简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

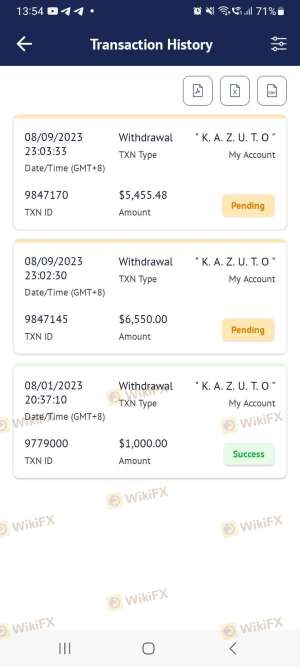

capital.com 、STARTRADER 交易商比较(前端未翻译)

Do you want to know which is the better broker between capital.com and STARTRADER ?

在下表中,您可以并排比较 capital.com 、 STARTRADER 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

EURUSD: 0.1

XAUUSD: -8

Long: -7.46

Short: 3.38

Long: -79.41

Short: 47.07

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of capital-com, iv-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

capital-com

| Quick capital.com Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Cyprus |

| Regulation | ASIC, CYSEC, FCA, SCA, SCB |

| Market Instruments | 3,000+ CFDs, shares, forex, indices, commodites, cryptocurrencies, ESG |

| Demo Account | ✅ |

| Min Deposit | 10 USD/EUR/GBP |

| Leverage | Up to 1:300 (professional) |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | Mobile Apps, Desktop, TradingView, MT4 |

| Deposit & Withdrawal Fee | ❌ |

| Inactivity Fee | 10 USD or equivalent for inactive for more than 1 year |

| Customer Support | 24/7 multilingual, live chat, phone, email, social media, Help Center |

capital.com Information

capital.com is a CFD (Contracts for Difference) broker registered in Cyprus and well regulated by a number of regulators. The broker offers access to 3,000 CFDs, including shares, forex, indices, commodites, cryptocurrencies, and ESG via the MT4 and other trading platforms. The platform offers a variety of trading tools and educational resources to help traders improve their skills and knowledge.

Pros & Cons

capital.com offers a user-friendly and comprehensive trading experience with a wide range of markets and instruments, competitive spreads, and a variety of trading platforms. The platform also provides extensive educational resources and trading tools. Additionally, capital.com has no deposit or withdrawal fees, and there are multiple payment methods available. However, overnight funding and guaranteed stop premiums can add to the cost of trading, and some traders may prefer more trading platforms and account types.

| Pros | Cons |

| • Offers a wide range of trading instruments | • Negative reviews and complaints |

| • Demo accounts available | • No MetaTrader 5 |

| • User-friendly and intuitive trading platforms | • Limited research tools |

| • Multiple account types and funding methods | • Overnight funding charges and guaranteed stop premiums |

| • No deposit and withdrawal fees | • Limited info on accounts and deposits & withdrawals |

| • Offers negative balance protection and guaranteed stop-loss | |

| • No funding fees, commission, or inactivity fees |

Is capital.com Legit?

Yes, it is regulated by several popular regulatory authorities.

| Regulator | Jurisdiction | Status | License Type | License Number |

| Australia Securities & Investment Commission (ASIC) | Australia | Regulated | Market Maker (MM) | 513393 |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulated | Market Maker (MM) | 319/17 |

| Financial Conduct Authority (FCA) | United Kingdom | Regulated | Straight Through Processing (STP) | 793714 |

| Securities and Commodities Authority (SCA) | United Arab Emirates | Regulated | Retail Forex License | 20200000176 |

| Securities Commission of The Bahamas (SCB) | Bahamas | Offshore Regulated | Retail Forex License | SIA-F245 |

Market Instruments

Capital.com offers 3,000+ market instruments for CFD trading, including shares, forex, indices, commodites, cryptocurrencies, and ESG.

The Forex category includes major, minor and exotic currency pairs.

The Indices category covers global indices such as the US 500, UK 100, and Germany 30. In the Commodities category, traders can trade on precious metals such as gold and silver, energy products such as oil and gas, and agricultural products such as wheat and corn.

The Shares category offers CFD trading on popular global companies such as Apple, Amazon, and Google.

Capital.com also offers CFD trading on a variety of cryptocurrencies such as Bitcoin, Ethereum, and Ripple, as well as ESG (Environmental, Social and Governance) trading, which focuses on socially responsible investments.

| Trading Assets | Supported |

| CFDs | ✔ |

| Shares | ✔ |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| ESG | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Accounts

Demo Account: Up to 100,000 virtual dollars and you can use your demo account for trading as long as you wish.

Live Account: capital.com does not provide much real account information. Generally, Forex brokers offer several different levels of real accounts with different trading conditions (leverage, spreads, commissions, etc.) depending on the minimum deposit amount. Due to the law prohibiting interest in the Islamic region, some brokers also offer Islamic accounts without overnight interest charges.

Leverage

The maximum leverage offered by capital.com is up to 1:300 for professional traders. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Capital.com offers variable spreads on its various trading instruments, which means the spreads can widen or narrow based on market conditions. The spreads for each instrument are transparently displayed on the website and can be easily monitored in real-time using the platform's trading tools.

As for commissions, capital.com does not charge any commissions for its CFD trading services. Instead, it makes money by incorporating a small markup on the spread, which is known as the “buy-sell spread.” This allows traders to have greater visibility and transparency into their trading costs.

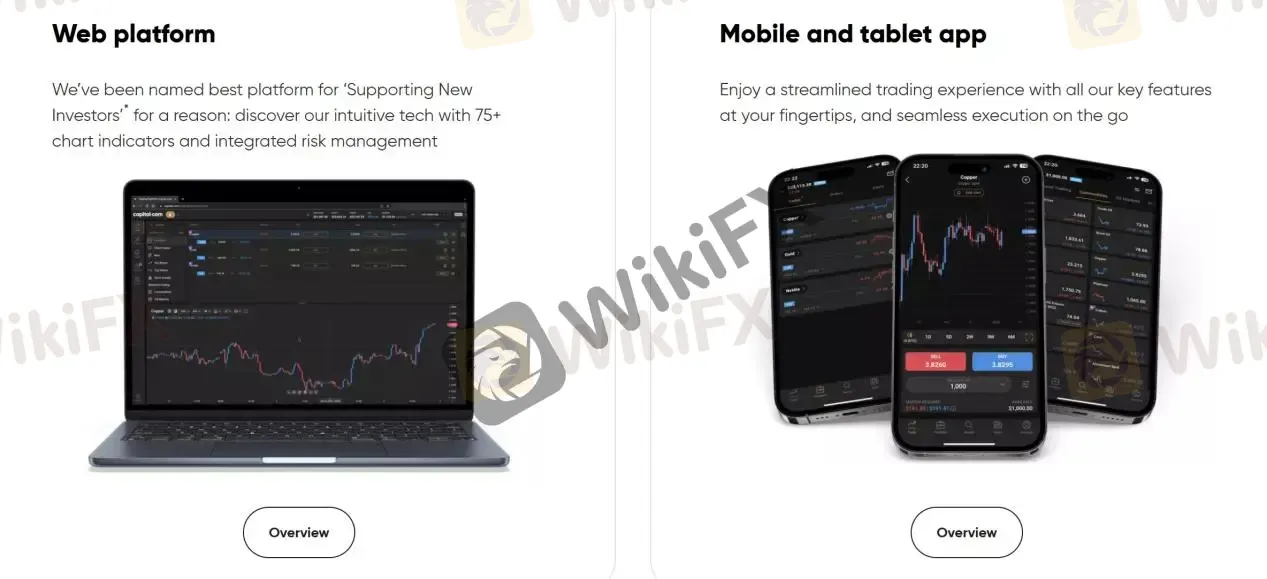

Trading Platforms

Capital.com offers a variety of trading platforms to cater to the needs of different traders. The platforms include Mobile Apps, Desktop, TradingView, and MT4.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile Apps | ✔ | Mobile | / |

| Desktop trading | ✔ | Desktop | / |

| MetaTrader 4 | ✔ | Dekstop, Mobile, Web | Beginners |

| TradingView | ✔ | Dekstop, Mobile, Web | / |

| MetaTrader 5 | ❌ | / | Experienced traders |

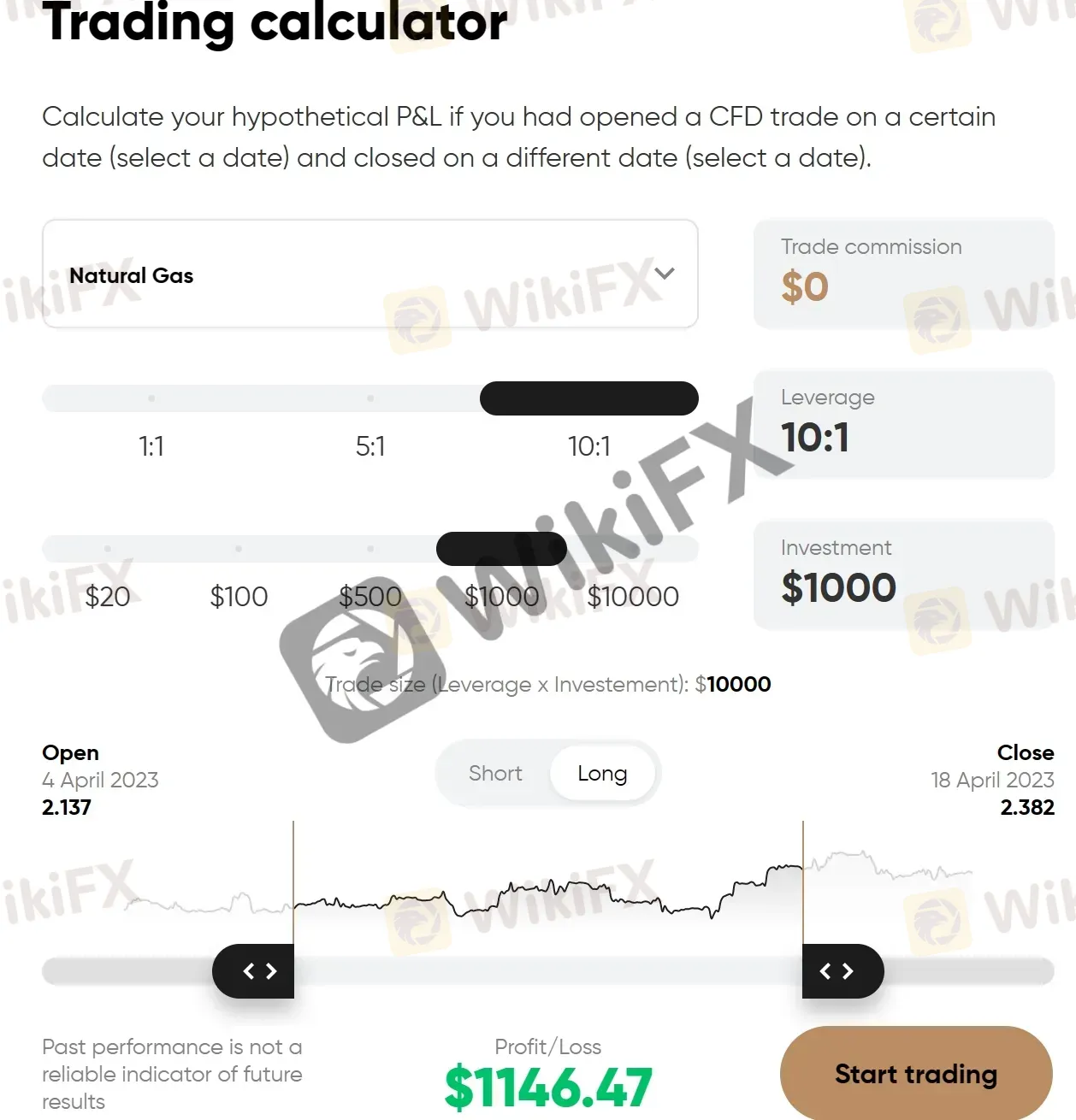

Trading Tools

Capital.com offers a range of trading tools to help its clients make informed trading decisions. The trading calculator is one such tool that allows traders to calculate the potential profits and losses of a trade before placing it. Other tools include an economic calendar, market news, and an education section with a range of guides and tutorials for traders of all levels.

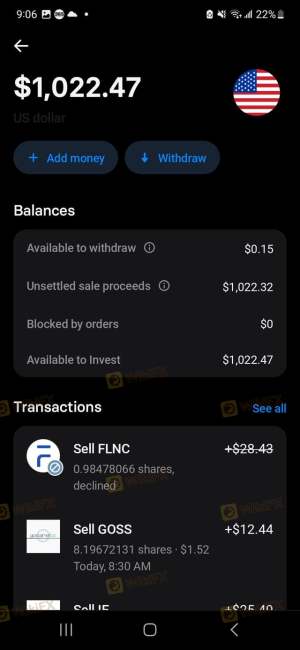

Deposits & Withdrawals

Capital.com offers a variety of payment methods for both deposits and withdrawals, including Apple Pay, VISA, MasterCard, wire transfer, PCI, worldpay, RBS, and Trustly. One of the main advantages of Capital.com's deposit and withdrawal system is that there are no fees associated with either process. This means that traders can deposit and withdraw funds as frequently as needed without incurring any additional costs.

capital.com minimum depoit vs other brokers

| capital.com | Most Other | |

| Minimum Deposit | 10 USD/EUR/GBP | $100 |

Fees

Capital.com's fee structure is designed to be transparent and competitive. The broker charges spreads on its trading instruments, which vary depending on market conditions and liquidity. More details can be found in the table below:

| Opening/Closing an account | ❌ |

| Demo account | ❌ |

| Inactivity fee | 10 USD or equivalent |

| Deposit & withdrawal fee | ❌ |

| Overnight fee | The fee will either be paid or received, depending on whether you are long or short. |

| Currency conversion | ❌ |

| Guaranteed stops | The GSL fee varies depending on the market you are trading, the positions open price and the quantity. |

Education

Capital.com provides a comprehensive educational section on their website, called the “Learning Hub”, where traders can find various materials to improve their trading skills and knowledge. They offer a wide range of educational resources, including articles, videos, webinars, and courses on various trading topics, such as technical analysis, risk management, and market psychology.

Additionally, they have a section dedicated to market guides, where traders can learn more about specific markets, and a section for trading strategies guides, where traders can find useful tips and strategies to enhance their trading performance.

Customer Service

| Service Time | 24/7 |

| Live chat | ✔ |

| Phone | +44 20 8089 7893 |

| support@capital.com | |

| Social Media | Facebook, Instagram, LinkedIn, YouTube, Twitter |

| Help Center | ✔ |

Conclusion

In conclusion, capital.com is a reputable online broker with a wide range of market instruments, low fees, and a variety of user-friendly trading platforms. The company offers free deposits and withdrawals with multiple payment methods, as well as educational resources to help traders of all levels. However, there are some negative reviews and complaints from their users. Overall, capital.com is a good choice for traders seeking a comprehensive and user-friendly trading experience.

Frequently Asked Questions (FAQs)

| Q 1: | Is capital.com regulated? |

| A 1: | Yes. It is regulated by ASIC, CYSEC, FCA, SCA and SCB. |

| Q 2: | Does capital.com offer demo accounts? |

| A 2: | Yes. Demo accounts has up to 100,000 virtual dollars and you can use your demo account for trading as long as you wish. |

| Q 3: | Does capital.com offer the industry-standard MT4 & MT5? |

| A 3: | Yes. It supports Mobile Apps, Desktop Trading, MetaTrader 4, and TradingView. |

| Q 4: | Is capital.com a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

iv-markets

| STARTRADER Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | Forex, shares, indices, metals, commodities, and ETF |

| Account Type | STP Account, ECN Account |

| Demo Account | ✔ |

| Leverage | Up to 1:500 |

| Spread | Start from 0.0 pips |

| Minimum trading set | 0.01 lots |

| Trading Platform | MT4, MT5, Web Trader, STARTRADER APP, copy trade |

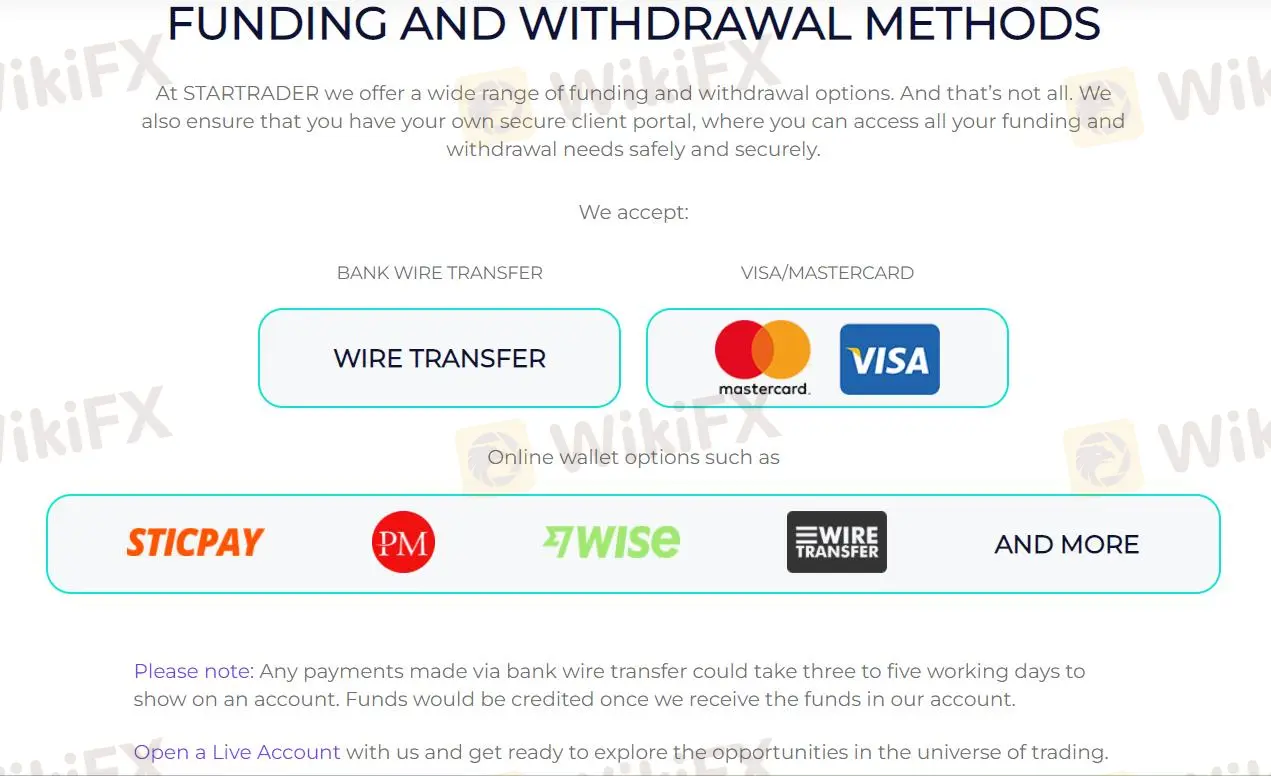

| Payment Method | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

| Customer Support | Phone: +61 2 9925 4396 |

| Email: info@startrader.com | |

| Physical Address: Suite 201, 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, Mauritius | |

STARTRADER Information

STARTRADER, founded in 1997, is a brokerage registered in Australia. The trading instruments it provides cover more than 50 types of forex , more than 70 types of shares, indices, metals, commodities, and ETF.

Pros and Cons

| Pros | Cons |

| Regulated | No clear information on the minimum deposit for each accounts |

| Wide range of trading instruments | No Islamic account |

| Generous leverage up to 1:500 | |

| MT4 and MT5 supported | |

| Copy trading available | |

| Demo account available |

Is STARTRADER Legit?

STARTRADER is regulated by ASIC. Its current status is regulated.

| Regulated Country | Regulated Authority | Regulated Entity | License Number | Current Status |

| Australia | ASIC | STARTRADER PRIME GLOBAL PTY LTD | 000421210 | Regulated |

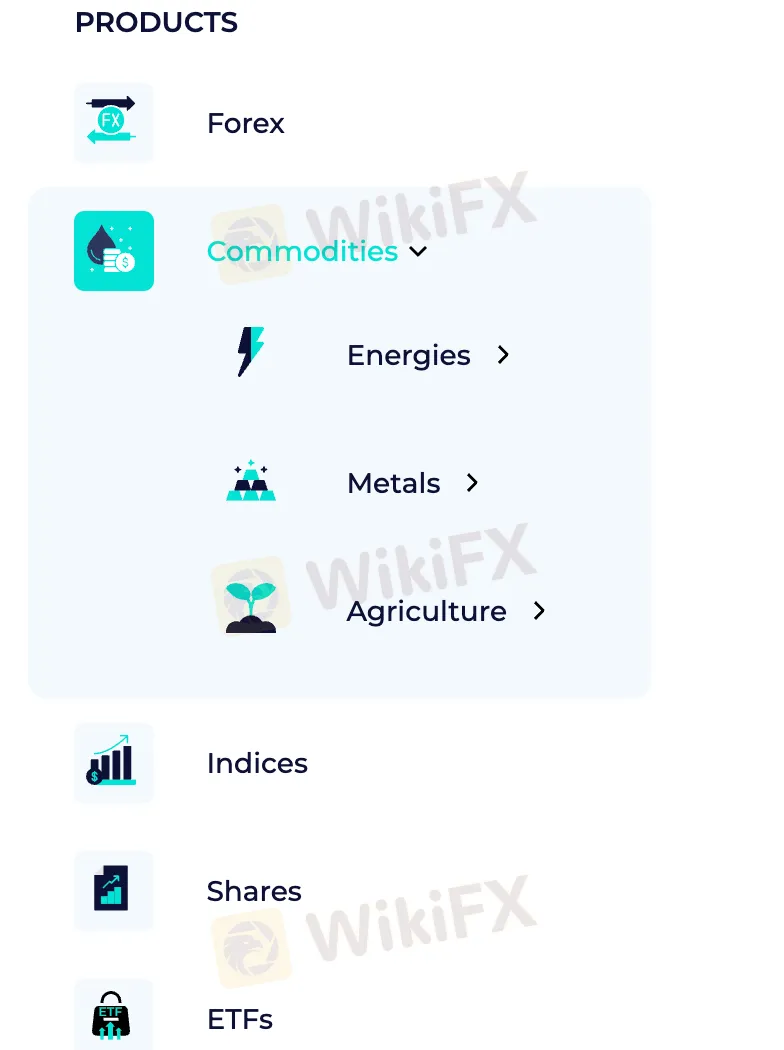

What Can I Trade on STARTRADER?

STARTRADER offers traders more than 1000 types of instruments - more than 50 types of forex , more than 70 types of shares, indices, metals, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| ETF | ✔ |

| Futures | ❌ |

| Options | ❌ |

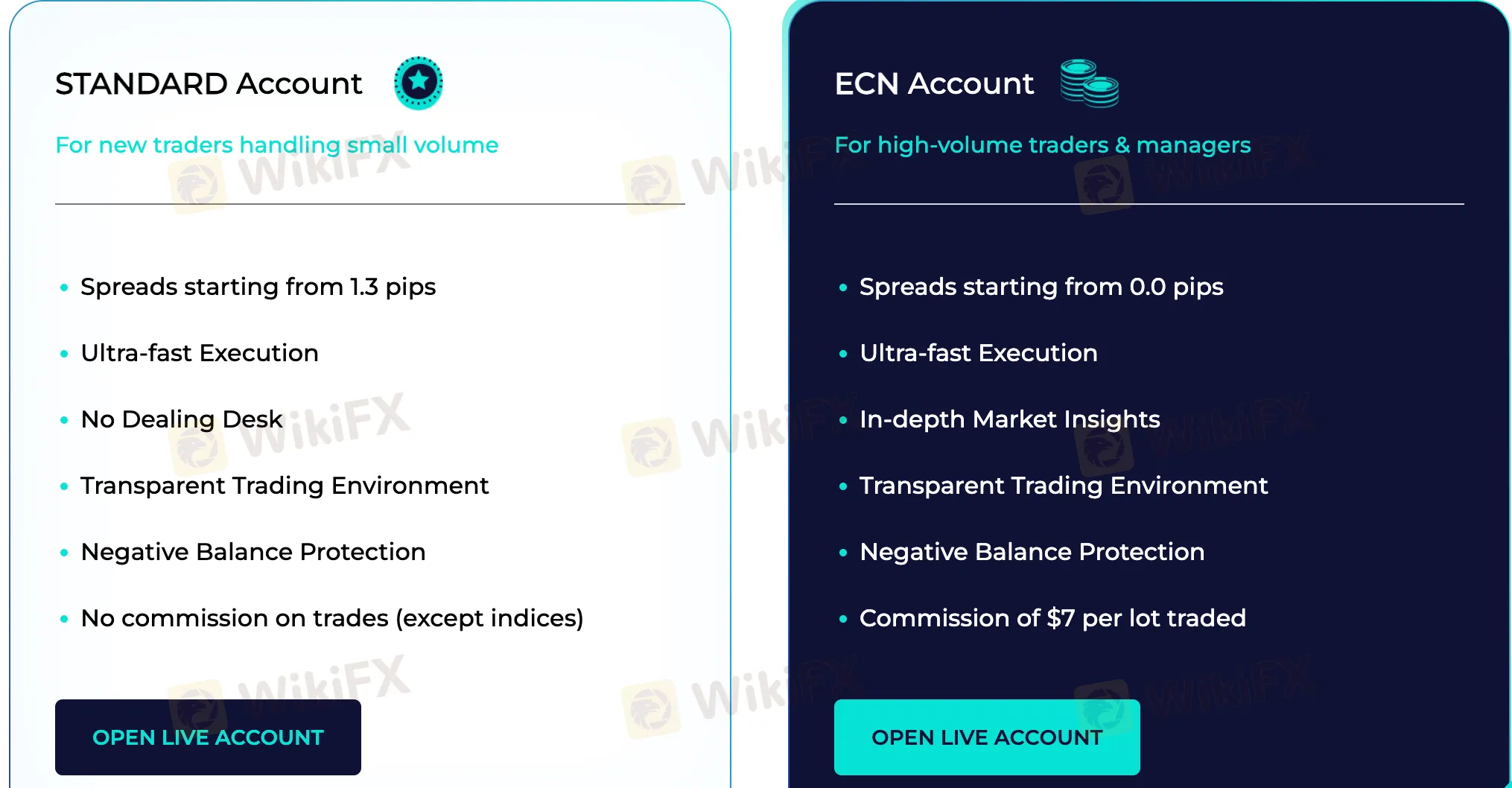

Account Types

STARTRADER offers 2 different types of accounts to traders - Standard Account, ECN Account.

| Account Type | Standard Account | ECN Account |

| Spreads | As low as 1.3 pips | As low as 0.0 pips |

| Commission | No | Yes, $7/lot |

| Minimum Volume per Trade | 0.01 lots | 0.01 lots |

| Account Currency Type | AUD, CAD, EUR, GBP, USD, NZD | AUD, CAD, EUR, GBP, USD, NZD |

| Payment Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

| Demo Account | ✔ | ✔ |

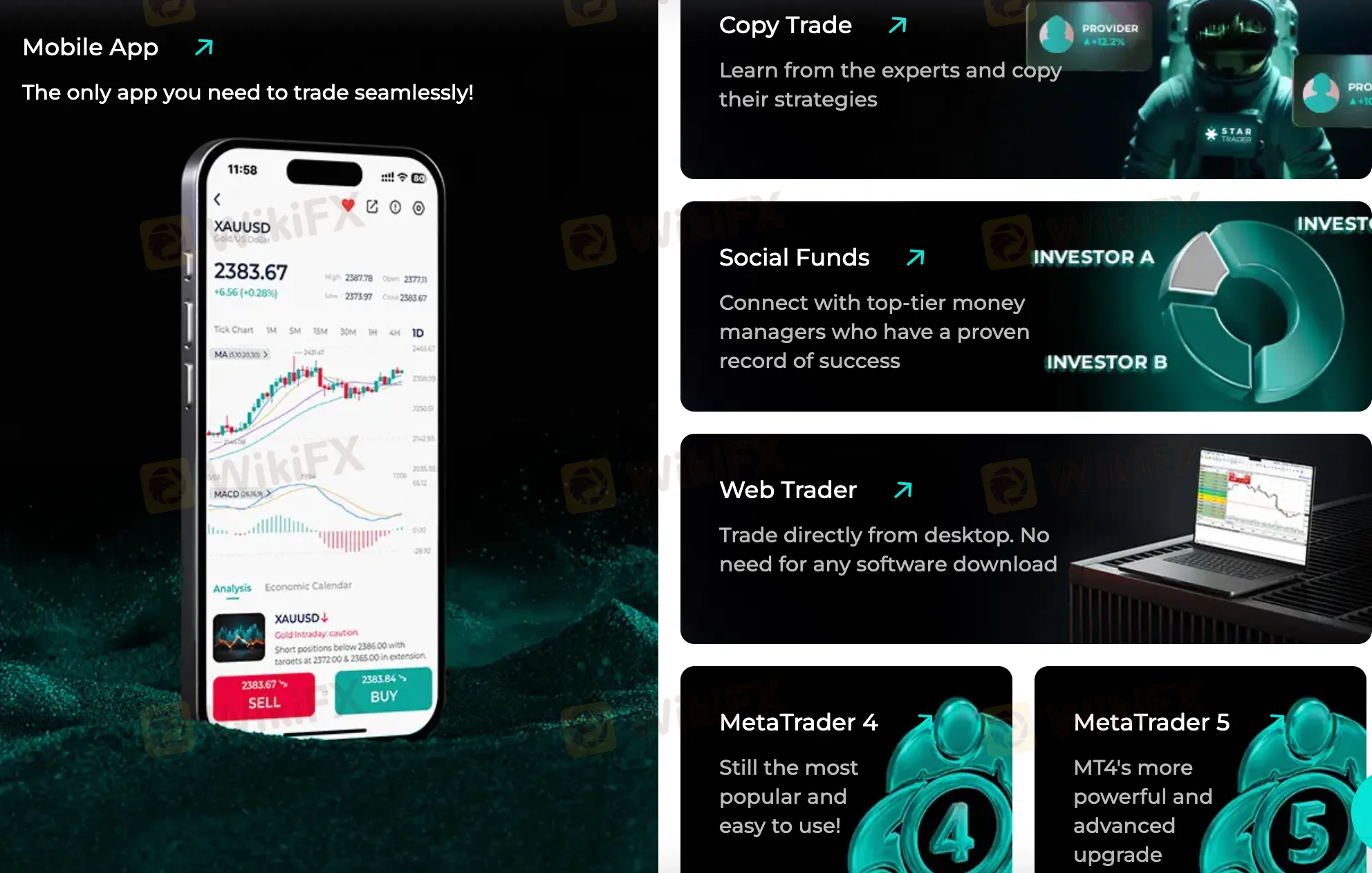

Trading Platform

STARTRADER's trading platforms are MT4, MT5, Web Trader, STARTRADER APP, which support traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT4 Margin WebTrader | ✔ | Web, Mobile |

| MT5 | ✔ | Web, Mobile |

| Web Trader | ✔ | Web |

| STARTRADER APP | ✔ | Mobile |

| Copy Trade | ✔ |

Deposit and Withdrawal

The broker supports Visa, Mastercard, E-Wallet, Bank Wire, China Union Pay, Dragonpay, Help2Pay, Payment Asia and tether.

Copy Trading

STARTRADER's copytrading offers an opportunity to follow good traders and monitor the markets.

Are the transaction costs and expenses of capital-com, iv-markets lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive capital-com and iv-markets are, we first considered common fees for standard accounts. On capital-com, the average spread for the EUR/USD currency pair is -- pips, while on iv-markets the spread is from 1.0.

Which broker between capital-com, iv-markets is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

capital-com is regulated by ASIC,CYSEC,FCA,CMA,CMA,SCB. iv-markets is regulated by ASIC,FSCA,FSA.

Which broker between capital-com, iv-markets provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

capital-com provides trading platform including -- and trading variety including --. iv-markets provides trading platform including STANDARD,ECN and trading variety including 60+ currency pairs, 700+ stocks, 20+ commodities, 25+ indices.