No data

Do you want to know which is the better broker between eToro and FP Markets ?

In the table below, you can compare the features of eToro , FP Markets side by side to determine the best fit for your needs.

EURUSD: -0.3

XAUUSD: 1.7

Long: -5.88

Short: 2.51

Long: -35.22

Short: 20.75

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of etoro, fp-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| eToro | Basic Information |

| Founded in | 2007 |

| Headquarters | United Kingdom |

| Regulations | CySEC, FCA, ASIC |

| Tradable Assets | Stocks, Cryptocurrencies, Currencies, Commodities, ETFs |

| Minimum Deposit | $10 |

| Trading Fees | Commission-free trading, Spreads from 0.75 pips on EUR/USD |

| Non-Trading Fees | Withdrawal fee of $5, Inactivity fee of $10/month after 12 months of inactivity |

| Leverage | Up to 1:30 for retail clients, up to 1:400 for professional clients |

| Trading Platforms | eToro proprietary platform, MetaTrader 4 |

| Mobile Trading | Yes, available on iOS and Android |

| Customer Support | 24/5 live chat, email support |

| Educational Resources | Social trading, educational videos, blog articles, eToro Academy |

| Demo Account | Yes, unlimited time |

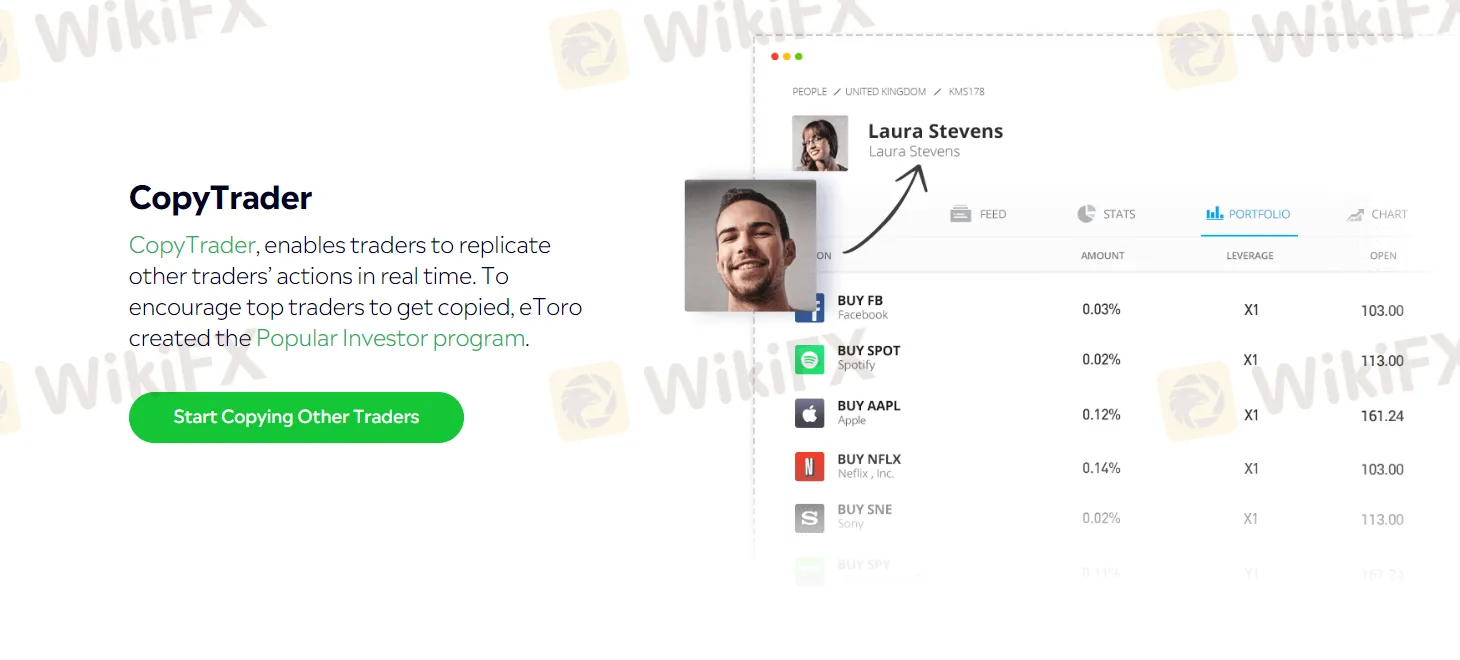

| Other Features | CopyTrader, Popular Investor Program, eToro Wallet |

eToro is a multi-asset social trading platform that has gained widespread popularity among investors, traders, and social media enthusiasts since its inception in 2007. It offers users access to a wide range of financial instruments, including stocks, cryptocurrencies, forex, indices, and commodities, among others. The platform provides a user-friendly interface that caters to both novice and experienced traders alike, making it one of the most popular trading platforms on the market.

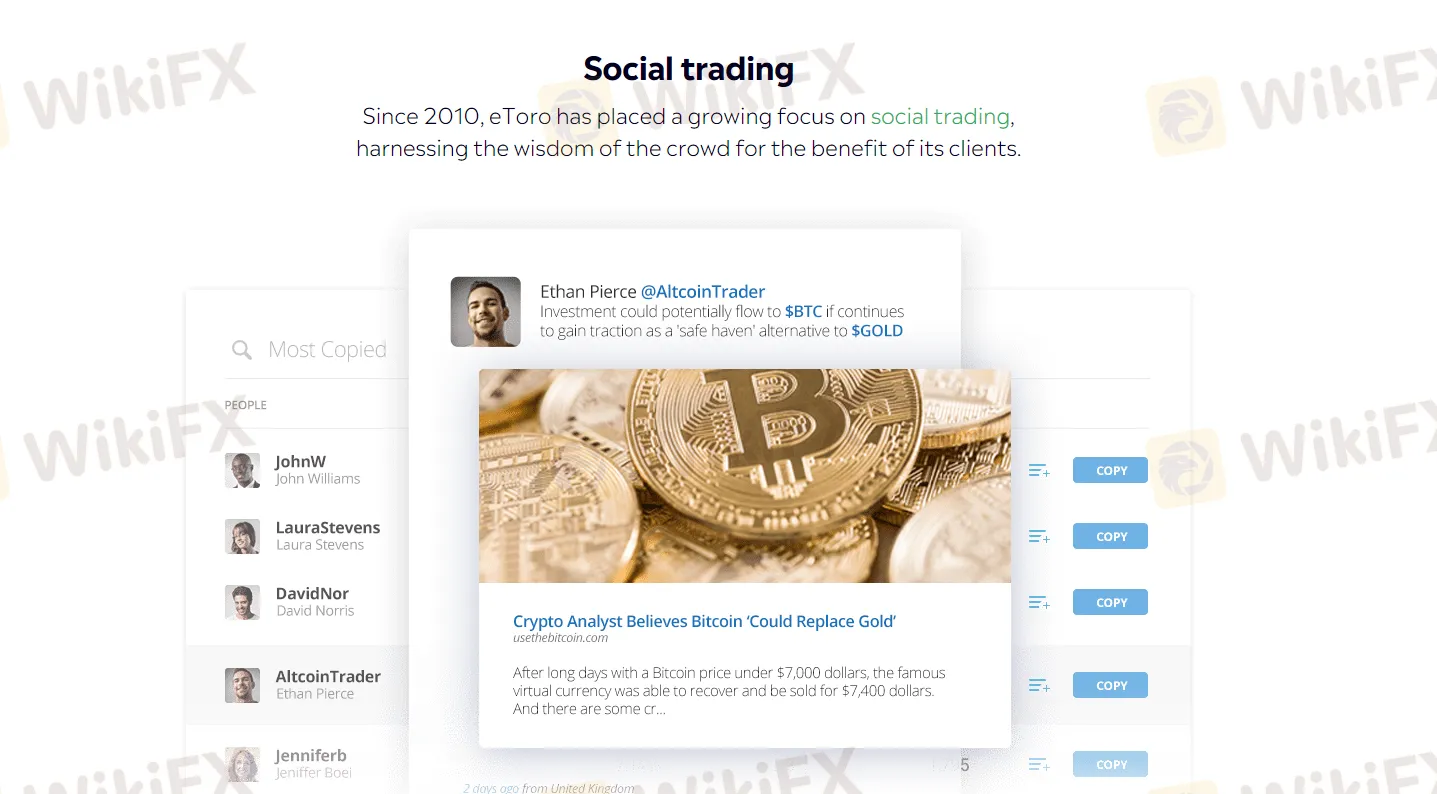

One of eToro's standout features is its social trading capabilities, which allow users to copy the trades of successful traders and build their investment portfolios. The platform has a large community of traders who share insights, strategies, and knowledge, making it an excellent learning resource for traders looking to improve their skills.

eToro is a legitimate and regulated online brokerage firm that has been operating since 2007. It is licensed and regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). The company is also a member of the Investor Compensation Fund, which provides additional protection for traders' funds. However, as with any investment platform, there are risks involved in trading, and traders should always be aware of the potential risks and take steps to protect their investments.

eToro's user-friendly interface, range of trading assets, and social trading features have made it popular among both beginner and experienced traders. However, as with any trading platform, eToro has its pros and cons, which potential users should consider before signing up. In this section, we will discuss the advantages and disadvantages of using eToro as a trading platform.

| Pros | Cons |

| User-friendly and easy-to-use platform | Higher spreads compared to some other brokers |

| Regulated by reputable financial authorities | Limited range of tradable assets |

| Copy trading and social trading features | Limited research and analysis tools |

| Wide range of payment methods | Inactivity fee charged after 12 months of inactivity |

| Commission-free trading on stocks and ETFs | Withdrawal fee of $5 |

| Demo account available for practice | Limited customer support options |

Market Instruments

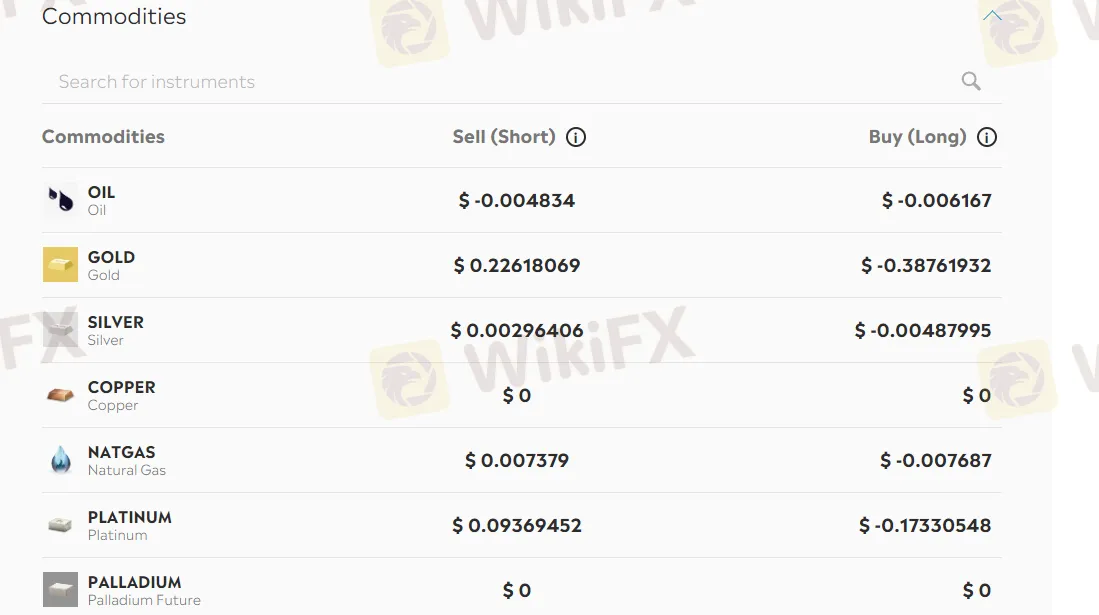

eToro offers a wide range of financial instruments for traders to choose from, covering various markets globally. Traders can access more than 2,400 assets, including popular currencies, commodities, indices, and stocks from exchanges around the world. Furthermore, eToro enables traders to trade cryptocurrency, such as Bitcoin and Ethereum, which has become a popular asset class in recent years due to its high volatility and potential for substantial profits. With this wide range of instruments available, traders can diversify their portfolios and explore various markets to find the best investment opportunities.

| Pros | Cons |

| Wide variety of assets including stocks, cryptocurrencies, commodities, forex, and more | Limited selection of options and futures contracts |

| Commission-free trading on most instruments | Limited research tools for fundamental analysis |

| Availability of social trading, allowing for copy trading and following other traders' strategies | Limited access to less popular or niche assets |

| Option to trade fractional shares for stocks, making it accessible to investors with small capital | Limited trading hours on certain assets, such as cryptocurrencies |

| Lack of transparency in pricing structure for some assets |

eToro provides traders with two primary types of accounts to choose from, namely the Retail and Professional accounts. These account types differ in various aspects, such as trading features, account requirements, leverage limits, and the level of regulatory protection they offer.

eToro's Retail account is suitable for most traders and investors. This account type requires a minimum deposit of $500 and provides access to all eToro's trading instruments, including cryptocurrencies, stocks, ETFs, commodities, and more. Retail account holders can also benefit from eToro's social trading features, which allow users to follow and copy other successful traders on the platform. However, retail account holders are limited to a maximum leverage of 1:30, as per regulatory requirements.

eToro's Professional account is designed for experienced traders who meet certain criteria, such as having a minimum of two years of trading experience and meeting certain financial thresholds. This account type provides access to higher leverage of up to 1:400, and allows users to benefit from reduced margin requirements and negative balance protection. However, professional account holders are not eligible for certain investor protection rights, such as compensation schemes, as they are deemed to have a higher level of trading knowledge and experience.

| Aspects | Pros | Cons |

| Account Types | Offers both retail and professional accounts | Professional accounts require certain qualifications |

| Minimum Deposit | Low minimum deposit requirement for retail account | High minimum deposit requirement for professional account |

| Commission | No commission on trades for most assets | Higher spreads compared to other brokers |

| Leverage | Up to 1:30 for major currency pairs | Limited leverage options for professional accounts |

| Platform | User-friendly platform with social trading features | Limited customization options |

| Customer Support | 24/7 customer support in multiple languages | Phone support only available during market hours |

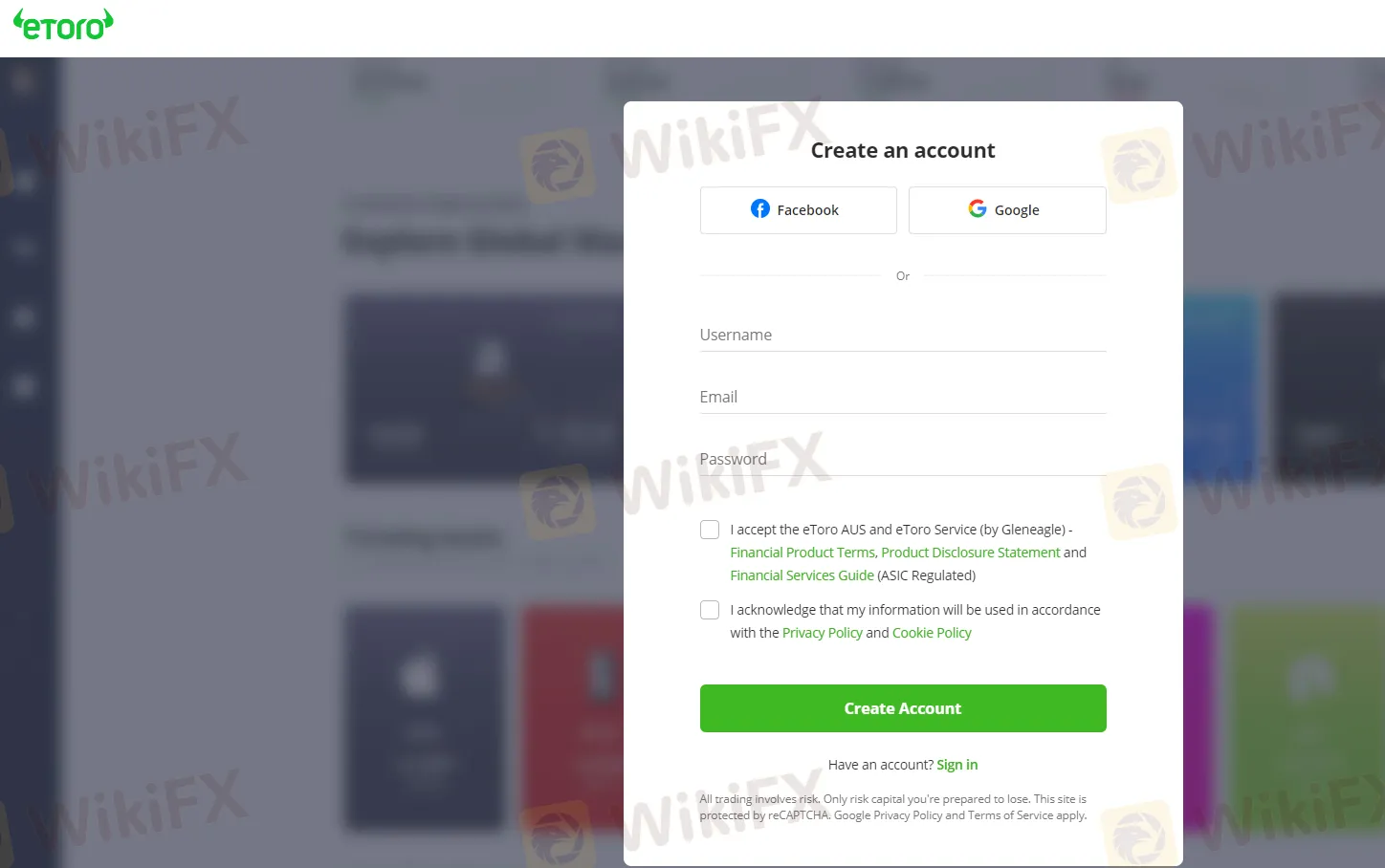

To open an account with eToro, you need to follow these steps:

Go to the eToro website and click on the “Join Now” button.

Enter your personal information, including your name, email address, and phone number.

Verify your email address by clicking on the verification link sent to your email. Provide additional information, including your date of birth, address, and tax ID number. Agree to the terms and conditions and submit your application.

Wait for eToro to review and approve your account, which usually takes a few minutes to a few business days.

After approval, you can fund your account with preferable payment methods and then start your real trading with this broker.

eToro offers a demo account for traders who want to practice trading strategies without risking real money. The eToro demo account provides $100,000 in virtual money and is valid for an unlimited amount of time, allowing traders to familiarize themselves with the platform and practice their trading skills.

To open a demo account, traders can simply sign up for an eToro account and select the option to use the demo account. It's important to note that the eToro demo account does not require any deposit or funding, making it a risk-free way to test out the platform.

When using the demo account, traders should keep in mind that the virtual money provided is not real, and any profits or losses made are also not real. It's also important to note that while the demo account provides a good introduction to the platform, it may not accurately reflect the actual market conditions and trading experience.

eToro offers leverage for trading various financial instruments. The maximum leverage provided by eToro varies depending on the instrument and the jurisdiction of the client. For example, for major forex pairs, eToro offers leverage up to 1:30 for retail clients and up to 1:400 for professional clients. For commodities such as gold and silver, leverage can be up to 1:20 for retail clients and up to 1:100 for professional clients. For stocks, eToro offers leverage up to 1:5 for both retail and professional clients. It is noted that high leverage can amplify your potential returns, but more importantly, it can increase your risks.

eToro's spreads vary depending on the asset being traded. The platform charges variable spreads, which means that the spread can widen or narrow depending on market conditions. The typical spread for major currency pairs such as EUR/USD and GBP/USD is around 3 pips during normal market conditions. However, this can vary depending on market volatility and liquidity.

For other assets, such as cryptocurrencies and commodities, eToro's spreads are generally higher. For example, the spread for Bitcoin can range from 0.75% to 5% depending on market conditions.

| Pros | Cons |

| Zero commission on stock and ETF trading | Wider spreads compared to other brokers |

| Competitive spreads on major forex pairs | Overnight fees charged on leveraged positions |

| No hidden fees or surprises | Limited selection of exotic currency pairs |

| Transparent pricing | Higher spreads on cryptocurrencies |

| Tight spreads on commodities and indices | Spreads can widen during volatile market conditions |

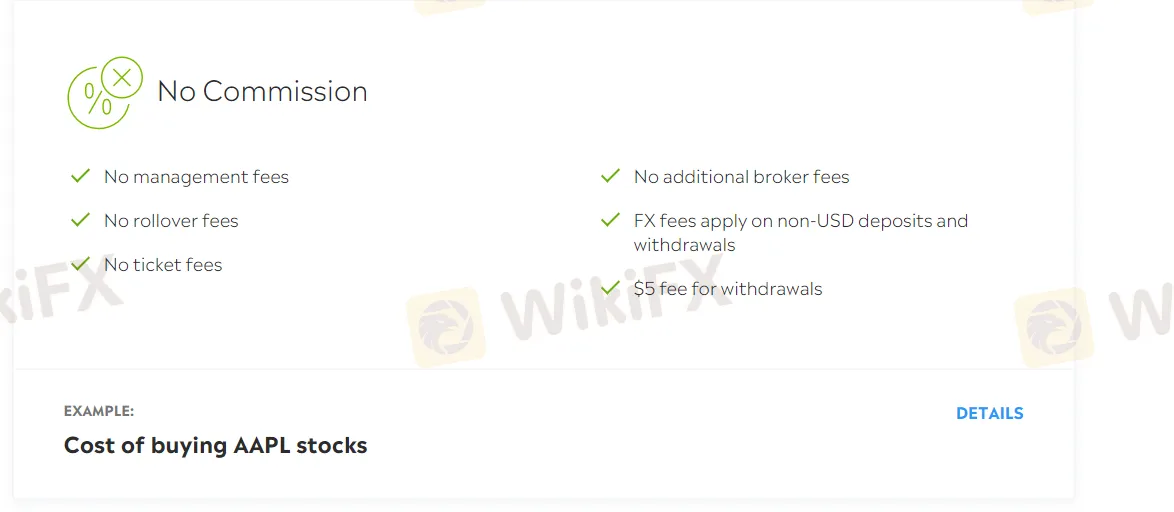

In addition to spreads and commissions, eToro also imposes a few non-trading fees that traders should take into consideration before trading on this platform. These fees include:

Withdrawal fee: eToro charges a withdrawal fee of $5 per withdrawal. This fee is relatively low compared to other brokers.

Inactivity fee: If you don't log in to your eToro account for 12 months, an inactivity fee of $10 per month will be charged to your account. This fee is charged until you log in again or until your account balance reaches zero.

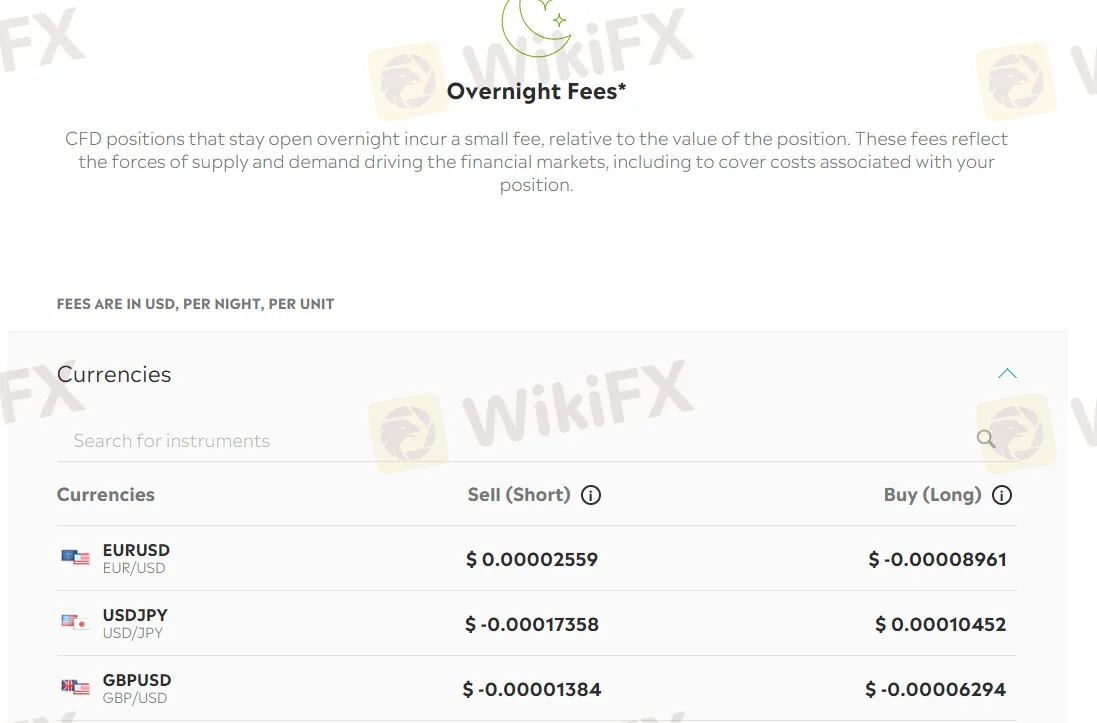

Overnight fees: eToro charges overnight fees or rollover fees for positions held open overnight. The amount of the fee depends on the instrument traded, the direction of the position, and the size of the position.

Currency conversion fee: If you deposit funds in a currency different from the base currency of your account, eToro charges a currency conversion fee. The fee is 0.5% of the deposited amount, and it's calculated based on the exchange rate at the time of the conversion.

| Pros | Cons |

| No commissions on stock and ETF trading | Higher spreads compared to other brokers |

| No deposit fees | High withdrawal fees |

| No account maintenance fees | Inactivity fee after 12 months of inactivity |

| No fees for using the CopyTrader feature | Limited payment methods |

| No fees for currency conversion | Overnight fees for positions held overnight |

| High fees for using PayPal as a payment method |

eToro offers its proprietary trading platform, which is designed to be user-friendly and intuitive, particularly for novice traders. The platform provides a variety of tools and features, including real-time market data, advanced charting tools, and an easy-to-use order entry system.

One of the most notable features of the eToro platform is its social trading functionality, which allows users to follow and copy the trades of successful traders. This feature is particularly appealing to new traders who may lack the knowledge or experience to make their own trades.

In addition to its proprietary platform, eToro also supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its advanced charting capabilities, extensive library of technical indicators, and the ability to automate trading strategies through the use of Expert Advisors (EAs).

Here is a comparison table of the trading platform offered by eToro, FP Markets and Exness:

| Broker | Trading Platform | Desktop | Web-based | Mobile |

| eToro | eToro Platform | ✔️ | ✔️ | ✔️ |

| FP Markets | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

| Exness | MetaTrader 4 (MT4) | ✔️ | ✔️ | ✔️ |

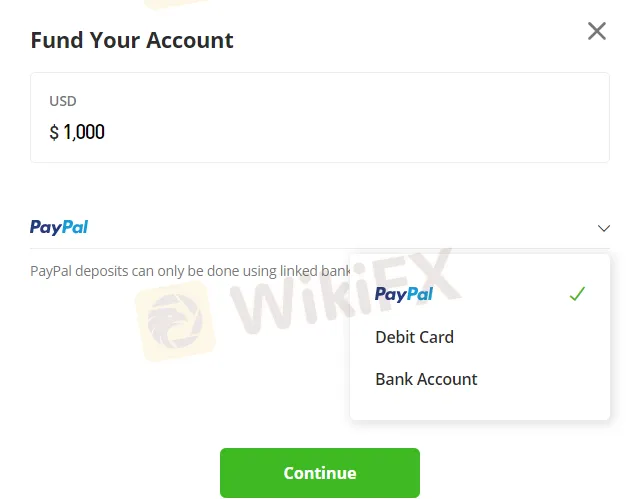

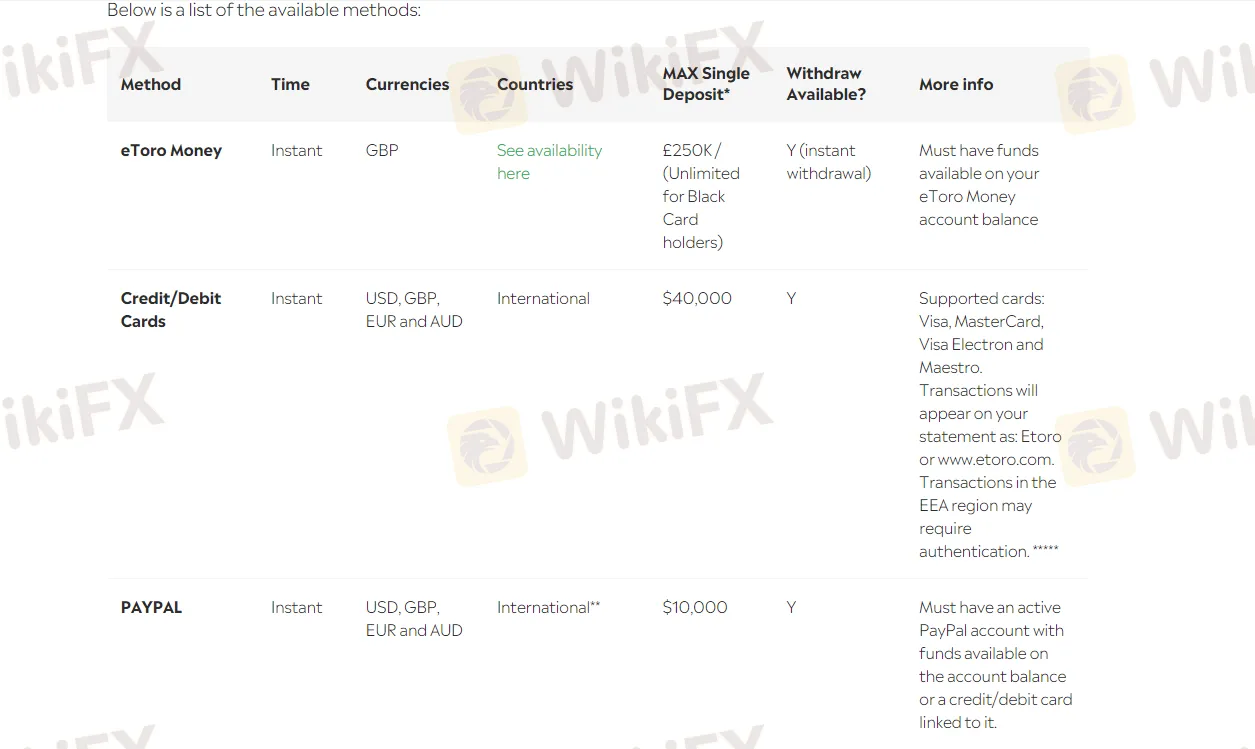

eToro accepts multiple payment methods, including credit/debit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill. The minimum deposit amount is $10, which is relatively low compared to other brokers in the industry. Deposits are usually processed instantly or within one business day, depending on the payment method. eToro does not charge any deposit fees, but some payment providers may have their own fees.

eToro allows you to withdraw funds using the same payment methods as deposits.The minimum withdrawal amount is $30, and there is a withdrawal fee of $5.Withdrawals are usually processed within one business day, but it may take longer for bank transfers.Before making a withdrawal, you need to verify your identity and complete the necessary KYC (Know Your Customer) procedures. eToro also has a policy of returning funds to the original payment method used for deposits, whenever possible.

| Pros | Cons |

| Wide range of payment methods available including credit/debit cards, PayPal, and bank transfer | Withdrawal fee of $5 per transaction |

| Quick and easy deposit process with most methods being processed instantly | Minimum withdrawal amount of $30 |

| No deposit fees charged by eToro | Limited number of currencies available for deposits and withdrawals |

| Supports deposits and withdrawals in multiple currencies | Withdrawal processing time can take up to 7 business days |

| Allows users to set up multiple payment methods for convenience | Third-party fees may be charged by payment processors |

| Negative balance protection ensures that users cannot lose more than they have deposited | Users may need to provide additional verification documents for withdrawals |

Customer support is an important aspect of any online brokerage firm, and eToro is no exception. eToro offers various channels for customers to get in touch with its support team. These channels include:

Live chat: This is available 24/5, Monday to Friday. It is the fastest and most efficient way to get support.

Email: Customers can send an email to the eToro support team. The response time is usually within 24 hours.

Phone: Customers can also call the support team during office hours. eToro provides local phone numbers for various countries.

Social media: eToro has a presence on various social media platforms, including Twitter and Facebook. Customers can use these platforms to get in touch with the support team.

FAQ section: eToro offers a comprehensive FAQ section on their website that covers a wide range of topics related to their services, trading, account management, and more. The FAQ section is organized into categories, making it easy for users to find answers to their questions quickly.

When it comes to educational resources, Toro offers a variety of educational content to help traders improve their skills and knowledge of the financial markets.

These resources include:

eToro Academy: This is an online education portal that provides traders with a wide range of educational materials, including articles, videos, webinars, and courses on various topics such as trading strategies, market analysis, risk management, and more.

Trading Guides: eToro also offers a series of trading guides that provide in-depth information on various trading topics, including stocks, commodities, currencies, and indices.

Market News and Analysis: eToro provides traders with up-to-date news and analysis on the financial markets. This includes daily market updates, weekly market analysis, and other educational content.

Blog: eToro has a blog that provides traders with the latest news, market analysis, and trading tips.

Virtual Portfolio: eToro offers a virtual portfolio feature that allows traders to practice trading without risking real money. This is a great way for beginners to gain experience and test out their trading strategies before trading with real money. Here is an instructional video for users to know clearly what Virtual Portfolio is:https://www.youtube.com/watch?v=GWK7uQ98KpM.

Overall, eToro is a reputable and user-friendly online trading platform that offers a wide range of financial instruments and trading options to its clients. Its innovative social trading features, intuitive platform, and excellent customer service make it an attractive choice for both beginner and experienced traders. However, it does have some drawbacks, such as relatively high fees, limited research tools, and a lack of advanced charting capabilities.

FAQs

Q: Is eToro a regulated broker?

A: Yes, eToro is a regulated broker. It is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia.

Q: What trading instruments are available on eToro?

A: eToro offers a wide range of trading instruments, including stocks, ETFs, cryptocurrencies, forex, commodities, and indices.

Q: What is the minimum deposit required to open an account on eToro?

A: The minimum deposit required to open an account on eToro varies depending on your location and the type of account you choose. For most countries, the minimum deposit is $500.

Q: Does eToro offer a demo account?

A: Yes, eToro offers a demo account that allows you to practice trading with virtual funds. The demo account is free and can be used for an unlimited period of time.

Q: What is eToro's customer support like?

A: eToro's customer support is available 24/5 and can be reached through email, live chat, and phone. They also have a comprehensive help center and a community forum where you can get answers to common questions and connect with other traders.

| FP Markets | Basic Information |

| Registered Country | Sydney, Australia |

| Founded in | 2005 |

| Regulation | ASIC, CySEC |

| Minimum Deposit | $100 |

| Trading Instruments | Forex, Indices, Commodities, Shares, Cryptocurrencies, Metals, Bonds, and ETFs |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Iress |

| Account Types | Standard, Raw, Islamic, Demo |

| Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Commission | $3.00 per side per 100k traded (Raw Account only) |

| Deposit and Withdrawal Methods | Bank Wire Transfer, Credit/Debit Card, Skrill, Neteller, POLi, FasaPay, China Union Pay, BPay, PayPal |

| Customer Support | 24/7 Live Chat, Email, Phone Support, Knowledge Base, Video Tutorials |

| Educational Resources | Webinars, eBooks, Trading Videos, Trading Tools, Market Analysis, Economic Calendar |

FP Markets is an Australian-based online brokerage firm that offers various trading instruments including forex, shares, indices, metals, and cryptocurrencies. The company was founded in 2005 and is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). FP Markets provides clients with access to multiple trading platforms including MetaTrader 4, MetaTrader 5, and IRESS. The broker also offers several account types to cater to the needs of different traders, including Standard andRaw, with the minimum deposit to open a standard account starting from $100 AUD or equivalent amount. The standard account is designed for novice traders, while the Raw account is intended for more experienced traders who require tighter spreads and faster execution speeds. In addition, the company offers Islamic accounts, as well as a free demo account for traders to test their strategies in a risk-free environment.

When it comes to trading conditions, FP Markets is known for its competitive spreads and low commissions. The broker also offers high leverage options of up to 500:1 for forex trading. Additionally, the broker offers various 24/7 customer support and rich educational resources such as webinars, trading guides, and video tutorials, which can help both novice and experienced traders to improve their trading skills.

Yes, FP Markets is a regulated broker. They are regulated by two reputable regulatory bodies: the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). ASIC is known for its strict regulations and is considered to be one of the most trusted regulators in the world. CySEC is also a reputable regulator and is responsible for regulating the financial markets in Cyprus, which is an important hub for forex and CFD trading. FP Markets' adherence to these regulatory bodies' rules and regulations ensures its transparency, and fairness in its operations.

FP Markets has several pros, including its strong regulatory framework, low trading fees, diverse range of financial instruments, and robust trading platforms. The broker also offers various account types to suit the needs of different traders and provides excellent customer support. However, some potential cons of FP Markets include limited live trading account types, high inactivity fees, and the fact that the broker is not available to clients from certain countries.

| Pros | Cons |

| Regulated by reputable authorities (ASIC, CySEC) | No support for U.S. clients |

| Wide range of trading instruments | Limited live account types |

| Website easy to navigate | Inactivity fee charged on dormant accounts |

| Low spreads and competitive pricing | No social trading platform offered |

| Generous leverage up to 1:500 | Minimum deposit not the friendiest compared to other brokers |

| Rich educational resources available | |

| Negative balance protection | |

| Multiple trading platforms, MT4, MT5 and Iress | |

| High-quality customer service and support |

FP Markets offers over 2250 market instruments for traders to choose from, including forex pair ( over 60) , indices, commodities (Coffee, natural gas, corn & more) , metals (Gold, oil, silver & more), cryptocurrencies, bonds (US10YR & UK Long Gilt Futures GILT), shares ( more than 10,000) and more. With Forex, traders can access major currency pairs, as well as minor and exotic currency pairs. For indices, FP Markets offers a selection of popular indices from around the world, including the S&P 500, NASDAQ, FTSE 100, DAX 30, and more. In the commodities market, traders can trade precious metals like gold and silver, as well as oil, natural gas, and other commodities. FP Markets also offers trading in cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, as well as shares from various exchanges, including the NYSE and NASDAQ. Overall, FP Markets provides a diverse range of market instruments for traders to choose from.

Behold, a comparison table of the vast array of market instruments offered by reputable brokers FP Markets, IC Markets, FXTM, and Exness:

| Market Instruments | FP Markets | IC Markets | FXTM | Exness |

| Forex | 60+ | 65+ | 60+ | 120+ |

| Commodities | 15+ | 19+ | 3+ | 10+ |

| Indices | 20+ | 18+ | 11+ | 10+ |

| Stocks | 10,000+ | 120+ | 180+ | 0 |

| Cryptocurrencies | 5+ | 10+ | 5+ | 5+ |

When it comes to FP Markets' account types, there are a few important things to consider. Firstly, it is worth noting that the available account types depend on which trading platform you choose to use. The MT4 and MT5 platforms offer Standard and Raw account types, while the iRESS trading platform offers both Retail and Wholesale/Professional account types.

Let's take a closer look at each account type. The Standard account offers commission-free trading with spreads starting from 1.0 pip, while the Raw account offers commission-based trading with spreads starting from 0.0 pips. The Raw account is designed for traders who require lower spreads and are willing to pay a commission for the privilege.

On the other hand, the iRESS trading platform offers both Retail and Wholesale/Professional account types. The Retail account offers commission-free trading with spreads starting from 0.0 pips, while the Wholesale/Professional account offers commission-based trading with spreads starting from 0.0 pips. The Wholesale/Professional account is designed for traders who require lower spreads and have higher trading volumes, and are therefore able to access deeper liquidity pools.

Each account type has its own minimum deposit requirement, which varies depending on the platform and account type you choose, with Standard and Raw (MT4 & MT5)starting from $100 AUD or equivalent, retail and wholesale account from $1,000. In addition, each account type offers different leverage options, depending on the financial instrument being traded.

| Pros | Cons |

| Multiple account types to choose from | Limited leverage options for certain account types |

| Low minimum depoist for Standard and Raw account | Minimum deposit requirements can be high for some retail and professional account |

| Ability to trade multiple markets with IRESS platform | Some account types may have higher commission fees |

| Access to multiple trading platforms | Limited cryptocurrency trading options |

| Professional account options for experienced traders | Demo accounts only available for a limited time period |

| High-speed order execution with ECN trading technology | Swap-free account options may not be available for all account types |

FP Markets offers free demo accounts for both the MT4 and MT5 platforms, allowing traders to practice their strategies and familiarize themselves with the platforms before opening a live trading account. The demo accounts provide access to real-time market data, competitive spreads, and a range of trading tools, making it an ideal option for traders of all levels to test their trading skills without risking their capital.

One of the key advantages of FP Markets' demo accounts is that they allow traders to experience the same trading conditions as their live accounts, giving them a realistic view of the market environment. In addition, the demo accounts are unlimited, meaning that traders can practice for as long as they want without any time restrictions.

FP Markets' demo accounts are valid for 30 days. However, if you require an extension, you can contact their customer support team to request it. They may extend the demo account for an additional 30 days.

FP Markets offers Islamic or swap-free accounts to clients who follow the Muslim faith and cannot receive or pay interest due to religious reasons. These accounts comply with Sharia law and allow traders to hold positions overnight without incurring any rollover fees or interest charges.

FP Markets' Islamic accounts are available for all account types, including the Standard and Raw accounts for MT4 and MT5, as well as the iRESS Trading platform. Traders can open an Islamic account by submitting a request to the FP Markets support team, which will review and approve the application.

Here is some more detailed information about how to open an account with FP Markets:

To begin the account opening process, prospective clients can go to the FP Markets website and click on the “Open Live” button. They will then be directed to a page where they can choose between opening a live or a demo account.

After selecting the account type, clients will need to fill out an application form that requires personal and financial information. This includes details such as their full name, email address, phone number, country of residence, and employment status.

Clients will also need to provide some identification documents, such as a passport or national ID card, as well as proof of address, which could be in the form of a utility bill or bank statement. FP Markets takes security seriously and has a strict verification process to ensure the safety of client funds and information.

Once the application has been submitted and the client's identity and address have been verified, they will receive an email with their login credentials and instructions on how to fund their account. FP Markets offers a variety of payment options, including credit/debit cards, bank transfers, and various e-wallets.

The leverage offered by FP Markets for other instruments varies based on the type of instrument and the entity under which it operates. For example, the Australian entity of FP Markets offers a maximum trading leverage of up to 1:500 for major forex trading, while the CySEC entity offers a maximum trading leverage of up to 1:30 for forex trading. Besides, for commodities and indices, the maximum leverage available is usually lower than for forex trading.

Please bear in mind that trading with leverage involves a higher degree of risk, and traders should use it wisely and with caution. It is always advisable to understand the risks involved and have a sound risk management plan in place before using leverage in trading.

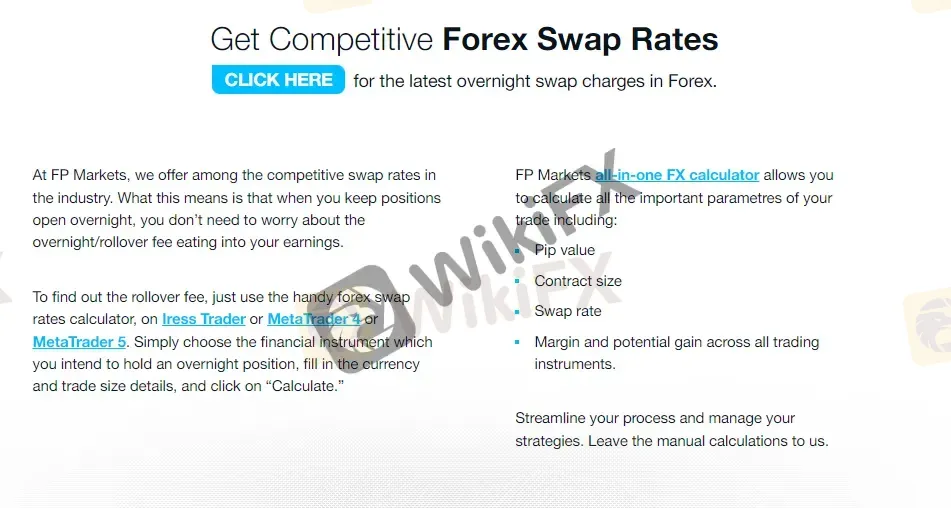

FP Markets offers competitive spreads and commissions for its traders. The spreads for forex trading start from as low as 0.0 pips, depending on the type of account and trading platform. The Raw account, which is available on both the MT4 and MT5 trading platforms, charges a commission of $3 per side per lot traded, while the Standard account has no commission but slightly wider spreads.

For trading CFDs on indices, FP Markets charges a commission starting from $10 per lot, while the spreads start from 0.5 points. The commission and spreads for other instruments, such as commodities, shares, and cryptocurrencies, vary depending on the specific instrument and trading platform.

FP Markets offers an Active Traders program that provides discounted trading fees for high-volume traders. Traders who meet certain trading volume requirements can receive rebates on their commissions and reduced spreads.

We've gathered data on EUR/USD, XAU/USD, Brent Crude Oil, and Bitcoin (BTC/USD) from top-notch brokers, including FP Markets, IC Markets, FXTM, and Exness, so you can make an informed decision on where to place your trades.

| Broker | EUR/USD Spreads (pips) | XAU/USD Spreads(pips) | Brent Crude Oil Spreads(pips) | Bitcoin Spreads(pips) |

| FP Markets | 0 | 15 | 3 | 18.66 |

| IC Markets | 0 | 20 | 3 | 60 |

| FXTM | 1.3 | 20 | 3 | 130 |

| Exness | 0.9 | 17 | 2 | 80 |

In addition to trading fees, FP Markets also charges non-trading fees that traders should be aware of before opening an account. The broker charges an inactivity fee of AUD 10 per month on accounts that have been inactive for more than six consecutive months. FP Markets also charges a withdrawal fee of AUD 20 for withdrawals made via bank transfer, while withdrawals made via credit/debit card or e-wallets are free of charge.

Moreover, FP Markets offers a VPS service to its clients, allowing them to access their trading accounts from anywhere in the world. However, the VPS service is not free and is available at an additional cost of AUD 30 per month. The broker also offers a copy trading service called “MAM/PAMM,” which allows traders to copy the trades of professional traders. This service is also available at an additional cost of 10% performance fee.

Besides, FP Markets also charges swap interest for holding positions overnight. The swap rates can be either positive or negative depending on the currency pair and the direction of trade.

| Pros | Cons |

| No deposit or withdrawal fees for most methods. | Inactivity fee charged after 6 months of inactivity. |

| No account administration fees. | Some payment methods may incur fees charged by third-party providers. |

| No fees charged for Islamic accounts. | Overnight financing fees (swaps) are charged on positions held overnight. |

| Low conversion fees for deposits and withdrawals in different currencies. |

FP Markets offers its clients a variety of trading platforms to choose from, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as the IRESS platform for advanced traders.

The MT4 platform is well-known for its user-friendly interface and extensive range of analytical tools, making it a popular choice among traders of all levels. The MT5 platform is an upgraded version of MT4, offering additional features such as more timeframes, additional order types, and advanced technical analysis tools.

The IRESS platform is designed for more advanced traders who require direct market access (DMA) and the ability to trade a variety of financial instruments, including stocks, futures, and options, as well as forex and CFDs.

Please note that FP Markets charges fees for using the MT4 and MT5 trading platforms. The fees depend on the account type and trading platform being used. For example, Standard account holders using the MT4 platform are charged zero commissions for various tarding assets, while Raw account holders are charged a commission of $3.5 AUD per lot for forex trades on the same platform. On the MT5 platform, both Standard and Raw account holders are charged a commission of $6 per lot for forex trades. It's important to note that these fees are subject to change and may vary depending on the instrument being traded.

Here is the comprehensive table comparing the top trading platforms offered by FP Markets and other reputable brokers such as IC Markets, Exness, and Avatrade:

| Broker | Trading Platform | Desktop/Mobile/Web | Number of Instruments | Minimum Deposit |

| FP Markets | MT4, MT5, IRESS | Desktop, Mobile | 10,000+ | $100 |

| IC Markets | MT4, MT5, cTrader | Desktop, Mobile, Web | 300+ | $200 |

| Exness | MT4, MT5 | Desktop, Mobile, Web | 150+ | $1 |

| Avatrade | MT4, MT5, AvaOptions | Desktop, Mobile, Web | 1000+ | $100 |

FP Markets presents comprehensive copy trading services. The options include an embedded MT4 service from a leading algorithmic broker, an embedded MT5 service ideal for equity CFD copy trading, and an embedded cTrader service as a reasonable MT4 alternative. Additionally, traders can leverage the well-trusted third-party service Myfxbook AutoTrade or explore the fee-based emerging alternative Signal Start. Furthermore, FP Markets provides an in-house maintained copy trading service, FP Markets Social Trading, catering to traders seeking a proprietary solution.

FP Markets requires a minimum deposit of $100. This means that you can not open an account with FP Markets unless you deposit at least $100. However, it is important to note that some payment methods may require a higher minimum deposit. For example, if you are using a bank wire transfer, the minimum deposit may be higher than $100 due to processing fees.

The following is a table showing the comparison of the minimum deosit required by FP Markets and other brokers, avatrade, exness, and ic markets:

| Broker | Minimum Deposit |

| FP Markets | $100 |

| Avatrade | $100 |

| Exness | $1 |

| IC Markets | $200 |

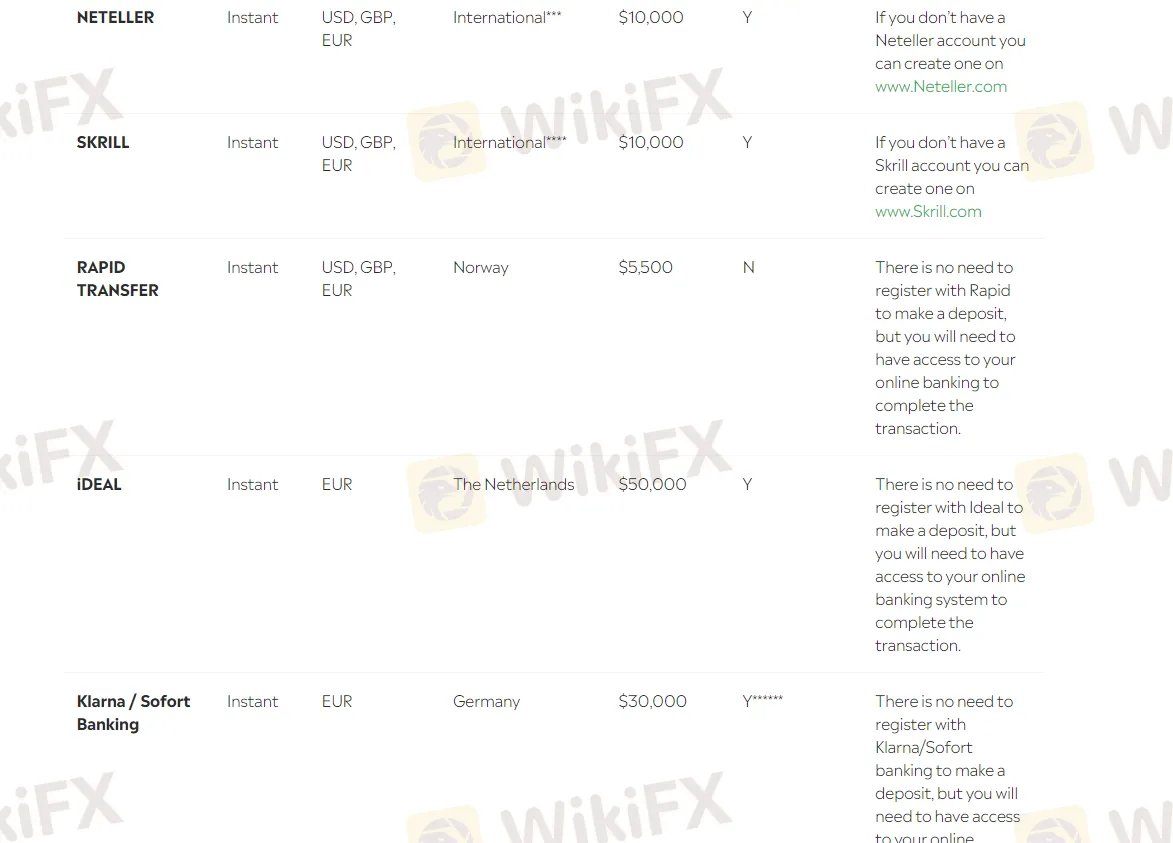

FP Markets offers a variety of convenient deposit and withdrawal methods to ensure that clients can easily fund and withdraw their accounts. Clients can deposit funds using credit/debit cards, bank wire transfers, electronic wallets such as Neteller, Skrill, POLi, and FasaPay. FP Markets does not charge any deposit fees, and the processing time for deposits is usually instant or up to 1 business day, depending on the deposit method.

For withdrawals, clients can use the same methods they used for depositing, and FP Markets does not charge any fees for most withdrawal methods. Withdrawal processing times vary depending on the method used, with electronic wallets usually taking up to 24 hours, while bank transfers can take 3-5 business days. Clients are advised to verify their accounts before making a withdrawal to avoid any delays or complications in the withdrawal process. Additionally, FP Markets offers free internal transfers between accounts, making it easy for clients to manage their funds across multiple trading accounts.

| Pros | Cons |

| Fast processing times for deposits and withdrawals | Limited payment options compared to other brokers |

| No fees for most deposit and withdrawal methods | High withdrawal fees for bank transfers |

| Multiple currency options for account funding | No support for some popular payment methods |

| Availability of convenient payment methods |

FP Markets offers a range of customer support options to its clients, including email, phone, live chat, and an online contact form. The broker also provides access to a range of educational resources and tools, including a knowledge base, video tutorials, webinars, and trading guides. Additionally, FP Markets offers multilingual support in several languages, including English, Chinese, Spanish, and Portuguese.

In addition, FP Markets has an extensive FAQ section on their website that covers a wide range of topics and can help clients find answers to their questions quickly. 24/7 customer support is a significant advantage for clients who may need assistance outside of regular business hours.

| Pros | Cons |

| 24/7 customer support availability | Limited language support for customer service |

| Multiple customer support channels (phone, email, live chat) | No dedicated account manager for clients |

| Fast response times to customer inquiries and requests | No in-person support or local offices in some countries |

| Extensive knowledge base and educational resources | Limited social media presence for customer support |

FP Markets offers a wide range of educational resources to help traders improve their knowledge and skills in trading. These resources include video tutorials, webinars, trading guides, and market analysis. The broker also provides a demo account for traders to practice their trading strategies without risking real money. Additionally, FP Markets has a blog section on its website, which covers various trading topics and market updates.

Overall, the educational resources provided by FP Markets are comprehensive and easily accessible to traders. The broker's commitment to educating its clients is commendable, and it shows that it values the success of its clients. However, some traders may find that resources are not sufficient for their needs, and may require more personalized educational support.

| Pros | Cons |

| Comprehensive educational resources | Some traders may require more personalized support |

| Demo account available for practice | |

| Regular webinars and market analysis | |

| Blog section with trading insights |

To sum up, FP Markets is a reputable and well-regulated broker that offers a wide range of instruments for traders to choose from, including forex, stocks, commodities, cryptocurrencies, and more. The broker offers multiple account types, including demo, Islamic, and standard accounts, as well as various trading platforms such as MT4, MT5, and iRESS. FP Markets also provides 24/7 customer support and a comprehensive range of educational resources for traders of all levels. While there are some potential drawbacks such as non-trading fees and limited leverage for certain instruments, the overall trading experience with FP Markets is generally positive.

Question: Does FP Markets offer demo accounts?

Answer: Yes, FP Markets offers demo accounts which can be used for practicing trading strategies and familiarizing oneself with the trading platforms.

Question: What is the minimum deposit requirement at FP Markets?

Answer: The minimum deposit requirement at FP Markets is $100.

Question: What instruments can be traded at FP Markets?

Answer: FP Markets offers a wide range of instruments including forex, shares, indices, commodities, cryptocurrencies, and more.

Question: Does FP Markets offer Islamic accounts?

Answer: Yes, FP Markets offers Islamic accounts for clients who require them.

Question: What is the maximum leverage available at FP Markets?

Answer: The maximum leverage available at FP Markets varies depending on the regulatory jurisdiction. The Australian entity offers up to 1:500 leverage for forex trading, while the CySEC entity offers up to 1:30.

Question: What are the trading fees at FP Markets?

Answer: FP Markets charges spreads and commissions on trades, with the specific fees varying depending on the trading instrument and account type.

Question: What are the deposit and withdrawal options at FP Markets?

Answer: FP Markets offers a range of deposit and withdrawal options including bank transfers, credit/debit cards, e-wallets, and more.

Question: What kind of customer support is available at FP Markets?

Answer: FP Markets offers 24/7 customer support through various channels including live chat, email, and phone.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive etoro and fp-markets are, we first considered common fees for standard accounts. On etoro, the average spread for the EUR/USD currency pair is -- pips, while on fp-markets the spread is From 0.0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

etoro is regulated by ASIC,CYSEC,FCA,FSC. fp-markets is regulated by ASIC,CYSEC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

etoro provides trading platform including -- and trading variety including --. fp-markets provides trading platform including Raw,Standard and trading variety including 70+ FX pairs, metals, indices, commodities.