No data

Do you want to know which is the better broker between Octa and Windsor Brokers ?

In the table below, you can compare the features of Octa , Windsor Brokers side by side to determine the best fit for your needs.

EURUSD: 0.5

XAUUSD: -0.4

Long: -7.51

Short: 1.61

Long: -33.73

Short: 18.35

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of octafx, windsor-brokers lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Cyprus |

| Regulated by | CYSEC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | 28 Currency pairs + 2 metals + 2 energies + 10 indices |

| Minimum Initial Deposit | 100 euro |

| Maximum Leverage | 1:30 |

| Minimum spread | 0.3 pips onwards |

| Trading platform | MetaTrader 5 |

| Deposit and withdrawal method | VISA, skrill, Swissquote Bank SA, Rietumu Bank, BlueOrange Bank. |

| Customer Service | Email, address, live chat |

| Fraud Complaints Exposure | Yes |

| Negative balance protection | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide range of trading instruments available, including 28 currency pairs, 2 metals, 2 energies, and 10 indices.

Competitive spreads, starting from as low as 0.3 pips, with zero commission charges.

Convenient and feasible payment methods, with no extra fees charged by the company.

MetaTrader 5 platform available for trading, with a user-friendly interface and a variety of features.

Back office support available from 9:00 to 18:00 EET Monday to Friday, and live chat service also provided for customers.

Regulated by the CYSEC, ensuring a high level of safety and security for clients' funds.

Straightforward and detailed website, making it easy for clients to navigate and find the information they need.

Cons:

Limited educational resources, with only a few calculators available.

No other account types are offered besides the MetaTrader 5 account.

Maximum leverage is relatively low, only up to 1:30.

Limited customer support options, with only email and live chat available.

No physical office or phone support available, which may be inconvenient for some clients.

Limited bonuses or promotions offered compared to other brokers.

No mobile app available for trading, which may be a disadvantage for clients who prefer to trade on-the-go.

| Advantages | Disadvantages |

| OctaFX offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, OctaFX has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

OctaFX is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, OctaFX acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that OctaFX has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with OctaFX or any other MM broker.

OctaFX is a Cyprus-based forex broker regulated by the CYSEC. The company offers trading in 28 currency pairs, 2 metals, 2 energies, and 10 indices with a maximum leverage of up to 1:30. OctaFX has only one MetaTrader 5 account type with zero commission and a minimum deposit requirement of 100 euros. Deposits and withdrawals are feasible through a variety of payment methods, with no extra fees charged by OctaFX. Customer support is available through email and live chat, and the broker's correspondence address is in Limassol, Cyprus.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of currency pairs and other instruments available for trading | Limited selection of commodities and cryptocurrencies |

| Option to trade indices | No individual stock trading available |

| Competitive spreads | Limited selection of exotic currency pairs |

| Access to trading gold and silver | No access to other precious metals such as platinum or palladium |

OctaFX offers a diverse range of instruments for traders to choose from, including 28 currency pairs, 2 metals, 2 energies, and 10 indices. Traders can access major currency pairs such as EUR/USD and USD/JPY, as well as less commonly traded pairs like USD/TRY and USD/HKD. In addition, OctaFX offers trading in gold and silver, as well as energies such as Brent crude oil and natural gas. Traders can also access indices such as the FTSE 100 and the Nikkei 225. However, OctaFX's instrument selection does have some limitations, such as a limited selection of cryptocurrencies and no individual stock trading available. Overall, the range of instruments offered by OctaFX is competitive, with a strong focus on forex trading.

| Advantages | Disadvantages |

| No commission fees | Limited account types |

| Low spreads for major currency pairs | Higher spreads for minor and exotic pairs |

| Detailed information on spreads, SWAPs, and stop levels | No variable spreads |

| No hidden fees or charges | Limited transparency on rollover costs |

OctaFX offers a no-commission fee trading model with a single account type, which can be an advantage for traders who prefer simplicity and transparency. The broker offers competitive spreads for major currency pairs, with spreads for EURUSD ranging from 0.4 to 0.5 pips. In addition, OctaFX provides detailed information on spreads, SWAPs, and stop levels for each trading instrument, which can help traders make informed decisions. However, there are some disadvantages to consider, such as higher spreads for minor and exotic currency pairs, limited transparency on rollover costs, and the lack of variable spreads, which may not suit some traders' needs. Overall, the costs and fees of OctaFX are relatively low, and the broker provides transparency and clarity in its pricing structure.

| Advantages | Disadvantages |

| Only one account type makes it simple and easy to choose and use | Limited options for traders who may want more customization |

| Zero commission allows for more cost-effective trading | Potentially limited profit margins for the broker, which could affect service quality |

| Low minimum deposit of 100 euro makes trading accessible to more individuals | Some traders may prefer higher deposit requirements for increased credibility and access to more features |

| Competitive spreads from 0.3 pips can result in better trading conditions | Spread may widen during news releases and other market events, resulting in increased trading costs |

Regarding the account types dimension, OctaFX offers a single account type using the popular MetaTrader 5 trading platform. This simplicity may appeal to traders looking for an uncomplicated trading experience. Additionally, the absence of commissions and competitive spreads starting from 0.3 pips may result in more cost-effective trading for clients. However, the single account type may not be ideal for traders looking for more customization, and some may prefer higher minimum deposit requirements for increased credibility and access to additional features. It's worth noting that spreads may widen during news releases and other market events, which could result in increased trading costs.

| Advantages | Disadvantages |

| Advanced Trading Tools | May be overwhelming for beginner traders |

| Flexible Trading Options | No mobile or web-based platforms available |

| Customizable Interface | Limited access to third-party plugins and add-ons |

| Supports Automated Trading | Limited educational resources for platform-specific features |

| Access to Market Depth Information | Limited charting tools and technical indicators |

OctaFX offers the popular MetaTrader 5 (MT5) platform as their sole trading platform. MetaTrader 5 is well-known in the forex industry for its advanced trading tools, customizable interface, and support for automated trading. With MetaTrader 5, traders can access flexible trading options, including access to market depth information, as well as a wide range of trading instruments. However, the platform may be overwhelming for beginner traders and it currently lacks mobile or web-based platforms. Additionally, while MetaTrader 5 does offer some charting tools and technical indicators, it may be limited compared to other trading platforms. Finally, there is also a limited number of third-party plugins and add-ons available for the platform, and there are limited educational resources for platform-specific features.

| Advantages | Disadvantages |

| Allows for potentially larger profits with smaller account balances | Can increase the risk of large losses for inexperienced traders |

| Provides flexibility in trading strategies | May lead to overleveraging and margin calls |

| Enables traders to take larger positions in the market | Can amplify market volatility and increase the likelihood of slippage |

| Can be useful for hedging or risk management purposes |

OctaFX offers a maximum leverage of 1:30, which can provide traders with the opportunity to potentially increase profits with smaller account balances and take larger positions in the market. However, it is important to note that high leverage can also significantly increase the risk of large losses, especially for inexperienced traders who may be more susceptible to overleveraging and margin calls. It is crucial for traders to use leverage wisely and implement proper risk management strategies to mitigate these risks. Additionally, not all trading instruments or account types may offer the maximum leverage, so traders should be aware of the limitations and requirements for each instrument and account type.

| Advantages | Disadvantages |

| Various payment methods available | Limited payment options |

| Detailed information on deposit and withdrawal | No local payment options |

| No extra fees charged | Long processing times for some payment methods |

| Quick and efficient processing times | High minimum deposit amount of €50 |

| Secure payment options | No cryptocurrency payment options |

OctaFX provides a wide range of payment methods, making it convenient for traders to deposit and withdraw funds. They also provide detailed information on the deposit and withdrawal process, which makes it easy for traders to understand the process. Another advantage is that there are no extra fees charged by OctaFX for any payment method. Additionally, the processing times are quick and efficient. However, the payment options are limited, with no local payment options available. Some payment methods may also have long processing times. The minimum deposit amount of €50 is also relatively high compared to some other brokers. Finally, OctaFX doesn't accept cryptocurrency payments, which might be a disadvantage for some traders.

| Advantages | Disadvantages |

| Basic calculators | Limited educational resources |

| Easy to use | No webinars or tutorials available |

| Helpful for beginners | No market analysis or trading ideas provided |

OctaFX has a limited selection of educational resources available for its customers, with only basic calculators provided to help with trading. While these tools may be helpful for beginners, the lack of other educational resources such as webinars, tutorials, market analysis, and trading ideas may make it challenging for more experienced traders to improve their skills and stay up-to-date with market trends. The absence of educational articles or eBooks may also be a disadvantage for traders looking to expand their knowledge and gain a deeper understanding of the market. Overall, OctaFX's educational resources are limited and may not be suitable for traders seeking a more comprehensive learning experience.

However, if you're not limited to their website, you can see more educational resources on their official YouTube channel. Here is a video of a market analysis.

| Advantages | Disadvantages |

| Multiple ways to contact customer support including email and live chat | No 24/7 customer support |

| Back office service available during regular business hours | No phone support |

| Physical correspondence address provided for customer inquiries | Limited availability on weekends |

OctaFX provides a range of customer care options for its clients, including email support and live chat. They also offer a back office service during regular business hours for additional assistance. A physical correspondence address is also provided for clients to send inquiries. However, OctaFX does not offer 24/7 customer support and phone support is not available. Additionally, their customer support availability is limited on weekends.

In conclusion, OctaFX is a reputable forex broker that provides traders with access to a wide range of trading instruments, including currency pairs, metals, energies, and indices. The company offers a user-friendly MetaTrader 5 platform, low spreads, and no commissions, which makes it an attractive choice for traders. OctaFX also provides a detailed deposit and withdrawal process with a range of feasible payment methods. However, the company's educational resources are limited, and the maximum leverage offered is relatively low compared to some other brokers. Overall, OctaFX is a reliable option for traders who value a simple and straightforward trading experience, with efficient customer support available via email and live chat.

What is OctaFX?

OctaFX is a forex broker that offers online trading services to customers around the world. It is a Cyprus registered company regulated by the CYSEC.

What trading platforms does OctaFX offer?

OctaFX offers the popular MetaTrader 5 trading platform, which is available for desktop and mobile devices.

What instruments can I trade with OctaFX?

OctaFX offers a range of trading instruments, including 28 currency pairs, 2 metals, 2 energies, and 10 indices.

Does OctaFX charge any commissions?

No, OctaFX does not charge any commissions on trades.

What is the minimum deposit required to open an account with OctaFX?

The minimum deposit required to open an account with OctaFX is 100 euro.

What payment methods are available for deposits and withdrawals?

OctaFX accepts a variety of payment methods, including VISA, Skrill, Swissquote Bank SA, Rietumu Bank, and BlueOrange Bank.

What customer support options are available at OctaFX?

OctaFX offers customer support via email at clientsupport@octafx.eu, live chat, and a back office service available from 9:00 to 18:00 EET Monday to Friday.

| Windsor Brokers Review Summary in 10 Points | |

| Founded | 1988 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

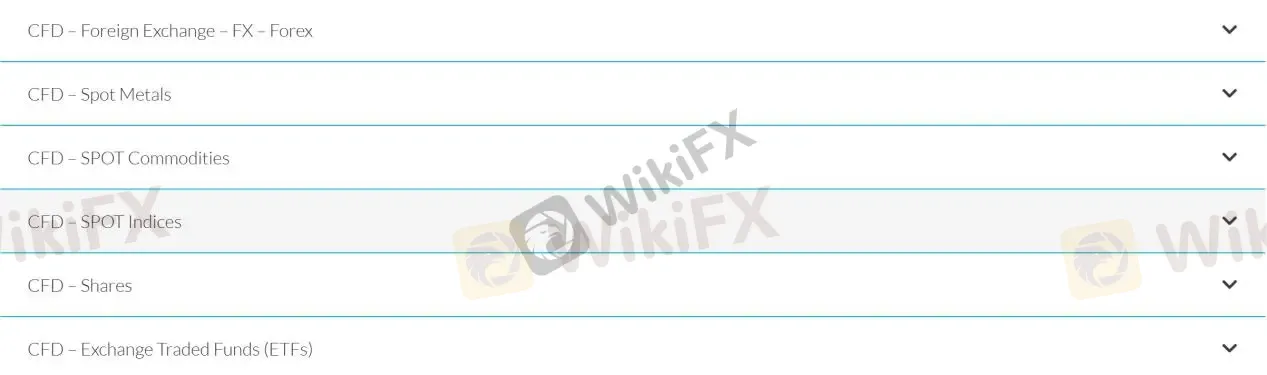

| Market Instruments | CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs |

| Account Types | Prime account, Zero account |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Windsor Broker Ltd, founded in 1988 and headquartered in Limassol, Cyprus, is an European brokerage firm that has been providing financial services to retail, corporate and institutional investors worldwide for many years, offering a wide range of financial instruments, including Forex, commodities, indices, and shares, as well as a variety of trading platforms and trading tools. Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC, No. 030/04).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by CySEC | • Limited payment methods |

| • Negative balance protection | • Clients from the USA, Japan and Belgium are not accepted |

| • Wide range of trading tools | • Limited info on accounts |

| • MT4 for all devices | |

| • Low spreads and commissions | |

| • Wide product portfolios | |

| • Demo accounts available |

Regulation by a reputable authority like Cyprus Securities and Exchange Commission (CySEC) is a positive factor indicating that Windsor Brokers is a legitimate broker. Additionally, the fact that they offer negative balance protection is also a plus for traders.

CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs are all available at Windsor Brokers. The broker allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade with Windsor Brokers.

Demo Account: Windsor Brokers provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Windsor Brokers offers two types of real trading accounts: the Prime Account and the Zero Account. The Prime Account, geared towards support-oriented traders, has a lower $50 minimum deposit and spreads starting from 1.0 pips on major pairs. It provides zero commission on forex CFDs, an $8 commission per lot for crypto CFDs, and includes training resources.The Zero Account targets heavy traders with a $1,000 minimum deposit, zero spreads on major currency pairs, and a maximum leverage of 1:1000. It charges an $8 commission per lot for forex, metals, and crypto CFDs, with no commission on other CFDs. Both accounts offer negative balance protection, personal account managers, a 0.01 minimum trade volume, a 50 lot restriction per ticket, hedging allowance, and a 20% stop-out level with a 100% margin call. Notably, the Zero Account does not support Islamic/swap-free accounts.

The maximum leverage offered by Windsor Brokers is only 1:30, which may seem too low to you. Margin requirements for professional clients based on 1:100 leveraged accounts. Other leverages are available to Professional Clients only.

In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

It is commendable that in the trading instruments interface, Windsor Brokers provides a detailed table showing the spreads, margin requirement, pip value, and stop levels of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Windsor Brokers | 0.2 pips | $0 |

| BlackBull Markets | 0.8 pips | $6 |

| Eightcap | 0.6 pips | $3.50 |

| FOREX TB | 0.7 pips | $0 |

Note: Spreads can vary depending on market conditions and volatility.

Windsor Brokers offers traders the popular MT4 trading platform for PC, Mac, WebTrader, Android, iPhone, Android Tablet and iPad, which is ideal for all traders, whether they are professional traders or beginners. MT4 trading platform features powerful charting capabilities, a large number of indicators and algorithmic trading features, a user-friendly interface, a dynamic security system, and multi-terminal functionality.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Windsor Brokers | MT4, WebTrader |

| BlackBull Markets | MT4, MT5, WebTrader |

| Eightcap | MT4, MT5, WebTrader |

| FOREX TB | MetaTrader 4 |

Windsor Brokers provides a variety of trading tools to its clients to help them make informed trading decisions. These tools include market analysis and commentary, an economic calendar, and information on market holidays. Additionally, the broker offers several Forex calculators, such as Profit, Margin, Pip, Fibonacci, and Pivots calculators, which can be useful in managing risk and determining potential profits. By providing these trading tools, Windsor Brokers aims to empower traders with the necessary knowledge and resources to navigate the financial markets.

In terms of deposits and withdrawals, Windsor Brokers offers these payment methods: Credit/debit cards (Visa/MasterCard), WebMoney, Wire Transfer, Neteller and Skrill.

| Windsor Brokers | Most other | |

| Minimum Deposit | $100 | $100 |

The broker does charges fees for deposits and withdrawals, which vary on the payment method. All deposits are processed on the same day, while most withdrawals can be processed on the same day with the exception of wire transfer withdrawal.

More details concerning deposit/withdrawal fees and processing time can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Credit/debit cards (Visa/MasterCard) | 3% | $/€/£3/transaction | Same day | Same day |

| WebMoney | 0.8% | 0.8% | ||

| Wire Transfer | Vary | Vary $0-30 | Vary | |

| Neteller | 3% | $/€/£3/transaction | Same day | |

| Skrill | 3% | 1% - min $/€/£3£ | ||

| Broker | Deposit Fees | Withdrawal Fees |

| Windsor Brokers | Vary on the method | Vary on the method |

| BlackBull Markets | None | None |

| Eightcap | None | None |

| FOREX TB | None | None |

Note: Fees may vary based on the payment method and currency used. Please refer to the broker's website for the most up-to-date information.

Below are the details about the customer service.

Service Hour: 24/5

Live Chat/Fill in Contact Form

Email: support@windsorbrokers.eu

Phone: +357 25 500 700

Fax: +357 25 500 555

Address: Spyrou Kyprianou 53, Windsor Business Center, 3rd Floor, Mesa Geitonia, 4003 Limassol, Cyprus,

Or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Overall, Windsor Brokers' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual customer support | • No 24/7 customer support |

| • Multi-channel support | |

| • Live chat available | |

| • Quick response time for customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Windsor Brokers' customer service.

Windsor Brokers offers a variety of educational resources to help traders improve their skills and knowledge. They have a video library that covers topics such as technical analysis, risk management, and trading strategies. They also have a glossary of trading terms and an ebook library that covers a range of topics such as trading psychology, fundamental analysis, and more. These educational resources are available for free to all clients of Windsor Brokers.

On our website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Windsor Brokers is a regulated broker that offers access to multiple markets and trading platforms, as well as a range of trading tools and educational resources. The broker's negative balance protection is a positive feature that helps protect traders from incurring losses beyond their deposited funds.

However, some users have reported difficulties with withdrawals, which may raise concerns about the broker's reliability. Overall, Windsor Brokers appears to be a reputable broker that offers a good range of services, but potential traders should carefully consider the reported withdrawal issues before deciding to open an account.

| Q 1: | Is Windsor Brokers regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Windsor Brokers, are there any regional restrictions for traders? |

| A 2: | Yes. It does not accept clients from the USA, Japan and Belgium. |

| Q 3: | Does Windsor Brokers offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Windsor Brokers offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Windsor Brokers? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is Windsor Brokers a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive octafx and windsor-brokers are, we first considered common fees for standard accounts. On octafx, the average spread for the EUR/USD currency pair is from 0.3 pips, while on windsor-brokers the spread is 0.1.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

octafx is regulated by CYSEC. windsor-brokers is regulated by CYSEC,FSC,FSA,BaFin.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

octafx provides trading platform including MT5 account and trading variety including 28 Currency pairs + 2 metals + 2 energies + 10 indices. windsor-brokers provides trading platform including Standard account,ECN VIP,ECN Standard and trading variety including Foreign exchange, precious metals, CFDs.