No data

Do you want to know which is the better broker between MONEX and Windsor Brokers ?

In the table below, you can compare the features of MONEX , Windsor Brokers side by side to determine the best fit for your needs.

EURUSD: -1.5

XAUUSD: 11

Long: -2.21

Short: 0.22

Long: -4.16

Short: 1.63

EURUSD: 0.5

XAUUSD: -0.4

Long: -7.51

Short: 1.61

Long: -33.73

Short: 18.35

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of monex, windsor-brokers lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Registered Country/Area | Japan |

| Founded Year | 1999 |

| Company Name | Monex Group |

| Regulation | FSA |

| Minimum Deposit | Not specified |

| Spreads | Not specified |

| Trading Platforms | Monex Trader (Stocks & Futures), Monex Trader FX (Forex), Multiboard 500, Full Board Information Tool, Market Board, and Monex Vision |

| Tradable Assets | Domestic stocks, US stocks, Chinese stocks, investment trusts, bonds, IPOs, stock lending services, ETFs, foreign exchange currency pairs, cryptocurrency CFDs, bonds, etc. |

| Account Types | Not specified |

| Customer Support | Email & Phone support |

| Payment Methods | Instant deposit services, regular automatic deposit services, ATM deposits through Monex Saison cards, bank transfers |

| Educational Tools | Financial investment information, and monthly disclosure of company information, news releases, etc. |

Monex Group, Inc. is a financial services company based in Japan. It was founded in 1999 and is regulated by the Financial Services Agency (FSA) of Japan. The company offers various trading platforms, including Monex Trader for stocks and futures, Monex Trader FX for forex trading, Multiboard 500, Full Board Information Tool, Market Board, and Monex Vision.

Monex Group provides a wide range of tradable assets to its clients. These include domestic stocks, US stocks, Chinese stocks, investment trusts, bonds, initial public offerings (IPOs), stock lending services, ETFs, foreign exchange currency pairs, cryptocurrency CFDs, and more.

The specific account types and minimum deposit requirements are not specified in the available information. However, Monex Group offers customer support through email and phone. It provides various payment methods, such as instant deposit services, regular automatic deposit services, ATM deposits through Monex Saison cards, and bank transfers.

For educational purposes, Monex Group offers financial investment information and monthly disclosure of company information, news releases, and other resources to assist traders and investors in making informed decisions.

Monex Group, represented by its licensed institution Monex Securities Inc. (マネックス証券株式会社), is a legitimate and regulated online securities company operating under the supervision of the Financial Services Agency in Japan. Since September 30, 2007, Monex Securities Inc. has held a retail forex license (License No.: 関東財務局長(金商)第165号), ensuring compliance with industry standards and regulations. The company's headquarters are located at 1-12-32 Akasaka, Minato-ku, Tokyo, and they can be contacted at 03-4323-3800. This regulatory oversight and transparency contribute to the trustworthiness and credibility of Monex Group.

Monex Group, a reputable online securities company based in Tokyo, Japan, offers several advantages and drawbacks to consider. One of its significant strengths is being FSA-regulated, ensuring a level of security and adherence to regulatory standards. Additionally, Monex Group provides a diversified range of products and services, catering to the needs of various investors. Another advantage is the availability of multiple trading platform options, allowing traders to choose the one that suits their preferences. Moreover, Monex Group supports various payment methods, enhancing convenience for clients.

However, there are a couple of downsides to be aware of. Firstly, there is no clear information regarding the minimum deposit requirement, which may pose a challenge for potential investors. Secondly, the customer support provided by Monex Group is considered average, and some clients may have higher expectations in terms of responsiveness and assistance. Overall, Monex Group offers a regulated and diverse investment environment but could improve certain aspects like providing more transparent deposit information and enhancing customer support.

| Pros | Cons |

| FSA-regulated | No clear Minimum deposit info |

| Diversified range of products & services | Relatively high fees for some products |

| Multiple trading platform options | Limited languages support |

| Various payment methods | No specific information on account types, leverage, and spreads |

| Established and reputable company |

Monex Group offers a comprehensive range of products and services to investors. These include domestic stocks, US stocks, Chinese stocks, investment trusts, bonds, IPOs, stock lending services, ETFs, foreign exchange currency pairs, cryptocurrency CFDs, and bonds. With such a diverse selection, investors have the opportunity to diversify their portfolios and access a wide range of investment options. Whether they are interested in stocks, bonds, or alternative investments like cryptocurrency, Monex Group aims to meet the diverse needs and preferences of its clients.

Commissions

The diverse lineup of products offered by MONEX is from 110 yen for physical trading to 99 yen for margin trading (tax included), both beginners and experienced traders can make a small investment at a reasonable price. The monthly Fixed Commission Process calculates the commission for the total daily contract amount, which traders can choose according to their needs. For example, the brokerage fee for China stocks (tax included) is 0.275% of the contract price (minimum fee HK$49.5, maximum fee HK$495). The fee for Nikkei 225 Mini Index is 38 yen per order, and the fee for Nikkei 225 Futures is 275 yen per order.

Trading Platforms

Monex Group provides a wide range of flexible trading platforms to cater to the needs of traders. These platforms include Monex Trader, which supports trading in stocks and futures, Monex Trader FX, specifically designed for forex trading, Multiboard 500, Full Board Information Tool, Market Board, and Monex Vision. These platforms offer different features and functionalities to enhance the trading experience and allow traders to access a variety of financial instruments. Whether traders are interested in stocks, futures, forex, or market information, Monex Group offers diverse options to suit their preferences and trading strategies.

TradeStation offers state-of-the-art trading technology and online electronic brokerage services to active individual and institutional traders. TradeStation has been able to leverage its award-winning technology solutions in global markets extending from Europe to Japan, China, and South Korea. TradeStations powerful yet convenient mobile and web trading apps let clients capitalize on trading opportunities virtually anytime anywhere, while its desktop platform provides all the tools needed to design, test, optimize, automate, and monitor custom equities, options and futures trading strategies. TradeStation also provides personalized support from fully licensed brokerage professionals, a vast array of educational offerings to help clients improve their trading skills, different accounts to meet every trading and investment objective, and simplified low-cost commission pricing.

MONEX provides investors with a diverse selection of deposit and withdrawal options, ensuring convenience and flexibility. Investors can choose from instant deposit services, regular automatic deposit services, ATM deposits through Monex Saison cards, and bank transfers. These options allow investors to easily fund their investment accounts and access their funds when needed. With a variety of choices available, MONEX aims to accommodate the preferences and requirements of its clients, making the deposit and withdrawal process efficient and user-friendly.

Clients with any inquiries or trading-related issues can easily contact MONEX through various accessible channels. They can reach out to MONEX via telephone at +81 0120-430-283 or send an email to feedback@monex.co.jp. Additionally, MONEX maintains an active presence on popular social media platforms such as Twitter, Facebook, and YouTube, allowing clients to stay updated and engage with the company. These multiple contact channels provide clients with convenient options to seek assistance, receive support, and stay connected with MONEX, ensuring a responsive and interactive customer experience.

Monex Group claims to provide comprehensive educational resources for investors. Here are some key points about the educational resources offered by Monex Group:

1. For New Investors:

Monex Group provides tailored educational materials and resources specifically designed for new investors. These materials cover a wide range of topics, including investment basics, risk management, and investment strategies.

2. Financial Result Related Materials:

Monex Group regularly publishes financial result-related materials to keep investors informed about the company's performance. These materials include financial statements, earnings reports, and management commentary, providing a transparent view of the company's financial health.

3. IR Library:

Monex Group maintains an extensive IR (Investor Relations) library, which serves as a repository for various important documents. This library includes consolidated financial summaries, presentation materials, and the annual report, offering comprehensive information about the company's operations and performance.

4. Stock & Rating Information:

Monex Group provides detailed stock and rating information to help investors make informed decisions. This information includes stock profiles, stock prices, credit ratings, and analyst coverage, enabling investors to stay updated on the company's stock performance and market analysis.

In conclusion, Monex Group is a legitimate online securities company based in Tokyo, Japan, regulated by the Financial Services Agency. They offer a wide range of market instruments, including domestic and international stocks, investment trusts, bonds, IPOs, and various trading services. Monex provides different trading platforms to cater to the needs of traders, and they offer flexible deposit and withdrawal options. While Monex Group has several advantages such as a diverse product lineup and regulated operations, some potential disadvantages may include transaction fees and spreads associated with certain products. Overall, Monex Group presents itself as a reputable option for individuals interested in online securities trading, backed by a strong regulatory framework and customer support channels.

Q: What is the Global Vision business strategy of Monex Group?

A: The Global Vision is a comprehensive initiative that brings together all companies within Monex Group worldwide, aiming to establish a truly global online financial institution that generates beneficial synergies for all stakeholders.

Q: How does Monex Group aspire to be a Global Technology-based Retail Financial Service Provider?

A: Monex Group, formed through the merger of Monex, Inc. and Nikko Beans, Inc., leverages its expertise and strengths in the capital markets to become a leading Global Technology-based Retail Financial Service Provider.

Q: How does Monex Group disclose information?

A: Monex, Inc., a subsidiary of Monex Group, provides monthly disclosures. While the Monex, Inc. website is available only in Japanese, information about Monex Group, Inc., the parent company listed on the Tokyo Stock Exchange, can be found in both Japanese and English on their website at https://www.monexgroup.jp/en/. This includes company information and news releases.

Q: What affiliations does Monex, Inc. have?

A: Monex, Inc. is a registered financial instruments firm under the Financial Instruments and Exchange Law of Japan (registered number 165). It is a member of several associations, including the Japan Securities Dealers Association, Type II Financial Instruments Firms Association, The Financial Futures Association of Japan, Japan Virtual and Crypto Assets Exchange Association, and Japan Investment Advisers Association.

| Windsor Brokers Review Summary in 10 Points | |

| Founded | 1988 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

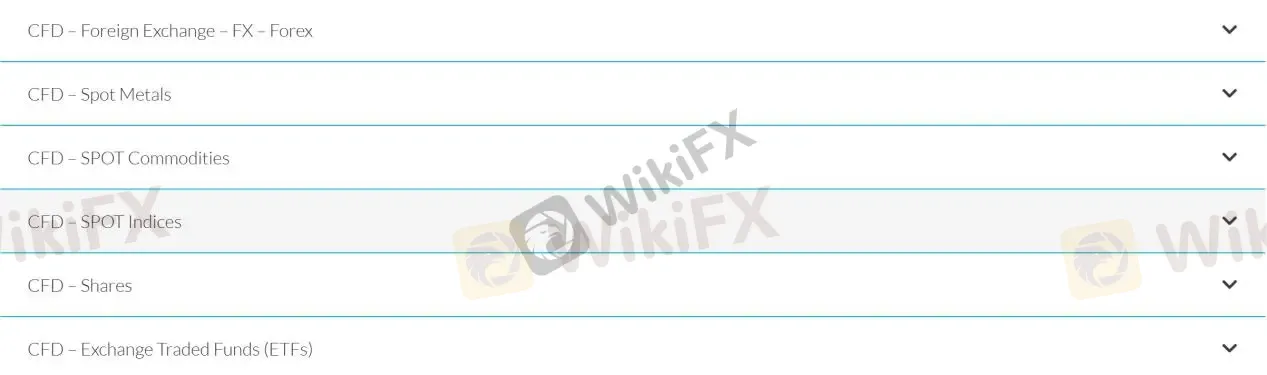

| Market Instruments | CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $100 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Windsor Broker Ltd, founded in 1988 and headquartered in Limassol, Cyprus, is an European brokerage firm that has been providing financial services to retail, corporate and institutional investors worldwide for many years, offering a wide range of financial instruments, including Forex, commodities, indices, and shares, as well as a variety of trading platforms and trading tools. Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC, No. 030/04).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by CySEC | • Limited payment methods |

| • Negative balance protection | • Clients from the USA, Japan and Belgium are not accepted |

| • Wide range of trading tools | • Limited info on accounts |

| • MT4 for all devices | |

| • Low spreads and commissions | |

| • Wide product portfolios | |

| • Demo accounts available |

Regulation by a reputable authority like Cyprus Securities and Exchange Commission (CySEC) is a positive factor indicating that Windsor Brokers is a legitimate broker. Additionally, the fact that they offer negative balance protection is also a plus for traders.

CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs are all available at Windsor Brokers. The broker allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade with Windsor Brokers.

Demo Account: Windsor Brokers provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Windsor Brokers does not provide much real account information, so how much is require for the minimum initial deposit is not clear yet.

The maximum leverage offered by Windsor Brokers is only 1:30, which may seem too low to you. Margin requirements for professional clients based on 1:100 leveraged accounts. Other leverages are available to Professional Clients only.

In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

It is commendable that in the trading instruments interface, Windsor Brokers provides a detailed table showing the spreads, margin requirement, pip value, and stop levels of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Windsor Brokers | 0.2 pips | $0 |

| BlackBull Markets | 0.8 pips | $6 |

| Eightcap | 0.6 pips | $3.50 |

| FOREX TB | 0.7 pips | $0 |

Note: Spreads can vary depending on market conditions and volatility.

Windsor Brokers offers traders the popular MT4 trading platform for PC, Mac, WebTrader, Android, iPhone, Android Tablet and iPad, which is ideal for all traders, whether they are professional traders or beginners. MT4 trading platform features powerful charting capabilities, a large number of indicators and algorithmic trading features, a user-friendly interface, a dynamic security system, and multi-terminal functionality.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Windsor Brokers | MT4, WebTrader |

| BlackBull Markets | MT4, MT5, WebTrader |

| Eightcap | MT4, MT5, WebTrader |

| FOREX TB | MetaTrader 4 |

Windsor Brokers provides a variety of trading tools to its clients to help them make informed trading decisions. These tools include market analysis and commentary, an economic calendar, and information on market holidays. Additionally, the broker offers several Forex calculators, such as Profit, Margin, Pip, Fibonacci, and Pivots calculators, which can be useful in managing risk and determining potential profits. By providing these trading tools, Windsor Brokers aims to empower traders with the necessary knowledge and resources to navigate the financial markets.

In terms of deposits and withdrawals, Windsor Brokers offers these payment methods: Credit/debit cards (Visa/MasterCard), WebMoney, Wire Transfer, Neteller and Skrill.

| Windsor Brokers | Most other | |

| Minimum Deposit | $100 | $100 |

The broker does charges fees for deposits and withdrawals, which vary on the payment method. All deposits are processed on the same day, while most withdrawals can be processed on the same day with the exception of wire transfer withdrawal.

More details concerning deposit/withdrawal fees and processing time can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Credit/debit cards (Visa/MasterCard) | 3% | $/€/£3/transaction | Same day | Same day |

| WebMoney | 0.8% | 0.8% | ||

| Wire Transfer | Vary | Vary $0-30 | Vary | |

| Neteller | 3% | $/€/£3/transaction | Same day | |

| Skrill | 3% | 1% - min $/€/£3£ | ||

| Broker | Deposit Fees | Withdrawal Fees |

| Windsor Brokers | Vary on the method | Vary on the method |

| BlackBull Markets | None | None |

| Eightcap | None | None |

| FOREX TB | None | None |

Note: Fees may vary based on the payment method and currency used. Please refer to the broker's website for the most up-to-date information.

Below are the details about the customer service.

Service Hour: 24/5

Live Chat/Fill in Contact Form

Email: support@windsorbrokers.eu

Phone: +357 25 500 700

Fax: +357 25 500 555

Address: Spyrou Kyprianou 53, Windsor Business Center, 3rd Floor, Mesa Geitonia, 4003 Limassol, Cyprus,

Or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Overall, Windsor Brokers' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual customer support | • No 24/7 customer support |

| • Multi-channel support | |

| • Live chat available | |

| • Quick response time for customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Windsor Brokers' customer service.

Windsor Brokers offers a variety of educational resources to help traders improve their skills and knowledge. They have a video library that covers topics such as technical analysis, risk management, and trading strategies. They also have a glossary of trading terms and an ebook library that covers a range of topics such as trading psychology, fundamental analysis, and more. These educational resources are available for free to all clients of Windsor Brokers.

On our website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Windsor Brokers is a regulated broker that offers access to multiple markets and trading platforms, as well as a range of trading tools and educational resources. The broker's negative balance protection is a positive feature that helps protect traders from incurring losses beyond their deposited funds.

However, some users have reported difficulties with withdrawals, which may raise concerns about the broker's reliability. Overall, Windsor Brokers appears to be a reputable broker that offers a good range of services, but potential traders should carefully consider the reported withdrawal issues before deciding to open an account.

| Q 1: | Is Windsor Brokers regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Windsor Brokers, are there any regional restrictions for traders? |

| A 2: | Yes. It does not accept clients from the USA, Japan and Belgium. |

| Q 3: | Does Windsor Brokers offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Windsor Brokers offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Windsor Brokers? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is Windsor Brokers a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive monex and windsor-brokers are, we first considered common fees for standard accounts. On monex, the average spread for the EUR/USD currency pair is -- pips, while on windsor-brokers the spread is 0.1.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

monex is regulated by FSA. windsor-brokers is regulated by CYSEC,FSC,FSA,BaFin.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

monex provides trading platform including -- and trading variety including --. windsor-brokers provides trading platform including Standard account,ECN VIP,ECN Standard and trading variety including Foreign exchange, precious metals, CFDs.