No data

Do you want to know which is the better broker between ATFX and CXC ?

In the table below, you can compare the features of ATFX , CXC side by side to determine the best fit for your needs.

EURUSD: 0.3

XAUUSD: 1.2

Long: -6.02

Short: 2.33

Long: -34.43

Short: 19.17

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of atfx, cxc-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| ATFX | Basic Information |

| Company Name | AT Global Markets (UK) Limited |

| Regulated By | FCA, CYSEC |

| Year Founded | 2014 |

| Headquarters | London, UK |

| Trading Platforms | MT4, MT5, and their own proprietary trading platform |

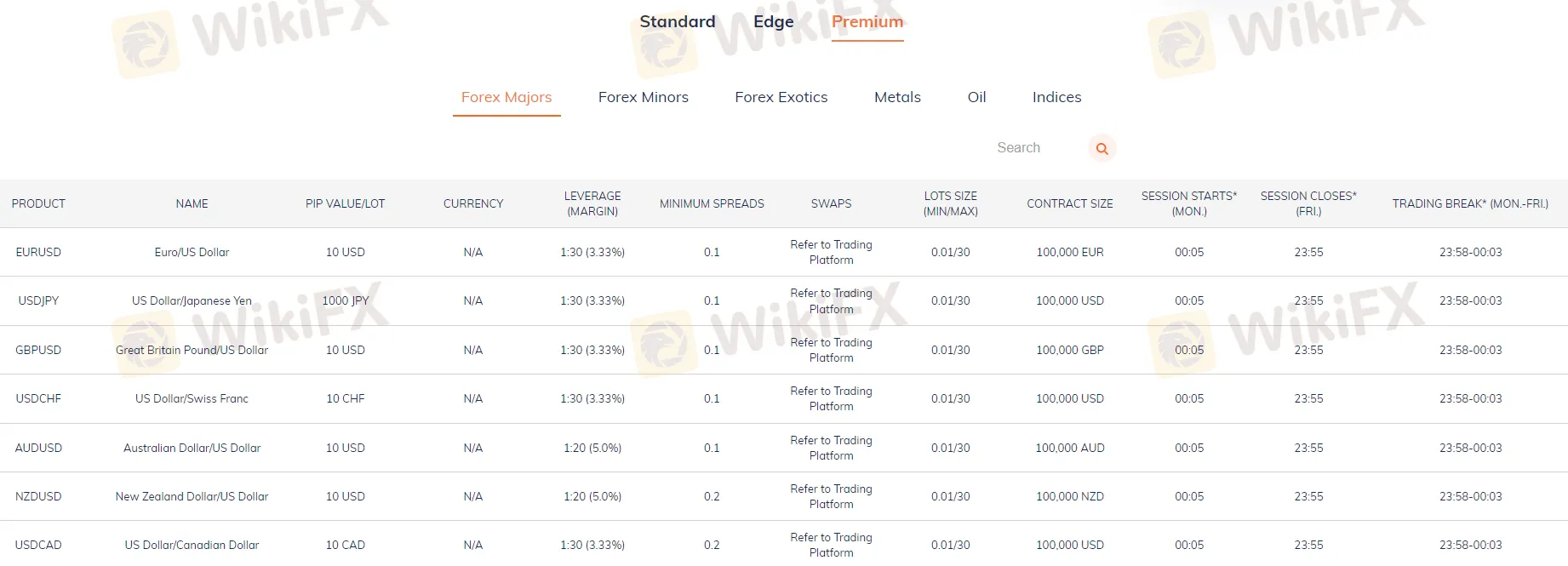

| Account Types | Standard, Edge, Premium |

| Demo Account | Yes |

| Minimum Deposit | $/€/£100 |

| Leverage | Up to 1:30 for retail traders and up to 1:400 for professional traders |

| Spreads | Variable, starting from 0.0 pips |

| Tradable Assets | Forex, CFDs on indices, commodities, and stocks |

| Deposits & Withdrawal Methods | VISA, MasterCard, Skrill, Neteller, Bank Transfer, Trustly |

| Education and Analysis | Webinars, articles, daily market outlooks, technical analysis tools |

| Customer Support | 24/5 via phone, email, live chat, and social media |

ATFX is a global online forex and CFD broker established in 2014, offering a range of trading instruments, including forex, commodities, indices, and shares. The broker also offers several account types, including the Standard Account, Edge Account, and Premium Account, each with different features and benefits to suit different trading needs, with $100 to start. Besides, the broker also offers a demo account for traders to practice and test their strategies. One of the key features of ATFX is its trading platforms. The broker offers the popular MetaTrader 4 (MT4) platform, which is known for its advanced charting tools and user-friendly interface.

ATFX provides its clients with a range of educational resources to help traders improve their trading knowledge and skills. These resources include trading guides, webinars, seminars, and video tutorials. The broker also offers customer support services 24/5 via live chat, phone, and email.

ATFX is a legitimate forex broker that operates under strict regulations. TThis broker is currently regulated by two major financial regulators, the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. These regulators are known for their strict oversight and regulations in the financial industry, which provides traders with a higher level of security and protection. ATFX's compliance with these regulations demonstrates its commitment to transparency and fairness in its business practices.

ATFX has a number of advantages and disadvantages that traders should consider before choosing this broker. On the positive side, ATFX is a well-regulated broker that offers a range of trading platforms and tools, including MetaTrader 4, WebTrader, and mobile trading apps. The broker also provides a wide range of trading instruments, including forex, CFDs, and cryptocurrencies, and offers competitive spreads and low trading fees. In addition, ATFX provides its clients with a variety of educational resources to improve their trading skills and knowledge, and customer support services are available 24/5 through live chat, phone, and email.

On the downside, ATFX has limited options for deposit and withdrawal methods, as it only accepts payments via bank transfers and credit/debit cards. Another potential disadvantage is that ATFX does not offer social trading or copy trading features, which may be important to some traders. Finally, ATFX has limited research and analysis tools compared to other brokers, which may be a concern for more advanced traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATFX provides a wide range of tradable assets to its clients, including forex, metals, oils, indices, cryptocurrencies, and shares. This diverse range of instruments allows traders to diversify their portfolios and take advantage of various market conditions.

Forex-The forex market is the largest financial market in the world, and ATFX provides access to over 100 currency pairs, including major, minor, and exotic pairs.

Precious Metals-The broker also offers trading in precious metals such as gold and silver, which are popular safe-haven assets during times of market volatility.

Indices-Additionally, traders can speculate on the price movements of various indices, including the popular S&P 500 and NASDAQ.

Oils-Oils, such as Brent and Crude Oil, are also available for trading, which are popular among traders due to their high volatility.

Cryptocurrency-ATFX also offers trading in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, which have gained increasing popularity in recent years.

Shares-Lastly, traders can also invest in shares of some of the world's largest companies such as Apple, Amazon, and Google.

| Pros | Cons |

| Wide range of market instruments including forex, metals, oils, indices, cryptocurrencies, and shares. | The selection of instruments may not be as extensive as some other brokers. |

| Highly liquid markets, allowing for efficient trading and price discovery. | Market volatility can lead to significant price fluctuations and potential losses. |

| Ability to trade on leverage, allowing traders to increase their buying power and potential profits. | Trading on leverage also increases the risk of losses, especially for inexperienced traders. |

| Opportunity for diversification, as traders can access a variety of different asset classes through a single broker. | Certain market instruments may have high trading fees or commissions. |

| Market events or news can have a significant impact on market instruments, making them unpredictable at times. |

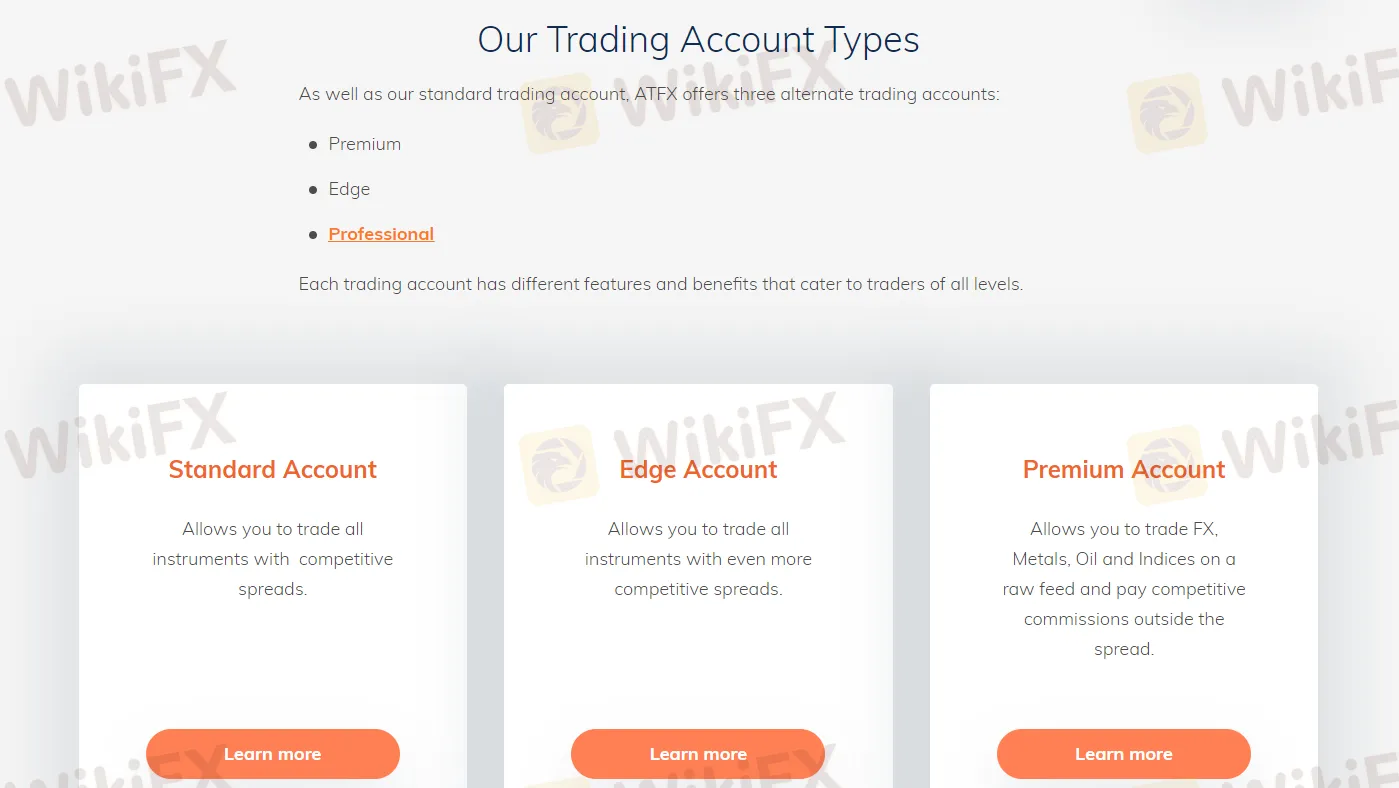

ATFX understands that every trader has their own trading style, preferences, and needs, which is why the broker offers a range of account types to choose from. Whether you're a beginner or an experienced trader, there is an account type that is suitable for you.

The Standard Account is a basic account type that is suitable for beginner traders who are just starting in the forex market. It requires a minimum deposit of $100 and offers fixed spreads starting from 1.0 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares.

The Edge Account is a more advanced account type that is suitable for traders who have some experience in the forex market. It requires a minimum deposit of $5,000 and offers variable spreads starting from 0.6 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares. In addition, the Edge Account offers free VPS hosting, market analysis, and a personal account manager.

The Premium Account is the most advanced account type offered by ATFX, designed for professional traders who require advanced trading features and tools. It requires a minimum deposit of $10,000 and offers variable spreads starting from 0.0 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares. The Premium Account offers free VPS hosting, market analysis, a personal account manager, and access to exclusive trading tools, such as Autochartist and Trading Central.

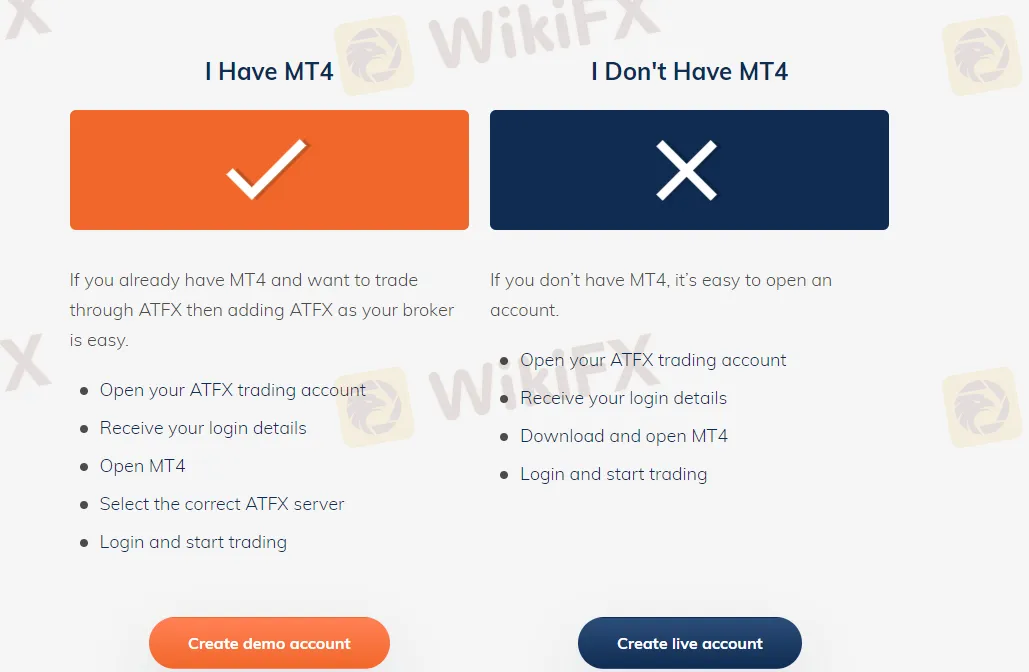

ATFX offers demo trading accounts to its clients, allowing them to practice and familiarize themselves with the trading platform and strategies before committing real funds. Demo accounts are available for all account types, including Standard, Edge, and Premium accounts. These accounts simulate real market conditions, providing traders with the opportunity to test their trading skills and strategies without any financial risks.

The demo accounts are also an excellent tool for beginners who are new to trading as it enables them to learn the basics of trading without the fear of losing money. The demo accounts offer the same features as live accounts, including access to all trading instruments and educational resources, enabling traders to experience the real trading environment.

ATFX's demo accounts have no time limit, giving traders ample time to perfect their trading strategies and techniques. Moreover, traders can switch between the demo and live accounts anytime they want, enabling them to transition smoothly to live trading when they are ready. The demo accounts offered by ATFX are an excellent resource for traders looking to improve their trading skills and strategies in a risk-free environment.

Visit the ATFX website: Go to the ATFX website and click on the “Start Trading” button on the top right corner of the homepage.

Fill in your personal information: You will be directed to a page where you will need to provide your personal information, including your full name, date of birth, contact details, and country of residence. You will also need to choose your preferred account type.

Provide your financial information: You will be asked to provide information about your financial status, including your employment status, annual income, and investment experience.

Submit verification documents: To complete the registration process, you will need to submit a copy of your passport or ID card, as well as a proof of address, such as a utility bill or bank statement.

Fund your account: Once your account is verified, you can fund it using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallet.

Start trading: Once your account is funded, you can start trading on the ATFX platform using your preferred trading instruments and strategies.

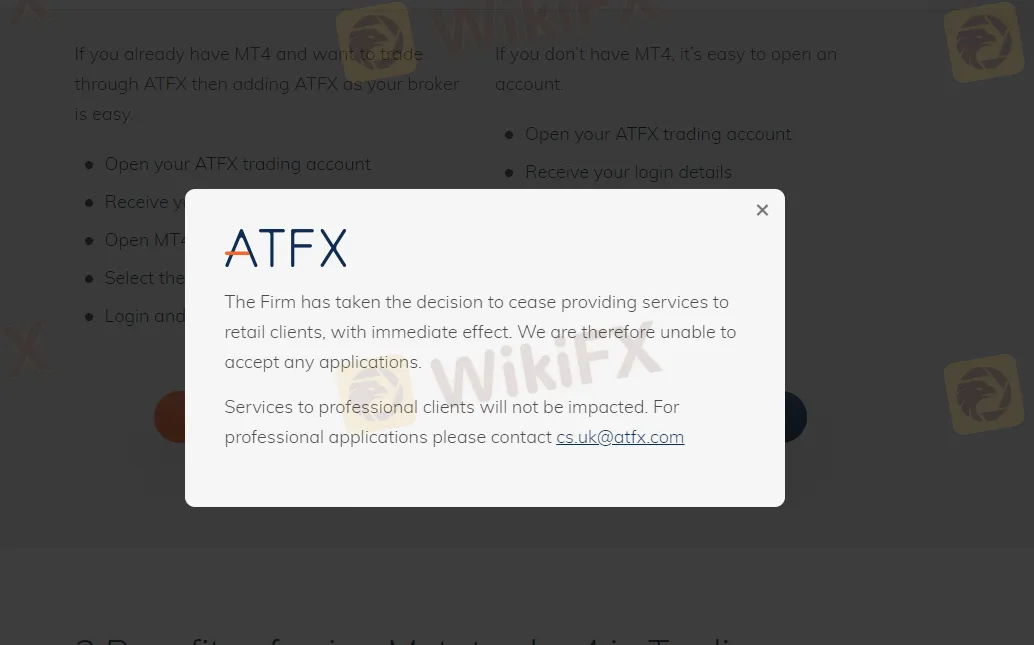

However, when browsing through the broker's website, an unwelcomed page showed up. A message popped up on the screen informing us that only the big shots - professional clients - were allowed to use the trading platform, while retail clients were left out in the cold.

Here's a table that compares the spreads on EUR/USD, UK100, and Oil offered by ATFX, Avatrade, IC Markets, and FP Markets:

| Broker | EUR/USD Spread | UK100 Spread | Oil Spread |

| ATFX | 0.6 pips | 2.5 pips | 0.05 pips |

| Avatrade | 0.9 pips | 1.0 pips | 0.03 pips |

| IC Markets | 0.1 pips | 1.0 pips | 0.03 pips |

| FP Markets | 0.0 pips | 1.0 pips | 0.02 pips |

ATFX offers varying levels of leverage depending on the type of trading account and financial instrument.

For forex trading, the maximum leverage available for retail clients is typically 30:1 for major currency pairs and 20:1 for minor and exotic currency pairs. Professional clients may have access to higher leverage, up to a maximum of 400:1, depending on their trading experience and other criteria.

For trading other financial instruments such as commodities, indices, and shares, the leverage may vary depending on the asset class and market conditions.

It's important to note that while leverage can amplify potential profits, it also magnifies potential losses, so it's crucial to use leverage responsibly and only trade with funds you can afford to lose. Additionally, different regulations may apply in different regions and countries, which could impact the maximum leverage available to traders.

ATFX offers competitive spreads and commissions on its trading accounts, which vary depending on the type of account and trading instrument.

For forex trading, ATFX offers both fixed and variable spreads, depending on the account type. The spreads for major currency pairs on the standard account start from 1.0 pip, while the spreads on the Edge account start from 0.0 pips but come with a commission of $7 per lot traded.

For other financial instruments such as commodities, indices, and shares, the trading fees may vary depending on the specific asset class and trading platform used.

Aside from trading fees, ATFX may charge non-trading fees that traders should be aware of, including:

Inactivity Fee: ATFX may charge an inactivity fee of $50 per quarter for accounts that have been inactive for more than 90 days. This fee may be waived for active traders or in certain circumstances.

Conversion Fees: If you deposit or withdraw funds in a currency different from your account's base currency, ATFX may charge a conversion fee to cover the costs of currency conversion.

Overnight Financing Charges: If you hold a position overnight, ATFX may charge or credit you with an overnight financing charge, also known as a swap fee. This fee is based on the interest rate differential between the two currencies being traded and is typically charged at a fixed percentage of the position value.

Withdrawal Fees: While ATFX does not charge any withdrawal fees, third-party payment providers may charge a fee for their services.

Deposit Fees: ATFX does not charge any deposit fees, but third-party payment providers may charge a fee for their services.

ATFX currently provides the MetaTrader 4 (MT4) platform for its traders, which is a widely used platform among forex traders. It offers advanced charting tools, technical analysis indicators, and automated trading options through Expert Advisors (EAs).

While some traders may prefer other trading platforms, the MT4 platform is a robust and reliable option with a large community of users and third-party developers creating and sharing custom indicators and EAs.

In addition to the MT4 platform, ATFX also offers a range of trading tools and resources, including economic calendars, market analysis, and educational resources such as webinars and tutorials.

Check out this table that compares the trading platforms of ATFX, IC Markets, FP Markets, and Exness:

| Feature | ATFX | IC Markets | FP Markets | Exness |

| Trading Platform | MT4 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Web Trading Platform | Yes | Yes | Yes | Yes |

| Mobile Trading Platform | Yes | Yes | Yes | Yes |

| Social Trading | No | Yes | Yes | No |

| Copy Trading | Yes | Yes | Yes | Yes |

| Trading Signals | Yes | Yes | Yes | Yes |

| Automated Trading | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes | Yes |

ATFX's minimum deposit requirement of $100 makes it an accessible option for traders who are just starting out or those who prefer to trade in smaller amounts. The following payment methods are available for deposits:

Credit/Debit Cards: Visa and Mastercard are accepted. The processing time for deposits made via credit/debit cards is instant, and there are no fees charged by ATFX.

Bank Wire Transfer: Deposits can be made via bank wire transfer. The processing time for this method varies, and it may take 2-5 business days to reflect in the trader's account. ATFX does not charge fees for deposits made through bank wire transfer, but traders should check with their bank for any charges that may apply.

Online Payment Methods: ATFX also supports online payment methods such as Skrill, Neteller, and Trustly. Deposits made using these methods are typically processed instantly. ATFX does not charge fees for deposits made through online payment methods, but third-party payment providers may charge a fee for their services.

How to withdraw money from my trading account?

Log in to the secure Client Portal section of our homepage, then click “Withdrawal”.

This broker will always return funds to the original source they were deposited. For example, if a deposit is made by credit card, funds will be returned to the same credit card. The return can be done through bank transfer, credit/debit card or e-wallet transfers.

If you are withdrawing profit, this broker may ask you for bank account details to send funds directly to your account.

Please note: Your bank account must be fully verified before submitting a withdrawal request.

The time it takes for funds to return to a trader's bank account will depend on the withdrawal method used.

For bank transfers, once the funds have been removed from the trading account, it will take 3-5 business days before they arrive in the trader's bank account. The actual time required for processing may vary, and traders should refer to their bank for more information.

If using an e-wallet, funds will typically be returned to the trader's e-wallet within 2 business days.

For refunds to credit/debit cards, the process typically takes 2-5 business days after the withdrawal has been successfully processed. However, if there are restrictions preventing funds from being returned to the card, ATFX may request a valid bank statement and return the funds to the trader's registered bank account. In such cases, the trader will be contacted by their relationship manager.

All withdrawal requests received before 2 pm (UK time) on a business day will be processed on the same day. Requests received after this time will be processed on the next available business day.

It seems that ATFX understands the importance of providing reliable and efficient customer support to help traders along the way. Whether you're a seasoned professional or just starting out, the brokerage firm offers a range of customer support options to ensure that you have access to the assistance you need, when you need it.

Live Chat: ATFX provides a live chat feature on their website, which allows traders to chat with a customer support representative in real-time. This option is convenient and efficient, as traders can get their questions answered without having to wait for a response via email or phone.

Email: Traders can contact ATFX's customer support team by email. The brokerage firm aims to respond to all queries within 24 hours, making this a good option for non-urgent matters.

Phone: ATFX also provides a phone number for traders to call if they prefer to speak to a customer support representative directly. The phone lines are open from Monday to Friday, during business hours.

FAQ Section: ATFX's website also features a comprehensive FAQ section, which covers a range of topics such as account opening, funding, trading platforms, and more. This section can be a useful resource for traders who prefer to find answers to their questions independently.

Social Media: ATFX has an active presence on social media platforms such as Facebook, Twitter, and LinkedIn. Traders can use these channels to connect with the company and stay up to date with news and updates.

ATFX offers a wide range of educational resources to help traders improve their skills and knowledge.

One of the primary educational resources available through ATFX is their comprehensive online trading academy. This academy provides traders with a variety of resources, including webinars, videos, articles, and e-books, all designed to help traders learn the fundamentals of trading and improve their strategies. The academy covers a range of topics, from basic concepts such as market analysis and risk management to more advanced topics like trading psychology and algorithmic trading.

In addition to the online trading academy, ATFX also offers a range of educational resources specifically tailored to the needs of different traders. For example, beginners can take advantage of the company's beginner's course, which provides an introduction to the basics of trading, while more experienced traders can benefit from advanced courses covering topics such as technical analysis and trading psychology.

ATFX also provides traders with access to a variety of market analysis tools and resources. These include daily market analysis reports, economic calendars, and real-time news feeds, all of which can help traders stay informed about the latest market trends and make more informed trading decisions.

ATFX is a well-known brokerage firm that offers a variety of trading services and features for traders of all levels. The brokerage's competitive trading conditions, such as low spreads, high leverage, and multiple trading instruments, provide traders with opportunities across various markets.

Additionally, ATFX provides several customer support channels, including live chat, email, and phone, to help traders with their queries and concerns. The brokerage also offers educational resources, such as an online trading academy and tailored courses, to help traders develop their knowledge and skills.

While ATFX has received positive feedback from some traders, as with any brokerage firm, there are also negative reviews and complaints online. However, these reviews should be taken with a grain of salt, and traders are encouraged to conduct their research and make informed decisions before investing their funds with any broker.

Q: Is ATFX a regulated broker?

A: Yes, ATFX is a regulated broker that is authorized and regulated by multiple financial authorities, including the FCA in the UK, the CySEC in Cyprus.

Q: What is the minimum deposit requirement for ATFX?

A: The minimum deposit requirement for ATFX is $100.

Q: What trading platforms does ATFX offer?

A: ATFX offers the popular MetaTrader 4 (MT4) trading platform for desktop, web, and mobile devices.

Q: What are the trading fees and spreads at ATFX?

A: ATFX offers competitive trading conditions, including tight spreads and low commissions. The exact trading fees will depend on the account type and trading instrument.

Q: What payment methods are accepted by ATFX?

A: ATFX accepts a range of payment methods, including bank wire transfer, credit/debit cards, and e-wallets. The availability of payment methods may vary depending on the trader's location.

Q: Does ATFX offer a demo account?

A: Yes, ATFX offers a demo account for traders to practice their trading strategies and familiarize themselves with the trading platform before trading with real money.

Q: Does ATFX offer customer support?

A: Yes, ATFX provides customer support through multiple channels, including live chat, email, and phone. Traders can also access a comprehensive FAQ section on the ATFX website.

Q: Is ATFX suitable for beginner traders?

A: Yes, ATFX offers a range of educational resources, including an online trading academy and tailored courses, to help beginner traders develop their knowledge and skills. Additionally, the broker offers a demo account for traders to practice their trading strategies before trading with real money.

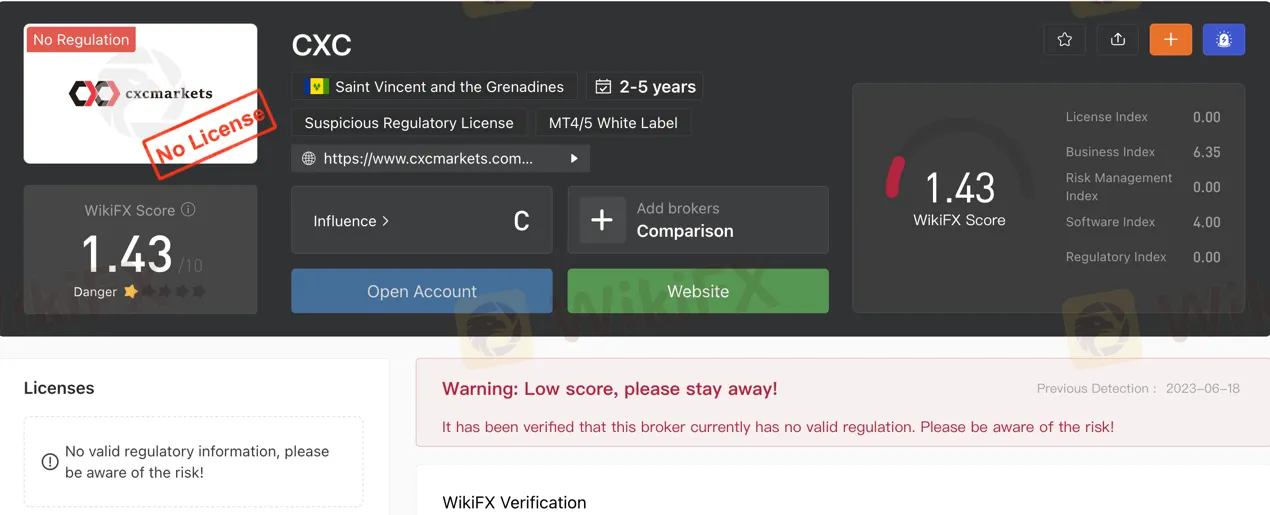

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | CXCMarkets Group |

| Regulation | No valid regulatory information, please be aware of the risk! |

| Minimum Deposit | $100 for Micro account |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Micro Account: From 1.3 pips, Zero Account: From 0 pips, Standard Account: From 1.3 pips |

| Trading Platforms | MetaTrader 4, Web Trader |

| Tradable Assets | Forex currency pairs, precious metals, cryptocurrencies, stock index CFDs |

| Account Types | Micro Account, Zero Account, Standard Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Online support available 24/7 in multiple languages; Email support |

| Payment Methods | Bank cards, Bitwallet (including Bitcoin, Litecoin, Ripple) |

CXC is a trading platform known as CXCMarkets and Tech-FX, which recently underwent a brand merger and upgrade. However, it's important to note that CXC is not regulated by any financial regulatory authority, which means there is no government oversight or customer protection. This lack of regulation poses a higher risk of fraud or financial losses for traders.

CXC offers a range of market instruments, including forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs. Forex currency pairs allow traders to speculate on exchange rate fluctuations, while precious metals and cryptocurrencies provide opportunities to benefit from price movements and global events. Stock index CFDs offer exposure to broader market trends.

CXC provides different account types, such as the Micro Account, Zero Account, and Standard Account, each with its own features and benefits. The leverage offered by CXC is up to 1:1000, allowing traders to control larger positions with a smaller initial investment. Spreads and commissions vary across account types, and the minimum deposit starts at $100 for the Micro Account.

CXC offers the MetaTrader 4 platform and a web trader platform for trading activities. Customer support is available online through email, but no telephone number is provided for inquiries. Reviews about CXC are mixed, with some users expressing satisfaction with trading conditions and others reporting server issues and problems with payments.

In conclusion, CXC is an unregulated trading platform that offers various market instruments and account types. Traders should be cautious due to the lack of regulation and the associated risks. It's advisable to consider other factors and conduct thorough research when evaluating a broker.

CXC, operating as CXCMarkets and Tech-FX, presents a range of pros and cons for potential traders to consider. On the positive side, CXC offers a diverse selection of market instruments and different account types, along with leverage of up to 1:1000. Traders can access MetaTrader 4 and a web trader platform, benefiting from online customer support available around the clock. Additionally, CXC provides various deposit and withdrawal methods, accommodating different trader preferences. However, there are significant drawbacks to consider. Notably, CXC lacks regulation from any financial authority, increasing the risk of fraud or financial losses. Additionally, the absence of an official website raises transparency concerns, limiting access to essential information. Mixed user reviews and a suspicious regulatory license further contribute to the overall evaluation of CXC's potential as a reliable broker.

| Pros | Cons |

| Offers a variety of market instruments | Not regulated by any financial regulatory authority |

| Different account types available | Higher risk of fraud or financial losses |

| Leverage of up to 1:1000 | Limited deposit and withdrawal options |

| Customer support available in multiple languages | No official website available |

| Online customer support available 24/7 | No telephone customer support |

| Provides access to MetaTrader 4 platform | Mixed user reviews |

| Offers a web trader platform for browser-based trading | Lack of transparency due to no regulatory information |

CXC. is not regulated by any financial regulatory authority. This means that there is no government agency that oversees CXC.'s activities or protects its customers. As a result, there is a higher risk of fraud or other financial losses when trading with CXC.

CXC Markets is a trading platform that offers a variety of market instruments for investors. These instruments include forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs.

FOREX CURRENCY PAIRS: CXC Markets provides trading services for forex currency pairs. Forex, also known as foreign exchange, involves the buying and selling of different currencies. Traders can speculate on the exchange rate fluctuations between currency pairs, such as EUR/USD or GBP/JPY. The forex market is known for its high liquidity and round-the-clock trading, allowing investors to take advantage of global economic trends.

PRECIOUS METALS: CXC Markets also offers trading opportunities in precious metals. Precious metals, including gold, silver, platinum, and palladium, are valued for their rarity and industrial uses. Traders can speculate on the price movements of these metals, taking advantage of market fluctuations and global events that impact supply and demand. Precious metals are often considered a safe haven investment during times of economic uncertainty.

CRYPTOCURRENCY: CXC Markets enables trading in cryptocurrencies, which are digital or virtual currencies. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have gained significant popularity in recent years. Traders can participate in the price movements of cryptocurrencies, taking advantage of their volatility. Cryptocurrency markets operate 24/7 and provide opportunities for both short-term trading and long-term investment.

STOCK INDEX CFD: CXC Markets offers trading in stock index contracts for difference (CFD). A stock index represents the performance of a group of stocks from a specific market or sector. With stock index CFDs, traders can speculate on the price movements of the entire index without owning the underlying assets. This allows for greater ability to take both long and short positions. Stock index CFDs provide exposure to broader market trends and are popular among traders seeking diversification.

| Pros | Cons |

| Offers diverse market instruments | Not regulated by any financial regulatory authority |

| Access to forex currency pairs | Higher risk of fraud or financial losses |

| Availability of precious metals trading | Limited information on risk management and regulatory index |

| Enables trading in cryptocurrencies | Lack of transparency due to no regulatory information |

| Offers stock index CFDs for broader market exposure | Limited information on software index and licenses |

CXC offers a range of account types to cater to the diverse needs of traders. These accounts include the Micro Account, Zero Account, and Standard Account. Each account type has its own unique features and benefits.

MICRO ACCOUNT:

The Micro account offered by CXC is designed for traders who prefer smaller trading volumes. With a maximum leverage of 1:500, traders can amplify their trading positions. The minimum deposit required for this account is 10,000 JPY, and the minimum spread starts from 1.3 pips. Traders can trade various products, particularly focusing on currency trading. The minimum position size is 0.01 lots, and the account supports the use of Expert Advisors (EAs). CXC provides deposit and withdrawal methods for this account type, although specific methods are not mentioned. No commission is charged for trades executed in the Micro account.

ZERO ACCOUNT:

With a maximum leverage of 1:500, traders can have increased trading power. The minimum deposit required for this account is 100 USD, and the minimum spread starts from 0 pips. Similar to the Micro account, traders can access a wide range of products, mainly focusing on currency trading. The minimum position size is 0.01 lots, and Expert Advisors (EAs) are supported. Traders using the Zero account will be charged a commission of 8 USD per trade.

STANDARD ACCOUNT:

The Standard account offered by CXC caters to traders looking for a more flexible trading experience. With a maximum leverage of 1:500, traders can enhance their trading potential. The minimum deposit required for this account is 100 USD, and the minimum spread starts from 1.3 pips. Traders can access a variety of products, particularly focusing on currency trading. The minimum position size is 0.01 lots, and the account supports the use of Expert Advisors (EAs). No commission is charged for trades executed in the Standard account.

| Pros | Cons |

| No commission charged in Micro and Standard accounts | Lack of transparency on deposit and withdrawal methods |

| Access to a wide range of trading products | Limited information on specific deposit/withdrawal methods |

| Support for Expert Advisors (EAs) | Commission charged for trades in Zero account |

Leverage refers to the borrowing of funds to increase the potential return on an investment. CXC Markets offers a maximum leverage of 1:1000 for forex trading, which provides traders with the opportunity to control larger positions with a smaller initial investment. This high leverage allows traders to potentially magnify their profits.

CXC offers varying spreads and commission structures across its account types. The Micro Account has a minimum spread of 1.3 pips with no commission, while the Zero Account provides spreads starting from 0 pips but charges a commission of 8 USD per trade. The Standard Account also has a minimum spread of 1.3 pips but does not charge any commission. Traders can choose the account type that aligns with their trading preferences and cost considerations.

The Trading Platform offered by CXC provides an accessible and user-friendly interface for traders. It caters to various account types, with the minimum deposit set at $100 for the Micro account. The platform ensures that traders can engage in their preferred trading activities. Additionally, different account tiers are available, requiring deposits of $500, $1,000, and $10,000, respectively, offering a range of options to suit individual trading preferences.

Deposit and withdrawal options at CXC Markets are straightforward but limited. Traders can fund their accounts using two main methods: bank cards and Bitwallet, which includes cryptocurrencies such as Bitcoin, Litecoin, and Ripple. While these options provide a means of transferring funds, it is important to note that using cryptocurrencies for funding comes with inherent risks. Unlike traditional payment methods, such as bank cards, there is no possibility of initiating a chargeback in case of an issue or error. Therefore, caution should be exercised when choosing to use cryptocurrencies for depositing and withdrawing funds from CXC Markets.

| Pros | Cons |

| Supports Bit wallet for cryptocurrency transfers | Limited deposit and withdrawal options |

| Availability of bank card payments | Using cryptocurrencies for funding carries inherent risks |

| No possibility of initiating a chargeback with cryptocurrency transactions |

CXC Markets offers a range of trading platforms to meet the diverse needs of its users.

META TRADER 4 PLATFORM: CXC Markets provides access to the MetaTrader 4 trading platform, a highly regarded and widely used platform in the brokerage industry. This platform offers numerous trading tools and instruments that enhance the trading experience. Some notable features include a financial calendar, virtual private server (VPS) capabilities, trading signals (available for a subscription fee), a code base with customizable scripts, and a demo account for practice.

WEB TRADER: In addition to MetaTrader 4, CXC Markets also offers a web trader platform. This web-based platform allows traders to access their accounts and execute trades directly through a web browser. It provides an option for traders who prefer not to download and install trading software on their devices. The web trader platform offers similar functionality to the MetaTrader 4 platform, allowing for seamless trading experiences.

Pros and Cons

| Pros | Cons |

| MetaTrader 4 platform, widely used in the brokerage industry | No mention of specific innovative features or advanced tools |

| Web trader platform for browser-based trading | Lack of information on additional platform functionalities |

| Demo account for practice and testing | No mention of integrated educational resources or tutorials |

| Virtual private server (VPS) capabilities for enhanced trading | Limited information on platform customization options |

CXC Markets provides customer support through various channels to cater to the needs of their clients. Their online support is available 24/7, 365 days a year, and can be accessed in multiple languages such as Japanese, English, French, Chinese, and Korean. Clients can reach out to them via email at support@cxcmarkets.com. However, they do not provide a telephone number for customer inquiries. This approach ensures that clients can easily communicate with CXC Markets and receive assistance promptly.

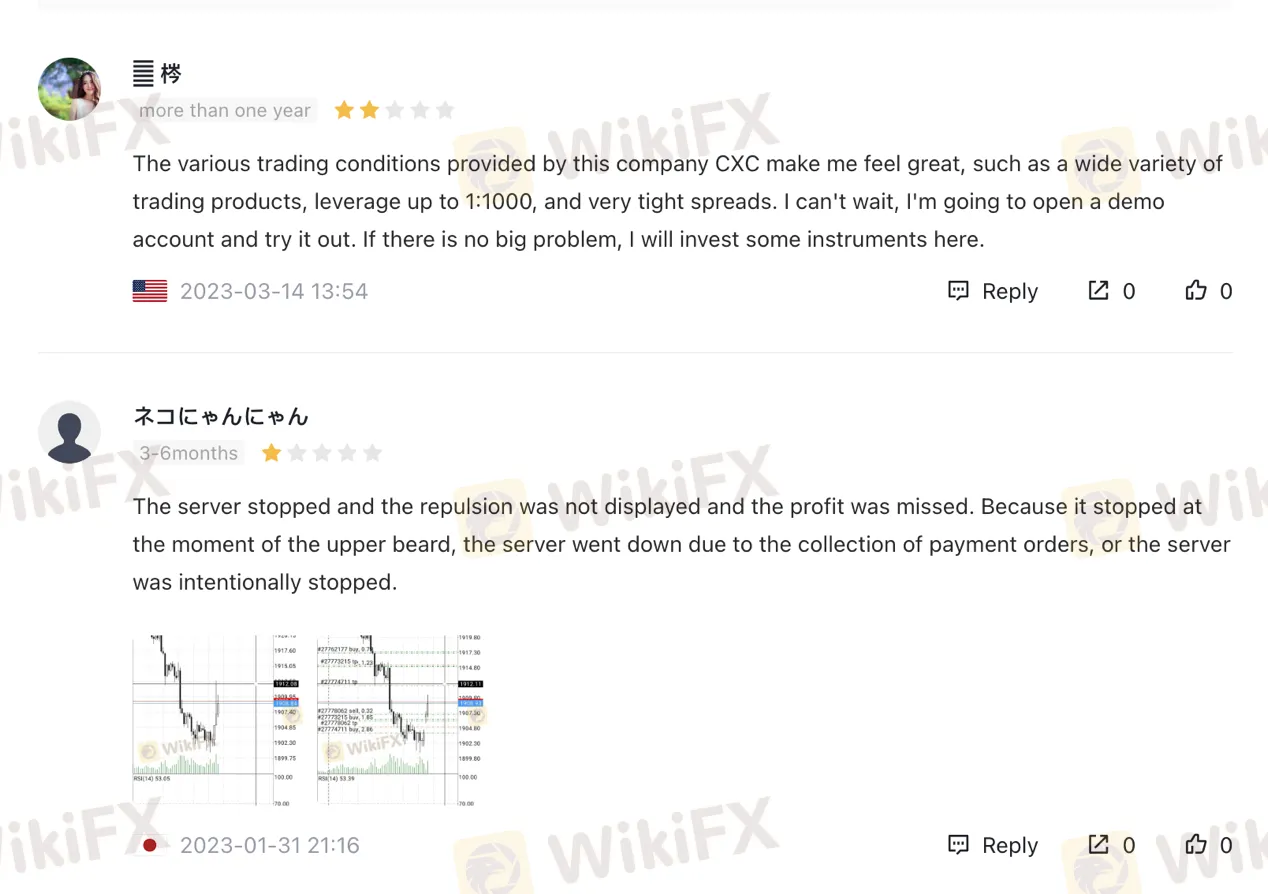

Based on the reviews on WikiFX, there are mixed opinions about CXC. One user expressed satisfaction with the various trading conditions provided by CXC, such as a wide variety of trading products, high leverage of up to 1:1000. They were eager to open a demo account and potentially invest in instruments offered by the broker. However, another user had a negative experience, mentioning server issues that resulted in missed profits. They suspected intentional server shutdowns or problems with payment orders. It is important to note that these reviews reflect individual experiences and should be considered alongside other factors when evaluating a broker.

In conclusion, CXC is a trading platform that offers various market instruments such as forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs. However, it is important to note that CXC is not regulated by any financial regulatory authority, which means there is no government oversight or customer protection. This lack of regulation increases the risk of fraud or financial losses for traders. While CXC provides different account types with features like leverage and low spreads, the limited deposit and withdrawal options and mixed user reviews raise concerns about the reliability and quality of their services. Traders should carefully consider these factors and exercise caution when dealing with CXC.

Q: Is CXC a regulated broker?

A: No, CXC is not regulated by any financial regulatory authority, which increases the risk of trading with them.

Q: What market instruments are available on CXC?

A: CXC offers trading in forex currency pairs, precious metals, cryptocurrencies, and stock index CFDs.

Q: What are the account types offered by CXC?

A: CXC offers Micro, Zero, and Standard accounts, each with its own features and benefits.

Q: What is the maximum leverage offered by CXC?

A: CXC provides a maximum leverage of 1:1000 for forex trading.

Q: What are the deposit and withdrawal methods supported by CXC?

A: CXC supports deposits through bank cards and Bitwallet, including cryptocurrencies like Bitcoin, Litecoin, and Ripple.

Q: What trading platforms are available on CXC?

A: CXC offers the MetaTrader 4 platform and a web trader platform.

Q: How can I contact CXC's customer support?

A: You can contact CXC's customer support through email at support@cxcmarkets.com.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive atfx and cxc-markets are, we first considered common fees for standard accounts. On atfx, the average spread for the EUR/USD currency pair is -- pips, while on cxc-markets the spread is 1.3~.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

atfx is regulated by ASIC,FCA,CYSEC,SCA. cxc-markets is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

atfx provides trading platform including -- and trading variety including --. cxc-markets provides trading platform including Micro account,Zero Account,Standard Account and trading variety including --.