简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weltrade 、admiral markets 交易商比较(前端未翻译)

Do you want to know which is the better broker between Weltrade and admiral markets ?

在下表中,您可以并排比较 Weltrade 、 admiral markets 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

- Average transaction cost

- (EURUSD)

- Average transaction cost

- (XAUUSD)

Long: -11.42

Short: -5.35

Long: -284.69

Short: -99.41

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of weltrade, admiral-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

weltrade

| WELTRADE Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | NBRB/FSC (Revoked), FSCA (Exceeded) |

| Market Instruments | Forex, metals, index CFDs, commodities, stock CFDs |

| Demo Account | ✅ |

| Spread | Floating from 1.5 pips (Micro account) |

| Leverage | Up to 10000x |

| Trading Platform | MT4, MT5, Weltrade App |

| Minimum Deposit | USD 1 |

| Customer Support | Live chat, FAQ |

| Social platforms: Facebook, LinkedIn, Instagram | |

| Email: info@weltrade.com | |

| Registered Address: Unit Suite 305, Griffith Corporate Centre, PO BOX 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines | |

| Email and registered offices in other countries: https://www.weltrade.com/customersupport/ | |

| Restricted Regions | USA, Canada, EU, Belarus and Russia |

WELTRADE Information

WELTRADE was initially registered in Saint Vincent and the Grenadines and also now operates in dozens of countries worldwide. The broker offers a wide range of trading services in forex, metals, index CFDs, commodities, stock CFDs. It offers a demo account for you to get familiar with the platform and your trading strategy. Besides, four tiered live accounts are available to suit different levels of investors.

Traders can excute trades on the well-acclaimed MetaTrader 4 and 5 platforms, as well as the broker's self-developed Weltrade App. Trading tools such as trading/pip/profit/Fibonacci calculators, tradingview charts and economic calenders are available to enhance trading efficiencies.

Moreover, the broker offers a series of educational resources including webinars and seminars, MetaTrader guides, indicators, etc to help traders better understand the financial world and trading.

However, one fact that cannot be neglected is that although the broker claims to be regulated by the NBRB, FSC, and FSCA, none of them is normal.

Pros and Cons

| Pros | Cons |

| Demo accounts | Revoked NBRB and FSC license |

| MT4 and MT5 platforms | Exceeded FSCA license |

| Multiple trading tools | Abnormal high leverage levels |

| Affordable minimum deposit | |

| Promotion programs | |

| No trading commissions | |

| Rich educational resources |

Is WELTRADE Legit?

No. WELTRADE currently has no valid regulations. It only holds revoked NBRB and FSC licenses, and an exceeded FSCA license. Please be aware of the risk!

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| National Bank of the Republic of Belarus (NBRB) | Revoked | LLC SystemGates Limited | Retail Forex License | 192727233 |

| Financial Services Commission (FSC) | Revoked | Systemgates Capital Ltd. | Retail Forex License | IFSC/60/350/TS/17 |

| Financial Sector Conduct Authority (FSCA) | Exceeded | WELTRADE SA (PTY) LTD | Financial Service Corporate | 50691 |

What Can I Trade on WELTRADE?

| Trading Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Index CFDs | ✔ |

| Commodities | ✔ |

| Stock CFDs | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

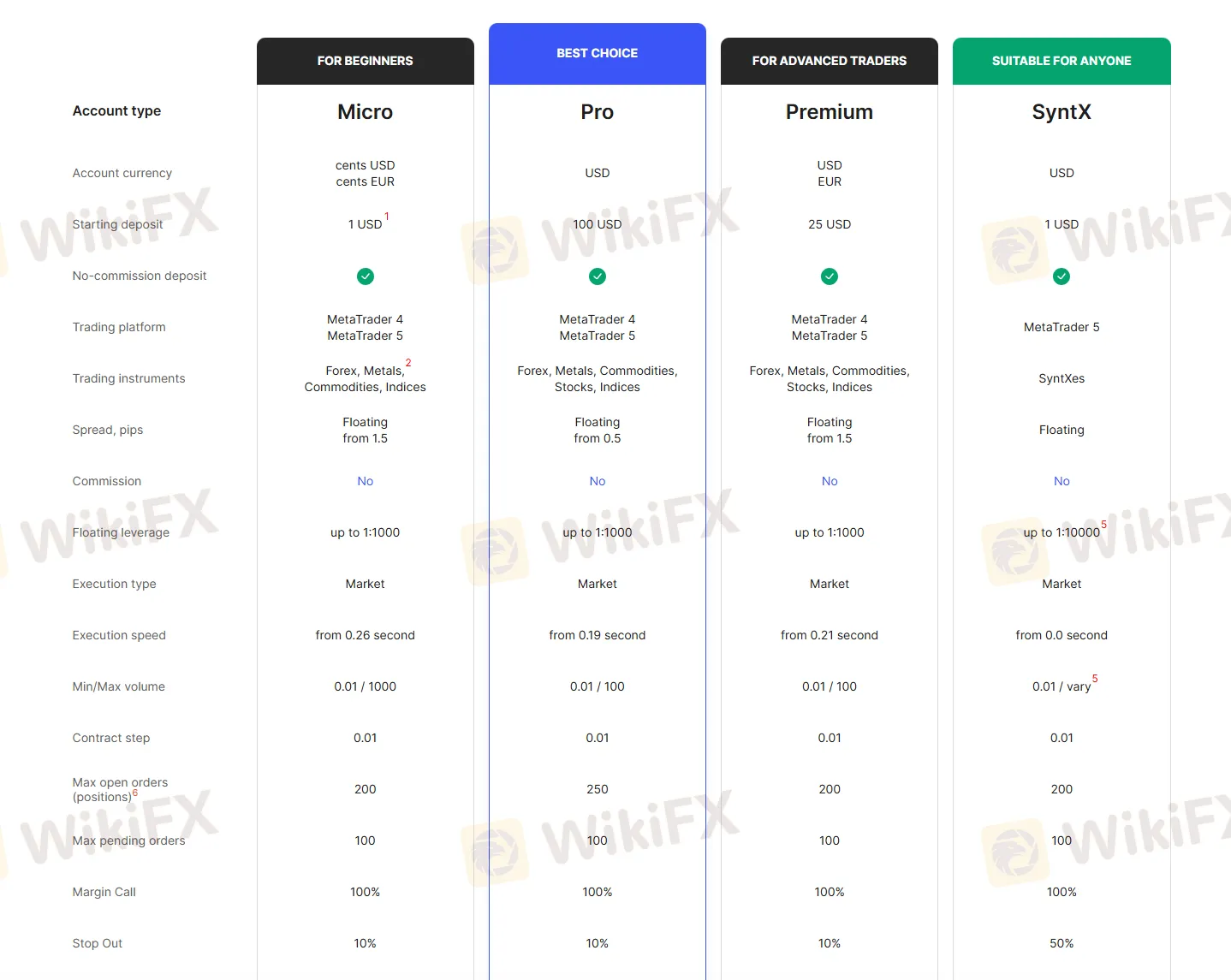

Account Type

WELTRADE not only offers a demo account for you to simulating real trading with virtual funds before tapping into real trading, but also four tiered live accounts with different traidng conditions to suite various levels of investors and different products:

| Account Type | Minimum Deposit | Accepted Currencies | Spread | Commission |

| Micro | USD 1 | Cents USD, cents EUR | Floating from 1.5 pips | ❌ |

| Pro | USD 100 | USD | Floating from 0.5 pips | |

| Premium | USD 25 | USD, EUR | Floating from 1.5 pips | |

| SyntX | USD 1 | USD | Floating |

Leverage

WELTRADE offers leverage up to 10000x, which is not normal among most brokerage companies. Usually leverage not only signifies profits, but also losses, thus it's strongly recommended that you should deal with leverage with this broker in extreme caution.

| Account Type | Maximum Leverage |

| Micro | 1:1000 |

| Pro | |

| Premium | |

| SyntX | 1:10000 |

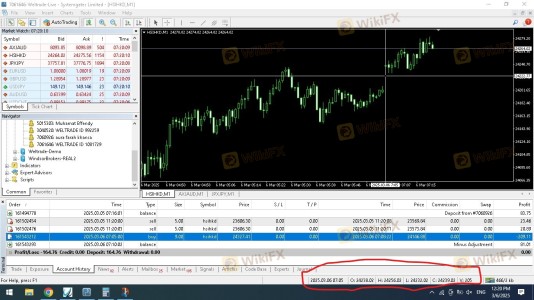

Trading Platform

WELTRADE claims to use the world renowned MetaTrader 4 and 5 platforms, which are well-recognized by its advanced charting tools and robust functionalities.

You can reach the platforms on web, or download app from Windows, mobiles phones and Mac.

Besides, the company also developed its own trading platform WELTRADE App, downloadble from both iOS and Android devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | iOS, Android, Windows, MacOS, Web | Beginners |

| MT5 | ✔ | iOS, Android, Huawei, Windows, MacOS, Web | Experienced traders |

| Weltrade App | ✔ | iOS, Android | / |

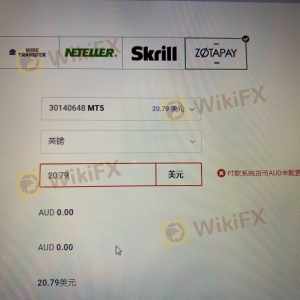

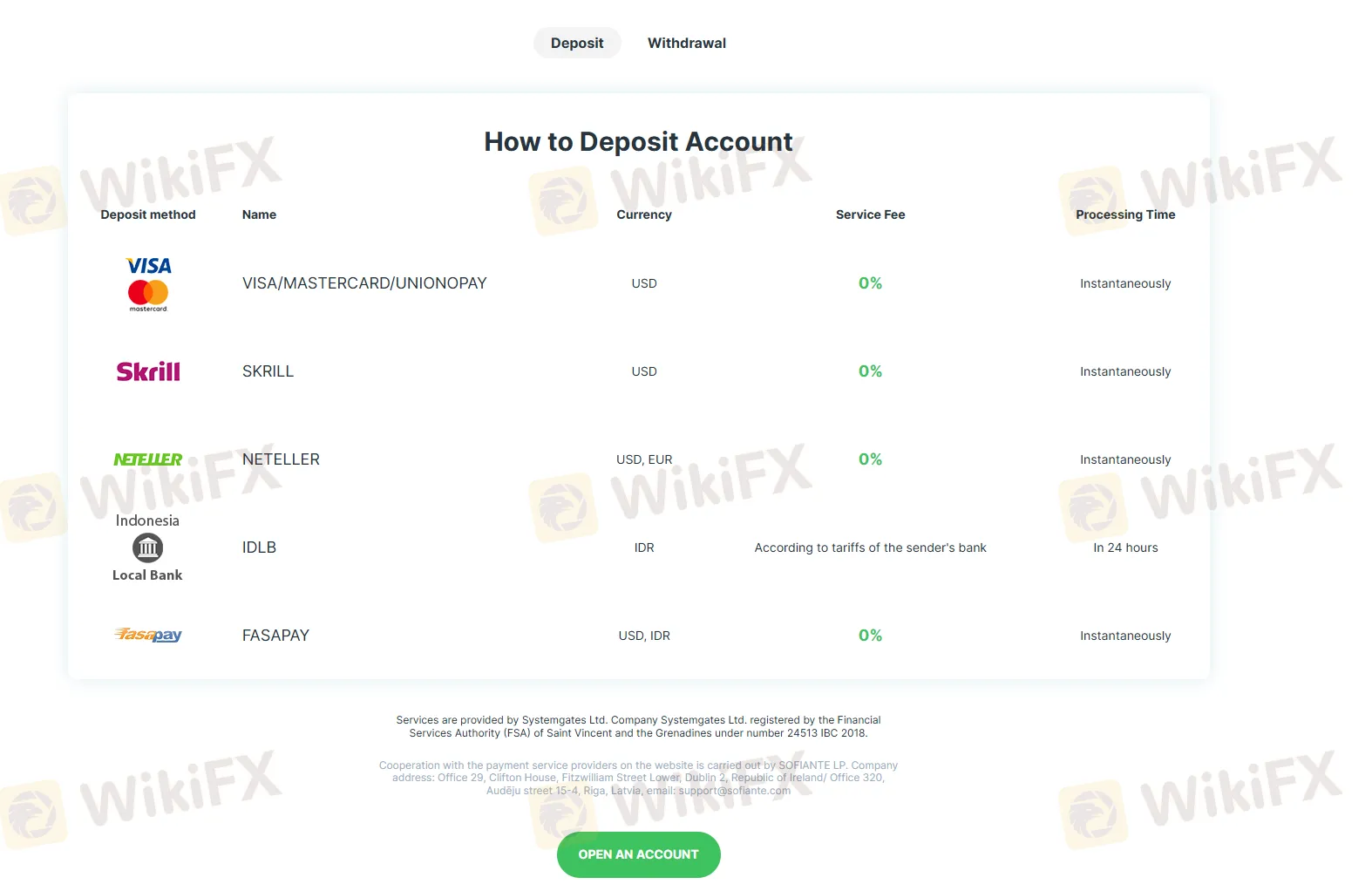

Deposit and Withdrawal

WELTRADE supports several funding methods:

| Payment Method | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Time | Withdrawal Time |

| VISA/MASTERCARD/UNIONPAY | USD | ❌ | 4% + 2 USD | Instantaneous | 30 min, 24/7 |

| Skrill | 1% | ||||

| Neteller | USD, EUR | 2% (min. $1.00) | |||

| IDLB | IDR | Sender's bank tariff | ❌ | Within 24 hours | |

| FasaPay | USD, IDR | ❌ | 0.5% (min. $0.01, max. $5.00) | Instantaneous |

admiral-markets

| Founded in | 2001 |

| Headquarters | Seychelles |

| Regulated by | ASIC, FCA, CySEC, FSA (Offshore) |

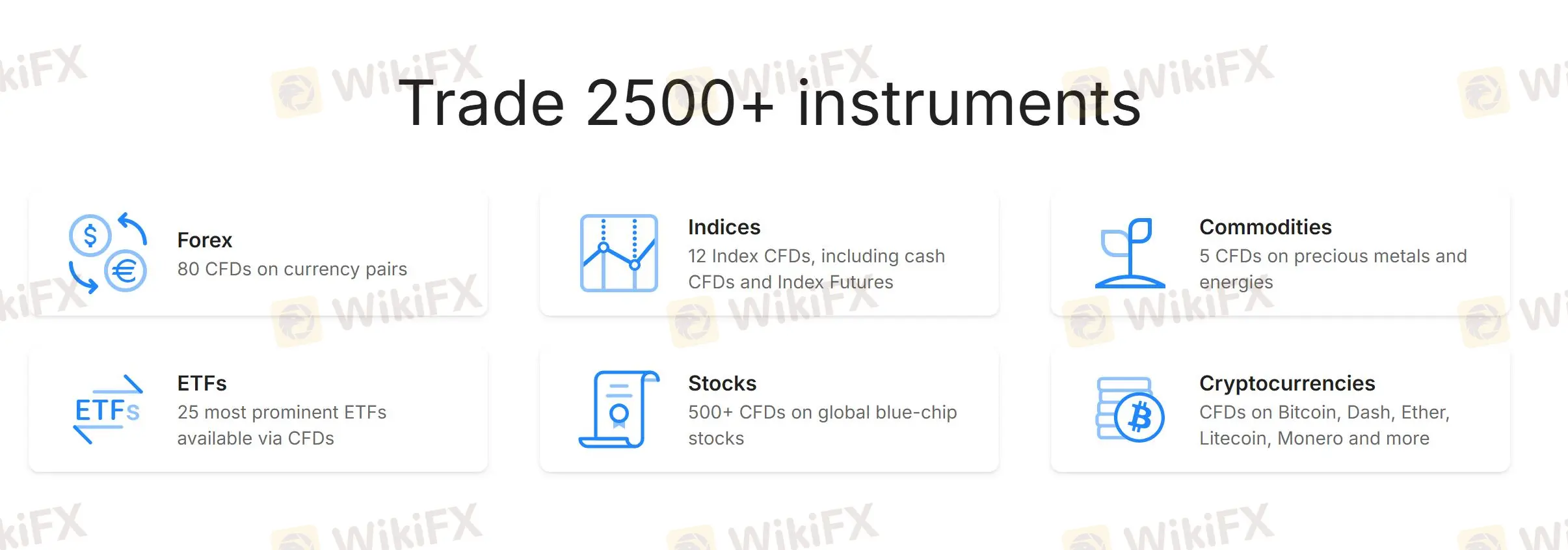

| Trading instruments | 2,500+, forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Account Type | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5 |

| Min Deposit | $25 |

| Leverage | 1:3-1:1000 |

| EUR/USD Spread | Floating around 0.1 pips |

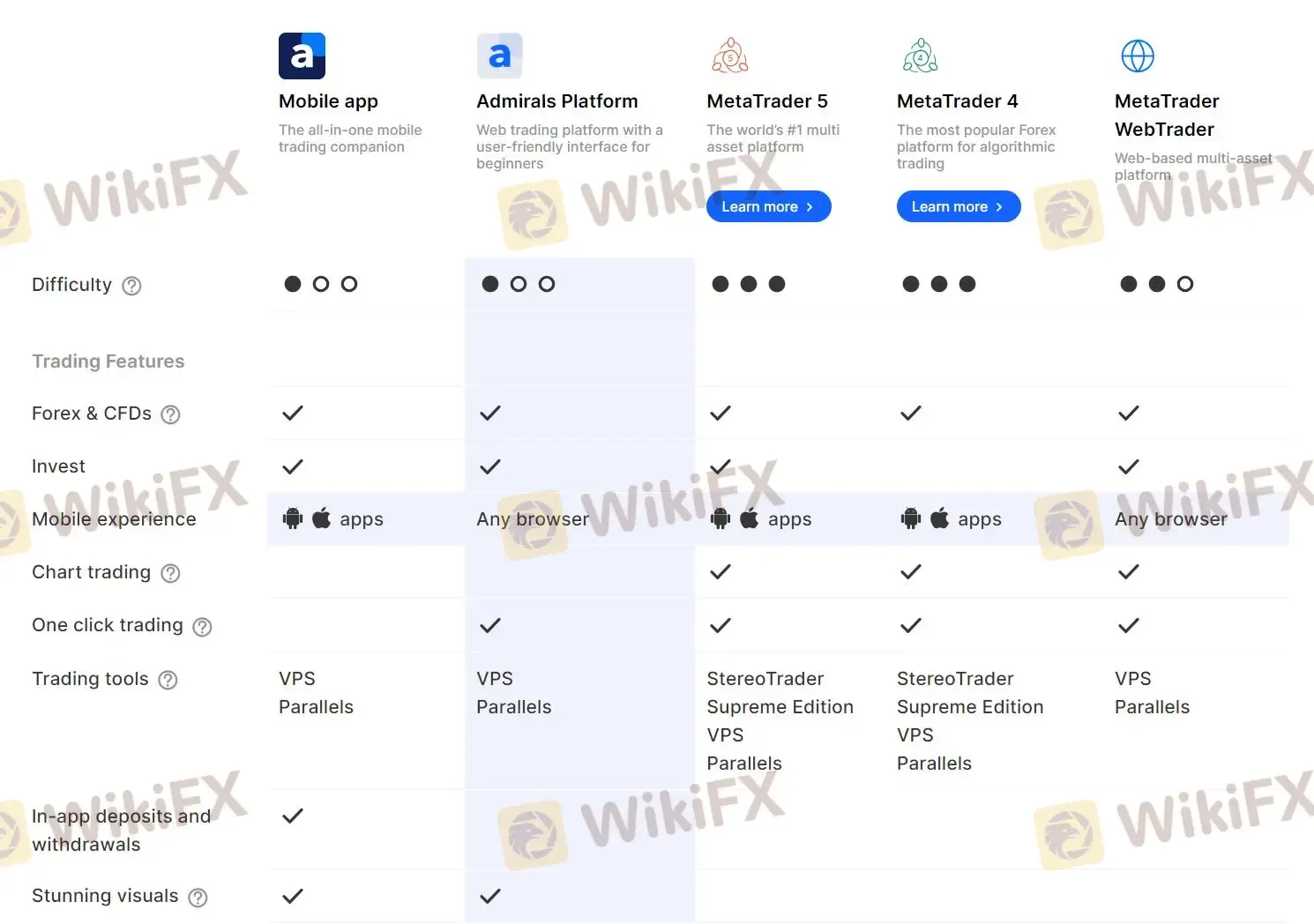

| Trading platform | MT4/5, Trading App, Admirals Platform, StereoTrader |

| Payment Methods | Visa, MasterCard, Skrill, Neteller, Crypto payments, Bank Wire |

| Deposit Fee | ❌ |

| Withdrawal Fee | One free withdrawal request every month, 5 EUR/USD thereafter |

| Inactivity Fee | 10 EUR per month (only charged if the account balance is greater than zero) |

| Customer Support | Live chat, contact form |

| Tel: +2484671940, +3726309306 | |

| Email: global@admiralmarkets.com | |

| Regional Restriction | Belgium |

Admiral Markets Overview

Admiral Markets is a global online trading provider offering trading services in 2,500+ financial instruments, including forex, indices, commodities, ETFs, stocks, and cryptocurrencies. The company was founded in 2001 and is headquartered in Seychelles, with offices in various countries around the world.

Admiral Markets is regulated by several financial authorities, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). The company offers a range of trading platforms, account types, and educational resources to its clients.

Admiral Markets is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Admiral Markets acts as an intermediary and takes the opposite position to its clients.

Regulatory Status

Admiral Markets is regulated by several respected financial authorities globally.

In Australia, it is regulated by Australia Securities & Investment Commission (ASIC) under the Market Making (MM) model.

In the United Kingdom and Cyprus, the firm is overseen by the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC) respectively, both also under the Market Making model.

Additionally, it holds a Retail Forex License in Seychelles, further extending its regulatory framework to offshore jurisdictions.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| ASIC | Regulated | ADMIRALS AU PTY LTD | Market Making (MM) | 000410681 |

| FCA | Regulated | Admiral Markets UK Ltd | Market Making (MM) | 595450 |

| CySEC | Regulated | Admirals Europe Ltd (ex Admiral Markets Cyprus Ltd) | Market Making (MM) | 201/13 |

| FSA | Offshore Regulated | Admirals SC Ltd | Retail Forex License | SD073 |

Pros and Cons of Admiral Markets

Advantages:

- Wide range of trading instruments and account types to choose from

- Flexible maximum leverage options (1:3-1:1000)

- Multiple payment methods available without deposit fees

- Comprehensive educational resources for traders of all levels

- Customized customer service for different regions and languages

- Access to various trading platforms including MT4/5, Trading App, Admirals Platform, and StereoTrader

- A variety of trading tools and features such as negative balance protection and free VPS

Disadvantages:

- Belgium clients are not accepted

- Only one free withdrawal request every month, 5 EUR/USD thereafter

- Inactivity fee of 10 EUR per month charged if the account balance is greater than zero

Market Instruments

Admiral Markets offers a diverse range of trading products, encompassing over 2,500 instruments across various asset classes to cater to different investment preferences.

| Asset Class | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| ETFs | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Ooptions | ❌ |

Trading Accounts/Fees

Admiral Markets offers five account types: Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.

The Invest.MT5 account has the lowest minimum deposit requirement, starting at just $1 USD/EUR, and offers the widest range of trading instruments including over 4500 stocks and more than 400 ETFs; however, it does not support leverage trading.

Only the Trade.MT5 account offers the option for an Islamic account.

For more detailed differences among the account types offered by Admiral Markets, please refer to the table below:

| Account Type | Trade.MT4 | Zero.MT4 | Trade.MT5 | Zero.MT5 | Invest.MT5 |

| Min Deposit | 25 USD/EUR, 100 BRL, 500 MXN, 20 000 CLP, 50 SGD, 1000 THB, 500 000 VND, 25 AUD | 1 USD/EUR | |||

| Trading Instruments | 37 currency pairs, 5 cryptocurrency CFDs, 2 metal CFDs, 3 energy CFDs, 12 cash index CFDs, 200+ stock CFDs | 80 currency pairs, 3 metal CFDs, 8 cash index CFDs, 3 energy CFDs | 80 currency pairs, 18 cryptocurrency CFDs, 2 metal CFDs, 3 energy CFDs, 12 cash Index CFDs, 2,300+ stock CFDs, 350+ ETF CFDs | 80 currency pairs, 3 metal CFDs, 8 cash index CFDs, 3 energy CFDs | 4,500+ stocks, 400+ ETFs |

| Leverage (Forex) | 1:3-1:1000 | ❌ | |||

| Leverage (Indices) | 1:10-1:500 | ❌ | |||

| Spread | From 1.2 pips | From 0 pips | From 0.6 pips | From 0 pips | |

| Commission | Single Share & ETF CFDs - from 0.02 USD per share | Forex & Metals - from 1.8 to 3.0 USD per 1.0 lots | Single Share & ETF CFDs - from 0.02 USD per share | Forex & Metals - from 1.8 to 3.0 USD per 1.0 lots | Stocks & ETFs - from 0.02 USD per share |

| Other instruments - no commissions | Cash Indices - from 0.15 to 3.0 USD per 1.0 lots | Other instruments - no commissions | Cash Indices - from 0.15 to 3.0 USD per 1.0 lots | ||

| Energies - 1 USD per 1.0 lots | Energies - 1 USD per 1.0 lots | ||||

| Islamic Account | ❌ | ❌ | ✔ | ❌ | ❌ |

Leverage

Admiral Markets offers a range of leverage options from 1:10 to 1:1000, allowing traders to select the level that aligns with their strategy and risk tolerance. While higher leverage can amplify profits from smaller investments, it also increases the potential for significant losses.

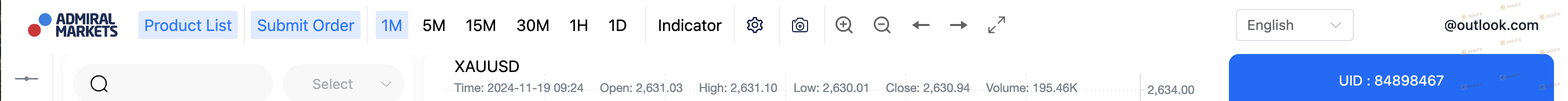

Trading Platforms

Admiral Markets offers a comprehensive suite of trading platforms to cater to various trading needs:

- MetaTrader 4 (MT4): Known for its reliability and powerful analytical tools, MT4 is available for Windows and offers advanced trading capabilities in a secure environment. It supports Forex and CFD trading.

- MetaTrader 5 (MT5): Available for Windows, Android, iOS, and Mac, MT5 is a multi-asset platform favored globally for trading Forex, CFDs, exchange-traded instruments, and futures. It features advanced charting tools, automated trading options, and mobile apps that allow trading on the go.

- Admirals Mobile App: Developed in-house, this mobile app provides a user-friendly interface for trading CFDs on various instruments. Available for mobile devices, it ensures trading accessibility anytime, anywhere.

- StereoTrader: An advanced MetaTrader panel that enhances trading with strategic order types, stealth modes, and intelligent automation. It's designed for traders looking for precision and flexibility in their strategies.

Deposit and Withdrawal

Admiral Markets accepts deposits and withdrawals via Visa, MasterCard, Skrill, Neteller, Crypto payments, and Bank Wire.

All deposits are free of charge, while only one free withdrawal request every month, and 5 EUR/USD thereafter.

Fees

In addition to commissions and withdrawal fees that we have mentioned before, some other fees may be charged, as follows:

Internal transfer

| Between a client's separate trading accounts | |

| Accounts with the same base currency | ❌ |

| Accounts with different base currencies | 1% of the amount |

| Between a client's separate wallets, wallet and trading account | |

| Wallets, wallet and account with the same base currency | ❌ |

| Wallets, wallet and account with different base currencies | 5 free transfers, 1% of the amount thereafter (min 1 EUR) |

Additional fees

| Opening a live or demo trading account | ❌ |

| Inactivity fee | 10 EUR per month |

| Currency conversion fee | 0.3% |

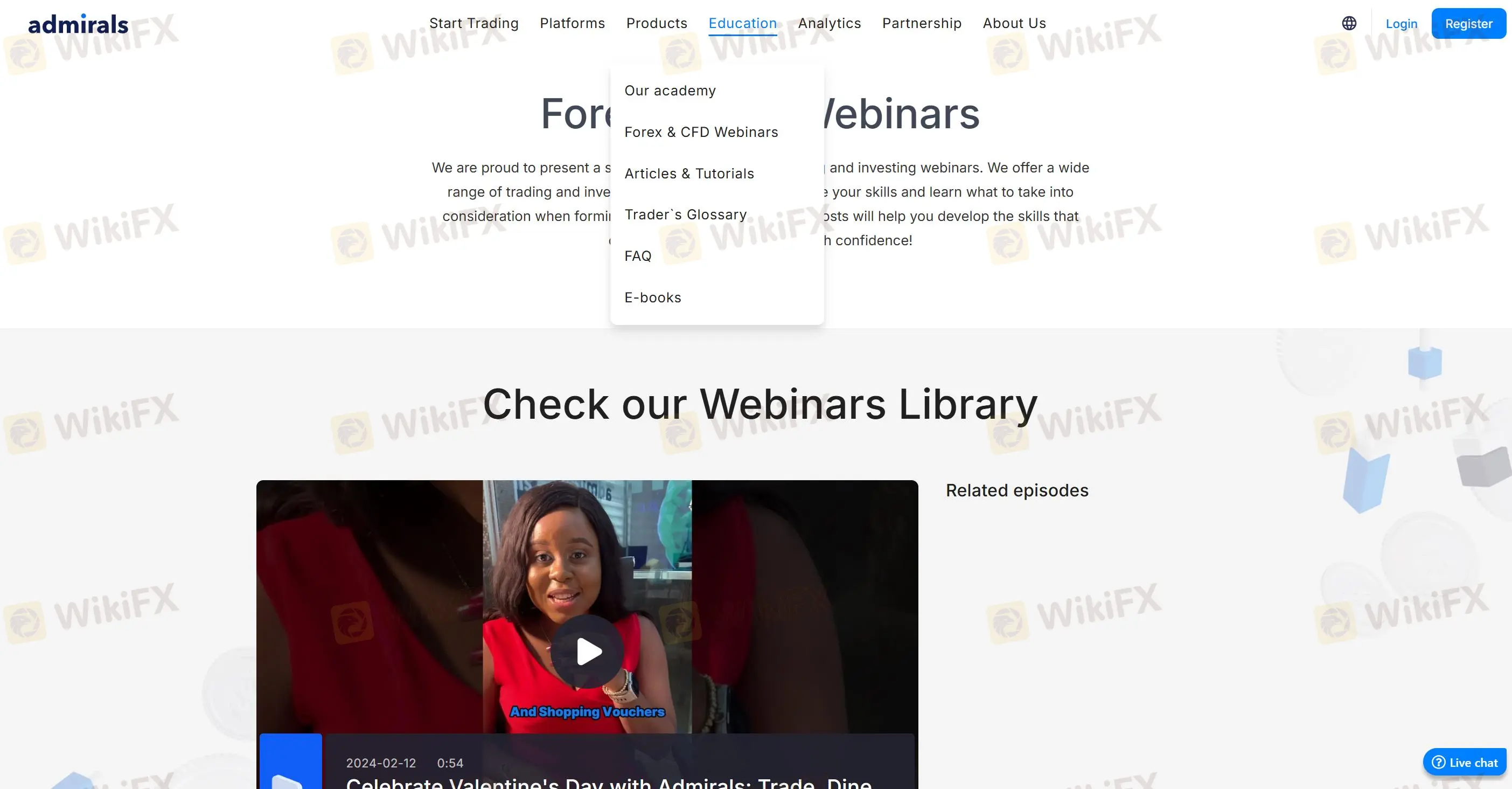

Educational Resources

Admiral Markets offers a robust suite of educational resources suitable for traders of all experience levels. These resources encompass an economic calendar to monitor significant market events, comprehensive market reports, and real-time charts that provide up-to-date market conditions.

Additionally, traders can benefit from a variety of learning formats including video tutorials for practical guidance on trading platforms, interactive webinars and seminars for insights from market experts, as well as eBooks that delve into trading strategies and concepts.

A glossary is also available to help traders familiarize themselves with trading terminology, enhancing their understanding of the financial markets.

Conclusion

Admiral Markets is a well-established online trading broker with over 20 years of industry experience, offering a diverse range of financial instruments, platforms, and account types to traders globally. The broker provides robust tools and educational resources to support informed trading decisions, along with flexible leverage and multiple payment options.

While Admiral Markets stands out for its tailored services across different regions, various fees can't be overlooked.

FAQs

What regulatory bodies oversee Admiral Markets?

Admiral Markets is regulated by ASIC, FCA, CYSEC, and holds an offshore Retail Forex License from the FSA in Seychelles.

What can I trade on Admiral Markets?

The platform offers 2,500+ tradable instruments, including forex, indices, commodities, stocks, bonds, cryptocurrencies, and ETFs.

Which trading platforms does Admiral Markets support?

Admiral Markets supports MT4/5, Trading App, Admirals Platform, and StereoTrader.

Does Admiral Markets provide educational resources?

Yes, it offers webinars, seminars, eBooks, and market analysis.

What account types does Admiral Markets offer?

Available accounts include Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.

Are there fees or commissions at Admiral Markets?

Yes. Both withdrawal fee and inactivity fee are charged, as well as some other fees. You can find detailed info above.

How can I manage funds in my Admiral Markets account?

Funds can be deposited or withdrawn via Visa, MasterCard, Skrill, Neteller, Crypto payments, and Bank Wire.

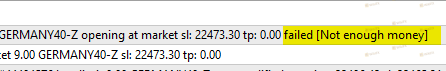

Are the transaction costs and expenses of weltrade, admiral-markets lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive weltrade and admiral-markets are, we first considered common fees for standard accounts. On weltrade, the average spread for the EUR/USD currency pair is from 0.5 pips, while on admiral-markets the spread is From 0.

Which broker between weltrade, admiral-markets is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

weltrade is regulated by NBRB,FSCA. admiral-markets is regulated by FCA,CYSEC,FSA,ASIC.

Which broker between weltrade, admiral-markets provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

weltrade provides trading platform including Pro,Micro,SyntX and trading variety including Forex, Metals, Commodities, Stocks, Indices. admiral-markets provides trading platform including Zero.MT4,Trade.MT4, Zero.MT5, Trade.MT5,Invest.MT5 and trading variety including Currency pairs, Metal CFDs, Cash Index CFDs, Energy CFDs.