- Seguire

- Business

- Momenti

外汇全套搭建TG:@Float99

Seguire

white label / brokrage / forex / crypto / cfd / setup / build / solution / Trading Platform / Tradin

Ouchuang is a professional platform building company. After decades of development, we have an absolute leading position in the field of financial technology services.

This is thanks to our large team of experts in the financial and Internet fields. The continuous and repeated calculation and upgrading of products and services and the application of advanced technologies have won us the trust of more than 500 customers around the world.

Ouchuang's services are obvious to all, well-known and well-received. In addition to providing a safe, stable and fast trading system. At the same time, we also have more than 40 sets of product supporting service solutions, truly providing "one-stop" services.

Glofen GFT

Seguire

THE OBJECTIVE OF THIS COMPANY

Join us on this exciting journey as we redefine the future of finance, one trade at a time. Glofen Empowering you to unlock the full potential of cryptocurrency."

telegram-GN518

Seguire

@mt4mt5 software construction, foreign exchange broker platform construction, cryptocurrency trading

mt4/mt5 software construction, foreign exchange broker platform construction, cryptocurrency trading #System#

加我飞机@tom312341或SK live:.cid.42d88687c1dcf88d

Seguire

Bamboo Pay

VND, MYR, USDT, payment channel

The most stable in the market, automatic deposits arrive in seconds, and withdrawals are T0, fast and safety. Mainly engaged in forex broker, BC, welcome to discuss

Alpha Trade

Seguire

Alpha Trade: Professional leader of liquidity service, creator of a safe trading environment

A safe and regular liquidity supplier is critical to foreign exchange traders. Especially in the trading of funds, foreign exchange liquidity suppliers that can provide security guarantees are more popular with investors. As a professional liquid service provider, Alpha Trade can provide customers with a safe and stable trading environment, and has a good reputation in the customer group.

Alpha Trade can ensure the security of funds, and strict supervision is a major reason. The existence of supervision can ensure the compliance and transparency of the foreign exchange market, and then protect the rights and interests of investors. Alpha Trade follows strict and formal international financial regulatory standards and has successfully obtained the Australian ASIC license (hereinafter referred to as ALPHA Trade (Australia)). As Australia's financial regulatory agency, ASIC has won widespread recognition of global investors with its strict regulatory standards and efficient execution. In operating under ASIC's regulation, Alpha Trade (Australia) can provide customers with a truly safe and reliable, compliant and transparent trading environment for customers' funds.

Secondly, a series of security trading tools and functions are also the fund security guarantee brought by Alpha Trade to customers. Choose Alpha Trade's fund manager, and can use a dedicated PAM/MAM system. The system can help fund managers efficiently manage customer accounts through flexible transaction distribution, real -time information inspection, customer volume detection, and transaction volume and order frequency analysis. Decisions and risk management, transactions are more secure.

In addition, Alpha Trade and HSBC HSBC Bank, Credit Suisse Swiss, Barclays Barclays Bank, UBS UBS Group, Citibank Citi Bank and other banking institutions cooperate to ensure their sufficient liquidity. At the same time, through ECN, POP, non -bank liquidity, and special liquidity pools, Alpha Trade can provide Alpha Trade Liquidity better than all POP providers in today's market to escort customers' security transactions.

As the amount of funds continues to increase, the customer's security requirements for the platform will be stricter. And Alpha Trade's liquidity supplier will adhere to the bottom line of security, and is committed to providing the most competitive liquidity services for various types of assets. Create a truly safe trading environment to ensure the smooth progress of the transaction.

清风飞机V1686

Seguire

✔Various financial platform software construction, including foreign exchange mt4/mt5, stock exchan*

Foreign exchange main label white label, exchange platform construction/dedicated deposit channel docking, license application, and those who can achieve stable long-term cooperation can be appropriately relaxed, click to view the link and join me to discuss in detail #System#

Various financial platform software construction, including foreign exchange mt4/mt5, stock exchange

提供长期稳定技术7

Seguire

Intraday trading EA, full process EA, automated trading intelligent EA, currency hedging actual trading for many years

Chrisclipx

Seguire

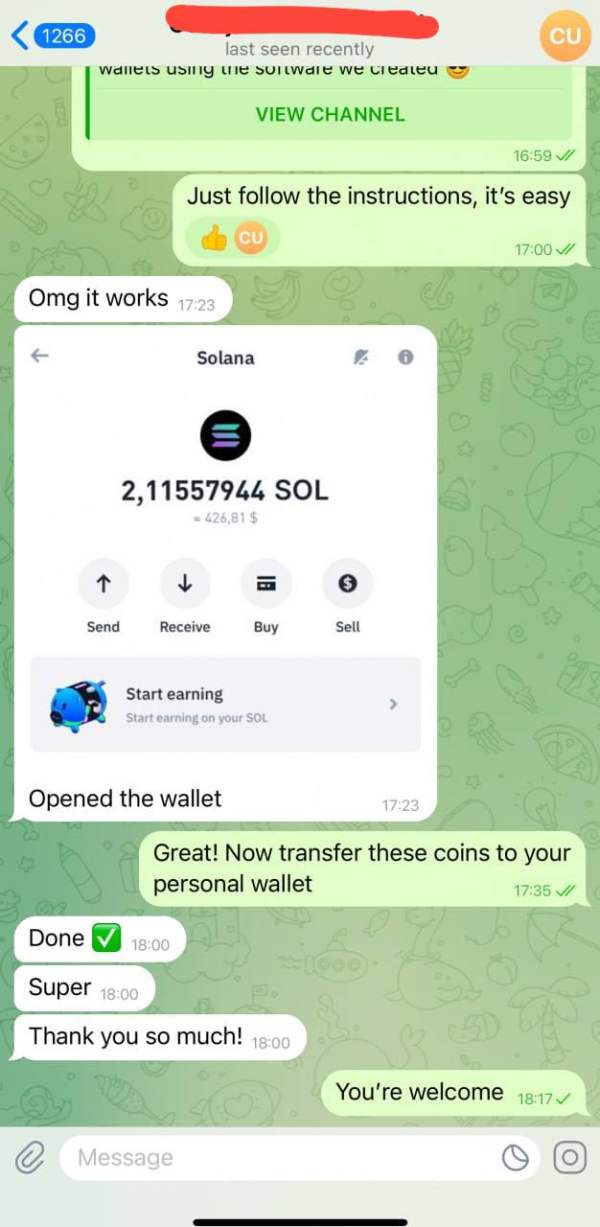

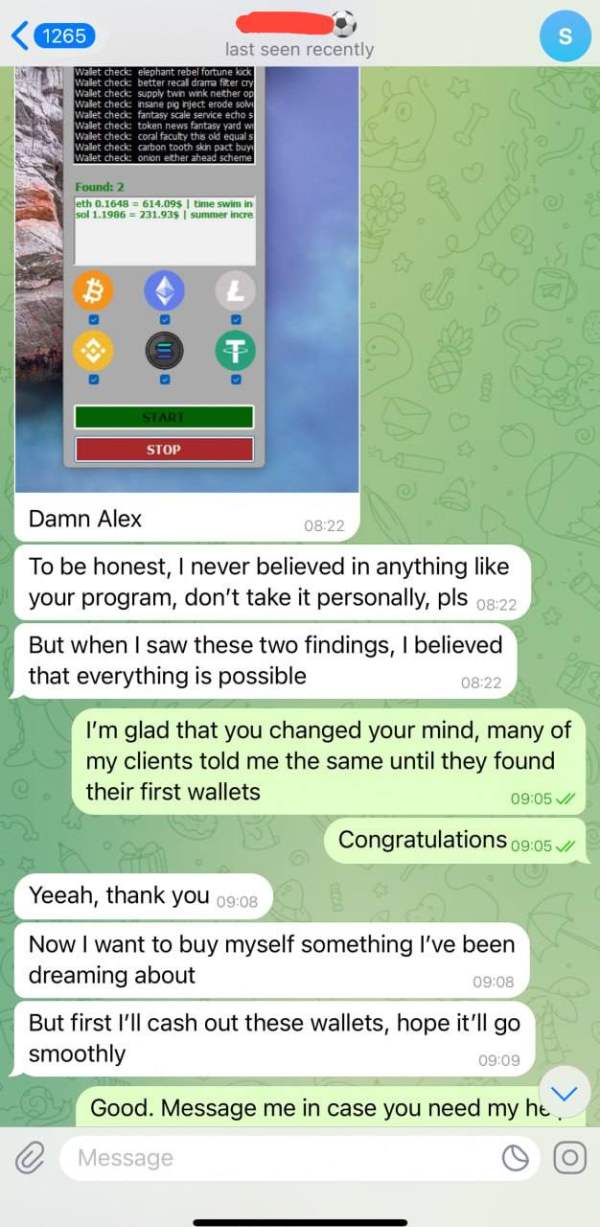

wallet finder software

HOW TO MAKE PASSIVE INCOME LIKE WE DO🔥

➡ TO CHOOSE A SUBSCRIPTION for wallets searching based on what level of income we expect

➡ TO RUN A SOFTWARE, click START and to wait for a wallet to be found

➡ TO ENTER THE KEYS to get access to a wallet with any application, like Trust Wallet

➡ TO WITHDRAW ALL COINS that you see inside to your personal wallet

more instructions on channel

While you're waiting for the next Monday to start - MY CLIENTS GET THEIR FIRST WALLETS NOW 💎

And remember - The only limit to our realization of tomorrow will be your doubts of today❗️

GUYS, JUST TO MENTION - I'm not saying that with our software you'll become rich overnight or find a wallet with millions inside ❌

✔ But, what you can really get is a WORKING AND STABLE TOOL 💻 that you can use to make a some thousand dollars a month depending on the subscription type👌🏻

copy the link to join us on telegram

https://t.me/+_e7cURjxIaQ1YTY0

纸飞机@GN518

Seguire

Foreign exchange business license application, license application, regulatory compliance, company registration, financial regulatory issues services,One-stop platform construction/license processing, stable and safe, aggregating payment channels: wide selection of payment currencies, diverse payment methods, undertaking long-term business operations, If You Are the One+++

飞机@Float99

Seguire

One-stop MT5,MT4 🌟#ST5, #FX6, #Tradingweb

Carica di più

Accesso/Registrati

Business

Momenti

Persone che potrebbero essere interessate

Modificare

FX1840849093

Seguire

FX2032207426

Seguire

Professor Tayyab

Seguire

VT招代理、高返佣、EA信号源跟单-小风经理

VT Markets·Dipendente

Seguire

FX2337172387

Seguire