No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between XM and CMCMarkets ?

In the table below, you can compare the features of XM , CMCMarkets side by side to determine the best fit for your needs.

EURUSD: -0.3

XAUUSD: 0.1

Long: -7.23

Short: 1.11

Long: -46.74

Short: 19.67

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of xm, cmc-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulatory status | ASIC, CYSEC, FSA, FSC and DFSA |

| Year(s) of incorporation | 10-15 years |

| Market instruments | Currency pairs, stocks, commodities, precious metals, energies, indices... |

| Minimum initial deposit | $5 |

| Maximum leverage | 1:1000 |

| Minimum spread | From 0.6 pips |

| Trading platform | MT5, MT4, own platform |

| Deposit and withdrawal methods | credit or debit card, Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay |

| Customer Service | Email/phone number/address/live chat |

| Fraud allegations | Not yet |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide variety of financial instruments to operate.

It offers popular platforms such as MT4 and MT5, as well as its own APP.

Demo account available to practice before trading with real money.

It offers educational resources such as market analysis, economic calendars and courses.

24/7 customer service via live chat, email and telephone.

Cons:

The $10,000 minimum deposit for the stock account may be prohibitive for some traders.

Spreads on some accounts may be higher than those offered by other brokers.

Commissions are applied to the share account.

The maximum leverage of 1:1000 may increase risk for inexperienced traders.

Regulation in Cyprus may be less stringent than in other European countries.

| Dimension | Advantages | Disadvantages |

| Broker Model | XM offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' operations, XM has a potential conflict of interest that can lead to decisions that are not in the best interest of its clients. |

XM is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, XM acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of offering leverage. However, this also means that XM has a certain conflict of interest with its clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interest of their clients. It is important for traders to be aware of this dynamic when trading with XM or any other MM broker.

Regulation is a key dimension to consider when choosing a forex broker, as it offers some protection to the client in terms of security of funds, transparency and fairness of operations. XM is a Cyprus registered company and regulated by several major regulatory bodies, including ASIC, CYSEC, FSA, FSC and DFSA.

ASIC is the Australian Financial Services Authority and is responsible for regulating the financial sector in Australia. CYSEC is the Cyprus Securities and Exchange Commission and is the financial regulatory authority in Cyprus. The FSA is the Financial Services Authority of the United Kingdom and regulates the financial sector in the United Kingdom. The FSC is the Financial Services Commission of Mauritius, which regulates the financial sector in Mauritius. The DFSA is the Dubai Financial Services Authority and is the financial regulatory authority in Dubai.

Multi-entity regulation provides greater customer protection, as it means that the broker is subject to multiple sets of regulations and standards. In addition, this can enhance the broker's reputation in the industry.

In summary, XM is a forex broker regulated by several entities, which provides clients with greater protection and transparency in their operations.

XM is a Forex and CFD broker based in Cyprus and regulated by several internationally renowned financial authorities, including ASIC, CYSEC, FSA, FSC and DFSA. It offers a wide variety of financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies, etc. Clients have access to several trading platforms, including MT4, MT5 and the XM mobile app, and can choose from four different account types. XM also offers a free demo account, educational resources and 24/7 customer support.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of financial instruments to choose from | It can be overwhelming for new or inexperienced traders. |

| Traders can diversify their portfolio | Some financial instruments may have limited liquidity |

| Opportunities to take advantage of different markets | Traders may need to perform additional analysis of the different markets and their influencing factors. |

| Greater flexibility to implement different strategies | Some traders may not be interested in certain financial instruments. |

XM offers its traders a wide variety of over 1000 financial instruments, including cryptocurrencies, stocks, metals, currency pairs, indices, energies and more. This variety allows traders to diversify their portfolios and take advantage of different markets to implement different trading strategies. Traders also have the flexibility to choose from a wide range of financial instruments and select the ones that best suit their trading preferences and objectives. However, for some new or inexperienced traders, the variety of financial instruments can be overwhelming, and some instruments may have limited liquidity, which can make trading them difficult.

| Advantages | Disadvantages |

| Low Spreads | Spreads can be higher during periods of high volatility |

| No commissions charged on the first three accounts | A commission is charged on the share account. |

| Highly leveraged accounts | Spreads may vary according to account type and time of day. |

In terms of spreads and commissions, XM offers low spreads on the first three commission-free accounts. However, during periods of high volatility, spreads may be higher. On the equity account, a commission is charged in addition to the spreads. The accounts offer high leverage, which means that investors can trade significantly more money than they have in their account. Spreads can vary by account type and time of day, so investors should keep an eye out for changes. In general, XM offers competitive spreads and account options to suit different investment levels.

| Advantages | Disadvantages |

| Low minimum deposit accounts | The share account has a high minimum deposit |

| Offers account options for different investment levels | A commission is charged on the share account. |

| No commissions charged on the first three accounts | There is no leverage in the share account. |

| High leverage on the first three accounts | The ultra low account has higher spreads than other accounts. |

XM offers a variety of account types to suit different investment levels. The micro, standard and ultra low accounts have no high minimum deposit and no commissions are charged. The ultra low account has higher spreads than the other accounts, but the goal is to offer even lower spreads than those offered in the micro and standard accounts. The stock account has a minimum deposit of $10,000 and a commission is charged. No leverage is offered on the share account, which means investors must invest the full amount of their trade. In general, XM offers account options for different investment levels.

The XM demo account is an excellent tool for novice traders or those who wish to test new trading strategies without risking their capital. The demo account comes with a virtual trading platform that replicates live trading conditions and can be accessed from any device. Traders can practice their trading skills and familiarize themselves with the financial instruments available at XM without having to risk their money. In addition, the XM demo account has no time restrictions, which means that traders can use it for as long as they need before they start trading with a live account. Overall, the XM demo account is a valuable tool for those who wish to improve their trading skills before getting involved in live trading.

XM, is a broker, which has an account opening with a minimum deposit of $5. The steps for account opening

How can you open an XM Broker account?

Currently, there are numerous online brokers on the market, where you can trade forex, CFDs. Each of them offers a variety of trading accounts, in a simple and fast way, where there are brokers that have an easier registration process. Below are the steps to follow for opening an XM Broker account:

a) Fill in your personal data and address in the online registration form.

b) Usually, you have to choose the leverage, to comply with regulatory bodies, in this broker does not meet the regulatory parameters. So be careful.

c) Upon completion, it is recommended to read, agree and accept the terms and conditions of the contract.

d) Sending documentation, there are brokers that request documentation, in this case, the company does not indicate the requirement of the same.

e) Proof of identity, you must send a scanned document proving your identity, e.g. passport, ID card or driver's license. Must be valid

f) Proof of Address: as to the veracity of the address, a scanned copy of the current utility bill verifying the address must be provided.

g) Make initial deposit: each Broker establishes its minimum deposit, for the opening of the trading account it offers.

h) Upon completion of the registration process, you have access to the client area with the Broker.

| Advantages | Disadvantages |

| It offers the popular MT4 and MT5 platforms, which are widely used by traders around the world. | XM's proprietary trading platform may have fewer features than MT4 and MT5. |

| MT4 and MT5 offer extensive customization possibilities and a wealth of technical indicators and analysis tools. | The learning curve can be steep for beginners using MT4 and MT5. |

| The XM mobile app is easy to use and is available for both iOS and Android. | Users may have trouble switching from one platform to another if they are used to a particular one. |

XM offers its clients a selection of trading platforms, including the popular MT4 platform and its successor, MT5. In addition, the company has also developed its own custom trading platform for those looking for something different. Both platforms offer a wide variety of technical indicators, analysis tools and customization possibilities. XM's mobile app is also easy to use and is available on iOS and Android. However, for those who are comfortable with a particular platform, it may be difficult to switch to another platform. Beginners may also find the MT4 and MT5 learning curve steep, although the customization possibilities and variety of analysis tools may make it worth the effort. Overall, XM offers a solid selection of trading platforms to meet the needs of all traders.

XM also offers a series of instructional videos, such as this one from its YouTube channel, on how to open an account using MT4.

| Advantages | Disadvantages |

| Enables operators to expand their investment capacity | Significantly increases the risk of loss |

| Possibility of obtaining higher profits with less capital | Requires greater knowledge and experience of the market |

| Allows diversification of the portfolio with larger positions | Lack of proper management can lead to large losses |

| Greater flexibility to operate different instruments | Increased exposure to the risk of market fluctuations |

Leverage is an important tool in Forex trading that allows traders to have greater exposure to the market with limited capital. At XM, the maximum leverage offered is 1:1000, which means that for every $1 of capital, the trader can control up to $1000 in the market. This can be attractive to traders looking to maximize their profits with less capital.

However, it is also important to note that high leverage carries a higher risk of loss. If the market moves against the trader's position, losses can be significant. That is why it is important for traders to have proper risk management and understand the risks associated with trading with leverage before trading XM.

In XM deposits and withdrawals are made from the user's site, and is functional on mobile devices can use mobile trading.

There are brokers that accept bank transfers and credit or debit card payments. Some brokers offer greater facilities by implementing the possibility of payment through electronic means of payment such as Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay, etc.

| Advantages | Disadvantages |

| Wide variety of educational resources, including market analysis, economic calendars, signals and online courses. | Not all educational resources are available in all languages. |

| Offers trading tools and videos to help traders improve their skills. | The quality of educational resources may vary depending on the trader's level of experience. |

| Offers regular webinars and online seminars. | Some educational resources may not be up to date with the latest market developments. |

XM strives to provide a wide variety of educational resources to help their clients improve their trading skills. They offer a wide range of tools and resources, such as market analysis, economic calendars, signals and online courses. In addition, XM regularly offers webinars and online seminars, which are an excellent way to learn from experienced traders and gain a better understanding of the markets. However, not all educational resources are available in all languages and the quality of educational resources may vary depending on the trader's level of experience. In addition, some educational resources may not be up to date with the latest developments in the markets, so traders should be careful in selecting the resources they use. Overall, XM makes a solid effort to provide a variety of useful educational resources for its clients.

| Advantages | Disadvantages |

| Live chat available 24/7 | No toll-free number |

| Multilingual customer service | |

| Registered address provided on the website | No estimated response time is mentioned |

| E-mail available for inquiries | No fax support |

| International phone numbers available | No callback service available |

XM excels in its customer service by providing a live chat available 24 hours a day, which means that customers can get real-time help at any time. In addition, XM's website offers the company's registered address, which provides greater transparency and confidence to the customer. Multi-language customer support is also a significant advantage for international customers. In addition, XM provides an international e-mail address and phone numbers for support inquiries. However, a disadvantage is the lack of a toll-free number, as well as the lack of social media and fax support. In addition, there is no mention of an estimated response time for support inquiries and no callback service is offered.

Overall, XM is a well-regulated and secure company that offers a wide range of financial instruments and a good variety of accounts. Its focus on customer education and 24/7 multilingual support is also a big plus. Disadvantages include floating spreads that can be higher than the competition and the lack of a proprietary trading platform. Overall, XM is a good choice for those looking for a regulated broker with a wide range of products and customer support services.

Question: Is XM a regulated company?

Answer: Yes, XM is regulated by multiple agencies such as ASIC, CYSEC, FSA, FSC and DFSA.

Question: What are the account types offered by XM?

Answer: XM offers four account types: micro account, standard account, ultra low account and share account.

Question: What is the minimum deposit required to open an XM account?

Answer: The minimum deposit required for the first three accounts (micro account, standard account and ultra low account) is $5, while for the share account it is $10,000.

Question: What trading platforms does XM offer?

Answer: XM offers the most popular trading platforms in the industry: MT4 and MT5, as well as its own mobile application.

Question: What is the maximum leverage offered by XM?

Answer: The maximum leverage offered by XM is 1:1000.

Question: Does XM offer a demo account?

Answer: Yes, XM offers a demo account for clients to practice without risking their own money.

Question: What educational resources does XM offer?

Answer: XM offers a wide range of educational resources such as market analysis, economic calendars, trading signals, tools, videos, courses and webinars.

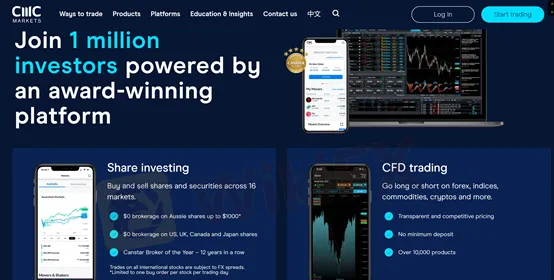

| Registered in | Australia |

| Regulated by | FCA, FMA, MAS, IIROC |

| Year(s) of establishment | Above 20 years |

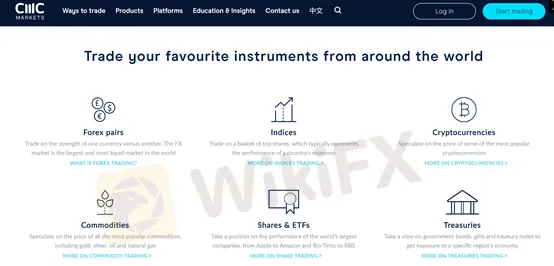

| Trading instruments | forex, indices, commodities, cryptos and stocks, treasuries, ETFs |

| Minimum Initial Deposit | $0 |

| Demo account | Yes |

| Maximum Leverage | Information not available |

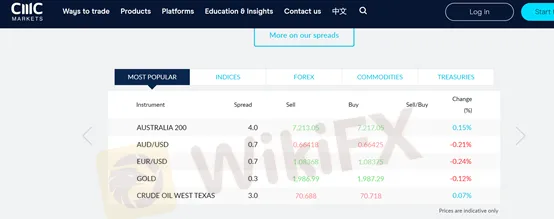

| Minimum spread | 0.7 pips onwards for EURUSD |

| Trading platform | MT4 and its own platform CMC Markets Invest. |

| Deposit and withdrawal method | POLi, PayPal, credit and debit card, plus bank transfers. No cash or cheque. |

| Customer Service | 24/5, phone number, address, live chat, social medias |

| Fraud Complaints Exposure | No for now |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros of CMCMarkets:

Regulatory Compliance: Being registered in Australia and regulated by reputable authorities like FCA, FMA, MAS, and IIROC, CMCMarkets provides a sense of trust and security for traders.

Wide Range of Trading Instruments: With access to forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs, CMCMarkets offers a diverse portfolio for traders to choose from.

Flexible Account Options: CMCMarkets provides a variety of account types, including standard and alpha accounts, catering to different trading preferences and experience levels.

Free Demo Account: The availability of a free demo account allows traders to practice and familiarize themselves with the platform before risking real money.

Multiple Trading Platforms: CMCMarkets supports the widely used MT4 platform, known for its advanced features, as well as their proprietary platform CMC Markets Invest, offering versatility for traders.

Educational Resources: The company offers a comprehensive range of educational resources such as video tutorials, glossary, webinars, eBooks, podcasts, and news analysis to help traders enhance their knowledge and skills.

Customer Support: CMCMarkets provides 24/5 customer support through various channels, including phone, live chat, and social media platforms, ensuring prompt assistance and resolving queries effectively.

Cons of CMCMarkets:

Maximum Leverage Unknown: The lack of information regarding the maximum leverage offered by CMCMarkets can be a limitation for traders who rely on leverage as a trading strategy.

Limited Information on Spreads and Commissions: The absence of detailed information about spreads and commissions may make it challenging for traders to accurately assess the cost of trading on the platform.

Dormancy Fee: CMCMarkets charges a dormancy fee if there is no trading activity for 12 months, which may pose an additional cost for inactive accounts.

Merchant Fees for Deposits: Deposits made via credit or debit cards attract merchant fees, which can add to the overall transaction costs for traders.

Withdrawal Restrictions: The limitation on withdrawing funds only up to the initial deposit amount on the registered card may restrict traders' flexibility in managing their funds.

Limited Availability of Information on Leverage, Deposits, and Withdrawals: The provided information lacks specific details regarding leverage options, minimum deposit requirements, and withdrawal processing times, which may require traders to seek additional clarification.

| Advantages | Disadvantages |

| CMCMarkets offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, CMCMarkets has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

CMCMarkets is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, CMCMarkets acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that CMCMarkets has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with CMCMarkets or any other MM broker.

CMCMarkets is an established brokerage firm registered in Australia and regulated by FCA, FMA, MAS, and IIROC. With over 20 years of experience, they offer a wide range of trading instruments including forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs. Traders can access their services through the popular MT4 platform as well as CMC Markets Invest. CMCMarkets provides a flexible account structure with no minimum initial deposit requirement and offers a free demo account for practice trading. They have a strong customer support system, available 24/5, and provide various educational resources to assist traders in their financial journey.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

CMC Markets provides a diverse range of trading instruments to cater to the needs of different traders. With CFD trading, users have the flexibility to go long or short on a variety of assets including forex, indices, commodities, and cryptocurrencies. This allows traders to profit from both rising and falling markets, maximizing their trading opportunities. In addition, CMC Markets offers share investing, enabling users to buy and sell shares and securities across 16 markets. This allows for a comprehensive portfolio diversification and investment in different sectors and industries. Furthermore, CMC Markets provides access to treasuries and ETFs, allowing traders to trade and invest in these financial instruments.

| Advantages | Disadvantages |

| Competitive spreads for major currency pairs. | Spreads are indicative and may vary in volatile market conditions. |

| Transparent commission structure for specific instruments. | Commissions apply to certain markets, which may increase trading costs. |

| Clear information on minimum commission charges. | Dormancy fee charged for accounts with no trading activity for 12 months. |

| Dormancy fee based on account currency, providing clarity for users. | Dormancy fee may be considered a disadvantage for inactive traders. |

| Wide range of country-specific commission charges. | Commissions vary depending on the country/market, potentially impacting trading costs. |

CMC Markets offers competitive spreads for major currency pairs, with a live spread form indicating indicative prices. However, it's important to note that spreads may vary, especially during volatile market conditions. The company adopts a transparent commission structure, with commissions varying depending on the specific instruments traded. Traders can refer to the provided information to determine the commission charges applicable to their trades. It is worth mentioning that commissions are subject to minimum charge requirements, such as the minimum commission charge of US$10 for US shares. Additionally, CMC Markets implements a dormancy fee for accounts with no trading activity for 12 consecutive months, based on the account currency. While this fee promotes account activity, traders who remain inactive may incur additional costs. Traders should carefully consider these factors and evaluate their trading strategies to effectively manage spreads, commissions, and other associated costs.

| Account currency | Monthly inactivity fee |

| AUD | 15 |

| USD | 15 |

| HKD | 100 |

| Country/market | Commission charge | Minimum commission charge |

| Australia | 0.09% | AUD 7.00 |

| UK | 0.08% | GBP 9.00 |

| US | 2 cents per unit | USD 10.00 |

| Austria | 0.08% | EUR 9.00 |

| Belgium | 0.10% | EUR 9.00 |

| Denmark | 0.08% | DKK 90.00 |

| Finland | 0.08% | EUR 9.00 |

| France | 0.06% | EUR 5.00 |

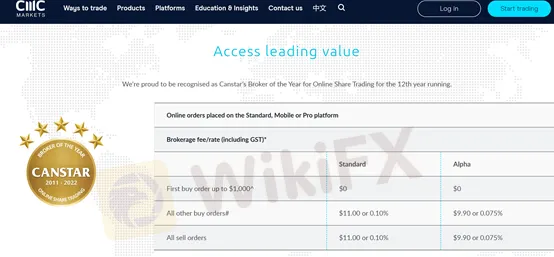

| Advantages | Disadvantages |

| Two live account options: Standard and Alpha. | Different account types may have varying features and requirements. |

| Standard account offers zero brokerage fee for the first buy order up to $1,000. | Alpha account may have higher brokerage fees for certain buy and sell orders. |

| Alpha account provides lower brokerage fees for most buy and sell orders. | Alpha account may have specific eligibility criteria or minimum balance requirements. |

| Flexibility to choose an account type based on individual trading preferences. | Different account types may have different access to certain features or trading tools. |

| Demo account available, allowing users to practice and familiarize themselves with the platform. | Account types may have specific terms and conditions, which traders should review before choosing. |

CMC Markets offers two live account types, Standard and Alpha, providing traders with options that suit their individual needs. The Standard account offers a unique advantage by providing zero brokerage fee for the first buy order up to $1,000. This feature allows traders to make their initial investment without incurring any brokerage costs. On the other hand, the Alpha account offers lower brokerage fees for most buy and sell orders, providing cost-saving opportunities for active traders. It is important to note that different account types may have specific eligibility criteria or minimum balance requirements, and traders should consider these factors when choosing an account type. Additionally, CMC Markets provides a free demo account, enabling traders to practice and familiarize themselves with the platform before opening a live account. Traders have the flexibility to select the account type that aligns with their trading preferences, taking advantage of the benefits offered by each option. It's recommended to review the terms and conditions associated with each account type to ensure a comprehensive understanding of the features, costs, and available support.

| Advantages | Disadvantages |

| MT4 platform widely recognized and popular. | CMC Markets Invest may have a learning curve. |

| Access to a wide range of technical indicators and automated trading tools. | Limited features compared to CMC Markets Invest. |

| CMC Markets Invest offers a proprietary platform. | Smaller community and fewer third-party plugins compared to MT4. |

| Seamless integration with other CMC Markets services and features. | Compatibility limitations with certain operating systems or devices. |

| User-friendly interface and intuitive navigation. | MT4 platform may require technical knowledge for advanced customization. |

| Access to a wide range of trading instruments and market analysis tools. | Less frequent updates or improvements compared to CMC Markets Invest. |

CMC Markets provides traders with two platform options: MT4 and CMC Markets Invest. MT4 is a widely recognized and popular trading platform known for its extensive range of technical indicators and automated trading tools. It offers a user-friendly interface and provides access to a diverse set of features. On the other hand, CMC Markets Invest is a proprietary platform specifically designed for CMC Markets clients. It offers seamless integration with other CMC Markets services and features, providing a cohesive trading experience. While MT4 has a larger community and third-party plugins, CMC Markets Invest may have a learning curve for new users and a smaller community. Traders can choose the platform that suits their preferences, whether they prefer the familiarity and customization options of MT4 or the integrated features of CMC Markets Invest.

The maximum leverage offered by CMCMarkets is currently unknown. While leverage can provide traders with several advantages, such as greater trading flexibility, potential for higher profits, increased market access, and enhanced trading opportunities, it also comes with certain disadvantages. One of the primary disadvantages is the increased risk exposure, as leverage magnifies both gains and losses. Traders need to exercise caution and implement proper risk management strategies to avoid significant losses. Additionally, the use of leverage requires a good understanding of the market and trading principles to make informed decisions. It's important to note that the lack of information regarding the maximum leverage offered by CMCMarkets may make it difficult for traders to assess the level of risk involved in their trading activities.

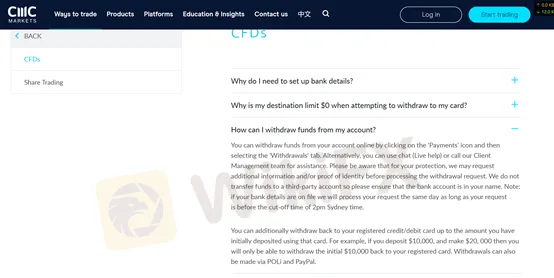

| Advantages | Disadvantages |

| Multiple funding options (credit/debit cards, bank transfers) | Charges for credit card payments (1%) and debit card payments (0.6%) |

| Convenient online withdrawal process | Additional charges for bank transfers from outside Australia |

| Ability to withdraw funds to registered credit/debit cards | Limited withdrawal amount to initial deposit |

| Withdrawal requests processed quickly | Possible requirement for additional information/proof of identity |

| Secure withdrawal process |

The dimension of deposits and withdrawals with CMCMarkets offers several advantages and a few considerations to keep in mind. One of the advantages is the variety of funding options available, including credit/debit cards and bank transfers. The online withdrawal process is convenient, and funds can be withdrawn to registered credit/debit cards. Withdrawal requests are typically processed quickly, ensuring prompt access to funds. Additionally, the overall process is secure to safeguard user transactions. However, it's important to note that there are charges associated with credit card (1%) and debit card (0.6%) payments. Additional charges may apply for bank transfers from outside Australia. Moreover, withdrawals are limited to the initial deposit amount on the registered card, and there may be a requirement for additional information or proof of identity. Despite these considerations, the deposits and withdrawals dimension of CMCMarkets provides flexibility and efficiency for users managing their trading accounts.

| Advantages | Disadvantages |

| 1. Wide range of educational resources available | 1. Some resources may require additional fees or charges |

| 2. Diverse formats including videos, webinars, eBooks, etc. | 2. Information overload can be overwhelming for beginners |

| 3. Official YouTube channel for additional video content | 3. Lack of personalized guidance or mentorship |

| 4. Comprehensive resources such as glossary and FAQ | 4. Quality of educational content may vary |

| 5. News and analysis provide up-to-date market insights | 5. Self-directed learning requires discipline and effort |

| 6. Accessible for users to enhance their knowledge |

The educational resources dimension at CMCMarkets offers a range of advantages to traders and investors. They provide a wide variety of educational materials, including videos, webinars, eBooks, podcasts, news, analysis, guides, and more. The availability of different formats ensures that users can choose the learning style that suits them best. Additionally, CMCMarkets has an official YouTube channel where users can find additional video content. The comprehensive resources, such as the glossary and FAQ section, help users understand key concepts and terms. The inclusion of news and analysis keeps users informed about market developments. Overall, these educational resources are easily accessible and can greatly enhance users' knowledge and understanding of the financial markets.

You may also visit their official YouTube channel to watch more videos. Here is a video about some basic knowledge that every trader should know.

| Advantages | Disadvantages |

| 1. 24/5 contact availability for customer support | 1. Limited customer support availability on weekends |

| 2. Dedicated phone lines for CFD and Share Trading inquiries | 2. Potential waiting times to reach a customer support agent |

| 3. Multiple channels of communication (phone, social media) | 3. Lack of 24/7 customer support |

| 4. Convenient customer service hours for Share Trading | 4. Language limitations may exist for non-English speaking users |

| 5. Physical office address provides a sense of trust and security | |

| 6. Active presence on popular social media platforms |

The customer care dimension at CMCMarkets offers several advantages to users. Firstly, they provide 24/5 contact availability, ensuring that customers can reach out for support during weekdays. The dedicated phone lines for CFD and Share Trading inquiries allow for specialized assistance in each area. Multiple communication channels, including phone, social media platforms like Facebook, Twitter, LinkedIn, and YouTube, offer users flexibility in choosing their preferred method of contact. The convenient customer service hours for Share Trading align with market opening hours, enabling timely assistance. Additionally, the physical office address in Sydney provides customers with a sense of trust and security. CMCMarkets' active presence on popular social media platforms allows users to stay updated and engaged. However, it's important to note that there may be limitations to customer support availability on weekends and potential waiting times to connect with a representative.

In conclusion, CMCMarkets is an Australia-registered company that has established itself as a reputable and regulated broker in the financial industry. With over 20 years of experience, they offer a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs. Traders have the flexibility to choose from different account types and access their platform through MT4 or their proprietary platform, CMC Markets Invest. The availability of a free demo account and extensive educational resources further enhance the trading experience for both novice and experienced traders. Customer support is readily available through various channels, ensuring prompt assistance and resolving queries effectively. However, the lack of information on maximum leverage, detailed spreads and commissions, as well as certain fees like the dormancy fee and merchant fees for deposits, could be considered as limitations. Despite these drawbacks, CMCMarkets' strong regulatory compliance, diverse trading offerings, and commitment to providing educational resources contribute to its appeal as a trusted brokerage firm. Traders should conduct thorough research and consider their individual needs before deciding to engage with CMCMarkets or any other broker.

Question: How can I fund my CMCMarkets account?

Answer: You can fund your CMCMarkets account by using a credit or debit card or by transferring funds from your bank account. Please note that third-party payments are not accepted, and additional charges may apply for bank transfers from outside of Australia.

Question: What are the trading platforms offered by CMCMarkets?

Answer: CMCMarkets provides two trading platforms: MT4 and their own platform called CMC Markets Invest. These platforms offer a range of features and tools to support your trading activities.

Question: Is there a minimum initial deposit required to open an account with CMCMarkets?

Answer: No, CMCMarkets does not require a minimum initial deposit. You can start trading with any amount you are comfortable with.

Question: Does CMCMarkets offer a demo account?

Answer: Yes, CMCMarkets provides a free demo account that allows you to practice trading with virtual funds. It's a great way to familiarize yourself with the platform and test your trading strategies without risking real money.

Question: How can I contact customer support at CMCMarkets?

Answer: You can contact CMCMarkets' customer support team by calling their phone number 1300 303 888. They are available 24/5 for CFD inquiries and have specific hours for Share Trading inquiries. You can also reach out to them through their official social media channels or visit their office in Sydney, Australia.

Question: What are the trading instruments available on CMCMarkets?

Answer: CMCMarkets offers a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, stocks, treasuries, and ETFs. This provides you with various options to diversify your trading portfolio.

Question: Does CMCMarkets charge any fees for deposits or withdrawals?

Answer: CMCMarkets does not charge any fees for deposit or withdrawal operations. However, please note that payment systems may have their own fees, and internal currency conversion rates may apply.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive xm and cmc-markets are, we first considered common fees for standard accounts. On xm, the average spread for the EUR/USD currency pair is as low as 1 pips, while on cmc-markets the spread is Currency pairs 0.7 pips, gold0.3 US dollars, crude oil 0.03 US dollars.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

xm is regulated by ASIC,CYSEC,FSC,DFSA,FSCA. cmc-markets is regulated by FCA,FCA,FMA,BaFin,AMF,CIRO,MAS,ASIC,BaFin.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

xm provides trading platform including Micro Account,Standard Account,Ultra Low Spread Standard & Micro Account,Stock Account and trading variety including Major FX pairs, Minor FX pairs, Commodities, Indices CFDs. cmc-markets provides trading platform including Next Generation and trading variety including Forex, stocks, stock indexes, commodities, bonds, CFDs.