No data

Do you want to know which is the better broker between ATFX and Hirose Financial ?

In the table below, you can compare the features of ATFX , Hirose Financial side by side to determine the best fit for your needs.

EURUSD: 0.3

XAUUSD: 1.2

Long: -6.02

Short: 2.33

Long: -34.43

Short: 19.17

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of atfx, hirose-financial lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| ATFX | Basic Information |

| Company Name | AT Global Markets (UK) Limited |

| Regulated By | FCA, CYSEC |

| Year Founded | 2014 |

| Headquarters | London, UK |

| Trading Platforms | MT4, MT5, and their own proprietary trading platform |

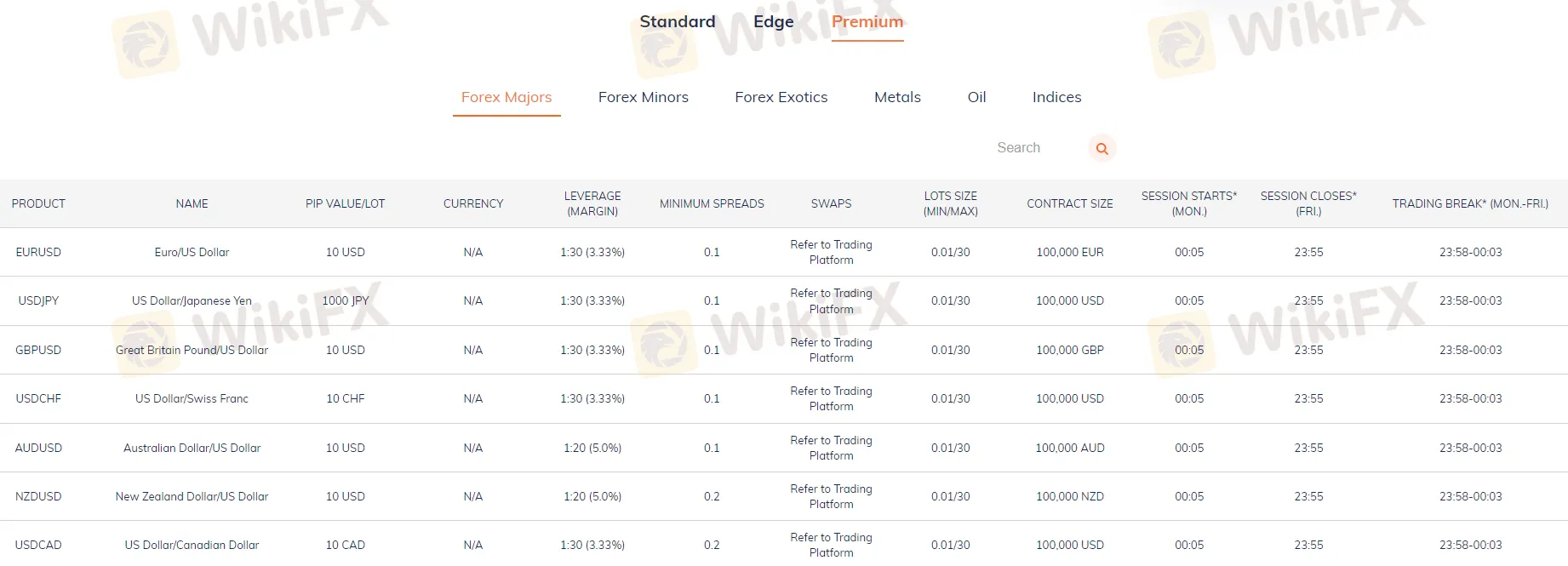

| Account Types | Standard, Edge, Premium |

| Demo Account | Yes |

| Minimum Deposit | $/€/£100 |

| Leverage | Up to 1:30 for retail traders and up to 1:400 for professional traders |

| Spreads | Variable, starting from 0.0 pips |

| Tradable Assets | Forex, CFDs on indices, commodities, and stocks |

| Deposits & Withdrawal Methods | VISA, MasterCard, Skrill, Neteller, Bank Transfer, Trustly |

| Education and Analysis | Webinars, articles, daily market outlooks, technical analysis tools |

| Customer Support | 24/5 via phone, email, live chat, and social media |

ATFX is a global online forex and CFD broker established in 2014, offering a range of trading instruments, including forex, commodities, indices, and shares. The broker also offers several account types, including the Standard Account, Edge Account, and Premium Account, each with different features and benefits to suit different trading needs, with $100 to start. Besides, the broker also offers a demo account for traders to practice and test their strategies. One of the key features of ATFX is its trading platforms. The broker offers the popular MetaTrader 4 (MT4) platform, which is known for its advanced charting tools and user-friendly interface.

ATFX provides its clients with a range of educational resources to help traders improve their trading knowledge and skills. These resources include trading guides, webinars, seminars, and video tutorials. The broker also offers customer support services 24/5 via live chat, phone, and email.

ATFX is a legitimate forex broker that operates under strict regulations. TThis broker is currently regulated by two major financial regulators, the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. These regulators are known for their strict oversight and regulations in the financial industry, which provides traders with a higher level of security and protection. ATFX's compliance with these regulations demonstrates its commitment to transparency and fairness in its business practices.

ATFX has a number of advantages and disadvantages that traders should consider before choosing this broker. On the positive side, ATFX is a well-regulated broker that offers a range of trading platforms and tools, including MetaTrader 4, WebTrader, and mobile trading apps. The broker also provides a wide range of trading instruments, including forex, CFDs, and cryptocurrencies, and offers competitive spreads and low trading fees. In addition, ATFX provides its clients with a variety of educational resources to improve their trading skills and knowledge, and customer support services are available 24/5 through live chat, phone, and email.

On the downside, ATFX has limited options for deposit and withdrawal methods, as it only accepts payments via bank transfers and credit/debit cards. Another potential disadvantage is that ATFX does not offer social trading or copy trading features, which may be important to some traders. Finally, ATFX has limited research and analysis tools compared to other brokers, which may be a concern for more advanced traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATFX provides a wide range of tradable assets to its clients, including forex, metals, oils, indices, cryptocurrencies, and shares. This diverse range of instruments allows traders to diversify their portfolios and take advantage of various market conditions.

Forex-The forex market is the largest financial market in the world, and ATFX provides access to over 100 currency pairs, including major, minor, and exotic pairs.

Precious Metals-The broker also offers trading in precious metals such as gold and silver, which are popular safe-haven assets during times of market volatility.

Indices-Additionally, traders can speculate on the price movements of various indices, including the popular S&P 500 and NASDAQ.

Oils-Oils, such as Brent and Crude Oil, are also available for trading, which are popular among traders due to their high volatility.

Cryptocurrency-ATFX also offers trading in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, which have gained increasing popularity in recent years.

Shares-Lastly, traders can also invest in shares of some of the world's largest companies such as Apple, Amazon, and Google.

| Pros | Cons |

| Wide range of market instruments including forex, metals, oils, indices, cryptocurrencies, and shares. | The selection of instruments may not be as extensive as some other brokers. |

| Highly liquid markets, allowing for efficient trading and price discovery. | Market volatility can lead to significant price fluctuations and potential losses. |

| Ability to trade on leverage, allowing traders to increase their buying power and potential profits. | Trading on leverage also increases the risk of losses, especially for inexperienced traders. |

| Opportunity for diversification, as traders can access a variety of different asset classes through a single broker. | Certain market instruments may have high trading fees or commissions. |

| Market events or news can have a significant impact on market instruments, making them unpredictable at times. |

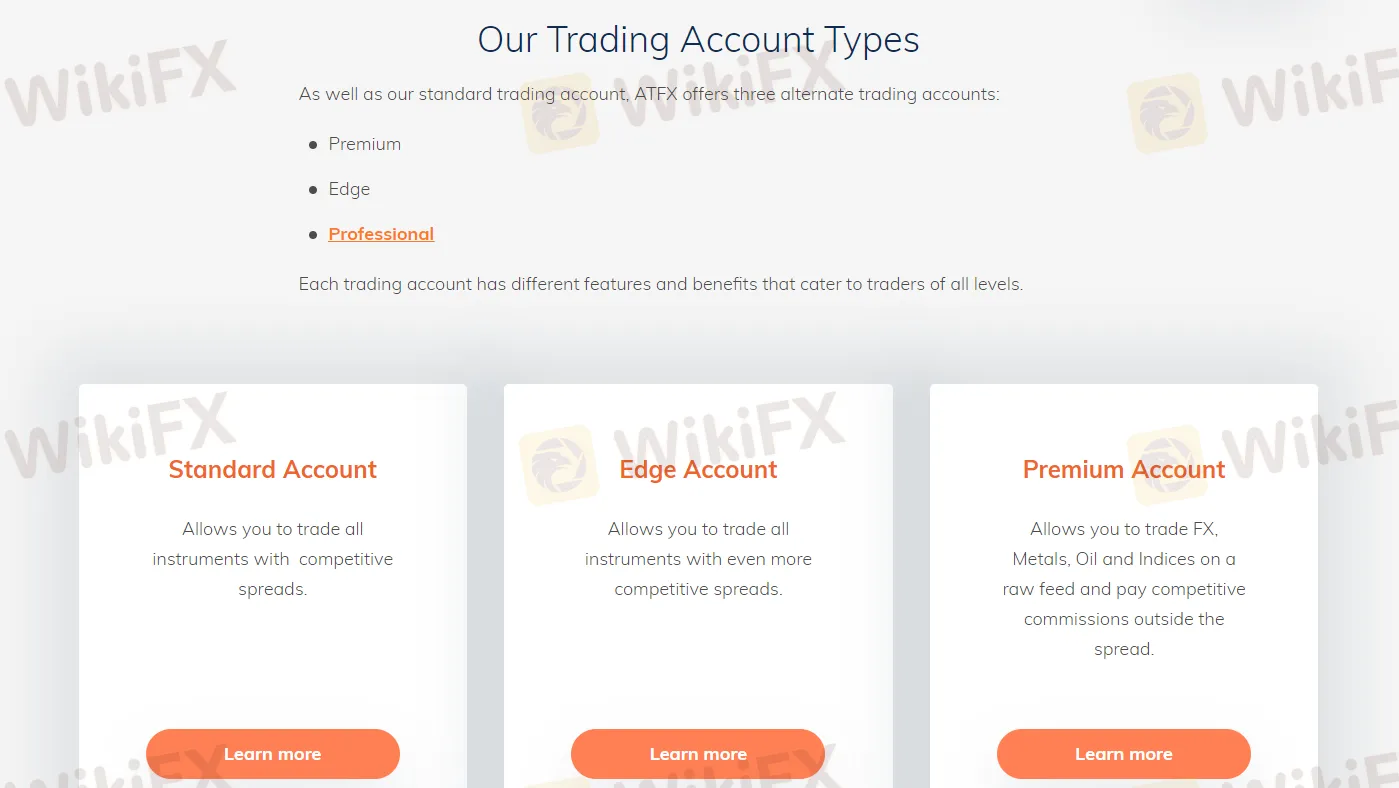

ATFX understands that every trader has their own trading style, preferences, and needs, which is why the broker offers a range of account types to choose from. Whether you're a beginner or an experienced trader, there is an account type that is suitable for you.

The Standard Account is a basic account type that is suitable for beginner traders who are just starting in the forex market. It requires a minimum deposit of $100 and offers fixed spreads starting from 1.0 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares.

The Edge Account is a more advanced account type that is suitable for traders who have some experience in the forex market. It requires a minimum deposit of $5,000 and offers variable spreads starting from 0.6 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares. In addition, the Edge Account offers free VPS hosting, market analysis, and a personal account manager.

The Premium Account is the most advanced account type offered by ATFX, designed for professional traders who require advanced trading features and tools. It requires a minimum deposit of $10,000 and offers variable spreads starting from 0.0 pips. This account type also provides access to the MT4 trading platform and a range of trading instruments, including forex, metals, oils, indices, cryptocurrencies, and shares. The Premium Account offers free VPS hosting, market analysis, a personal account manager, and access to exclusive trading tools, such as Autochartist and Trading Central.

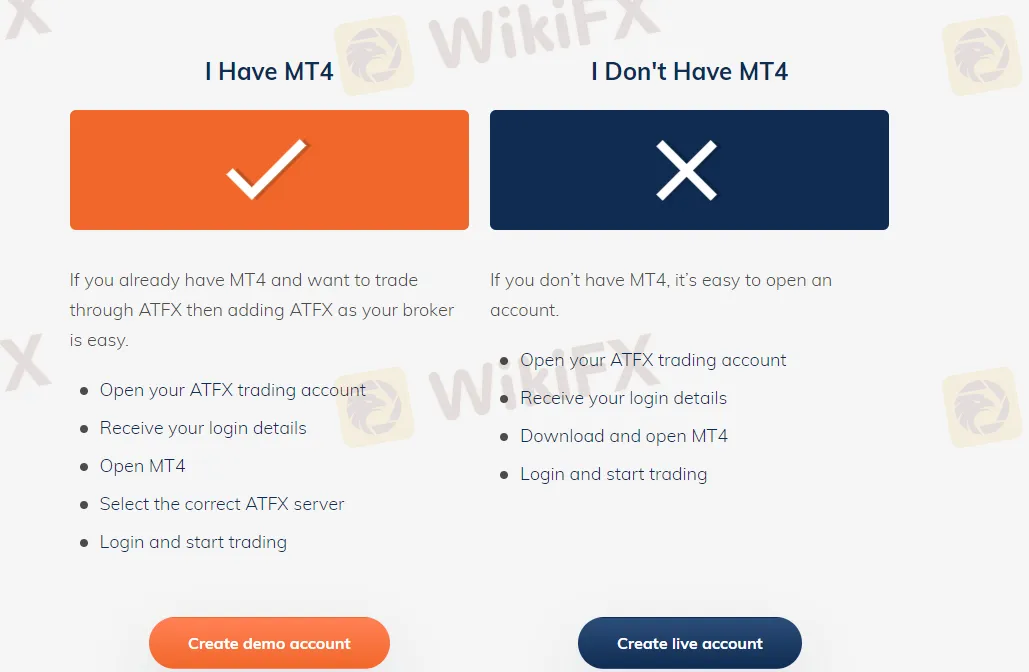

ATFX offers demo trading accounts to its clients, allowing them to practice and familiarize themselves with the trading platform and strategies before committing real funds. Demo accounts are available for all account types, including Standard, Edge, and Premium accounts. These accounts simulate real market conditions, providing traders with the opportunity to test their trading skills and strategies without any financial risks.

The demo accounts are also an excellent tool for beginners who are new to trading as it enables them to learn the basics of trading without the fear of losing money. The demo accounts offer the same features as live accounts, including access to all trading instruments and educational resources, enabling traders to experience the real trading environment.

ATFX's demo accounts have no time limit, giving traders ample time to perfect their trading strategies and techniques. Moreover, traders can switch between the demo and live accounts anytime they want, enabling them to transition smoothly to live trading when they are ready. The demo accounts offered by ATFX are an excellent resource for traders looking to improve their trading skills and strategies in a risk-free environment.

Visit the ATFX website: Go to the ATFX website and click on the “Start Trading” button on the top right corner of the homepage.

Fill in your personal information: You will be directed to a page where you will need to provide your personal information, including your full name, date of birth, contact details, and country of residence. You will also need to choose your preferred account type.

Provide your financial information: You will be asked to provide information about your financial status, including your employment status, annual income, and investment experience.

Submit verification documents: To complete the registration process, you will need to submit a copy of your passport or ID card, as well as a proof of address, such as a utility bill or bank statement.

Fund your account: Once your account is verified, you can fund it using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallet.

Start trading: Once your account is funded, you can start trading on the ATFX platform using your preferred trading instruments and strategies.

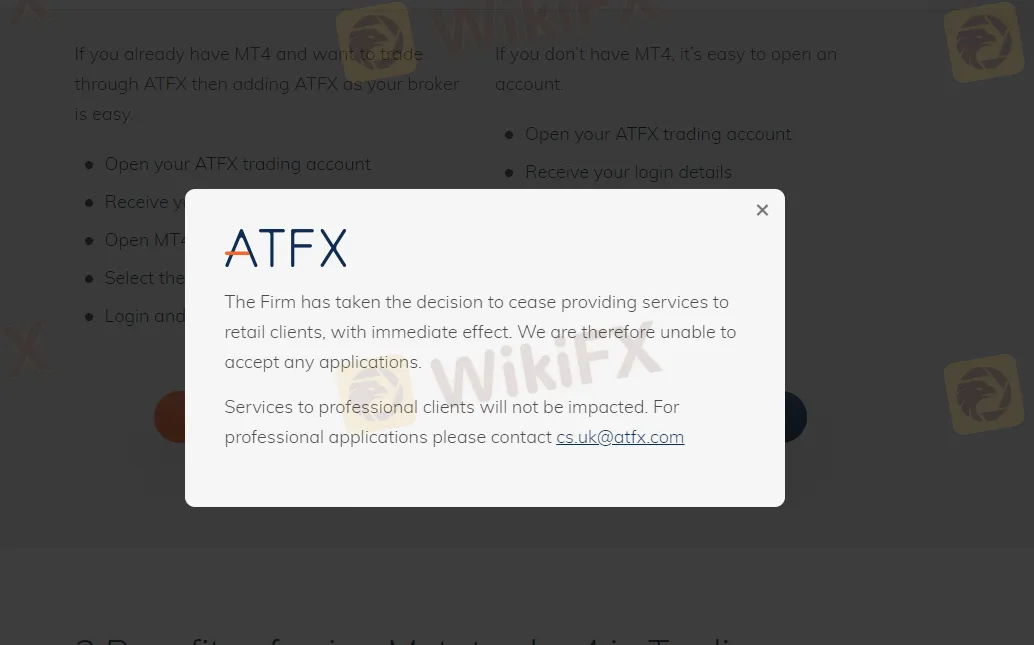

However, when browsing through the broker's website, an unwelcomed page showed up. A message popped up on the screen informing us that only the big shots - professional clients - were allowed to use the trading platform, while retail clients were left out in the cold.

Here's a table that compares the spreads on EUR/USD, UK100, and Oil offered by ATFX, Avatrade, IC Markets, and FP Markets:

| Broker | EUR/USD Spread | UK100 Spread | Oil Spread |

| ATFX | 0.6 pips | 2.5 pips | 0.05 pips |

| Avatrade | 0.9 pips | 1.0 pips | 0.03 pips |

| IC Markets | 0.1 pips | 1.0 pips | 0.03 pips |

| FP Markets | 0.0 pips | 1.0 pips | 0.02 pips |

ATFX offers varying levels of leverage depending on the type of trading account and financial instrument.

For forex trading, the maximum leverage available for retail clients is typically 30:1 for major currency pairs and 20:1 for minor and exotic currency pairs. Professional clients may have access to higher leverage, up to a maximum of 400:1, depending on their trading experience and other criteria.

For trading other financial instruments such as commodities, indices, and shares, the leverage may vary depending on the asset class and market conditions.

It's important to note that while leverage can amplify potential profits, it also magnifies potential losses, so it's crucial to use leverage responsibly and only trade with funds you can afford to lose. Additionally, different regulations may apply in different regions and countries, which could impact the maximum leverage available to traders.

ATFX offers competitive spreads and commissions on its trading accounts, which vary depending on the type of account and trading instrument.

For forex trading, ATFX offers both fixed and variable spreads, depending on the account type. The spreads for major currency pairs on the standard account start from 1.0 pip, while the spreads on the Edge account start from 0.0 pips but come with a commission of $7 per lot traded.

For other financial instruments such as commodities, indices, and shares, the trading fees may vary depending on the specific asset class and trading platform used.

Aside from trading fees, ATFX may charge non-trading fees that traders should be aware of, including:

Inactivity Fee: ATFX may charge an inactivity fee of $50 per quarter for accounts that have been inactive for more than 90 days. This fee may be waived for active traders or in certain circumstances.

Conversion Fees: If you deposit or withdraw funds in a currency different from your account's base currency, ATFX may charge a conversion fee to cover the costs of currency conversion.

Overnight Financing Charges: If you hold a position overnight, ATFX may charge or credit you with an overnight financing charge, also known as a swap fee. This fee is based on the interest rate differential between the two currencies being traded and is typically charged at a fixed percentage of the position value.

Withdrawal Fees: While ATFX does not charge any withdrawal fees, third-party payment providers may charge a fee for their services.

Deposit Fees: ATFX does not charge any deposit fees, but third-party payment providers may charge a fee for their services.

ATFX currently provides the MetaTrader 4 (MT4) platform for its traders, which is a widely used platform among forex traders. It offers advanced charting tools, technical analysis indicators, and automated trading options through Expert Advisors (EAs).

While some traders may prefer other trading platforms, the MT4 platform is a robust and reliable option with a large community of users and third-party developers creating and sharing custom indicators and EAs.

In addition to the MT4 platform, ATFX also offers a range of trading tools and resources, including economic calendars, market analysis, and educational resources such as webinars and tutorials.

Check out this table that compares the trading platforms of ATFX, IC Markets, FP Markets, and Exness:

| Feature | ATFX | IC Markets | FP Markets | Exness |

| Trading Platform | MT4 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Web Trading Platform | Yes | Yes | Yes | Yes |

| Mobile Trading Platform | Yes | Yes | Yes | Yes |

| Social Trading | No | Yes | Yes | No |

| Copy Trading | Yes | Yes | Yes | Yes |

| Trading Signals | Yes | Yes | Yes | Yes |

| Automated Trading | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes | Yes |

ATFX's minimum deposit requirement of $100 makes it an accessible option for traders who are just starting out or those who prefer to trade in smaller amounts. The following payment methods are available for deposits:

Credit/Debit Cards: Visa and Mastercard are accepted. The processing time for deposits made via credit/debit cards is instant, and there are no fees charged by ATFX.

Bank Wire Transfer: Deposits can be made via bank wire transfer. The processing time for this method varies, and it may take 2-5 business days to reflect in the trader's account. ATFX does not charge fees for deposits made through bank wire transfer, but traders should check with their bank for any charges that may apply.

Online Payment Methods: ATFX also supports online payment methods such as Skrill, Neteller, and Trustly. Deposits made using these methods are typically processed instantly. ATFX does not charge fees for deposits made through online payment methods, but third-party payment providers may charge a fee for their services.

How to withdraw money from my trading account?

Log in to the secure Client Portal section of our homepage, then click “Withdrawal”.

This broker will always return funds to the original source they were deposited. For example, if a deposit is made by credit card, funds will be returned to the same credit card. The return can be done through bank transfer, credit/debit card or e-wallet transfers.

If you are withdrawing profit, this broker may ask you for bank account details to send funds directly to your account.

Please note: Your bank account must be fully verified before submitting a withdrawal request.

The time it takes for funds to return to a trader's bank account will depend on the withdrawal method used.

For bank transfers, once the funds have been removed from the trading account, it will take 3-5 business days before they arrive in the trader's bank account. The actual time required for processing may vary, and traders should refer to their bank for more information.

If using an e-wallet, funds will typically be returned to the trader's e-wallet within 2 business days.

For refunds to credit/debit cards, the process typically takes 2-5 business days after the withdrawal has been successfully processed. However, if there are restrictions preventing funds from being returned to the card, ATFX may request a valid bank statement and return the funds to the trader's registered bank account. In such cases, the trader will be contacted by their relationship manager.

All withdrawal requests received before 2 pm (UK time) on a business day will be processed on the same day. Requests received after this time will be processed on the next available business day.

It seems that ATFX understands the importance of providing reliable and efficient customer support to help traders along the way. Whether you're a seasoned professional or just starting out, the brokerage firm offers a range of customer support options to ensure that you have access to the assistance you need, when you need it.

Live Chat: ATFX provides a live chat feature on their website, which allows traders to chat with a customer support representative in real-time. This option is convenient and efficient, as traders can get their questions answered without having to wait for a response via email or phone.

Email: Traders can contact ATFX's customer support team by email. The brokerage firm aims to respond to all queries within 24 hours, making this a good option for non-urgent matters.

Phone: ATFX also provides a phone number for traders to call if they prefer to speak to a customer support representative directly. The phone lines are open from Monday to Friday, during business hours.

FAQ Section: ATFX's website also features a comprehensive FAQ section, which covers a range of topics such as account opening, funding, trading platforms, and more. This section can be a useful resource for traders who prefer to find answers to their questions independently.

Social Media: ATFX has an active presence on social media platforms such as Facebook, Twitter, and LinkedIn. Traders can use these channels to connect with the company and stay up to date with news and updates.

ATFX offers a wide range of educational resources to help traders improve their skills and knowledge.

One of the primary educational resources available through ATFX is their comprehensive online trading academy. This academy provides traders with a variety of resources, including webinars, videos, articles, and e-books, all designed to help traders learn the fundamentals of trading and improve their strategies. The academy covers a range of topics, from basic concepts such as market analysis and risk management to more advanced topics like trading psychology and algorithmic trading.

In addition to the online trading academy, ATFX also offers a range of educational resources specifically tailored to the needs of different traders. For example, beginners can take advantage of the company's beginner's course, which provides an introduction to the basics of trading, while more experienced traders can benefit from advanced courses covering topics such as technical analysis and trading psychology.

ATFX also provides traders with access to a variety of market analysis tools and resources. These include daily market analysis reports, economic calendars, and real-time news feeds, all of which can help traders stay informed about the latest market trends and make more informed trading decisions.

ATFX is a well-known brokerage firm that offers a variety of trading services and features for traders of all levels. The brokerage's competitive trading conditions, such as low spreads, high leverage, and multiple trading instruments, provide traders with opportunities across various markets.

Additionally, ATFX provides several customer support channels, including live chat, email, and phone, to help traders with their queries and concerns. The brokerage also offers educational resources, such as an online trading academy and tailored courses, to help traders develop their knowledge and skills.

While ATFX has received positive feedback from some traders, as with any brokerage firm, there are also negative reviews and complaints online. However, these reviews should be taken with a grain of salt, and traders are encouraged to conduct their research and make informed decisions before investing their funds with any broker.

Q: Is ATFX a regulated broker?

A: Yes, ATFX is a regulated broker that is authorized and regulated by multiple financial authorities, including the FCA in the UK, the CySEC in Cyprus.

Q: What is the minimum deposit requirement for ATFX?

A: The minimum deposit requirement for ATFX is $100.

Q: What trading platforms does ATFX offer?

A: ATFX offers the popular MetaTrader 4 (MT4) trading platform for desktop, web, and mobile devices.

Q: What are the trading fees and spreads at ATFX?

A: ATFX offers competitive trading conditions, including tight spreads and low commissions. The exact trading fees will depend on the account type and trading instrument.

Q: What payment methods are accepted by ATFX?

A: ATFX accepts a range of payment methods, including bank wire transfer, credit/debit cards, and e-wallets. The availability of payment methods may vary depending on the trader's location.

Q: Does ATFX offer a demo account?

A: Yes, ATFX offers a demo account for traders to practice their trading strategies and familiarize themselves with the trading platform before trading with real money.

Q: Does ATFX offer customer support?

A: Yes, ATFX provides customer support through multiple channels, including live chat, email, and phone. Traders can also access a comprehensive FAQ section on the ATFX website.

Q: Is ATFX suitable for beginner traders?

A: Yes, ATFX offers a range of educational resources, including an online trading academy and tailored courses, to help beginner traders develop their knowledge and skills. Additionally, the broker offers a demo account for traders to practice their trading strategies before trading with real money.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Hirose Financial Review Summary in 10 Points | |

| Founded | 2010 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | Forex, Spot Gold |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.8 pips |

| Trading Platforms | MT4, LION Trader (ActTrader) |

| Minimum Deposit | USD 0 |

| Customer Support | Email, Phone, Live chat, Request form |

Hirose Financial UK is a FCA regulated Forex trading company offering multiple trading solutions to the FX community basing in the UK. It is founded in 2010, a subsidiary of Hirose Tusyo of Japan. The broker provides online trading services for the foreign exchange market, allowing clients to trade various currency pairs. They offer both major and minor currency pairs, as well as exotic currency pairs.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • No commission fees | • Limited trading instruments |

| • Demo account available | • No MetaTrader 5 platform integration |

| • MetaTrader 4 (MT4) platform support | • Limited payment methods |

| • No minimum deposit requirement | |

| • Regulated by FCA | |

| • Multiple base currencies available for accounts |

There are many alternative brokers to Hirose Financial depending on the specific needs and preferences of the trader. Some popular options include:

IC Markets - A popular and reputable Forex and CFD broker with competitive pricing and advanced trading platforms.

Pepperstone- An award-winning Forex and CFD broker with low fees, fast execution speeds, and multiple trading platforms.

OANDA- A trusted global Forex and CFD broker with an easy-to-use trading platform, competitive pricing, and excellent customer service.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Based on the information available, Hirose Financial is authorized and regulated by the Financial Conduct Authority (FCA), which makes it appears to be a reliable and reputable online broker. But it is important to note that experience alone does not guarantee the legitimacy or security of a brokerage firm. Exposure of withdrawal and fraud issues are red flags that should not be ignored as well.

Anyway, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Hirose Financial UK offers a large range of Forex instruments for traders, with a wide selection of over 46 currency pairs to trade.

Forex trading involves the buying and selling of different currencies in pairs, with the aim of profiting from the fluctuations in their exchange rates. Traders can engage in trading major currency pairs such as EUR/USD, GBP/USD, USD/JPY, as well as minor and exotic currency pairs through Hirose Financial.

Demo Account: Hirose Financial provides a free demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Hirose Financial offers the advantage of no minimum deposit requirement to open a live account, allowing traders to start trading without any specific financial commitment while deposit requirements vary depending on the chosen deposit method.

When it comes to leverage, Hirose Financial enables its clients to use the maximum trading leverage up to 1:30. Leverage is a mechanism that allows traders to control larger positions in the market with a smaller amount of capital. With a leverage ratio of 1:30, traders can potentially amplify their trading positions by up to 30 times their invested capital. This means that for every $1 of capital, traders can have exposure to $30 worth of assets in the market.

While leverage can magnify potential profits, it's important to note that it also increases the risk of losses. Higher leverage ratios come with increased market exposure and the possibility of larger losses if the trades move against the trader's expectations. Therefore, it's crucial for traders to use leverage judiciously and implement appropriate risk management strategies to protect their capital.

Hirose Financial's provision of leverage up to 1:30 may be suitable for traders who are comfortable with a certain level of risk and have a thorough understanding of the potential implications of trading with leverage. It's important for traders, especially beginners, to educate themselves about leverage, its risks, and how to use it responsibly before engaging in leveraged trading.

Hirose Financial offers competitive spreads on its trading platforms. For the LION Trader (ActTrader) platform, traders can benefit from spreads starting from as low as 0.7 pips. This means that the difference between the buying and selling prices of currency pairs or other instruments can be as minimal as 0.7 pips, offering potentially tighter pricing for traders.

On the MetaTrader 4 (MT4) platform, Hirose Financial provides spreads starting from 1.9 pips. While slightly higher than the LION Trader platform, it still offers competitive pricing for traders using MT4. Both platforms aim to offer traders access to tight spreads, allowing for more cost-effective trading.

It's worth noting that Hirose Financial does not charge commissions on trades. This indicate that traders can execute their trades without incurring additional fees beyond the spread. This fee structure can be beneficial for traders, as it allows for more transparent and predictable transaction costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Hirose Financial | Variable | No commissions |

| IC Markets | 0.1 pips | $7 (round turn) |

| Pepperstone | 0.09 pips | No commissions |

| OANDA | 0.9 pips | No commissions (except for ECN) |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Hirose Financial UK offers its clients the flexibility to trade on multiple devices through their supported platforms. Traders can access the popular MetaTrader 4 (MT4) platform on various devices, including PC, iPad, iPhone, and Android devices. This allows for seamless trading experiences across different operating systems and devices, catering to the diverse needs of traders.

Additionally, Hirose Financial provides the Lion Trader platform, which is available on PC, iPhone, iPad and Android devices. The Lion Trader platform offers a user-friendly interface and features specifically designed to enhance the trading experience. Traders can conveniently access their trading accounts, monitor market movements, execute trades, and manage their positions from their preferred devices.

Overall, Hirose Financial's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Hirose Financial | MT4, Lion Trader |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, WebTrader |

| OANDA | OANDA Trade, MetaTrader 4, MT4 Hedging |

Hirose Financial offers convenient options for depositing and withdrawing funds.

Deposits: Traders can make deposits using Neteller, a popular electronic payment method, or through wire transfers. Additionally, Hirose Financial allows for account balance transfers between accounts without any extra fees.

Withdrawals: When it comes to withdrawals, traders have the choice of using Neteller, local wire transfer, or international wire transfer. Neteller offers a seamless and quick withdrawal process. Local wire transfers are available for withdrawals in GBP, EUR, and USD, with specific handling fees applicable. For international wire transfers, fees vary based on the currency, and additional fees may apply when funds are returned to the beneficiary bank.

There are no extra fees when making deposit within Hirose Financial, while for withdrawals, theres different thresholds and handling fees:

Neteller: with Neteller withdrawals, there are no fees involved, and the minimum withdrawal amount is 20 GBP, 20 USD, or 20 EUR, maximum withdrawal limit is 5,000 USD per transaction.

Local wire transfers: Clients can expect a fee of £6.00 for GBP, £8.50 for EUR, and £8.50 for USD, along with a minimum withdrawal amount of 20 GBP, 20 USD, or 20 EUR by this method.

International wire transfers: there will be £5.00 for EUR and £8.50 for USD and GBP via this method, with a minimum withdrawal amount of 50 GBP, 50 USD, or 50 EUR.

It's important to note that additional fees may apply for certain transactions, such as when returning international wire transfers to the beneficiary bank. Clients should consult their own banks for specific details regarding any additional fees.

On our website, you can see that a report of unable to withdraw. Traders are encouraged to carefully review the available information. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Hirose Financial provides multiple customer service options to assist its clients. Customers can reach out to Hirose Financial through various channels to address their queries and concerns as below:

Phone: +44 (0)20 3089 3880

Customer support email: info@hiroseuk.com.

Additionally, Hirose Financial offers a Contact Us form on their website. Customers can fill out this form with their queries, providing details about their specific needs or concerns.

Live chat support is also available for immediate assistance.

Additionally, Hirose Financial offers screen sharing functionality through Skype.

Besides of this, you can also get in touch with this broker on some social networks such as Twitter, Facebook and YouTube while their FAQ section is a valuable resource for finding quick answers to common queries as well.

Overall, Hirose Financial's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • Direct Contact | • Quality and Expertise |

| • Accessibility | |

| • Personalized Support | |

| • Multi-channel support |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Hirose Financial's customer service.

Hirose Financial offers a comprehensive educational package to support traders in their journey.

The educational resources include a forex guide, trading manual, and glossary, providing valuable insights and knowledge about the foreign exchange market. These resources aim to enhance traders' understanding of forex trading concepts, strategies, and terminology.

In addition to the foundational materials, Hirose Financial also offers educational resources on technical analysis and economic indicators. Technical analysis equips traders with tools and techniques to analyze price charts, identify trends, and make informed trading decisions. Economic indicators provide valuable information about the overall economic health which can impact currency markets. By understanding and interpreting these indicators, traders can better anticipate market movements and adjust their strategies accordingly.

Whether traders are beginners or experienced, these educational materials can serve as valuable references to improve their trading abilities and make more informed decisions in the forex market.

According to available information, Hirose Financial is a regulated UK-based brokerage firm. While the firm has significant experience in the industry and offers a professional Forex trading and receives a lot of good reviews from their clients, it is important to consider certain factors such as reports of unable to withdraw that may raise concerns. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from Hirose Financial before making any investment decisions.

| Q 1: | Is Hirose Financial regulated? |

| A 1: | Yes. It is regulated by Financial Conduct Authority (FCA). |

| Q 2: | At Hirose Financial, are there any regional restrictions for traders? |

| A 2: | Yes. Hirose Financial UK is unable to open accounts from US citizens or residents and Japan residents. |

| Q 3: | Does Hirose Financial offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Hirose Financial offer the industry leading MT4 & MT5? |

| A 4: | Yes. It offers MT4 on Windows, iOS and Android devices. |

| Q 5: | What is the minimum deposit for Hirose Financial? |

| A 5: | The minimum initial deposit to open an account is $0. |

| Q 6: | Is Hirose Financial a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various Forex trading instruments with competitive trading conditions on the leading MT4 platforms and its own LION Trader. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive atfx and hirose-financial are, we first considered common fees for standard accounts. On atfx, the average spread for the EUR/USD currency pair is -- pips, while on hirose-financial the spread is EURUSD 1.9 GBPUSD 2.9 AUDUSD 2.9 USDJPY 1.9.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

atfx is regulated by ASIC,FCA,CYSEC,SCA. hirose-financial is regulated by FCA,LFSA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

atfx provides trading platform including -- and trading variety including --. hirose-financial provides trading platform including MT4,LION Trader and trading variety including --.