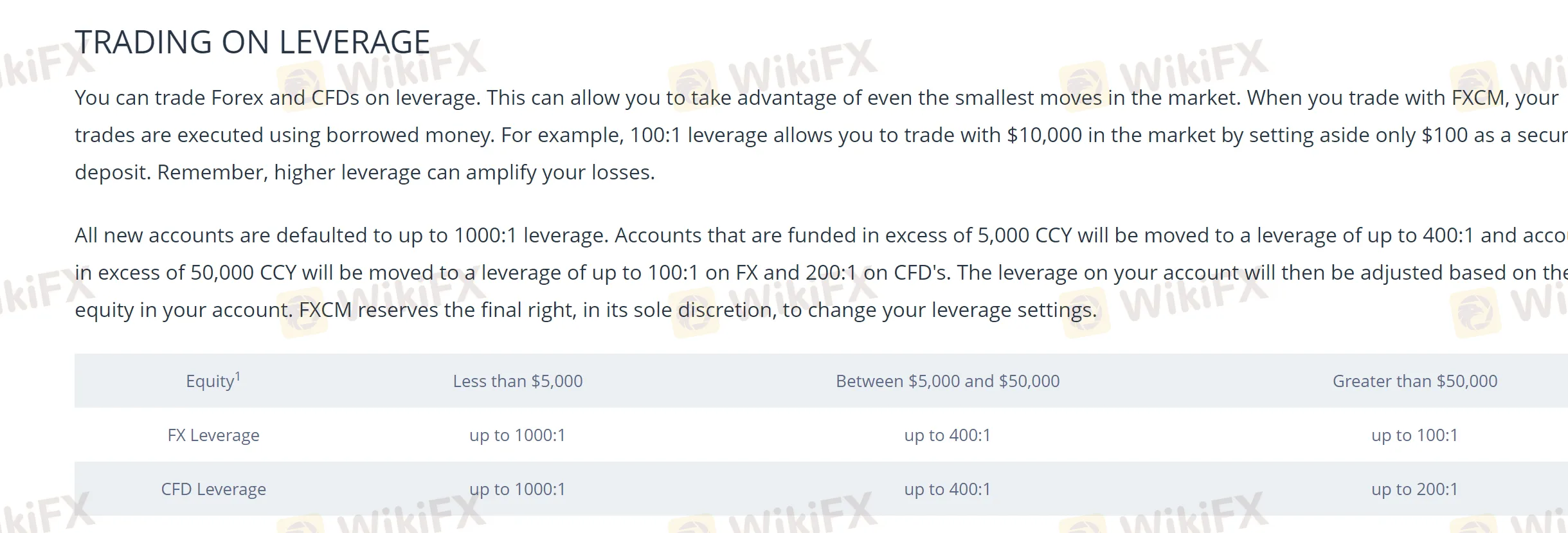

FXCM offers several leverage options for trading Forex (FX) and Contracts for Difference (CFDs), depending on the account equity.

For equity less than $5,000, traders can access up to 1000:1 leverage for both FX and CFDs.

Accounts with equity between $5,000 and $50,000 are eligible for up to 400:1 leverage on both FX and CFDs.

Accounts with equity greater than $50,000 can leverage up to 100:1 for FX and up to 200:1 for CFDs.

Trading Platforms

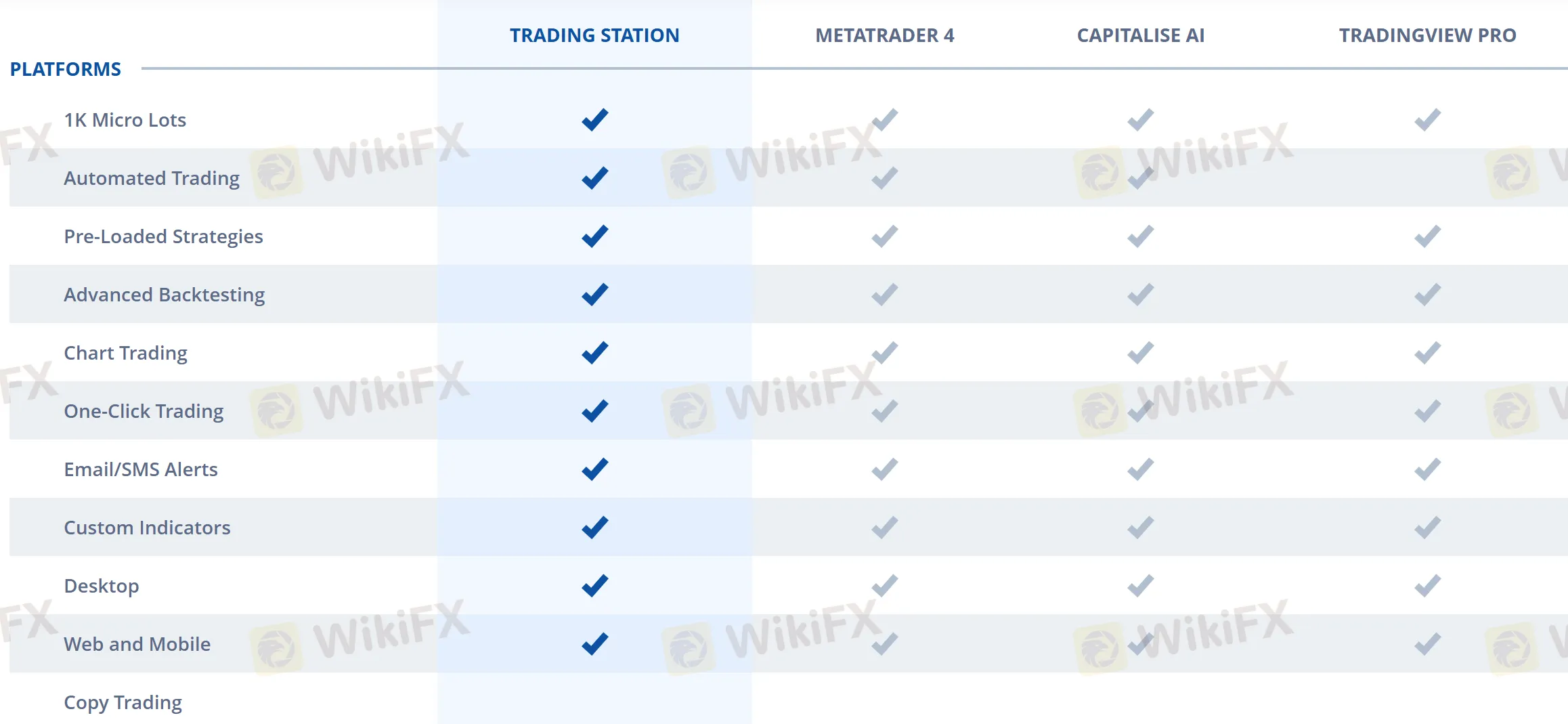

FXCM offers four different trading platforms for traders to choose from, Trading Station, MT4, Capitalise AI, and TradingView Pro. All are available on desktop, web and mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Trading Station | ✔ | Desktop, Web, Mobile | / |

| MT4 | ✔ | Desktop, Web, Mobile | Beginners |

| Capitalise AI | ✔ | Desktop, Web, Mobile | / |

| TradingView Pro | ✔ | Desktop, Web, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

Deposits & Withdrawals

FXCM welcomes several payment methods, including Bank Transfer, Visa, MasterCard, Google Pay, Neteller, and Skrill.

FXCM minimum deposit vs other brokers

| FXCM | Most Other | |

| Minimum Deposit | $50 | $100 |

Conclusion

In conclusion, FXCM is a well-established and reputable broker that offers a range of trading instruments and account types with competitive spreads and commissions. The broker's trading platforms are user-friendly and offer advanced features for traders of all levels. Additionally, FXCM provides educational resources and excellent customer support, including 24/5 live chat support.

However, FXCM is not available in all countries, clients from the USA, Canada, UK, European Union, Hong Kong, Australia, Israel and Japan are not accepted.

Frequently Asked Questions (FAQs)

| Is FXCM regulated? |

| Yes. It is regulated by ASIC, FCA, CySEC, and ISA. |

| Does FXCM offer demo accounts? |

| Yes. |

| Does FXCM offer industry-standard MT4 & MT5? |

| Yes. Not only MT4, but also Trading Station, TradingView Pro, and Capitalise AI. |

| What is the minimum deposit for FXCM? |

| The minimum initial deposit to open an account is $50. |

| Is FXCM a good broker for beginners? |

| Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions via multiple trading platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating.

alpari

| Quick Alpari Review Summary | |

| Company Name | Alpari (Comoros) Ltd |

| Founded in | 2002 |

| Registered in | Mauritius |

| Regulated by | NBRB |

| Trading Instruments | 120+ trading products including Forex, Metals, Commodities, Indices, Cryptos, and Stocks |

| Currency Pairs quantity | 60+ |

| Demo Account | ✅ |

| Islamic Account | ✅ |

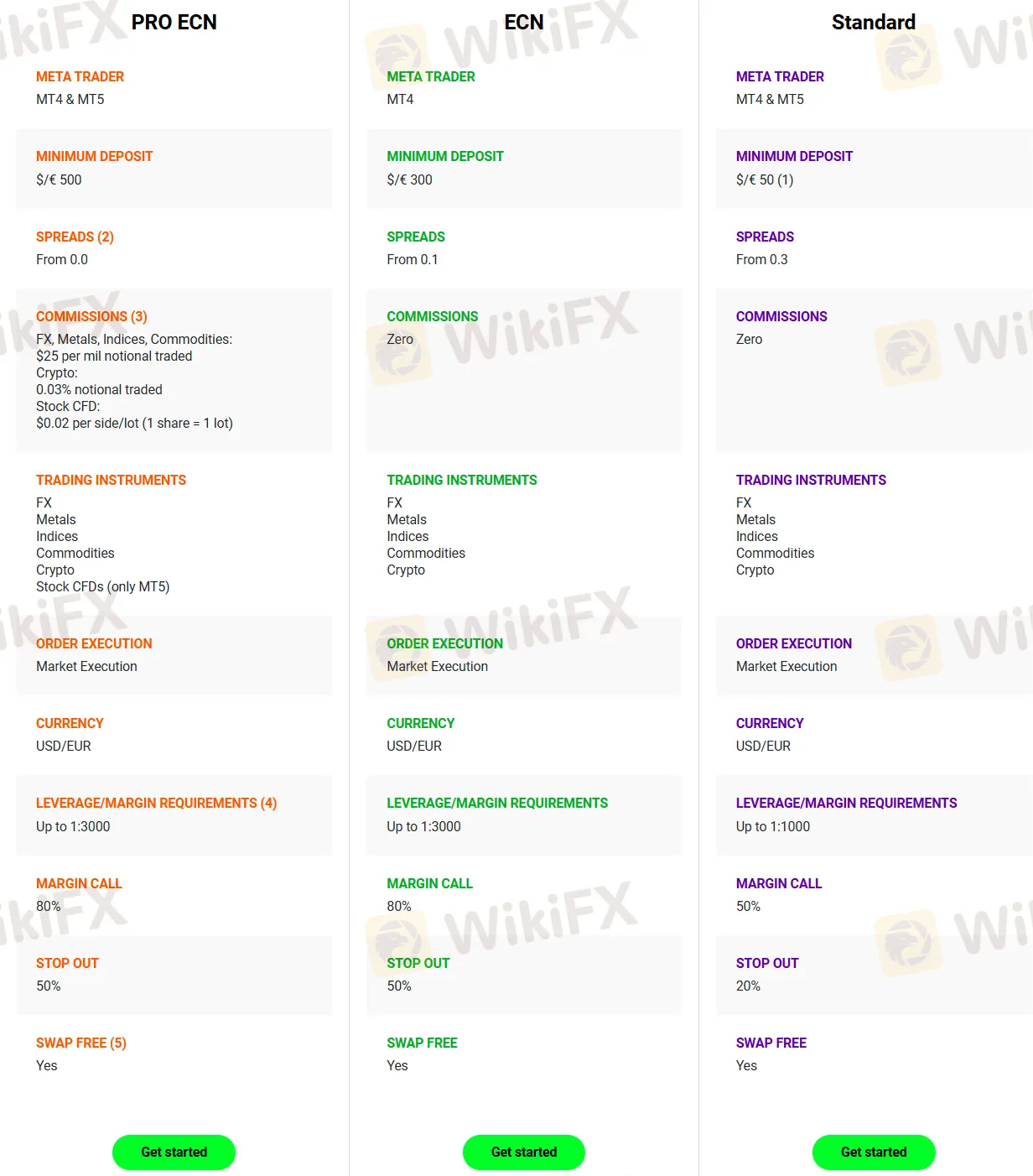

| Account Type | Pro ECN, ECN, Standard |

| Min Deposit | $20 |

| Max Leverage | 1:3000 |

| Spread | 0.3 pips onwards (Standard account) |

| Trading Platform | Alpari App, MT4/MT5 |

| Deposit and Withdraw Methods | Credit/debit cards, e-wallets, bank wire transfers, and local payment solutions |

| Customer Service | Email: legal@alpari.com, Phone: 00 44 20 45 77 19 51, Livechat, Facebook |

| Customer Services Languages | English, Farsi, Russian |

| Headquarter Address | Bonovo Road, Fomboni, Island of Moheli, Comoros |

| Clients Regional Restriction | Alpari (Comoros) Ltd, does not provide services to residents of the USA, JMyanmarthe Democratic Republic of Korea, European Union, United Kingdon2, |

Alpari Information

Founded in 2002, Alpari is regulated by the NBRB in Belarus and has eight global offices with operations on three continents. Alpari does not offer services for the residents from the USA, Japan, Canada, Myanmar, the Democratic Republic of Korea, European Union, United Kingdom, Syria, Sudan and Cuba.

Pros and Cons

| Pros | Cons |

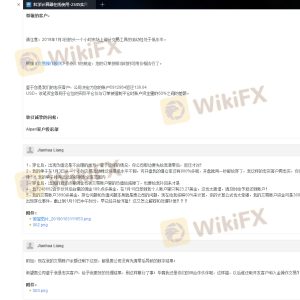

| Regulated by NBRB | Too many complaints |

| Many instruments available | No copy trading |

| Demo accounts | Regional restrictions |

| Low minimum deposit | |

| MT4 and MT5 platforms | |

| Live chat support |

Is Alpari Legit?

Yes. Alpari is regulated by National Bank of the Republic of Belarus (NBRB).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| NBRB | Alpari Evrasia Limited Liability Company | Retail Forex License | УНП192637625 |

Market Instruments

Alpari offers trading in Forex, Metals, Commodities, Indices, Cryptos, and Stocks.

| Tradable Assets | Available |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| Stocks | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Types/Fees

Demo Account: Alpari provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: there are in total 3 types of live account: Pro ECN, ECN, and Standard. In the table below you can see the details. The minimum deposit ranges from $/€50 to $/€500, and other conditions such as leverage, spread, and commissions are also different.

| Account Type | Pro ECN | ECN | Standard |

| Trading Instruments | FX, metals, indices, commodities, cryptos, stock CFDs (only MT5) | FX, metals, indices, commodities, cryptos | FX, metals, indices, commodities, cryptos |

| Min Deposit | $/€500 | $/€300 | $/€50 |

| Max Leverage | 1:3000 | 1:3000 | 1:1000 |

| Spread | From 0.0 pips | From 0.1 pips | From 0.3 pips |

| Commission | $25 per mil notional traded (FX, metals, indices, commodities) | ❌ | ❌ |

| 0.03% notional traded (crypto) | |||

| $0.02 per side/lot (stock CFD) | |||

| Trading Platform | MT4/MT5 | MT4 | MT4/MT5 |

| Margin Call | 80% | 80% | 50% |

| Stop Out | 50% | 50% | 20% |

| Swap Free | ✔ | ✔ | ✔ |

Leverage

Alpari offers a maximum leverage of up to 1:3000 for the Pro ECN and ECN accounts, while 1:1000 for the Standard accounts. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

| Account Type | Max Leverage |

| Pro ECN | 1:3000 |

| ECN | 1:3000 |

| Standard | 1:1000 |

Trading Platforms

Alpari uses MetaTrader 4 and MetaTrader 5, which offer great flexibility, extensive charting tools and a user-friendly interface. Besides, Alpari offers a proprietary platform, which is available on desktop and mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Proprietary platform | ✔ | Mobile | / |

| MT4 | ✔ | iOS, Android, Mac, Webtrader | Beginners |

| MT5 | ✔ | iOS, Android, PC, Mac | Experienced traders |

Deposit and Withdrawal

Alpari accepts deposits and withdrawals via credit/debit cards, e-wallets, bank wire transfers, and local payment solutions.

The minimum deposit amount depends on the trading account you choose, and can vary between $20 and $500. There's no maximum deposit restriction on Alpari.

You can withdraw as much as you like, as long as you use the same payment method that you used to deposit with. If you still have open positions, youll need to leave enough free margin in your account to cover the withdrawal and any extra fees that may occur.

Are the transaction costs and expenses of fxcm, alpari lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxcm and alpari are, we first considered common fees for standard accounts. On fxcm, the average spread for the EUR/USD currency pair is -- pips, while on alpari the spread is --.

Which broker between fxcm, alpari is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxcm is regulated by ASIC,FCA,CYSEC,ISA. alpari is regulated by NBRB,CBR.

Which broker between fxcm, alpari provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxcm provides trading platform including -- and trading variety including --. alpari provides trading platform including STANDARD,ECN,PRO ECN and trading variety including FX Metals Indices Commodities Crypto ETFs (only MT5).