SuperTrader Markets

Abstract:SuperTrader Markets is an Australian financial derivatives broker founded by a team with extensive experience in the financial, foreign exchange, and technology sectors. SuperTrader Markets says to be regulated by the Australian Securities and Investments Commission (ASIC, License No. 443886). However, it is a suspicious clone.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| SuperTrader Markets Review Summary in 10 Points | |

| Founded | 2003 |

| Registered Country/Region | Australia |

| Regulation | ASIC (suspicious clone) |

| Market Instruments | Currency pairs, indices, precious metals, commodities, energy |

| Demo Account | N/A |

| Leverage | 1:400 |

| EUR/USD Spread | From 1.5 pips (Std) |

| Trading Platforms | MT4/5 |

| Minimum Deposit | $100 |

| Customer Support | Phone, email |

What is SuperTrader Markets?

SuperTrader Markets is an Australian financial derivatives broker founded by a team with extensive experience in the financial, foreign exchange, and technology sectors. SuperTrader Markets says to be regulated by the Australian Securities and Investments Commission (ASIC, License No. 443886). However, it is a suspicious clone.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

SuperTrader Markets offers a wide range of financial instruments through the popular trading platforms like MT4 and MT5.

However, SuperTrader Markets Australia Securities & Investment Commission (ASIC, License No. 443886) license is a suspicious clone. Additionally, there are reports of potential scams and withdrawal issues associated with SuperTrader Markets, which raises concerns about the reliability of the platform.

| Pros | Cons |

| • Wide range of financial instruments available for trading | • Suspicious clone ASIC license |

| • Support for popular trading platforms like MT4 and MT5 | • Reports of potential scams and withdrawal issues |

| • Diverse selection of payment methods for deposits and withdrawals | • Limited info on deposit/withdrawal details |

| • Various fees charged |

Considering these factors, traders are advised to proceed with caution, conduct thorough research, and carefully evaluate the risks before engaging with SuperTrader Markets. It's crucial to prioritize the security of funds and ensure the legitimacy of the platform before making any trading decisions.

SuperTrader Markets Alternative Brokers

AvaTrade - a reputable broker with a user-friendly platform, offering a wide range of instruments and excellent customer service.

Swissquote - a reliable broker known for its strong regulatory framework, advanced trading technology, and comprehensive research tools.

Hantec Markets - a trusted broker that provides competitive spreads, multiple trading platforms, and a range of educational resources for traders of all levels.

There are many alternative brokers to SuperTrader Markets depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is SuperTrader Markets Safe or Scam?

SuperTrader Markets is associated with a suspicious clone Australia Securities & Investment Commission (ASIC, License No. 443886) license and there are concerns about its legitimacy, it's important to exercise caution. It is recommended to thoroughly research the company, verify its regulatory status independently, and consider the risks associated with trading on an unregulated platform. Additionally, it is advisable to consult with financial professionals or regulatory authorities for further guidance before engaging with SuperTrader Markets or any similar entity.

Market Instruments

SuperTrader Markets offers a diverse range of financial trading instruments to investors. One of their primary focuses is the Forex market, where traders can access popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more. These currency pairs allow investors to engage in foreign exchange trading and take advantage of fluctuations in exchange rates.

In addition to Forex, SuperTrader Markets provides access to various indices, which represent the performance of a group of stocks from a specific market or sector. Investors can trade on major global indices like the S&P 500, FTSE 100, DAX 30, and others. This allows for exposure to the broader stock market performance and the opportunity to speculate on the direction of specific indices.

SuperTrader Markets also offers trading opportunities in precious metals like gold, silver, platinum, and palladium. These metals are considered safe-haven assets and are often sought by investors during times of market uncertainty. Trading in precious metals allows investors to hedge against inflation or diversify their portfolio.

Furthermore, SuperTrader Markets provides access to commodities and energy products, including oil, natural gas, agricultural products, and more. Commodities trading allows investors to participate in the price movements of these essential resources, which can be influenced by factors such as global supply and demand, geopolitical events, and weather conditions.

Lastly, SuperTrader Markets offers offshore RMB trading, which allows investors to trade the Chinese currency, Renminbi (RMB), against other major currencies. This feature enables traders to take advantage of the growing importance of the Chinese economy and its currency in the global financial markets.

Accounts

There are two different types of accounts available on the SuperTrader Markets platform, Standard and ECN accounts. The Standard account is designed for traders with a lower initial deposit requirement of $100. It provides access to a wide range of trading instruments and features, making it suitable for both beginner and intermediate traders.

On the other hand, the ECN account is tailored for more experienced traders who require direct market access and tighter spreads. It requires a higher minimum initial deposit of $2,000. The ECN account provides traders with the opportunity to trade with some of the best available bid/ask prices from multiple liquidity providers. This type of account offers transparency, faster trade execution, and potentially lower trading costs.

Leverage

SuperTrader Markets provides traders with a maximum trading leverage of up to 1:400. Leverage is a financial tool that allows traders to amplify their trading positions by borrowing funds from the broker. With higher leverage, traders can control larger positions in the market with a smaller amount of capital.

The offered leverage of 1:400 by SuperTrader Markets is relatively high and provides traders with the potential for significant profit opportunities. However, it is important to note that leverage is a double-edged sword and comes with increased risk. While it can magnify profits, it also amplifies losses, and traders need to exercise caution and have a solid risk management strategy in place.

Spreads & Commissions

SuperTrader Markets offers different spreads and commissions depending on the chosen account type. For the Standard account, traders can expect spreads starting from 1.5 pips on major currency pairs like EUR/USD. This means that there is a 1.5 pip difference between the buying and selling price of the currency pair. It's important to note that spreads may vary depending on market conditions and volatility.

One advantage of the Standard account is that it does not require any commissions. Traders can execute trades without incurring additional charges beyond the spread. This can be beneficial for traders who prefer a straightforward pricing structure and want to avoid paying commissions.

On the other hand, the ECN account offered by SuperTrader Markets comes with tighter spreads, starting from as low as 0.0 pips on major currency pairs. ECN accounts provide traders with direct access to liquidity providers, resulting in potentially lower spreads. However, it's important to note that ECN accounts typically require a commission per trade.

For the ECN account at SuperTrader Markets, there is a commission of $7 per standard lot traded. This means that traders will be charged a fixed commission fee for each round-turn trade (opening and closing a position). The commission is a separate cost that traders need to consider in addition to the spread.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| SuperTrader Markets | From 1.5 pips (Std) | No commission (Std) |

| AvaTrade | Variable | No commission |

| Swissquote | Variable | No commission |

| Hantec Markets | Variable | No commission |

Please note that the actual spreads and commissions may vary depending on market conditions and the specific account type chosen with each broker. It's always recommended to refer to the brokers' official websites or contact their customer support for the most up-to-date and accurate information on spreads and commissions.

Trading Platforms

SuperTrader Markets provides traders with access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Both platforms are widely recognized in the industry for their advanced features, user-friendly interface, and comprehensive trading tools.

The MetaTrader 4 platform offered by SuperTrader Markets is known for its stability and robustness. It provides a wide range of features that cater to the needs of both beginner and experienced traders. Traders can access real-time market quotes, execute trades with a single click, and customize their trading strategies using various technical indicators and charting tools. MT4 also supports automated trading through the use of expert advisors (EAs) and allows for the development of custom indicators and scripts.

For traders seeking an enhanced trading experience, SuperTrader Markets also offers the MetaTrader 5 platform. MT5 builds upon the strengths of its predecessor and provides additional features and functionalities. Traders can access a greater variety of financial instruments, including stocks and futures, on the MT5 platform. It offers an improved depth of market (DOM) feature, allowing traders to view the liquidity of different price levels and make more informed trading decisions. MT5 also supports hedging, allowing traders to open multiple positions in the same instrument, including both long and short positions.

Both MT4 and MT5 platforms offered by SuperTrader Markets are available for desktop computers (Windows and macOS), as well as mobile devices (iOS and Android). This enables traders to access their trading accounts and monitor the markets at any time and from anywhere. The platforms are highly regarded for their stability, speed, and extensive functionality, making them suitable for traders of all levels.

Overall, SuperTrader Markets' offering of both the MT4 and MT5 platforms provides traders with a powerful and flexible trading environment, equipped with advanced tools and features to support their trading strategies and decision-making process.

See the trading platform comparison table below:

| Broker | Trading Platform |

| SuperTrader Markets | MetaTrader 4 (MT4) |

| AvaTrade | AvaTradeGO, MT4, MT5 |

| Swissquote | Advanced Trader, MT4 |

| Hantec Markets | MT4, Currenex |

Deposits & Withdrawals

SuperTrader Markets offers a variety of convenient and secure payment options for depositing and withdrawing funds from traders' investment accounts. Traders can choose from several popular methods, including VISA, MasterCard, wire transfer, Skrill, PayPal, China UnionPay, Neteller, and Alipay.

The minimum deposit requirement at SuperTrader Markets is $100, allowing traders with different budgets to start trading. This lower minimum deposit threshold makes it more accessible for traders to enter the market and begin their trading journey.

SuperTrader Markets minimum deposit vs other brokers

| SuperTrader Markets | Most other | |

| Minimum Deposit | $100 | $100 |

Fees

There are specific fees associated with different destinations. For transactions to China, a fee of A$20 applies, while transactions to Hong Kong incur a fee of A$30. For transactions to other locations, the fee is slightly higher at A$40. For local bank transfers of less than A$10,000, there is a fixed fee of A$20.

Additionally, there is a non-exchange fee of 2% applicable to certain transactions. This fee is typically levied on non-trading-related transactions and may vary depending on the specific nature of the transaction. In the event of a TT amendment, where changes need to be made to a bank transfer, SuperTrader Markets charges a bank fee of A$30.

Customer Service

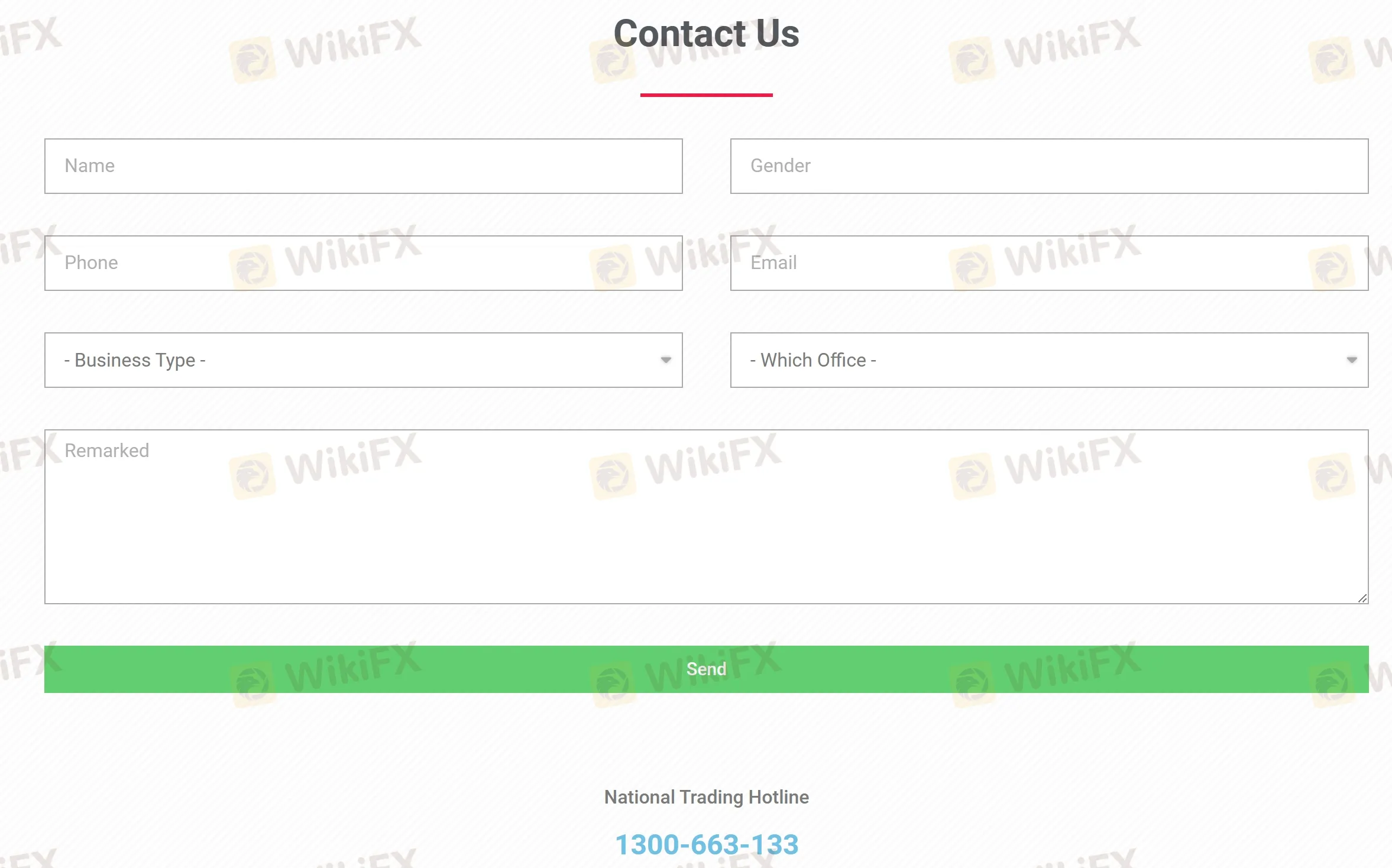

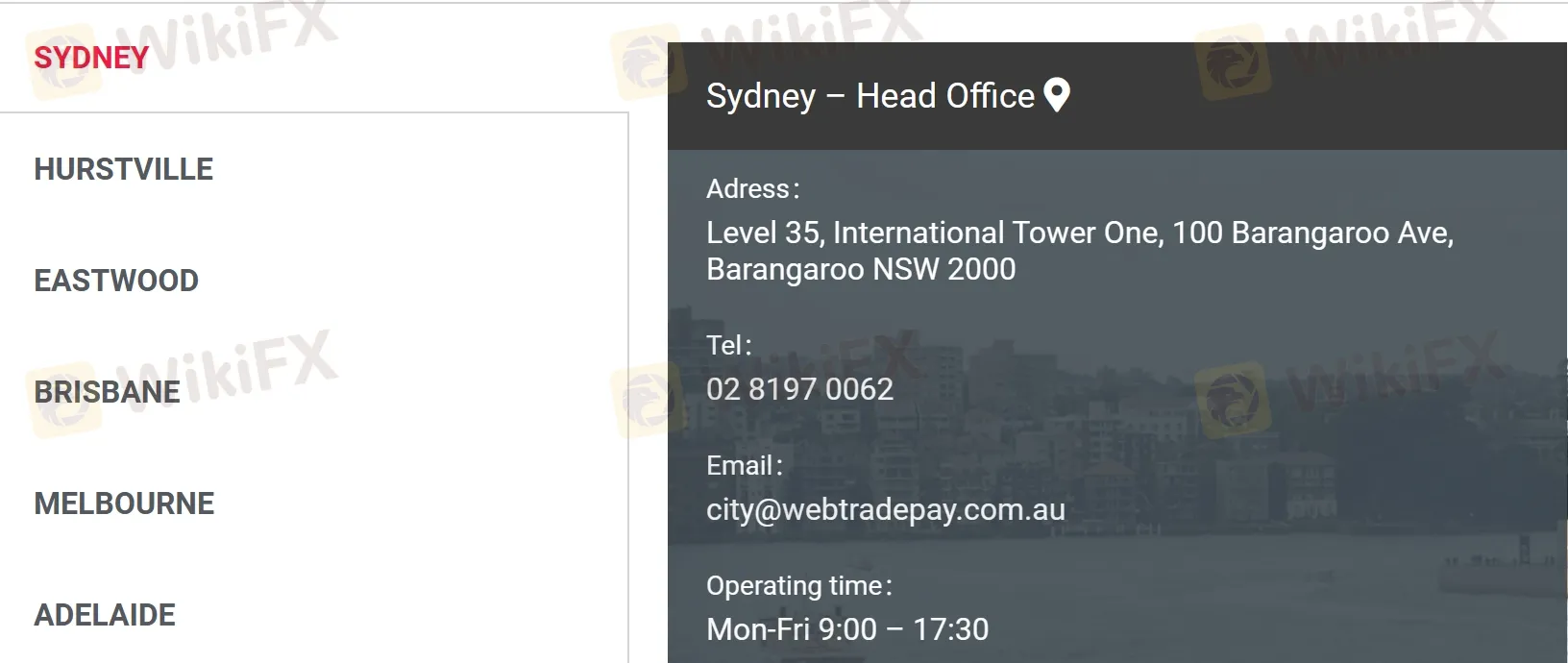

SuperTrader Markets is committed to providing customer support through various channels to ensure that clients' inquiries and concerns are addressed promptly. Traders can reach out to the customer service team via phone, email, or by sending messages online. This allows for flexibility and convenience in contacting the support team, regardless of the preferred communication method.

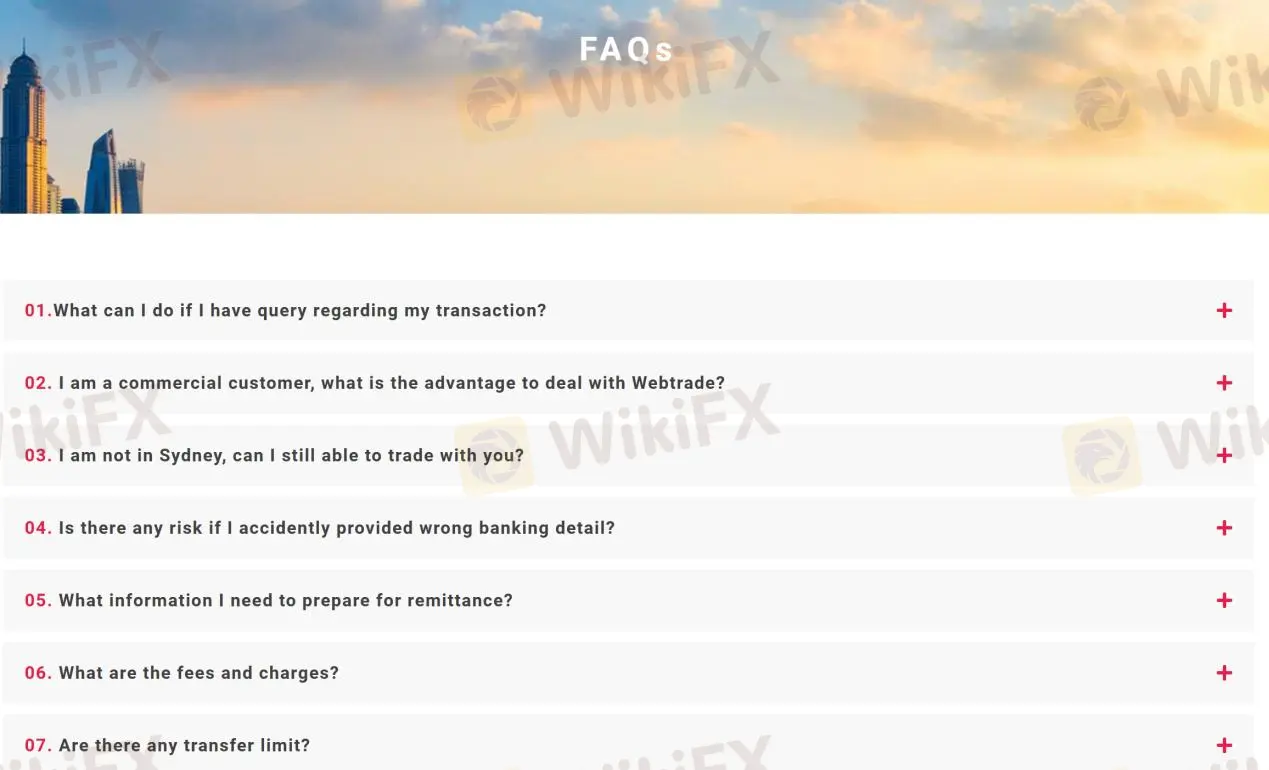

In addition to direct contact options, SuperTrader Markets provides an extensive Frequently Asked Questions (FAQs) section on their website. This resource serves as a valuable self-help tool, covering common questions and providing detailed explanations on various aspects of trading, account management, and platform features. Traders can refer to the FAQs section to find answers to their queries without the need for immediate assistance from the customer service team.

| Pros | Cons |

| • Multiple contact options | • No 24/7 customer support |

| • FAQ section available for quick self-help | • No live chat support |

| • No social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with SuperTrader Markets' customer service.

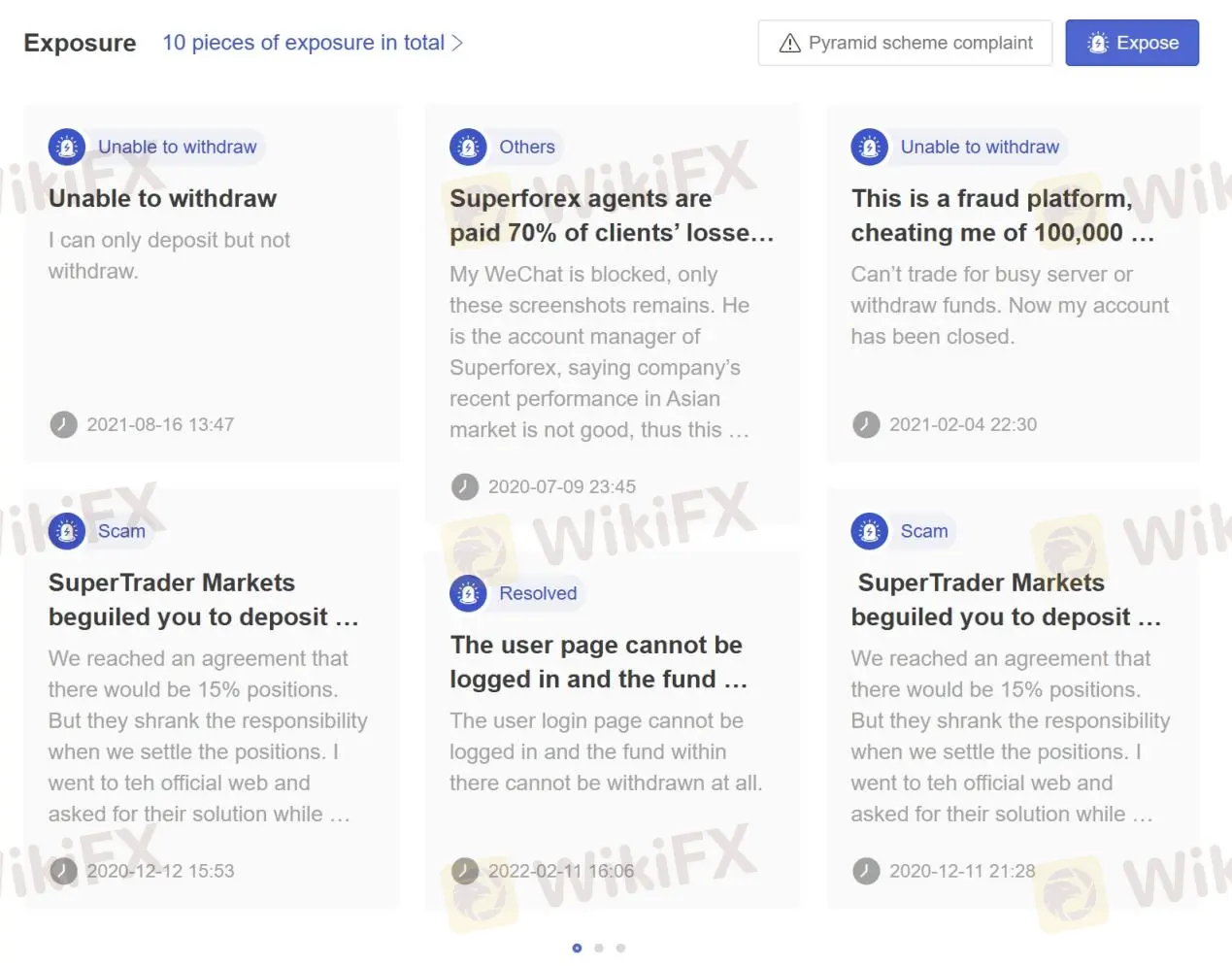

User Exposure at WikiFX

On our website, you can see that reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

SuperTrader Markets presents itself as a financial trading platform offering a diverse range of instruments and regulated by the Australia Securities & Investment Commission (ASIC) (clone license). However, there are concerns and reports of potential scams and withdrawal issues associated with the platform, which raises doubts about its credibility.

While the availability of different trading accounts, high leverage ratios, and support for popular trading platforms like MT4 and MT5 are beneficial, the lack of transparency is a drawback. Traders are advised to exercise caution, thoroughly research the platform, and consider the associated risks before engaging with SuperTrader Markets.

Frequently Asked Questions (FAQs)

| Q 1: | Is SuperTrader Markets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does SuperTrader Markets offer the industry leading MT4 & MT5? |

| A 2: | Yes. It supports MT4 and MT5. |

| Q 3: | What is the minimum deposit for SuperTrader Markets? |

| A 3: | The minimum initial deposit to open an account is $100. |

| Q 4: | Is SuperTrader Markets a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Though it advertises well, it lacks valid regulation. |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binance’s ChangPeng Zhao to Face 3 Years of Imprisonment?

FCAA warns Investors against Fintech Market

PH SEC Warns Against TRADE 13.0 SERAX

CFI Collaborates with TradingView for Enhanced Trading Experience

U.S. Seeks 3-Year Sentence for Ex-Binance CEO Zhao

FCA exposed a clone firm

Crypto.com Faces Regulatory Issues with South Korea's Launch

Crypto Exchange CoinW Launches Prop Trading in Dubai

Clone of Morgan Financial Ltd.

CAPPMOREFX AGAIN IN NEWS !!

Currency Calculator