简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/GBP Price Momentum Fades into Eurozone GDP, UK Inflation

Abstract:Spot EURGBP could gyrate and even drift lower if high-impact event risk surrounding Eurozone GDP and UK inflation data due Wednesday sparks a reversal in favor of the British Pound.

BRITISH POUND TURNS TO INFLATION DATA AS EURO SINKS AHEAD OF EUROZONE GDP

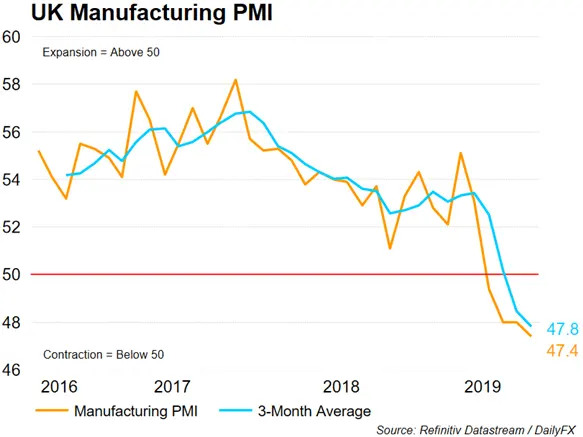

The British Pound remains bogged down by Brexit turmoil, but selling pressure could wane if July UK inflation data stimulates risk appetite

Spot EURGBP prices might retrace lower if firm UK inflation keeps Bank of England rate cuts at bay amid deteriorating Eurozone GDP growth and rising prospects for ECB stimulus

Check out our Q3 GBP Forecast for comprehensive fundamental and technical analysis

EURGBP has recorded an impressive stretch of gains since May with the influx of no-deal Brexit risk driven by Prime Minister Boris Johnson taking over as head of British Parliament. Meanwhile, the ECB has communicated a monetary policy stance that appeared less dovish than expected which has exacerbated upward price action in spot EURGBP. That said, the currency pair seems overdue for a retracement lower and spot EURGBP selling pressure could be sparked by Wednesdays high-impact economic data due for release out of the UK and EU.

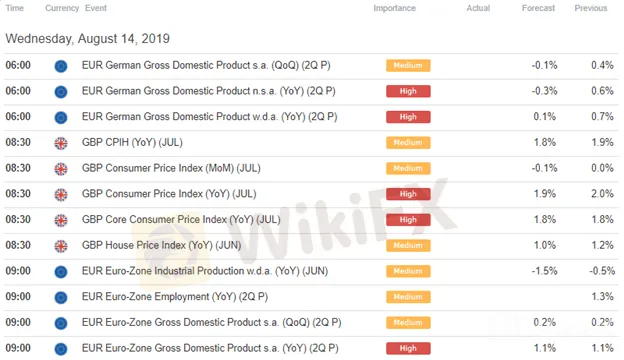

EURGBP – FOREX ECONOMIC CALENDAR

Take a look at the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases!

EURGBP forex traders will likely turn to the latest readings on UK inflation and Eurozone GDP slated to cross the wires at 8:30 GMT and 9:00 GMT respectively. Although, German GDP data will be released slightly earlier at 6:00 GMT Wednesday which could preview the headline Eurozone GDP figure considering that Germany is the cornerstone of the EUs economic engine. Increasingly pessimistic outlook and disappointing data prints for the Eurozone economy does not bode well for bullish Euro prospects as it will likely accelerate expectations for additional ECB stimulus.

Also, the potential of UK inflation coming in hotter than the 1.8% figure expected could keep BOE rate cut bets at bay with the central bank opting to stay sidelined as the latest Brexit developments unfold. According to overnight swaps, rate traders are pricing in a 55% probability that the BOE cuts rates by 25 basis points before year-end.

EURGBP PRICE CHART: DAILY TIME FRAME (APRIL 29, 2019 TO AUGUST 13, 2019)

EURGBP overnight implied volatility of 8.11%, which is slightly higher than its 12-month average of 7.09%, suggests that spot prices will trade between 0.9226-0.93050 with a 68% statistical probability. Despite potential for a British Pound rebound, however, sterling selling pressure will likely linger with no-deal Brexit risk casting a shadow over GBP price action.

EURGBP – IG CLIENT SENTIMENT INDEX PRICE CHART: DAILY TIME FRAME (FEBRUARY 14, 2019 TO AUGUST 13, 2019)

Yet, retail forex traders remain overwhelmingly net-short EURGBP according to IG Client Sentiment data and suggests spot prices could continue to rise seeing that we typically take a contrarian view to crowd sentiment. The number of traders net-long is 18.2% higher than last week while the number of traders net-short is 2.4% higher than last week. Overall, 19.1% of spot EURGBP traders are net-long resulting in a short-to-long ratio of -4.23.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Euro Gaps Lower vs British Pound Ahead of ECB, Brexit Volatility

The British Pound and the Euro will be closely watching how Brexit negotiations unfold as the October 31 deadline approaches.

UK PM Johnson May Call Snap Election, GBP/USD Slammed

UK PM Johnson May Call Snap Election, GBP/USD Slammed

GBP/USD Price Outlook: Rebel MPs Attempt to Block No-Deal Brexit

GBP/USD Price Outlook: Rebel MPs Attempt to Block No-Deal Brexit

GBPUSD Outlook: Volatility Begins to Awaken as Brexit Risks are Priced In

GBPUSD Outlook: Volatility Begins to Awaken as Brexit Risks are Priced In

WikiFX Broker

Latest News

BSP Approves Coins.ph to Launch Peso Stablecoin

FCA bans and fines James Lewis £120,300 for putting investors at risk

FCAA Warns Against Morgan Stern

FCA Warns Against SolidusMarkets

INFINOX Leads the Financial Sector with Green Initiatives

FCA Warns Against CryptosMarket

Is StoneX Reliable?

IC Markets Secures Regulatory License in Kenya

ASIC freezes assets of Brisbane financial advisor

Q1 2024: Philippine Economy Grows 5.7%, Impacts on Filipinos

Currency Calculator