No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between LION and FXPRIMUS ?

In the table below, you can compare the features of LION , FXPRIMUS side by side to determine the best fit for your needs.

EURUSD: -0.2

XAUUSD: -0.2

Long: -6.25

Short: 2.56

Long: -32.84

Short: 20.78

EURUSD: -0.9

XAUUSD: --

Long: -7.5

Short: 1.38

Long: -41.09

Short: 18.55

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of lion, fxprimus lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Company Name | LION |

| Registered Country/Area | Cayman Islands |

| Founded Year | 2016 |

| Regulation | SFC (Futures contracts), CIMA, MAS, and SFC (Dealing in securities, out of scope bussiness) |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips |

| Trading Platforms | Web-based and mobile trading platforms |

| Tradable Assets | Forex, commodities, indices, cryptocurrencies |

| Account Types | standard account, professional account, and ECN account |

| Demo Account | Yes |

| Customer Support | 24/5 customer support via live chat, email, and phone |

| Deposit & Withdrawal | Credit/debit cards, bank transfers, e-wallets |

| Educational Resources | Webinars, tutorials, articles, and e-books |

Established in 2016 and headquartered in the Cayman Islands, LION emerges as a dynamic force in the world of online trading. This broker is distinguished by its regulatory compliance, offering a secure and accountable trading environment. Regulated by various authorities, including the SFC for futures contracts, CIMA, and MAS, but exceeded with SFC, dealing in securities.

With a minimum deposit requirement as low as $100, LION ensures accessibility to a broad spectrum of traders. The broker's substantial maximum leverage of 1:500 provides traders with the potential to amplify their positions, while competitive spreads starting from 0.0 pips enhance cost efficiency.

RLION combines accessibility, regulatory compliance, comprehensive support, and educational resources to create a platform that caters to traders of all levels.

LION operates as a regulated entity in the financial sector, adhering to stringent regulatory standards set forth by several reputable authorities. This commitment to regulatory compliance ensures a secure and accountable trading environment for its clients. Here is an overview of LION's regulatory status:

SFC (Securities and Futures Commission) - Futures Contracts Regulation:LION is regulated by the Securities and Futures Commission (SFC) in Hong Kong for its activities related to futures contracts. This regulation signifies LION's compliance with the regulatory framework governing futures trading, providing assurance to traders regarding the broker's adherence to industry standards and best practices.

CIMA (Cayman Islands Monetary Authority) - Offshore Regulation:LION is regulated by the Cayman Islands Monetary Authority (CIMA). As an offshore regulatory authority, CIMA oversees financial activities within the Cayman Islands jurisdiction. While offshore regulation can vary in stringency compared to major financial centers, it still imposes essential standards on financial entities like LION.

MAS (Monetary Authority of Singapore) Regulation:LION is regulated by the Monetary Authority of Singapore (MAS). MAS is the central bank and financial regulatory authority in Singapore, responsible for overseeing and regulating financial activities in the country. Regulation by MAS underscores LION's commitment to compliance with Singapore's financial laws and regulations.

SFC - Dealing in Securities (Exceeded Regulation):In addition to its regulation by the SFC for futures contracts, LION has also exceeded the regulatory requirements of the Securities and Futures Commission for dealing in securities.

Being regulated by multiple reputable authorities provides traders with confidence in the broker's operations, ensuring that it operates within a framework designed to protect investors and maintain the integrity of the financial markets.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros:

Low Minimum Deposit: LION offers accessibility to a wide range of traders with its low minimum deposit requirement of $100. This allows both new and experienced traders to get started with a relatively small investment.

High Leverage: The broker provides a substantial maximum leverage of 1:500. This high leverage can amplify trading potential, enabling traders to control larger positions with a relatively smaller amount of capital.

Competitive Spreads: LION offers competitive spreads starting from 0.0 pips. Competitive spreads reduce trading costs, which can be advantageous for traders looking to maximize their profits.

Diverse Tradable Assets: Traders have access to a wide range of tradable assets on LION's platform, including Forex, commodities, indices, and cryptocurrencies. This diversity allows traders to diversify their portfolios and explore various global markets.

Versatile Trading Platforms: LION provides both web-based and mobile trading platforms, catering to traders' preferences for where and how they execute their trades. This versatility ensures convenience and flexibility.

Cons:

Limited Educational Resources: LION may have limited educational materials available for traders seeking comprehensive learning opportunities. More extensive educational content could enhance the trading experience.

Limited Account Types: While LION offers a range of account types, the variety may be limited compared to some other brokers. Traders with specific requirements for account types may find options constrained.

Limited Payment Methods: The availability of payment methods for deposits and withdrawals on LION's platform may be restricted. This could inconvenience traders who require specific payment options.

Limited Transparency on Islamic Accounts: Information regarding Islamic accounts, which adhere to Islamic finance principles, is not readily available. Traders who require Sharia-compliant accounts may find it challenging to determine if such accounts are offered.

LION offers a diverse range of financial products for traders to access and trade on their platform. These products span various asset classes, providing traders with opportunities to diversify their portfolios and explore global markets. Here's a concrete description of the products offered by LION:

Forex (Foreign Exchange): LION facilitates trading in the Forex market, the world's largest financial market. Traders can engage in the buying and selling of currency pairs, such as EUR/USD, GBP/JPY, or USD/JPY. Forex trading allows participants to speculate on the exchange rate movements between different currencies.

Commodities: Traders on the LION platform have access to trading commodities. These physical assets include precious metals like gold and silver, energy resources like oil and natural gas, and agricultural products like wheat and coffee. Commodity trading enables investors to capitalize on price fluctuations in these essential global resources.

Indices: LION provides opportunities to trade on indices. These are measures of the performance of groups of stocks or bonds. Traders can speculate on the overall performance of specific indices, such as the S&P 500 or the FTSE 100, without trading individual stocks.

Cryptocurrencies: LION allows traders to participate in the cryptocurrency market. Cryptocurrencies are digital currencies created using blockchain technology. Popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) are available for trading. Traders can take advantage of the price volatility in the cryptocurrency market.

These products collectively offer a wide spectrum of trading opportunities for LION's clients. Traders can choose from these asset classes based on their preferences, risk tolerance, and market outlook, allowing for diversified investment strategies within a single platform. Additionally, the competitive spreads and leverage options further enhance the attractiveness of these trading products on the LION platform.

LION offers three types of trading accounts: standard account, professional account, and ECN account. All accounts offer attractive trading conditions and provide a wide range of base currencies to suit the preferences of different traders.

Traders can select the account type that aligns with their trading strategy and enjoy competitive spreads and high leverage for enhanced trading opportunities.

| Account type | Minimum deposit | Spreads | Leverage | Trading products | Additional features |

| Standard | $100 | From 0.0 pips | 1:500 | Forex, commodities, indices, and stocks | None |

| Professional | $500 | From 0.0 pips | 1:500 | Forex, commodities, indices, and stocks | No trading commissions and higher leverage |

| ECN | $1,000 | From 0.0 pips | 1:500 | Forex, commodities, indices, and stocks | Most competitive spreads and execution speeds |

To open an account with LION, follow these concrete steps:

Access the Registration Page: Look for the “Register” or “Open Account” button and click on it to initiate the account creation process.

Provide Personal Information:

Begin by entering your full name in the designated field.

Input your email address to create a unique login ID for your account.

Enter your mobile number, including the country code (e.g., +84).

Review and Accept Agreements: Ensure you understand the terms and conditions outlined in these agreements.

Verification and Activation: You may be required to verify your email address and mobile number to activate your account. Follow any verification instructions provided by LION to complete this process.

Begin Trading: Once your account is funded, you can start exploring the platform, accessing educational resources, and executing trades in the financial markets.

LION offers its traders a maximum leverage of 1:500. Maximum leverage represents the ratio of the trader's own capital to the borrowed funds provided by the broker. In this case, for every $1 of the trader's own capital, they can control a trading position of up to $500.

High leverage, such as 1:500, can be advantageous for traders looking to magnify their trading positions and potentially increase their profits.

| Trading product | Leverage |

| Forex | 1:500 |

| Commodities | 1:500 |

| Indices | 1:500 |

| Stocks | 1:500 |

LION offers three account types: Standard, Professional, and ECN. The spreads and additional fees for each account type are as follows:

Standard Account: The Standard Account has spreads from 0.0 pips. For forex currency pairs, spreads are typically between 0.0 pips and 1.0 pips. For commodities, indices, and stocks, spreads are typically between 0.1 pips and 1.0 pips. The Standard Account does not charge any additional fees.

Professional Account: The Professional Account has spreads from 0.0 pips. For forex currency pairs, spreads are typically between 0.0 pips and 0.5 pips. For commodities, indices, and stocks, spreads are typically between 0.05 pips and 0.5 pips. The Professional Account does not charge any additional fees.

ECN Account: The ECN Account has spreads from 0.0 pips. For forex currency pairs, spreads are typically between 0.0 pips and 0.2 pips. For commodities, indices, and stocks, spreads are typically between 0.05 pips and 0.2 pips. The ECN Account charges a small commission, the amount of which depends on the trading product and the trading volume.

| Account type | Spreads | Additional fees |

| Standard | From 0.0 pips | None |

| Professional | From 0.0 pips | None |

| ECN | From 0.0 pips | Small commission, depending on trading product and volume |

LION offers two trading platforms and tools to facilitate the intuitive execution of trading strategies on industry-leading platforms.

MetaTrader 4 Platform: LION provides access to the popular MetaTrader 4 platform, which offers a user-friendly interface and advanced features for seamless trading experiences. Traders can utilize its comprehensive charting tools, technical indicators, and Expert Advisors (EAs) to enhance their trading strategies.

MetaTrader 5 Platform: Additionally, LION offers the MetaTrader 5 platform, an advanced version of MT4 with enhanced functionalities. MT5 provides more timeframes, additional technical indicators, and support for trading a wider range of financial instruments.

LION makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies.

| Payment method | Processing time (deposits) | Processing time (withdrawals) | Accepted currencies | Fees |

| Credit/debit cards | Instant | Up to 3 business days | USD, EUR, GBP, AUD, JPY | None |

| Bank transfers | Up to 3 business days | Up to 5 business days | USD, EUR, GBP, AUD, JPY | May vary depending on the bank |

| E-wallets | Instant | Up to 24 hours | USD, EUR, GBP, AUD, JPY | May vary depending on the e-wallet |

| Global ACH | Up to 3 business days | Up to 3 business days | USD, EUR, GBP, AUD, JPY | May vary depending on the bank |

LION provides comprehensive customer support to assist traders with their inquiries, and concerns:

Live Chat: LION offers a live chat feature, allowing traders to engage in real-time text-based conversations with customer support representatives. This instant communication method is often preferred for quick inquiries and problem resolution.

Email: Traders can also contact LION's customer support via email. Email support provides a written record of interactions and is suitable for more detailed inquiries or issues that may require documentation.

Phone: For those who prefer voice communication, LION offers phone support. Traders can call the provided phone number to speak directly with customer support representatives, facilitating immediate assistance and clarification.

LION offers a range of educational resources to assist traders in making informed decisions:

Webinars: LION provides live webinars conducted by experienced traders and financial experts. These webinars cover a wide range of topics, including market analysis, trading strategies, risk management, and more. Webinars offer traders the opportunity to learn from professionals in real time and engage in interactive Q&A sessions.

Tutorials: LION offers comprehensive tutorials that cater to traders of all levels, from beginners to experienced traders. These tutorials typically cover essential trading concepts, platform navigation, order execution, and other fundamental aspects of trading. Tutorials serve as a valuable resource for those looking to build a solid foundation in trading.

Articles: The broker publishes articles on various financial and trading topics. These articles provide in-depth insights into market trends, analysis, and trading strategies. Traders can access articles to stay informed about current events and trends affecting the financial markets.

E-books: LION offers e-books that delve deeper into specific trading subjects. These e-books are typically more extensive than articles and provide a more comprehensive understanding of topics such as technical analysis, chart patterns, risk management, and more. E-books are valuable resources for traders looking for in-depth knowledge.

In conclusion, LION offers several notable advantages, including a low minimum deposit requirement, high maximum leverage, competitive spreads, a diverse range of tradable assets, and versatile trading platforms that cater to traders' preferences. However, there are also certain limitations, such as limited educational resources, account types, and payment methods. Additionally, the transparency regarding Islamic accounts and potential regulatory complexities could pose challenges for specific traders.

Overall, LION presents an opportunity for traders to access global financial markets with favorable conditions but may require traders to seek additional educational resources independently and carefully consider their account needs and payment preferences.

Q: What is the minimum deposit requirement to start trading with LION?

A: To commence trading on the LION platform, you need a minimum deposit of $100. This accessibility allows traders with varying capital levels to participate in the financial markets.

Q: Can I access educational materials to enhance my trading knowledge with LION?

A: Yes, LION provides a range of educational resources, including webinars, tutorials, articles, and e-books. These resources are designed to help traders improve their understanding of the markets and trading strategies.

Q: Is there a demo account available on LION's platform?

A: Indeed, LION offers a demo account, allowing traders to practice and refine their trading strategies without risking real capital. It's a risk-free way to get accustomed to the platform and test trading approaches.

Q: How can I contact LION's customer support if I have questions or need assistance?

A: LION provides customer support through various channels, including live chat, email, and phone. Traders can access support during trading hours to address inquiries or seek assistance with their trading activities.

Q: Does LION offer a copy trading tool for traders interested in automated trading strategies?

A: Specific details about a copy trading tool on LION's platform are not specified in the provided information. It's recommended to check with LION directly or visit their website for the most up-to-date information on available trading tools.

Q: Are there any bonuses or promotional offers available to traders on LION?

A: Information regarding bonuses or promotional offers is not provided in the available data. Traders interested in potential bonuses should refer to LION's official website or contact their customer support for relevant details.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| FXPRIMUS Review Summary in 10 Points | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Market Instruments | Forex, Metals, Energies, Equities, Indices, Futures and CFD Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | From 0 pips |

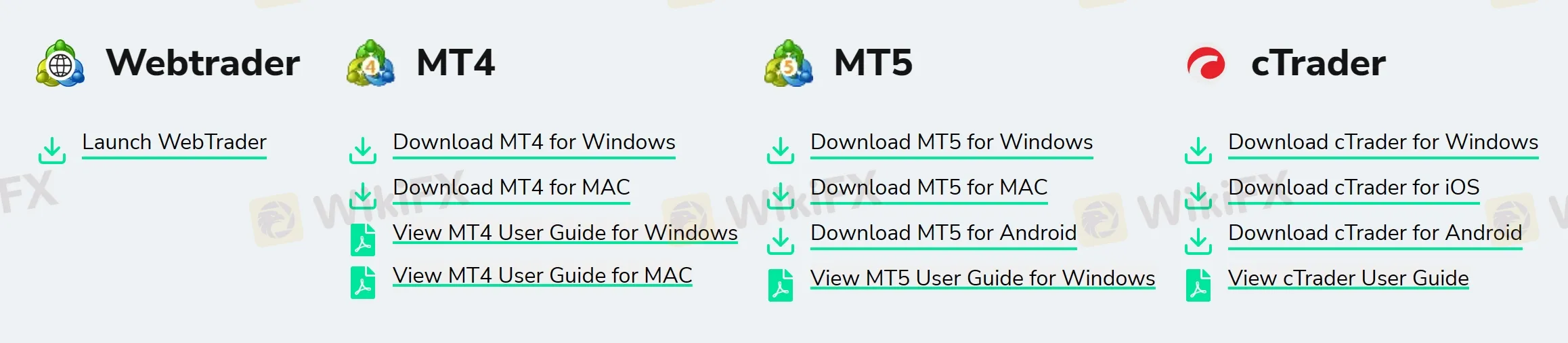

| Trading Platforms | MT4, MT5, cTrader, WebTrader |

| Minimum deposit | $15 |

| Customer Support | 24/5 live chat, email |

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on a range of financial instruments including Forex, Metals, Energies, Equities, and Indices, different account types with varying minimum deposits and leverages, and multiple trading platform choices of MT4, MT5, cTrader, and WebTrader.

| Pros | Cons |

| • Regulated by CYSEC | • Clients from Australia, Belgium, Iran, Japan, North Korea and USA are not accepted |

| • High-level protection measures for clients | • Higher minimum deposit for certain account types |

| • Wide range of market instruments | • Limited copy trading availability |

| • Low minimum deposit | |

| • No deposit or withdrawal fees | |

| • Competitive spreads and commissions | |

| • Various deposit and withdrawal methods | |

| • Strong customer service support | |

| • Comprehensive trading tools and educational resources |

Overall, FXPRIMUS appears to be a legitimate and reliable broker with strong regulatory oversight and high-level protection measures. They offer a wide range of trading instruments and account types, as well as various trading platforms and educational resources.

There are many alternative brokers to FXPRIMUS depending on the specific needs and preferences of the trader. Some popular options include:

FXCM - a well-established broker with a good reputation and comprehensive trading tools;

FxPro - offers competitive pricing and advanced trading platforms;

Exness - has a user-friendly platform and low minimum deposits.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

FXPRIMUS is a legitimate online broker that is regulated by the Cyprus Securities and Exchange Commission (CySEC). It is also a member of the Investor Compensation Fund (ICF) in Cyprus, which provides protection to clients in the event of the company's insolvency. Overall, FXPRIMUS appears to be a reputable broker.

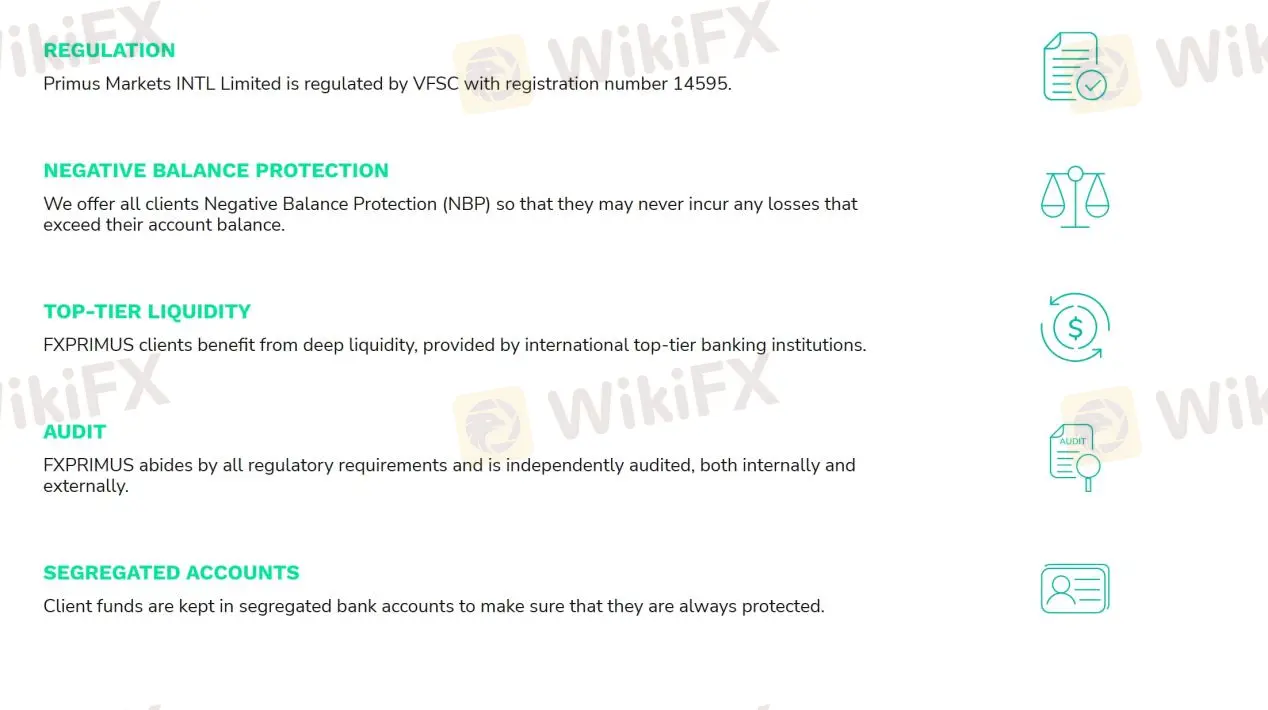

FXPRIMUS places a strong emphasis on client protection measures. It offers Negative Balance Protection, which means that clients will never lose more than their account balance. Additionally, FXPRIMUS uses top-tier liquidity providers, ensuring fast and reliable execution of trades. The broker's funds are audited by a third-party auditor to ensure transparency, and client funds are held in segregated accounts, separate from the broker's operating funds. These measures help to ensure that FXPRIMUS clients are protected from financial fraud and malpractice.

Based on the information provided, FXPRIMUS appears to have strong protection measures in place for their clients, including regulation by CYSEC, negative balance protection, top-tier liquidity, and audit and segregated accounts. These measures provide a level of assurance that FXPRIMUS is committed to the security of its clients' funds. Therefore, it can be concluded that FXPRIMUS is a trustworthy broker for traders.

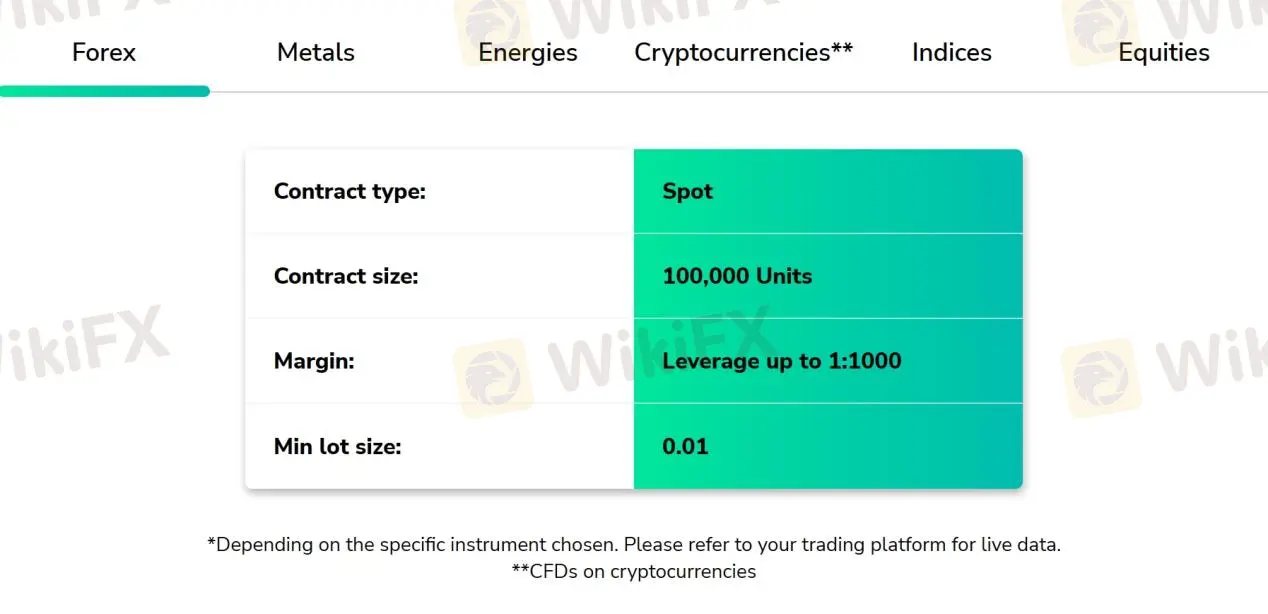

FXPRIMUS offers a diverse range of market instruments for its clients to trade. In addition to forex pairs, clients can also trade metals such as gold and silver, as well as energies such as oil and natural gas. The broker also offers equities, indices, futures, and CFD cryptocurrencies. With such a wide range of market instruments available, clients can diversify their trading portfolios and take advantage of different market opportunities.

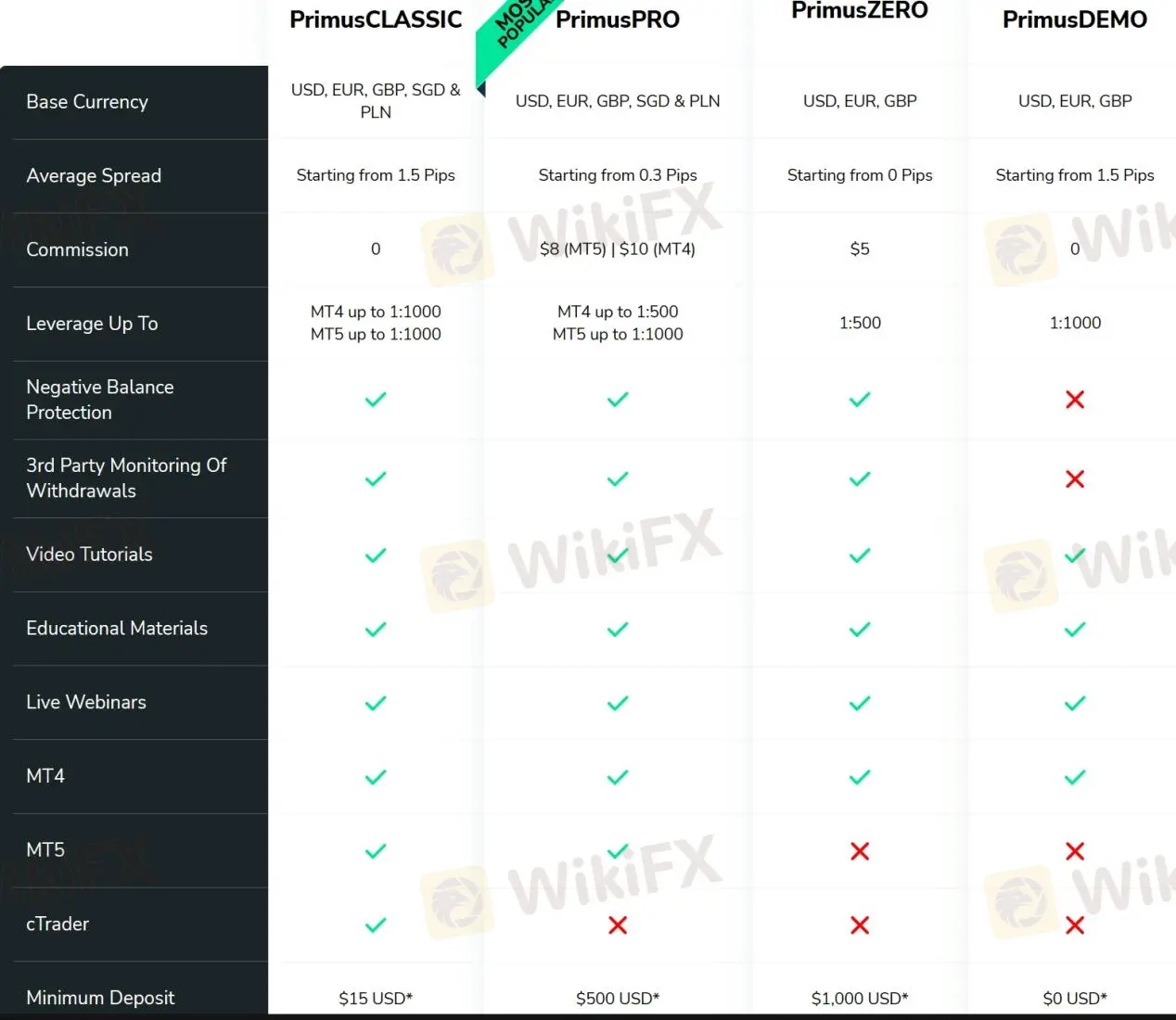

FXPRIMUS offers three account types, Primus Classic, Primus Pro, and Primus Zero, with minimum deposits ranging from $15 to $1,000. Primus Classic accounts are the most accessible with a low minimum deposit requirement of $15, while Primus Pro and Primus Zero accounts require higher minimum deposits of $500 and $1,000, respectively. Copy trading is only available for Primus Classic accounts. FXPRIMUS also offers demo accounts for traders to practice their strategies before committing to a live account.

FXPRIMUS provides varying leverage options depending on the account type and trading platform. For instance, for the Primus Classic account, clients can enjoy up to 1:1000 leverage. On the other hand, for the Primus Pro account, leverage is up to 1:500 on the MT4 platform and up to 1:1000 on the MT5 platform. For the Primus Zero account, the maximum leverage offered is up to 1:500. It is essential to note that high leverage levels carry a higher risk of potential losses, and traders should exercise caution when using high leverage levels.

FXPRIMUS offers competitive spreads and commissions across its account types. The spreads for the Primus Classic account start from 1.5 pips with no commission, which is suitable for beginners who are looking for a commission-free trading experience. For the Primus Pro account, the spreads are variable and start from as low as 0.3 pips, but the commissions are higher at $8 on the MT5 and $10 on the MT4. For experienced traders who prefer tighter spreads, the Primus Zero account offers spread from 0 pips with a commission of $5, making it suitable for high-frequency trading strategies.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXPRIMUS | From 0.0 pips | No commission on Primus Classic |

| FXCM | From 0.2 pips | No commission on Standard |

| FxPro | From 0.0 pips | From $4.5 on cTrader |

| Exness | From 0.3 pips | No commission on Standard |

Note: Spreads can vary depending on market conditions and volatility.

FXPRIMUS offers a range of popular trading platforms to cater to the needs of different types of traders. The platform options include the widely used MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and WebTrader.

The MT4 and MT5 platforms are popular among traders due to their user-friendly interface, advanced charting capabilities, and customizable indicators.

The cTrader platform is preferred by traders who seek a more transparent trading environment with direct market access (DMA) and Level II pricing.

The WebTrader platform is a web-based platform that allows traders to access their accounts from any device with an internet connection, without the need to download or install any software.

Overall, FXPRIMUS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| FXPRIMUS | MT4, MT5, cTrader, WebTrader |

| FXCM | Trading Station, MT4 |

| FxPro | MT4, MT5, cTrader |

| Exness | MT4, MT5, WebTerminal |

Trading tools

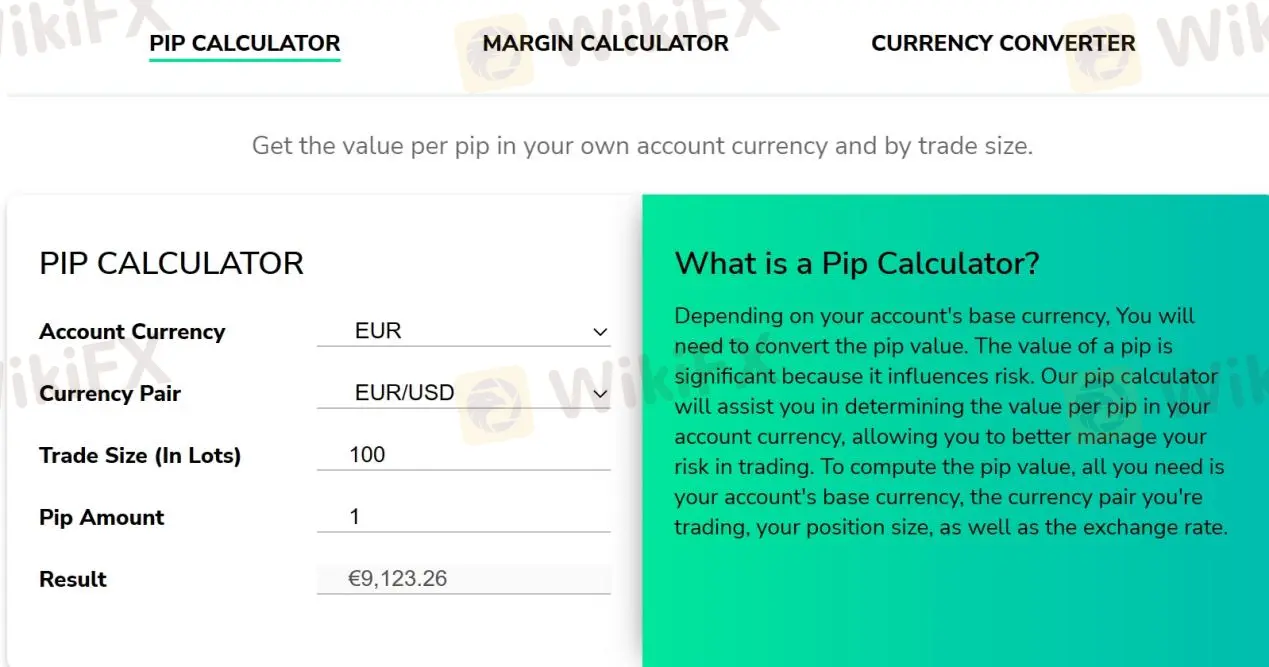

FXPRIMUS offers a variety of trading tools to assist its clients. The pip calculator helps traders calculate the value of a pip for a given currency pair and position size. The margin calculator allows traders to calculate the margin required to open and hold a position. The currency converter helps traders convert one currency to another at current exchange rates.

In addition, FXPRIMUS provides a market calendar that shows the schedule of economic events and their expected impact on the market, which can help traders make informed trading decisions. These tools can be accessed through the FXPRIMUS website or the trading platforms.

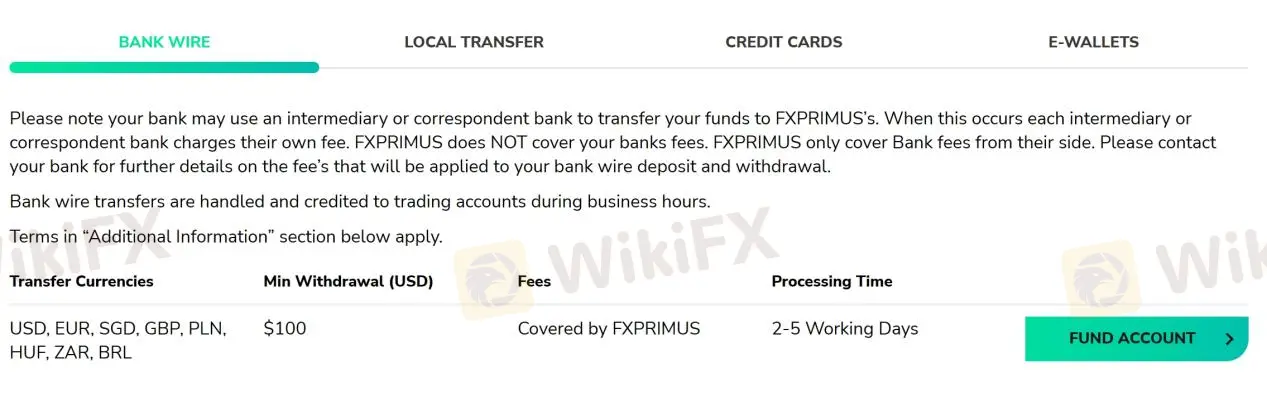

FXPRIMUS offers various deposit and withdrawal methods, including Bank Wire, Local Transfer, Credit Cards, and e-Wallets.

The minimum deposit is relatively low at $15. There are no deposit or withdrawal fees charged by FXPRIMUS, but your payment provider may charge a fee. However, it is worth noting that the minimum withdrawal amount is $100, which may be higher than some traders would prefer.

| FXPRIMUS | Most other | |

| Minimum Deposit | $15 | $100 |

The processing time for withdrawals varies depending on the payment method chosen, with Bank Wire taking 2-5 working days, Local Transfer taking 1-5 working days, and Credit Cards and e-Wallets taking up to 5 minutes.

To withdraw funds from FXPRIMUS, you can follow these steps:

Step 1: Log in to your FXPRIMUS account and click on the “Withdrawals” option in the main menu.

Step 2: Select the payment method you want to use for the withdrawal.

Step 3: Enter the amount you want to withdraw and click on the “Submit” button.

Step 4: Follow the instructions provided by the payment method you selected to complete the withdrawal process.

FXPRIMUS does not charge any deposit or withdrawal fees; however, payment provider fees may apply.

The broker charges an inactivity fee of $10 per month for accounts that have been inactive for 180 days or more. This fee is charged to cover the costs of maintaining the account and providing access to trading services, educational resources, and customer support. However, the inactivity fee can be avoided by simply logging into the trading account at least once every 180 days. It's important to note that the inactivity fee is only charged on the balance of the account and not on the deposited amount.

It also charges swap fees for holding positions overnight, and these fees vary depending on the instrument being traded.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXPRIMUS | Free | Free | $10 per month after 180 consecutive days of inactivity |

| FXCM | Free | Free | $50 per year after 12 months of inactivity |

| FxPro | Free | Free | $0 after 12 months of inactivity |

| Exness | Free | Varies by payment method | No |

It is important to note that fees and charges are subject to change, and clients should refer to the brokers websites for up-to-date information.

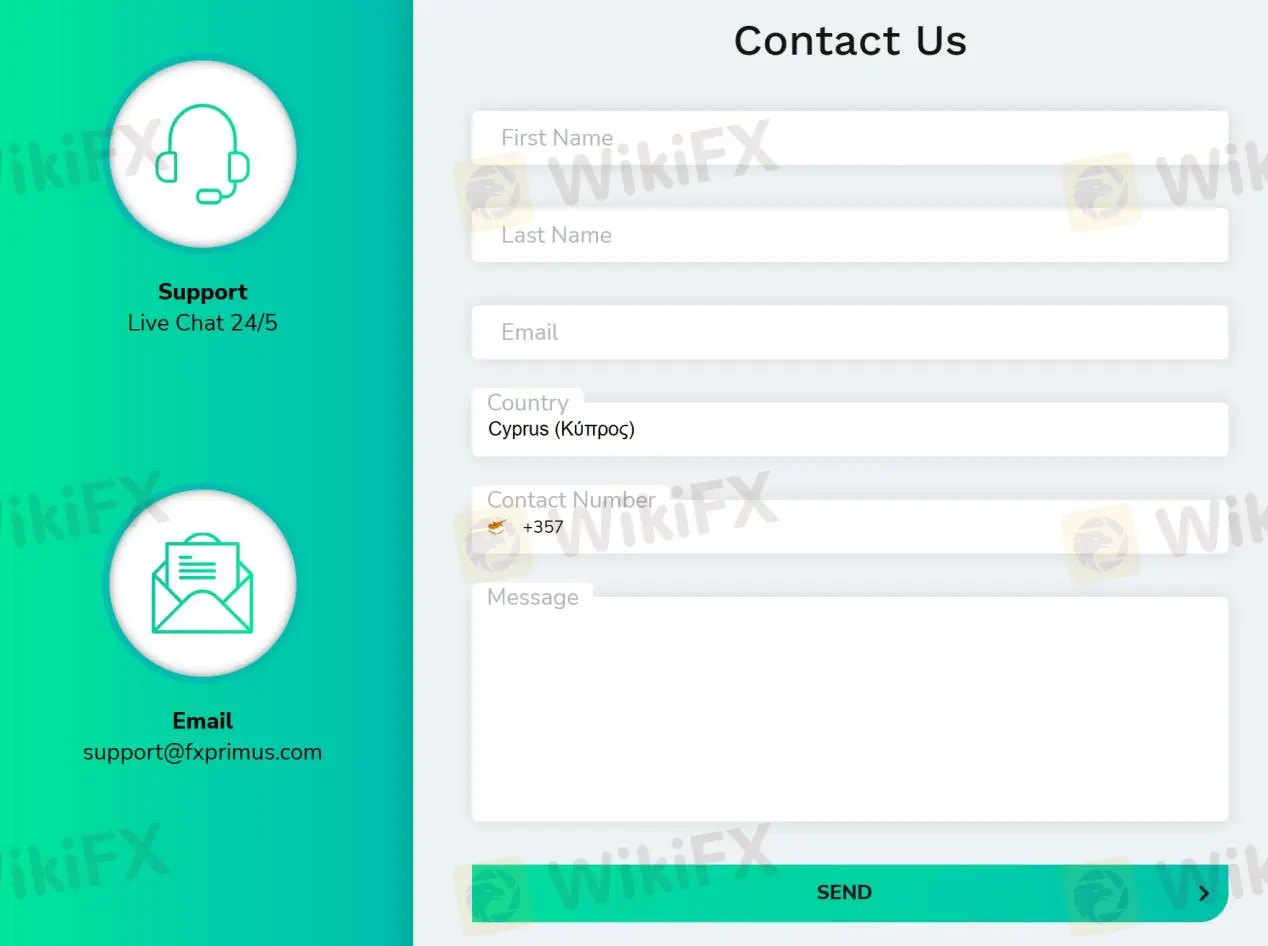

FXPRIMUS customer service offers various channels for clients to reach out for support. Clients can access 24/5 live chat, email, and online messaging to get in touch with customer support representatives. In addition, the broker provides support via messaging apps such as Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram. This allows clients to contact customer support representatives in a convenient and accessible way.

Furthermore, FXPRIMUS has a presence on social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay up-to-date with the latest news and updates from the broker.

| Pros | Cons |

| • 24/5 live chat | • No phone support |

| • Multiple language support for live chat and email | • No support on Weekends |

| • Active on social media channels for customer engagement | • Live chat can be slow to respond during busy periods |

Note: These pros and cons are subjective and may vary depending on the individual's experience with FXPRIMUS' customer service.

FXPRIMUS offers a variety of educational resources for traders of all levels. These resources include video tutorials, educational materials, live webinars, and articles.

The video tutorials cover a range of topics, from basic concepts such as trading terminology and chart analysis to more advanced topics such as risk management and trading strategies.

The educational materials include e-books, trading guides, and other resources to help traders improve their skills and knowledge.

The live webinars are led by experienced traders and cover a variety of topics, including market analysis, trading psychology, and risk management.

The articles on FXPRIMUS' website cover current market news and analysis, trading strategies, and other relevant topics.

In conclusion, FXPRIMUS is a regulated and reliable broker that offers a range of account types with competitive spreads and commissions. The broker provides a variety of trading platforms and trading tools to enhance clients' trading experience. Additionally, the broker offers excellent customer service and educational resources to support traders.

| Q 1: | Is FXPRIMUS regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At FXPRIMUS, are there any regional restrictions for traders? |

| A 2: | Yes. FXPRIMUS does not offer its services to residents of certain countries/jurisdictions including, but not limited to, Australia, Belgium, Iran, Japan, North Korea and USA. |

| Q 3: | Does FXPRIMUS offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does FXPRIMUS offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4, MT5, cTrader, and WebTrader. |

| Q 5: | What is the minimum deposit for FXPRIMUS? |

| A 5: | The minimum initial deposit to open an account is $15. |

| Q 6: | Is FXPRIMUS a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive lion and fxprimus are, we first considered common fees for standard accounts. On lion, the average spread for the EUR/USD currency pair is -- pips, while on fxprimus the spread is from 0 Pips.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

lion is regulated by SFC,SFC,CIMA,MAS. fxprimus is regulated by CYSEC,FSCA,VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

lion provides trading platform including -- and trading variety including --. fxprimus provides trading platform including PrimusZERO,PrimusCLASSIC,PrimusCENT,PrimusPRO and trading variety including --.