No data

Do you want to know which is the better broker between TMGM and Super Forex ?

In the table below, you can compare the features of TMGM , Super Forex side by side to determine the best fit for your needs.

Long: -6.15

Short: 2.22

Long: -32.04

Short: 19.73

EURUSD: 0.1

XAUUSD: 0.3

Long: -10.59

Short: 4.14

Long: -12.29

Short: -3.72

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of tmgm, super-forex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

TMGM appears to a respected forex broker, presenting access to more than 12,000 spanning forex, CFDs, and cryptocurrencies. Traders can enjoy competitive spreads across various instruments, exemplified by the EUR/USD currency pair with an average spread of around 0.1 pips. Moreover, TMGM extends a diverse set of trading platforms, notably including MetaTrader 4 and IRESS. Besides, TMGM enriches the trading journey with rich educational resources and trading tools. Lastly, 24/7 multilingual customer support stands ready. However, the question remains: Does TMGM truly live up to its claims? Let's explore more.

| TMGM Review Summary in 10 Points | |

| Founded | 2013 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, FMA, VFSC (Offshore) |

| Market Instruments | forex, indices, shares, futures, precious metals, energies and cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | 1.0 pips |

| Trading Platforms | MT4, MT5 (coming soon), IRESS |

| Minimum deposit | $100 |

| Customer Support | Live chat, phone, email |

Founded in 2013 and headquartered in Sydney, Australia, TMGM is an online ECN/STP broker. Notably, in 2016, TMGM introduced its MetaTrader 5 platform. Subsequently, the company achieved FCA membership in the UK during 2017. The year 2019 witnessed the launch of TMGM's mobile trading app, further enhancing accessibility. By 2021, TMGM's reach expanded to encompass over 200 countries worldwide.

Offering a diverse array of more than 12,000 trading instruments spanning forex, commodities, cryptocurrencies, and stocks, TMGM caters to traders through popular platforms including MetaTrader 4 (MT4) and Iress.

TMGM has some strong points: solid regulation, competitive costs, lots of assets, and top-notch support. But there are a couple of downsides, like inactivity fees and no MT5 yet.

| Pros | Cons |

| • ASIC and FMA regulation | • No US clients accepted |

| • Competitive spreads and low commissions | • Inactivity fees applied |

| • Over 12000 trading instruments | • MT5 not provided yet |

| • Both MT4 and IRESS platforms offered | |

| • 24/7 multilingual cutsomer support | |

| • Multiple account types with flexible options | |

| • Rich educational resources | |

| • High leverage up to 1:500 |

TMGM, a regulated broker, holds authorization from the tier-one regulator ASIC and is also licensed by the New Zealand Financial Markets Authority (FMA). Additionally, TMGM's international operations are overseen by the VFSC in Vanuatu offshore. Now, let's quickly delve into TMGM's regulations and licenses, which will shed light on how the broker ensures compliance with industry standards and protects clients.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

|

ASIC | TRADEMAX AUSTRALIA LIMITED | Market Making(MM) | 436416 |

|

FMA | TRADEMAX GLOBAL MARKETS (NZ) LIMITED | Market Making(MM) | 569807 |

|

VFSC | Trademax Global Limited | Retail Forex License | 40356 |

Under the oversight of ASIC, a prominent tier-1 regulatory authority, TMGM's Australian branch known as TRADEMAX AUSTRALIA LIMITED operates with regulatory number 436416. This entity is licensed for Market Making (MM). As per the stringent rules set by ASIC, which is globally recognized, brokers must ensure the safety of clients' funds.

Since TMGM claims to obtain the ASIC license, an investigation team from WikiFX visited the company's registered address in Australia. This visit, conducted in person, revealed that the company is operating smoothly and on a large scale. This direct observation by the investigator enhances our confidence in TMGM's legitimacy and highlights its strong and credible operations under ASIC's regulation.

TMGM's another entity, the entity in New Zealand known as TRADEMAX GLOBAL MARKETS (NZ) LIMITED, similarly, holds a Maket Making (MM) lincense from the authorization of FMA.

Lastly, TMGM's international branch, Trademax Global Limited, operates under the regulation and authorization of VFSC offshore, holding a license for retail forex activities.

TMGM goes above and beyond by offering an impressive collection of 12,000+ trading instruments, setting it apart as a broker with an exceptional range of options, covering 60 currency pairs, indices, and stocks sourced from major global exchanges. Moreover, TMGM extends its offerings to include futures, as well as sought-after precious metals like gold and silver. Adding to the mix are energies such as oil and natural gas, not to mention a selection of 10 cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

| Trading Assets | Available |

| Forex | |

| Shares | |

| Energies | |

| Indices | |

| Precious Metals | |

| Cryptocurrencies | |

| Futures | |

| Indices CFD Dividend | |

| Shares CFD Dividend | |

| ETFS | |

| Stocks | |

| Options |

TMGM tailors its account types to match the chosen trading platform. If you're using the MetaTrader 4 platform, they provide EDGE and CLASSIC accounts. Opting for the IRESS trading platform brings you a choice of STANDARD, PREMIUM, and GOLD accounts. Plus, for those who prefer Swap Free accounts or want to practice with demo accounts, TMGM offers those options as well.

MT4 Accounts: EDGE and CLASSIC

Both accounts require a minimum deposit of $100, quite reasonable for most regular traders to get started.

| Classic | Edge | |

| Min Deposit | $100 | $100 |

| Min Lot Size | 0.01 Lot | 0.01 Lot |

| Max Leverage | 1:500 | 1:500 |

| Funding | Free | Free |

| Execution Type | ECN | ECN |

| EA Available | ||

| Islamic Account | ||

| Hedging Allowed |

IRESS Accounts: STANDARD, PREMIUM and GOLD

The minimum deposit requirement is $5,000 for STANDARD Account, $10,000 for PREMIUM Account, and $50,000 for GOLD Account. When it comes to fees, the Standard account entails a platform fee of $35 USD or $45 AUD per month. The Premium and Gold account holders, on the other hand, enjoy fee-free access to the platform. Additionally, all account types are subject to a data fee for each exchange they use.

| Standard | Premium | Gold | |

| Minimum Deposit | $5,000 USD | $10,000 USD | $50,000 USD |

| Platform Fee | $35 USD or $45 AUD / per month | No Fee | No Fee |

| Data Fee | For Every Exchange | For Every Exchange | For Every Exchange |

| Min. Commission | $ 10 | N/A | N/A |

| Commission Rate (cps) | 2.25 | 7 | 1.8 |

| Minimum(Trade Size) | 333Shares | N/A | N/A |

| Financing | Libor+3.5%/-3.5% | Libor +3%/-3% | Libor +2.5%/-2.5% |

| Demo Account |

Swap-Free Account

TMGM also provides a Swap Free account for those who are unable to pay or receive interest owing to their religious convictions. To open a Swap-Free account, you'll need to have an Edge account, which requires a minimum of $100 and a minimum lot size of 0.01.

Demo Account

Demo trading accounts are available through TMGM for anyone interested in testing the waters before opening a real account. These accounts allow you to test out the broker's services before committing any real money. In addition, it provides a means of learning as much as possible about TMGM before you commit to an investment account.

The MetaTrader4 trading platform (which we'll come to in a moment) is available to demo accounts for an entire year. However, in the event of inactivity for six months, your access will be terminated. A $5,000, $10,000, or $50,000 virtual currency balance is available to you.

TMGM offers quite a high trading leverage up to 1:500 on all account types. Forex products trading can use leverage of up to 1:500, indices and energy with leverage of 1:100, and precious metals featuring 400x leverage.

Here's a table comparing leverage provided by major industry players. Notably, TMGM offers relatively higher leverage, though it appears somewhat more cautious compared to the other three competitors. However, users should remember that high leverage is a two-edged tool with potential risks.

| Broker | Exness | FXTM | IC Markets | TMGM |

| Leverage | Up to 1:Unlimited | Up to 1:2000 | Up to 1:500 | Up to 1:500 |

TMGM offers competitive spreads and commissions on their trading instruments. The exact spreads and commissions vary depending on the account type and trading platform used. The spreads on CLASSIC accounts start at 1.0 pips, with no commission charged, while the spreads on EDGE accounts start at 0.0 pips, and a commission of $7 (round turn) is charged per lot.

Generally, TMGM offers tight spreads on major forex pairs such as EUR/USD, with spreads as low as 0.0 pips. Commissions may be charged on some trading instruments, such as shares and futures. However, these commissions are generally competitive compared to other brokers in the industry.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| TMGM | 0.0 pips | $7 per round turn |

| Pepperstone | 0.09 pips | $3.5 per lot |

| eToro | 1.0 pips | $0 |

| IG | 0.6 pips | $0 |

| Plus500 | 0.8 pips | $0 |

| XM | 0.9 pips | $0 |

Note that commission rates may vary based on account type and trading volume, and spread rates may also vary depending on market conditions.

TMGM offers two popular trading platforms for their clients: MetaTrader4 (MT4) and IRESS.

| Available Devices | PC, Mac, Mobile ( OS and Android) |

| Language | English |

| Scalping | |

| Hedging | |

| Automated Trading | |

| One-click Execution | |

| Web-based Trading | |

| Mobile Trading | |

| MT5 | |

| IRESS | |

| cTrader | |

| Proprietary Platform |

MT4 is a popular and widely used platform that provides advanced charting tools, technical analysis indicators, and customizable trading robots. It also supports a variety of order types and execution modes, allowing for flexible and efficient trading.

IRESS, on the other hand, is a more sophisticated and feature-rich platform that is designed for more experienced traders. It offers advanced order management, risk management, and portfolio analysis tools, as well as advanced charting and technical analysis capabilities.

Both platforms are available on desktop, mobile, and web versions, providing traders with the flexibility to trade on their preferred device.

Additionally, MetaTrader5 is not provided yet, and according to the announcement of TMGM's website, this popular trading platform is coming soon.

TMGM provides its traders with various trading tools to enhance their trading experience. These tools include:

Trading Calendar: A calendar that shows the dates and times of upcoming economic events, including central bank meetings, interest rate decisions, and other important announcements.

Market Sentiment Tool: A tool that allows traders to gauge market sentiment by analyzing the number of long and short positions held by other traders.

ForexVPS: A virtual private server that allows traders to run their trading strategies 24/7 without the need for a personal computer.

Trading Central: A research platform that provides traders with market analysis, trading ideas, and technical analysis tools to help them make informed trading decisions.

Traders Terminology: Type the keyword or term that you are looking for or select the letters to see the list of words.

Max-Calculator : The Max-Calculator is one of the best ways to help traders quickly evaluate the possible outcome of potential transactions or actions. In addition, this calculator will also help you calculate the margin easily.

| Educational Contents | Available |

| HUBx | |

| Trading Calendar | |

| Market Sentiment Tool | |

| ForexVPS | |

| Trading Central | |

| Traders Terminology | |

| Max-Calculator |

| TMGM | Most other | |

| Minimum Deposit | $100 | $100 |

The minimum deposit and withdrawal amount is both $100. Depositing doesn't cost anything, but the time it takes and the currency options depend on your chosen payment method. Be aware, though, that some deposit methods like Union Pay, FasaPay, Visa, and MasterCard can't be used for withdrawals.

| Payment Options | Currencies | Min.Deposit | Min.Withdrawal | Fees | Processing Time ( Deposit) | Processing Time ( Withdrawal) |

|

NZD, USD, AUD, EUR, CAD | $100 | $100 | $0 | 1-3 Working Day | 1 Working Day |

|

USD | $100 | $100 | $0 | Instant | 1 Working Day |

|

NZD | $100 | N/A | $0 | 1 Working Day | N/A |

|

USD | $100 | $100 | $0 | Instant | 1 Working Day |

|

USD, EUR, GBP, AUD, NZD, CAD | $100 | $100 | $0 | 1 Working Day | 1 Working Day |

|

USD, EUR, GBP, AUD, NZD, CAD | $100 | $100 | $0 | 1 Working Day | 1 Working Day |

|

CNY | $100 | N/A | $0 | Instant | N/A |

|

CNY | $100 | $100 | $0 | Instant | 1 Working Day |

|

USD | $100 | N/A | $0 | Instant | N/A |

|

USD, EUR, GBP, AUD, NZD, CAD | $100 | N/A | $0 | 3 Working Days | N/A |

|

MYR, THB, IDR, VND | $100 | $100 | $0 | Instant | N/A |

|

USD, EUR, GBP, AUD, NZD, CAD | $100 | N/A | $0 | Instant | N/A |

|

USD, EUR, GBP, AUD, NZD, CAD | $100 | N/A | $0 | Instant | N/A |

TMGM charges various fees, including spreads and commissions that we have mentioned before, as well as overnight financing fees. The specific fees vary depending on the type of account and trading platform used. TMGM does not charge any deposit or withdrawal fees, but clients may incur fees from their payment providers.

Additionally, TMGM charges an inactivity fee of $10 per month if there is no activity in the trading account for a period of six months or more. This fee will be deducted from the available balance of the account. However, if the available balance is less than $10, no inactivity fee will be charged. It is important to note that the inactivity fee is a common practice in the industry and is designed to encourage active trading and to offset the costs of maintaining inactive accounts.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| TMGM | Free | Free | $10/month after 6 months of inactivity |

| Pepperstone | Free | Free for Australian Bank Transfer, $20 for International Transfer | $0 after 12 months of inactivity |

| eToro | Free | $5 | $10/month after 12 months of inactivity |

| IG | Free | $1 for AUD, CAD, and USD, £1 for GBP, €1 for EUR | $18/month after 24 months of inactivity |

| Plus500 | Free | $1.5-$10 depending on withdrawal method | $10/month after 3 months of inactivity |

| XM | Free | Free | $5/month after 90 days of inactivity |

TMGM offers customer support through multiple channels including live chat, phone, email, and social media (YouTube, Twitter, Facebook, Instagram and LinkedIn).

| Contact Channels | Details |

|

+612 8036 8388 |

|

support@tmgm.com |

|

24/7 |

|

Sydney office, Melbourne Office, Adelaide Office, Canberra Office, Auckland Office |

|

https://www.facebook.com/TMGMgroup |

|

https://twitter.com/TMGMgroup |

|

https://www.youtube.com/tmgmgroup |

|

https://www.instagram.com/tmgmgroup/ |

|

https://www.linkedin.com/company/tmgmgroup |

|

https://api.whatsapp.com/send/?phone=61452597488&text&app_absent=0 |

You'll find an extensive and user-friendly FAQ section right on their website, covering a wide range of topics, from account setup to trading strategies, making it an invaluable tool for traders of all levels.

| Pros | Cons |

| • Multiple languages supported | • No dedicated account manager or personal service |

| • Quick response times to inquiries | • Limited availability on weekends and holidays |

| • Personalized service with tailored solutions |

TMGM's special feature is TMGM Academy, and it's available in addition to the usual customer service. You may get a thorough education in foreign exchange trading by enrolling in the TMGM Academy. There are three levels to choose from Basic, Intermediate, and Expert.

The beginner stage prepares you for your journey into forex trading. The Beginner Stage develops a strong foundation based on understanding margin trading, how to read various types of charts, plus an introduction to trading instruments, oscillators, indicators, and support plus resistance.

TMGM Academies Intermediate Stage starts focusing on more technical aspects of forex trading. This includes considering indicators like MACD, RSI, ATRs, Moving Averages, and more. Additionally, TMGM introduces Fibonacci and Fundamental analysis, plus effective ways to employ them in trading.

The Advanced Stage in the TMGM Academy is where traders get deep into various trading strategies and how to apply them. This stage includes learning about advanced forms of Fibonacci extensions and retracements, RSI, correlation, and trade management.

To sum it up, TMGM stands out as a respected and regulated broker. They offer a diverse set of trading options and platforms, including the sought-after MetaTrader4 and IRESS. Plus, they shine when it comes to customer service and educational materials. Not to mention, their spreads and commissions are pretty darn competitive too. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

Q1: Is TMGM regulated?

A1: Yes. It is regulated by ASIC, FMA and VFSC (offshore).

Q2: At TMGM, are there any regional restrictions for traders?

A2: Yes. Products and Services offered on their website are not intended for residents of the United States.

Q3: Does TMGM offer demo accounts?

A3: Yes.

Q4: Does TMGM offer the industry-standard MT4 & MT5?

A4:Yes. It supports MT4, and MT5 is coming soon.

Q5: What is the minimum deposit for TMGM?

A5: The minimum initial deposit at TMGM to open an account is $100.

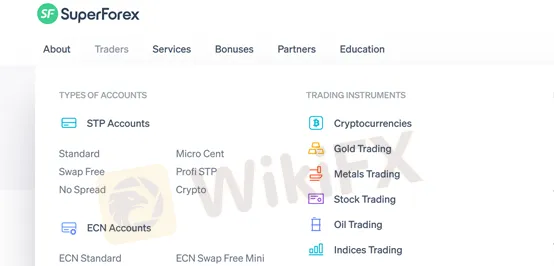

| Registered in | Belize |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 5-10 years |

| Trading instruments | Cryptocurrencies, precious metals, stock, oil, forex pairs, indices |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:3000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4 |

| Deposit and withdrawal method | Bank Wire Transfers, Credit/Debit Cards, E-Payments, Cryptocurrencies, Local Payments and superforex money |

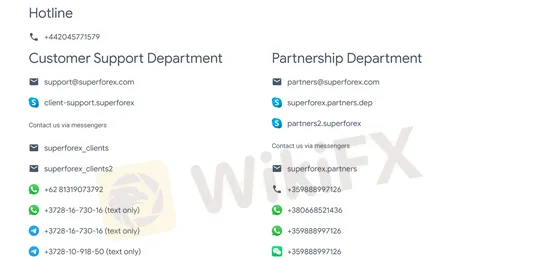

| Customer Service | Email, phone number, WhatsApp, WeChat, telegramInstagram, YouTube, Facebook, twitter, LinkedInFAQ, Callback |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide range of trading products and account types to choose from

High leverage of up to 1:3000

No additional fees on transactions with your account

Extensive educational resources available, including videos and seminars

Multiple channels of customer support, including social media platforms and callback option

Fast processing time for deposits

Cons:

Limited regulatory oversight and licensing

Limited information on the company's history and ownership

Some account types have high minimum deposits, such as the Profi STP and ECN accounts

The spreads on some trading products can be higher compared to other brokers

Withdrawals may take longer to process compared to deposits

Limited options for trading platforms, only offering the MT4 platform.

| Advantages | Disadvantages |

| Super Forex offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Super Forex has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Super Forex is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Super Forex acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Super Forex has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Super Forex or any other MM broker.

SuperForex is a global forex broker established in 2013 with a mission to provide its clients with top-quality financial services and a wide range of trading instruments. The company is headquartered in Belize. With its client-centric approach, SuperForex offers various account types, flexible trading conditions, a range of trading platforms, a variety of payment options, and a comprehensive set of educational resources to cater to the needs of both novice and experienced traders.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Super Forex offers a wide range of trading instruments, including cryptocurrencies, precious metals, stocks, oil, forex pairs, and indices. The availability of multiple asset classes provides traders with diversification opportunities, access to global markets, and the potential for high returns. With access to popular asset classes such as forex pairs and indices, traders can also benefit from high liquidity, which means they can quickly enter and exit positions at the desired price. However, trading multiple asset classes can be complex, may require extensive knowledge and expertise, and may come with higher margin requirements, increasing trading costs. Additionally, as the research and analysis on each asset class may not be as detailed or comprehensive as traders would prefer, traders should conduct their own research and analysis to make informed trading decisions.

| Advantages | Disadvantages |

| Competitive spreads | Unregulated broker |

| Detailed fee table | Potential hidden fees |

| Zero commissions | High leverage up to 1:3000 |

| No deposit or withdrawal fees | Lack of negative balance protection |

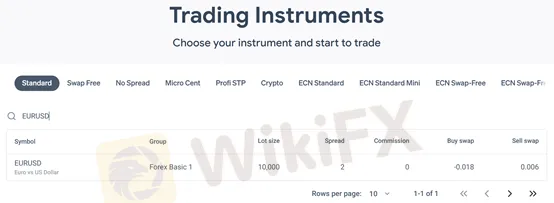

Super Forex offers competitive spreads and provides a detailed fee table that outlines spreads, commissions, SWAPs and lot sizes for various accounts and products. The absence of commissions and deposit/withdrawal fees makes trading cost-effective. However, as an unregulated broker, Super Forex carries a risk of potential hidden fees. Also, the high leverage of up to 1:3000 can be both beneficial and risky, as it can magnify profits and losses. Moreover, the lack of negative balance protection is a disadvantage that can expose traders to significant losses.

STP accounts:

| Account type | Standard | Swap-Free | No Spread | Micro Cent | Profi STP | Crypto |

| Minimum deposit | 5 USD | 5 USD | 50 USD | 1 USD | 500 USD | 50 USD |

| Maximum leverag | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:3000 | 1:10 |

| Swaps | Yes | No | No | Yes | No | No |

| Spreads | Fixed | Fixed | 0 | Fixed | from 0.01 pips | Fixed |

ECN accounts:

| Account type | ECN Standard | ECN Standard-Mini | ECN Swap-Free | ECN Swap-Free Mini | ECN Crypto |

| Minimum deposit | 100 USD | 5 USD | 100 USD | 5 USD | 50 USD |

| Maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:10 |

| Swaps | Yes | Yes | No | No | No |

| Spreads | Floating | Floating | Floating | Floating | Floating |

Super Forex offers a variety of account types, ranging from Standard and Micro Cent accounts to more specialized accounts like No Spread and Crypto. The broker also offers ECN accounts with floating spreads for traders looking for a more transparent pricing model. Each account type has its own minimum deposit requirement and maximum leverage, giving traders the flexibility to choose an account that best fits their needs. Additionally, the Swap-Free account option is available for those who require it, and the Profi STP account is specifically designed for professional traders. However, it should be noted that some account types have limited leverage and some have higher spreads compared to others.

| Advantages | Disadvantages |

| User-friendly and intuitive interface | Outdated and not as advanced as newer platforms |

| Flexible and customizable | Limited charting tools compared to other platforms |

| Large community support with abundant resources | No two-factor authentication for added security |

| Ability to use expert advisors (EAs) | Limited access to market data and news |

| Multiple language support | Limited integration with third-party plugins and tools |

Super Forex offers its clients the popular MetaTrader 4 (MT4) platform for trading, which has been in use for over a decade and is known for its user-friendly interface and flexible customization options. With MT4, traders have access to advanced charting tools, automated trading through expert advisors (EAs), and a large community of support with abundant resources. However, MT4 has limitations in terms of access to market data and news compared to newer platforms, and it does not offer two-factor authentication for added security. Additionally, while the platform is flexible and customizable, it does have limitations in terms of charting tools compared to other platforms.

| Advantages | Disadvantages |

| Potential for higher profits with smaller initial investments | Increased risk of substantial losses |

| Increased market exposure and flexibility in trading strategies | High leverage can lead to rapid depletion of funds in case of unfavorable market movements |

| Can provide access to larger positions and more trades | Requires a higher level of experience and risk management skills |

| Can amplify both profits and losses | Limited availability in certain jurisdictions due to regulatory restrictions |

Super Forex offers a very high maximum leverage of up to 1:3000, which can be advantageous for experienced traders looking to amplify their profits and gain greater market exposure with smaller initial investments. However, high leverage also carries a significant amount of risk, as it can lead to substantial losses in a short period of time. This requires traders to possess advanced risk management skills and strategies to mitigate the risks. Additionally, high leverage is not available in all jurisdictions due to regulatory restrictions.

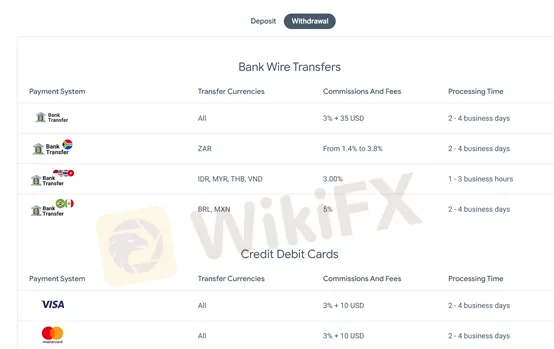

| Advantages | Disadvantages |

| Multiple deposit and withdrawal options | No information on fees charged by payment systems or banks |

| No additional fees charged by SuperForex on transactions | Processing time for withdrawals may take up to 4 business days |

| Instant processing time for deposits | Lack of information on withdrawal limits |

| Availability of local payment options | Limited cryptocurrency options compared to some competitors |

SuperForex offers a variety of deposit and withdrawal options to cater to clients' different preferences. One advantage is that the company does not charge any additional fees on transactions with your account. However, there is no information available on the fees charged by payment systems or banks, which may lead to unexpected charges for clients. Processing time for withdrawals may also take up to four business days, which may be longer than some competitors. On the other hand, deposits are processed instantly. SuperForex also offers local payment options, which can be convenient for clients in certain regions. However, the cryptocurrency options are limited compared to some competitors. It would be helpful for SuperForex to provide more information on withdrawal limits to assist clients in planning their transactions.

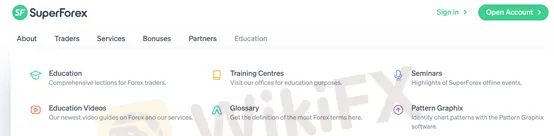

| Advantages | Disadvantages |

| Comprehensive educational resources available | Limited personal guidance |

| Variety of resources such as lections, glossary, seminars, and videos | No formal certification |

| Official YouTube channel available for additional resources | Self-directed learning may not suit all learners |

| Free of charge for Super Forex clients | No interactive learning tools |

| Accessible to clients worldwide | Some resources may be more basic than others |

Super Forex offers a variety of educational resources for its clients. The company provides comprehensive lections, a glossary, seminars, training centers, educational videos, and other resources to help traders learn more about forex trading. Additionally, Super Forex has an official YouTube channel where clients can access even more videos to supplement their learning. These resources are available free of charge to Super Forex clients, and they are accessible to traders worldwide. However, there are some disadvantages to Super Forex's educational resources. While they are comprehensive, they do not offer personalized guidance, and there is no formal certification process. Additionally, the resources are self-directed, which may not be suitable for all learners, and some of the materials may be more basic than others.

You may also visit their official YouTube channel to watch more videos. Here is a recent video about technical analysis.

| Advantages | Disadvantages |

| 24/5 customer support available via various channels | No 24/7 customer support |

| Several social media channels for customer support and engagement | No live chat available on website |

| FAQ section available on the website for quick self-help | No phone support for some countries |

| Callback feature available for personalized assistance | No physical office or location available for in-person assistance |

Super Forex offers a variety of customer care options for their clients. The company provides 24/5 customer support through various channels, including email, phone, WhatsApp, WeChat, Telegram, and social media platforms such as Instagram, YouTube, Facebook, Twitter, and LinkedIn. The FAQ section on their website is another helpful resource for clients who prefer self-help. Additionally, the callback feature is available for personalized assistance. However, Super Forex does not offer 24/7 customer support and live chat is not available on their website. Furthermore, phone support may not be available for some countries and there is no physical office or location available for in-person assistance.

In conclusion, Super Forex is a reputable and reliable forex broker that offers a wide range of trading instruments and account types to its clients. Its multiple deposit and withdrawal options, as well as its educational resources and customer support channels, make it an attractive option for traders of all levels of experience. The company also stands out with its high leverage of up to 1:3000, which can potentially lead to significant profits. However, traders must be aware of the risks involved in high leverage trading and exercise caution when trading with such high ratios. Overall, Super Forex provides a solid trading environment for traders looking to participate in the forex market.

Question: What is Super Forex?

Answer: Super Forex is a global forex broker that provides online currency trading services for both retail and institutional clients worldwide.

Question: Is Super Forex regulated?

Answer: No, Super Forex is not regulated.

Question: What trading platforms does Super Forex offer?

Answer: Super Forex offers the popular MetaTrader 4 (MT4) trading platform, which is available for both desktop and mobile devices.

Question: What is the minimum deposit required to open an account with Super Forex?

Answer: The minimum deposit required to open a Standard account with Super Forex is 5 USD.

Question: What types of accounts does Super Forex offer?

Answer: Super Forex offers various types of accounts, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, Crypto, ECN Standard, ECN Standard-Mini, ECN Swap-Free, ECN Swap-Free Mini, and ECN Crypto accounts.

Question: What is the maximum leverage offered by Super Forex?

Answer: Super Forex offers a maximum leverage of up to 1:3000.

Question: What educational resources are available on the Super Forex website?

Answer: Super Forex provides a variety of educational resources, including comprehensive lessons, a glossary, seminars, training centers, and educational videos, which are all designed to help traders improve their knowledge and skills in the forex market.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive tmgm and super-forex are, we first considered common fees for standard accounts. On tmgm, the average spread for the EUR/USD currency pair is From 0 pips, while on super-forex the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

tmgm is regulated by ASIC,FMA,VFSC. super-forex is regulated by FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

tmgm provides trading platform including Edge ,Classic and trading variety including FX: 56 Bullion: 3 Oil: 2 CFD: 20 Crypto: 12 Shares: 48. super-forex provides trading platform including Profi STP,Crypto,Standard,Swap Free,Micro Cent,No Spread and trading variety including USD, EUR, GBP, ZAR.