No data

Do you want to know which is the better broker between World Forex and VT Markets ?

In the table below, you can compare the features of World Forex , VT Markets side by side to determine the best fit for your needs.

EURUSD: -0.1

XAUUSD: --

Long: -12.3

Short: 2.8

Long: -2.19

Short: -1.71

Long: -5.36

Short: 2.47

Long: -30.8

Short: 18.9

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of world-forex, vt-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| World Forex Review Summary in 10 Points | |

| Founded | 2007 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Non-regulated |

| Market Instruments | Forex, CFDs for American shares, Precious metal, Oil, Cryptocurrency |

| Demo Account | Available |

| Leverage | 1:33 - 1:1000 |

| EUR/USD Spread | Start from 0.0 pips |

| Trading Platforms | MT4/5 |

| Minimum Deposit | USD 1 |

| Customer Support | Phone, Email, Address, Live chat, Social media, Contact us form |

World Forex, a brokerage firm based in Saint Vincent and the Grenadines and operates all over the world including countries such as Thailand, British, Saint Lucia and Russia. It provides a variety of market instruments, including Forex, CFDs for American shares, Precious metal, Oil, Cryptocurrency, to traders globally. However, it's important to consider that World Forex is currently under no valid regulations from any recognized authorities.

In the following article, we will analyze the characteristics of this broker from multiple perspectives, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also make a brief summary so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Multiple account types | • Unregulated |

| • MT4/5 trading platforms | • Not accept clients from some countries |

| • Acceptable minimum deposit | |

| • Floating spreads | |

| • Abundant customer support channels | |

| • Demo account available | |

| • Flexible leverage ratios |

World Forex spells strength with a variety of offerings that cater to traders of all levels. They extend a selection of multiple account types, suiting diverse trading styles and strategies. The popular MT4/5 trading platforms, with their wide range of tools and features, are available to users across different devices. The acceptable minimum deposit at just $1 and the provision of floating spreads make trading accessible and competitive. Further benefits include abundant customer support channels for comprehensive assistance, an option for a demo account for risk-free practice, and flexible leverage ratios ranging 1:33- 1:1000 catering to risk-tolerant and risk-averse traders alike.

However, potential traders need to be aware of a few aspects. The most significant concern is that World Forex is unregulated, which can raise doubt over its credibility and security measures. Moreover, it doesn't accept clients from certain jurisdictions due to regulatory considerations.

When considering the safety of a brokerage like World Forex or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: The broker operates with an unregulated status, signifying potential risks as it lacks the assurance of full protection for traders trading on its platform.

User feedback: You can gain valuable insights into the experiences of other clients by reviewing their opinions and feedback about the brokerage. It's advisable to look for these reviews on trustworthy websites and discussion platforms to ensure the credibility of the information.

Security measures: World Forex prioritizes security through anti-money laundering and privacy policies, ensuring compliance with financial regulations and protecting clients' personal data. These measures in some extent enhance the safety and confidentiality of the trading environment.

Ultimately, the decision of whether or not to trade with World Forex is a personal one. You should weigh the risks and benefits carefully before making a decision.

World Forex offers a comprehensive range of market instruments, including:

Forex: The broker enables access to a wide variety of 52 currency pairs, from major to exotic, for forex trading.

CFDs for American Shares: Trade Contracts for Difference (CFDs) on U.S. stocks with this broker which allows you to speculate on price movements without owning the underlying assets.

Precious Metals: Investment options in gold and silver, commonly considered safe-haven assets is another choice.

Oil: Opportunities to trade in the oil market, including WTI and Brent Crude.

Cryptocurrency: Trading access to popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others.

This diverse array of instruments caters to the preferences and strategies of traders, offering exposure to various financial markets.

World Forex presents a wide array of account types, each serving different trading needs. They offer a Demo Account for practice and skill development, alongside various other accounts named W-CENT-fix, W-CENT, W-PROFI-fix, W-PROFI, W-CRYPTO, and W-DIGITAL. These accounts vary in features and are tailored to suit different trading scenarios and preferences.

Uniquely, World Forex has kept the entry barrier minimalistic, with a petite minimum deposit requirement of only USD 1 across these accounts. This makes World Forex's offerings readily accessible to a broad range of individuals interested in exploring the trading universe.

Furthermore, Islamic or 'swap-free' Account is also available. Traders just need to choose a trading account like W-PROFI or W-CENT and simply tick the 'swap-free' option during the account opening process.

World Forex provides its clients with a dynamic trading leverage structure, which varies significantly from 1:33 to a whopping 1:1000. The concept of leverage in trading means that traders can essentially 'borrow' funds to place larger trades than their actual deposit. The dynamic range in leverage of this broker lets traders pick a comfortable risk level while allowing potentially higher returns.

However, it's also important to note that while higher leverage can lead to amplified profits if the market moves in favor, it equally amplifies the potential losses if the market takes a downturn. Hence, effective risk management is crucial while using leverage.

World Forexs wide array of accounts feature different types of spreads and commission structures.

Both the W-CENT-fix and W-PROFI-fix Accounts provide a fixed spread starting from 1.8 pips and impose no commission.

The W-CENT and W-PROFI Accounts present a floating spread starting from 0.6 pips, again with no commission charged.

Unique W-CRYPTO Account offers a floating spread beginning from 0 pips, but with a 0.5% commission involved.

Lastly, W-DIGITAL Account users experience a fixed spread starting from 1.8 pips specifically for 'Digital contract 0-100', alongside a hefty 40% commission for early closing, which applies exclusively to American digital contracts.

World Forex provides excellent versatility in terms of platform accessibility by offering MT4/5 renowned trading platforms, across a variety of devices and operating systems. Whether you're a Windows user, a macOS patron, an Android enthusiast, an iOS adherent, or even a Linux user, you can flawlessly operate and engage with your trading strategies. This broad compatibility ensures that trading activities remain uninterrupted and convenient, regardless of the operating system used by the trader. From desktop to handheld devices, World Forex makes seamless trading a reality, enabling traders to stay connected with markets anytime, anywhere, and through any device.

World Forex provides traders with a set of powerful trading tools designed to enhance their trading experience.

First and foremost, their Economic Calendar is a key instrument that keeps traders informed about global economic events, allowing them to make well-informed trading decisions.

To facilitate uninterrupted and automated trading, they offer Virtual Private Server (VPS) services, ensuring consistency in trade execution without interruptions.

Next on the roaster is the MQL5 signal — a feature that allows traders to copy trades from successful signal providers, beneficial for those who may lack time to research and analyze the markets.

Last but not least, the Forex calculator enables traders to calculate various trading parameters with precision, such as margin requirements, profit, and conversion rates.

World Forex enhances the trading experience by offering a “Copy Trading” option, which is a phenomenal feature particularly for novice traders or those who wish to diversify their strategies. With this feature, users have the advantage of copying the trades of experienced, successful traders directly into their own account.

This can not only save substantial time required for market analysis, but also helps new traders learn by observing strategies used by experienced ones.

World Forex provides diverse modes for transactions, ensuring convenient trading for clients.

The broker accepts Bank cards and Internet banking, adhering to users who prefer traditional methods of transactions. Moreover, modern Payment systems are also supported, including popular ones like Apple Pay and Google Pay. For large transactions, Bank transfer facilities are readily available. These avenues support different currencies, enhancing global accessibility.

Notably, each method has its specific minimum deposit request, processing time, and commission charges. Traders interested in exploring these specifics can visit the broker's official website at below link reach out to their broker directly for personalized assistance.

https://wforex.com/payment

World Forex optimizes client communication with multiple contact channels. Clients can get in touch with World Forex via Phone or Email for personalized assistance. The broker's physical Address for different branches is readily available for those looking for direct engagement. For details you can visit https://wforex.com/contacts.

They can also opt for real-time responses through the live chat feature. More so, World Forex extends its reach to various Social Media platforms such as Facebook, Twitter, Instagram and Trading View.

Lastly, the Contact Us form on their website offers an easy way to send in queries, suggestions, or feedback.

World Forex is commendable in its approach to educating its traders. Included in their educational resources are the 'Knowledge Base' and the 'Glossary'.

The Knowledge Base is an extensive collection of articles and information crucial to understanding various aspects of trading. It is a great starting point for novices, covering topics from fundamental concepts to complex trading strategies.

The Glossary, on the other hand, is a comprehensive list of trading terminologies, assisting traders in understanding complex terms used in the trading world.

Together, these resources equip traders with the essential tools for navigating the trading landscape effectively and confidently.

World Forex, a brokerage firm based in Saint Vincent and the Grenadines who also operate in British, Russia, Thailand and Saint Lucia, offers a range of market instruments including Forex, CFDs for American shares, Precious metal, Oil, Cryptocurrency.

However, potential investors should be wary of the fact that World Forex is currently unregulated. This represents a major red flag as regulated brokers conform to strict financial oversight, thereby protecting clients from potential misconduct.

As such, those considering World Forex as their broker should tread carefully, conduct thorough research and consider alternative, well-regulated brokers that prioritize transparency, security and client protection.

| Q 1: | Is World Forex regulated? |

| A 1: | No. It has been verified that this broker is currently under no valid regulation. |

| Q 2: | Does World Forex offer demo account? |

| A 2: | Yes. |

| Q 3: | Is World Forex a good broker for beginners? |

| A 3: | No. It is not a good choice for beginners because it is unregulated by any recognized financial authorities. |

| Q 4: | Does World Forex offer the industry leading MT4 & MT5? |

| A 4: | Yes, it offers MT4 /5 platform on windows, Ios, MacOS, Linux and Android devices. |

| Q 5: | What‘s the minimum deposit does World Forex request? |

| A 5: | World Forex request a minimum deposit of $1. |

| Q 6: | At World Forex, are there any regional restrictions for traders? |

| A 6: | Yes. World Forex’s products and services are not intended for the following countries and jurisdictions: America (USA), Canada, Northern Korea, Iran and for the jurisdictions included in the sanction lists of FATF and EU. This list can be amended at any moment of time. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | Australia |

| Found | 2016 |

| Regulation | Regulated by FSCA |

| Market Instrument | forex, precious metals, soft commodities, indexes, cryptocurrencies, energy, US stocks and Hong Kong stocks |

| Account Type | STP & Raw ECN |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MetaTrader4, MetaTrader5, WebTrader, Mobile App |

| Minimum Deposit | $200 |

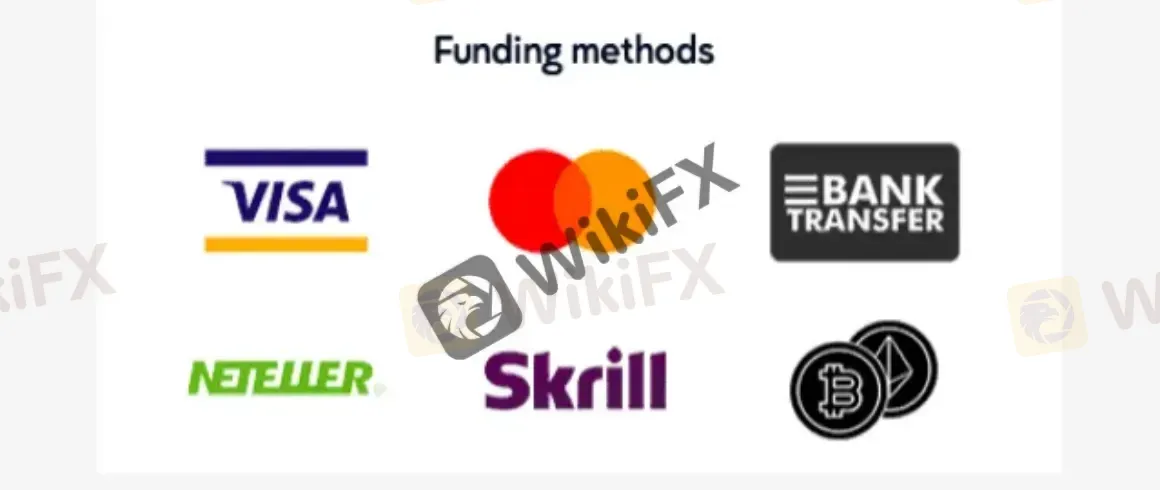

| Deposit & Withdrawal Method | credit/debit cards, Wire Transfers, Skrill, Neteller, Bitcoin, etc |

VT Markets was founded in 2016 and headquartered in Sydney, Australia, a subsidiary of Vantage International Group Limited, has over ten years' experience and expertise in global financial markets. As a regulated broker, VT Markets operates under the oversight of the Financial Sector Conduct Authority (FSCA). VT Markets offers a suite of trading instruments, including major, minor, and exotic currency pairs, allowing traders to capitalize on various market opportunities. In addition to forex, the broker also provides access to other financial instruments, including Soft Commodities, Indices, Cryptocurrencies, Energy, Share CFDs, Bonds CFDs, ETFs trading, Precious Metals .

Traders can benefit from competitive trading conditions at VT Markets, including low minimum deposit of $100, fast execution speeds, and flexible leverage options up to 1:500. The broker employs advanced technology infrastructure to ensure reliable and efficient trading, catering to the needs of both novice and experienced traders.

VT Markets supports the industry-standard MetaTrader 4 (MT4) trading platform and MetaTrader 5 (MT5) trading platform, as well as webtrader, known for its robust functionality, advanced charting tools, and customizable features, offering a seamless trading experience, with access to a wide range of technical indicators, expert advisors (EAs), and automated trading capabilities.

VT Markets provides a responsive and professional customer support team to assist traders with their inquiries and concerns. Support is available through various channels, including phone, email and live chat, ensuring timely and efficient assistance. The broker's website also features a comprehensive FAQ section, providing answers to commonly asked questions.

VT Markets operates under the regulation of multiple regulatory authorities, including the Australian Securities and Investments Commission (ASIC) in Australia and the Financial Sector Conduct Authority (FSCA) in South Africa.

With its entity in South Africa regulated by the FSCA, VT Markets complies with the regulatory requirements set by this reputable financial authority. The FSCA is known for its stringent oversight and supervision of financial services providers.

Additionally, VT Markets also holds an Investment Advisory License. It is important for traders to evaluate the specific details and limitations of this license to determine its scope and relevance to their individual investment needs.

VT Markets offers several advantages, including a wide range of trading instruments, multiple account types and flexible leverage options to cater to the diverse needs of traders. The user-friendly trading platforms, along with advanced trading tools and features, enhance the trading experience.

However, it's important to consider some drawbacks. VT Markets operates with limited regulatory oversight, which may raise concerns for some traders seeking a higher level of regulatory protection. They also have limited educational resources available, which may be a drawback for traders looking to enhance their knowledge and skills.

| Pros | Cons |

| Wide range of trading instruments | Limited regulatory oversight |

| Low trading fees | Limited educational resources |

| Multiple account types | Limited customer support options |

| Multiple trading platforms, MT4, MT5 and Webtrader | No demo accounts |

| Advanced trading tools and features | No Islamic trading accounts available |

| Flexible leverage up to 1:500 | Limited research and analysis resources |

| Swap-free options available | |

| Wide selection of payment methods | |

| Social Trading Aavailable | |

| Deposit and welcome bonuses offered |

VT Markets is a forex broker that offers a wide range of tradable assets to cater to the diverse needs of traders. With a comprehensive selection of instruments, including Forex, Soft Commodities, Indices, Cryptocurrencies, Energy, Share CFDs, Bonds CFDs, ETFs trading, and Precious Metals, VT Markets provides ample opportunities for traders to participate in various global markets.

Forex Pairs-Forex trading is one of the primary offerings of VT Markets, allowing traders to engage in currency pairs from major, minor, and exotic currencies. This enables them to take advantage of fluctuations in the forex market and capitalize on potential profit opportunities.

Soft Commodities-VT Markets also provides access to Soft Commoditiessuch as agricultural products, including wheat, corn, soybeans, and more. Traders interested in diversifying their portfolios can take advantage of price movements in these markets.

Indices-Indices trading is another prominent asset class offered by VT Markets. Traders can trade popular stock market indices like the S&P 500, NASDAQ, FTSE 100, and more, allowing them to speculate on the performance of the broader market.

Cryptocurrencies-Cryptocurrencies have gained significant popularity in recent years, and VT Markets acknowledges this trend by offering a range of digital currencies for trading. Traders can participate in the crypto market and potentially benefit from the volatility and potential growth of cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others.

Energy-Energy products, such as crude oil and natural gas, are also available for trading on VT Markets. Traders can speculate on the price movements of these essential energy commodities, influenced by various geopolitical and economic factors.

Share CFDs-Share CFDs provide an opportunity for traders to engage in equity trading without actually owning the underlying shares. VT Markets offers a selection of share CFDs from leading global companies, allowing traders to speculate on their price movements.

Bonds CFDs-Bonds CFDs and ETFs trading are additional asset classes offered by VT Markets, providing traders with exposure to fixed-income securities and diversified investment portfolios, respectively.

Precious Metals-Precious Metals like gold, silver, platinum, and palladium are also available for trading. These metals are often seen as safe-haven assets and can be an attractive option for traders looking for alternative investments.

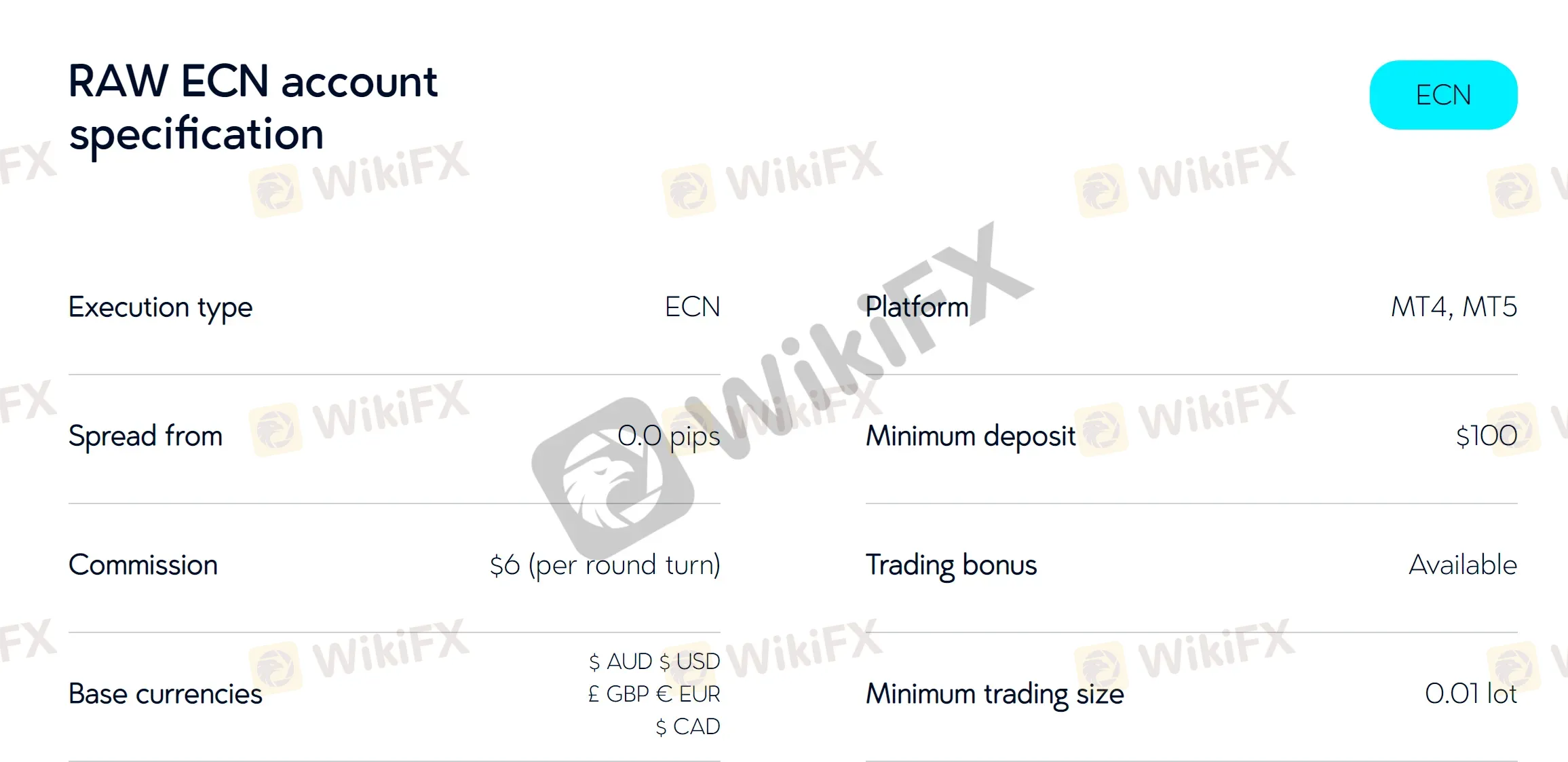

VT Markets offers two distinct types of trading accounts designed to cater to the diverse needs of traders. The first account type is the Standard STP account, which operates on the execution model of Straight Through Processing (STP). The second account option is the Raw ECN account, which utilizes an Electronic Communication Network (ECN) execution model. This account type is particularly suitable for traders seeking direct market access, tighter spreads, and increased liquidity.

Both the Standard STP and Raw ECN accounts require a minimum deposit of $100, making them accessible to traders with varying levels of capital. Additionally, VT Markets offers a range of base currencies for account holders to choose from, including USD, AUD, GBP, EUR, and CAD. This allows traders to select their preferred currency for more convenient account management.

Furthermore, VT Markets provides swap-free options for both account types, also known as Islamic or Sharia-compliant accounts. These accounts are designed for traders who adhere to Islamic principles, as they eliminate any interest charges on positions held overnight.

Aside from live trading accounts, VT Markets also provides demo accounts for traders to test the trading environment and practice their trading skills.

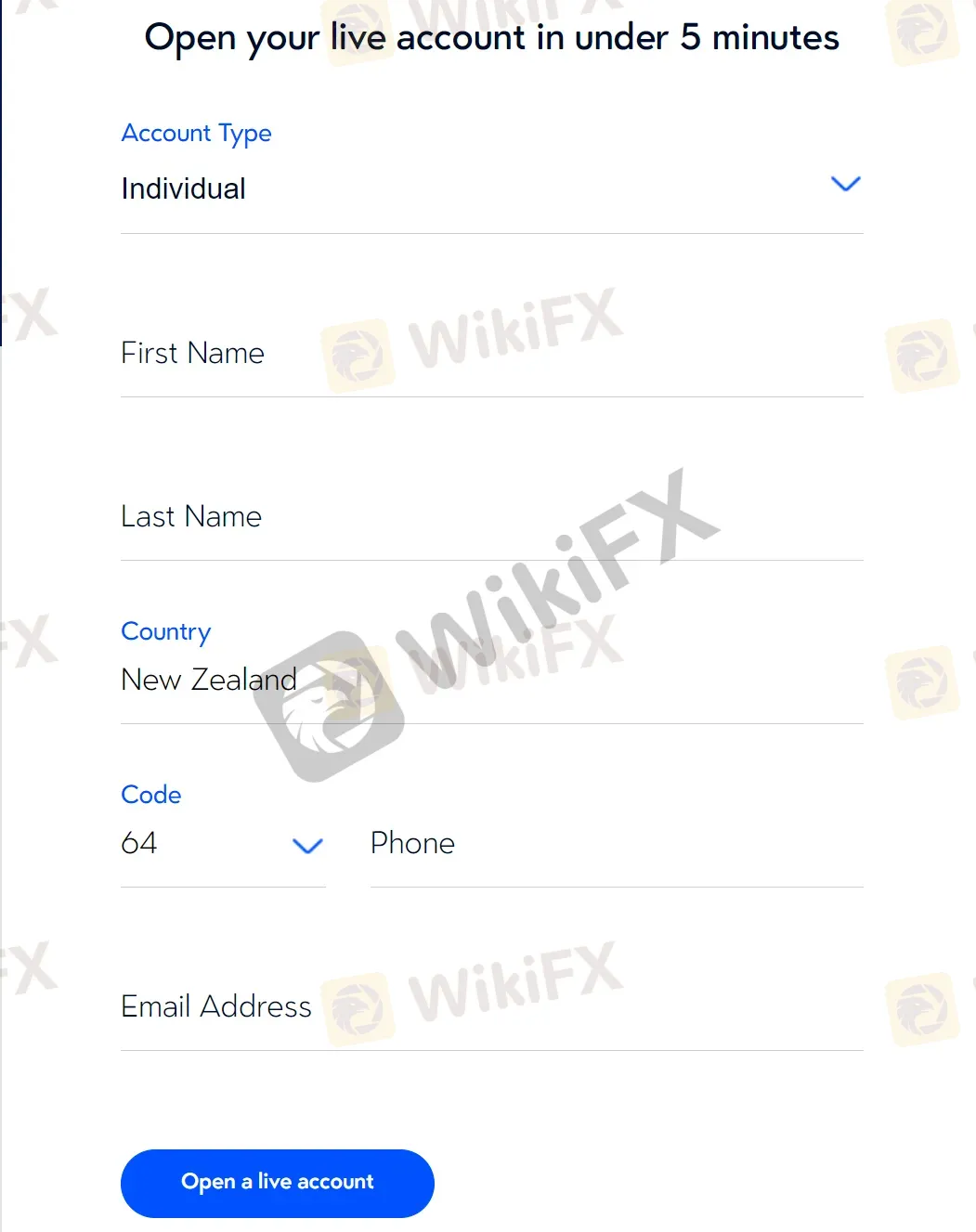

Opening an account is the first step towards accessing the financial markets and participating in forex trading. VT Markets has simplified the account opening process to ensure a seamless experience for traders. Here is a step-by-step guide on how to open an account with VT Markets:

1. Visit the VT Markets official website,and click on the “Open Live Account” button: On the VT Markets website, locate the “Open Account” button or a similar option that signifies the account opening process. This will redirect you to the account registration page.

2. Fill out the account registration form: Complete the account registration form with accurate personal information, including your full name, email address, phone number, and country of residence. Ensure that you provide all the required details correctly to avoid any issues during the verification process.

3. Select the desired account type: VT Markets offers different account types to cater to the diverse needs of traders. Choose the account type that aligns with your trading preferences and objectives.

4. Submit the necessary documents: As part of the account opening process, VT Markets may require you to submit certain identification documents for verification purposes. These documents typically include a valid ID proof (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement). Follow the instructions provided by VT Markets to upload the required documents securely.

5. Fund your trading account: Once your account is successfully opened and verified, you can proceed to fund your trading account. VT Markets supports various deposit methods, including Visa, MasterCard, bank wire transfer and more.

With a leverage of up to 1:500, its customers can trade 40 different currency pairings and spot gold contracts. One can use a leverage of up to 1:333 on energy commodities, 1:100 on Silver Spot, and 1:20 on soft commodities such as cocoa, coffee, cotton, orange juice, and raw sugar (Crude Oil, Natural gas, Gasoline, and Gasoil). Stocks of the 50 largest U.S. and Hong Kong firms are available for trading via Contracts for Difference (CFDs), with leverage of 1:20. You can trade 15 stock indexes, including the SP 500, DJ30, and US 2000, with high leverage (up to 1:333).

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

VT Markets offers different trading accounts with varying spreads and commission structures to cater to the diverse needs of traders.

The standard account at VT Markets provides a zero-commission trading environment, which means that you won't be charged any commissions on your trades. However, it offers average spreads on currency pairs. For example, the spreads on major pairs like EUR/USD start from 1.3 pips, GBP/USD from 1.8 pips, AUD/USD from 1.6 pips, and USD/JPY from 1.5 pips. While these spreads are competitive, they are slightly wider compared to ECN account spreads.

On the other hand, VT Markets' ECN accounts offer relatively low spreads. For instance, the spreads on EUR/USD can start from as low as 0.0 pips, GBP/USD from 0.6 pips, AUD/USD from 0.4 pips, and USD/JPY from 0.5 pips. These tight spreads are particularly attractive for traders who prioritize lower transaction costs.

However, it's important to note that ECN accounts incur a commission fee. VT Markets charges a commission of $3 per lot traded on ECN accounts. This commission is added on top of the spreads and is a transparent fee for accessing the interbank market liquidity and tighter spreads.

Overall, VT Markets provides a range of account options with competitive spreads and commission structures. Traders can choose between the standard account with zero commissions but slightly wider spreads, or the ECN account with lower spreads and a commission fee per lot.

VT Markets prides itself on its transparent fee structure, and while the focus is primarily on competitive trading conditions, there are a few non-trading fees to be aware of. Let's explore these fees in more detail to gain a comprehensive understanding of the costs involved.

One of the notable non-trading fees charged by VT Markets is the inactivity fee. This fee is applied when an account remains inactive for a specified period of time, typically several months. It is important to review the specific terms and conditions of the inactivity fee, including the duration of account inactivity and the associated charges.

Another non-trading fee to consider is the withdrawal fee. While VT Markets offers various convenient withdrawal methods, it's important to be aware that certain fees may apply when transferring funds from your trading account to your personal bank account or e-wallet. These fees can vary depending on the chosen withdrawal method, so it's advisable to review the broker's official website or contact their customer support for detailed information on withdrawal fees.

Additionally, VT Markets may impose fees for specific services or requests, such as account statement requests or document processing. These fees are typically disclosed in the broker's fee schedule or terms and conditions, so it's recommended to familiarize yourself with these details to avoid any unexpected charges.

VT Markets offers a range of advanced trading platforms to cater to the diverse needs of traders. With their selection of robust platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, WebTrader+, and the VT Market App, traders can access the financial markets with ease and precision. Each platform provides unique features and capabilities to enhance trading experiences and execute trades efficiently.

MetaTrader 4 (MT4):MT4 is a globally recognized and widely used trading platform, renowned for its user-friendly interface and extensive range of trading tools. It offers real-time market data, advanced charting options, and customizable indicators to help traders analyze the markets and make informed trading decisions. MT4 also supports automated trading through expert advisors (EAs), allowing traders to automate their strategies.

MetaTrader 5 (MT5):MT5 is the successor to MT4 and comes with additional features and enhanced capabilities. It offers an improved interface, advanced charting tools, and an expanded range of technical indicators. MT5 also allows traders to access different asset classes, including stocks and futures, in addition to forex trading. With its powerful analytical tools and multi-asset support, MT5 caters to traders seeking advanced trading functionalities.

VT Market App:The VT Market App is a mobile trading platform designed for traders who prefer to trade on the go. Available for both iOS and Android devices, the app allows traders to access their accounts, monitor market conditions, and execute trades from anywhere, anytime. The VT Market App provides a seamless trading experience, ensuring traders never miss out on potential trading opportunities.

WebTrader:The WebTrader platform is a web-based trading solution that provides traders with the flexibility to access their accounts from any web browser without the need for software installation. It offers a user-friendly interface, real-time market data, and essential trading features. Traders can analyze charts, place trades, and manage their positions conveniently through WebTrader.

WebTrader+:WebTrader+ is an enhanced version of the WebTrader platform, offering additional features and functionalities. It provides advanced charting tools, technical indicators, and customizable trading settings. With WebTrader+, traders can monitor market movements in real-time, execute trades swiftly, and manage their positions effectively, all within a browser-based interface.

VT Markets offers clients access to a diverse range of supported payment methods, including VISA, Mastercard, Bank Transfer, Neteller, Skrill, UnionPay, Alipay, FasaPay, Tether, and Bitcoin. The minimum deposit requirement of $100 makes VT Markets accessible to a wide range of traders, whether they are beginners starting with a smaller capital or experienced traders looking to add funds to their trading accounts.

It is important to note that specific terms, conditions, and fees may apply to each payment method, and it is advisable to review the broker's official website or contact their customer support for detailed information regarding the deposit and withdrawal process.

VT Markets claims to offer various trading incentives at the time, including a 50% Welcome Bonus, 20% Deposit Bonus and referral bonuses. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators.

It's important to note that bonuses come with specific terms and conditions that traders should be aware of. These terms may include minimum deposit requirements, trading volume requirements, and certain restrictions on bonus withdrawals. Traders are encouraged to carefully review the bonus terms and conditions on VT Markets' official website or consult with their customer support for detailed information.

VT Markets offers a comprehensive range of educational resources designed to empower traders with the knowledge and tools necessary for their trading.

One of the standout features of VT Markets' educational resources is the availability of various trading tools. Traders can leverage expert advisors, forex signals, and an economic calendar to make informed trading decisions. These tools provide valuable insights, automate trading strategies, and help traders stay updated with key economic events that can impact the markets.

Additionally, VT Markets offers the MAM/PAMM (Multi-Account Manager/Percentage Allocation Management Module) system, allowing experienced traders to manage multiple accounts simultaneously. This feature is especially beneficial for fund managers and traders looking to diversify their trading strategies.

For technical analysis enthusiasts, VT Markets integrates Trading Central MT4 tools into its platform. These tools provide in-depth market analysis, including price forecasts, trend analysis, and key levels to watch. Traders can utilize this information to identify potential trading opportunities and make well-informed trading decisions.

VT Markets also provides daily market analysis to keep traders informed about the latest market trends, news, and insights. This analysis covers various financial instruments, including forex, commodities, indices, and more. It helps traders stay ahead of market developments and adapt their trading strategies accordingly.

To assist traders in navigating the MT4 trading platform effectively, VT Markets offers an MT4 guide. This comprehensive guide covers the platform's features, functionalities, and how to optimize its use for trading purposes. It is particularly useful for beginner traders who are new to the MT4 platform.

Moreover, VT Markets supports social trading through its innovative program called VTrade. This program allows traders to connect, interact, and share trading ideas with other traders within the VT Markets community. Traders can learn from experienced traders, gain insights, and even replicate successful trading strategies.

VT markets customer support can be reached by email: info@vtmarkets.com. You can also follow this broker on social networks such as Twitter, Facebook, Instagram, YouTube and LinkedIn. Company address: Level 35, 31 Market St, Sydney NSW 2000, Australia; 4th Floor, the Harbour Centre, 42 N Church St, George Town, Cayman Islands.

VT Markets offers various channels for customer assistance. Traders can reach out to the dedicated support team through email, and online chat, allowing for convenient communication and prompt resolution of queries or concerns.

Additionally, VT Markets recognizes the importance of staying connected with clients through social media platforms. They actively engage with traders on platforms like Facebook, Twitter, and Linkedin and Youtube, providing updates, market insights, and addressing customer inquiries in a timely manner.

One of the key advantages of VT Markets' customer support is its multilingual capability. The support team is proficient in multiple languages, enabling them to effectively assist clients from diverse backgrounds and ensure clear communication.

VT Markets is a forex broker that offers a range of trading services and features. As with any broker, there are both positive and negative aspects to consider when evaluating their offerings.On the positive side, VT Markets provides a user-friendly trading platform that is equipped with advanced charting tools and a wide range of technical indicators. Moreover, VT Markets offers a diverse selection of trading instruments, including major and minor forex currency pairs, commodities, indices, and cryptocurrencies.

However, it's important to consider the potential drawbacks. VT Markets has limited customer support options, as they primarily rely on email communication. This may result in slower response times and limited real-time assistance for urgent queries.

Additionally, while VT Markets provides educational resources such as webinars and tutorials, the availability and depth of these materials could be further expanded to better support traders in their learning journey.

| Q 1: | Is VT markets regulated? |

| A 1: | Yes. VT markets is regulated by FSCA. |

| Q 2: | Does VT markets offer the industry-standard MT4 & MT5? |

| A 2: | Yes. Both MT4 and MT5 are available. |

| Q 3: | What is the minimum deposit for VT markets? |

| A 3: | The minimum initial deposit at VT markets to open any account type is $200. |

| Q 4: | Is VT markets a good broker for beginners? |

| A 4: | No. VT markets is not a good choice for beginners. It is regulated and offers popular MT4 and MT5 platforms though, its website is unavailable and the minimum deposit requirement is unfriendly for beginners. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive world-forex and vt-markets are, we first considered common fees for standard accounts. On world-forex, the average spread for the EUR/USD currency pair is from 1.8 pips for Digital contract 0-100 only pips, while on vt-markets the spread is 1.2.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

world-forex is regulated by --. vt-markets is regulated by FSCA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

world-forex provides trading platform including W-DIGITAL,W-CRYPTO,W-PROFI,W-PROFI-fix,W-CENT,W-CENT-fix and trading variety including --. vt-markets provides trading platform including STP,RAW ECN and trading variety including Forex/precious metals/soft commodities/indexes/cryptocurrencies/energy/US stocks/Hong Kong stocks.